Cranberry Capsules Market Size and Forecast 2026 to 2035

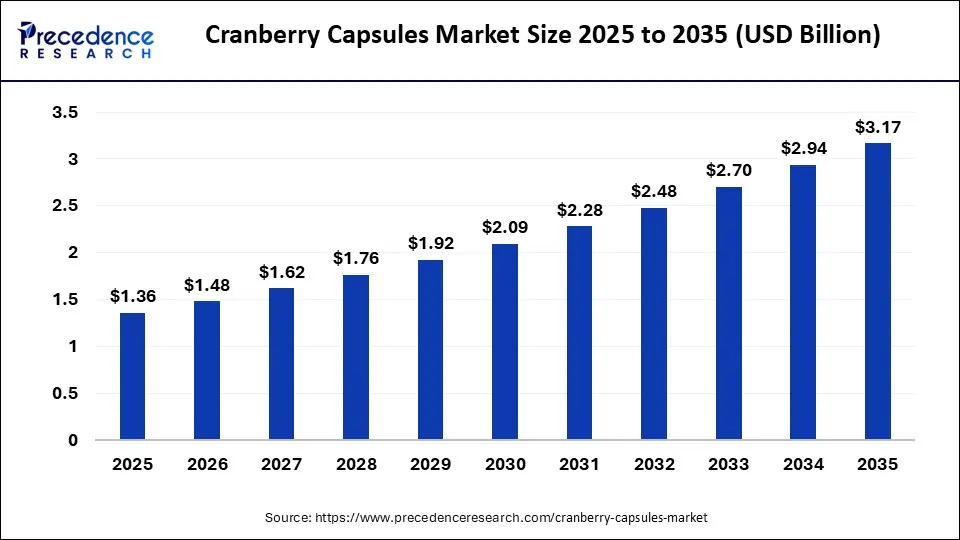

The global cranberry capsules market size accounted for USD 1.36 billion in 2025 and is predicted to increase from USD 1.48 billion in 2026 to approximately USD 3.17 billion by 2035, expanding at a CAGR of 8.83% from 2026 to 2035. The market is growing due to rising consumer awareness of its benefits in supporting urinary tract health and overall wellness.

Cranberry Capsules MarketKey Takeaways

- In terms of revenue, the global cranberry capsules market was valued at USD 1.25 billion in 2025.

- It is projected to reach USD 2.94 billion by 2035.

- The market is expected to grow at a CAGR of 8.94% from 2026 to 2035.

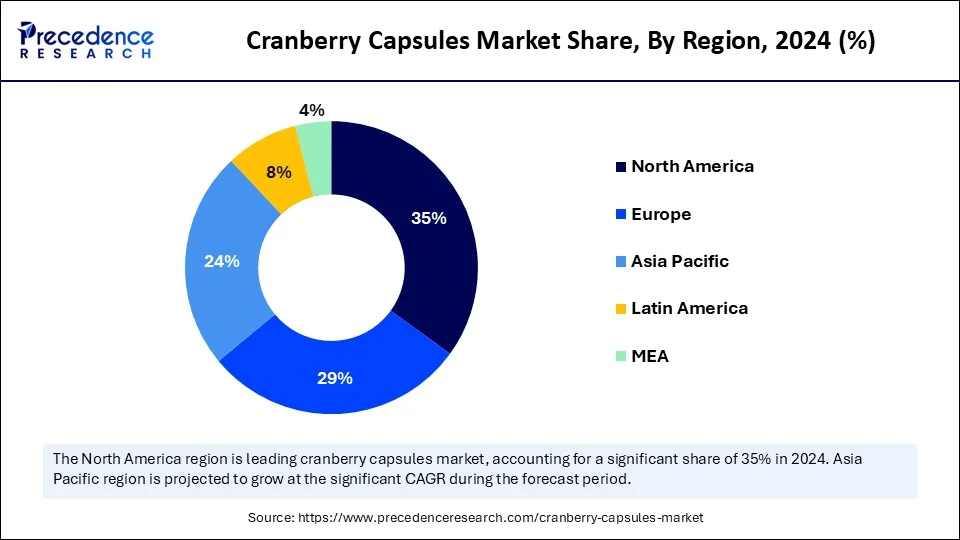

- North America dominated the cranberry capsules market with the largest market share of 35% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR during the forecast period.

- By formulation type, the pure cranberry extract capsules segment held the biggest market share 40% in 2025.

- By formulation type, the cranberry+ probiotic blend capsules segment is expected to grow at the fastest CAGR during the forecast period.

- By dosage strength, the mid-dose (151-300) segment captured the highest market share of 45% in 2025.

- By dosage strength, the high dose (301-500mg) segment is projected to grow at the fastest CAGR during the forecast period.

- By extract type, the standardized Proanthocyanidin (PAC) extract segment contributed the major market share of 50% in 2025.

- By extract type, the whole fruit extract segment is emerging as the fastest-growing during the forecast period.

- By target consumer segment, the women (UTI-oriented health) segment accounted for the significant market share of 50% in 2025.

- By target consumer segment, the general adult (general antioxidant) supplements segment is expected to grow at the fastest CAGR during the forecast period.

- By distribution channel, the pharmacy/retail health stores segment generated the major market share of 35% in 2025.

- By distribution channel, the online direct-to-consumer sales segment is expected to grow at the fastest CAGR during the forecast period.

How Can AI Help Identify Consumer Trends for Cranberry Capsules in Different Markets?

Artificial Intelligencehelps identify consumer trends for cranberry capsules by analyzing large datasets from e-commerce platforms, social media, online reviews, and search queries across different regions. Natural language processing (NLP) and sentiment analysis are two ways AI can map seasonal demand patterns and identify new preferences, like a growing interest in organic vegan or high-potency cranberry formulations. This enables businesses to swiftly modify their product lines and marketing plans in response to shifting consumer demands.Predictive analyticspowered by AI can forecast future buying behavior by studying historical sales trends and external factors such as health awareness campaigns, disease prevalence, and regional economic conditions. By recognizing these patterns early, brands can optimize their supply chain, launch targeted ad campaigns, and enter untapped markets with higher success rates.

- On 11 July 2025, Smart Solution Lab introduced AI-powered cranberry ripening analysis utilizing vision foundation models for precision agriculture.

(Source: https://www.nutraceuticalsworld.com)

Market Overview

The cranberry capsules market refers to the global industry segment involving the manufacturing and sale of dietary supplement capsules containing cranberry extracts or concentrates, typically used for urinary tract health, antioxidant benefits, and other nutraceutical purposes. The market is witnessing steady growth, caused by the rising incidence of urinary tract infections (UTIs), especially in women, and the growing consumer focus on preventive healthcare. Demand is being driven by growing knowledge of cranberries' antibacterial and antioxidant qualities, as well as their benefits for kidney and urinary tract health. Market uptake is also being aided by the trend toward natural and plant-based supplements as well as the ease of capsules over traditional juice forms.

Cranberry Capsules Market Growth Factors

- The rising prevalence of UITs promotes preventive health measures.

- Increasing awareness of cranberries' health benefits, including antioxidant and antibacterial properties.

- Shift toward natural and plant-based supplements for overall wellness.

- Convenience of the capsule form over juices, offering portability and precise dosage.

- Expansion of e-commerce and retail availability, making products more accessible.

- Innovation in product formulations, such as high-potency extracts and blends with probiotics.

- A growing aging population seeking preventive healthcare solutions.

- Rising health-conscious consumers prioritize preventive nutrition.

- Increased marketing and educational campaigns by supplement brands.

- Greater adoption of men's health routines for kidney and bladder support.

- Regulatory approval and certifications are boosting consumer trust and product credibility.

Market scope

| Report Coverage | Details |

| Market Size by 2035 | USD 3.17 Billion |

| Market Size in 2026 | USD 1.48 Billion |

| Market Size in 2025 | USD 1.36 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 8.83% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Formulation Type, Dosage Strength, Extract Type, Target Consumer Segment, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing Demand for Preventive Healthcare Solutions

In order to prevent recurrent urinary tract infections (UTIs), consumers are actively turning to preventive solutions like cranberry capsules due to rising healthcare costs and growing awareness of chronic health conditions. Increasingly, preventive supplementation is being incorporated into everyday wellness practices, particularly among the urban population. Regular use of supplements is also encouraged by their long-term cost-effectiveness when compared to medical treatments. Furthermore, cranberry capsules are becoming more and more recommended by medical professionals as a safe, natural supplement to traditional treatments.

Increasing Preference for Natural, Plant-based Supplements

Thanks to the clean label movement, botanical and herbal supplements are becoming more popular worldwide. Customers are looking for alternatives made from plants that have few negative effects rather than synthetic ones. This need is satisfied by cranberry capsules, which provide a naturally occurring remedy with advantages that have been proven in studies. Additionally, the plant-based positioning supports vegetarian and vegan lifestyle choices, increasing the product's customer base.

Restraints

Limited Clinical Evidence for Certain Health Claims

The quality of the scientific evidence supporting cranberries' benefits for urinary tract health varies, especially when it comes to the long-term preventive effects in various populations. Certain regulatory agencies restrict how aggressively brands can advertise benefits by requiring substantial clinical support for marketing claims. Some customers become skeptical of this, particularly those who base their decisions on evidence. Therefore, awareness by itself does not always result in purchasing behavior.

Competition from Alternative Natural Remedies

There are several options available to customers for urinary tract health, including herbal products like D-mannose, probiotics, and other botanicals. Certain of these remedies are supported by comparable or more robust clinical studies, detracting from cranberry capsules. Price competition is heightened, and brand differentiation is difficult in the crowded natural supplement market.

Opportunities

Integration with Probiotics and Multivitamin Blends

Herbal products such as D-moose probiotics and other botanicals are also marketed for urinary tract health, providing consumers with multiple alternatives. In contrast to cranberry capsules, some of these solutions are supported by comparable or more robust clinical research. Brand differentiation is difficult in the crowded natural supplement market, and price competition is heightened.

Growth of E-commerce and Online Pharmacies

Cranberry capsule brands can now reach a global audience through digital retail channels, overcoming the limitations of traditional brick-and-mortar stores. Retaining customers is made simpler by subscription-based business models and focused internet marketing initiatives. Personalized product offerings and niche branding are also made possible by this online expansion.

Formulation Type Insights

Why did the pure cranberry capsules segment dominate the cranberry capsules market?

The pure cranberry extract capsules segment dominates the cranberry capsules market due to their well-established ability to promote general wellness and urinary tract health, because of their standardized concentration of active compounds, which guarantees consistent results. They are widely trusted by both consumers and healthcare professionals. People looking for specific benefits without extra ingredients are drawn to the formulation's simplicity, which makes it a popular option for both therapeutic and preventive use.

The cranberry+ probiotic blend capsules segment is the fastest growing, driven by increased consumer interest in multipurpose supplements as a result. In addition to promoting digestive balance and urinary tract health, this combination appeals to a broader range of health-conscious consumers. Growing clinical data on the benefits of probiotics and cranberry extracts working together is driving up demand in this market.

Dosage Strength Insights

The mid-dose (151-300) segment dominated the cranberry capsules market as it provides effective preventive care while maintaining affordability and safety for long-term use. This dosage range is recommended by many healthcare practitioners, balancing potency and tolerance. It caters well to daily wellness routines for a broad consumer base.

The high dose (301-500mg) segment is growing rapidly as customers look for more concentrated solutions due to stronger health needs or recurrent UTIs. Additional factors driving demand include the growing availability of high-strength formulations with clinical validation and targeted marketing to individuals with particular therapeutic needs.

Extract Type Insights

Why did the standardized Proanthocyanidin (PAC) extract capsules segment dominate the cranberry capsules market?

The standardized Proanthocyanidin (PAC) extract segment dominates due to its effectiveness in stopping bacterial adhesion in the urinary tract, which has been clinically demonstrated. Consistent levels of active compounds, which guarantee predictable health outcomes, are valued by consumers. The dominance of this market segment is further supported by the existence of well-known brands selling PAC-standardized goods.

The whole fruit extract segment is the fastest growing, appealing to customers looking for supplements that are less processed and more natural. They satisfy the clean label and holistic health trends by providing a wider range of cranberry phytonutrients than PACs. Demand is growing as more people become aware of the advantages of bioactive compounds derived from whole fruits.

Target Consumer Segment Insights

UTI-oriented health supplements dominate the market

The women (UTI-oriented health) segment dominates, as urinary tract infections are significantly more prevalent among women, particularly in certain age groups. Targeted marketing, physician recommendations, and dedicated product lines make this segment the core driver of cranberry capsule sales.

The general adult (general antioxidant) supplements segment is the fastest growing, as more customers look for cranberry capsules because of their general anti-inflammatory and antioxidant properties. This market is growing to include skin care, cardiovascular support, and overall wellness in addition to urinary health.

Distribution ChannelInsights

The pharmacy/retail health stores segment dominates the cranberry capsules market since they continue to be the main locations for buying over-the-counter supplements. Steady sales are driven by their accessibility to walk-in clients, pharmacist recommendations, and credibility.

The online direct-to-consumer sales segment is the fastest-growing channel, driven by the ease of e-commerce subscription services and the availability of niche brands around the world. Influencer endorsements and digital marketing are also increasing the momentum of online sales.

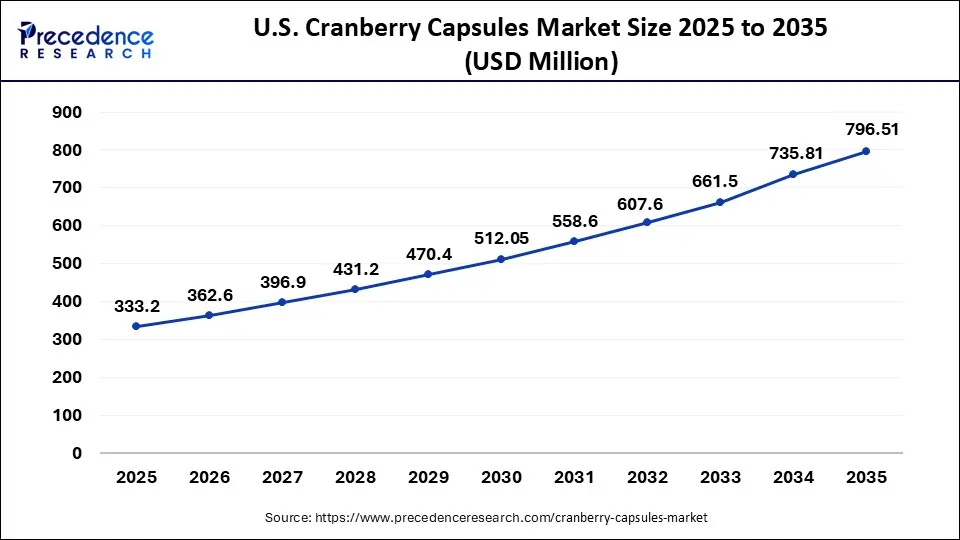

U.S. Cranberry Capsules Market Size and Growth 2026 to 2035

The U.S. cranberry capsules market size was exhibited at USD 333.2 million in 2025 and is projected to be worth around USD 796.51 million by 2035, growing at a CAGR of 9.11% from 2026 to 2035.

Why did North America dominate the cranberry capsules market in 2025?

North America dominates the cranberry capsules market, supported by strengthened by a well-established dietary supplement market, a high level of consumer awareness regarding urinary tract health, and the presence of well-known nutraceutical brands. The area enjoys strong retail distribution networks that guarantee widespread product availability in pharmacies and health stores. The demand for cranberry-based supplements is consistently driven by the high adoption of preventive healthcare practices. Consumer trust is further strengthened by supplement manufacturers' ongoing clinical research and marketing initiatives. The region's dominance in the market is maintained by the well-established regulatory frameworks for supplements, which also contribute to the preservation of consumer confidence and product quality.

U.S.

The U.S. is the leading country in North America with regards to cranberry supplement consumption because of high levels of awareness related to urinary and digestive health. Therefore, consumers continue to seek out and use clinically supported and naturally derived products. Extensive accessibility via local drug stores, grocery stores, and electronic commerce is driving volume growth in the United States. Ongoing product launches and an increasing focus on preventive health will strengthen U.S. market leadership.

Asia Pacific is fastest fastest-growing region in the cranberry capsules market, due to the nutraceutical industry's explosive growth and growing health consciousness, spending on preventive health products is rising as a result of the expanding middle class and rising disposable incomes. Cranberry supplements are now more widely available, even to people living in remote locations, thanks to e-commerce platforms. Strong prospects for cranberry capsule brands are being created by the growing popularity of clean-label and natural supplements. In the upcoming years, the region is anticipated to maintain strong growth momentum as awareness of women's health and diets high in antioxidants increases.

China

The Asia-Pacific cranberry market for capsules is led by China, which has experienced significant growth due to a long-standing demand for traditional and natural health supplements. Increasing awareness of health-related issues, an aging demographic, and the wide range of ways to access health supplements through online purchases have all aided in boosting sales. The increased emphasis on supporting women's health and the rise in discretionary income have led to greater acceptance of international nutraceutical in the region, allowing China to continue to dominate as the largest consumer and distributor of cranberry products in the Asia-Pacific region.

How Europe is Showing Steady Growth in Trail Mixes M Cranberry Capsules Market?

Cranberry capsules are rapidly evolving in Europe, due to increased interest in preventative health, as well an increasing focus on using natural products. There is also strong consumer demand for plant-derived dietary supplements, with very few adverse effects. Combined with an increasing population over 65, more people being diagnosed with urinary tract health issues, and regulations supporting the use of nutraceutical, the European cranberry capsule market is continuing to grow steadily. Pharmacy and health food stores are the primary places where cranberry capsules are sold in European countries.

Germany

Germany has become Europe's leading country in terms of the cranberry capsule market, due largely to customers feeling confident about using natural and pharmaceutical products. Germany has one of the world's best developed pharmacy networks, along with many highly educated consumers, and customers are generally focused on preventative healthcare. Women in Germany are increasingly focused on maintaining overall good health, and the increasing population of older adults in Germany will continue to create opportunities for both prescriptions to pharmaceutical types of products and over-the-counter dietary supplements.

Are You Seeing Some Improvement in Latin America?

Latin America is regarded as a developing market for cranberry capsules, because of the increasing number of people becoming aware of health care and the growing interest in dietary supplements. The growth of pharmacy stores and the use of the Internet for purchasing products are improving the visibility and availability of cranberry capsules. Though the level of awareness varies greatly across Latin America, the increase in educational initiatives and the positive focus on women's health are expected to lead to a steady increase in market penetration throughout the region.

Brazil

With a large population, and the continued growth of the consumption of nutraceutical in the country, Brazil is the current leader in Latin America. Factors that are driving the growth of cranberry capsules in Brazil include: increasing awareness of women's urinary health issues; increasing participation of women in the workforce; and the continued increase in the number of health food stores in Brazil. The growth of online wellness sites and the growing acceptance of imported dietary supplements have also aided Brazil's position as the most significant driver of growth for cranberry capsules in Latin America.

How Middle East & Africa Development Progressing Slowly?

The Middle East and Africa are a rapidly advancing market for both health awareness and dietary supplements. As consumers continues to transition toward preventive medicine and natural wellness products. As population health issues connected with lifestyle increase in incidence, along with new pharmacy infrastructures and increased urbanization, the demand for dietary supplements continues to grow. Although the dietary supplement market is still relatively immature, improved distribution channels will aid in increasing purchase rates of dietary supplements throughout the region.

Saudi Arabia

Saudi Arabia is expected to hold the largest share of the cannabis-based pharmaceutical capsule market in the Middle East and Africa, driven by the increasing health consciousness of the population and the desire for preventive supplements. The impact of a highly developed retail pharmacy market, increasing interest from women about their health, and supportive government policies encouraging a healthy lifestyle are all contributing factors to the market growth of cranberry capsules. Increased available income and preference for natural solutions for health promotion will further fuel the growth of cranberry capsules.

Value Chain Analysis for Cranberry Capsules Market

Cranberry Cultivation & Sourcing: Cranberries are grown in specially managed bogs and harvested, cleaned, and sent to processors for further refinement. This ensures that high-quality cranberries are available for the manufacturing of supplements, with standard amounts of phytochemicals present in all harvested cranberries.

- Key Players: Ocean Spray Cranberries, Decas Cranberry Products, Fruit d'Or, Northland Cranberries, New Jersey Cranberry Company

Processing & Extract Manufacturing: Harvested cranberries are processed into measured amounts of standardized powders and extracts containing active components like PACs that met nutraceutical quality and regulatory requirements.

- Key Players: Givaudan (Naturex), Nexira, Martin Bauer Group, Indena S.p.A., Fruit d'Or Nutraceuticals

Capsule Formulation & Manufacturing: Blended extracts from cranberries are put into capsules to ensure proper blending, followed by testing for purity and packaging of finished capsules. All of the above processes follow GMP sanitation standards and dietary supplement regulations.

- Key Players: NOW Foods, NutraScience Labs, Herbalife Nutrition, AdvaCare Pharma

Distribution, Branding & Retail: Finished cranberry capsules are sold through pharmacies, vitamin and supplement retail stores, and online (e-commerce) sites, with marketing support through branding, consumer education, and retail relationships.

- Key Players: Nature's Bounty, GNC, Holland & Barrett, CVS Health, Amazon

Cranberry Capsules Market Companies

- Nature's Bounty

- NOW Foods

- GNC (General Nutrition Centers)

- Puritan's Pride

- Swanson Health Products

- Solaray

- Jarrow Formulas

- Gaia Herbs

- Cranberry King (e.g., Swanson)

- Nature's Way

- Carlson Labs

- Life Extension

- Oregon's Wild Harvest

- BioSchwartz

- NutraPro

- Pure Encapsulations

- Natrol

- Evalar (if exporting internationally)

- Healthy Origins

- Schiff (Blackmores Group)

Recent Developments

- On 22 April 2025, Solv Wellness introduced GennaMD, a cranberry-based supplement formulated with a refined extraction process yielding 30% PAC concentrations nearly double the typical 18 % making it among the most potent and compact UTI preventive capsules in the market. It's also filler-free and clinically supported via their proprietary “bioPAC” ingredient. (Source:https://www.nutraceuticalsworld.com)

- On 22 July 2024, Fruit d'Or Nutraceuticals unveiled encapsulated are free from fillers, lubricants, and additives, delivering up to 500mg of pure cranberry powder per vegetarian capsule, standardized to at least 7% PACs and compliant with Cranberry Quality Assurance (CQA) standards.(Source: https://www.supplysidesj.com)

- On 18 October 2024, Fruit d'Or launched Blue d'Or vitality, an organic, clean-label blend of wild blueberry and cranberry powder designed for the sports nutrition sector. This product, combining antioxidant-rich berries, was unveiled at SupplySide West 2024 and targets vitality recovery and overall wellness. (Source: https://pasdept.wisc.edu)

Segments Covered in the Report

By Formulation Type

- Pure Cranberry Extract Capsules

- Cranberry + Probiotic Blend Capsules

- Cranberry + Vitamin Blend Capsules

- Cranberry + Herbal Blend Capsules

By Dosage Strength (per capsule)

- Low-dose (≤ 150 mg)

- Mid-dose (151 – 300 mg)

- High-dose (301 – 500 mg)

- Ultra-high-dose (> 500 mg)

By Extract Type

- Standardized Proanthocyanidin (PAC) Extract

- Whole-Fruit Extract

- Freeze-dried Powder

- Concentrated Juice Extract

By Target Consumer Segment

- Women (UTI-oriented health)

- General Adult (general antioxidant)

- Seniors (age 60+)

- Athletes/Fitness-oriented

By Distribution Channel

- Pharmacy/Retail Health Stores

- Online Direct-to-Consumer

- E-Commerce Marketplaces

- Hospital/Clinic Channel

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting