What is the Direct-to-Satellite Market Size?

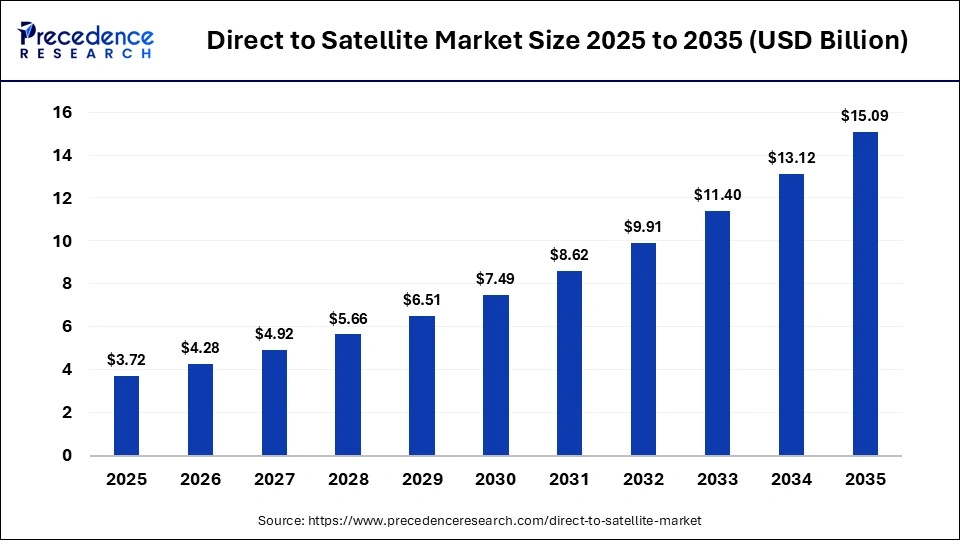

The global direct-to-satellite market size was calculated at USD 3.72 billion in 2025 and is predicted to increase from USD 4.28 billion in 2026 to approximately USD 15.09 billion by 2035, expanding at a CAGR of 15.03% from 2026 to 2035. The direct-to-satellite market is expanding due to the urgency to be connected all the time for emergency cases, bridging terrestrial cellular gaps, and increasing advancements in LEO constellations with 5G NTN standards.

Market Highlights

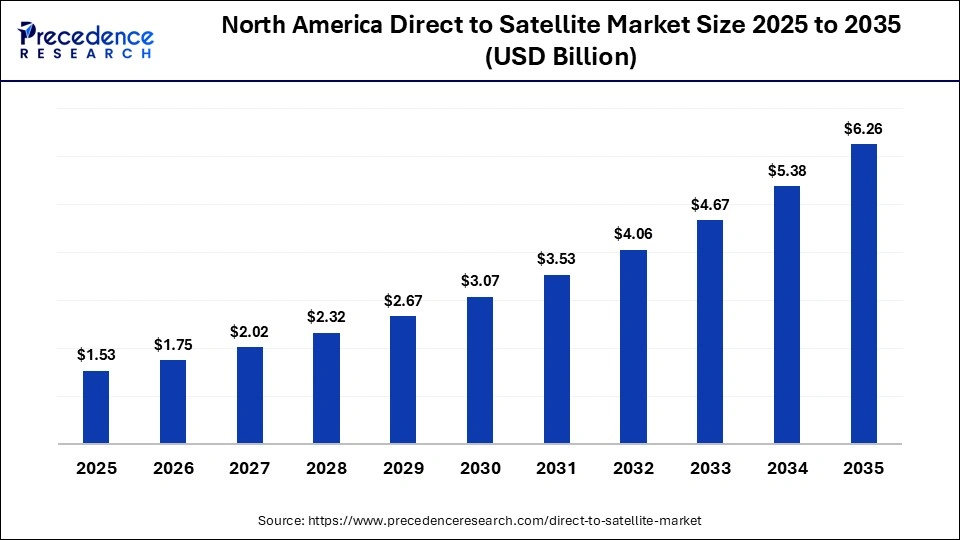

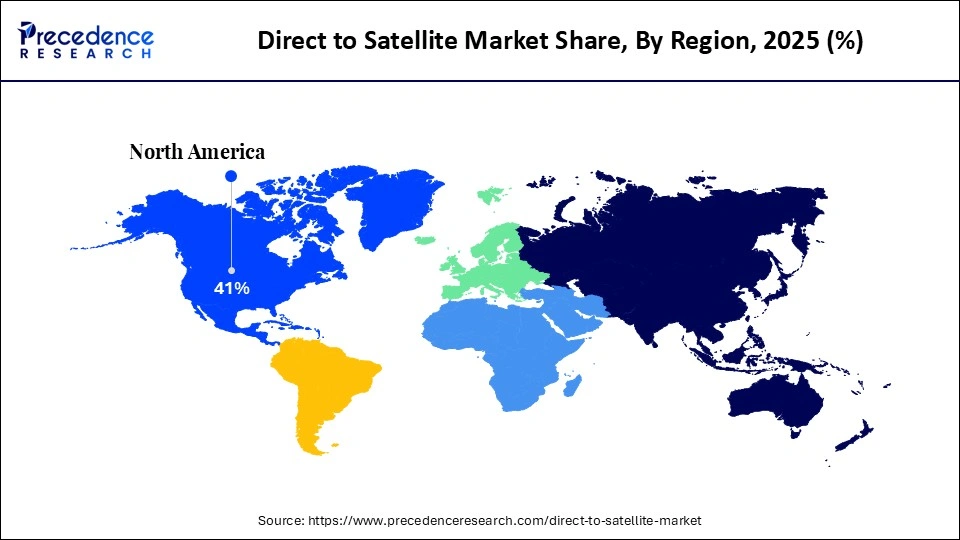

- North America accounted for the largest market share of 41% in 2025.

- Asia Pacific is projected to grow at the fastest CAGR from 2026 to 2035.

- By service type, the direct-to-home broadcasting segment held the largest market share in 2025.

- By service type, the direct broadband/internet access segment is projected to grow at the fastest CAGR from 2026 to 2035.

- By type of satellite, the geostationary earth orbit segment held the largest market share in 2025.

- By type of satellite, the low earth orbit segment is projected to grow at the fastest CAGR from 2026 to 2035.

- By component, the satellite transponders segment held the largest market share in 2025.

- By component, the network management systems segment is projected to grow at the fastest CAGR from 2026 to 2035.

- By end user industry, the media & entertainment segment held the largest market share in 2025.

- By end user industry, the telecommunications segment is projected to grow at the fastest CAGR from 2026 to 2035.

Direct-to-Satellite Market Means

Direct to satellite is a type of connectivity that allows devices, especially smartphones, to directly communicate with satellites without the need for hardware such as an antenna or dongle. The popular example of this is the latest agreement by Apple with Globalstar that allows new iPhone users to access the constellation of global star satellite by using the embedded chipset in iPhones.

The market is largely expanding due to the growing adoption of 3GPP standards that allow seamless satellite integration with smartphones. Teh expansion of LEO satellites is another key driver of the market growth due to the low latency, high bandwidth, and enhanced coverage offered by these satellites. Also, rising collaborative efforts between mobile network operators and satellite operators are further boosting the market's growth.

AI Shifts in the Direct-to-Satellite Market

The integration of artificial intelligence to bolster the direct-to-satellite market seems a promising avenue to establish satellite internet even in underserved areas by automating complex operations, optimizing network performance in real time, and autonomous decision-making in orbit for highly established and resilient global connectivity. AI algorithms can analyze user demand in real time, weather status, and network load, and dynamically select bandwidth and frequency resources that ensure optimal signal strength and maximum coverage area while minimizing network congestion.

AI can further support smart antennas to adjust their orientation by beamforming on specific users automatically. Such a dynamic adjustment leads to higher signal quality, minimized latency, and improved data transfer speed for direct communication with smartphones or other user devices trying to connect with the satellite.

Direct-to-Satellite Market Trends

- The direct-to-satellite market is witnessing significant trends like the growing integration of 5G Non-Terrestrial Networks that allow seamless connectivity between cellular and satellite networks, fueling the market growth.

- The rapid expansion of LEO satellites is boosting the market growth by offering low latency with major deployments from Starlink and Amazon's project Kuiper.

- The accelerated growth of the satellite IoT market provides specialized and low-power connections for continuous monitoring in remote areas and asset tracking.

- The growing merger, acquisitions, and collaboration between industry leaders and mobile operators, along with satellite operators, are widening the market's growth area and potential applications.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.72 Billion |

| Market Size in 2026 | USD 4.28 Billion |

| Market Size by 2035 | USD 15.09 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 15.03% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Service Type, Type of Satellite, Component, End-User Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Service Type Insights

Why is Direct-to-Home Service Preferred in the Direct-to-Satellite Market?

The direct-to-home broadcasting segment held the largest market share in 2025 due to its unmatched offerings like superior quality, reliable data transmission, no buffering, widespread coverage, and emergency connectivity. DTH provides uninterrupted services across vast geographical areas like remote, mountain, and challenging areas where traditional telecom infrastructure falls short in offering seamless connectivity. DTH is relatively simple to implement due to its ability to connect satellites to home-based receivers. DTH further offers crucial communication links even during natural disasters.

The direct broadband/internet access segment is projected to grow at the fastest CAGR during the foreseeable period due to its unmatched connectivity in remote areas where conventional ground-based infrastructure is difficult to build. Direct broadband is, therefore, the most feasible option for businesses or residents staying in isolated areas, for emergency response cases, and short-term set-ups. Many companies and governments are embracing satellite connectivity due to its rapid deployment, wide range of availability, and bypasses the need to build complex infrastructure to access remote areas.

Type of Satellite Insights

What Does a Geostationary Satellite Offer in the Direct-to-Satellite Market?

The geostationary earth orbit segment held the largest market share in 2025 due to its wide area coverage, nearly 40% of the earth's surface with a single satellite that allows stable connectivity like SOS messaging/texting without the need for a separate user device to track satellite location or movement. Geostationary satellites do not need complex and fast-tracking antennas on user devices, which are ideal for direct-to-smartphone connectivity. Hence, they offer highly reliable services in an emergency scenario by messaging, voice communication, and texts uninterruptedly. Geostationary satellites like Inmarsat and EchoStar are utilized for dependable messaging services and act as a backup coverage in some regions.

The low earth orbit segment is projected to grow at the fastest CAGR during the foreseeable period due to its key offerings like persistent coverage, low-patency broadband, and connectivity to smartphones and IoT devices without the need of separate antenna. Earth proximity allows real-time applications like voice calls, internet browsing, and video conferencing. Also, large constellations of LEO satellites offer constant coverage, which is highly essential for maritime, aviation, and remote areas, along with underserved areas.

Component Insights

What are the Benefits of Satellite Transponders in the Direct-to-Satellite Market?

The satellite transponders segment held the largest market share in 2025 due to their unmatched benefits like expanded coverage, high-quality broadcasting, improved data transmission, and higher scalability. High-throughput satellite uses advanced technologies like Ka-band, spot beams, and Ku-band that offer high data capacities with faster internet speed. All these factors are highly crucial for data-intensive applications such as telemedicine, video-streaming, and e-learning in remote areas. Also, its ability to lease transponder capacity offers service providers the opportunity to scale their coverage rapidly as per demand and with cost-effectiveness.

The network management systems segment is projected to grow at the fastest CAGR during the foreseeable period due to its key offerings like proactive monitoring and fault management, efficient resource and bandwidth management with automation. An intelligent network management system assists in the allocation of network resources and bandwidth in real-time. Satellite networks often need to expand rapidly to cover the increasing number of devices like IoT sensors and smartphones with new services.NMS offers this scalability to manage such expanding multi-vendor environments effectively.

End User Industry Insights

Why Do Direct-to-Satellite Market Largely Driven by the Media & Entertainment Sector?

The media & entertainment segment held the largest market share in 2025, owing to its ability to offer high-quality transmission, one-to-many broadcasting with higher efficiency, various types of content delivery, and reliability for live events. Satellite technology is inherently effective for point-to-multipoint communication. Also, a single uplink can be received by millions of people at the same time and can even be received by various dishes, making it an ideal alternative for mass media distribution. Live broadcasts are highly in demand in sectors like media and entertainment for news, sports, and other significant events that require resilient transmission, which is also less susceptible to failures for smooth and consistent viewer experiences.

The telecommunications segment is projected to grow at the fastest CAGR during the foreseeable period due to the increasing demand for unprecedented global coverage in remote and challenging areas where traditional infrastructure for telecommunication systems is nearly impossible. The telecommunication industry is rapidly moving towards hybrid network strategies aiming to integrate seamlessly with terrestrial networks. Also, the 3GPP standards have already allowed for non-terrestrial networks that enable various smartphones and IoT devices to directly connect with satellites and assist in their expanding applications like logistics, environmental monitoring, and agriculture.

Regional Insights

How Big is the North America Direct-to-Satellite Market Size?

The North America direct-to-satellite market size is estimated at USD 1.53 billion in 2025 and is projected to reach approximately USD 6.26 billion by 2035, with a 15.13% CAGR from 2026 to 2035.

How did North America lead the Direct-to-Satellite Market?

North America held the largest market share in 2025 due to its massive investments in LEO constellations by leading key marketers like SpaceX and Amazon, early adoption of 5G satellite integration, and strategic government support, along with robust infrastructure that supports technological advancements. The region boasts a strong base for satellite infrastructure, making it a global frontier of LEO constellation deployment that reduces latency and enhances connectivity speed. Significant venture capital and private sector investment, with ongoing 5G advancements, are supporting non-terrestrial networks, further expanding the market's reach in the region.

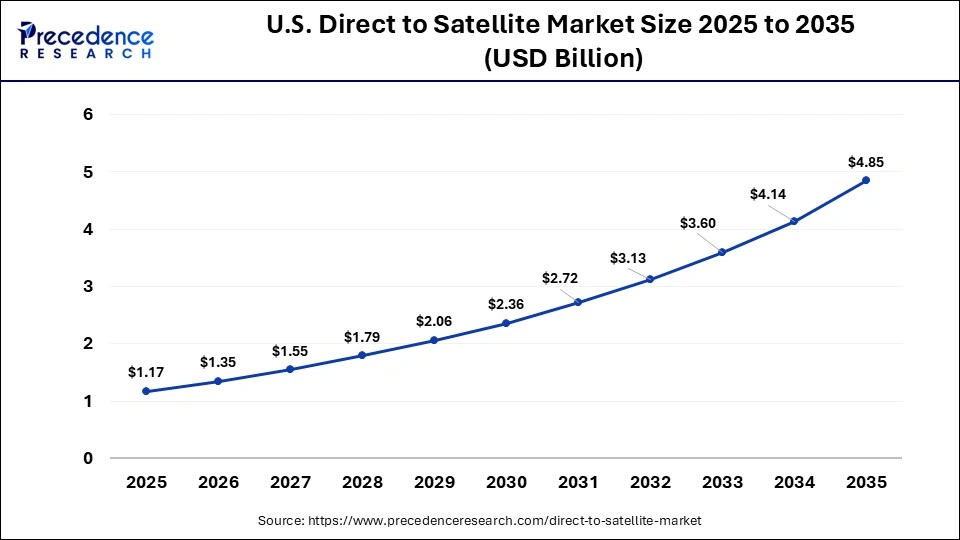

What is the Size of the U.S. Direct-to-Satellite Market?

The U.S. direct-to-satellite market size is calculated at USD 1.17 billion in 2025 and is expected to reach nearly USD 4.85 billion in 2035, accelerating at a strong CAGR of 15.28% between 2026 and 2035.

The U.S. Direct-to-Satellite Market Analysis

The country is largely expanding in the space and satellite industry due to the record-breaking launching activities by leading players like NASA and SpaceX, with scientific milestones. As orbital congestion is intensified, new technologies have emerged rapidly, including direct-to-satellite connectivity, and are expanding significantly. For example, the U.S. federal communications commission has established a comprehensive' supplemental coverage from space' framework in 2024, allowing satellite operators to reuse terrestrial mobile spectrum through leasing agreements with MNOs.

What made Asia Pacific the fastest-growing region in the Direct-to-Satellite Market?

Asia Pacific is projected to grow at the fastest CAGR during the foreseeable period as Asia Pacific boasts the world's most dynamic telecommunications sector with rapid advancements in 5G connectivity and satellite technology, particularly in LEO, with a major focus on non-geostationary satellite orbits driven by the explosive demand in consumer broadband. Increasing approval by leading telecommunication authorities for modern technologies is further expanding the region's growth significantly.

For example, Thaicom unveiled that its subsidiary IPSTAR has achieved approval from the IN-SPACe to offer satellite services with its own satellite in India. Also, in the Philippines, DICT-led satellite broadband initiatives have connected over 438 remote areas, highlighting the bolstering growth of the Asia Pacific in the direct-to-satellite market.

China Direct-to-satellite Market Analysis

China is rapidly accelerating its space-based avenues via mega-constellation deployments and telecommunications breakthroughs. For example, SpaceX's Qianfan constellations have already deployed 90 satellites in Earth orbit and plan for a fleet of 1500 next satellites. On the other hand, Hongqing Technology is preparing to take part in a race with its Honghu-3 constellation and targeting 10,000 satellites in the near future. Also, leading regions like Shanghai and Beijing in China have designed an action plan to accelerate the innovation and development of the commercial space industry during the period of 2024-2028.

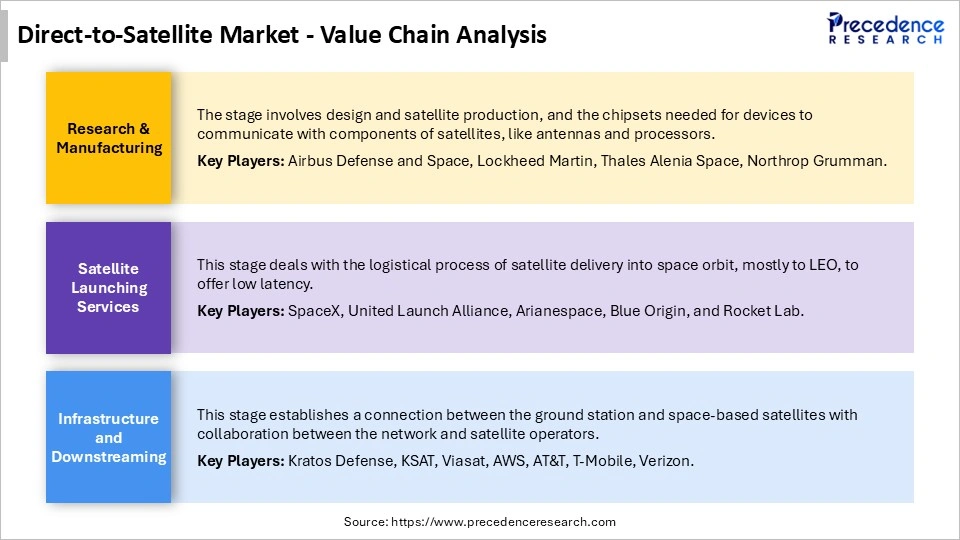

Direct-to-Satellite MarketValue Chain Analysis

Who are the Major Players in the Global Direct-to-Satellite Market?

The major players in the direct-to-satellite market include SpaceX, AST SpaceMobile, Lynk Global, Globstar, Iridium Communications, Skylo Technologies, ASTROCAST, Sateliot, Omnispace, Viasat, Fleet Space Technologies, HEAD Aerospace Group, Ligado Networks, Lacuna Space, Telesat, and Amazon (Project Kuiper).

Recent Developments

- In January 2026, the wireless division of PLDT and Smart Communications collaborated and successfully tested direct-to-device satellite service through their technology partner Lynk Global on the island of Catanduanes in the Bicol region. This test shows a strong possibility to seamlessly offer mobile services even in rural, underserved, and naturally challenging areas.(Source: https://www.telecomreviewasia.com)

- In December 2025, a leading space technology solution company, SES, and Abra Group collaboratively launched fast and reliable multi-orbit inflight connectivity services on its 100 aircraft, aiming to strengthen the position of SES as a leader in satellite-powered broadband inflight service provider in the Americas.(Source: https://www.ses.com)

Segments Covered in the Report

By Service Type

- Direct-to-Home (DTH) Broadcasting

- Direct Broadband/Internet Access

- Direct TV & Video Streaming

- Direct IoT/M2M Communication

- Direct Navigation/Auxiliary Services

By Type of Satellite

- Geostationary Earth Orbit (GEO)

- Low Earth Orbit (LEO)

- Medium Earth Orbit (MEO)

- Highly Elliptical Orbit (HEO)

By Component

- Satellite Transponders

- User Terminals/Ground Stations

- Network Management Systems

- Antennas & RF Components

- Modems & Receivers/Set-Top Boxes

- Launch Services

By End-User Industry

- Media & Entertainment

- Telecommunications

- Government & Defense

- Enterprise/Corporate Networks

- Healthcare & Telemedicine

- Education (Distance Learning)

- Energy & Utilities

- Transport (Maritime & Aviation)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content