What is the Data Center UPS Market Size?

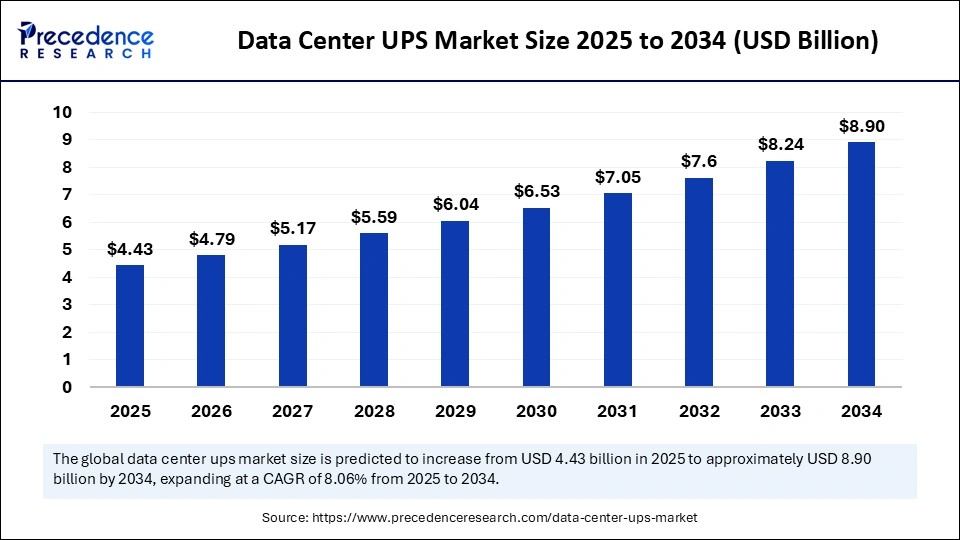

The global data center UPS market size accounted for USD 4.43 billion in 2025 and is predicted to increase from USD 4.79 billion in 2026 to approximately USD 8.90 billion by 2034, expanding at a CAGR of 8.06% from 2025 to 2034. Government initiatives and incentives for green data centers and the integration of smart monitoring and energy-efficient UPS systems are driving the growth of the market.

Data Center UPS Market Key Takeaways

- In terms of revenue, the global data center UPS market was valued at USD 4.10 billion in 2024.

- It is projected to reach USD 8.90 billion by 2034.

- The market is expected to grow at a CAGR of 8.06% from 2025 to 2034.

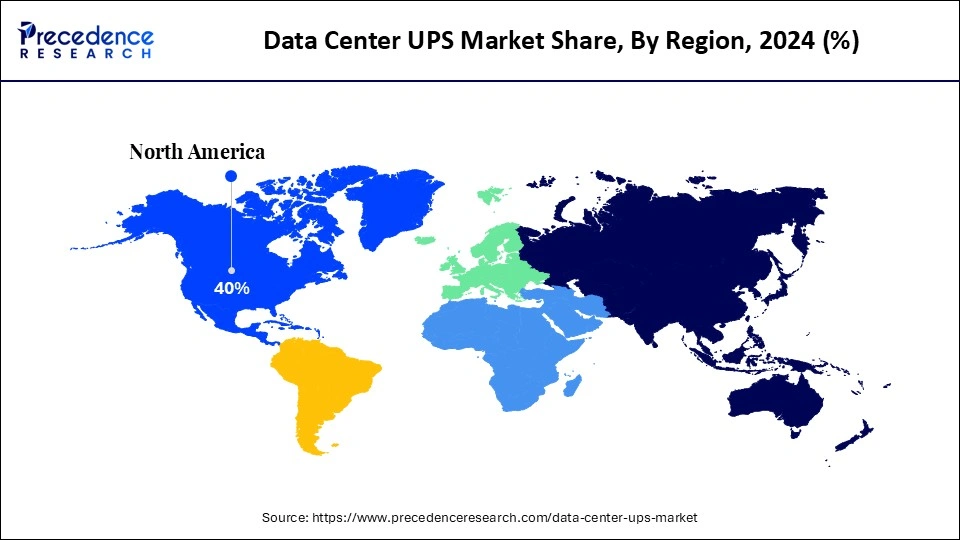

- North America dominated the global data center UPS market with the largest market share of 40% in 2024.

- Asia Pacific is anticipated to grow at the fastest rate during the forecast period.

- By type, the online UPS segment held the biggest market share of 40% in 2024.

- By type, the modular UPS segment is expected to grow at the fastest CAGR in during the forecast period of 2025 to 2034.

- By power rating, the 10 kVA-50 kVA segment accounted for a considerable share of 35% in 2024.

- By power rating, the 5kVA-10 kVA segment is projected to experience the highest growth CAGR between 2025 and 2034.

- By end-user, the IT & data centers segment contributed the maximum market share of 50% in 2024.

- By end-user, the healthcare segment is set to experience the fastest CAGR from 2025 to 2034.

- By battery technology, the lead-acid batteries segment generated the major market share of 45% in 2024.

- By battery technology, the lithium-ion batteries segment is anticipated to grow with the highest CAGR during the studied years.

Market Overview

The data center UPS market refers to the production, distribution, and use of data center UPS is essentially a battery backup that supplies power to our system in order to provide enough time to properly power down our equipment when there is a failure in utility power. We may have a facility that already has a UPS (Uninterruptible Power Supply) or even a generator. The three major types of UPS system configurations are online double conversion, line-interactive, and offline. These UPS systems are defined by how power moves through the unit.

The primary role of UPS is to provide short-term emergency power when there is a complete mains failure or blackout. Additionally, most modern online UPSs* can correct a wide range of common power problems, including short periods when the voltage is below the usual mains supply level. A large data-center-scale UPS installed by electricians. A UPS is generally used to protect hardware like data centers, hospital equipment, computers, telecommunications equipment, or other electrical equipment where an unexpected power disruption can cause injuries, fatalities, serious business disruption, or data loss.

How is Artificial Intelligence (AI) Transforming the Data Center UPS Market?

Artificial intelligence (AI) based UPS systems minimize the risk of downtime, ensuring seamless data center operations, and providing robust power protection, and predictive maintenance & energy-efficient designs lower operational costs. AI-based power systems automate power monitoring, load balancing, and energy optimization. They analyze real-time data to make instant adjustments, thus ensuring consistent power delivery and significantly reducing the risk of overloads. AI in the data center allows for the optimization of compute, storage, and networking for each application and workload without having to make physical changes to the infrastructure.

AI data centers need innovative network visualization technology with better interconnection, scalability, and performance. It also includes benefits like increasing automation, improving security, and optimizing resource utilization. AI analysis allows data centers to predict potential threats and vulnerabilities, closing gaps in defenses before bad actors take advantage.

What Factors are Fueling the Rapid Expansion of the Data Center UPS Market?

- Integration of smart monitoring and energy-efficient UPS systems: The benefits of remote monitoring for UPS include scalability, maintenance, and cost savings. Remote monitoring significantly improves the efficacy of UPS systems by transforming maintenance from a routine schedule to a data-informed process. The shift allows for maintenance activities to be based on the actual performance and the usage of the UPS, ensuring that interventions are timely and precisely targeted.

- Government initiatives and incentives for green data centers: Green data centers' benefits include lower long-term operating costs, reduced physical space needs, less carbon emissions, and a smaller carbon footprint due to the fewer and more energy-efficient data center gear.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 8.90 Billion |

| Market Size in 2025 | USD 4.43 Billion |

| Market Size in 2024 | USD 4.10 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.06% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Power Rating, End-user, Battery-Technology, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising cloud computing design

A cloud data center reduces both hardware investment and the ongoing maintenance cost of any infrastructure. Cloud computing gives our business more flexibility. We can quickly scale resources and storage up to meet business demands without having to invest in physical infrastructure. Companies don't need to pay for or build the infrastructure needed to support their highest load levels. Data centers provide the necessary infrastructure and support for cloud services, allowing users to access and use applications and data from anywhere with an internet connection.

Restraint

Technical limitations in UPS systems

Data centers tend to have high barriers to entry- they require access to significant amounts of power. They also have relatively predictable revenues and earnings due to medium to long-term contracts. The challenges in data centers include sustainability, space and scalability, cybersecurity and protection from data breaches, data management issues, data center cooling, and power demand. The main challenges are in the data center complex management and the higher initial cost.

Opportunity

Adoption of lithium-ion and modular UPS systems

The lithium-ion batteries can operate at higher temperatures than VRLA without losing capacity, which reduces the load on cooling systems. Li-ion batteries for UPS systems offer safer chemistries, bigger operating parameters, more robust materials, and less stressed user environments. The modular UPS system offers easy installation, maintenance, replacement, and positioning. With its smaller and lightweight form when compared to traditional UPS, a modular unit allows for easy installation and movement for all but the biggest units.

Type Insights

The online UPS segment held a dominant presence in the data center UPS market in 2024. The primary benefit of online UPS include it is its double conversion technology that completely isolates connected equipment from raw utility power. Online UPS systems offer zero transfer time, meaning connected equipment never experiences any interruption during power failures. Online UPS provides power with the help of a rectifier and an inverter combination. It also provides power to the load as well as the battery, so that the battery can be charged to supply power in case of a power failure.

The modular UPS segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. Modular UPS systems offer easy installation, maintenance, replacement, and positioning. With its smaller and lightweight from when compared to traditional UPS, a modular unit allows for easy installation and movement. This type of UPS uses a set of individual models that work together to provide the necessary power, while allowing for easy expansion or maintenance without interrupting service.

Power Rating Insights

The 10 kVA-50 kVA segment accounted for a considerable share of the data center UPS market in 2024. Power scale 10Kva-50kVA maximizes availability with the power scale. As saving costs and 100 percent uptime are their top priorities. Power scale offers the lowest cost of ownership by any UPS system, by providing energy efficiency. A 10kVA UPS is commonly used in mid-sized server rooms, small-scale data centers, and factory control systems to maintain power during outages or electrical anomalies.

The 5kVA-10 kVA segment is projected to experience the highest growth rate in the market between 2025 and 2034. One of the primary benefits of a 5kVA online UPS is its ability to provide uninterrupted power to critical devices. The UPS gives an accurately controlled sine wave AC output without any line disturbances. A 5kVA generator can generally run a mid-sized air conditioner (AC) of around 1.5 tons, depending on its dependency and startup surge.

End-User Insights

The IT & data centers segment led the data center UPS market. The UPS system in IT & data centers not only provides backup power but also ensures the quality of power feeding into servers and networking equipment, preventing data loss and hardware damage. The automation of UPS systems provides many benefits over manual systems, including increased efficiency, improved reliability, and reduced downtime.

The healthcare segment is set to experience the fastest rate of market growth from 2025 to 2034. The UPS system offers full health insurance to hourly employees who have been with the company for a minimum of 30 days. All medical expenses with be handled through UPS' insurance. UPS in healthcare is designed to ensure organizations can protect their systems and applications by maintaining a consistent stream of energy, even under extreme circumstances.

Battery Technology Insights

The lead-acid batteries segment registered its dominance over the data center UPS market in 2024. Lead-acid batteries in data centers benefit include cost-effectiveness, data center operations, and are affordable to install and maintain. The primary function of lead-acid batteries in a UPS system is energy storage. The battery acts as a reservoir where electrical energy is stored in chemical form.

The lithium-ion batteries segment is anticipated to grow with the highest CAGR in the market during the studied years. Compact lithium-ion batteries reduce the area occupied by an uninterrupted power supply system by 50-80%. The lithium-based UPS systems tend to be up to 14.6% lighter than conventional UPS systems, making them easier to install and relocate. Lithium batteries are used in almost all 5G sites, alongside their wide use in the data centers in the data centers of some large ISPs.

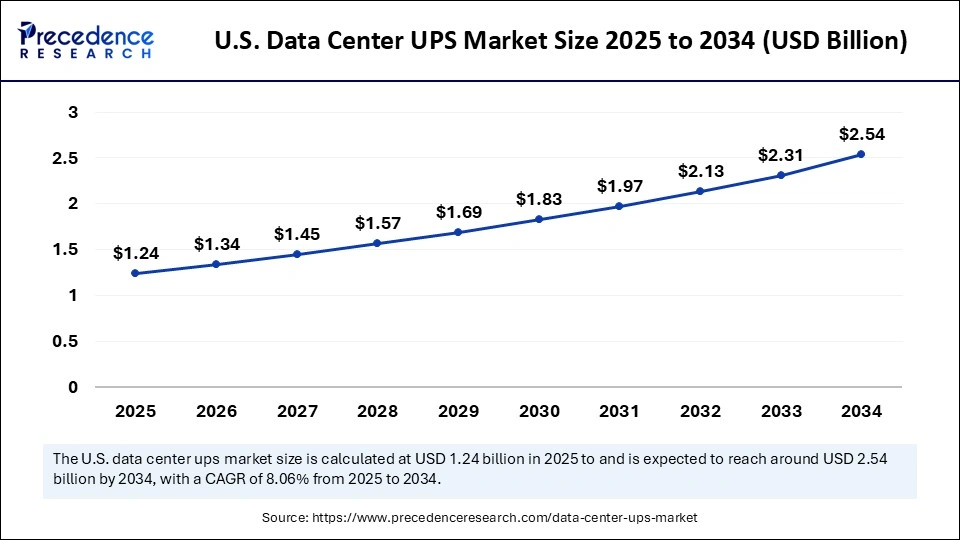

U.S. Data Center UPS Market Size and Growth 2025 to 2034

The U.S. data center UPS market size was evaluated at USD 1.24 billion in 2025 and is projected to be worth around USD 2.54 billion by 2034, growing at a CAGR of 8.06% from 2025 to 2034.

North America dominated the global data center UPS market in 2024. Government initiatives & incentives for green data centers, integration of energy-efficient and smart monitoring UPS systems, and digital infrastructure demand contribute to the growth of the market in the North American region.

North America Data Center UPS Market Analysis:

North America's data center UPS demand continues to benefit from hyperscaler and colocation expansion, increased rack density for AI workloads, and operators upgrading legacy lead-acid UPS with new modular (li-ion) or modular UPS architectures, which take less footprint and offer lower lifecycle cost. Recent market writeups and industry analysis focus on the large hyperscale buildout in the U.S. and increased rental-rate pressure from the commercial real estate (CRE) sector. Both these factors keep power-infrastructure procurement top-of-mind for end-users and CRE procurement teams working with tenants in the U.S.

- The U.S. has remained in the lead because hyperscalers, cloud-service providers, and AI tenants occupy or concentrate their largest additional capacity builds in the U.S. market, which generates large and recurring procurement cycles for UPS systems and an ongoing opportunity for retrofits in existing campuses.

On the other hand, Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period. Rapid advancements in UPS technology, increasing power outages & grid instability, and rising demand for data centers contribute to the growth of the data center UPS market in the region. The Government of Karnataka (GoK) formulated Karnataka's Data Center Policy 2022, with a focus on creating demand and value for data centers by providing a robust and well-connected ecosystem for the growth of data centers in the state.

What Makes Data Center UPS Market in Asia Pacific Grow Rapidly?

The growth in Asia Pacific is due to structural factors: dynamic sovereign digitalization programs are expanding power capacity and driving urgent demand for scalable, efficient UPS solutions, along with a rapid national hyperscale and colocation builds, national AI initiatives around the world of higher education, cloud computing investments. Additionally, the large cloud players will link national computing expectations to infrastructure spending in order to create predictable pipelines for UPS purchases across campus and edge operating.

- China's data-center capex cycle, including AI and sovereign/cloud buildouts, is aggregating high-density compute and new campus programs, which relates directly to bulk UPS and battery procurement. According to industry analysts and previous acquisition reports, there are large, national level investment programs along with rising on grid power requirements boosting UPS demand in China.

How Sustainability-Driven Modernization Fuels UPS Demand in Europe?

In Europe, the data center UPS market is expanding on the back of new energy-efficiency regulations, sustainability initiatives, and upgrades to older mature colocation facilities. Vendors that focus on high and ultra-high-efficiency, modular UPS, and compatibility with renewable energy sources are gaining momentum. Germany leads Europe in hyperscale investment, the tightest standards, and demands lifecycle support and incorporation of clean energy.

How Sovereign Cloud and Hyperscale Projects Boost UPS Growth in Middle East & Africa?

The Middle East and Africa are experiencing growth due to sovereign cloud programs, hyperscale deployment announcements, and the need for data localization. The UAE and Saudi Arabia are driving regional demand through government-funded programs focused on key digital infrastructure (hardware), which will require rugged, high-temperature UPS systems that are accompanied by renewable and hybrid power supplies, designed to work with a regionally supported service network.

Data Center UPS Market Companies

- Vertiv Co.

- Toshiba

- Siemens AG

- Schneider Electric

- Mitsubishi Electric Corporation

- Microtek

- Legrand

- Eaton Corporation

- ABB Ltd

- Emerson Electric Co.

- Socomec Group

- Huawei Technologies Co., Ltd.

- AEG Power Solutions

- Delta Electronics, Inc.

- Fujitsu Limited

- KSTAR

- Rittal GmbH & Co. KG

- Kirloskar Electric Company

- APPC by Schneider Electric

- TOSHIBA Corporation

- Toshiba Infrastructure Systems & Solutions Corporation

- S&C Electric Company

Recent Development

- In June 2025, the latest uninterruptible power supply (UPS) system, the AI-ready MegaFlex UL USP for 415V 60Hz applications designed to meet the evolving load profile demands of modern data centers, was launched by ABB. It is engineered with high efficiency, scalability, and reliability. This new system reinforces ABB's position at the forefront of intelligent power management. (Source:https://new.abb.com)

Segment Covered in the Report

By Type

- Modular UPS

- Standby UPS

- Online UPS

- Line-interactive UPS

By Power Rating

- Below 1 kVA

- 1kVA-5kVA

- 5kVA-10kVA

- 10kVA-50kVA

- 50kVA-200kVA

- Above 200kVA

By End-user

- Telecommunications

- Banking & Financial Services

- Government & Public Sector

- Healthcare

- IT & Data Center

- Retail

By Battery-Technology

- Lead-acid Batteries

- Lithium-ion Batteries

- Nickel-cadmium Batteries

By Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting