What is the Digital Denture Market Size?

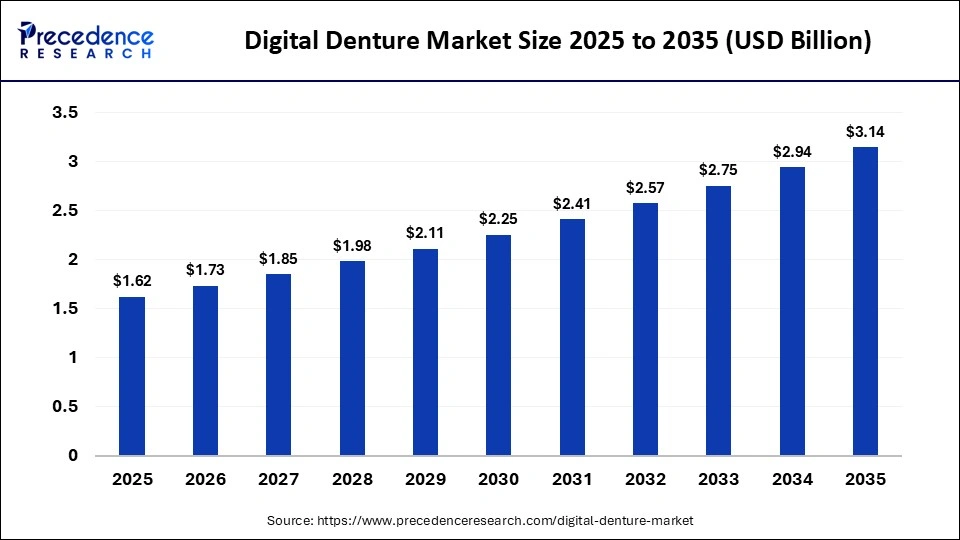

The global digital denture market size was calculated at USD 1.62 billion in 2025 and is predicted to increase from USD 1.73 billion in 2026 to approximately USD 3.14 billion by 2035, expanding at a CAGR of 6.83% from 2026 to 2035. The market is rapidly growing as dental practices adopt CAD/CAM and 3D printing technologies to create more precise, efficient, and customizable denture solutions for patients.

Market Highlights

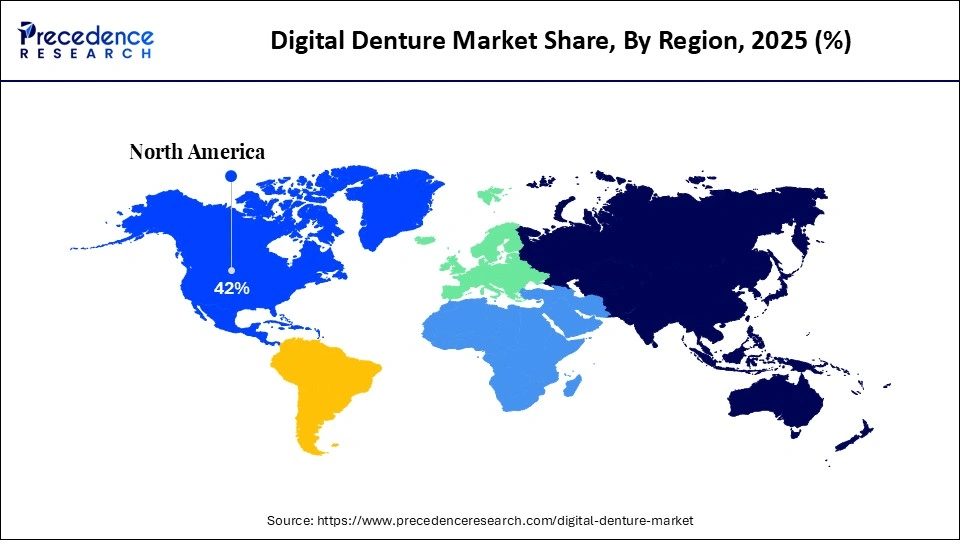

- North America led the digital denture market in 2025 with approximately 42% market share.

- The Asia Pacific is expected to grow at the fastest rate in the upcoming period.

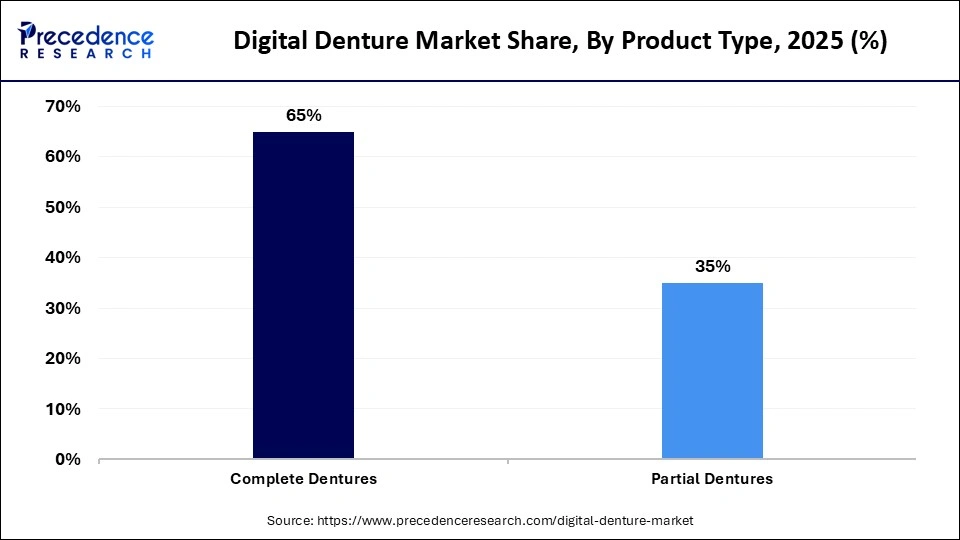

- By product type, the complete dentures segment held approximately 65% market share in 2025.

- By product type, the partial dentures segment is expected to expand at the fastest CAGR during the forecast period.

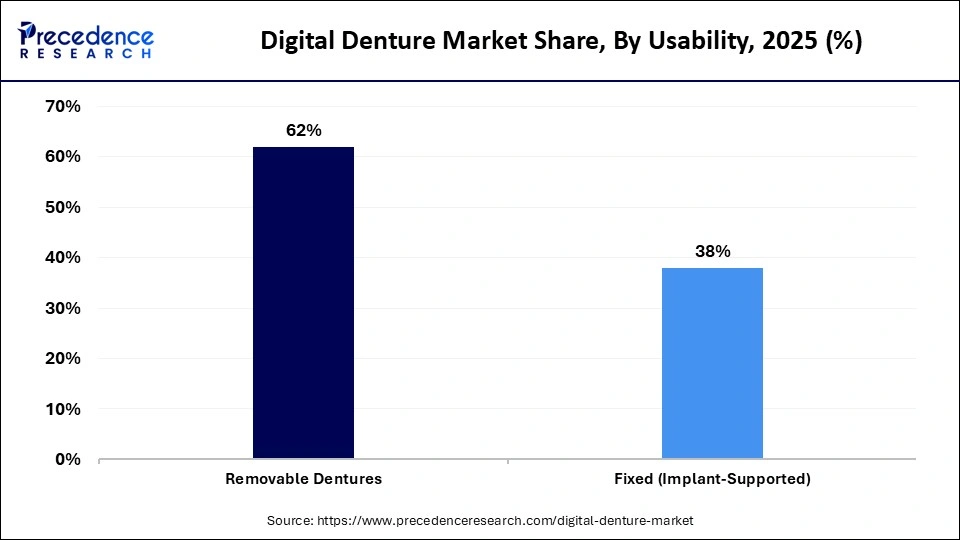

- By usability, the removable dentures segment led the global market in 2025, holding approximately 62% share.

- By usability, the fixed segment is expected to grow at the fastest rate in the foreseen period.

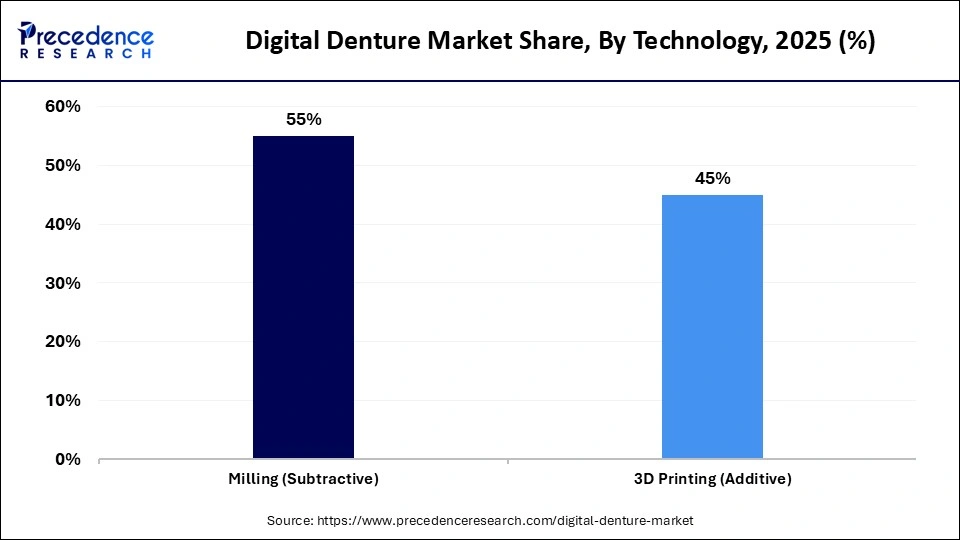

- By technology, the milling segment dominated the market with approximately 55% share in 2025.

- By technology, the 3D printing segment is observed to be the fastest-growing segment in the foreseeable period.

- By component, the equipment segment led the global market in 2025 with approximately 60% market share.

- By component, the software and materials segment is observed to be the fastest-growing segment in the foreseen period.

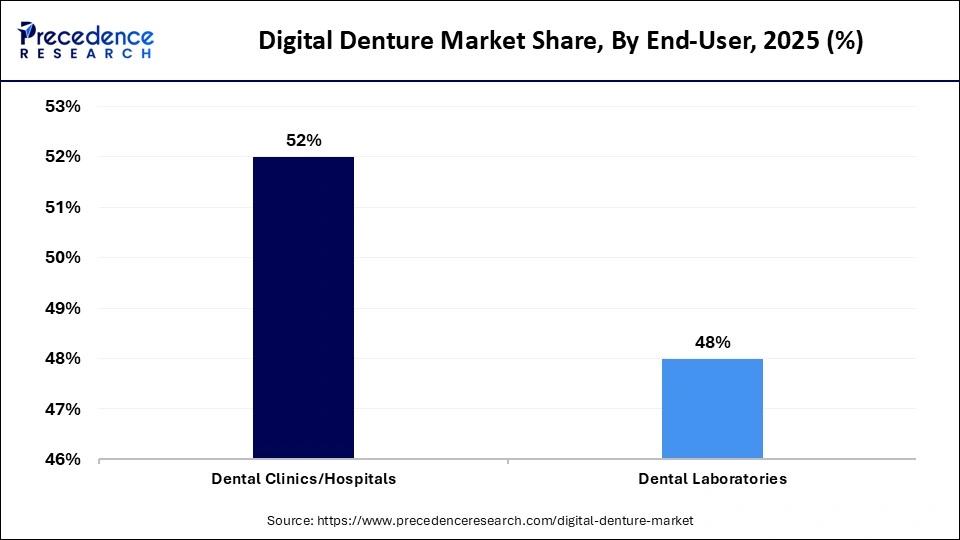

- By end-user, the dental clinics/hospitals segment held approximately 52% share of the market in 2025.

- By end user, the dental laboratories segment is expected to grow at the fastest rate in the upcoming period.

Market Overview

The digital denture market refers to the transformation of traditional prosthetic dentistry through CAD/CAM technology, 3D printing (additive manufacturing), and milling (subtractive manufacturing). It replaces manual wax-ups and physical impressions with high-precision digital intraoral scans and automated fabrication to deliver superior fit, aesthetics, and faster clinical turnaround. Rising awareness of oral health, an aging population with a higher prevalence of tooth loss, and the demand for improved patient comfort and aesthetics are also driving market growth. Additionally, dental clinics and laboratories are increasingly embracing digital workflows to reduce production time, minimize errors, and enhance overall treatment efficiency.

Impact of Artificial Intelligence on the Digital Denture Market

Artificial intelligence is transforming digital dentistry, with a strong impact on denture design, diagnosis, and suitability. By leveraging AI, dental specialists can create dentures that are more comfortable and better-fitting, improving patients' quality of life and allowing them to speak, eat, and smile confidently, without discomfort or fear of slippage. AI algorithms analyze patients' bite and jaw movements to ensure correct alignment and provide customized aesthetics through facial mapping.

AI-driven dental RPD design systems provide dentures that fit better, look natural, and require fewer adjustments. AI-designed removable partial dentures are developed using machine learning to analyze clinical data and generate optimal designs by integrating anatomical landmarks, biomechanical stress zones, and material constraints into a fast, data-driven process. Moreover, AI in CAD/CAM assists in automating aesthetic factors, occlusal schemes, and previous CAD choices in the fabrication of dental restorations such as crowns, bridges, inlays and onlays, veneers, and implant restorations, while also reducing debonding risk and opening possibilities for future developments in this field.

What are the Major Trends Influencing the Market?

- Teledentistry is gradually gaining traction, as it supports remote consultations and simplifies the initial diagnosis and denture planning process.

- The growing adoption of dual-core materials with superior durability, translucency, dimensional accuracy, and flexibility is redefining product performance and strengthening the market's growth.

- Innovation in materials, precision hardware, software integration, and UDI/NFC/RFID-based traceability enhances clinical outcomes and ensures regulatory compliance, supporting broader market adoption.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.62 Billion |

| Market Size in 2026 | USD 1.73 Billion |

| Market Size by 2035 | USD 3.14 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 6.83% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Usability, Technology, Component, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Product Type Insights

What Made Complete Dentures the Dominant Segment in the Market?

The complete dentures segment dominated the digital denture market in 2025, accounting for approximately 65% share. This is mainly due to their cost-effectiveness and the ease with which they restore a natural smile, along with the ability to chew and speak. This segment primarily targets patients with complete tooth loss. It is estimated that around 350 million people are affected by complete tooth loss worldwide yearly, which significantly creates the need for complete dentures. The segment's dominance is also reinforced by advancements in CAD/CAM milling and 3D printing, which enhance fit, aesthetics, durability, and shape of complete dentures.

The partial dentures segment is expected to grow at the fastest rate in the foreseeable period. This growth is primarily driven by the high prevalence of partial tooth loss, as many individuals lose some teeth due to periodontal disease, trauma, and age-related factors, thereby driving the demand for partial dentures. Digital advancement now enables the design and production of partial dentures with improved fit, comfort, and aesthetics, helping preserve a natural smile. Moreover, clinical studies indicate that innovative digital processes significantly enhance the quality of removable partial dentures.

Usability Insights

Why Did the Removable Dentures Segment Lead the Market in 2025?

The removable dentures segment led the digital denture market by holding approximately 62% share in 2025. This dominance is mainly attributed to their flexibility of use based on patient needs. A removable denture is a set of artificial teeth that is placed on the gums and can be taken out when not in use. Over time, as the oral anatomy changes, these dentures can be personalized or adjusted. Moreover, removable dentures are increasingly preferred by consumers who wish to avoid surgical procedures.

The fixed segment is expected to expand at the fastest rate in the upcoming period, fueled by rising edentulism among the elderly and growing demand for durable, high-aesthetic permanent solutions. By eliminating the limitations of removable options, fixed dentures offer superior stability, improved mastication, and enhanced patient comfort. Fixed dentures, including implant-supported dentures, ceramic and metal-based bridges, and hybrid prostheses, are gaining popularity. The segment is also driven by technological advancements, demographic trends, and a growing preference for long-lasting functional outcomes.

Technology Insights

How Does the Milling Segment Dominate the Market in 2025?

The milling segment registered dominance in the digital denture market by holding around 55% share in 2025. This is mainly due to its ability to produce a wide range of high-precision prosthetics, including crowns, bridges, implants, inlays, onlays, and veneers. As a subtractive manufacturing technique, dental milling uses high-precision machines to fabricate accurate and customizable dental restorations, ensuring superior fit and consistency. In addition, laboratories increasingly prefer milling machines because of their advanced features that cater to complex dental requirements and enable reliable large-scale production.

The 3D printing is the fastest-growing segment in the market. As an additive manufacturing technique, dental 3D printing enables the development of crowns, bridges, dentures, aligners, surgical guides, and anatomical dental models. It provides accurate, efficient, and highly customized solutions for both dental professionals and patients. By enabling precise fabrication and supporting multiple applications, it enhances workflow efficiency and improves treatment outcomes, leading to its rapid adoption across dental laboratories and clinics.

Component Insights

What Made Equipment the Dominant Segment in the Market?

The equipment segment dominated the digital denture market in 2025 with approximately 60% share. This is because equipment, such as advanced CAD/CAM systems, 3D printers, scanners, and milling machines, is fundamental to denture production. These equipment enable precise, efficient fabrication, encouraging strong adoption across dental laboratories and high-volume clinics. Continuous improvement in digital equipment further reinforces the segment's market leadership.

The software and materials segment is expected to grow at the fastest CAGR in the market. This is because advanced design software and specialized materials are essential for creating precise, customizable, and durable dentures. By integrating scanning, design, and manufacturing into a unified digital workflow, software enhances precision, customization, and operational efficiency, driving increasing adoption across dental laboratories and clinics. As AI-driven technologies continue to advance, this segment is expected to sustain strong growth.

End-User Insights

Why Did the Dental Clinics/Hospitals Segment Lead the Market in 2025?

The dental clinics/hospitals segment dominated the digital denture market in 2025, accounting for approximately 52% share. This is because clinics and hospitals are the preferred choice for consumers, as they serve a large patient base. Moreover, the adoption of advanced technologies such as 3D printing and CAD/CAM software attracts both patients and clinicians by reducing chair time and increasing accuracy. The segment's leadership is further supported by increasing patient visits, rising awareness of oral health, and the ability of clinics and hospitals to invest in integrated digital workflows that enhance treatment outcomes and operational efficiency.

The dental laboratories segment is expected to grow at the fastest rate over the forecast period due to their rapid adoption of advanced technologies. By integrating digital workflows and AI-driven systems, laboratories enhance production accuracy and efficiency. They also offer strong customer support and a high level of customization tailored to individual patient requirements. Additionally, the presence of skilled dental technicians further strengthens their operational capabilities. They are capable of efficiently handling the needs of multiple patients simultaneously, enhancing overall productivity and service capacity.

Regional Insights

How Big is the North America Digital Denture Market Size?

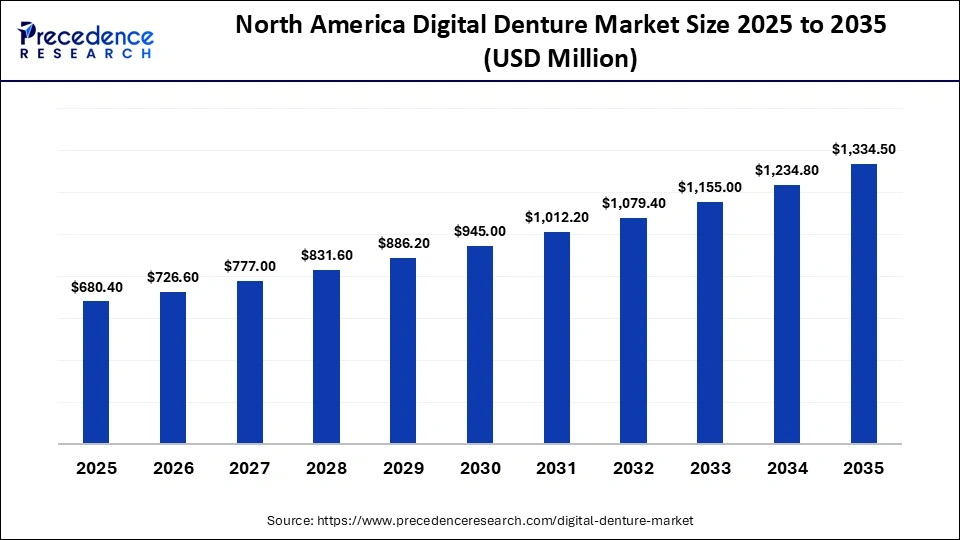

The North America digital denture market size is estimated at USD 680.40 million in 2025 and is projected to reach approximately USD 1334.50 million by 2035, with a 6.97% CAGR from 2026 to 2035.

Why Did North America Dominate the Digital Denture Market?

North America dominated the digital denture market by capturing the largest share of 42% in 2025. The region's dominance in the market is driven by the widespread adoption of CAD/CAM technologies, the strong presence of leading industry players, and a growing geriatric population with substantial disposable income. More than 20% of adults aged 65 and older in the region experience tooth loss, increasing the demand for durable, functional, and aesthetically advanced denture solutions.

What is the Size of the U.S. Digital Denture Market?

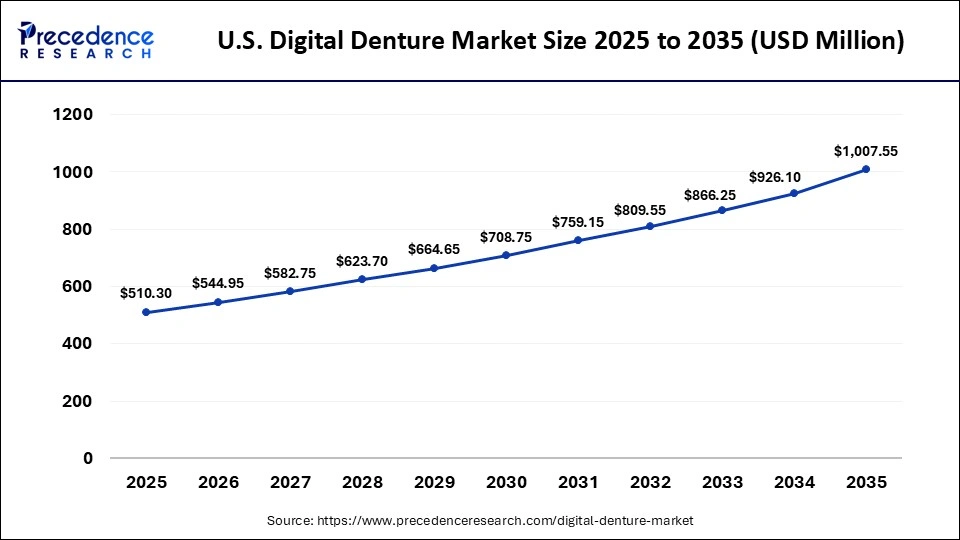

The U.S. digital denture market size is calculated at USD 510.30 million in 2025 and is expected to reach nearly USD 1007.55 million in 2035, accelerating at a strong CAGR of 7.04% between 2026 and 2035.

U.S. Digital Denture Market Analysis

The U.S. and Canada remain at the forefront of developing digital dentures. Greater commercial availability in the U.S. has significantly influenced the digital dentistry landscape, supporting solutions for tooth alignment, protection, restoration, and replacement. At the same time, major global companies such as Dentsply Sirona and Straumann are strengthening their footprint in Canada by capitalizing on their advanced technological capabilities.

Rising venture capital funding and strategic partnerships in digital dental startups highlight strong investor confidence in the market's future. North America's advanced healthcare infrastructure, high adoption of innovative dental technologies, and supportive regulatory framework further drive growth. The shift from conventional removable dentures to digitally engineered solutions, enabled by intraoral scanning, CAD/CAM systems, 3D printing, and AI-powered design tools, is transforming the regional market landscape.

How is the Opportunistic Rise of Asia Pacific in the Market?

Asia Pacific is expected to grow at the fastest rate in the digital denture market in the foreseeable period. This is mainly due to rising dental health awareness, increased dental care spending, rapid adoption of digital workflows, and ongoing clinic modernization. Advances in digital dentistry are enhancing denture manufacturing by providing higher accuracy, faster turnaround times, and patient-specific customization. Additionally, growing adoption of CAD/CAM technologies is further improving the precision and efficiency of denture production in the region.

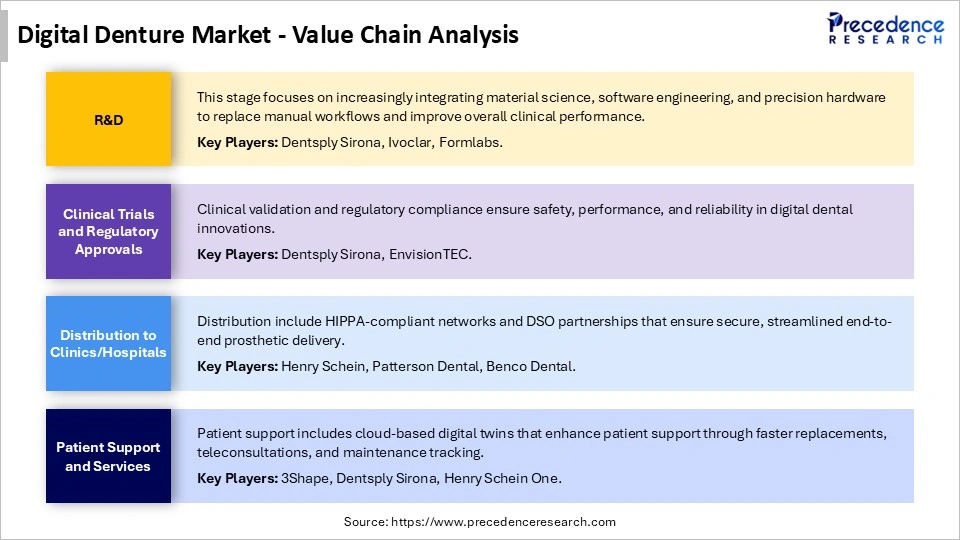

Digital Denture Market Value Chain Analysis

Who are the Major Players in the Global Digital Denture Market?

The major players in the digital denture market include Dentsply Sirona, Ivoclar Vivadent, 3Shape A/S, Envista Holdings (Nobel Biocare), Institut Straumann AG, Formlabs, Planmeca Oy, Amann Girrbach AG, Kulzer GmbH, Avadent Digital Dental Solutions, Desktop Metal (Desktop Health), Zimmer Biomet, Carbon, Inc., Asiga, Medit Corp.

Recent Developments

- In 2025, 3D Systems announced full commercial release of its NextDent Jetted Denture Solution for the U.S. market. This first-to-market approach for jetted monolithic dentures employs multiple materials in a single printing process to provide patients with durable, long-lasting, and aesthetically appealing prosthetics. It represents a newly FDA-cleared dental solution.(Source: https://www.3dsystems.com)

- In 2025, Carbon launches dual-cure FP3D resin for flexible partial dentures. FP3D is a flexible resin specifically designed for manufacturing flexible removable partial dentures (FRPD). It is the first dental material in the market utilizing Carbon's dual-dure chemistry (FRPD). (Source: https://www.voxelmatters.com)

Segments Covered in the Report

By Product Type

- Complete Dentures

- Partial Dentures

By Usability

- Removable Dentures

- Fixed (Implant-Supported)

By Technology

- Milling (Subtractive)

- 3D Printing (Additive)

By Component

- Equipment (Scanner/Printers/Mills)

- Software and Materials

By End-User

- Dental Clinics/Hospitals

- Dental Laboratories

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting