What is the Electric Vehicle Transmission Market Size?

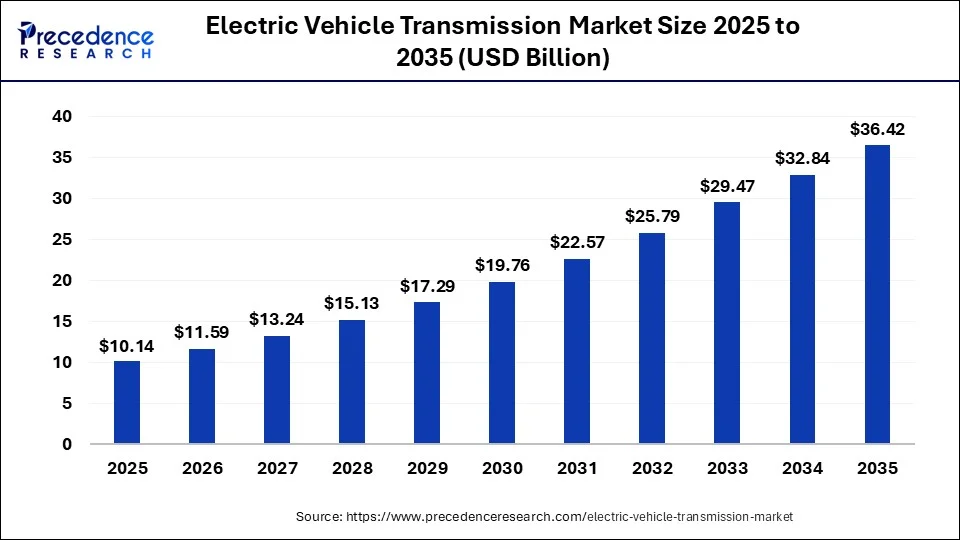

The global electric vehicle transmission market size is calculated at USD 10.14 billion in 2025 and is predicted to increase from USD 11.59 billion in 2026 to approximately USD 36.42 billion by 2035, expanding at a CAGR of 13.64% from 2026 to 2035.

Key Takeaways

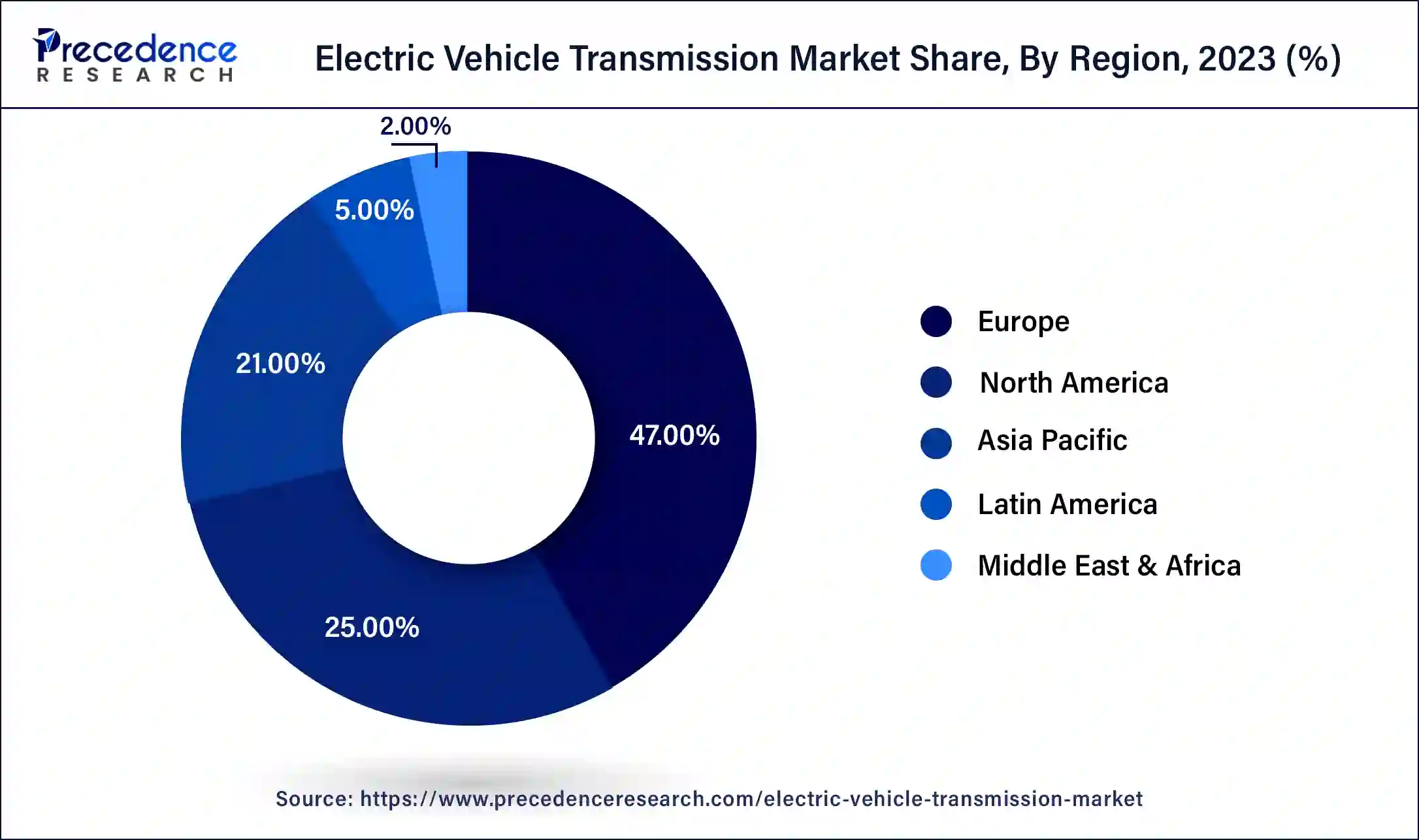

- Europe region has made up 47% revenue share in 2025.

- The battery EV is expected to hit an opportunity of more than USD 20,000 million from 2026 to 2035.

- The AT transmission system segment has accounted revenue share of around 55% in 2025.

- By vehicle, the cars segment accounted for 61% of revenue share in 2025.

- The offline segment is expected to grow at a CAGR of 22.39% from 2026 to 2035.

Market Overview

Transmission has always been an integral component of any car on the road today. Fuel efficiency, acceleration, driving comfort, and enjoyment are all important factors in a car buyer's selection, and they are all strongly tied to the gearbox options available. The function of gearbox in a buyer's purchase choice in an EV will be less important than it is in a gas-powered car. The reason for this is that in a gas-powered vehicle that works between 1,000 and 7,000 RPM, the gearbox serves as an intermediate between the engine and the wheels.

An electric vehicle transmission system is made up of components that help in vehicle propulsion. It is comprised of a motor system, a control system, and a battery system. Electric car transmission system advancements, such as the 4-speed transmission system, can raise motor performance and extend the range of an electric vehicle. Many nations' preference for electric vehicles has contributed in the resolution of various economic, power, environmental, and other challenges. Many firms in the electric vehicle transmission market, as well as its parent industry, are focusing on producing automobiles with cutting-edge technology and innovative features that will be accessible to all target groups across multiple economies. Long-standing companies have a strong grasp on demand to maintain their market presence. The electric vehicle transmission market is expanding due to growing worries about carbon emissions.

Furthermore, several key manufacturers in the EV transmission industry are developing multi-speed transmission sailing operation and load shifting capabilities for electric vehicles and want to deploy them in the near future. Electric vehicle development is gaining traction at a rapid pace, owing to the need to fulfil government pollution limits and future fuel use. Because of this exceptional growth and continuing progress in battery-powered autos, restrictions related to vehicle weight, battery capacity, and other factors that impede the growth of the electric vehicle sector are likely to be eradicated throughout the projection period.

Electric Vehicle Transmission Market Growth Factors

Factors such as increased demand for fuel-efficient and low-emission automobiles, as well as increased manufacturing of electric vehicles, are propelling the EV transmission industry forward. Furthermore, government measures to encourage the usage of electric cars are expected to drive the growth of the electric vehicle transmission market. Furthermore, technical developments in electric cars, as well as the introduction ofVehicle-To-Grid(V2g),electric vehicle charging station, are likely to generate significant growth prospects for major players in the electric vehicle transmission market.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 13.64% |

| Market Size in 2025 | USD 10.14 Billion |

| Market Size in 2026 | USD 11.59 Billion |

| Market Size by 2035 | USD 36.42 Billion |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Transmission System, Vehicle Type, Transmission Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Electric Vehicle Transmission Market Dynamics

Key Market Drivers

- Growing demand for low-emission and fuel-proficient automobiles to spur growth: Because gasoline is a fossil fuel and not a renewable energy supply, it is expected to be depleted in the near future. In compared to typical autos, electric vehicles do not use fuel and emit minimal levels of pollution. Fuel-powered cars transfer around 16%-20% of the energy stored in fuel to wheels, whereas electric vehicles convert more than 50% of the electric energy from the power source to the wheels.

- Increase in adoption of electric vehicles: The global increase in the purchasing of electric cars is boosting the growth rate of the EV transmission sector. For example, in the first half of 2021, Volkswagen Group's global deliveries of full-electric cars more than quadrupled, owing mostly to demand in Europe. Europe was the automaker's leading electric vehicle market, with 128,078, a 156 percent increase. As a result of such high demand, the global electric vehicle market's growth pace accelerates significantly.

- Growing Concerns related to carbon emissions: With the present revolution centred on the depletion of fossil resources, several nations are seriously contemplating implementing measures to benefit the environment, and hence society and the community at large. Every year, 995 metric tonnes of CO2 are emitted in India. People are adopting EV strategies as a result of such worrying data, which indirectly raises demand for the EV transmission business.

Key Market Challenges

- Lack of charging infrastructure - The governments of several nations are encouraging the usage of electric cars for business purposes in order to minimize greenhouse gas emissions into the environment. However, the absence of electric car charging infrastructure is a barrier to the electric vehicle industry. For example, the Indian government intends to have exclusively electric automobiles on the road by 2030. However, one of the most important criteria for ensuring the adoption of electric vehicles is the development of a solid electric vehicle infrastructure. Unfortunately, most developing nations' electric vehicle charging infrastructure is still insufficient and has yet to catch up to satisfy the demand, stifling the expansion of the electric car industry. As a result, the absence of charging infrastructure is limiting the expansion of the electric car transmission industry.

Key Market Opportunities

Downsizing of the transmission system is a vital trend

- Because of their potential to emit zero emissions, electric vehicles are expected to outperform conventional vehicles during the projection period. It will consequently increase demand for electric car transmission. Furthermore, manufacturers of electric car transmissions are always exploring for materials that might minimize the entire weight of the transmission system without sacrificing performance. All of these things will very certainly increase demand for electric automobiles.

- Aside from that, effective utilization of the power stored in EV battery packs is critical, prompting manufacturers to design specific transmission systems to satisfy the performance and close tolerances of batteries. Volkswagen, for example, launched an effort to build superlight automobiles by decreasing their weight by 85 kg using a multi-material strategy.

Increase in the manufacturing of electric vehicles

- Electric car demand and manufacturing have increased dramatically in recent years due to various benefits that electric vehicles have over gasoline-powered autos. Fan belts, air cleaners, oil, timing belts, head caskets, cylinder heads, and spark plugs do not need to be replaced, making them less expensive and more efficient for the expansion of the fuel-powered automotive industry. As a result, increased electric car manufacturing fuels the growth of the electric vehicle transmission industry.

Segment Insights

Transmission System Insights

The global market for electric transmission market is dominated by the automotive transmission category. AT has several advantages, including a smoother driving experience with minimal gear shift hassle and improved performance.

The AMT transmission category is also anticipated to grow considerably because to its availability in both automatic and manual gearbox modes. These transmissions offer the convenience of long-distance travel in the automatic gearbox and the necessary additional power in the manual transmission. The CVT transmission category is anticipated to grow slowly over the course of the forecast period as a result of declining demand for these gearboxes in electric automobiles.

Vehicle Type Insights

The global market for electric transmission is dominated by the BEV sector. The growing popularity of BEVs due to their numerous benefits, such as zero-emission cars and inexpensive maintenance, will fuel the expansion of this market.

Furthermore, the plug-in hybrid electric vehicle sector is expected to rise rapidly in the market throughout the projected period due to increased PHEV acceptance in various developed nations. The hybrid electric vehiclecategory is also expected to increase exponentially due to its increasing popularity in Asia.

Transmission Type Insights

The single-speed transmission is boosting the market for electric vehicle transmission in terms of transmission type. The growing usage of single-speed transmission systems in popular model electric vehicles is propelling the electric vehicle transmission industry forward. Manufacturers are increasingly using single-speed transmission systems due to their low cost, which is fuelling market expansion. Furthermore, the system decreases volume, energy waste, and drivetrain mass, allowing it to take up less space. Furthermore, it provides high-performance automobiles with a simpler gear system and quick torque when paired with a motor. Furthermore, the multi-speed transmission system is likely to boost the market throughout the forecast period due to its capacity to attain a vehicle's peak speed while keeping the electric motor efficient during electric vehicle operation. The inclusion of multi-gears in electric cars for dynamic performance is expected to boost the market for multi-speed transmission systems.

Regional Insights

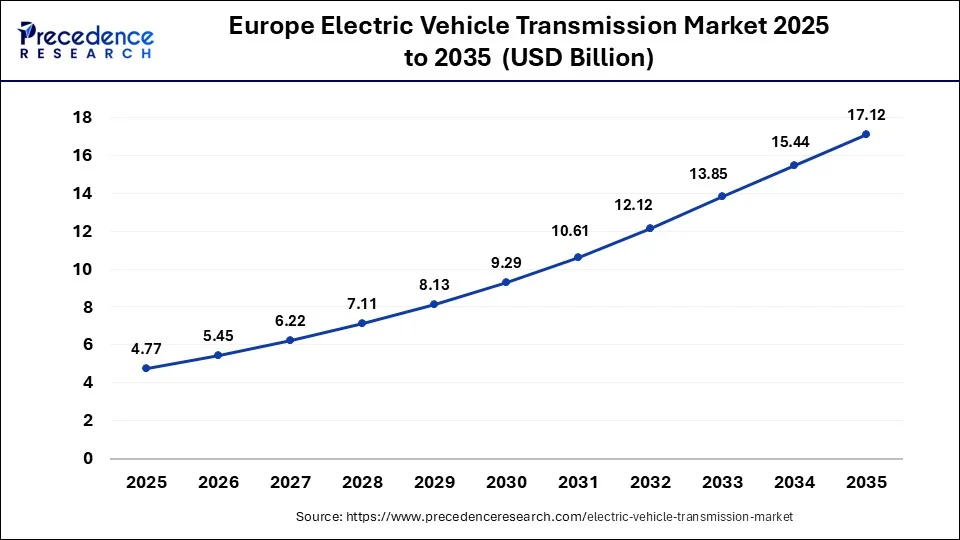

What is the Europe Electric Vehicle Transmission Market Size?

The Europe electric vehicle transmission market size reached USD 4.77 billion in 2025 and is anticipated to be worth around USD 17.12 billion by 2035, poised to grow at a CAGR of 13.63% from 2026 to 2035.

What Makes Europe the Dominant Region in the Electric Vehicle Transmission Market?

Europe dominated the electric vehicle transmission market with the largest share in 2024 due to its strong automotive manufacturing base, early adoption of EV technologies, and supportive government policies promoting electrification and sustainability. The region's focus on high-performance, energy-efficient, and low-emission drivetrains has accelerated the integration of advanced transmission systems in passenger and commercial EVs. Additionally, Europe's well-established R&D ecosystem and leading automotive suppliers drive continuous innovation, positioning it as the global leader in EV transmission technologies.

How is the Opportunistic Rise of Asia Pacific in the Market?

Asia Pacific is experiencing an opportunistic rise in the electric vehicle transmission market due to rapid growth in EV production, supportive government incentives, and expanding charging infrastructure across key countries like China, India, and Japan. Rising consumer demand for electric mobility, coupled with the region's large automotive manufacturing base, is driving the adoption of advanced EV transmissions. Additionally, opportunities in emerging markets such as Southeast Asia are growing as governments and manufacturers invest in sustainable transport solutions and localized EV production.

What Makes North America a Significant Region in the Market?

North America is a significant region in the electric vehicle transmission market due to its strong presence of leading EV manufacturers, advanced automotive R&D capabilities, and a well-established supply chain for high-performance drivetrain components. Government incentives, emission regulations, and growing consumer adoption of electric vehicles further accelerate demand for efficient and reliable EV transmissions. Additionally, the region's focus on innovation, including multi-speed and lightweight transmission technologies, positions it as a key player in the global market.

Electric Vehicle Transmission Market Companies

- Continental AG: A major German automotive technology company specializing in brake systems, powertrain and chassis components, vehicle electronics, infotainment solutions, tires, and technical elastomers.

- BorgWarner Inc.: An American company manufacturing automobile components, particularly for drivetrain and engine systems, with a significant focus on e-propulsion and clean energy solutions.

- Dana Limited (Dana Holding Corporation): An American supplier of drive shafts, axles, sealing solutions, and thermal management products for automotive and off-highway vehicle markets.

- EATON Corporation: A diversified power management company with an eMobility segment that provides intelligent power solutions for the automotive industry, including components for transmissions and hybrid systems.

- Denso Corporation: A global automotive components leader headquartered in Japan, providing thermal systems, powertrain systems, and mobility electronics to major vehicle manufacturers worldwide.

- GKN Plc (GKN Automotive): A global leader in drive systems and a first-tier supplier of driveline technologies, including CV joints and intelligent all-wheel drive systems.

- Hitachi Automotive Systems Ltd.: A Japanese company that is part of the Hitachi Group, focusing on a wide range of automotive components for engine management, electric power trains, drive control, and car information systems.

- Hewland Engineering Ltd.: A UK-based company renowned for the design and manufacture of transmission systems, especially for performance and motorsport vehicles.

Other Major Key Players

- Allison Transmission Inc.,

- Aisin Seiki Co., Ltd.,

- AVL List GmbH,

- JATCO Ltd.,

- Mando Corporation,

- Magna International,

- Porsche AG,

- Schaeffler Technologies AG & Co. KG,

- Robert Bosch GmbH,

- Xtrac Ltd,

- ZF Friedrichshafen AG

Recent Developments

- In February 2019, Dana unveiled a brand-new electronic Gearbox and electronic Clutch for off-road vehicles. A new e-hearbox and e-clutch for off-road vehicles were presented by Dana. These technologies are combined with the company's industry-leading selection of motors, control systems, and investors to enable electric propulsion inside the present vehicle design. Customers will be able to fulfil their needs for efficiency, performance, safety, and flexibility with the aid of these electrodynamic technologies.

- Shell Unveils New E-Fluid for Better EV Performance in May 2019 For BEVs, Shell revealed new e-fluids. The performance of the EV battery will be improved by the e-fluids and e-grease. Additionally, they will support electric vehicles and provide customers greater energy alternatives.

Segments Covered in the Report

By Transmission System

- AMT Transmission

- CVT Transmission

- AT transmission

- Others

By Vehicle Type

- Electric Vehicle Battery

- Plug-in Hybrid Electric Vehicle

- Hybrid Electric Vehicle

By Transmission Type

- Single Speed

- Multi Speed

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Get a Sample

Get a Sample

Table Of Content

Table Of Content