What is Electrosurgical Generators Market Size?

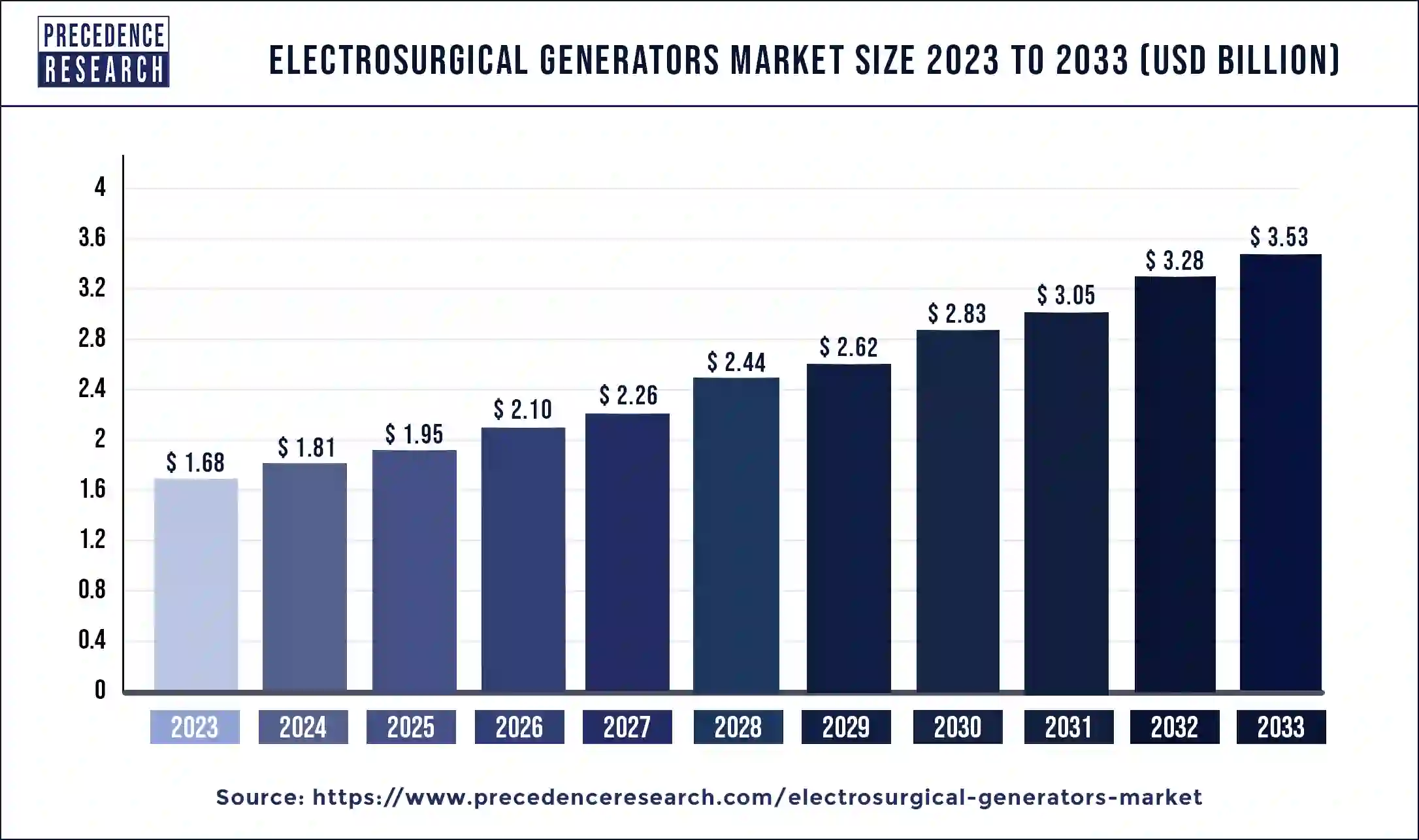

The global electrosurgical generators market size was valued at USD 1.95 billion in 2025 and is anticipated to reach around USD 4.03 billion by 2035, growing at a CAGR of 7.53% from 2026 to 2035. Technological advancement in healthcare practices and increasing preference towards MIS are expected to remain the key growth drivers for the electrosurgical generators market during the forecast period.

Market Highlights

- North America dominated the global electrosurgical generators market in 2025.

- Europe will experience notable growth in the market during the projected period.

- By type, the bipolar electrosurgical segment held a considerable share of the market in 2025.

- By type, the monopolar generator segment is expected to grow at a notable rate during the forecast period.

- By application, the dermatology segment held a significant share of the market in 2025.

- By application, the gynecology segment is projected to show notable growth in the market over the projected period.

- By end use, the hospital segment dominated the market in 2025.

- By end use, the ambulatory surgical centers segment will grow substantially in the market over the studied period.

How is AI Integration Transforming the Electrosurgical Generator Market?

The artifical intelligence is transforming the electrosurgical generator industry through greater accuracy, safety, and efficacy with regard to surgical activities. Generators with artificial intelligence will be able to change in real time to accommodate the type of tissue, impedance variation, and surgical condition, optimizing energy delivery so as to reduce collateral damage. The possibility of transforming it with surgical robots and image-guided systems comes with further decision-making and automation. Also, AI enables individual surgery, where their information is analyzed to adjust the output to energy to achieve better clinical results.

Market Overview

Electrosurgery is used for different medical purposes, such as stopping bleeding (hemostasis) and removing abnormal skin growth. This technique uses electricity to destroy tissue through dehydration, coagulation, or thermal vaporization. The tissue's resistance to the high-frequency current creates a heating effect that destroys the tissue. Electrosurgical generators produce a high-frequency electrical current to cut tissue and control bleeding by causing coagulation.

Electrosurgical generators are designed to create high-frequency electric currents and can produce different types of electrical currents for either bipolar or monopolar electrosurgery, depending on the specific type of surgery. In monopolar electrosurgery, the current flows from the probe electrode to the tissue and completes the circuit as it returns through the patient.

Electrosurgical Generators Market Growth Factors

- The growing number of cosmetic surgeries among most of the population can drive the demand for the electrosurgical generators market.

- The rising elderly population also has a positive impact on the market growth over the projected period.

- Increasing use of innovative models in the electrosurgical generators market is expected to fuel its growth.

- Developing research & development activities in the field is likely to boost market growth shortly.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.95 Billion |

| Market Size by 2026 | USD 2.1 Billion |

| Market Size by 2035 | USD 4.03 Billion |

| Market Growth Rate | CAGR of 7.53% from 2026 to 2035 |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing surgical procedures

The increasing demand for surgical techniques, including minimally invasive procedures, is a significant driver for the electrosurgical generators market. These generators are extensively used in various surgical fields, such as urology, general surgery, gynecology, and orthopedics, to cut, coagulate, and ablate tissues.

The growing global population and the prevalence of chronic diseases have led to a rise in surgical interventions and boosted the demand for electrosurgical generators. These devices allow for precise tissue cutting and coagulation by facilitating minimally invasive surgeries with smaller incisions and quicker recovery times. Additionally, electrosurgical generators enhance surgical precision, reduce bleeding, and improve patient safety, further driving the demand for the electrosurgical generators market.

- In June 2023, Olympus Corporation, a global medical technology company committed to making people's lives healthier, safer, and more fulfilling, announced the market availability of its newest electrosurgical generator for use in the treatment of bladder cancer and enlarged prostate.

Restraint

Safety concerns and risk of complications

While electrosurgery offers numerous benefits, such as reduced blood loss and shorter recovery times, it is not without risks. Incorrect use or settings can lead to complications like burns, tissue damage, or accidental harm to surrounding structures. These safety concerns have increased scrutiny and necessitated comprehensive training for healthcare professionals. Additionally, adverse events and litigation related to electrosurgery can deter some providers from adopting this technology and can pose a constraint to the growth of the electrosurgical generators market.

Opportunity

Rising adoption of electrosurgical generators in gynecology and neurology

In gynecology, the electrosurgical generators market services are employed for procedures such as endometrial ablation, cervical conization, and the removal of cervical and vaginal lesions. They enable precise tissue cutting and coagulation with minimal thermal damage to surrounding tissues, crucial for preserving fertility and ensuring patient recovery.

In neurosurgery, the electrosurgical generators market aids in spinal surgery, tumor removal, and epilepsy surgery. The precision provided by these devices is vital in neurology, where operations often involve delicate structures. The ability to perform exact tissue ablation and blood vessel coagulation without causing extensive damage is indispensable.

- In May 2023, Burjeel Medical City, the flagship facility of Burjeel Holdings, launched an Advanced Gynecology Institute designed to offer multidisciplinary healthcare solutions to women of all ages. The launch comes just months after the hospital joined hands with the globally renowned Franco-European Multidisciplinary Institute of Endometriosis Academy.

Segment Insights

Type Insights

The bipolar electrosurgical segment held a considerable share of the electrosurgical generators market in 2025. Bipolar electrosurgical generators are designed for procedures that demand precision and reduced thermal spread. In bipolar electrosurgery, the electrical current flows between the two tips of a forceps-shaped instrument, which is applied directly to the target tissue. This configuration confines the electrical energy to the specific tissue area held within the tips and provides enhanced control over the surgical site.

- In January 2023, Cook Medical announced that it had launched a streamlined portfolio of urological bipolar electrodes in the U.S. The electrodes are for daily use in bladder and prostate procedures. The new portfolio includes seven products. Six have configurations for use in transurethral resection, ablation, and soft tissue removal of the prostate and bladder and where hemostasis is required.

The monopolar generator segment is expected to grow at a notable rate during the forecast period. Monopolar electrosurgical generators are utilized in a wide range of surgical procedures, including general surgery, orthopedics, and urology. These systems are known for their versatility and ability to efficiently coagulate, cut, and dissect tissues. Technological advancements have led to the development of safer and more efficient monopolar electrosurgical generators, which propelled their rapid market growth.

Application Insights

The dermatology segment held a significant share of the electrosurgical generators market in 2025. This growth can be attributed to the increasing awareness of aesthetic dermatology procedures, such as skin resurfacing, mole removal, and cosmetic enhancements. The rising obsession with physical appearance and the desire to look youthful have escalated the demand for aesthetic surgeries. As people become more conscious of their appearance, the demand for dermatological procedures continues to surge, driving the adoption of electrosurgical generators in this field.

- In October 2023, Board certified and award-winning dermatologist Dr. Blair Rose launched the Skincare Junkie, a skincare line that utilizes powerful and clinically proven ingredients in just the right combinations and concentrations to solve common skin problems.

The gynecology segment is projected to show notable growth in the electrosurgical generators market over the projected period. Electrosurgery is employed to coagulate tissue during gynecological procedures, enhancing precision and minimizing unnecessary tissue injury. This increased precision contributes to the growth of the gynecology segment.

End-use Insights

The hospital segment dominated the electrosurgical generators market in 2025. The hospitals segment holds the largest revenue share over the forecast period. Hospitals extensively use electrosurgical generators for various surgical procedures due to their high patient volume. Given hospitals' critical role in ensuring patient safety and delivering high-quality care, stringent regulations mandate the use of safe and effective electrosurgical generators, further driving their adoption in this segment.

The ambulatory surgical centers segment will grow substantially in the electrosurgical generators market over the studied period. The ambulatory surgical center segment is expanding due to the rise in surgeries, the prevalence of chronic diseases, and the growing elderly population. Ambulatory surgery centers (ASCs) are a crucial part of the healthcare industry, offering outpatient surgical procedures cost-effectively and conveniently. These centers provide high-quality care in a specialized setting and help to enhance the efficiency of the healthcare system.

Regional Insights

U.S. Electrosurgical Generator Market Trends

The United States enjoys massive funding for healthcare infrastructure, which has helped hospitals and clinics install technologically advanced systems. The rising chronic conditions, especially among older people like cancer, heart-related diseases, and obesity, have greatly contributed to the rise and hence the demand for surgical procedures, which further boosts the electrosurgical generators. Many surgical procedures require these tools to ensure precision and control in cutting and coagulating tissues. Moreover, the increasing importance of minimally invasive surgical procedures, which limit the duration of patient recovery and events, has driven the usage of electrosurgical instruments that facilitate these techniques.

Europe

UK Electrosurgical Generator Market Trends

The UK electrosurgical generator market is expected to grow at a significant CAGR during the forecast period due to the growing incidence of neurological diseases, including epilepsy and dementia. The National Health Service (NHS) is fully working on improving dementia care and diagnosis, with a need to inspire the demand for the new surgical technologies. Further, the UK gives special emphasis to the reduction of invasiveness and patient safety, thus creating a trend in the transition to the next generation of electrosurgery equipment. Healthcare-friendly policies, technological improvement, and more funds that go into hospital infrastructure also drive the development of the electrosurgical generator market within the region.

Asia Pacific Electrosurgical Generator Market Trends

The Asia Pacific electrosurgical generator market is experiencing rapid growth due to a remarkable rise in the healthcare infrastructure and more surgical volume. Japan, South Korea, and India are leading the ranks of this expansion with their investments into the modernization of the structure of healthcare and the use of modern medical technologies. The new focus on infection control, hygiene, and surgical efficiency has also added momentum to their application to hospitals and ambulatory surgical centers. Also, the improvement of patient care and surgical results is increasingly gaining popularity among healthcare providers, which also adds to the popularity of electrosurgical technologies.

China

The electrosurgical generator market in China is likely to experience a lucrative CAGR over the forecast period due to the intensive investments undertaken by the government in the expansion and modernization of healthcare infrastructure. There is an existence of various new hospitals and health centers located in both urban and rural areas, which have seen more people using more advanced surgical equipment. The increased cases of age-related health conditions and chronic diseases in China and India are known to require more surgical interventions.

Recent Developments

- In January 2025, Medtronic agreed to a distribution agreement in the United States with Contego Medical to increase its market share in the carotid and peripheral vascular disease markets. Such collaboration may lead to the expansion of the electrosurgical generators in the market, especially concerning vascular and minimally invasive surgeries.

- In September 2024, Mindray, a medical equipment manufacturer, unveiled the UP700 Electrosurgical Diathermy Generator Unit at the 27th International Federation for the Surgery of Obesity and Metabolic Disorders (IFSO) World Congress in Melbourne, Australia.

- In January 2024, Olympus released its new redesigned ESG-410 Surgical Energy Platform, an all-in-one energy system in surgical specialties, into the market. ESG-410 offers a variety of energy modes needed to handle a variety of surgical requirements: monopolar, bipolar, advanced bipolar, ultrasonic, and hybrid energy.

Electrosurgical Generators Market Companies

- Medtronic

- Johnson & Johnson

- B. Braun Melsungen AG

- ConMed Corporation

- ERBE Elektromedizin GmbH

- Olympus Corporation

- Boston Scientific Corporation

- Ethicon Inc.

- Symmetry Surgical Inc.

- KLS Martin Group

- Megadyne Medical Products Inc.

- Bovie Medical Corporation

- Smith & Nephew plc.

- Applied Medical Resources Corporation

Segments Covered in the Report

By Type

- Bipolar

- Monopolar

By Application

- Optical

- Gynecology

- Dermatology

- Cardiac

- Dental

- ENT

- Maxillofacial

- Orthopedic

- Urology

- Neurology

- Others

By End-use

- Hospitals

- Ambulatory Surgical Centers

- Clinics

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting