What is the Data Center Immersion Cooling Market Size?

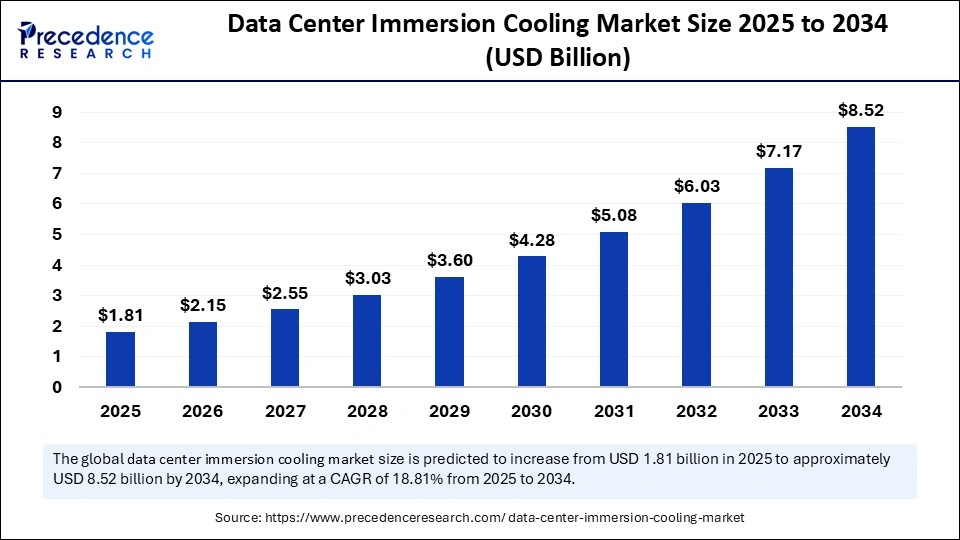

The global data center immersion cooling market size accounted for USD 1.52 billion in 2024 and is predicted to increase from USD 1.81 billion in 2025 to approximately USD 8.52 billion by 2034, expanding at a CAGR of 18.81% from 2025 to 2034. The market is driven by the rising demand for energy-efficient and sustainable cooling solutions to manage high-performance computing workloads.

Market Highlights

- North America dominated the data center immersion cooling market with the largest market share of 44% in 2024.

- Asia Pacific is anticipated to witness the fastest growth during the forecasted years.

- By product/cooling technology, the single-phase immersion segment held a significant share in 2024.

- By product/cooling technology, the two-phase immersion segment is anticipated to show considerable growth over the forecast period.

- By deployment/form-factor, the rack-level/in-rack tanks segment held a significant share in 2024.

- By deployment/form-factor, the module/pod/room-scale immersion modules segment is anticipated to show considerable growth in the market over the forecast period.

- By cooling fluid/coolant type, the mineral oil/hydrocarbon-based fluids segment held a significant share in 2024.

- By cooling fluid/coolant type, the synthetic dielectric fluids segment is anticipated to show considerable growth in the market over the forecast period.

- By application/workload, the high-performance computing (HPC)/AI training and inference segment held a significant share in 2024.

- By application/workload, the hyperscale cloud/data-center cores segment is anticipated to show considerable growth in the market over the forecast period.

Market Size and Forecast

- Market Size in 2024: USD 1.52 Billion

- Market Size in 2025: USD 1.81 Billion

- Forecasted Market Size by 2034: USD 8.52 Billion

- CAGR (2025-2034): 18.81%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

Market Overview

The data center immersion cooling market is a quickly emerging sector of the broader data center infrastructure that offers an emerging and advanced cooling technology to satisfy the growing demand for energy efficiency and high-density computing. Immersion cooling involves immersing servers or server parts in dielectric fluids either singly or in pairs, or immersing them in fluid tanks or fluid modules. They are being popularly deployed in hyperscale, colocation, enterprise, edge, and specialized data centers, where performance, energy efficiency, and sustainability are the key issues.

The trends of the data center immersion cooling market are motivated by the increasing usage of high-performance computing (HPC), artificial intelligence (AI), and big data analytics that demand an immense amount of processing power and produce significant heat loads. Government and organizations around the globe are also encouraging the use of energy-efficient technologies, which makes the world to be open to using renewable energies. With the ever-growing workloads in the data center due to cloud computing, the growth of 5G, and the implementation of edge deployments.

How is AI Integration Transforming the Data Center Immersion Cooling Market?

The data center immersion cooling market is being transformed at the stage of the incorporation of AI to guarantee the optimization of performance, efficiency, and reliability. Immersion cooling systems can have artificial intelligence to monitor real-time temperature, fluid flow, and energy consumption so that precautions can be implemented before the system overheats and fails. The AI is also used to enhance automation, reduce human involvement in monitoring and maintenance of the system, and improve system resilience. The future of green, smart data centres is being characterized by AI and immersion cooling, which is more dynamic, functional, and effective.

What Factors Are Fueling the Rapid Expansion of the Data Center Immersion Cooling Market?

- Rising Demand for High-Performance Computing and AI: The adoption of high-performance computing, artificial intelligence, and machine learning is increasing, and puts large workloads, which form greater heat densities. Compared to immersion cooling, tower cooling offers better thermal control and allows efficient processing with fewer downtimes, and therefore requires providing support to next-generation computing environments.

- Sustainability Goal and Energy Efficiency: The adoption is being driven by increasing attention to green data centers and the reduction of carbon footprint. Energy consumption can be significantly decreased through the utilization of immersion cooling since it lowers the utilization of traditional air conditioning and water-based cooling.

- Immersion Cooling Technology Developments: There are constant improvements in immersion technology, such as superior dielectric fluids, modular immersion systems, and superior controlling instruments, to make immersion cooling safer, less costly, and easier to install. These developments bring new colocation, enterprise, and edge data center usage to a massive scale and enhance performance, as well as reduce the maintenance requirements.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 1.52 Billion |

| Market Size in 2025 | USD 1.81 Billion |

| Market Size by 2034 | USD 8.52 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 18.81% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product/Cooling Technology, Deployment/Form-factor, Cooling Fluid/Coolant Type, Application/Workload, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Demand for High-Density Data Centers

The adoption of high-density data centers is an important driver of the data center immersion cooling market. Conventional air-cooling systems are finding it difficult to handle these thermal loads effectively, resulting in inefficiency in energy use, overheating, and shortening of the life of hardware. A better alternative is immersion cooling, which has the advantage of directly immersing the servers in dielectric fluids or placing them into fluid-filled modules, whereby a uniform and appropriate cooling of the servers can be achieved even at very high rack densities. This enables the data centers to be used vertically, and more computing power can be fitted in the same space without affecting the performance.

Restraint

High Initial Investment Costs

The high initial costs of implementing immersion cooling systems within data centers can act as a barrier to market growth. The immersion cooling necessitates special tanks, dielectric fluids, cooling unit pumps, and complicated monitoring instruments, which are expensive than traditional air-cooling systems. In addition, the process of retrofitting already operational data centers with immersion cooling can become costly in terms of infrastructure and can increase capital expenditure.

Opportunity

Expansion in Edge and Hyperscale Data Centers

The growing edge of computation and hyperscale data center construction rate is a massive opportunity for the data center immersion cooling market. These facilities need high-density server designs that generate high heat as the workloads of computing become increasingly decentralized and as the list of data processing needs expands. Immersion cooling solutions, in particular, are very effective in holding these thermal loads as well as reducing the energy consumption and operation costs.

Suppliers can use changing trends to capitalize on it by offering scalable, retrofit, and modular immersion cooling solutions with custom requirements in hyperscale and edge deployments. With many organizations opting to increase their digital infrastructure to facilitate cloud services, AI applications, and IoT devices, immersion cooling will be adopted in large numbers, and the segment will serve as an excellent investment and innovation choice.

Segment Insights

Product/Cooling Technology Insights

Why does the single-phase immersion segment lead the data center immersion cooling market?

The single-phase immersion segment led the data center immersion cooling market and accounted for the largest revenue share in 2024, because it is reliable, easy, and economical. In single-phase immersion cooling, the servers are dipped in a dielectric fluid that stays in a liquid state and absorbs heat and passes it to external cooling systems. The approach is simpler to manage and deploy than two-phase systems, and popular model in numerous hyperscale, enterprise, and colocation data centers. Also, the development of dielectric fluids and modular tank design, as well as monitoring systems, has improved the performance of the system, and single-phase immersion is a reliable solution in high-density workloads.

The two-phase immersion segment is expected to grow at a significant CAGR over the forecast period. The dielectric fluid in two-phase systems is changed into a vapor by absorbing heat in the servers, and therefore, it allows a rapid and highly successful thermal management of the dielectric fluid. The two-phase immersion allows higher rack densities, less requirement of extra cooling infrastructure, and may provide energy savings over the single-phase solutions. Since data centers are increasingly growing to address the requirements of cloud computing, edge computing, and hyperscale implementations, the two-phase immersion segment is becoming popular.

Deployment/Form-factor Insights

Why did rack-level/in-rack tanks contribute the most revenue in 2024?

The rack-level/in-rack tanks segment contributed the most revenue in 2024 and are expected to dominate throughout the projected period. Their simplicity in installation, as well as the opportunity to be retrofitted easily, make them popular systems because current data centers can adopt the immersion cooling without causing a substantial redesign. Rack-level solutions are localized thermal control solutions, which are a good fit to hyperscale, enterprise, and colocation sites interested in providing high-density server racks with effective cooling. Besides, the tank material and dielectric fluids, as well as monitoring innovations, have led to increased reliability and reduced energy usage.

The module/pod/room-scale immersion modules segment is expected to grow substantially in the data center immersion cooling market. These modular designs are advantageous to hyperscale operators, AI clusters, and prefabricated data center buildings because of fast deployment, scalability, and integration. Mod/ pods actually allow the operator to expand capacity rapidly and simultaneously provide efficient thermal control and energy savings. They would particularly be suitable for edge data centers and AI-centric deployments, where the space type is highly constrained, and workloads are dense; they should have flexible options.

Cooling Fluid/Coolant Type Insights

Why did the mineral oil/hydrocarbon-based fluids segment lead the data center immersion cooling market in 2024?

The mineral oil/hydrocarbon-based fluids segment led the data center immersion cooling market and accounted for the largest revenue share in 2024, owing to their established adoption and large number of installed bases. The fluids find extensive applications in a single-phase immersion system since they provide a good thermal management capability, good dielectric behavior, and can be purchased at relatively lower costs than engineered counterparts. Operators of data centers prefer the use of mineral oil and hydrocarbon-based fluids because they have a record of their compatibility with the existing hardware of the servers, low chances of corrosion, and long-term operational stability.

The synthetic dielectric fluids segment is expected to grow at a significant CAGR over the forecast period, because of the rising need for custom thermal management solutions. The fluids are optimized in thermophysical, environmental, and compatibility characteristics to promote cooling efficiency, minimize consumption, and promote high-density workloads. Also, engineered fluids could be differentiated to address sustainability requirements, including a smaller environmental footprint and recyclability, and it is in line with the global movement toward green data centers.

Application/Workload Insights

Why did high-performance computing (HPC)/AI and related high-density workloads contribute the most revenue in 2024?

The high-performance computing (HPC)/AI training and inference segment contributed the most revenue in 2024 and are expected to dominate throughout the projected period. The high workloads pose extremely high temperatures as a result of the heavy computational tasks, and this cannot be handled effectively by the traditional air-cooling systems. Immersion cooling offers better thermal operation, where servers can be made to run in dense configurations without limiting their performance or overheating. The immersion cooling was applied to HPC and AI systems because of the opportunities of the technology to increase reliability, reduce energy consumption, and improve computing performance.

The hyperscale cloud/data-center cores segment is expected to grow substantially in the data center immersion cooling market. Tasks like model training and inference, which use AI hyperscalers, consume large amounts of heat, which needs to be effectively handled by the high-density server environment. Immersion cooling offers a scalable and efficient resolution that enables hyperscalers with dense computing clusters without affecting performance. Also, more hyperscalers are going green and sustainable, and, therefore, immersion cooling that uses less energy is an appealing option to achieve sustainability.

Region Insights

U.S. Data Center Immersion Cooling Market Size and Growth 2025 to 2034

The U.S. data center immersion cooling market size was exhibited at USD 468.16 million in 2024 and is projected to be worth around USD 2,672.94 billion by 2034, growing at a CAGR of 19.03% from 2025 to 2034.

Why did North America dominate the data center immersion cooling market in 2024?

North America held the dominating share of the data center immersion cooling market in 2024, with early adopters of the new technology being the primary market adopters, including the hyperscale cloud computing and high-end enterprise data centers. The U.S., being the home to large technology companies, hyperscalers, and research facilities, has been at the focal point of large-scale computing specialties that require efficient thermal management. Immersion cooling solutions are widely used in hyperscale facilities to take care of the heat generated by AI workloads, high-performance computing, and other data-intensive applications.

The U.S. market is growing as more people invest in AI, cloud computing, and edge data centers, and this has led to the necessity of having scalable and reliable cooling systems. The government programs that promote the use of energy-efficient and green data centers have helped market expansion. The existence of high disposable income, developed technological infrastructure, as well as availability of a skilled workforce are contributing factors to the rapid deployment and experimentation with innovative immersion cooling technologies. With AI-related workloads and high-density clusters of servers continuing to rise, the U.S and the North American region overall are bound to be at the forefront of the global data center immersion cooling market.

Why is Asia Pacific expected to grow at the fastest CAGR?

Asia Pacific is estimated to grow at the fastest CAGR during the forecast period, due to the high rate of hyperscale, cloud, and AI data center deployment. Countries such as China, India, Japan, and South Korea are experiencing the increasing need for high-density computing infrastructure to support AI, data analytics, and edge computing applications. Further concentration on sustainability and energy-efficient solutions in the region concerning the data centers boosts the accelerated adoption of immersion cooling technologies. The increasing investments in the building of the modern data centers, the assistance of the government programs, and the positive regulatory mechanisms also contribute to the environment in which the rapid installation of single-phase and two-phase immersion systems will be possible.

China has been one of the major regions that has been driving the adoption of immersion cooling in data centers. The hyperscale cloud providers and AI businesses in the area are building their computers as fast as possible to meet the growing backlash of digitalization, e-commerce, and AI studies. Immersion cooling is a high-density workload cooling technique, and the operators can maintain high performance at less energy consumption and reduced operation costs. The mass application is also supported by the government's support for the application of green data centers and energy-saving technologies.

Data Center Immersion Cooling Market Companies

- Green Revolution Cooling (GRC)

- Submer

- LiquidStack

- Asperitas

- Fujitsu

- Iceotope

- CoolIT Systems

- Midas Immersion/Midas

- 3M

- ExaScaler

- SINKUP/Submergence

- Vertiv

- Schneider Electric

- LiquidCool Solutions/LiquidCool

- Midwest Cooling Towers/regional integrators offering immersion products

Recent Developments

- In September 2024, LiquidStack secured another USD 20 million, raising its total Series B funding to USD 35 million using Tiger Global funds. The capital will be used to expand the capacity and provide additional product lines in immersion cooling AI data centers globally.(Source: https://www.globenewswire.com)

- In September 2024, Stellium Datacenters had a merger with Submer and ExxonMobil around an Open Compute Project. The joint venture is the merger of the immersion cooling at Submer and ExxonMobil DC 3235 Super cooling fluid in an effort to enhance efficiency.(Source: https://digitalisationworld.com)

- In February 2024, Green Revolution Cooling (GRC) became a member of the ElectroSafe Fluid Partner Program by TotalEnergies Fluids. TotalEnergies will supply BioLife immersion cooling fluids, which are biosourced, biodegradable, and designed to work best.(Source: https://specialfluids.totalenergies.com)

Segments Covered in the Report

By Product/Cooling Technology

- Single-phase immersion (dielectric liquid remains liquid)

- Two-phase immersion (boiling/evaporation of working fluid)

By Deployment/Form-factor

- Rack-level/In-rack tanks (self-contained rack tanks)

- Enclosure/Cabinet-level systems

- Module/Pod/Room-scale immersion modules (end-to-end modular systems)

- Facility/Plant-level (large tanks/centralized immersion farms and heat-reuse integration)

By Cooling Fluid/Coolant Type

- Mineral oil/hydrocarbon-based fluids

- Synthetic dielectric fluids (engineered hydrocarbons)

- Fluorocarbon/perfluorinated two-phase fluids (e.g., Novec/FCs)

- Biobased/specialty engineered coolants

By Application/Workload

- High-Performance Computing (HPC)/AI training and inference

- Hyperscale cloud/data-center cores

- Colocation providers

- Enterprise data centers (on-prem)

- Edge and telecom sites

- Cryptocurrency/blockchain mining

- Telecom and industrial control applications

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting