What is Data Center Generator Market Size?

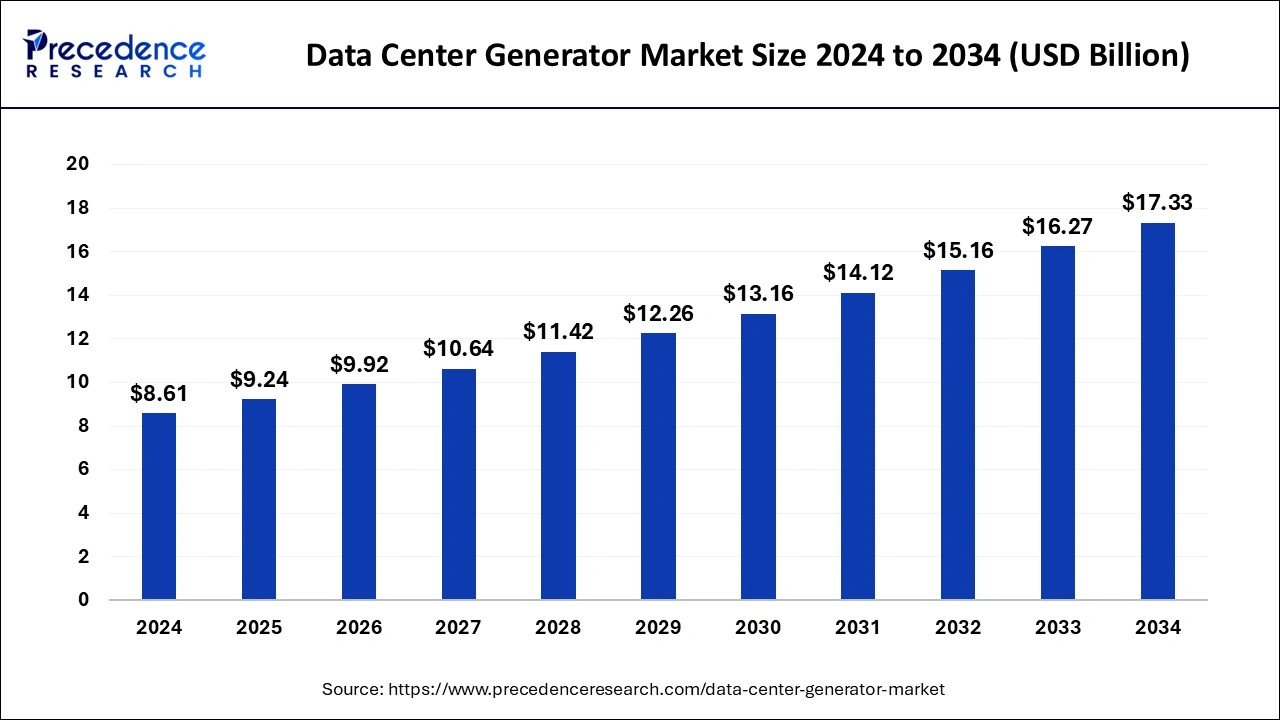

The global data center generator market size accounted for USD 9.24 billion in 2025 and is predicted to increase from USD 9.92 billion in 2026 to approximately USD 17.33 billion by 2034, expanding at a CAGR of 7.25% from 2025 to 2034. At the time of power failures and power crunches, data center generators are helpful, which increases the demand for generators in data centers.

Market Highlights

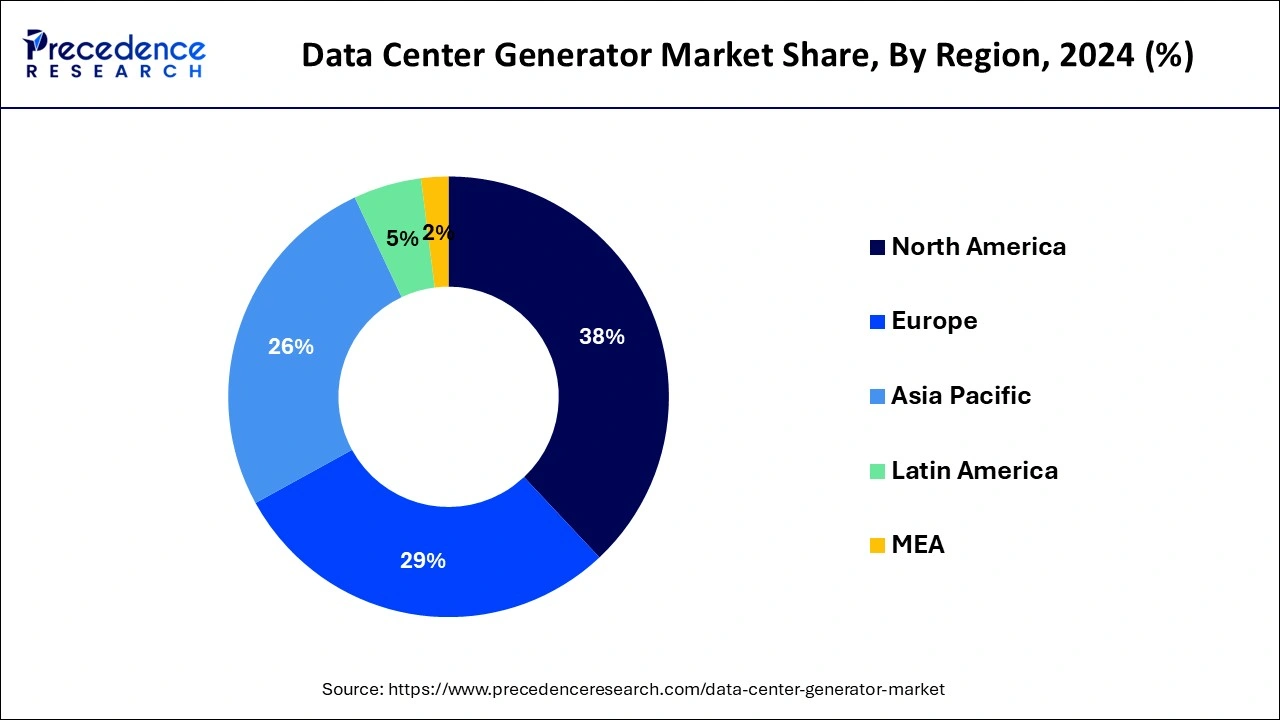

- The North America data center generator market size accounted for USD 3.05 billion in 2024 and is expected to attain around USD 6.18 billion by 2034.

- North America dominated the market with the major market share of 38% in 2024.

- Asia Pacific is estimated to grow at a notable CAGR of 9.74% during the forecast period of 2025-2034.

- By product type, the diesel type segment has generated more than 74% of market share in 2024.

- By product type, the gas type segment is the growing at a remarkable CAGR of 8.95% during the forecast period.

- By tier standards, the tier I & II segment has accounted the biggest market share of 54% in 2024.

- By tier standards, the tier IV segment is projected to expand at a CAGR of 8.93% during the forecast period.

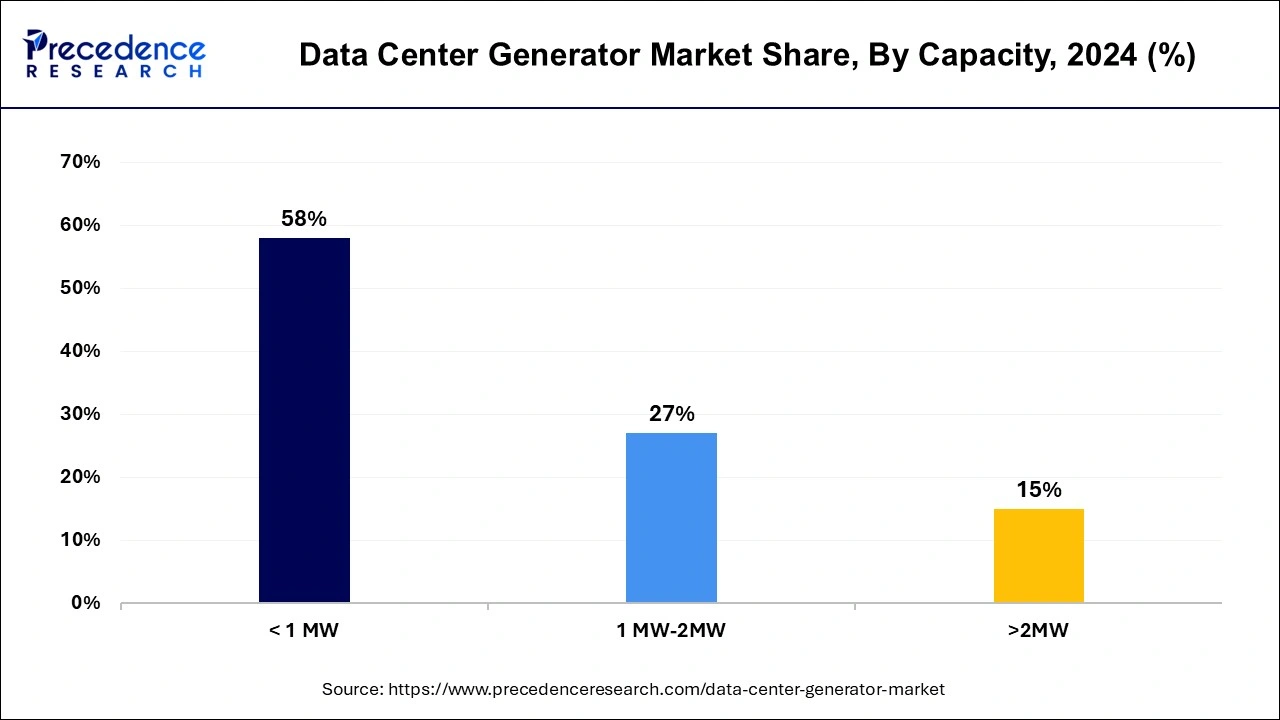

- By capacity type, the <1MW segment has recorded more than 58% of market share in 2024.

- By capacity type, the 1MW-2MW segment is the growing at a 7.05% during the forecast period.

Market Overview

The data center generator is a piece of equipment used to provide backup power to the data center. The data center generator market deals with providing backup power supply sources during power interruption for various industries like hospitals, data centers, construction sites, and other applications. The data center generators are the main point for processing, storing, and distributing high volumes of applications and data for businesses. The data center generators help to meet the requirements of consumers with condition, quality, and sustainable needs.

The data center generators provide fuel efficiency, sustainability, noise suppression, emission reduction, block load acceptance, quick start capability, and transient response, which are helpful advantages. When data centers lose their main power source, generators provide peace of mind by providing a backup power supply. In an emergency, generators are helpful for data centers and offer peace of mind to the employees and clients.

Data Center Generator Market Growth Factors

- The data center generators are beneficial for environmental responsibility and cost savings due to sustainability and fuel efficiency.

- Noise suppression and emission reduction are helpful due to the use of environmentally friendly generators.

- The data center generators are helpful due to block load acceptance, quick start capabilities, and transient response.

Market Growth Overview:

- Between 2025 and 2034, the data center generator market is expected to grow rapidly, driven by the ongoing spread of cloud computing, hyperscale data centers, and edge computing networks worldwide. The surge in AI-, IoT-, and 5G-related data traffic has created an urgent need for a reliable, continuous power supply. Diesel, gas, and hybrid generators are increasingly used because they provide scalable, high-capacity backup power during outages or unstable grids. Government initiatives on critical infrastructure resilience and energy security are also impacting the market and speeding up the global installation of generators.

- Sustainability Trends: Sustainability is becoming a key differentiator in the market as operators aim to reduce carbon emissions and meet ESG commitments. The use of low-emission, LNG-powered, and hybrid generators is on the rise, and new energy management systems are also in development, incorporating renewable energy sources such as solar and wind. The main players, such as Cummins, Wartsila, and Atlas Copco, are heavily focused on R&D to improve fuel efficiency, reduce operational costs, and lessen environmental impact.

- Global Expansion: Leading vendors are aggressively expanding their global manufacturing and service networks to meet the increasing demand for reliable power solutions. Atlas Copco, Siemens AG, and Generac have been actively investing in regional facilities and service centers to enable quicker response times for critical power deployments.

- Major Investors: Major investors in the market include global companies such as Caterpillar, Cummins, and Rolls-Royce, which provide high-performance backup power solutions critical for ensuring uninterrupted data center operations. These companies contribute by developing and supplying reliable, efficient generators, incorporating advanced technologies like hybrid systems and remote monitoring, and expanding their product offerings to meet the growing demand for data storage and processing capabilities in both established and emerging markets.

- Startup Ecosystem: The startup ecosystem is flourishing, with companies focusing on creating energy-efficient, modular, and smart power solutions. Firms like Aggreko, Blue Energy Systems, and Wartsila Microgrids are introducing IoT-enabled generators, hybrid power integration, and scalable microgrids. Startups are also targeting automation, predictive analytics, and real-time monitoring, leading to higher uptime and reduced operational risks. Innovation, flexibility, and environmental performance are shaping startups as key disruptors in a market traditionally led by legacy industrial players.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 9.24 Billion |

| Market Size in 2026 | USD 9.92 Billion |

| Market Size by 2034 | USD 17.33 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.25% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Capacity, and Tier Standards Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Energy backup

During a power outage, there is an instant requirement for energy backup or a power generator. Datacenter generators are useful for energy backup due to their number of properties, like low engine emission calibration, low sub-transient alternators, and high ambient cooling systems. The data center generator is helpful energy backup because it avoids data loss and maintains a functioning period. It also offers peace of mind for the employees and clients during the period of power interruption. Data outages have no effect on workers in different industries due to power backups in the form of generators. These factors of energy backup contribute to the growth of the data center generator market.

Restraint

Regulatory compliance

Regulatory compliance regulations include energy consumption regulations, regulation on greenhouse gas emission restrictions, electronic and electric waste regulations, water consumption regulations, regulations on noise emissions, and electrical safety regulations. Many countries have regulations based on energy consumption due to zero emission goals and an increase in carbon neutrality. European Commission has modified the energy consumption regulations and included requirements for energy data reporting for data center generators.

The data center generators may emit some harmful greenhouse gases, and regulations on greenhouse gases will be changed accordingly. Many regions have banned specific greenhouse gas use. Regulations on electronic and electric waste due to toxic substances releases from the waste of the data center generators.

The data center generators have considered the regulations for preventing water pollution and water stress. Regulations on noise emissions are also important due to issues regarding the safety and health of the neighboring peoples. The noise emission has a negative impact on the workers who work in the data center generators. Arc flash, high voltage circuits, and panels are hazards at the data center generators, and there is a need for electrical safety regulations. Therefore, the regulations can restrict the growth of the data center generator market.

Opportunity

Increasing greener and sustainable future

Generators are an important component in data centers' functioning. When the data center stops working during power outages, it must instantly be powered by the backup power supply generator. A transition from the use of fossil fuels to other sustainable resources like wind energy and solar energy minimizes the power outage. Increasing the hydrogen fuel cell generator supply chain as an alternative to diesel for the power backup supply.

The data center generator can be developed in terms of greenery and sustainability. Implementation of hydrogen power fuel cell generators can help with renewable energy. Because it generates electricity, the chemical reaction between oxygen and hydrogen and the byproduct will only heat and water. These opportunities can help the growth of the data center generator market.

Segment Insights

Product Type Insights

The diesel segment dominated the market in 2024. The diesel product type segment of data center generators never goes offline. Diesel generators are used in data center generators for backup power. Modern diesel generators are getting better features than earlier models of diesel generators. Modern diesel generators overcome maintenance costs and higher noise. Diesel generators are low maintenance because they require fewer components to start and need not change spark plugs like gas generators. These are durable and safe storage. Diesel has lower ignition risks than other types of fuel, such as gasoline, which helps to store diesel generators safely.

It can run longer periods and handle larger power loads than the other types of generators. These diesel generators are stronger and more reliable. This requires diesel, which is an easily accessible fuel that we use for vehicles, which means there is no need for different fuels. Diesel generators are more fuel-efficient than petrol generators. Diesel fuel and generators require less cost and less maintenance than petrol fuel and generators. These factors help to the growth of the segment and contribute to the growth of the data center generator market.

The gas type segment is observed to be the fastest growing during the forecast period in the data center generator market. Gas generators are used in data center generators because they provide reliability and cutting-edge performance. Gas generators are made in storage with the reliability of gas, which avoids the risk of refueling and limited run times. They are beneficial due to lower emissions and instant start gas generators. Gas generators are helpful in data center generators because they provide decriminalization opportunities. These factors are helpful for the growth of the market.

Tier Standard Type Insights

The tier I & II segment dominated the data center generator market in 2024. Tier-I type has a single path for cooling and power. Backup and extra components, including storage and power superabundance, are non-existent or little. The tier-I data center generator option is the cheapest for small, traditional businesses. Tier-II data center generator has more measures and infrastructures to ensure slighter sensitivity to unpredicted downtime. Tier-II data center generators must have extra capacity, such as auxiliary generators, cooling systems, and uninterrupted power supply (UPS). These factors of tier-I and tier-II help to the growth of the market.

The tier IV segment is the fastest growing during the forecast period. The tier-IV is an essential level of data center generator tiers. The tier IV type data center generator is completely fault resistant, and it also includes requirements for tier I, tier II, and tier III types. These factors help to the growth of the data market. However, tier-IV type standards are more expensive than tier-I and tier-II type standards.

Capacity Insights

The <1MW segment dominated the data center generator market in 2024. The amount of electricity generated by the generator is within a specific period. If a generator with 1MW power operates constantly for 1 hour, it will produce 1MWh of electricity, and the same for a 0.5MW power generator operates for 1 hour, it will produce 0.5 MWh of electricity. In various sectors, 0.5 MW of power generators are normally required.

The <1MW generator applications in various industries, including entertainment events, manufacturing facilities, maintenance upgrades, pulp or paper mills, construction sites, agriculture, municipalities, forestry, mining, oilfield, and other applications. Its ability to extend and fuel many fans, pumps, and motors can used for backup power supply during a power outage. This leads to the growth of the segment and contributes to the growth of the market.

The 1MW-2MW segment is observed to be the fastest-growing segment during the forecast period in the data center generator market. The 1MW-2MW generators have various applications due to their compact size, low weight, high power density, efficiency, higher reliability, lower maintenance, operational flexibility, and versatility properties. Design features and advanced technologies lead to reliability improvement and less cost due to generators' lifespan. The 1MW-2MW generators are used in diesel generator sets, high-speed motors or generators, Generac single-engine generators, and Generac Modular Power Systems (MPS). These applications and various properties of 1MW-2MW generators help the growth of the segment and contribute to the growth of the market.

Regional Insights

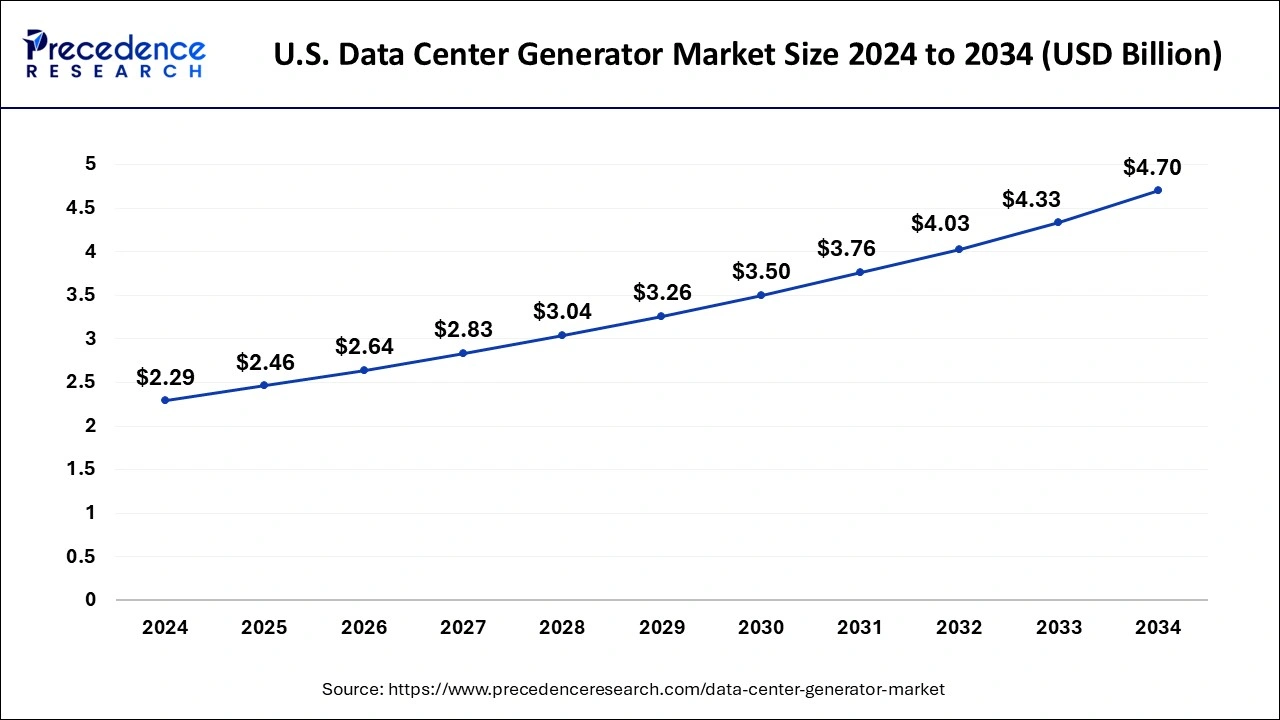

U.S. Data Center Generator Market Size and Growth 2025 to 2034

The U.S. data center generator market size is exhibited at USD 2.46 billion in 2025 and is projected to be worth around USD 4.70 billion by 2034, growing at a CAGR of 7.45% from 2025 to 2034.

U.S. Data Center Generator Market Analysis

The U.S. dominated the North American data center generator market in recent years and is expected to maintain its leadership as demand for sustainability grows. Efforts to mitigate carbon footprints are driving the adoption of low-emission and hybrid generators, while service-based fuel management, predictive analytics, and ongoing maintenance solutions further enhance the long-term sustainability and efficiency of generator deployments.

North America dominated the data center generator market in 2024.Increased awareness and use of advanced technologies in data center generators contribute to the growth of the market. Increased use of internet-connected devices is helpful for data center generators. Industries depend upon data analytics and data to increase cost-effectiveness, security, productivity, and efficiency, which contributes to the growth of the market. Increasing the number of data center generators helps the growth of the market in this region. The United States and Canada are the leading countries for data center generators in the North American regions.

- In October 2023, the latest Tier-IV final generators were launched by Aggreko, the world's leading provider of energy solutions, temperature control, and modular power for mobile in Canada. For Canadian customers, Aggreko offers low-emission technology with Canadian Standard Association (CSA) certifications, and its range is from 100kW to 500kW. The Tier IV type of generator designed by Aggreko follows emission regulations for diesel generators of the Canadian Environmental Protection Acts (CEPA) with the United States Environmental Protection Agency (EPA), which is helpful for Canada and the United States.

What Makes Asia Pacific the Fastest-Growing Market?

Asia Pacific is estimated to be the fastest growing region during the forecast period of 2025-2034 in the data center generator market. China and India are the leading countries in the Asia Pacific region that use data center generators. Market leaders increasing investment in developing countries such as China and India in the Asia Pacific region helps the growth of the market. To reduce carbon footprints, the Indian data center generators are holding up sustainability measures and renewable energy power contracts. Energy consumption regulations in energy management to follow green energy standards and policies are a must factor in the newly designed data centers in China. These factors help to the growth of the data generator market in the Asia Pacific region.

China Data Center Generator Market Analysis

China is the largest and fastest-growing market for data center generators in the Asia Pacific region, driven by the rapid expansion of hyperscale data centers supported by domestic cloud providers. The high demand for backup generators with substantial capacity is also driven by grid reliability issues in some areas, making on-site power generation essential to maintain operational continuity.

What Potentiates the Growth of the Data Center Generator Market in Europe?

Europe is expected to experience steady market growth, driven by expanding data center infrastructure and stricter environmental regulations. The move toward hybrid, gas-powered, and low-emission generator systems is likely be fueled by increasing regulatory focus on carbon emissions and improved energy efficiency. These sustainability requirements and high operational standards probably promote further growth in the number of generators in the region.

Germany Data Center Generator Market Analysis

Germany is a leading contributor to the European data center generator market, with colocation and hyperscale data centers becoming significant hubs in Frankfurt and Berlin, driving high demand for backup power infrastructure. Strict European Union environmental and sustainability policies are also pushing operators to adopt gas-powered, low-emission, and hybrid generator systems to meet regulatory standards.

How is the Opportunistic Rise of Latin America in the Market?

Latin America is experiencing an opportunistic rise in the data center generator market, with Brazil and Mexico emerging as the primary contributors. The growing shift towards cloud-based infrastructure, digital services, and enterprise-level data centers is driving demand for modular, scalable generator solutions, while both international and local suppliers are expanding their services and spare parts offerings to meet regional needs. Brazil is leading the market. Regular blackouts and grid unpredictability in rural areas make it essential to have stable backup systems in data centers. Domestic companies are investing in Service networks, spare parts, and maintenance services to meet the rising demand.

What Opportunities Exist in the Middle East & Africa (MEA) for the Market?

The Middle East & Africa offer significant opportunities for the data center generator market, driven by recent activities from sovereign wealth funds, international cloud service providers, and domestic colocation companies. As a result, demand for high-capacity diesel, gas, and hybrid generators is rising, while sustainability regulations and environmental practices are driving the adoption of eco-friendly, low-energy-consumption solutions in the region.

UAE Data Center Generator Market Analysis

The UAE is emerging as a major player in the data center generator market within the Middle East & Africa, driven by significant investments from sovereign wealth funds, global cloud providers, and colocation developers. The growing focus on scalable, resilient power solutions is further supported by sustainability initiatives and the regional emphasis on adopting low-emission and hybrid generators to align with clean-energy goals.

Data Center Generator Market – Value Chain Analysis

- Raw Material Sourcing

The foundation of generator production relies on the procurement of essential raw materials such as steel, copper, aluminum, and high-grade alloys for engine and alternator manufacturing.

Key Players: ArcelorMittal, Nucor Corporation, Hindalco Industries, Outokumpu - Component Fabrication

Raw materials are processed into critical generator components, including engines, alternators, control panels, fuel systems, and cooling systems.

Key Players: Cummins, Mitsubishi Heavy Industries, Siemens AG, Atlas Copco - Generator Assembly & Manufacturing

Individual components are assembled into complete generator sets, with diesel, gas, or hybrid engines, ensuring compliance with power output, noise, and emission standards.

Key Players: Caterpillar, Generac Power Systems, HIMOINSA, KOHLER - Testing & Quality Assurance

Assembled generators undergo rigorous testing for efficiency, reliability, load capacity, and emergency performance to meet industry and data center standards.

Key Players: Piller, Rolls-Royce, Wärtsilä, ABB Ltd - Integration & Deployment

Generators are delivered and integrated into data center power infrastructure, often with remote monitoring, automation, and connection to uninterruptible power supply (UPS) systems for seamless operations.

Key Players: Siemens AG, Cummins, Atlas Copco, Doosan Corporation - Operation, Maintenance & After-Sales Services

Continuous operation and scheduled maintenance, including fuel management, spare parts, and emergency servicing, are crucial for an uninterrupted data center power supply.

Key Players: Wärtsilä, Generac, KOHLER, HIMOINSA

Top Companies in the Data Center Generator Market & Their Offerings:

- Atlas Copco (Sweden): Atlas Copco provides high-performance generators and backup power solutions for data centers and industrial applications.

- ABB Ltd (Switzerland): ABB offers reliable power systems, including generators and energy management solutions, for critical infrastructure.

- Caterpillar (U.S.): Caterpillar delivers robust diesel and gas generators tailored for data centers, commercial, and industrial facilities.

- Siemens AG (Germany): Siemens supplies advanced power generation systems, including backup generators and integrated energy solutions for data centers.

- Cummins (U.S.): Cummins specializes in diesel, gas, and hybrid generators with a focus on efficiency and continuous power supply.

- Eurodiesel Services (Italy): Eurodiesel Services provides customized generator sets and maintenance solutions for high-demand industrial and data center environments.

- Generac Power Systems, Inc. (U.S.): Generac offers residential, commercial, and industrial backup generators, including scalable solutions for data centers.

- HIMOINSA (Spain): HIMOINSA manufactures diesel and gas generator sets with emphasis on modularity and reliable continuous operation.

- Yanmar Co. Ltd (Japan): Yanmar delivers compact and energy-efficient generators suitable for small- to mid-sized data centers and commercial facilities.

- KOHLER (U.S.): KOHLER offers a wide range of backup generators, including data center-ready solutions with advanced monitoring systems.

- MITSUBISHI MOTOR CORPORATION (Japan): Mitsubishi provides high-capacity diesel and gas generators for industrial and critical power applications.

- Doosan Corporation (South Korea): Doosan supplies robust generator systems and turnkey solutions for large-scale industrial and data center projects.

- Piller (Germany): Piller specializes in high-precision, uninterruptible power supply (UPS) generators for sensitive data center environments.

- Wärtsilä Corporation (Finland): Wärtsilä develops large-scale, fuel-flexible generators for reliable continuous power in industrial and data center facilities.

- Rolls-Royce Plc. (UK): Rolls-Royce provides high-capacity gas and diesel generators with a focus on efficiency, reliability, and critical power backup.

Recent Developments

- In August 2023, Mitsubishi Heavy Industries Engine and Turbocharger, Ltd (MHIET) launched a new 3000 KVA class generator, MGS3100R, for industrial needs including data centers, hospitals, commercial buildings, and factories for supplying power at the time of disasters, power failures, and power crunches.

- In November 2023, Hitachi Energy announced a new emission-free alternative like hydrogen power generators for diesel-powered generators. Hydrogen power generators provide heat for hard-to-decarbonize and megawatt (MW) power, which is beneficial for hospitals, data centers, remote venues, and construction sites.

- In November 2023, in Laurient, France, the local government containerized data center was launched to feature on-site solar and the utilization of free cooling. It has 48 hours of fuel supply generator backup; duel energy feeds from EDF, and duel fiber feed properties.

Segments Covered in the Report

By Product Type

- Diesel

- Gas

- Others

By Capacity

- < 1 MW

- 1 MW-2MW

- >2MW

By Tier Standards Type

- Tier I & II

- Tier III

- Tier IV

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting