What is Empty Capsules Market Size?

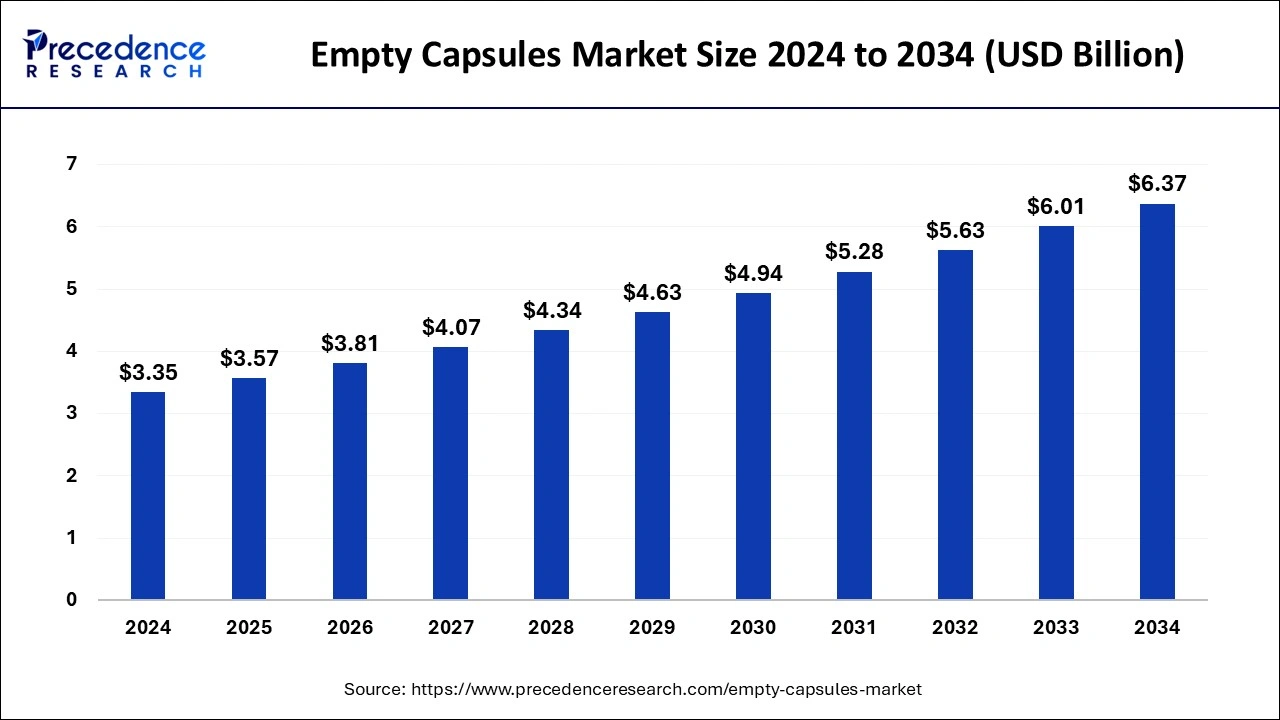

The global empty capsules market size is estimated at USD 3.57 billion in 2025 and is predicted to increase from USD 3.81 billion in 2026 to approximately USD 6.74 billion by 2035, expanding at a CAGR of 6.56% from 2026 to 2035. Therising demand for dietary supplements and the adoption of capsule-based drugs are driving the growth of the market.

Market Highlights

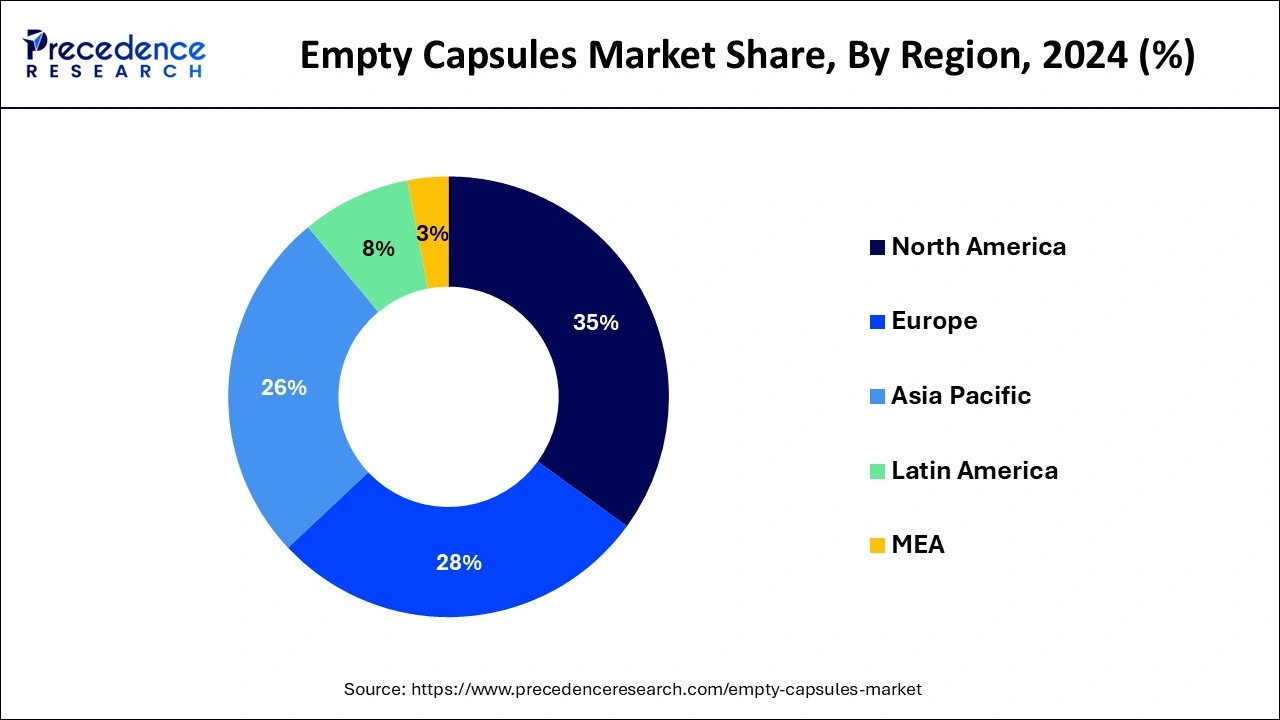

- North America led the empty capsules market with the largest market of 35% in 2024.

- By region, Asia Pacific is expected to witness the fastest growth in the market during the forecast period.

- By product, the gelatin segment dominated the market in 2024.

- By functionality, the immediate release segment is projected to witness the fastest growth in the market during the forecast period.

- By application, the antibiotics & antibacterial segment dominated the market in 2024.

- By end user, the pharmaceutical companies segment held the largest market share in 2024.

Market Overview

Capsules are one of the types of medicines made from gelatin, cellulose, and polysaccharides. The capsule contains various types of drug formations, such as solid, liquid, and powder forms, that are made for swallowing. The drugs that are packed in the capsule may irritate the gastric mucosa and esophagus, volatilize easily, taste bad, decompose in saliva, or should be inhaled into the trachea. The packing of the active ingredient into the capsule prevents all these irritations and protects it from degradation and damaging organs and the respiratory tract. Based on consumer preference trends and clinical requirements, these capsules can be made soft and hard using a variety of materials.

- According to an article published in the Nitta Gelatin India in June 2022, capsules are the second most preferred drug delivery format. They account for about 13% of the new drugs approved by the Food and Drug Administration (FDA), with the immediate-release variety being the most commonly prescribed for treating a wide range of diseases and disorders.

Empty Capsules MarketGrowth Factors

- The increasing prevalence of chronic diseases and the rising adoption of capsule-based drugs are propelling the growth of the empty capsules market.

- The rising global population, especially the geriatric population that is more likely to be prone to chronic diseases and illnesses, drives the demand for medication, which led to the rising demand for empty capsules for drug making or formulation.

- The rising prevalence of chronic diseases such as diabetes, cancer, cardiovascular diseases, and gastrointestinal diseases are contributing to the expansion of the empty capsules market.

- The rising investments by the public and private institutes for expanding the drug manufacturing units and the pharmaceutical industry are driving the growth of the market.

- The rising demand for capsule drug delivery formulations to overcome various diseases drives the growth of the market.

- The increasing investments in technological advancements in the pharmaceutical and manufacturing industries for better productivity and product quality are driving the growth of the empty capsules market.

- The increasing rate of illness and disease among the population due to infections, and other mediums drives the demand for the drugs which has led to the rising demand for the empty capsules market.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.57 Billion |

| Market Size in 2026 | USD 3.81 Billion |

| Market Size by 2035 | USD 6.74 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 6.56% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Type, By Functionality, By Application, and By End-user, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing adoption of capsule drug formation for disease as well as health supplements market

The increasing prevalence of chronic diseases such as cancer, cardiovascular disease, gastrointestinal diseases, diabetes, etc., is driving the expansion of the drug market. The increasing adoption of the drug in capsule formation due to its better effects and easy intake drives the growth of the empty capsules market.

- According to data published by the World Health Organization (WHO) in July 2022, it is estimated that around 1.7 billion people globally suffer some form of musculoskeletal disorders. Of these, 528 million are cases of osteoarthritis.

Along with therapeutic applications, the rising consumption of dietary supplements by people who come in capsule drug form leads to the increased demand for empty capsules in the market. The rising awareness about healthy lifestyles and dietary supplements for healthy gut health and the removal of skin issues contribute to the growth of the empty capsules market.

- According to an article published by M&R Label, in May 2022, around 77.0% of American adults consumed dietary supplements and spent an average of USD 56 per month on them.

Restraint

Shortage of raw materials and cost-related constraints

The shortage of raw materials, such as gelatin, and the fluctuating prices of the raw materials are restraining the growth of the empty capsules market. In adverse conditions like economic crises, deteriorating trade relationships, or global healthcare situations as faced during the COVID pandemic, there is an acute shortage of raw materials along with limited funds. As the capsule has little to no effect on the mechanism of the active ingredient, pharmaceuticals tend to sway away from capsule-based delivery. Moreover, a sudden surge in prices of raw materials in response to growing demand and a broken supply chain further hinders market growth.

- According to Procurement Resource, hydroxypropyl methylcellulose (HPMC) was priced at USD 6,015.6/ Metric Ton in the first half of the Indian market.

Opportunity

The rising potential of the pharmaceutical sector

The rising investment by the major private and government institutions in the development of the pharmaceutical sector is contributing to the growth of the market. The increasing research and development activities in the expansion of the market, product launches, and the latest drug development enhance the demand for empty capsules for the storage of drugs inside it for better consumption by the consumers. Additionally, the integration of technologies in the pharmaceutical manufacturing units for the improvement in quality and production drives the growth opportunities for the empty capsules market.

- In December 2022, Vantage Nutrition LLC, an ACG Group company, acquired Philadelphia-based AquaCap, an asset of Nestle Health Science. This acquisition aimed to expand Vantage Nutrition LLC's footprint and manufacturing capability.

- In July 2022, Sunil Healthcare Limited's export revenues improved by 25.0% during FY22, coupled with better profitability and operating margins from HPMC capsules compared to others.

Segment Insights

Type Insights

The gelatin segment dominated the empty capsules market in 2024. The growth of the segment is attributed to the rising use of the gelatine substance for capsule making due to its properties that drive demand for the segment. Water and gelatin are the two primary constituents of gelatin capsules. They are made from animal collagen, which is entirely different from those derived from plants.

Some types of gelatine capsules used in medicinal use are clear gelatin capsules, flavored gelatin capsules, and enteric-coated gelatin capsules. The gelatin capsules come in sizes of 5 to 000. Size 5 is the smallest size of the gelatin capsules, and size 000 is the biggest size of gelatin capsules. Each of them is used depending on the diameter of the capsules.

- In May 2022, Capsugel launched a titanium dioxide-free (TiO2-free) white hard gelatin capsule, which meets the demand for titanium dioxide-free foods in the European Union.

- In February 2023, Vivion, a brand of Operio Group, launched its new product range of empty gelatin, HPMC, and pullulan capsules.

Functionality Insights

The immediate release segment is projected to witness the fastest growth in the empty capsules market during the forecast period. The system of oral medication delivery comprises solid dose forms, including immediate release and traditional forms. For the past few decades, a variety of acute and chronic disease therapies have been used in traditional dosage forms, such as capsules, solids, pills, powder, solutions, emulsions, and aerosols.

Using super disintegrants such as sodium starch glycolate (Primogel, Explotab), polyvinylpyrrolidone (PVP), etc., that enable rapid tablet disintegration after administration is the fundamental method employed in the development of immediate-release solid dosage forms. A variety of methods, such as direct compression and wet granulation, can be used to formulate it.

Application Insights

The antibiotics & antibacterial segment dominated the empty capsules market. The growth of the segment is attributed to the rising prevalence of chronic diseases and infectious diseases caused by bacteria. Antibiotics are a class of medications that are crucial for treating bacterial infections.

Medical practitioners utilize them to treat a variety of illnesses, including skin infections, urinary tract infections, meningitis, pneumonia, and strep throat. Some types of antibiotics used in the various symptoms of infections are Beta-lactam Antibiotics, Aminoglycosides, Sulfonamides, Quinolones, Macrolides, Nitroimidazole antibiotics, Tetracyclines, Lincosamides, Oxazolidinones and Lipoglycopeptides, and Glycopeptides.

End-user Insights

The pharmaceutical companies segment held the largest share in the empty capsules market. The growth of the segment is attributed to the increasing expenditure and investments in the healthcare and pharmaceutical industry, which are driving the demand for the market the rising prevalence of chronic diseases that drives the demand for effective treatment and medication that drives the demand for empty capsules for the packing the drug which is on the form of power of liquid that contributed in the expansion of the empty capsules market. The increasing investments in the pharmaceutical industry by the public and private sectors are driving the expansion of the pharmaceutical industry.

Regional Insights

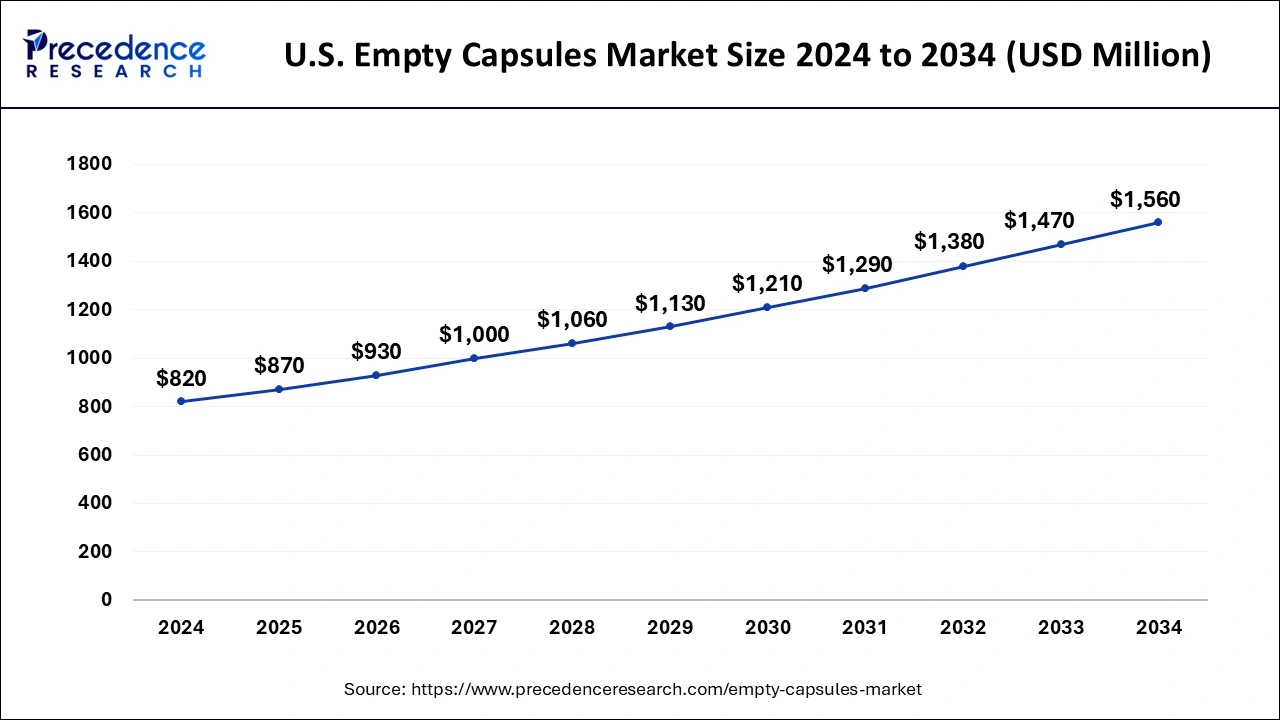

U.S. Empty Capsules Market Size and Growth2026 to 2035

The U.S. empty capsules market size is estimated at USD 870 million in 2025 and is projected to surpass around USD 1,650 million by 2035 at a CAGR of 6.61% from 2026 to 2035

U.S Empty Capsules Market Trends

The U.S. market is growing due to strong pharmaceutical manufacturing, rising demand for prescription and OTC drugs, and increasing prevalence of chronic diseases. Advanced healthcare infrastructure, continuous drug innovation, and growing use of capsules for precise dosing and improved patient compliance further support market expansion across the country.

North America at the Forefront: Driving Growth in the Empty Capsule Market

North America led the empty capsules market with the largest market size in 2024. The growth of the market in the region is attributed to the well-developed healthcare infrastructure and the rising number of pharmaceutical industries that led to the higher demand for empty capsules for drug packaging.

The increasing investments in research and development activities in the development of the pharmaceutical industry and for the latest drug launch drive the expansion of the pharmaceutical industry. The rising prevalence of chronic diseases in the population due to unhealthy lifestyles and the environment also contributes to the expansion of diseases and the demand for effective medicinal treatment. Thus, all these factors collectively contribute to the growth of the region's market.

- In February 2022, CapsCanada, a Lyfe Group company, received approval for a liquid-filled aspirin capsule. This product is based on the PLxGuard drug delivery platform aimed at delivering drugs in the gastrointestinal tract.

- In March 2023, an ACG company, Vantage Nutrition, acquired ComboCap Inc. in the U.S. and BioCap in South Africa, intending to expand their technology and footprint in North America and across the globe.

Asia Pacific Accelerates Ahead in the Global Empty Capsule Market

Asia Pacific is expected to witness the fastest growth in the empty capsules market during the forecast period. The growth of the market in the region is expected to increase due to the rising investments in healthcare infrastructural development by the regional governments. The rising population around the region is one of the major reasons for the expanding healthcare and pharmaceutical industry and the rising geriatric population that is more likely to get the illnesses and diseases that drive the demand for long-term, medicinal treatment, which is further propelling the demand for the empty capsules market in the region.

- In July 2022, Akums Drug & Pharmaceuticals Ltd. received approval from the European Union (EU) Good Manufacturing Practice (GMP) for their empty hard gelatin capsules manufacturing plants in Haridwar, India.

India Empty Capsules Market Trends

India's market is expanding due to the rapid growth of the pharmaceutical and nutraceutical industries, supported by low-cost manufacturing and strong export demand. Rising population, increasing chronic diseases, and growing use of generic medicines boost capsule consumption. Government support for healthcare infrastructure, expanding contract manufacturing, and higher demand for vegetarian and plant-based capsules further accelerate market growth.

Europe Advances with Consistent Growth in the Market

Europe is anticipated to grow at a notable rate due to strong pharmaceutical and nutraceutical manufacturing, increasing demand for advanced drug delivery systems, and rising prevalence of chronic diseases. Supportive regulatory frameworks, growing focus on preventive healthcare, and rising adoption of vegetarian and clean-label capsules further drive demand. Continuous investments in research, innovation, and sustainable pharmaceutical packaging also contribute to steady market growth across the region.

The UK Empty Capsules Market Trends

The UK is anticipated to grow at a notable rate due to a well-established pharmaceutical sector, increasing demand for prescription and over-the-counter medicines, and rising prevalence of chronic diseases. Strong research and development activities, supportive regulatory frameworks, and growing use of advanced and vegetarian capsule formulations further support market expansion during the forecast period.

Value Chain Analysis of the Empty Capsules Market

- R&D:Research and development in empty capsules focuses on creating advanced materials and technologies to enhance drug delivery, including vegetarian, clean-label, and controlled-release formulations.

Key Players: Capsugel, Aenova, Qualicaps, Suheung, Lonza. - Regulatory Approvals : Empty capsules require regulatory compliance with GMP, pharmacopeial standards, and certifications like Halal or Non-GMO, overseen by agencies such as the FDA and EMA, ensuring safety and quality.

Key Players: Qualicaps, Lonza, Suheung, Aenova, Capsugel. - Packaging and Serialization : Packaging and serialization of empty capsules ensure moisture protection, product integrity, and traceability, complying with GMP and regulations like the DSCSA to maintain safety in the pharmaceutical supply chain.

Key Players: West Pharmaceutical Services, Raps USA, Schott Pharma, ACG Capsules, Capsugel.

Top Companies in the Empty Capsules Market & Their Offerings

- ACG Worldwide – Offers hard and soft gelatin capsules, vegetarian capsules, and specialized formulations with advanced coating and encapsulation technologies for pharmaceutical and nutraceutical applications.

- Bright Pharma Caps Inc. – Provides a wide range of gelatin and vegetarian capsules, including size customization, controlled-release, and specialty capsule solutions for drug delivery and dietary supplements.

- CapsCanada Corporation – Manufactures gelatin and plant-based capsules, offering personalized solutions for pharmaceutical, nutraceutical, and dietary applications with emphasis on quality and regulatory compliance.

- Lonza Group Ltd. (Capsugel) – Offers hard and soft gelatin capsules, plant-based alternatives, and specialized controlled-release and functional formulations for the pharmaceutical and health industries globally.

- Medi-Caps Ltd. – Supplies gelatin and vegetarian capsules, supporting nutraceuticals and pharmaceuticals with customized sizes, coating options, and compliance with international quality and safety standards

Other Empty Capsules Market Companies

- Mitsubishi Chemical Holdings Corporation (Qualicaps, Inc.)

- Roxlor LLC

- Snail Pharma Industry Co. Ltd

- Suheung Co., Ltd

- Sunil Healthcare Ltd.

Recent Developments

- In March 2024, Lonza signed a deal to acquire Genentech's biologics manufacturing site in California for over USD 1 billion. The acquisition will expand Lonza's global biologics production capacity. The company plans to invest around USD 600 million to upgrade the facility and enhance capabilities for next-generation mammalian biologics therapies.(Source: https://www.lonza.com)

- In March 2024, West Wolf Medicinals announced the launch of vegan capsules with mushroom extracts. It is an organic-certified capsule. Cordyceps, Reishi, Turkey Tail, and Lion's Mane are 120 capsules packed in tin that are made from eco-friendly recycled aluminum by the consumer.

- In November 2022, Lonza launched Enprotect, a new capsule solution designed to target the delivery of ingested acid-sensitive active pharmaceutical ingredients (APIs). The launch of this product led to the expansion of the company's product portfolio.

- In January 2022 - Xi'an Le-Nutra Ingredients Inc. shipped 8.0 million HPMC capsules to Latvia, in Europe. These capsules were without titanium dioxide (TiO2), demonstrating the company's efforts to meet the demand for the product in the region.

Segments Covered in the Report

By Type

- Gelatin Capsules

- Bovine

- Porcine

- Non-gelatin Capsules

- Hpmc

- Pullulan

By Functionality

- Immediate-released

- Sustained-released

- Delayed-released

By Application

- Antibiotics

- Antacids

- Anti-inflammatory

- Cough

By End-user

- Pharmaceutical Companies

- Nutraceutical Companies

- Cosmeceuticals Companies

- Research Laboratories

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting