Digital Forensics Market Size and Forecast 2025 to 2034

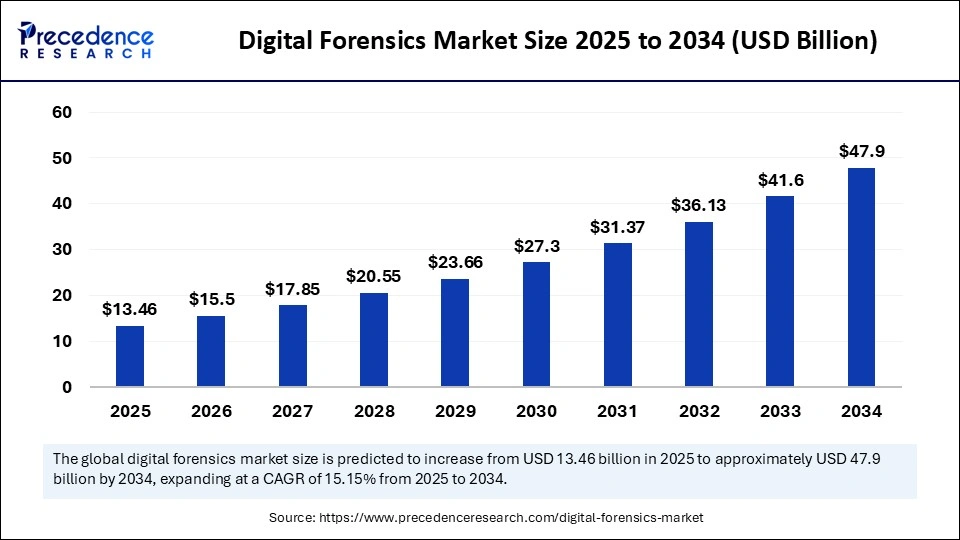

The global digital forensics market size accounted for USD 11.69 billion in 2024 and is predicted to increase from USD 13.46 billion in 2025 to approximately USD 47.9 billion by 2034, expanding at a CAGR of 15.15% from 2025 to 2034. The rising digital transformation and need to build a brand protection mechanism, which is resulting in transparent incident responses and quick financial fraud detection, are likely to boost the growth of the market.

Digital Forensics MarketKey Takeaways

- The global digital forensics market was valued at USD 11.69 billion in 2024.

- It is projected to reach USD 47.9 billion by 2034.

- The market is expected to grow at a CAGR of 15.15% from 2025 to 2034.

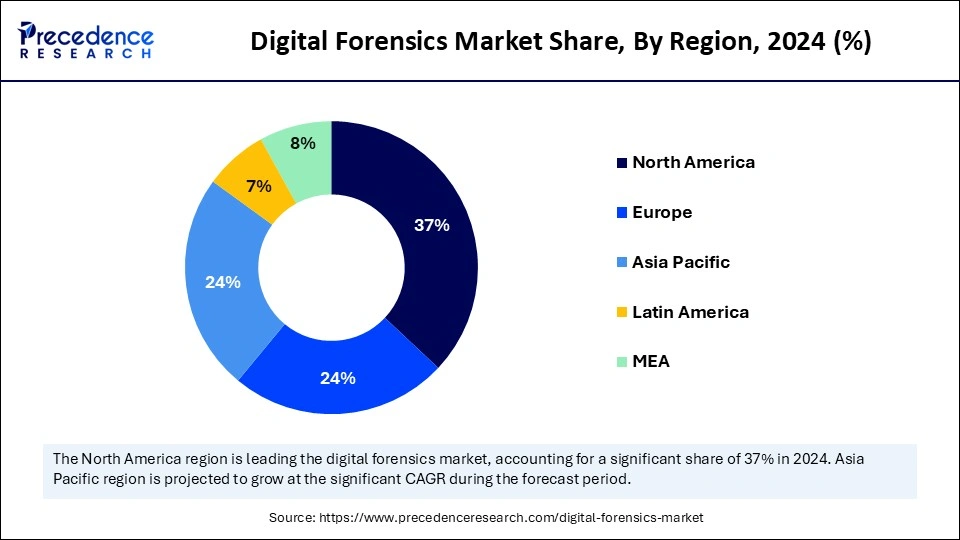

- North America dominated the global market with the largest market share of 37% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR in the upcoming period.

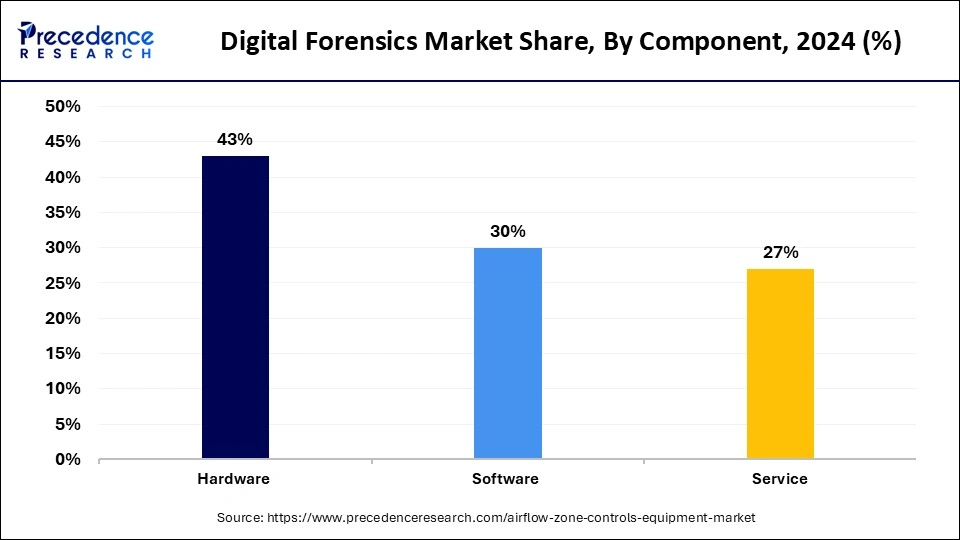

- By component, the hardware segment held the biggest market share of 43% in 2024.

- By component, the service segment is expected to grow at the highest CAGR between 2025 and 2034.

- By type, the computer forensics segment captured the market with the major market share in 2024.

- By type, the cloud forensics segment is expected to grow at a significant CAGR between 2025 and 2034.

- By tool, the forensic data analysis segment held the highest market share in 2024.

- By tool, the forensic decryption tools segment is expected to grow at the fastest CAGR in the coming years.

- By end-user, the government and defense segment accounted for the largest market share in 2024.

- By end-user, the healthcare segment is expected to grow at the fastest CAGR during the projection period.

How is AI revolutionizing the digital forensics market?

Artificial intelligence is reshaping the digital forensics market by automating evidence collection, accelerating data analysis, and improving accuracy in threat detection. AI algorithms can rapidly analyze vast amounts of unstructured data, identifying behavioral patterns and anomalies that would take weeks for human analysts. This accelerates criminal investigations and supports early intervention. Traditional forensic products are often time-consuming. However, AI simplifies log analysis, keyword searches, and image recognition, allowing investigators to focus on complex insight rather than administrative burdens. Machine learning models reduce the risk of human error in evidence authentication. AI tools ensure that digital evidence is tamper-proof, admissible in court, and collected with integrity.

U.S. Digital Forensics Market Size and Growth 2025 to 2034

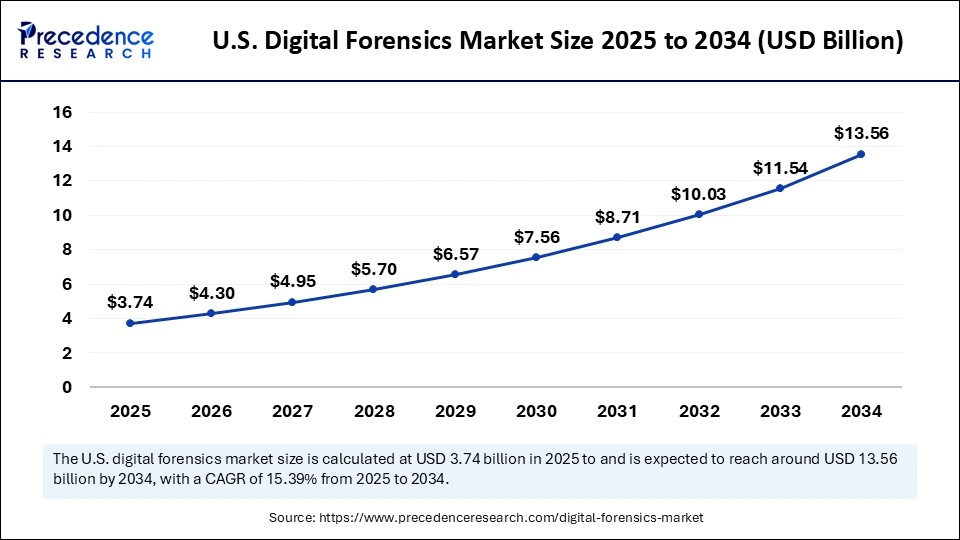

The U.S. digital forensics market size was exhibited at USD 3.24 billion in 2024 and is projected to be worth around USD 13.56 billion by 2034, growing at a CAGR of 15.39% from 2025 to 2034.

What Made North America the Dominant Region in the Digital Forensics Market?

North America dominated the market with the largest share in 2024. This is mainly due to the increased frequency of cyberattacks. The region boasts a potent combination of technological maturity, sophisticated cyber infrastructure, and robust legal frameworks, making it a fertile ground for digital forensic innovation and adoption. From corporate data breaches to organized cyberattacks, the frequency and complexity of cyber incidents have escalated significantly, prompting large-scale investment in digital investigation tools. Laws such as HIPAA, SOX, and the USA PATRIOT Act mandated organizations to retain digital evidence and have forensic mechanisms in place for regulatory compliance and litigation readiness.

The presence of major technology and cybersecurity firms headquartered in the U.S. and Canada, such as Magnet Forensics, Cellebrite (with strong North American operations), and Access Data, continues to spur research and development in cutting-edge forensics tools. Governmental initiatives, including cybersecurity funding under CISA, FBI cyber task forces, and military-grade forensic deployments in defense and intelligence networks, further bolster the growth of the market. Moreover, educational institutions and certification bodies in the U.S. are investing heavily in digital forensics tools to mitigate the risks of cyberattacks, ensuring the long-term growth of the market in the region.

Asia-Pacific Digital Forensics Market Trends

Asia Pacific is expected to grow at the fastest rate during the projection period, driven by rapid digital transformation, rising incidence of cyber threats, and government-backed cyber initiatives across emerging economies. The increasing adoption of cloud, 5G, and fintech services is opening up growth avenues for the market within the region. The surge in cybercrime targeting banks, telecom operators, and government entities is creating the urgent need for incident investigation and forensic readiness. National cyber missions such as India's Cyber Surakshit Bharat, China's Cybersecurity Law, and Australia's Critical Infrastructure Act have paved the way for heavy investments in forensic tools.

Expansion of smart city projects and IoT deployments, where forensic technology is essential to manage digital evidence from interconnected devices, are boosting the demand for digital forensics tools. Growing awareness and implementation of forensic education programs and certifications, especially in urban tech hubs across India, Japan, and Malaysia, further support regional market growth.

European Digital Forensics Market Trends

Europe is considered to be a significantly growing area, spurred by a transformative blend of data privacy concerns, stringent regulations regarding data privacy, and digital sovereignty ambitions. The General Data Protection Regulation (GDPR) has shifted the focus on data protection, breach accountability, and investigatory capabilities, catapulting digital forensics into mainstream enterprise operations. GDPR mandated swift breach reporting, forensic evidence collection, and documentation of data flows, making forensic tools indispensable for compliance.

The rise in cyber-espionage and ransomware attacks targeting European critical infrastructure, healthcare systems, and financial services creates the need for sophisticated digital forensics tools. Growing investments in cloud infrastructure across Germany, France, and the Nordics are accompanied by demand for forensic solutions to secure and monitor these platforms. The emergence of digital sovereignty policies encourages local forensic service providers and software developers to reduce dependency on foreign vendors. With both public and private sectors actively investing in forensic solutions, Europe is poised to become a major player in the market.

Market Overview

The applications of digital forensics span across industries, from law enforcement and defense to banking, healthcare, and private enterprises. The demand for digital forensics is fueled by the rise in cybercrime incidents, the complexity of digital services, and the legal necessity to preserve and present digital evidence with court-admissible standards. Digital forensics is no longer confined to courtrooms or crime scenes; it is now a strategic, operational, and reputational imperative. As technology continues to outpace legislation and security controls, the market for digital forensics must stay several steps ahead. With AI, forensic auditing, and next-gen investigation tools entering the fray, the field is evolving from a reactive necessity to a proactive shield.

Key Market Trends

- Volume and velocity of cybercrime: As attackers grow more resourceful, organizations must invest in equally agile forensic tools.

- Digital transformation and remote work: Cloud services, BYOD culture, and global data mobility have added complexity to investigations.

- Legislative push: Laws like GDPR, HIPAA, and national data protection bills compel organizations to retain forensic capabilities as part of compliance frameworks.

- Reputation risk: Companies view forensics not just as a technical tool, but as a brand protection mechanism, ensuring transparent incident responses.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 47.9 Billion |

| Market Size in 2025 | USD 13.46 Billion |

| Market Size in 2024 | USD 11.69 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 15.15% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Type, Tool, End Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Cybercrime Surge

In the digital age, crime has morphed from physical break-ins to invisible instructions. The exponential rise in cybercrime, from ransomware attacks and data breaches to identity theft and insider threats, is boosting the growth of the digital forensics market. Governments, corporations, and individuals are now more vulnerable than ever. With every breach, the demand grows for robust investigative capabilities that can trace footprints, reconstruct events, and preserve evidence in legally admissible formats. The complexity of attacks has evolved to include multi-stage phishing, deepfake impersonations, and zero-day exploits, now regular players in the cyber battlefield. Additionally, the increasing adoption of digital payments and online banking has led to complex financial frauds that require forensic auditing for resolution. The proliferation of mobile devices, encrypted apps, and remote work has expanded the surface area for forensic analysis. High-profile data leak cases have spurred regulatory mandates demanding that organizations have post-incident investigation protocols in place.

Restraint

Data Privacy Concerns

The digital forensics market grapples with several restraining factors. The most pressing of which is the rising concerns about data privacy. As forensic technologies penetrate deeper into personal devices, cloud accounts, and encrypted messages, concerns over civil liberties, data misuse, and consent are mounting. Laws like the GDPR impose strict rules on how personal data can be accessed and stored, limiting forensic teams' ability to examine systems without infringing on user rights. As end-to-end encryption becomes standard, especially in messaging and cloud platforms, forensic tools face roadblocks in extracting actionable intelligence.

Additionally, threat actors now deploy anti-forensic techniques such as file wiping, data obfuscation, and time-stamping manipulation. The absence of global standards for forensic tools and procedures leads to challenges in interoperability, legal admissibility, and cross-border investigations. Skilled digital forensic professionals are scarce, with high barriers to training, certification, and continuous learning due to the fast-evolving nature of cyber threats and technologies.

Opportunity

Emergence of Cloud Forensics

While traditional systems are being fortified, the real opportunity lies in cloud forensics, AI-led investigations, and predictive forensic frameworks. As businesses migrate to cloud environments and deploy hybrid architectures, the challenge of tracing and securing digital footprints across virtual boundaries opens an immense growth potential. Most organizations still lack tools to investigate breaches or policy violations within cloud-hosted data. There is an urgent need for scalable, cross-platform forensic tools that can monitor SaaS, LaaS, and PaaS environments. With growing interest in automation, forensic tools that embed AI for threat prediction, behavioral analysis, and anomaly detection will experience soaring demand. Moreover, developing economies in the Asia Pacific and Africa are investing in digital infrastructure and cybersecurity frameworks, opening up new growth opportunities for forensic tool providers, consultants, and cloud-security enablers. This is a moment of transformation where forensics are shifting from post-incident analysis to predictive intelligence, unlocking untapped markets and strategic partnerships.

Component Insights

Why did the Hardware Segment Dominate the Market in 2024?

The hardware segment dominated the digital forensics market with the largest share in 2024 as hardware plays a crucial role in digital forensics. From forensic imaging devices and write blockers to high-performance workstations, hardware enables the capture, preservation, and processing of digital evidence without tampering or alteration. Physical tools are used to clone drives, extract mobile data, and analyze memory cards, ensuring that digital trails remain intact, legally admissible, and uncorrupted.

Hardware plays a critical role in field-level investigations, where software alone cannot reach isolation or may damage systems. With the increasing complexity of devices like mobile phones, IoT sensors, routers, and personal computing systems, each requiring dedicated forensic equipment, the need for hardware increases. Growing demand from the law enforcement and military sectors, which prioritize rugged, portable forensic kits for on-site investigation, further support segmental growth. As data breaches become more sophisticated, hardware innovation is continuously evolving to meet the need for speed, accuracy, and compliance.

On the other hand, the service segment is expected to grow at the highest CAGR during the forecast period, driven by rising demand for outsourced forensic expertise, consulting, and managed investigation services. Organizations increasingly seek flexible, scalable solutions to respond to cyber incidents, often lacking the internal capabilities to conduct comprehensive digital investigations. The rising demand for managed, detection, and response (MDR) services that integrate real-time forensics into cyber incident management further contributes to segmental growth. The segment's growth is also driven by the increasing reliance on consultants and legal advisors for litigation support, compliance audits, and expert testimony. As digital ecosystems diversify and require tailored domain-specific forensic expertise, the need for specialized services increases.

Type Insights

What Made Computer Forensics the Dominant Segment in the Digital Forensics Market?

The computer forensics segment dominated the market with a major revenue share in 2024. Computer systems, also recognized as traditional computing systems, remain the central hubs of data processing, storage, and communication within both personal and enterprise networks. High-volume data recovery from PCs, laptops, and external drives is still central to fraud, IP theft, and insider threat investigations. In corporate environments, endpoint forensics offers the first clues in identifying breaches, unauthorized access, or policy violations. Legacy systems and enterprise servers often store historical logs, transaction data, and system-level metadata critical to building a forensic timeline. Thus, computer forensics remains the starting point for most digital investigations and forms the foundation for complex, multi-vector analysis.

Meanwhile, the cloud forensics segment is expected to grow at a significant CAGR in the upcoming period due to the dramatic shift of businesses and individuals to cloud-based environments. As organizations adopt SaaS, LaaS, and PaaS platforms, the need to trace user actions, data movements, and unauthorized activities in virtual spaces becomes paramount. Increased use of multi-cloud architecture complicates visibility and control. Legal requirements for data retention, breach reporting, and incident analysis in cloud-hosted systems further support segmental growth. Cloud-native forensic tools allow remote evidence collection from distributed data centers without disrupting live systems. The rapid digital transformation and the rising preference for hybrid work models make it a focal point of future forensic innovation.

Tool Insights

Why Does the Forensic Data Analysis Segment Dominate the Market in 2024?

The forensic data analysis segment dominated the digital forensics market by capturing the maximum share in 2024. This is mainly due to the increased volume of digital data and the need for accurate data analysis. Forensic data analysis tools are indispensable for investigators to reconstruct timelines, identify digital fingerprints, and interpret metadata across complex environments. These tools support multi-format investigation, allowing analysts to work across logs, chats, databases, images, and emails. Their utility spans prevention, detection, and prosecution, creating a seamless pipeline from evidence extraction to courtroom presentation. They enable the correlation of disparate data points, helping investigators build coherent narratives, especially in multi-device, cross-platform investigations. Data analysis tools are evolving rapidly, often integrating AI, machine learning, and visual dashboards to enhance forensic efficiency and credibility.

On the other hand, the forensic decryption tools segment is expected to grow at the fastest rate in the coming years. These tools help break passwords, decrypt communications, and access data concealed with steganography or property encryption protocols. Increased use of encrypted messaging apps and encrypted file systems created the need for decryption tools. Rising demand for crypto-wallet investigations, ransomware analysis, and secure messaging surveillance further support segmental growth. Integration of GPU-accelerated cracking algorithms and dictionary-based attack models for faster results also contributes to segmental growth. Forensic decryption tools are critical for law enforcement and intelligence agencies dealing with encrypted dark web data and cybercriminal infrastructure.

Why did the Government and Defense Segment Dominate the Market in 2024?

The government and defense segment dominated the digital forensics market with a major revenue share in 2024. This is mainly due to the increased investment by governments in digital forensics tools to enhance their capabilities in this area. National security threats, cyber espionage, borderless terrorism, and internal governance require a strong digital investigative backbone. The establishment of dedicated cyber forensic labs and cybercrime units across military, intelligence, and law enforcement bodies supports segmental growth. The increased need for digital sovereignty, wherein governments require internal control over forensic infrastructure for critical national data, bolstered segmental growth. Defense departments use digital forensics for investigation and strategic cyber threat intelligence, vulnerability assessment, and wartime readiness.

On the other hand, the healthcare segment is expected to grow at the fastest CAGR during the projection period as this sector is a prime target for cyberattacks. The shift to Electronic Health Records (EHRs), telemedicine, and cloud-based diagnostics has increased the need for forensic readiness. Patient records are highly sensitive and valuable, making data breach analysis and recovery vital. Healthcare organizations often grapple with strict regulatory scrutiny under HIPAA, GDPR, and regional health data laws. Post-ransomware analysis, data recovery tools, and network forensic services are essential to avoid repeated incidents and ensure business continuity. Forensic tools tailored to healthcare must comply with clinical data standards, boosting the adoption of digital forensic tools.

Digital Forensics Market Companies

- Paraben Corporation

- LogRhythm, Inc.

- Magnet Forensics

- MSAB

- Exterro

- NUIX

- Open Text Corporation

- Cellebrite

- Cisco Systems, Inc.

- IBM

Recent development

- In June 2025, ICAI (Institute of Chartered Accountants India), through its Digital Accounting and Assurance Board (DAAB), released an Exposure Draft proposing a comprehensive revision of the Forensic Accounting and Investigation Standards (FAIS) and its implementation guide.

(source: https://taxguru.in) - In July 2024, Exterro announced the launch of FTK 8.1, the award-winning, court-cited digital investigations solution built for speed and reliability. FTK 8.1 redefines mobile investigations with next-level data processing.

(Source: https://www.exterro.com)

Segments Covered in the Report

By Component

- Hardware

- Software

- Service

By Type

- Computer Forensics

- Network Forensics

- Mobile Device Forensics

- Cloud Forensics

By Tool

- Data Acquisition & Preservation

- Forensic Data Analysis

- Data Recovery

- Review & Reporting

- Forensic Decryption

- Others

By End Use

- Government and Defense

- Law Enforcement

- Banking, Financial Services, and Insurance (BFSI)

- IT & Telecom

- Retail

- Healthcare

- Others

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- MEA

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting