What is the Continuous Threat Exposure Management (CTEM) Market Size?

The CTEM Market is rising fast as organizations prioritize real-time threat exposure management for enhanced cybersecurity resilience. The rising frequency of cyberattacks is expected to boost the growth of the market.

Continuous Threat Exposure Management (CTEM) MarketKey Takeaways

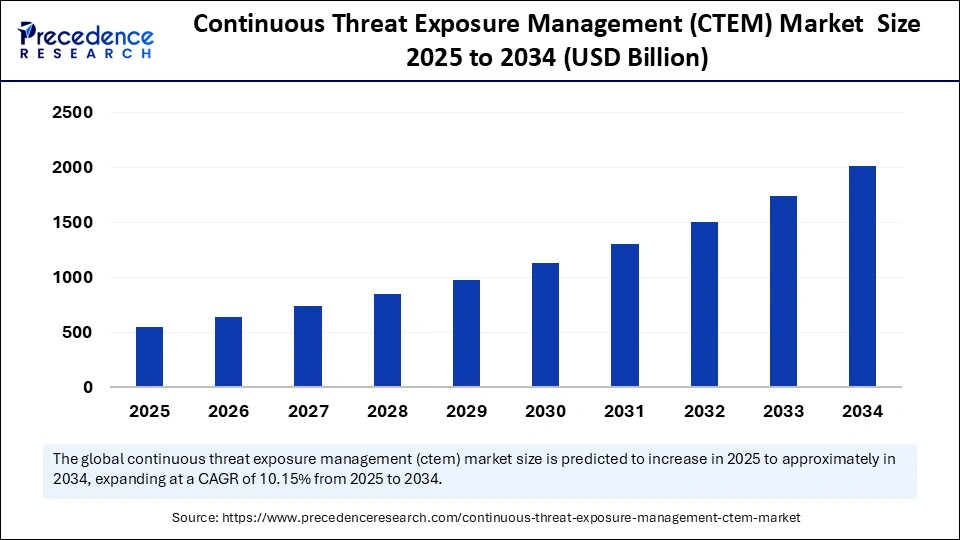

- The continuous threat exposure management (CTEM) market is expected to grow at a CAGR of 10.15% from 2025 to 2034.

- North America dominated the continuous threat exposure management (CTEM) market in 2024.

- Asia Pacific is expected to expand at the fastest CAGR during the forecast period.

- By component, the solution segment captured the biggest market share in 2024.

- By component, the service segment is expected to grow at the fastest CAGR in the coming years.

- By organization size, the large organizations segment led the market in 2024.

- By organization size, the SMEs segment is expected to grow at the fastest CAGR in the upcoming period.

- By industry vertical, the BFSI segment contributed the highest market share in 2024.

- By industry vertical, the retail segment is expected to grow at the fastest CAGR between 2025 and 2034.

- By deployment mode, the cloud segment held the major market share in 2024.

- By deployment mode, the on-premises segment is expected to grow at the fastest CAGR during the projection period.

What is the Flow Assurance In Oil And Gas Market?

The digital era's rise has shifted data centers and computing software to digital platforms, with businesses now using digital services extensively, which has increased cyber threats and system vulnerabilities. Continuous incidents of data breaches in financial institutions, healthcare organizations, and top science research institutes globally underscore the growing need for continuous threat exposure management and its market growth potential. Governments are continuously investing resources in cybersecurity, and new advanced technologies such as artificial intelligence and machine learning are playing a crucial role in threat detection, increasing the overall efficiency of the continuous threat exposure management market.

How is AI contributing to the Flow Assurance In Oil And Gas Market?

AI in flow assurance makes the oil and gas industry more efficient through the application of predictive analytics, real-time monitoring, and optimization. It foresees possible blockages, spots abnormal situations, and modifies the operations for maximum efficiency. AI, along with digital twins, drones, and data-driven insights, leads to proactive maintenance, less downtime, and ensures safe, uninterrupted hydrocarbon flow in the complicated production and transport systems.

Continuous Threat Exposure Management (CTEM) MarketGrowth Factors

- Cyberattacks are becoming extremely sophisticated, which is creating the need for CTEM to secure businesses and data systems.

- Proactive measures, such as identifying and fixing vulnerabilities before exploitation, are crucial for ensuring security, supplementing defense mechanisms, and driving market growth.

- As businesses continuously adopt digitization, the increased use of technology and data storage in digital mediums makes them highly prone to cyberattacks and data breaches, driving the need for enhanced security measures.

- Public cloud computing resources, widely used by data centers and servers, are more vulnerable than on-premises services due to high exposure to public traffic, potentially exposing systems to exploitable loopholes on a large scale. This, in turn, boosts the demand for CTEM.

Market Outlook

- Industry Growth Overview: The Market is likely to experience steady growth due to the demand for deepwater production.

- Sustainability Trends: Emphasis is on using fewer chemicals, switching to green tech, and incorporating carbon capture along with the usual carbon capture and storage methods.

- Global Expansion: The market is growing rapidly in areas where the underwater and offshore operations are complicated and require the use of advanced flow assurance to ensure the continued production.

- Major investors: Major oil and gas firms (example, Shell, TotalEnergies) are the investors who are pouring lots of money into R&D and innovative flow solutions.

- Startup Ecosystem: New companies are focusing on predictive modeling and efficient pipeline maintenance with the help of AI, big data, and IoT, thus improving the operability.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Organization Size, Industry Verticals, Deployment Mode,and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increased Frequency and Sophistication of Cyberattacks

The rising frequency and sophistication of cyberattacks, including ransomware and data breaches, are driving the growth of the continuous threat exposure management (CTEM) market. As businesses are turning toward digitalization, they are becoming more vulnerable to cyberattacks. This, in turn, boosts the demand for CTEM. It enables organizations to proactively identify and address vulnerabilities before they can be exploited by attackers. The shift to digital financial transactions and frequent healthcare data breaches underscores the critical importance of continuous threat exposure management to protect digital infrastructure, ensure seamless functionality, and guarantee data security and safety.

Restraint

High Implementation Cost and Skill Gap in the Market

The continuous threat exposure management (CTEM) market faces significant restraints, primarily due to the high costs associated with deployment, operation, and ongoing maintenance. These costs encompass expensive hardware and software tools alongside the need for highly skilled professionals, who are often difficult to find, thereby slowing market growth. Only large enterprises typically possess the financial resources to invest in top-quality continuous threat exposure management systems, leaving small businesses at a disadvantage. These smaller organizations may be forced to compromise other systems, potentially creating vulnerabilities because of interconnectedness. Unless robust firewall systems are implemented across all interconnected systems, and their efficiency is maintained, the complexity of these systems poses a challenge. A shortage of skilled cyber security professionals makes it difficult for organizations to implement and manage CTEM solutions effectively.

Opportunity

Rising Digitalization

The escalating digital landscape increases the risk of cyber security attacks, presenting immense opportunities in this market. The demand for sophisticated security systems and highly skilled individuals will surge to secure digital systems, detect incidents, investigate threats, and fix vulnerabilities. Ethical hacking experts are crucial for these tasks, ensuring data, systems, cloud infrastructure, and software security. Proactive solutions offered by CTEM are key due to their robust capabilities and risk management, with continuous upgrades.

Component Insights

Why Did the Solutions Segment Dominate the Market in 2024?

The solution segment dominated the continuous threat exposure management (CTEM) market with the largest share in 2024. The segment's dominance is primarily due to the comprehensive offering of features integrated into the solution, with platform automation, vulnerability management, and threat detection intelligence. Governments worldwide have imposed various rules and regulations, leading to an increased complexity in cybersecurity. Due to increased attacks and risk of cyber threats, solutions are focusing on ensuring all the requirements are fulfilled and enhancing the safety of the systems.

The service segment is expected to grow at the fastest rate in the upcoming period. This is mainly due to the increasing demand for skilled experts in navigating cyber threats. While challenges exist with regulations, compliance, and the need for highly customized solutions to reduce risk, there is a high demand for managed and professiknal services. As the adoption of CTEM solutions rises, so does the need for deployment, maintenance, and training services. The increasing sophistication of cyberattacks also encourages businesses to seek professional services.

Organization SizeInsights

How Does the Large Organizations Segment Dominate the Market?

The large organizations segment dominated the continuous threat exposure management (CTEM) market with the highest share in 2024 as they experienced more cyberattacks than SMEs. Large organizations deal with a large volume of data and massive digital infrastructure, encompassing cloud computing, networks, and data centers, making them vulnerable to cyberattacks. CTEM programs proactively manage all risks and threats to ensure the security of this complex infrastructure. Strong capital and resource availability ensure the utilization of sophisticated hardware and software solutions, bolstering the robustness and capability of security systems. Highly experienced individuals are also available within these organizations due to resource availability and market legacy, further enhancing their position in the market.

The SMEs segment is expected to grow at the fastest rate in the upcoming period. This is primarily due to growing cybersecurity awareness among small and medium organizations. The increased use of digital infrastructure in these organizations leads to a greater need for cybersecurity and threat management to safeguard sensitive data and digital assets. While budget allocation may be less than in large organizations, the effective use of available resources by an expert individual can significantly enhance security strength and capabilities within this segment.

Industry Vertical Insights

What Made BFSI the Dominant Segment in the Continuous Threat Exposure Management (CTEM) Market?

The BFSI (banking, financial services, and insurance) segment dominated the market with the largest share in 2024. Highly sensitive digital transactions within these institutions, especially in banking and financial services, are of paramount importance, necessitating sophisticated cybersecurity solutions to protect data from cyberattacks and maintain integrity. A compromise in these institutions could have severe economic and broader consequences, making it crucial to allocate the best possible resources to safeguard these critical assets. These institutes deal with vast customer data, making them a prime target for attackers and boosting the need for CTEM solutions.

The retail segment is expected to grow at the fastest CAGR during the forecast period. The rise of digital platforms and online services, including transactions and payments, has heightened cyberattack risks in the retail sector. Growing cybersecurity awareness is the primary driver behind the rapid growth in this sector. This includes the utilization of various solutions to protect data and ensure system safety and security.

Deployment ModeInsights

Why Did the Cloud Segment Hold the Highest Market Share in 2024?

The cloud segment dominated the continuous threat exposure management (CTEM) market by holding the highest share in 2024. This segment's dominance stems from the robust performance and security of cloud platforms, coupled with cost-effective pricing and the high scalability and flexibility they offer, which is a key growth factor. Large organizations have embraced cloud services, and small and medium organizations are also opting for them due to their cost-effectiveness and robust performance for computing and data center services. Cloud deployment enables remote monitoring of threats. Cloud platforms enable organizations to scale security infrastructure as per the requirements and eliminate high upfront investment in infrastructure, making them beneficial particularly for SMEs. The rapid shift toward a cloud environment supports segmental growth.

The on-premises segment is expected to grow at the fastest rate during the projection period. Organizations have become aware of the importance of cybersecurity, and due to the increased frequency of data breaches and cyber-attacks, the adoption of on-premises solutions is rising. This is because of full control over infrastructure and resources. Limited accessibility with proper authentication increases security levels and reduces the possibility of attacks due to less exposure to external networks in these solutions. On-premises platforms provide organizations with the ability to control their data, reducing data breaches.

Regional Insights

How Does North America Dominate the CTEM Market?

North America dominated the continuous threat exposure management (CTEM) market by capturing the largest share in 2024. This is mainly due to the increased incidence of cyberattacks and data breaches. To ensure security and build a defense against these threats, a highly capable protection mechanism is in high demand. Stringent regulations regarding data protection and security also bolstered the market in the region.

How is North America performing in the Flow Assurance In Oil And Gas Market?

This region is still the principal area of technological innovation in energy operations. The advanced shale exploration and digitalization of oilfields maintain the necessity for predictive flow assurance systems, which are capable of making the production faster and easier.

The U.S. is a major player in the market due to increased digitalization. The country has a well-established digital infrastructure, encouraging investments in cybersecurity solutions. The country is home to a large number of tech giants who deals with highly sensitive data, increasing the need for sophisticated cybersecurity infrastructure. In addition, increased awareness of the financial and reputational damage caused by cyberattacks is driving organizations to invest in CTEM solutions.

United States Flow Assurance In Oil And Gas Market Trends:

The United States is a major market that mainly revolves around smart operations and the use of data analytics. Utilization of AI in supervising and managing pipelines guarantees production safety, operational resilience, and efficiency in the energy sector.

Asia-Pacific Continuous Threat Exposure Management (CTEM) Market Trends

Asia Pacific is expected to grow at the fastest CAGR during the forecast period. The growth of the market in the region is driven by increasing digital infrastructure. Businesses in the region are shifting their operations toward cloud environments, increasing the risks of cyberattacks. Digital and cross-border payments are continuously increasing in the region. Considering this shift, there's been a rise in cyber threats and attacks recently, creating the need for CTEM solutions.

Banking and financial institutions are implementing the highest possible security measures to continuously track digital systems. This leads to increased integration of advanced cybersecurity solutions to avoid vulnerabilities. Due to increased cyber risk and attacks, businesses are also investing heavily in cybersecurity solutions to protect crucial assets.

How is Asia-Pacific leading in the Flow Assurance In Oil And Gas Market?

The region is undergoing a rapid expansion, which is mainly attributed to increased energy demand and industrial activities. The government initiatives to digitalize the industry, along with the rise in offshore exploration and refining projects, are creating the perfect environment for advanced flow assurance technologies being absorbed into the market.

European Continuous Threat Exposure Management (CTEM) Market Trends

Europe is expected to witness notable growth in the coming years. This is mainly due to the increased frequency of cyberattacks on various digital infrastructures. Thus, businesses are adopting a proactive risk management approach due to the rise in such incidents. Continuous scanning for vulnerabilities in digital systems and immediate actions to mitigate damage from cyberattacks are standard practices. Large organizations understand the importance of cyber resilience to maintain uninterrupted business operations and avoid emergencies. Companies are heavily investing in developing cybersecurity infrastructure and mechanisms to tackle security breaches, driving the growth of the market in the region.

China Flow Assurance In Oil And Gas Market Trends:

With its well-established oil and gas infrastructure, China is the forerunner in the regional market. The country's substantial energy consumption, combined with its drive for technological innovation, leads to heavy investment in AI-powered predictive maintenance and efficient flow systems.

What are the driving factors of the Flow Assurance In Oil And Gas Market in Europe?

Europe is on the way to achieving growth that may be referred to as steady; more and more people are focusing on safety, efficiency, and sustainability in the oil and gas industry. The digital flow assurance is increasingly taking over due to the combination of renewable systems and carbon management strategies.

Norway Flow Assurance In Oil And Gas Market Trends:

The North Sea sector continues to be the area where Norway is able to advance technologically. The country is so committed to operational safety, efficiency, and sustainability that it is willing to adopt high-performance monitoring and predictive systems just to maximize offshore production.

Value Chain Analysis

- Resource Extraction: The procurement of raw fossil fuels or minerals obtained through safe and sustainable means.

Key Players: Shell, BP, and ExxonMobil - Power Generation: The transformation of extracted resources into electricity for industrial and domestic use.

Key players: Siemens Energy - Distribution Network Management: The movement and delivery of hydrocarbons to end-users is managed in an efficient manner.

Key Players: Enbridge Inc. - Energy Storage Systems: The energy that has been extracted is stored to ensure a constant supply and to minimize disruptions in operations.

Key Players: Tesla - Grid Maintenance and Monitoring: Disabled, safe, and efficient hydrocarbon flow is achieved through the application of proactive measures.

Key Players: ROSEN Group

Key Players' Offering

- Oceaneering International, Inc.: Delivers a full set of advanced systems for deepwater intervention, subsea robots, as well as testing directed at pipeline integrity and performance.

- Baker Hughes Company: Provision of technology-based solutions for production enhancement, with predictive flow management and chemical optimization being the primary focus.

- Intertek Group plc: Offering of quality assurance, testing, and certification services in order to confirm the safety and reliability of flow assurance processes.

- ROSEN Group: Technologies for inline inspection and monitoring are developed that are advanced enough so that the pipeline can be kept healthy, and no interruptions occur.

Continuous Threat Exposure Management (CTEM) Market Companies

- AT&T

- Core Security

- Rapid7

- Digital Defence

- IBM

- RSA Security

- Micro Focus

- Qualys

- McAfee

- Symantec Corporation

Recent Developments

- In June 2025, AttackIQ announced the launch of AttackIQ Ready3. With expanded discovery capabilities, Ready3 continuously maps both internal and external attack surfaces. By correlating asset discovery with vulnerability context, attack paths and compensating controls, the platform helps security teams identify which vulnerabilities are truly exposed because existing defenses are failing to stop them.

(Source:https://www.attackiq.com)

- In May 2025, Check Point Software Technologies Ltd. acquired Veriti Cybersecurity, the first fully automated, multi-vendor pre-emptive threat exposure and mitigation platform. This is the first of its kind completely automated multi-vendor pre-emptive threat exposure and mitigation platform.

(Source:https://www.checkpoint.com)

- In November 2025, BP agreed to sell non-controlling interests in Permian and Eagle Ford midstream assets to Sixth Street-managed funds for $1.5 billion, with BP remaining the operator and phased payments.

(Source: https://www.bp.com )

- In June 2025, Baker Hughes and Repsol announced an agreement to deploy next-generation digital capabilities, including a generative AI-powered virtual assistant, via the Leucipa™ solution.

(Source: https://www.bakerhughes.com )

Segments Covered in the Report

By Component

- Solutions

- Services

By Organization Size

- Large Organizations

- SMEs

By Industry Verticals

- BFSI

- Aerospace and Defence

- Energy Utility

- Healthcare

- Public Sector

- IT Telecom

- Retail

- Others

By Deployment Mode

- Cloud

- On-premises

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting