What is Electronic Clinical Outcome Assessment (eCOA) Solutions Market Size?

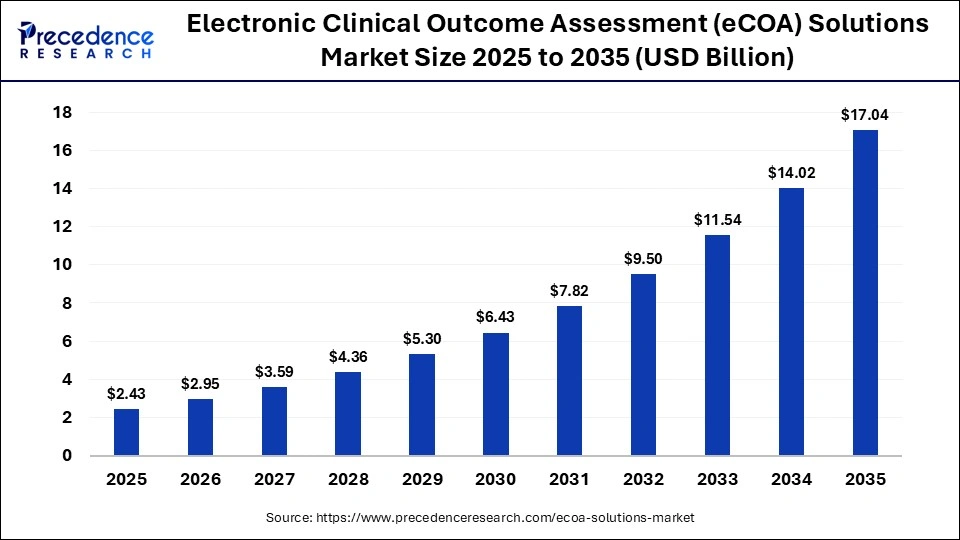

The global electronic clinical outcome assessment (eCOA) solutions market size accounted for USD 2.43 billion in 2025 and is predicted to increase from USD 2.95 billion in 2026 to approximately USD 17.04 billion by 2035, expanding at a CAGR of 21.50% from 2026 to 2035. Growth in the global electronic clinical outcome assessment (eCOA) solutions market is driven by the increasing adoption of decentralized and patient-centric clinical trials that require real-time, remote data capture and monitoring. Regulatory encouragement for digital endpoints, rising investment in clinical research technology, and the need to improve data quality, compliance, and patient engagement are further accelerating market expansion.

Market Highlights

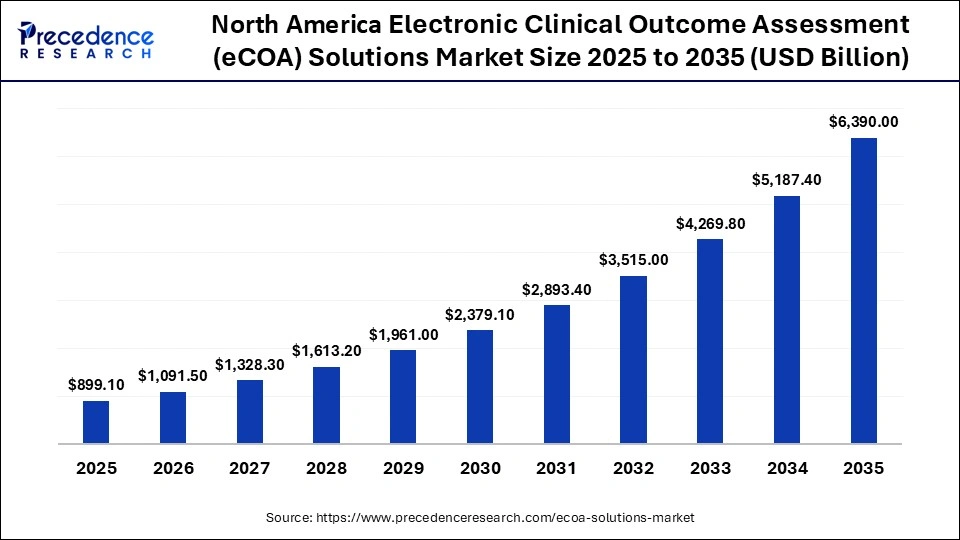

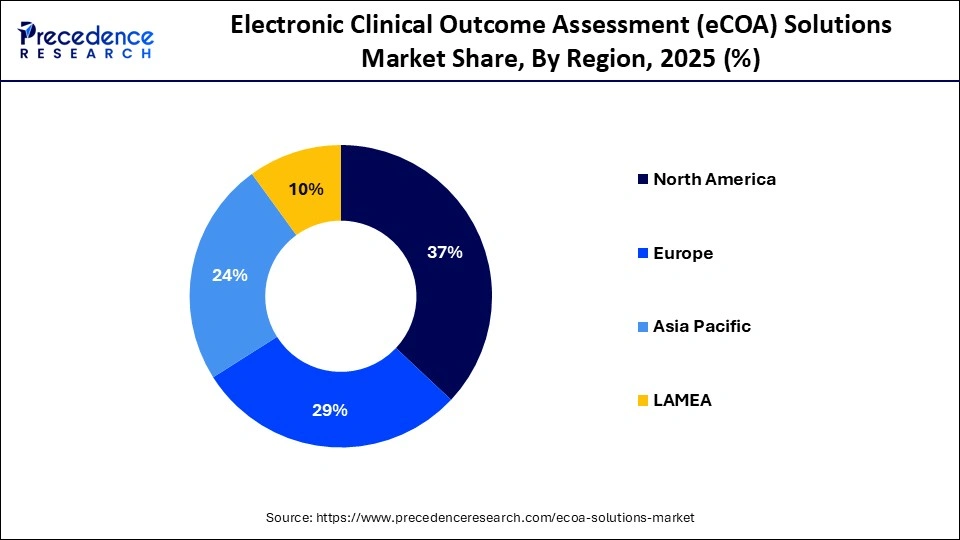

- North America dominated the market with 37% of the market share in 2025.

- Asia Pacific is expected to grow at the fastest CAGR of 21.50% between 2026 and 2035.

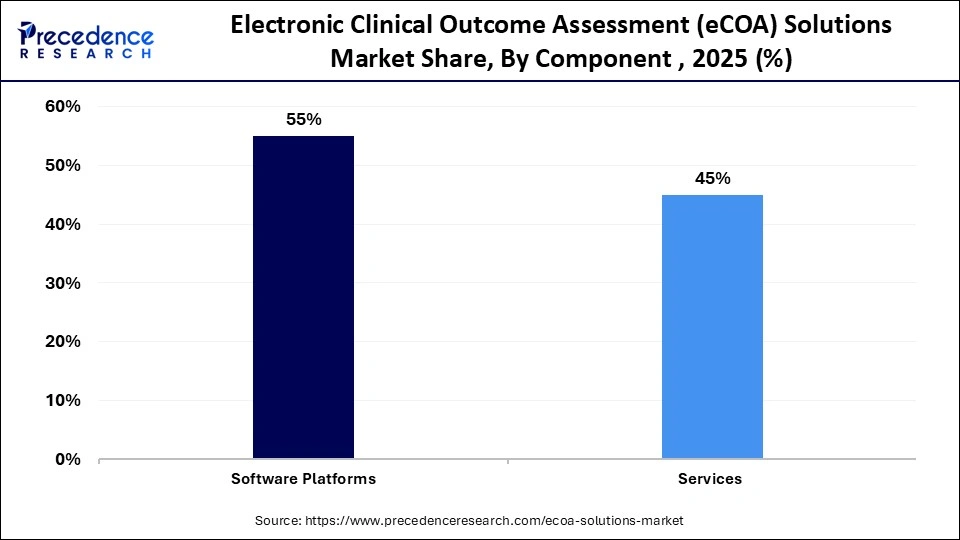

- By component, the software platforms segment contributed the highest market share of 55% in 2025.

- By component, the services (implementation & support) segment is growing at a strong CAGR of 22% between 2026 and 2035.

- By deployment mode, the cloud/SaaS solutions segment contributed the major market share of 60% in 2025.

- By deployment, the hybrid deployment segment is poised to grow at a notable CAGR of 21% from 2026 to 2035.

- By device/interface, the mobile application segment captured the highest market share of 50% in 2025.

- By device/interface, the wearables & sensor-enabled devices segment is grow at a healthy CAGR of 23.70% between 2026 and 2035.

- By therapeutic area, the oncology segment generated the biggest market share of 28% in 2025.

- By therapeutic area, the rare diseases segment is expanding at the fastest CAGR of 24% between 2026 and 2035.

- By end-user, the pharmaceutical & biotech companies segment accounted for the largest market share of 45% in 2025.

- By end-user, the CROs segment is projected to grow at a solid CAGR of 23.40% between 2026 and 2035.

Market Overview

The electronic clinical outcome assessment (eCOA) solutions are leading a significant digital shift in how clinical trials capture, manage, and analyze patient outcome data. The industry is increasingly adopting patient-reported outcomes (ePRO), clinician-reported outcomes (ClinRO), observer-reported outcomes (ObsRO), and performance outcomes (PerfO) as core components of modern trial design, enabling real-time, high-quality data capture compared with paper-based methods. The growing use of eCOA is improving trial efficiency, protocol adherence, and patient engagement across therapeutic areas and geographies.

This transition is supported by the rise of decentralized and hybrid clinical trial models that rely on remote data collection. Sponsors are adopting eCOA to reduce data entry errors and protocol deviations. Integration with electronic data capture and clinical trial management systems is improving end-to-end trial visibility. Regulatory acceptance of digital endpoints is accelerating adoption across late-phase studies. Together, these factors are positioning eCOA as a foundational technology in next-generation clinical research.

Impact of Artificial Intelligence on the Electronic Clinical Outcome Assessment (eCOA) Solutions Market

Artificial intelligence is transforming the market through the advancement of patient-reported and clinician-reported outcomes collection, analysis, and utilization. AI algorithms analyze large volumes of eCOA data in real time to detect trends and early indicators of patient response. improving decision-making during clinical trials. Machine learning also enables customization of eCOA workflows by tailoring reminders, questionnaires, and data capture frequency to individual patient behavior, strengthening engagement and adherence.

AI-driven analytics further support automated data quality checks by identifying missing entries, inconsistent responses, and protocol deviations. Natural language processing is increasingly used to interpret unstructured patient feedback and clinician notes. Predictive models help trial sponsors anticipate dropout risk and intervene early. Together, these capabilities are improving data reliability, patient compliance, and overall trial efficiency.

Growth Factors

- Growing Integration of Wearable and Sensor Technologies: Increasing use of connected devices in clinical studies is boosting eCOA adoption by enabling continuous monitoring of patient outcomes.

- Advancements in Cloud-Based and SaaS Platforms: Enhanced scalability, security, and real-time analytics in cloud solutions are driving broader deployment of eCOA systems across global trials.

- Fueling Patient Engagement and Retention: User-friendly mobile interfaces and gamified reporting tools are rising in popularity, boosting patient compliance and the quality of collected data.

- Propelling Regulatory Alignment and Standardization: Harmonization of global eCOA guidelines and endorsement by agencies like the FDA, EMA, and ISPOR is fueling trust and adoption among sponsors and CROs.

- Driving AI and Analytics-Enabled Insights: The integration of AI for predictive modeling, anomaly detection, and data visualization is propelling the use of eCOA for faster decision-making and trial optimization.

Electronic Clinical Outcome Assessment (eCOA) Solutions Market Outlook

- Industry Growth Overview: Accelerating digitization of clinical research operations is driving sustained momentum across the eCOA solutions landscape, as sponsors and research organizations increasingly replace paper-based assessments with validated digital tools. It is believed that the technology is going to be the key to executing a modern trial execution. This technology allows capturing structured patient-reported, clinician-reported, and observer-reported data with enhanced accuracy and traceability. The development of technology in eCOA platforms is expected to be based on interoperability, usability, and data integrity of regulatory quality. Furthermore, the eCOA platforms are likely to benefit from this shift as sponsors seek validated systems that support inspection readiness and transparent documentation.

- Sustainability Trends: Sustainability considerations are gaining relevance as trial sponsors prioritize operational efficiency and environmental responsibility. The shift to digital outcomes assessment, as compared to paper-based ones, is estimated to minimize physical resources, emissions due to the logistics, and duplicate processes at the sites. Deployment models based on clouds also contribute to energy-efficient data processing and scalable infrastructure. This helps eCOA implementation to remain consistent with the overall ESG promise in the life sciences industry.

- Global Expansion: Geographic expansion strategies are intensifying as eCOA providers seek proximity to high-growth clinical research hubs. North America remains a base of platform innovation and adoption that is driven by regulation, with a well-developed sponsor demand and mature digital infrastructure. Europe is becoming a region of critical harmonized digital trial implementation, with the focus on data protection, transnational studies, and multilingual interaction with patients. On the other hand, Asia-Pacific is expected to become faster in acceptance because clinical trial activities are growing in developing research markets.

- Major Investors:Investment activity in the eCOA segment is being driven by long-term confidence in digital clinical infrastructure. The eCOA platforms are also becoming mission-critical assets of integrated trial technology portfolios by private equity firms and strategic healthcare investors. The form of acquisitions and consolidation of platforms is likely to keep increasing as investors focus on scalable software models, which source recurring revenue and are highly defensible to regulatory bodies. Furthermore, the growing investment momentum reflects broader confidence in the sustained digitization of clinical development and the expanding role of patient-centric data capture technologies.

- Startup Ecosystem: The startup ecosystem surrounding eCOA innovation is expanding as new entrants focus on usability and integration with novel digital endpoints. New businesses are creating mobile-native interfaces, access-friendly designs, and analytics-driven compliance applications. This enhances the engagement of participants and the reliability of their data. Such innovations will not be competing with the established platforms only by scale, but complementing them. Startups that are facilitating the alignment of eCOA functionality with a decentralized trial workflow and real-world data strategies are getting venture capital interest.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.43 Billion |

| Market Size in 2026 | USD 2.95 Billion |

| Market Size by 2035 | USD 17.04 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 21.50% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component,Deployment Mode,Device/Interface,Therapeutic Area,End-User, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Component Insights

Why Are Software Platforms Dominating the eCOA Solutions Market?

The software segment dominated the electronic clinical outcome assessment (eCOA) solutions market in 2025, accounting for an estimated 55% market share. They offer cloud-based systems that are centralized and allow a smooth capturing of patient-reported, clinician-reported, and observer-reported outcomes. These platforms are used by sponsors and CROs to have real-time data visibility, protocol compliance, and cross-site harmonization. Furthermore, the increasing focus on decentralized trials also supports the eCOA relevance, as it allows for collecting remote data and monitoring in real-time.

The service segment is expected to grow at the fastest rate in the coming years, accounting for 22% of CAGR, owing to the growing demand for end-to-end trial enablement. Services involve protocol setup, system verification, training, and continuous technical support, which make the deployment of eCOA solutions smooth. Services are used to supplement software platforms, bringing about a complete solution to contemporary clinical trials. Moreover, the increase in services is also supported by the emergence of decentralized and hybrid trials in the coming years.

Deployment Mode Insights

Why Are Cloud/SaaS Solutions Dominating the eCOA Solutions Market?

Cloud/SaaS solutions segment held the largest revenue share in the market in 2025, holding a market share of about 60%. Due to the increasingly shifting eCOA workloads to the cloud to support global trials and cross-regional consistency. Through these platforms, sponsors and CROs can get consolidated data across different locations in real time. This enhances decision-making and reduces time wastage in clinical trials.

Businesses on cloud systems will testify to an increase in protocol compliance and fewer transcription mistakes with real-time interaction with patients and reminder alerts designed into mobile dashboards. Medable announced 80% revenue growth in 2024 from portfolio-wide cloud adoption, signaling that sponsors are expanding eCOA usage beyond single studies into enterprise digital strategies. Furthermore, the trends collectively reinforce that cloud/SaaS remains the dominant deployment mode for its performance and value delivery across global clinical operations.

Hybrid deployment segment is expected to grow at the fastest CAGR in the coming years, accounting for 21% CAGR, as sponsors seek solutions that combine cloud accessibility with localized data governance and compliance controls. Hybrid designs solve the problem of the regional data privacy regulations. This allows access to remote data analysis by study teams and patients, so they are highly compatible with multinational, adaptive clinical trials. Moreover, the increase in hybrid deployment is also associated with the emergence of decentralized and multimodal studies, which demand the flexibility of data capture pathways.

Device/Interface Insights

Why Are Mobile Applications Dominating the eCOA Solutions Market?

Mobile applications segment dominated the electronic clinical outcome assessment (eCOA) solutions market in 2025, accounting for an estimated 50% market share. Smartphone and tablet apps are a popular choice regarding the collection of electronic patient-reported outcomes in a broad spectrum of therapeutic issues. ePRO tools are often filled in by subjects using personal handheld devices. Furthermore, the ubiquitous smartphone access, user-friendly design, and solid evidence of engagement and data integrity improvement make mobile applications the leading tool/interface of eCOA implementations.

Wearables & sensor-enabled devices segment is expected to grow at the fastest rate in the coming years, accounting for 23.70% of CAGR, as sponsors seek continuous, objective patient data that complements traditional self-reported measures. Hybrid study designs incorporate more wearable feeds and mobile app reporting to facilitate more holistic digital observation of the effect of treatment over time. Moreover, the sponsors expect that a further decrease in sensor prices, advances in interoperability, and regulatory approval of digital biomarkers will increase the pace of wearable adoption.

Therapeutic Area Insights

Why is Oncology the Dominant Therapeutic Area in eCOA Deployments?

Oncology segment held the largest revenue share in the electronic clinical outcome assessment (eCOA) solutions market in 2025, holding a market share of about 28%, due to the growing use of patient-reported outcomes as a primary endpoint and discrimination of cancer research instead of secondary outcomes. The clinical processes require continuous monitoring of quality of life and symptoms digitally.

Medidata cited that more than one million patients and over 83,000 trial sites will have utilized eCOA platforms by 2025, with oncology forming a substantial part of that magnitude. The continued hegemony of oncology in the use of eCOA also indicates the changed trial design and regulatory expectations of patient-centric evidence generation. Embedded in oncology protocols to secure day-to-day fluctuating symptoms in endpoints is supporting HRQoL claims that eCOA instruments are increasingly embedded in the study design to ensure capture of daily symptom fluctuations. Moreover, the combination of scale, regulatory alignment, and data richness explains why oncology dominates digital outcome assessment strategies in advanced clinical research.

Rare diseases segment is expected to grow at the fastest CAGR in the coming years, accounting for 24% CAGR, owing to the digital outcome capture, which meets the unique demands of small, globally dispersed patient populations that traditional on-site assessments struggle to serve.

The use of eCOA platforms to facilitate common symptom reporting, functional performance, and observation of caregivers is becoming more popular. This is highly beneficial in research on rare diseases, where travel distance and patient burden constitute significant obstacles. Furthermore, the other changes in clinical research in the direction of patient-centric data strategies and continuous engagement models are also reflected in the adoption of the rare disease eCOA usage.

End-User Insights

Why Are Pharmaceutical and Biotech Companies Leading eCOA Adoption?

Pharmaceutical & biotech companies segment dominated the eCOA solutions market in 2025, accounting for an estimated 45% market share, driven by their focus on patient-centric evidence and regulatory compliance. The focus of sponsors in this segment is to use digital outcome capture to automate clinical trials, minimize errors in data, and facilitate submission-ready endpoints in accelerated approvals. These organizations have established themselves as the key force behind the implementation of the eCOA solutions in the world market.

The CROs segment is expected to grow at the fastest rate in the coming years, accounting for 23.40% of CAGR, owing to the sponsors outsourcing their trial operations to CROs. The use of eCOA allows such organizations to provide fully managed, compliant, and deep, rich services in decentralized and hybrid trials. The increase in decentralization and hybrid trials in 2025 has increased CRO interest in eCOA systems, especially in rare disease, oncology, and CNS studies.

Regional Insights

How Big is the North America Electronic Clinical Outcome Assessment (eCOA) Solutions Market Size?

The North America electronic clinical outcome assessment (eCOA) solutions market size is estimated at USD 899.10 million in 2025 and is projected to reach approximately USD 6,390.00 million by 2035, with a 21.67% CAGR from 2026 to 2035.

Why Is North America Leading eCOA Adoption Globally?

North America led the electronic clinical outcome assessment (eCOA) solutions market, capturing the largest revenue share in 2025 with an estimated 37% share, driven by high pharmaceutical R&D expenditure, early technology adoption, and a stable regulatory environment favoring patient-centric clinical trials. The United States and Canada widely deploy cloud-based eCOA platforms, mobile applications, and wearable integrations to enable endpoint collection and track patient-reported outcomes across decentralized settings. Continuous technological advancement, combined with strict adherence to regulatory and data integrity requirements, positions North America as an early adopter of eCOA solutions.

This leadership is reinforced by high penetration of decentralized and hybrid trial models across oncology, CNS, and rare disease studies. Strong sponsor and CRO demand for real-time monitoring is accelerating integration of eCOA with EDC and CTMS platforms. Mature digital health infrastructure supports large-scale, multi-site deployments without compromising data security. Together, these factors sustain North America's dominance in the global eCOA solutions market.

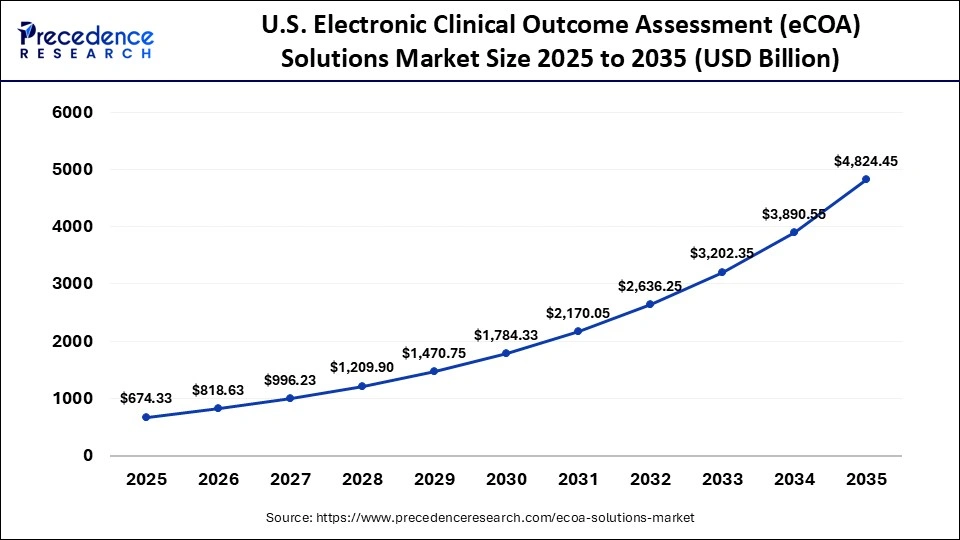

What is the Size of the U.S. Electronic Clinical Outcome Assessment (eCOA) Solutions Market?

The U.S. electronic clinical outcome assessment (eCOA) solutions market size is calculated at USD 674.33 million in 2025 and is expected to reach nearly USD 4,824.45 million in 2035, accelerating at a strong CAGR of 21.75% between 2026 to 2035.

Driving Digital Innovation: eCOA Solutions Transform U.S. Clinical Trials

The United States is a major player in the eCOA solutions market due to high pharmaceutical R&D intensity and early adoption of digital clinical technologies. Sponsors running oncology, CNS, and rare disease trials increasingly rely on cloud-based eCOA platforms, mobile applications, and wearable integrations to capture real-time patient-reported outcomes. High-speed connectivity and mature data infrastructure support seamless deployment across multi-site and multi-state studies.

This adoption is reinforced by strong CRO involvement in decentralized trial execution. Regulatory familiarity with digital endpoints is reducing approval friction. Integration with electronic data capture and remote monitoring tools is improving protocol compliance. Together, these factors are accelerating large-scale eCOA implementation across U.S. clinical research programs.

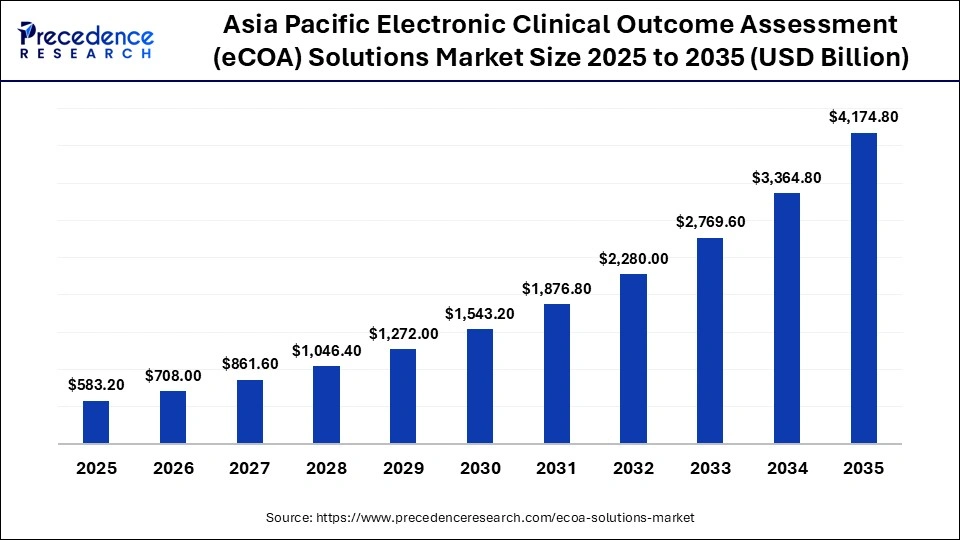

What is the Asia Pacific Electronic Clinical Outcome Assessment (eCOA) Solutions Market Size?

The Asia Pacific electronic clinical outcome assessment (eCOA) solutions market size is expected to be worth USD 4,174.80 million by 2035, increasing from USD 583.20 million by 2025, growing at a CAGR of 21.75% from 2026 to 2035.

Why Is Asia-Pacific Projected to be the fastest-growing eCOA Region?

Asia Pacific is anticipated to grow at the fastest rate in the eCOA solutions market during the forecast period, accounting for an estimated 21.50% CAGR, driven by rising pharmaceutical R&D activity and rapid adoption of digital health infrastructure across China, Japan, India, and South Korea. Cloud-enabled and hybrid eCOA platforms are increasingly addressing logistical challenges associated with large, geographically dispersed patient populations. Growing collaboration between regional sponsors and international CROs is accelerating standardization of digital outcome assessments.

Government-backed digital health programs are improving trial readiness across public hospital networks. Multilingual and culturally adapted eCOA interfaces are increasing patient compliance in diverse populations. Smartphone penetration is enabling large-scale mobile-based outcome collection. Sponsors are using eCOA to reduce site burden and improve data timeliness. Together, these factors are positioning Asia Pacific as a high-growth, scalable market for eCOA adoption.

China's Rapid Rise in eCOA Adoption Fuels Multinational Clinical Expansion

China is leading eCOA adoption in Asia Pacific due to substantial investment in clinical trial infrastructure and government support for decentralized and hybrid trial models. Sponsors conducting large, geographically dispersed studies are integrating cloud-based eCOA platforms with wearable devices to enable continuous, real-time outcome collection. Partnerships with international CROs and technology providers are strengthening local training, system deployment, and operational consistency.

This expansion is further supported by the rapid digitization of hospital networks participating in clinical research. National health data initiatives are improving interoperability between trial sites and digital platforms. High smartphone penetration is enabling scalable patient-reported outcome collection across urban and regional centers. Streamlined regulatory pathways for digital trial tools are reducing setup timelines. Together, these factors are accelerating multinational trial execution and positioning China as a central hub for large-scale eCOA deployment.

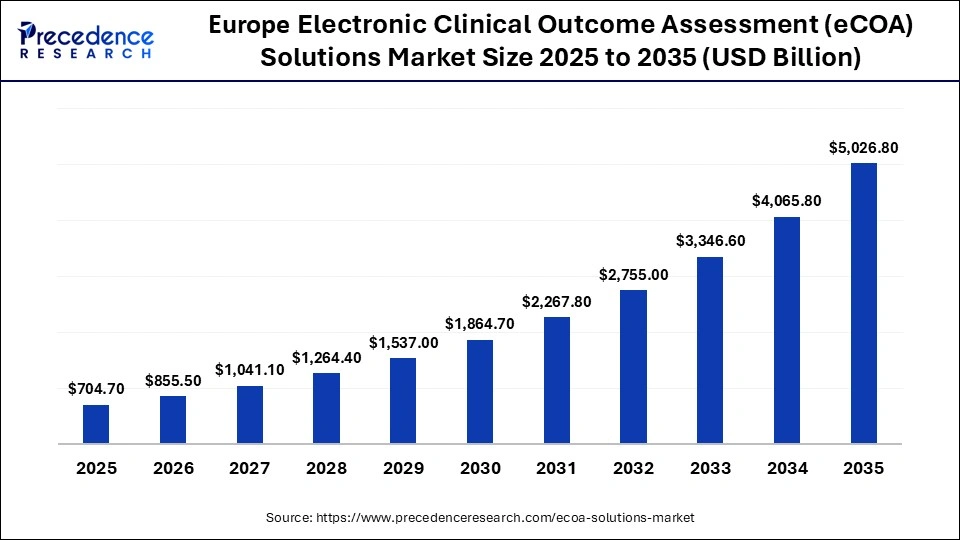

What is the Europe Electronic Clinical Outcome Assessment (eCOA) Solutions Market Size and Growth Rate?

The Europe electronic clinical outcome assessment (eCOA) solutions market size has grown strongly in recent years. It will grow from USD 704.70 million in 2025 to USD 5,026.80 million in 2035, expanding at a compound annual growth rate (CAGR) of 21.71% between 2026 to 2035.

Why Is Europe Emerging as a Key Growth Hub for eCOA Solutions?

Europe is emerging as a key growth hub for eCOA solutions due to increasing harmonization of digital health regulations and a strong shift toward patient-centric clinical research models. Regulatory bodies such as the European Medicines Agency are encouraging the use of standardized digital outcome measures that can be deployed consistently across multinational trials. Industry initiatives, including TransCelerate BioPharma, are further aligning sponsors and CROs on common eCOA implementation frameworks, reducing duplication and protocol variability.

Growth is also supported by Europe's dense concentration of multinational clinical trial sites capable of executing cross-border studies under unified regulatory standards. Increasing adoption of decentralized and hybrid trials in oncology, CNS, and rare diseases is raising demand for multilingual, GDPR-compliant eCOA platforms. European sponsors are prioritizing eCOA to improve patient retention and data completeness in long-duration studies. Investments in digital health infrastructure across public hospital networks are expanding trial readiness. Together, these factors are positioning Europe as a regulation-mature, operationally scalable hub for eCOA deployment.

Germany Leads Europe with Cutting-Edge eCOA Implementation

Germany leads eCOA implementation in Europe, supported by a strong pharmaceutical presence, stringent regulatory oversight, and high levels of patient digital literacy. The country's advanced digital health ecosystem and early adoption of electronic data capture tools make it an attractive environment for large-scale eCOA deployment. German sponsors and CROs frequently partner with global technology providers to pilot and scale compliant eCOA platforms.

This leadership is reinforced by widespread use of decentralized and hybrid trial designs across oncology and rare disease studies. Strong data protection frameworks aligned with GDPR are increasing sponsor confidence in digital outcome collection. Academic medical centers are actively integrating eCOA into routine clinical research workflows. Together, these factors are accelerating implementation speed and sustaining Germany's position as Europe's most advanced eCOA market.

Electronic Clinical Outcome Assessment (eCOA) Solutions Market-Value Chain Analysis

- eCOA Technology Development & Software Engineering

The foundation of the eCOA value chain lies in the design, development, and testing of core software platforms that enable electronic capture of clinical outcome assessments, patient diaries, and reporting interfaces. This stage includes the creation of secure architectures, compliance frameworks, and integration capabilities with other clinical systems.

• Key Players: AssisTek, Climedo Health GmbH, Clinical Ink, Raylytic GmbH

- Clinical Implementation & Service Deployment

After integration, eCOA solutions are deployed into live clinical trials with configurational support, validation of instruments, and customization to match study protocols. This includes setup, regulatory alignment, language adaptations, and user training to ensure data quality and protocol adherence.

• Key Players: Signant Health, ICON plc, Integra IT S.A.S, Kayentis

- Data Management, Analytics & Reporting

Collected eCOA data are processed, cleaned, and analyzed to generate actionable insights for clinical endpoints, safety monitoring, adaptive study decisions, and regulatory submissions. Advanced analytics, dashboards, and AI-enhanced tools add value by improving interpretation and accelerating decision-making.

• Key Players: IQVIA, EvidentIQ, Veeva Systems, Medidata

- Clinical Support & Regulatory Compliance Services

This stage ensures that eCOA deployments meet regulatory requirements such as 21 CFR Part 11, GDPR, and HIPAA while providing audit trails, documentation support, and ongoing technical assistance throughout the trial lifecycle. It also includes quality assurance and updates to maintain compliance as standards evolve.

• Key Players: ICON plc, Signant Health, Oracle Corporation, Integra IT S.A.S

Who are the Major Players in the Global Electronic Clinical Outcome Assessment (eCOA) Solutions Market?

The major players in the electronic clinical outcome assessment (eCOA) solutions market include AssisTek, Climedo Health GmbH, Clinical Ink, CRF Health, EvidentIQ, ICON plc, IQVIA, Integra IT S.A.S, and Kayentis

Recent Developments

- In October 2025, YPrime, a leading clinical trial technology provider, launched its Advanced eCOA Oversight functionality, strengthening how Principal Investigators (PIs) review and acknowledge participant data. The update aligns with recent EMA guidelines on computerized systems and ICH E6(R3) recommendations, emphasizing that investigator oversight must be documented, attributable, and demonstrable. The new functionality enables electronic review and endorsement at key study milestones, supporting data integrity, participant safety, and accurate reporting to sponsors.(Source: https://www.yprime.com)

- In December 2025, SuSuvoda announced that its Interactive Response Technology (IRT), also known as Randomization and Trial Supply Management (RTSM), earned a Leader designation in Everest Group's PEAK Matrix assessment for RTSM technology. The evaluation benchmarks providers on market impact, vision, and delivery capability, highlighting Suvoda's leadership in trial supply and randomization solutions. (Source: https://www.suvoda.com)

- In December 2025, Medable introduced its Innovation Evidence Workshop series, developed in collaboration with the Tufts Center for the Study of Drug Development (CSDD). The inaugural workshop, held on November 19 in Boston, brought together leaders from 20 pharmaceutical, biotech, and CRO organizations, along with representatives from the FDA, Harvard MRCT, and Medable. The series aims to advance AI-powered clinical trial technology and facilitate cross-industry knowledge sharing to accelerate trial innovation.(Source: https://www.businesswire.com)

Segments Covered in the Report

By Component

- Software Platforms

- Services

- Consulting & Implementation

- Integration & Validation

- Training & Support

By Deployment Mode

- Cloud/SaaS eCOA Solutions

- On-Premise eCOA Solutions

- Hybrid Deployment

By Device/Interface

- Mobile Applications (Smartphones / Tablets)

- Web Portals (PC/Laptop)

- Interactive Voice/Response Systems (IVRS/IVR)

- Wearables & Sensor-Enabled Devices

By Therapeutic Area

- Oncology

- CNS Disorders (Neuro, Psychiatry)

- Cardiovascular Diseases

- Metabolic Disorders (Diabetes, Obesity)

- Rare Diseases

- Infectious Diseases

- Others (Respiratory, GI, etc.)

By End-User

- Pharmaceutical & Biotech Companies

- Contract Research Organizations (CROs)

- Clinical Research Sites

- Healthcare Providers & Hospitals

- Academic & Research Institutions

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting