Commodity Services Market Size and Growth 2025 to 2034

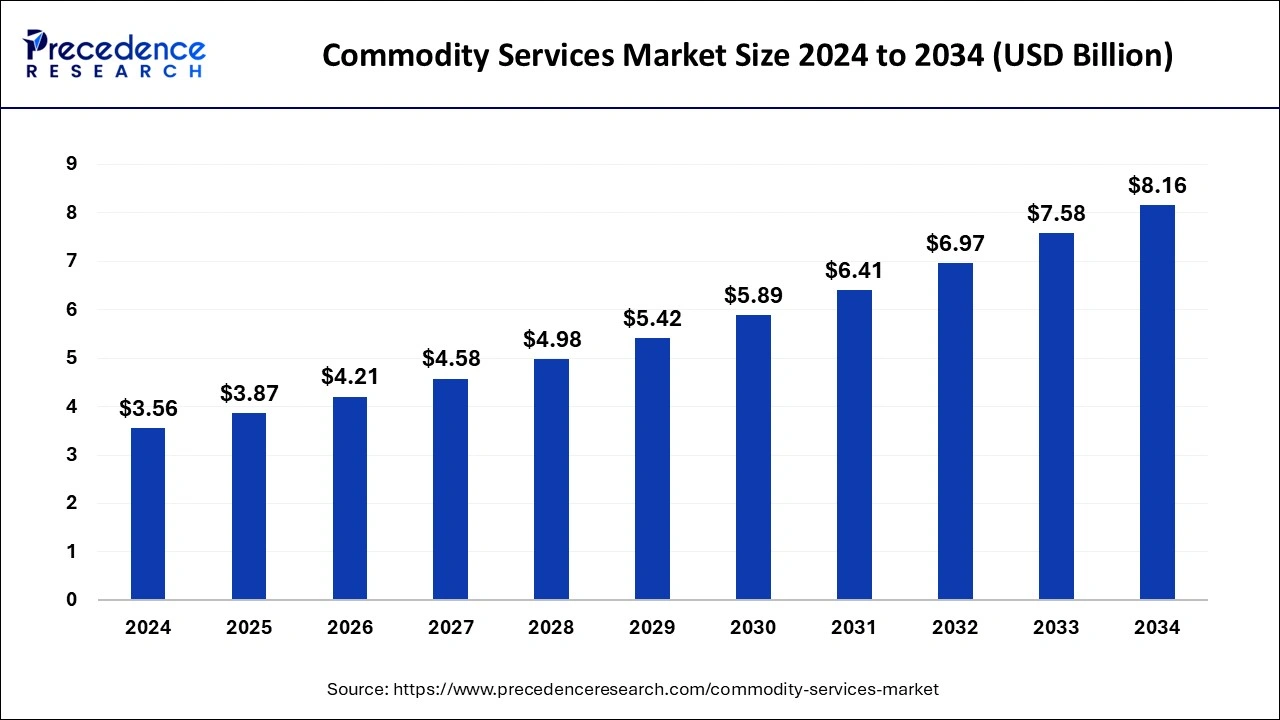

The global commodity services market size was estimated at USD 3.56 billion in 2024 and is predicted to increase from USD 3.87 billion in 2025 to approximately USD 8.16 billion by 2034, expanding at a CAGR of 8.65% from 2025 to 2034. Commodities like oil, gas, metals, and agricultural items are in high demand as economies expand. This gives the commodity service market the chance to satisfy this need by offering related services, including trading, storage, transportation, and other related services.

Commodity Services Market Key Takeaways

- In terms of revenue, the global commodity services market was valued at USD 3.56 billion in 2024.

- It is projected to reach USD 8.16 billion by 2034.

- The market is expected to grow at a CAGR of 8.65% from 2025 to 2034.

- North America holds the largest share of the commodity services market.

- Asia Pacific is expected to witness rapid growth in the market.

- By type, the agriculture segment dominated the market in 2024.

- By type, the metal segment is expected to be the fastest growth in the market during the forecast period.

- By entity, the producers segment held the largest share of the market in 2024.

- By entity, the manufacturers segment is expected to grow rapidly in the market during the forecast period.

Market Overview

The commodity services market refers to a segment of the financial market where standardized, raw, or primary products are traded. These items sometimes referred to as commodities, are usually simple commodities that can be substituted for other commodities of the same kind. The purchasing, selling, and trading of commodities which fall into two main categories: hard commodities and soft commodities make up the market for these services.

Commodity services markets can function via futures markets, where contracts are negotiated for the delivery of the commodity at a later time, or spot markets, where commodities are traded for immediate delivery. The Chicago Mercantile Exchange (CME), Intercontinental Exchange (ICE), and London Metal Exchange (LME) are three significant commodities exchanges.

A variety of services that make it easier to trade, hedge, and invest in commodities are included in the commodity services market. These consist of risk management, financial trading, physical trading, and advisory services offered by organizations such as commodity exchanges and brokerage firms. This segment's commodities are coal, natural gas, and crude oil. Geopolitical developments, improvements in energy production technology, and the state of the world economy all have a significant influence on energy commodities.

The necessity for hedging against price volatility, the requirement for portfolio diversification, and technological developments in commodity trading are the main growth drivers. There are a lot of prospects due to growing financial literacy and emerging markets. Future development is anticipated to be driven by innovations like agricultural commodity derivatives and new energy and metals trading alternatives.

Commodity Services Market Growth Factors

- One important growth factor is the growing desire among investors to diversify their portfolios with commodities rather than traditional securities. Increased capital market volatility is driving this trend, leading investors to look for alternatives like commodity trading services.

- The accessibility of trading commodities has increased with the launch of new digital exchanges and trading platforms. For example, Agridex trading was introduced by the National Commodity and Derivatives Exchange (NCDEX) in India to increase market participation in agricultural commodities.

- New opportunities are being created in emerging markets by an increase in financial literacy and awareness. The penetration of the commodity services market rises when more people and institutions become aware of the advantages and workings of commodities trading, especially in Asia and Africa.

- The dynamics of the global supply chain and geopolitical developments are two macroeconomic factors that have a big impact on commodities prices and trading volumes. For example, variations in output and swings in oil prices brought on by geopolitical unrest affect the general climate of the commodities market.

- Trading platforms that use cutting-edge technology like blockchain and artificial intelligence (AI) improve efficiency and security and draw more players to the commodity services market.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.87Billion |

| Market Size by 2034 | USD 8.16 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 8.65% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Entity, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamic

Driver

Diversification of the market

Because the commodity services market is inherently volatile and sensitive to a wide range of factors, including supply and demand dynamics, weather patterns, geopolitical events, and regulatory changes, it is imperative to diversify and manage risk. To further reduce risk, assets can be distributed throughout other investment categories, such as cash, fixed income, commodities, and stocks.

The best distribution is contingent upon a number of variables, including market conditions, risk tolerance, and investment goals. The mitigation of operational risks, including supply disruptions, transportation bottlenecks, and quality difficulties, is facilitated by efficient supply chain management. This could entail creating backup plans, keeping buffer stockpiles, and diversifying your suppliers.

Restraint

Cyclical nature of demand

Services related to the commodity services market are quite susceptible to changes in the economy. Commodity demand tends to rise during economic expansions as industries grow and services associated with these commodities are consumed at higher rates. In contrast, demand for commodities tends to decline during economic downturns as a result of industries scaling back, which in turn lowers demand for related services.

Demand for several commodities varies seasonally as a result of things like weather, farming cycles, and holiday seasons. For example, demand for agricultural services tends to be higher during planting and harvest seasons, whereas demand for heating oil usually peaks during the winter.

Opportunity

Commodity risk management

For companies in the commodity services market, managing commodity risk is essential in the commodity services market. A vast range of operations, including trading, shipping, warehousing, and processing of commodities, including metals, agricultural products, and energy resources, are included in commodity services. Risks can affect operations and profitability. Examples of these risks include delays in transportation, supply disruptions, and quality problems.

Implementing strong logistical plans, keeping buffer supplies, and diversifying suppliers are all necessary for effective supply chain risk management. To reduce this risk, businesses must evaluate the creditworthiness of their counterparties and trading partners and put policies in place such credit limits, collateral restrictions, and credit insurance.

Type Insights

The agriculture segment dominated the commodity services market in 2024. Despite the price drop, Southeast Asia's demand is recovering positively, fueled by China's strong demand as it diversifies its sources of grain in the wake of the crisis between Russia and Ukraine. The decline in soybean crops has resulted in a competitive market and declining pricing. It's anticipated that the powerful El Niño event will result in major weather disruptions. While some areas like southern Brazil and some portions of the United States might profit, others like Australian wheat and Indonesian palm oil might suffer negative effects. There is a slight recession going on in the world economy, especially in the U.S. and the Eurozone, which is predicted to reduce demand for commodities. This adds to the current geopolitical risks, which makes the market picture extremely hazy.

The metal segment is expected to grow the fastest in the commodity services market during the forecast period. The growing emphasis on green steel made with fewer carbon emissions is one of the major developments. Global initiatives to lessen environmental effects and adhere to stronger rules are what are causing this shift. Since the market for electric vehicles (EVs) is expanding, there is an increasing need for battery metals such as nickel, cobalt, and lithium. The market for battery recycling is growing as well, propelled by the need to safeguard supply chains and lessen environmental effects. Because of shifting demand levels, supply chain interruptions, and geopolitical concerns, metal prices are predicted to stay unstable. For example, supply shortages and strong demand from the EV and renewable energy industries affect copper pricing.

Entity Insights

The producers segment held the largest share of the commodity services market in 2024. Among the biggest and most internationally diversified natural resource enterprises in the world, it produces, trades, and markets energy products, agricultural commodities, and metals and minerals. Grain and other agricultural commodities are traded, bought, and distributed; logistics and transportation services are also given. Offers a range of financial services, such as risk management, commodities trading, investment strategy, and hedging advice. Provides risk management and commodity trading services to a range of industries, including agriculture, metals, and energy. It is one of the biggest derivatives markets, providing options and futures on a variety of commodities, such as metals, energy, agricultural products, and more.

The manufacturers segment is expected to grow rapidly in the commodity services market during the forecast period. Vitol is a significant energy and commodities dealer and a well-known figure in the world commodities market. The market is undergoing a number of changes, including a greater emphasis on sustainable and ethical investing, a rise in the digital transformation of the industry through technologies like blockchain and artificial intelligence, and an increase in the significance of commodities used in renewable energy, such as lithium and cobalt, as a result of the growth of electric vehicles and renewable energy projects. These major businesses are making substantial contributions to the overall evolution of the commodities services market by overcoming obstacles and seizing opportunities to boost industry growth.

Regional Insights

North America holds the largest share of the commodity services market. Over the next few years, the energy, metals, and agriculture sectors will likely drive significant expansion in the commodities services market in North America. A wide range of services are provided in this sector, including trading, risk management, and logistics for commodities such as metals, oil, gas, and agricultural products. The fundamentals for oil and gas are still robust despite some fluctuations in commodity prices, thanks to persistent demand and the requirement for long-term investments in energy infrastructure. Firmer guidelines concerning carbon emissions and ecological sustainability are compelling enterprises to embrace increasingly complex commodities services, such as those associated with carbon capture and storage initiatives.

Asia Pacific is expected to witness rapid growth in the commodity services market. The region has significant consumers and producers of commodities. It is home to some of the fastest-growing economies in the world, including China, India, and Southeast Asian nations. The need for commodities in industries such as manufacturing, energy, and construction has been driven by the rapid processes of industrialization and urbanization. Infrastructure investments are essential for the effective movement and distribution of commodities within the region and for export to other countries. These investments include ports, storage facilities, and transportation networks. The application of technological advancements like blockchain, IoT, and big data analytics to improve supply chain efficiency, transparency, and risk management is contributing to the market for commodity services.

Commodity Services Market Companies

- Cargill

- Gunvor

- Louis Dreyfus Company

- Mercuria energy group

- Trafigura

- Archer Daniels Midland

- Bunge limited

- Mabanaft

- Wilmar International

- COFCO Group

- Koch industries

- Hedgers

- Glencore

- Vitol

- Arbitrageurs

Recent Developments

- In February 2024, First-of-its-kind daily, spot market U.S. lithium carbonate price assessments have been made available by Platts, a division of S&P Global Commodity Insights, the premier independent source of information, data, analysis, benchmark prices, and workflow solutions for the commodities, energy, battery metals, and energy transition markets.

- In February 2024, With the introduction of the DoubleLine Commodity Strategy ETF and the Fortune 500 Equal Weight ETF, there are now six DoubleLine ETFs available. The DoubleLine Opportunistic Bond ETF, DoubleLine Mortgage ETF, DoubleLine Commercial Real Estate ETF, and DoubleLine Shiller CAPE U.S. Equities ETF1 are the other four exchange-traded funds.

Segment Covered in the Report

By Type

- Metal

- Energy

- Agricultural

- Livestock

- Meat

- Others

By Entity

- Investors

- Consumers

- Manufacturers

- Traders

- Business Entities

- Producers

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting