E-learning Services Market Size and Forecast 2025 to 2034

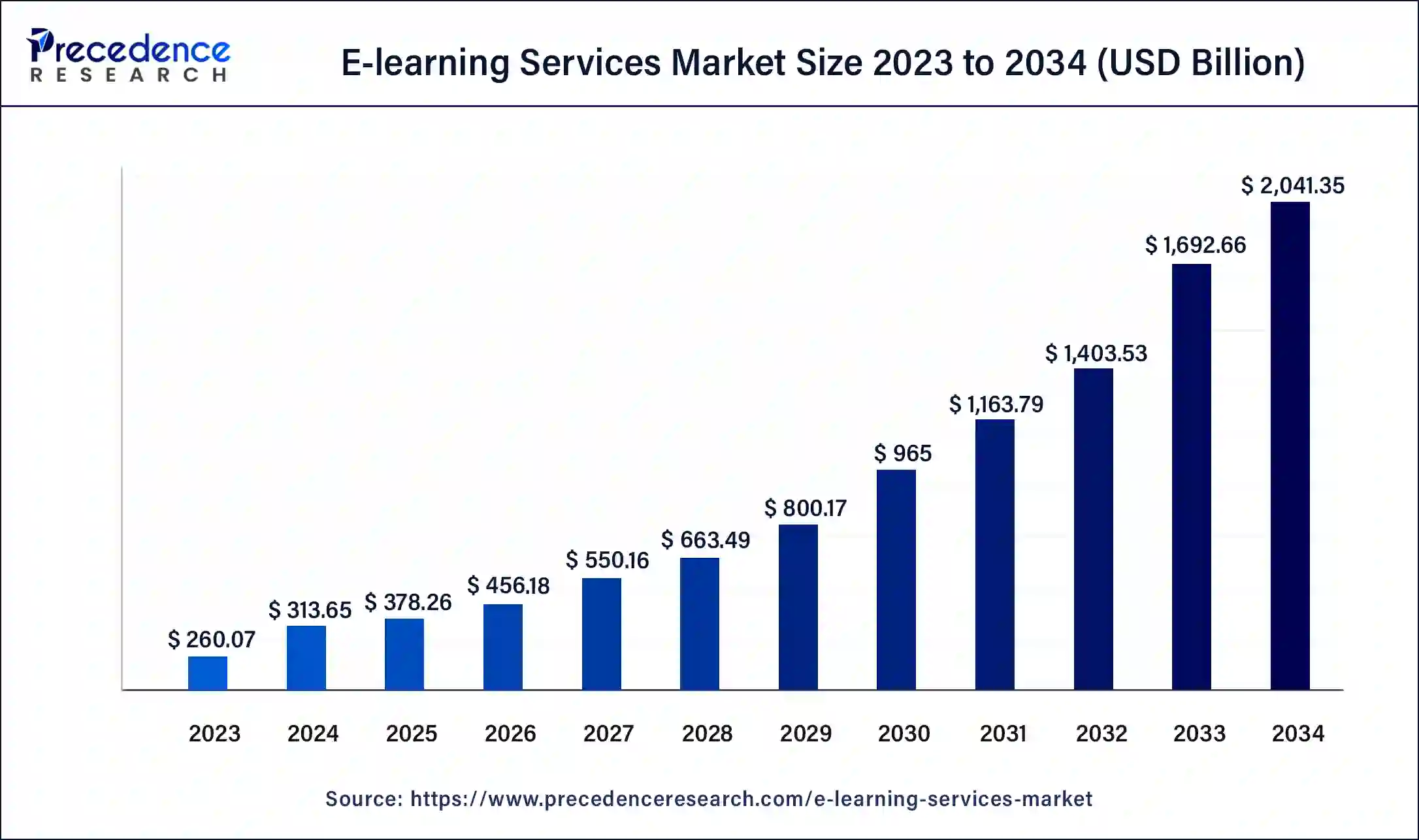

The global E-learning services market size was estimated at USD 313.65 billion in 2024 and is predicted to increase from USD 378.26 billion in 2025 to approximately USD 2,041.35 billion by 2034, expanding at a CAGR of 20.60% from 2025 to 2034.

E-learning Services Market Key Takeaways

- In terms of revenue, the market is valued at $378.26 billion in 2025.

- It is projected to reach $2,041.35 billion by 2034.

- The market is expected to grow at a CAGR of 20.60% from 2025 to 2034.

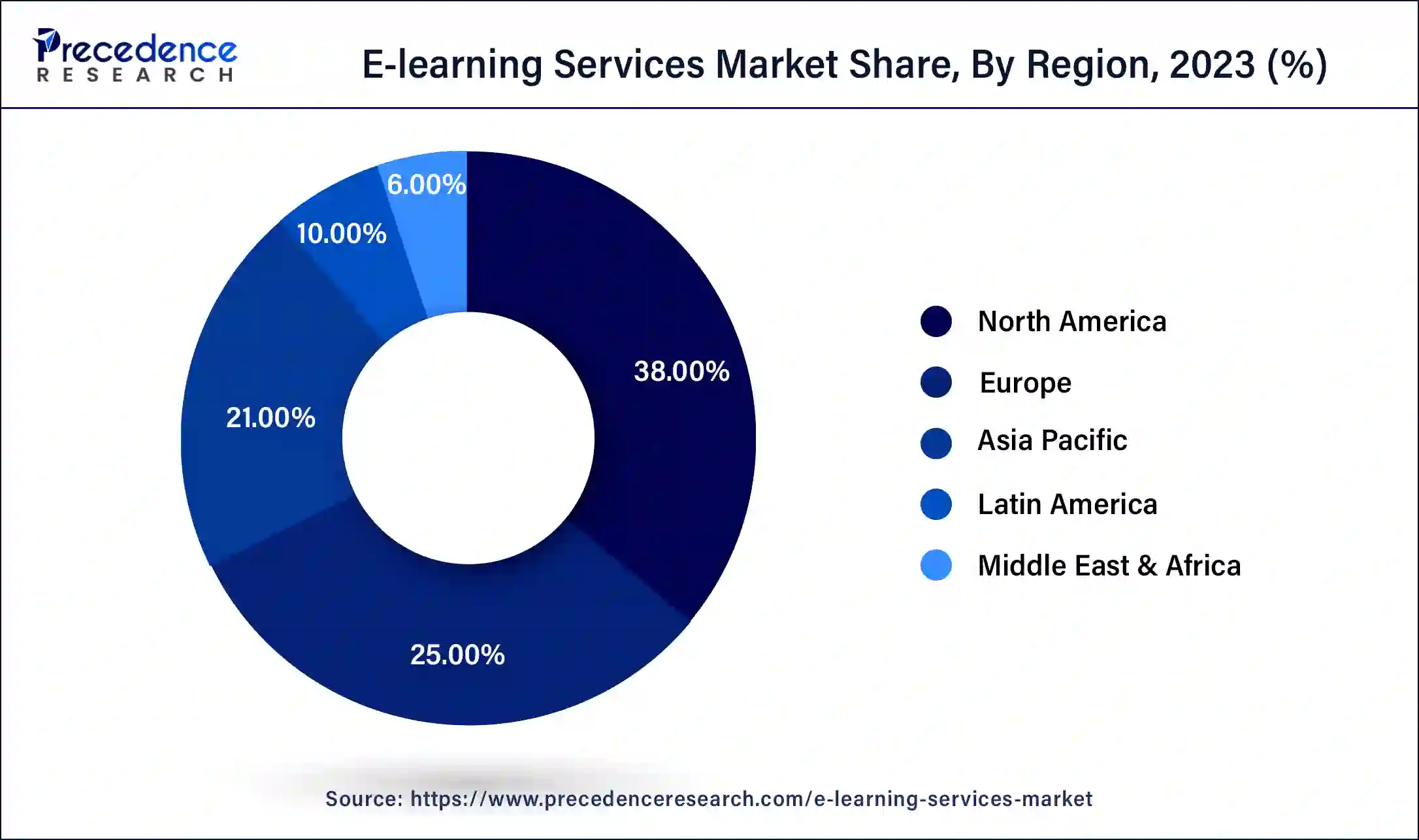

- North America dominated the market while carrying 38% of the market share in 2024.

- Asia Pacific is forecasted to experience the highest CAGR of 20.9% during the forecast period.

- By type, the custom e-learning segment held the largest share of 33% in 2024.

- By type, the game-based learning segment is projected to witness the highest CAGR during the forecast period.

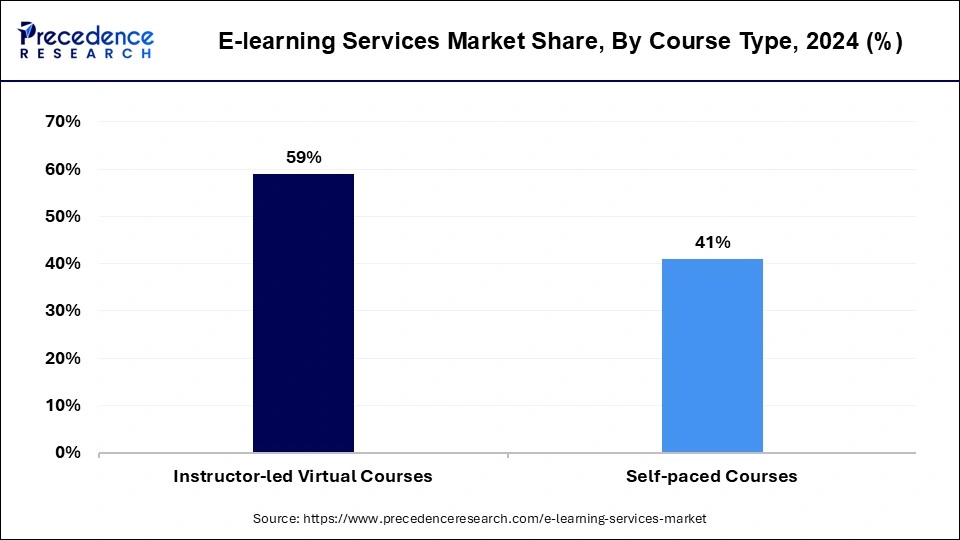

- By courses, the instructor-led virtual courses segment held the largest share of 59% in 2024.

- By courses, the self-paced courses segment is expected to witness the highest CAGR of 22.6% during the forecast period.

- By learning method, the blended learning segment held the largest share of 37% in 2024.

- By learning method, the simulation segment is projected to experience the CAGR during the forecast period.

- By technology, the cloud computing segment held the largest share of 38% in 2024 and is expected to maintain its dominance in the forecast period.

- By technology, the artificial intelligence segment is projected to witness the highest CAGR during the forecast period.

- By end-use, the academic segment held the largest share of 46% in 2023 and is expected to maintain its position in the forecast period.

- By end use, the corporate segment is projected to witness the highest CAGR during the forecast period.

U.S. E-learning Services Market Size and Growth 2025 to 2034

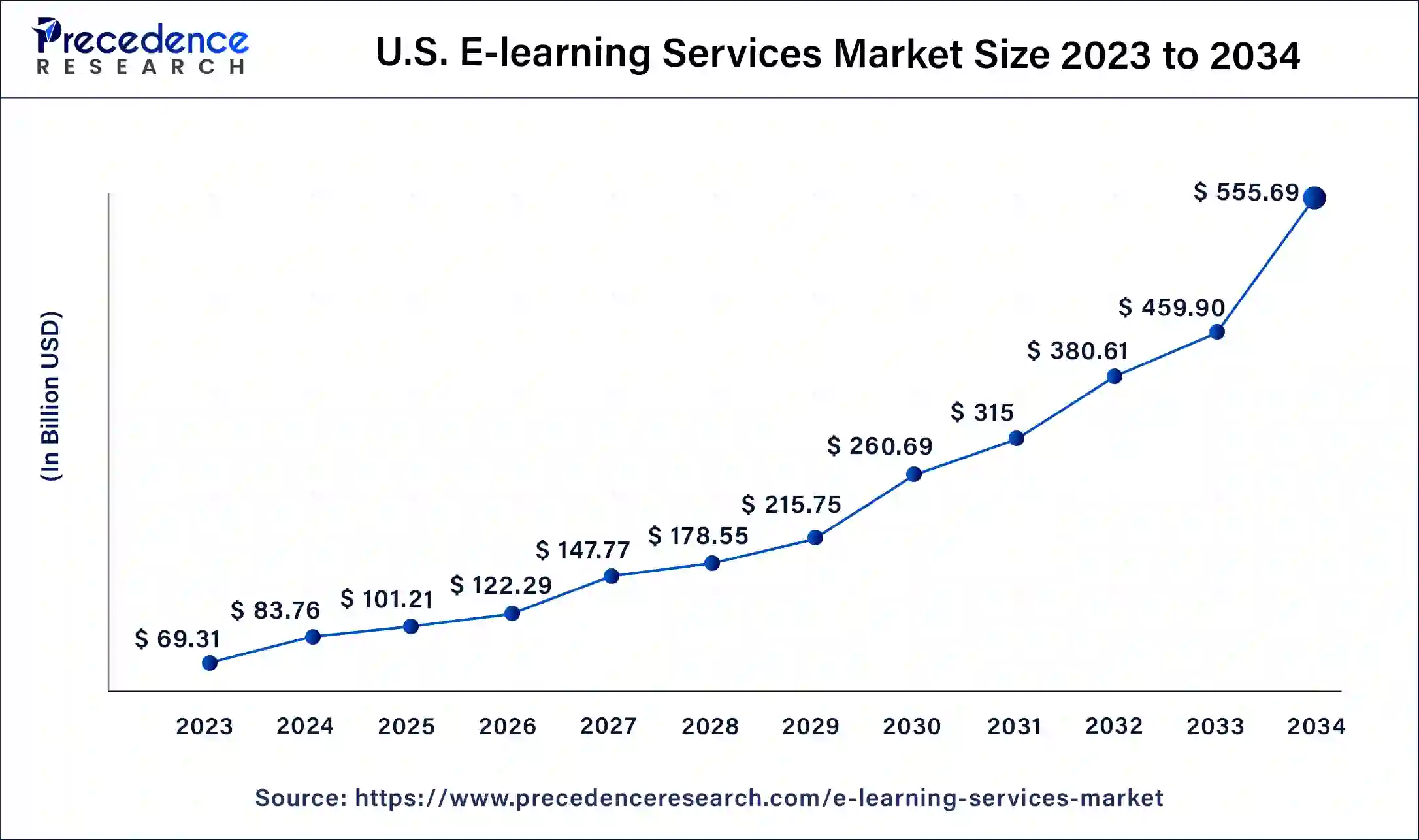

The U.S. E-learning services market size was estimated at USD 83.76 billion in 2024 and is predicted to be worth around USD 555.69 billion by 2034, at a CAGR of 20.83% from 2025 to 2034.

North America currently held the largest market share of 38% in the e-learning services market in 2024and is expected to maintain its dominance in the forecast period. This trend is driven by the increasing demand for e-learning services to cater to the growing adoption of digital technologies in education and training. Individuals are turning to e-learning platforms to enhance their knowledge and skills, while educational institutions, government organizations, and corporations are utilizing these services to deliver courses and training programs to students and employees. The platform offers specialized courses tailored to stakeholders in various industries, including specifiers, distributors, contractors, converters/fabricators, and OEM customers.

Asia Pacific is forecasted to experience the highest CAGR of 20.9% during the forecast period. E-learning has emerged as a vital tool for digital upskilling, enabling individuals to acquire and improve their digital competencies. The COVID-19 pandemic accelerated the adoption of e-learning, making it essential for individuals across industries to enhance their digital skills. In response to the pandemic's challenges, companies focused on hiring individuals based on their skill sets.

- In April 2025, the Punjab and Haryana High Court announced an order with significant implications by validating the academic qualifications earned via remote distance learning from deemed universities, private institutions, and state universities. However, courts confirmed that such degrees will be subject to relevant government departments or the University Grants Commission (UGC). Source: timesofindia.indiatimes.com

Microsoft reported that nearly 6 million individuals in Asia Pacific utilized various opportunities and resources provided by organizations like Microsoft to enhance their digital capabilities during the pandemic. This emphasis on digital upskilling is expected to drive the growth of the e-learning market in Asia Pacific in the post-pandemic era.

Market Overview

The e-learning services market encompasses the delivery of education and training through electronic technologies. Referred to by various names such as internet learning, distance learning, and online learning, e-learning has applications in both corporate training and academic learning settings. E-learning leverages various technologies such as learning management systems (LMS), video conferencing, interactive simulations, and multimedia resources to create engaging and effective learning experiences. It enables learners to progress at their own pace, access content anytime, anywhere, and engage in collaborative activities with peers and instructors.

Overall, e-learning services offer a flexible, scalable, and accessible approach to education and training, catering to the evolving needs of both corporate and academic learners in today's digital age. The growth of the e-learning services market is primarily fueled by the increasing demand for cost-efficient training and learning solutions in both corporate and academic sectors. Managing and storing large volumes of course content has become a challenge for these sectors.

The electronic delivery of content offers a solution by enabling them to store and manage their course materials online via websites or applications. The rising adoption of cloud-based platforms in the e-learning services market provides added flexibility in content storage, accessibility, and processing. Cloud learning platforms offer several advantages including remote access, enhanced security, data backup, and cost-effectiveness. Moreover, this technology facilitates easy content delivery and student access compared to traditional reliance on books and course materials.

Mobile E-learning Trends

The popularity of mobile e-learning is a transformative trend fostering the global e-learning services market. Global learners prefer learning through smartphones instead of computers, for more flexibility, convenience, and affordability. Mobile e-learning enables access to education content anywhere, anytime, making it ideal for busy schedules and learners who are living in remote areas.

- In the U.S., around 67% of companies have integrated mobile learning with their training programs, which help company employees to access courses and resources through phones or tablets.

- 70% of learners get motivated for training on a mobile device rather than a computer.

- Mobile learning is reported to improve retention rates by 45% compared to a conventional learning system.

- 94% of Gen Z learners prefer the use of smartphones for learning. Source: continu.com

E-learning Services Market Data and Statistics

- According to Coursera statistics in 2021, with a staggering 92 million students actively engaging with its platform. This data underscores the significant importance and growing popularity of online learning platforms in today's educational landscape.

- Adobe's e-learning solution has revolutionized design workflows, empowering instructional designers, corporate trainers, and educators alike. This platform enables the creation of exceptional digital learning experiences tailored to meet learners' needs effectively. Some of the refined design features include immersive learning through VR experiences, interactive 360⁰ videos, live device previews, and intelligent video recording combining webcam and screen capture functionalities.

- According to a survey conducted among students at the National Technical University of Athens, Greece, challenge-based gamified learning led to a remarkable 89.45% improvement in students' performance compared to traditional lecture-based education.

E-learning Services Market Growth Factors

- With e-learning, geographical barriers are eliminated, allowing organizations to reach learners worldwide and standardize training programs across different locations.

- Advanced E-learning platforms leverage data analytics and AI algorithms to deliver personalized learning experiences tailored to individual learner preferences and needs.

- E-learning content can be updated and distributed rapidly, ensuring that learners have access to the latest information and training materials.

- E-learning platforms facilitate compliance training and certification programs, helping organizations ensure regulatory compliance and track employee progress and completion.

- Seamless integration with LMS platforms streamlines course delivery, administration, and reporting, providing administrators with valuable insights into learner performance and engagement.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 20.60% |

| Market Size in 2024 | USD 313.65 Billion |

| Market Size in 2025 | USD 378.26 Billion |

| Market Size by 2034 | USD 2,041.35 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type, By Course, By Learning Method, By Technology, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Widespread use of smartphones and development of various application-based knowledge platforms

Mobile learning technologies are experiencing rapid growth within the e-learning services market, driven by the widespread use of smartphones. This trend has led to the development of various application-based knowledge platforms, allowing users to access real-time insights on diverse topics directly from their smartphones. Educational institutions, including universities and schools, are also leveraging mobile-based applications to provide students with convenient access to missed lectures and other learning resources through student portals.

In the corporate sector, several prominent mobile applications such as Udemy, Skill Pill, DesignJot, and BoostHQ are widely used to facilitate learning and skill development among employees. Additionally, developers are introducing game-based application platforms designed to engage children through interactive animated videos and pictures, thereby enhancing their logical reasoning skills and IQ levels. These mobile learning technologies offer flexibility and accessibility, enabling users to engage in learning activities anytime and anywhere using their smartphones.

As mobile devices become increasingly integrated into daily life, the demand for mobile learning solutions is expected to continue growing, driving innovation and adoption across various educational and professional settings.

Restraint

Concerns over data security

One of the major restraints facing the e-learning services market is the digital divide and unequal access to technology and internet connectivity. Despite the widespread adoption of digital learning platforms, many individuals, particularly in rural or underserved areas, lack reliable access to high-speed internet and digital devices. This disparity in access limits the effectiveness of e-learning initiatives and prevents certain segments of the population from fully participating in online education Moreover, issues related to digital literacy and technological infrastructure further exacerbate the digital divide.

Individuals who are not familiar with technology or lack the necessary skills to navigate online platforms may struggle to engage with eLearning content effectively. Hence, addressing these challenges related to digital access, literacy, infrastructure, and data security is crucial for unlocking the full potential of eLearning services and promoting equitable access to education for all.

Opportunity

Growing demand for soundproof transportation

One of the significant growth opportunities in the E-Learning services market lies in the expansion of personalized learning experiences through the use of artificial intelligence (AI) and machine learning (ML) technologies. These advanced technologies enable eLearning platforms to analyze user data, preferences, and learning patterns to tailor content and recommendations to individual learners. By leveraging AI and ML algorithms, eLearning platforms can offer adaptive learning paths that adjust based on each learner's strengths, weaknesses, and pace of learning. This personalized approach enhances learner engagement, comprehension, and retention by delivering content that is relevant and aligned with the learner's needs and learning style.

Furthermore, AI-powered features such as intelligent tutoring systems, virtual mentors, and chatbots provide learners with instant feedback, assistance, and support throughout their learning journey. These interactive and responsive features mimic the guidance and support of human instructors, thereby enhancing the overall learning experience. Another growth opportunity lies in the integration of immersive technologies such as virtual reality (VR) and augmented reality (AR) into eLearning platforms. VR and AR technologies enable learners to engage in realistic simulations, virtual labs, and interactive experiences that enhance their understanding of complex concepts and practical skills. Additionally, the increasing demand for microlearning and mobile learning solutions presents a significant growth opportunity for eLearning service providers.

Microlearning involves delivering bite-sized learning modules or content nuggets that are easy to consume and digest, making them ideal for learners with busy schedules or short attention spans. Mobile learning solutions allow learners to access educational content anytime, anywhere, using their smartphones or tablets, thereby increasing accessibility and flexibility. Hence, by embracing advanced technologies, personalizing learning experiences, and catering to evolving learner preferences, the e-learning services market can unlock new growth opportunities and address the diverse needs of learners across different industries and demographics.

Type Insights

The custom e-learning segment held the largest market share of 33% in 2024and is expected to continue dominating the market in the forecast period. Custom e-learning involves developing tailored educational content and experiences delivered through digital platforms to meet the specific needs and objectives of organizations, groups, or individuals.

Tthe game-based learning segment is projected to witness the highest CAGR during the forecast period. Game-based learning entails creating e-learning experiences that engage learners and motivate them to enhance their skills in a competitive environment. It leverages gamification techniques to foster learning by providing incentives and rewards for skill development. This approach is increasingly applied in workplace training, particularly in compliance, software applications, and communication training, as it encourages active participation and knowledge retention among learners.

Courses Insights

The instructor-led virtual courses segment held the largest market share of 59% in 2024. Instructor-Led Training (ILT), whether conducted online or in physical classrooms, involves instructors guiding the learning process. This method includes traditional classroom lectures, interactive workshops, or virtual sessions facilitated via video conferencing tools. ILT encourages interaction and meaningful discussions among learners and instructors, fostering a collaborative learning environment. Many companies and institutions are adopting these e-learning courses to upskill industry professionals.

The self-paced courses segment is expected to witness the highest CAGR of 22.6% during the forecast period. Self-paced learning allows learners to navigate through course materials at their own pace and preferred schedule. Individuals have the flexibility to allocate more or less time to specific lessons or course content according to their preferences. This approach provides a personalized learning experience, enabling learners to tailor their education to their unique needs and interests, which contributes to its anticipated growth in the e-learning market.

Learning Method Insights

The blended learning segment held the largest market share of 37% in 2024 in the e-learning services market. Blended learning combines traditional classroom training with online learning activities, maintaining instructor presence during face-to-face sessions, setting it apart from fully online eLearning.

The simulation segment is projected to experience the CAGR during the forecast period. E-learning simulations enable learners to practice and train for work procedures or routines within a virtual learning environment. These simulations replicate real-world scenarios using multimedia graphics and assets that closely resemble the actual working environment. They offer experiential learning opportunities through hands-on activities, enhancing learner engagement and retention. As a result, many organizations are leveraging e-learning simulations to attract customers and enhance their business offerings.

Technology Insights

The cloud computing segment held the largest market share of 38% in the e-learning services market and is expected to maintain its dominance in the forecast period. Cloud computing services encompass software, servers, databases, storage, networking, and analytics delivered over the internet. These solutions enable users to access shared resources and information from any location with internet connectivity, facilitating seamless access to e-learning platforms and resources.

The artificial intelligence segment is projected to witness the highest CAGR during the forecast period. AI has emerged as a transformative technology in the e-learning sector, reshaping how educational content is delivered and personalized to meet individual learner needs. The increasing adoption of AI in e-learning platforms is driven by its potential to improve learning outcomes and offer personalized educational experiences. Many organizations are integrating AI into their platforms to enhance learner engagement and retention rates, aiming to deliver more effective and tailored learning experiences.

End-Use Insights

The academic segment held the largest market share of 46% in the e-learning services market in 2024 and is expected to maintain its position in the forecast period. E-learning has significantly impacted the academic sector by offering a technologically advanced and innovative approach to education. It has transformed traditional teaching methods by leveraging digital platforms and online resources to deliver educational content, providing students with flexible and interactive learning experiences.

The corporate segment is projected to witness the highest CAGR during the forecast period. E-learning has become increasingly valuable for corporations seeking to enhance the knowledge and skills of their employees while optimizing training costs. Many companies across various industries are rapidly adopting e-learning platforms and courses to deliver efficient and effective employee training programs. These platforms offer scalability, convenience, and the ability to accommodate diverse learning styles, overcoming the limitations of traditional training methods such as time constraints and geographical barriers. As a result, corporate e-learning is poised to experience significant growth as organizations recognize its potential to improve workforce skills and productivity.

E-learning Services Market Companies

- McGraw Hill (USA)

- SAP SE (Germany)

- IBM Corporation (USA)

- upGrad Education Private Limited (India)

- NIIT (USA) Inc. (USA)

- Adobe (USA)

- LinkedIn Corporation (USA)

- Docebo (Canada)

- Coursera Inc. (USA)

- BYJU'S (India)

- edX LLC (USA)

- Udemy, Inc. (USA)

- Udacity, Inc. (USA)

Recent Developments

- In March 2025, a comprehensive online learning platform with a Rs 250-500 crore investment, 'Aakash Digital', was launched by the Aakash Educational Services. The launch targets small villages and remote areas. The platform provides cost-effective courses for various subjects, including IIT-JEE. Source: money.rediff.com

- In January 2025, Mayo Clinic partnered with Microsoft Research for the development of multimodal foundation models, enabling integration of text and images for radiology applications. The collaboration further explores the utilization of Microsoft Research's AI technology with the Mayo Clinic's X-ray data to improve personalized patient care and diagnostic accuracy. Source: news.microsoft.com

- In January 2024, Coursera announced the launch of several novel efforts in a bid to improve access to high-quality education in India, including new AI features to comply with the requirements of Indian learners, with over 4,000 courses now available in Hindi. It is a large catalog of learning content in Hindi and AI-powered features Source: hindustantimes.com

- In June 2023,IPC, a global association serving the electronics manufacturing industry, unveiled three online instructor-led courses aimed at empowering professionals in the electronics sector. These courses delve into the intricacies of lead-free production, offering comprehensive insights into challenges and solutions.

- In March 2022, Skilldom, a seasoned e-learning company, merged its Custom eLearning Services division with Cognigix, a provider of bespoke digital learning solutions, leveraging their combined expertise.

- In November 2021, KNOLSKAPE, a gaming and simulation software firm, introduced Leading Virtual Teams (LTV). LTV provides learners with a risk-free environment to experiment, embrace failure, unlearn outdated practices, and gain knowledge, all without real-world consequences.

Segments Covered in the Report

By Type

- Custom e-Learning

- Responsive e-Learning

- Micro e-Learning

- Translation & Localization

- Game-Based Learning

- Rapid e-Learning

By Courses

- Self-paced Courses

- Instructor-led Virtual Courses

By Learning Method

- Blended Learning

- Mobile Learning

- Virtual Classrooms

- Simulation

By Technology

- Artificial Intelligence

- Augmented Reality and Virtual Reality

- Big Data

- Cloud Computing

By End-use

- Academic

- Corporate

- Government

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content