What is Threat Intelligence Market Size?

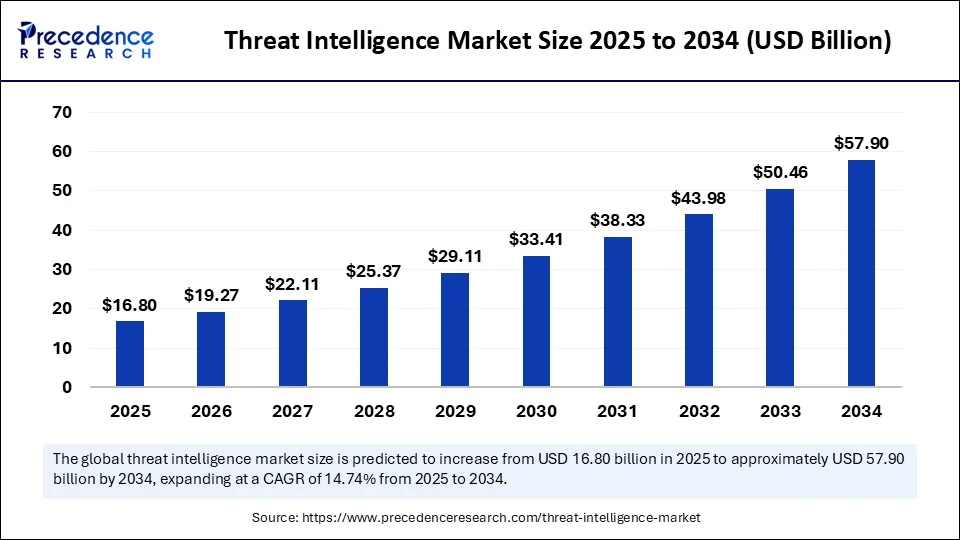

The global threat intelligence market size accounted for USD 16.80 billion in 2025 and is predicted to increase from USD 19.27 billion in 2026 to approximately USD 65.34 billion by 2035, expanding at a CAGR of 14.55% from 2026 to 2035.

Market Highlights

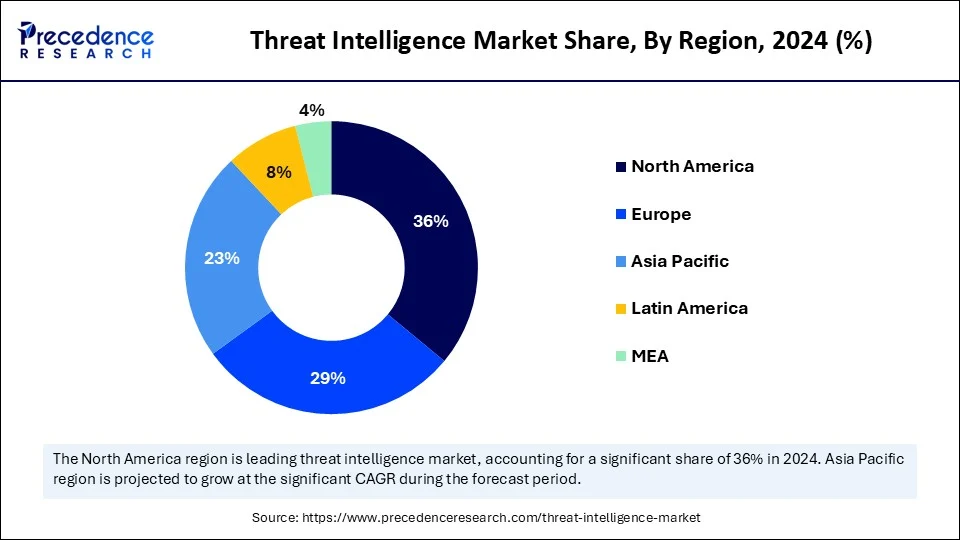

- North America dominated the threat intelligence market with the largest market share of 36% in 2025.

- Asia Pacific is is expected to grow at the fastest CAGR during the period.

- By type, the strategic intelligence segment led the market in 2025.

- By type, operational intelligence is the fastest growing segment during the forecast period.

- By component, the solutions segment held the largest market share in 2025.

- By component, the services segment is seen to grow at the fastest CAGR during the forecast period.

- By application, SIEM segment captured the biggest market share in 2025.

- By application, the GRC segment is expected to grow at the fastest CAGR during the forecast period.

- By deployment mode, the cloud segment generated the major market share in 2025.

- By deployment, the hybrid segment is seen to grow at the fastest rate during the forecast period.

- By industry vertical, the BFSI segment contributed the highest market share in 2025.

- By industry vertical, the healthcare segment is seen to grow at the fastest CAGR during the forecast period.

What is threat intelligence?

The threat intelligence market is rapidly evolving and has become a critical layer for modern cybersecurity. This market is driven by the increasing frequency and complex execution of cyberattacks across various industries. Many organizations today face a high amount of cyberattacks, ranging from organized cybercrime groups to hackers and insider threats. The primary objective of this market is to supply organizations with all the necessary information in order to identify, evaluate and respond to cybersecurity threats.

This includes threat detection, risk assessment and incident response, all of which helps the organization to manage and mitigate security risks in a proactive way. Additionally, advancements in artificial intelligence, machine learning, big data analytics and automation are further enhancing the capabilities of the threat intelligence system market, helping organizations to improve their overall security and stay ahead of potential threats.

How Is Artificial Intelligence Transforming the Threat Intelligence Market?

Artificial Intelligence has emerged as a transformative force in the threat intelligence market. It is completely reshaping how organizations detect, analyze and respond to cyber threats. Ai driven algorithms can now analyze vast amounts of data, network traffic, log files as well as user behavior to identify anomalies and malicious activity at a much faster speed and with much better accuracy than compared to manual or rule-based systems.

Machine learning tools can now analyze patterns from past attacks to predict future threats, helping organizations anticipate outcomes and keep preventive tactics ready. These tools can easily be integrated and tailored to specific industries, geographies and organizational risk profiles, making it more actionable. In addition to this, feedback loops within these tools ensure that the system remains up to date and improves itself with every incident, further refining threat detection effectiveness, making them critical components in the ongoing battle against cyber threats.

What Factors Are Fueling the Rapid Expansion of the Threat Intelligence Market?

- Rise of proactive security: Organizations are moving from traditional firewalls and antivirus systems to more sophisticated, predictive and intelligence driven tools in order to better anticipate cyber-attack behaviors.

- Integration of AI tools: The integration of artificial intelligence and machine learning tools are revolutionizing threat detection and response by enabling more sophisticated analysis and faster identification of potential security threats. This improves the accuracy and efficiency of threat detection, helping organizations respond more quickly.

- Dark web monitoring: There is a rise in dark web monitoring and underground economy surveillance where enterprises seek visibility in hacker forums and illicit marketplaces to better mitigate risks and take necessary actions well ahead of time.

- Industry specific intelligence: Threat intelligence systems are being actively integrated in various industries such as healthcare, banking and critical infrastructure to protect systems and assets, highlighting the rising demand for industry specific intelligence.

- Threat Intelligence Sharing: There is a growing emphasis on threat intelligence exchange processes. Organizations and governments are acknowledging the necessity of having collaborative cybersecurity strategies as individual defenses are proving to be inadequate against coordinated attacks and advanced threats.

Major Trends in the Threat Intelligence Market:

- Developments in Artificial Intelligence that will Enable Autonomous Threat Hunting: The growth of research focused on potential autonomous threat hunting frameworks driven by artificial intelligence (AI) and machine learning (ML) that will allow organizations to automatically discover, analyze, and react to emerging threats without requiring an ongoing level of human engagement, enabling a much more timely, accurate way to capture and disseminate intelligence than currently exists.

- The Importance of Interoperability & Developing Ontologies: Increased activity within academia is being directed toward increasing data interoperability through the development of robust threat intelligence ontologies and standardizing threat taxonomies so that various enterprise and security automation systems can share information between them, an area that hasn't been adequately developed within the current threat intelligence community.

- Reputational-Based Sharing of Threat Intelligence: Concepts utilizing distributed ledger technology (DLT) blockchain, along with decentralized reputation systems (DRS) for securely and credibly sharing threat intelligence (CTI), are emerging as an important area in developing long-term solutions for making inter-organizational collaboration more effective and reliable when sharing data.

- The Integration of Proactive Threat Hunting and Threat Intelligence (TTP Driven): Threat Hunting is a proactive form of defence that is not dependent on the fire alarm style of alerts that have been commonly utilized in the Threat Intelligence world, and its methodology is evolving to utilize threat intelligence in searching for, identifying, and defeating adversaries tactics, techniques and procedures (TTP) before an intrusion occurs.

Market Outlook

- Industry Growth Overview: The threat intelligence market is growing, driven by rising modification of cyber threats, a shift towards active security, and the increasing significance of cloud security. The growing frequency and sophistication of attacks, containing ransomware and nation-state strategies, are compelling organizations to accept threat intelligence services.

- Global Expansion: The threat intelligence market is increasing worldwide, driven by the expansion of cloud solutions, which is increasing the requirement for robust security services, including identity and access management, which is a significant component of the threat intelligence market. North America is dominant in the market due to strong spending from established players and government and private initiatives.

- Major investors: Major investors in threat intelligence include venture capital organizations such as Sequoia Capital and Spider Capital, corporate investors such as JPMorgan Chase, and government-linked entities like In-Q-Tel.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 16.80 Billion |

| Market Size in 2026 | USD 19.27 Billion |

| Market Size by 2035 | USD 65.34 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 14.55% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Component, Component (Solution Sub-Segments), Application, Deployment Mode, Industry Vertical, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Drivers

Rise in Sophisticated Threat Security Technology

The increase in sophisticated and complex cyber threats is forcing organizations to adopt a more proactive and predictive approach towards threat security, further fueling the need for cutting edge defense methods. They increasingly adopt advanced and connected technologies such as cloud computing, IoT devices and AI-driven platforms. This proves vital as more devices and systems become interconnected due to rapid digitization, making it easier for cybercriminals to target and exploit vulnerabilities.

Compliance pressure is another strong motivator as regulations push for timely incident reporting and detection. We can see that industries are increasingly investing in advanced threat intelligence solutions in order to reduce the attack surface of a network, thus boosting demand for the threat intelligence market.

Restraint

High Deployment Costs and Lack of Skilled Personnel

In spite of its vital contribution, the threat intelligence market does have its fair share of challenges. One of the major challenges is the high cost of deployment and the shortage of skilled cybersecurity professionals who are capable of analyzing and interpreting complex threat intelligence data. This heightened expense includes various factors such as charges for software licensing, hardware prerequisites as well as the cost for recruiting and training competent professionals to effectively manage and utilize these solutions.

Furthermore, there may also be hidden costs linked to system integration and customization to cater to the distinct requirements of diverse organizations. Organizations may face budget constraints, making it difficult to invest in advanced threat intelligence tools. This inadequacy can limit the adoption and effectiveness of threat intelligence platforms, especially for small scale organizations or underdeveloped nations with fewer resources.

Opportunity

Increase in Regulatory Compliance Requirements

With the increasing number of cyber threats, governments and regulatory bodies all over the world have enforced stringent data protection laws such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the U.S.

These regulations mandate organizations to enhance their cybersecurity frameworks, enforce stricter data protection measures and report breaches in a prompt manner. They have launched various programs and policies aimed at improving national and critical infrastructure security, thus strengthening the security infrastructure and driving the growth of the global threat intelligence market. This helps emerging enterprises to frequently gain assistance through research grants and partnerships, thus facilitating innovation and the advancement of cutting-edge technologies for the identification and analysis of threats.

Segment Insights

Type Insights

By type, the strategic intelligence segment dominated the threat intelligence market in 2025. This is because organizations are increasingly viewing cybersecurity as the priority, not just as a function. This segment provides long term insights into adversary motives, geopolitical risks and sector wide vulnerabilities, helping decision makers align their security goals with their investments. As more and more industries across various domains are adopting threat intelligence systems for business continuity and management, strategic intelligence systems have made their mark as the leading type.

The operational intelligence segment is observed to grow at the fastest rate during the forecast period. This growth is due to the urgent need for bridging high level strategy with day-to-day defense execution. Operational intelligence systems seamlessly merge into workflows, amplifying its effectiveness. The advantage of this segment lies in its agility as it allows organizations to move from detection to response at greater speed, minimizing the damage during cyber-attacks.

Component Insights

By component, solutions segment is dominating the threat intelligence market. This is because organizations increasingly require integrated platforms that can work with vast data streams, analyze patterns and deliver high quality, actionable intelligence into preexisting security ecosystems. By using AI tools and machine learning, solutions can analyze factors more effectively, corelate threat indicators to various events, reduce false positives and help enable faster prioritization.

Services is seen to grow at the rapid pace during the predicted timeframe. This is due to the widening gap between cybersecurity skills and the complex landscape of modern security threats. Many small size or medium size organizations lack the in-house expertise needed for threat intelligence systems, here, services come in handy by not just providing data, but also providing guidance. This segment is flexible in nature, making it easy to tailor according to the organization's needs and providing immediate value.

Component Insights (Solution Sub-Segments)

The TIP segment held the largest share of the market because of their ability to aggregate, normalize and contextualize vast amounts of data from diverse feeds such as commercial, dark web, open source and even government sources. This segment specializes in turning data into intelligence by filtering noise and aligning perfectly with the organization's risk profile. They can seamlessly integrate with other security tools, making them adaptable in nature. This makes them an indespensible force for aligning strategy with operations.

UEBA is observed to grow at the fastest rate during the forecast period. This growth is fueled by the need to detect threats that bypass traditional perimeter defenses. Organizations now require tools that go beyond static rules and analyze behavioral baselines. This segment uses AI and machine learning to analyze user activities, flag suspicious behaviour and prevent abnormal data accessing practices. This makes them highly precise in nature as they can identify subtle deviations that can be invisible to the human eye, providing an added layer of security.

Application Insights

By application, SIEM segment dominated the threat intelligence market in 2025. This dominance is because they serve as a central hub for threat intelligence feeds. SIEM tools ingest logs all across networks, endpoints and cloud services, then correlates them with real time threat data to surface alerts. This segment is used by nearly every organization due to its universality and efficiency in visibility, compliance and investigation practices.

GRC is the fastest growing segment. This is due to escalating regulations all over the world. The advantage lies in GRC's ability to translate technical threat data into a business language, helping executives and regulators view cybersecurity as a part of corporate governance. This helps organizations align security with industry mandates and regulatory requirements.

Deployment Mode Insights

By deployment mode, the cloud segment dominated the market in 2025. This is because organizations are increasingly shifting workloads and security infrastructure to cloud based platforms due to their scalability, security and cost efficiency. Cloud based systems provide real time updates without the added burden of manual patching in and hardware upgrades, helping enterprises keep up with the fast-changing tactics. It has high accessibility, helping it seamlessly integrates into SOAR, XDR and IAM, thus creating a cohesive ecosystem.

The hybrid segment is seen to grow at the fastest rate during the forecast period. Hybrid models combine the scalability of cloud delivery with the control of on-premise infrastructure, helping balance out flexibility with regulatory requirements. They can cater to various industries such as IT, banking, healthcare etc. making them highly adaptable.

Industry Vertical Insights

By industry vertical, the BFSI segment dominated the threat intelligence market in 2025 as it is the most highly targeted sector for cybercrimes. The financial sectors holds vast amounts of private data, making them the prime targets for data phishing, hacking and insider threats. This forces this domain to adopt advanced and proactive threat security strategies in order to prevent disruptions and safeguard customer trust.

Healthcare is the fastest growing during the forecast period. This growth is due to the accelerated digitization and transformation of medical systems as well as the expansion of telemedicine. Hospitals and healthcare clinics have become targets for data exfiltration and ransomware. This could not only endanger the patient's privacy but also their lives if critical systems are disrupted. This has made healthcare personnel more aware of the need for advanced security systems.

Regional Insights

U.S. Threat Intelligence Market Size and Growth 2026 to 2035

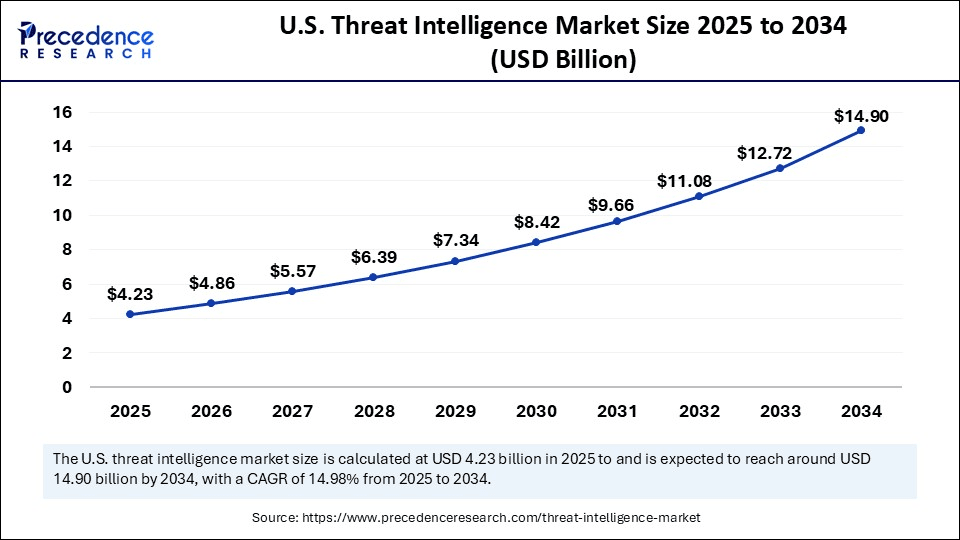

The U.S. threat intelligence market size is exhibited at USD 4.23 billion in 2025 and is projected to be worth around USD 17.08 billion by 2035, growing at a CAGR of 14.98% from 2026 to 2035.

North America: Presence Of Robust Infrastructure, Technological Leadership, and Innovation

North America held the largest share of the threat intelligence market and is expected to maintain its dominance throughout the forecast period. This growth is driven by the availability of robust infrastructure, cybersecurity vendors, tech companies, competent cybersecurity professionals and efficient financial institutions. In addition, the increasing adoption of IoT devices and the growing focus on cybersecurity by businesses is further fueling the demand for advanced threat intelligence solutions.

As more and more companies seek to protect their digital assets, the region's technological advancements are further reinforcing its position in the global market. In addition to this, in addition, several organizations have engaged in active participation in intelligence-sharing networks such as FS-ISAC and CISA-led initiatives, making North America the leading player in threat intelligence adoption and innovation on a global level.

U.S.: Increasing cybersecurity threat

In the U.S, threat intelligence systems are highly advanced. Various industries across the country have all faced persistent cyber security threats. This is encouraged the country to amp up their security systems and has also fostered a strong collaboration between the private sector and federal agencies. Companies regularly exchange information and intelligence with leading security vendors, making sure they gain visibility into new emerging threats.

Additionally, regulations such as HIPAA and CCPA have introduced new guidelines to encourage organizations to invest heavily in proactive intelligence, threat detection and compliance driven cyber security strategies. Many companies like Palo Alto Networks, IBM, CrowdStrike etc. are continuously experimenting with new technological tools and AI driven platforms that combine predictive analytics, real time monitoring and automated incident response, further cementing the country's position as a dominant hub of innovation and cutting-edge security.

Asia Pacific: Growing digital services

Asia-Pacific is the most rapidly expanding marketplace for the forecast period. This growth is due to accelerated digitization, increased cybercrime and a growing government focus on cybersecurity. As businesses increasingly recognize the importance of cybersecurity, the demand for such solutions also expands rapidly, particularly in sectors such as IT, banking, defense and manufacturing. Countries like India, China, South Korea and Australia are increasingly scaling up their defense against emerging threats by adopting advanced technologies, further pushed by government initiatives.

China: Heavy investment in AI and emerging technologies

The Chinese government is involved in broad cyber and industrial espionage to thoroughly acquire intellectual characteristics, sensitive data, and military secrets from different nations to bolster its own military and economy. China has invested strongly in advancing AI, quantum computing, and big data to improve both its defensive and offensive cyber processes.

Europe: Strict regulatory environment

Europe is significantly growing in the market as this region's vigorous government environment, specifically the GDPR, means data breaches output in huge fines and reputational injury. This high-stakes environment necessitates advanced intelligence to prevent and mitigate threats. Europe's complex, cross-border commerce and industrial sectors create a large attack surface that is exploited by sophisticated threat performers.

UK: Strong public health initiatives

The UK is a rapid target for both state-sponsored espionage and cybercrime, making it a hotbed for threat intelligence advancement and a significant market for cybersecurity organizations. The UK is vigorously pursuing leadership in regions such as AI-driven, which is closely tied to cybersecurity. This includes advancing secure AI-driven capabilities, which in turn drives the demand for progressive threat intelligence solutions.

The Cyber Shield: Latin America's Rapid Climb in Threat Intelligence Adoption

The Latin American market is expanding rapidly as organizations face an increasing volume and sophistication of cyberattacks, including ransomware, phishing, and state-sponsored intrusions. Growing digital transformation across banking, healthcare, government, and manufacturing sectors is driving demand for advanced threat intelligence solutions that provide real-time monitoring, analysis, and actionable insights.

Brazil Threat Intelligence Market Trends

Brazil's market is growing strongly as enterprises and government agencies increase cybersecurity investments to counter rising cyber threats, including ransomware, data breaches, and targeted attacks. The rise of digital transformation, especially in finance, e-commerce, healthcare, and utilities, is driving demand for real-time threat intelligence solutions that enhance detection, response, and proactive risk mitigation.

Value Chain Analysis

- Research and development

The foundation of the threat intelligence market lies in its research and development practices. This stage is a critical one as hackers and cybercriminals are constantly refining their tactics to attack their targets. This pushes organizations to innovate continuously. Several enterprises partner up with universities, research institutions, cyber security think tanks and also government bodies to bring fresh insights into threat behavior and patterns, thus helping shape cyber defense practices on a global scale.

Key players: IBM security, Palo Alto Networks, Cisco Systems, Broadcom (Symantec)

- Product development and integration

Once the theoretical models are conceptualized, the next step is transforming them into deployable solutions such as TIPs, UEBA and SIEMs. This stage has a strong emphasis on scalability, flexibility, adaptability and cost effectiveness, enabling companies to carry forward seamless integration processes and adopt layered security architectures. The advantage here is the ability to combine various tools for a greater resilience rather than relying on a single point defense.

Key players: FireEye, Splunk, LogRhythm, RSA Security

- Distribution practices and end user adoption

The most important aspect of this market is how effectively do threat intelligence systems reach enterprises, governments and managed security service providers. This includes direct sales channels, channel partners, cloud marketplaces as well as retailers. Cloud based delivery models have lowered entry barriers, making it easy for small scale and medium scale enterprises to access high quality threat intelligence systems. This adoption is also driven by the fact that cyber security is now being viewed as a business priority.

Key players: CrowdStrike, Trend Micro, SentinelOne, Fortinet

Top Vendors in the Threat Intelligence Market & Their Offerings

|

Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

|

IBM |

United States. |

Extensive investment in research and innovation |

IBM's threat intelligence focus includes large-scale credential theft, phishing with infostealers, and vulnerability exploitation |

|

Cisco |

United States |

Strong brand reputation |

Cisco introduced AI cybersecurity technologies and deepened ServiceNow collaboration, tackling evolving AI threats and talent shortages in cybersecurity. |

|

Trend Micro |

Japan |

Multi-platform protection |

Trend Micro's threat intelligence is heavily focused on the impact of Artificial Intelligence (AI) on the cyber threat landscape. |

|

McAfee |

United States |

High durability and robustness |

McAfee's consumer solutions are designed to defend against various threats, including malware, ransomware, phishing attacks, and identity theft. |

|

Anomali, Inc. |

California |

Unified security operations |

Anomali supports security teams' shift from raw data to operational intelligence, allowing faster, more precise identifications of cyber threats. |

Recent Developments

- In August 2025, Cyware launched their Open Source AI-Powered Threat Response Tool at Black Hat USA 25 where they highlighted their approach to artificial intelligence, exploring how AI can drive real operational value. One of Cyware's biggest moments was the announcement of its open source Model Context Protocol (MCP) Server. The platform is designed to securely connect large language models (LLMs) with Cyware's threat intelligence and automation ecosystems, allowing AI to interpret natural language requests and convert them into real-world actions while maintaining full context and control.

(Source: https://www.thefastmode.com) - In August 2025, SOCRadar launched its new Agentic Threat Intelligence Platform, which automates threat intelligence through the deployment of autonomous AI agents that proactively detect, analyze, and respond to external threats with minimal human intervention and unmatched speed and accuracy. SOCRadar's AI agents track threats, assess context, and trigger the right response autonomously, helping organizations be more protected and supported.

(Source: https://www.morningstar.com)

Segments Covered in the Report

By Type

- Strategic Intelligence

- Operational Intelligence

- Tactical Intelligence

By Component

- Solutions

- Services

By Component (Solution Sub-Segments)

- Threat Intelligence Platforms (TIP)

- SIEM

- IAM

- SVM

- UEBA

- Incident Forensics

By Application

- SIEM

- Governance Risk & Compliance (GRC)

- Business Continuity

By Deployment Mode

- Cloud

- On-Premise

- Hybrid

By Industry Vertical

- BFSI

- IT & Telecom

- Healthcare

- Retail

- Manufacturing

- Energy & Utilities

- Government & Defense

- Education

- Transportation

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting