What is the Cosmetic Polymer Ingredients Market Size?

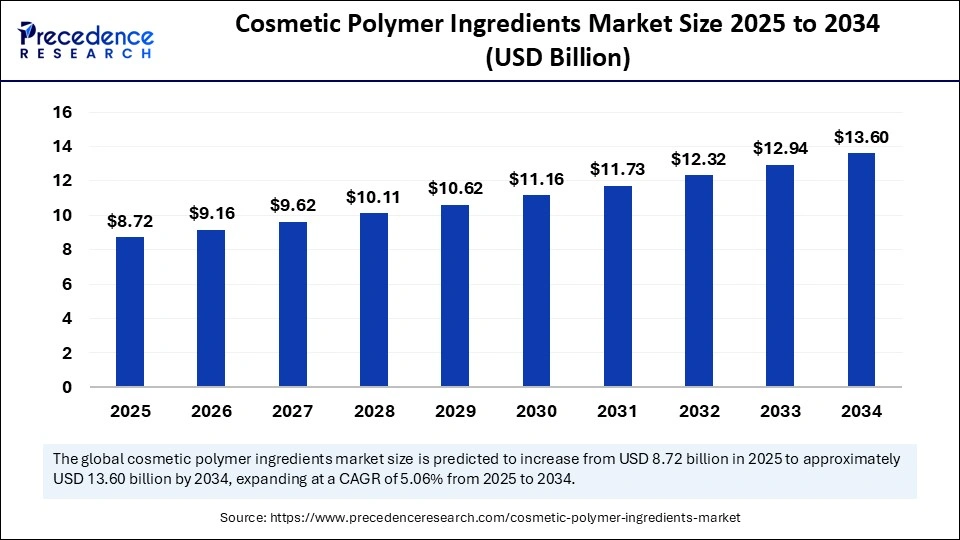

The global cosmetic polymer ingredients market size was calculated at USD 8.30 billion in 2024 and is predicted to increase from USD 8.72 billion in 2025 to approximately USD 13.60 billion by 2034, expanding at a CAGR of 5.06% from 2025 to 2034. The market is growing due to rising demand for advanced formulations that enhance product texture, stability, and performance in skincare, hair care, and personal care products.

Market Highlights

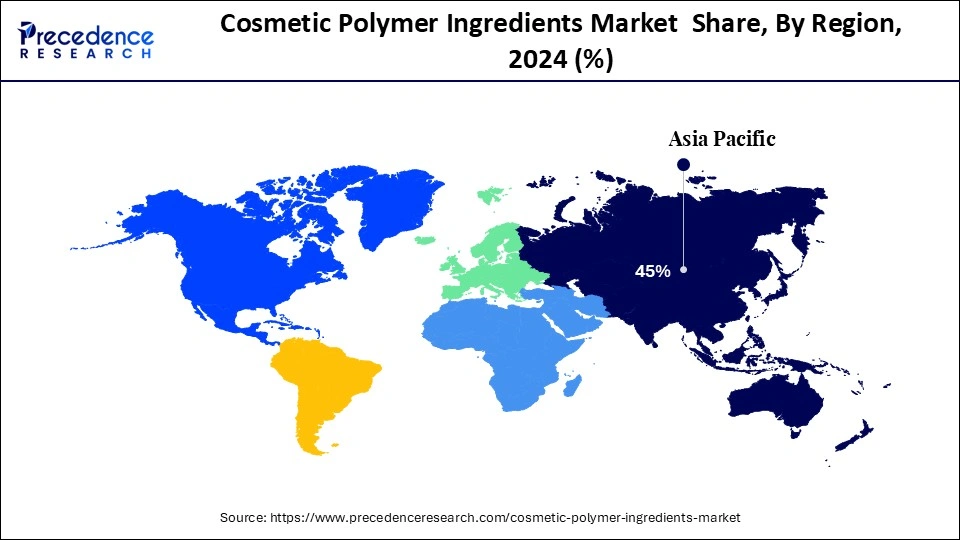

- Asia Pacific dominated the cosmetic polymer ingredients market with the largest market share of 45% in 2024.

- Latin America is expected to grow at the fastest CAGR during the forecast period.

- By product type, the acrylic polymers segment held the biggest share of 32% in 2024.

- By product type, the silicon polymers segment is expected to grow at the fastest CAGR during the forecast period.

- By application, the skincare segment captured the biggest market share of 40% in 2024.

- By application, the haircare segment is projected to grow at the fastest CAGR during the forecast period.

- By functionality, the thickeners segment contributed the maximum market share of 28% in 2024.

- By functionality, the surfactants segment is the fastest-growing during the forecast period

- By source, the synthetic segment generated the major market share of 70% in 2024.

- By source, the natural polymers segment is projected to grow at the fastest CAGR during the forecast period.

Market Size and Forecast

- Market Size in 2024: USD 8.30 Billion

- Market Size in 2025: USD 8.72 Billion

- Forecasted Market Size by 2034: USD 13.60 Billion

- CAGR (2025-2034): 5.06%

- Largest Market in 2024: Asia Pacific

- Fastest Growing Market: Latin America

Market Overview

What is the Cosmetic Polymer Ingredients Market?

The market for cosmetic polymer ingredients is growing because of increased demand for sophisticated formulations that enhance the feel, stability, and functionality of skincare, haircare, and personal care products. Businesses are being encouraged to invest in green chemistry and AI-driven research by the growing consumer interest in bio-based and sustainable polymers. Product innovation is evolving in response to the increased use of natural and recycled raw materials, as well as regulatory pressure to reduce reliance on petrochemicals.

- In January 2025, L'Oreal & IBM announced a generative AI model for advanced cosmetic formulations.(Source: https://www.personalcareinsights.com)

How Is Artificial Intelligence Impacting the Cosmetic Polymer Ingredients Market?

Artificial intelligence is transforming the market for cosmetic polymer ingredients by enabling the development, testing, and introduction of innovative polymer solutions that enhance sustainability, stability, and texture. AI-powered tools facilitate the rapid discovery of petroleum-based polymer substitutes and the creation of more effective, cleaner formulations.

- In January 2025, Cargill Beauty introduced its AI-based polymer mapping tool to support natural polymer selection.(Source: https://www.personalcareinsights.com)

Cosmetic Polymer Ingredients Market Outlook

- Industry Growth Overview: The cosmetic polymer ingredients market is growing due to rising demand for multifunctional, high-performance, and sustainablepersonal care products. The Asia Pacific region dominates consumption due to its strong R&D capabilities and high disposable incomes. Advanced biodegradableand natural polymers are enhancing product stability, texture, and delivery of active ingredients.

- Sustainability Trends: Companies focus on eco-friendly, bio-based polymers and low-impact production methods. Compliance with global regulations andtransparent labelling ensures safe and responsible formulation.

- Global Expansion: Businesses expand through partnerships, joint ventures, and regional manufacturing. Collaborations with cosmetic brands and academicinstitutions drive innovation and knowledge sharing.

- Major Investors: Key players include BASF, Dow Chemicals, Croda, Clariant, L'Oreal, and Evonik Industries. Cosmetic brands like Estee Lauder, Unilieve, and Shiseidoinvest in polymer R&D and sustainable sourcing to enhance product performance and sustainability.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 8.30 Billion |

| Market Size in 2025 | USD 8.72 Billion |

| Market Size by 2034 | USD 13.60 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.06% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Latin America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Application, Functionality, Source, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Consumer Preference for Naturally Sourced Products

The cosmetic polymer ingredients market is being greatly impacted by growing awareness of health and skin safety. Businesses are innovating and incorporating natural and organic ingredients into their formulations due to consumers' increasing preference for products that utilize these ingredients.

- In April 2024, Lubrizol Corporation announced the launch of its Carbopol Fusion S-20 polymer, a biodegradable rheology modifier for skin cleansing and hair care.(Source: https://personalcaremagazine.com)

Advancements in Polymer Technology

Polymer science research and development continue to produce new ingredients that enhance the functionality and sensory qualities of cosmetics. These developments enable the creation of polymers with improved compatibility across various skin types, controlled release characteristics, and enhanced stability.

Restraints

High Cost of Advanced Polymers

Advanced polymer ingredients, particularly those of natural or biodegradable types, are more expensive than conventional polymers. This increases the formulation costs, which may affect adoption among smaller cosmetic brands. High prices can also limit manufacturers' ability to maintain competitive pricing in the market.

- In September 2024, Tri-K Industries introduced Fision EcoSil, an upcycled emollient as a natural silicone alternative. The development of such specialized, naturally-sourced ingredients reflects an industry-wide trend toward higher-cost, advanced polymers designed to meet consumer demands for clean beauty.

(Source: https://www.tri-k.com)

Complex Regulatory Compliance

Manufacturers face challenges in meeting diverse global regulations regarding cosmetic ingredients. Stricter safety, labeling, and environmental guidelines can slow down product launches and increase compliance costs. Failure to meet compliance requirements can lead to fitness or product recalls, which can negatively impact brand reputations. Navigating region differences in chemical standards adds further complexity for multinational companies.

Opportunities

Rising Demand for Sustainable and Biodegradable Polymers

Opportunities for naturally sourced and biodegradable polymers are being created by consumers' preference for green products and growing environmental consciousness. To attract environmentally conscious customers, brands can experiment with sustainable polymers. Businesses can also stand out in a crowded market and support global sustainability objectives by implementing plant-based and renewable polymers.

Expansion in Emerging Markets

Increasing urbanization, rising disposable incomes, and growing awareness of personal care products in regions such as the Asia-Pacific, Latin America, and the Middle East present significant opportunities. Companies can introduce affordable cosmetic polymer products tailored to local preferences and needs. Emerging markets also offer potential for partnerships with local manufacturers to expand reach and distribution.

Segmental Insights

Product Type Insights

What Factors Contributed to the Dominance of the Acrylic Polymers Segment in the Cosmetic Polymer Ingredients Market?

The acrylic polymers segment dominated the cosmetic polymer ingredients market in 2024, as they can enhance texture and film-forming properties in various cosmetic formulations, while also being stable and adaptable. Their long-lasting effects improve spreadability and increase moisture retention, making them a proper choice among manufacturers worldwide for skincare, hair care, and makeup products.

- In September 2025, Seppic offers eco-designed polymers, like the Sepilife range, providing performance with naturality for thickening, emulsifying, and texturizing.(Source: https://www.seppic.com)

The silicon polymers segment dominated the cosmetic polymer ingredients market because of their superior sensory feel, water resistance, and ability to impart smoothness and shine to hair and skin. Their lightweight and non-greasy properties are driving adoption in high-end skincare, hair serums, and makeup formulations, particularly in premium and specialty products.

Application Insights

Why Did the Skincare Segment Dominate the Cosmetic Polymer Ingredients Market in 2024?

The skincare segment dominated the cosmetic polymer ingredients market, driven by rising demand for moisturizing and anti-aging products as well as rising consumer awareness of skin health. All across the world, polymers are essential in skincare formulations because they improve the texture, efficacy, and delivery of active ingredients in creams, lotions, and serums.

The hair care segment is experiencing rapid growth due to increasing consumer interest in hair health, styling, and repair solutions. Polymers help improve manageability, frizz control, shine, and longevity of hair care products, which is driving their rapid adoption in shampoos, conditioners, and styling products.

- In August 2024, Unilever showcased new technologies shaping the market for hair repair, with brands like TRESemmé leveraging technology for shine-boosting effects, reflecting the focus on advanced polymer formulations for hair health.(Source: https://www.unilever.com)

Functionality Insights

Why Did the Thickeners Segment Dominate the Cosmetic Polymer Ingredients Market in 2024?

The thickeners segment dominates the cosmetic polymer ingredients market because they give cosmetic products stability, improved sensory qualities, and viscosity control. They are frequently used to enhance texture consistency and product performance in skincare, hair care, and personal care products, guaranteeing a high-end customer experience.

Surfactants are the fastest-growing segment in terms of functionality, as demand for mild yet effective cleansing agents increases. Polymers acting as surfactants enhance foaming, cleansing, and emulsification properties in personal care products, including shampoos, body washes, and facial cleaners, driving growth in this segment.

Source Insights

Why Did the Synthetic Segment Dominate the Cosmetic Polymer Ingredients Market in 2024?

Synthetic segments dominate the cosmetic polymer ingredients market because they are widely accessible, priced, and of consistently high quality. They are the go-to option for large-scale production of personal care products because they offer consistent performance, stability, and compatibility across a variety of cosmetic formulations.

Natural polymers are the fastest-growing segment as consumers increasingly seek eco-friendly and sustainable ingredients. Derived from plant-based or renewable sources, these polymers appeal to environmentally conscious consumers and are gaining adoption in organic and clean-label cosmetic products.

Regional Insights

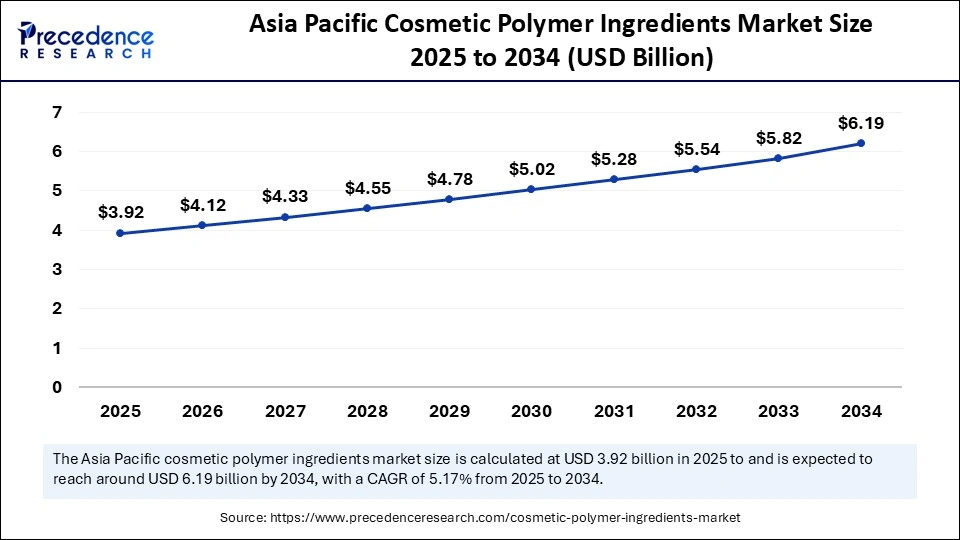

Asia Pacific Cosmetic Polymer Ingredients Market Size and Growth 2025 to 2034

The Asia Pacific cosmetic polymer ingredients market size was exhibited at USD 3.74 billion in 2024 and is projected to be worth around USD 6.19 billion by 2034, growing at a CAGR of 5.17% from 2025 to 2034.

What Made Asia Pacific Dominate the Cosmetic Polymer Ingredients Market in 2024?

The Asia Pacific dominates the cosmetic polymer ingredients market due to a combination of a high population, rising disposable income, increasing beauty consciousness, and a strong cosmetic manufacturing infrastructure. The region also benefits from rapid urbanization and the presence of leading cosmetic brands, driving overall polymer demand.

Latin America is the fastest-growing region, driven by increasing awareness of personal care products, a growing middle-class population, and expansion in retail and e-commerce channels. Rising consumer demand for premium and natural formulations is fueling the adoption of cosmetic polymers in skincare, haircare, and color cosmetics.

Cosmetic Polymer Ingredients Market Companies

- BASF

- Dow Chemical

- Evonik Industries

- Ashland Global

- Croda International

- Solvay

- Clariant

- Wacker Chemie AG

- Huntsman Corporation

- Sika AG

- Lubrizol Corporation

- AkzoNobel

- Kao Corporation

- Momentive Performance Materials

- Siltech Corporation

- Innospen

- Eastman Chemical Company

- Biochemica International

- Sumitomo Seika Chemicals Co., Ltd.

- Elementis PLC

Recent Developments

- In June 2025, Clariant introduced its new AddWorks PPA product line, a next-generation polymer processing aid (PPA) solution designed for polyolefin extrusion applications. These PFAS-free aids aim to provide sustainable alternatives to conventional fluoropolymer-based processing aids while maintaining strong performance standards.(Source: https://www.clariant.com)

- In September 2025, Croda International Plc launched Zenakine, a biotech-based neuroactive ingredient designed to counteract the effects of stress on the skin. Developed in collaboration with the University of Manchester and SkinBiotherapeutics plc, Zenakine was introduced at In-cosmetics Global 2025.

(Source: https://www.croda.com)

Segments Covered in the Report

By Product Type

- Acrylic Polymers

- Polyurethane Polymers

- Silicone Polymers

- Natural Polymers

- Polyester Polymers

- Polyvinyl Alcohol (PVA) Polymers

- Epoxy Polymers

- Polyethylene Glycol (PEG) Polymers

By Application

- Skincare

- Hair Care

- Color Cosmetics

- Fragrance

- Nail Care

- Oral Care

By Functionality

- Film Formers

- Thickeners

- Emulsifiers

- Stabilizers

- Conditioners

- Surfactants

- Anti-aging Agents

- UV Filters

By Source

- Synthetic

- Natural

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting