What is the Floating Production Systems Market Size?

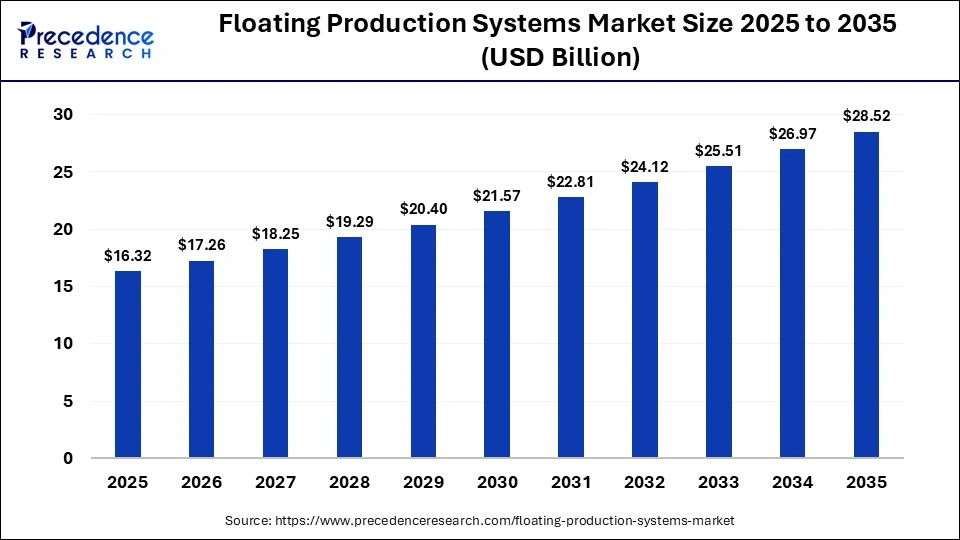

The global floating production systems market size was calculated at USD 16.32 billion in 2025 and is predicted to increase from USD 17.26 billion in 2026 to approximately USD 28.52 billion by 2035, expanding at a CAGR of 5.74% from 2026 to 2035.The growing offshore oil and gas exploration and depletion of onshore reserves are the major factors augmenting market growth. Increasing investment in deepwater and ultra-deepwater projects and the development of subsea technologies are hastening the use of floating production infrastructure.

Market Highlights

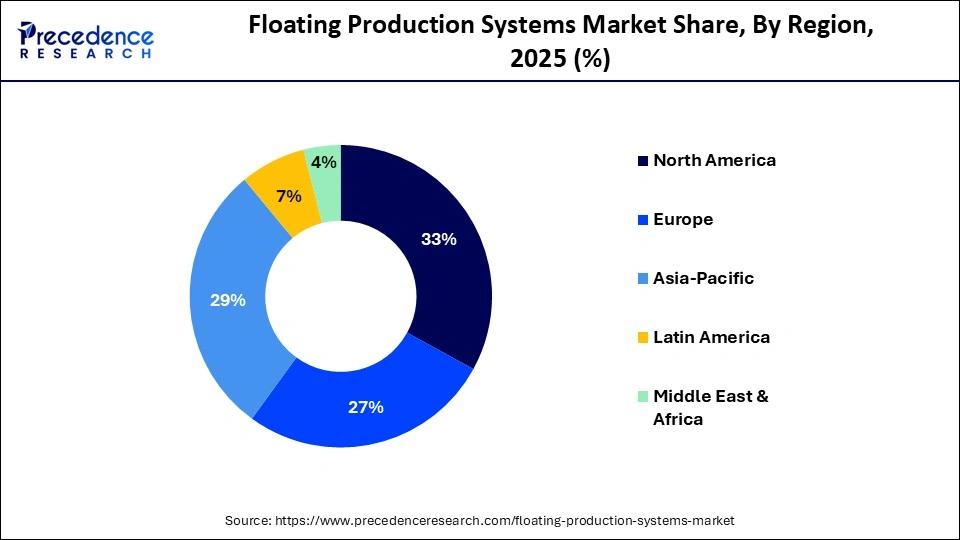

- North America dominated the global floating production systems market with a share of approximately 33% in 2025.

- Asia-Pacific is expected to witness the fastest growth with a CAGR of approximately 8.3% during the predicted timeframe.

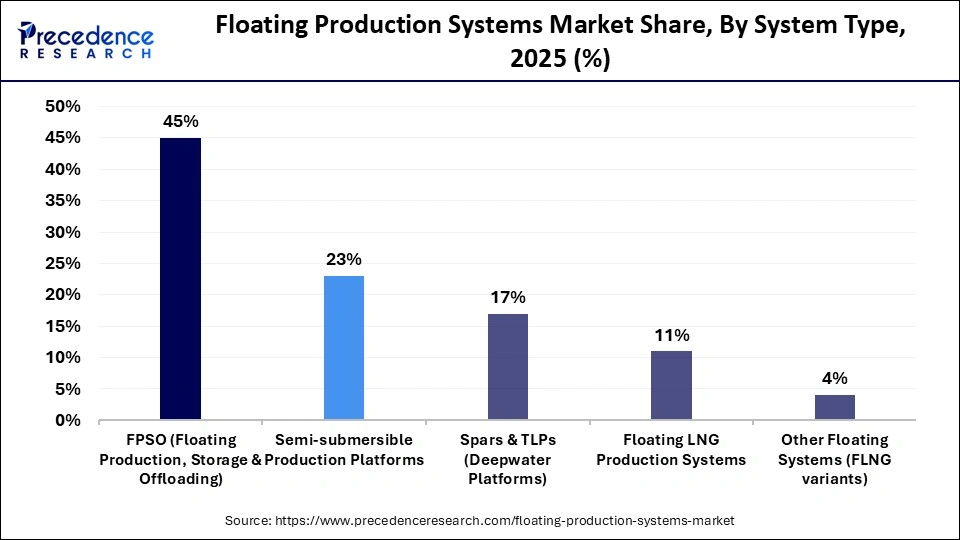

- By system type, the FPSO (Floating Production, Storage and Offloading) segment held a major revenue share of approximately 45% in the market in 2025.

- By system type, the floating LNG production systems segment is expected to show the fastest growth with a CAGR over the forecast period.

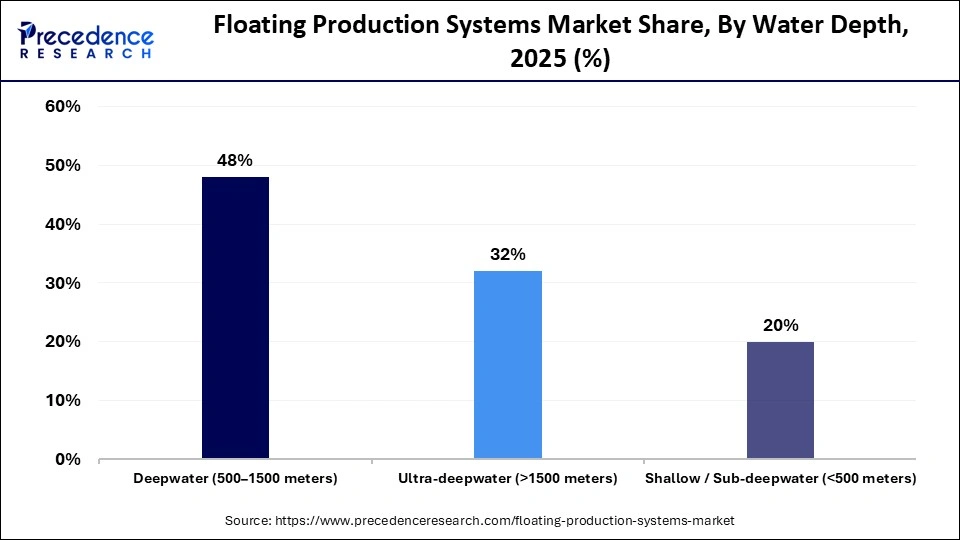

- By water depth, the deepwater (500-1500 meters) segment accounted for the highest revenue share of approximately 48% in the market in 2025.

- By water depth, the ultra-deepwater (>1500 meters) segment is expected to gain the highest market share between 2026 and 2035.

- By application, the oil production segment contributed the biggest revenue share of approximately 58% in the market in 2025.

- By application, the gas production/floating LNG segment is expected to witness the fastest growth in the market over the forecast period.

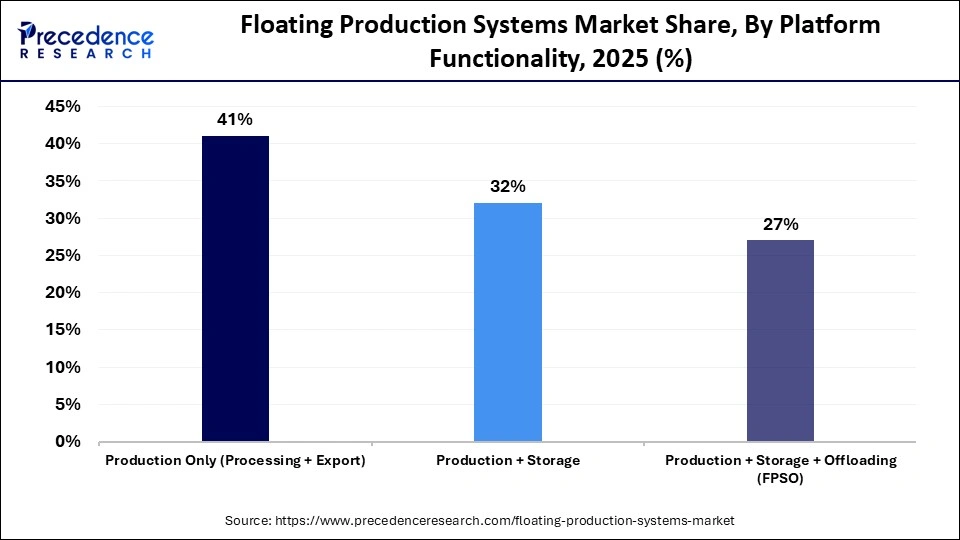

- By platform functionality, the production only (processing + export) segment held the largest revenue share of approximately 41% in the floating production systems market in 2025.

- By platform functionality, the production + storage + offloading segment is expected to account for the highest growth in the coming years.

- By contract/procurement model, the EPC (Engineering, Procurement and Construction) segment dominated the global market with a share of approximately 43% in 2025.

- By contract/procurement model, the lease/charter systems segment is expected to expand rapidly in the market in the coming years.

- By deployment location, the Asia-Pacific offshore segment registered its dominance over the global market with a share of approximately 31% in 2025.

- By deployment location, the Middle East and Africa offshore segment is expected to grow with the highest CAGR in the market during the studied years.

- By service type, the installation and commissioning services segment led the global floating production systems market with a share of approximately 37% in 2025.

- By service type, the maintenance and support services segment is expected to grow at the fastest CAGR in the market between 2026 and 2035.

- By contract duration, the short-term/project-based segment accounted for a considerable revenue share of approximately 46% in the market in 2025.

- By contract duration, the spot/as-needed deployments segment is expected to witness the fastest growth in the market over the forecast period.

- By deployment mode, the integrated floating systems segment held a dominant position in the market with a share of approximately 53% in 2025.

- By deployment mode, the modular/plug-and-play configurations segment is expected to grow rapidly during the forecast period.

Floating Production Systems: Tapping Offshore Potential

The floating production systems market is experiencing robust growth, with the energy companies moving their operations to deeper and more complicated offshore fields. Floating production systems (FPS) allow the production of oil and gas in remote sea setups, where fixed platforms are not technically and economically feasible. The increasing global energy demand, combined with better economics of offshore drilling, is reinforcing market growth. Moreover, floating systems are very appealing in terms of marginal and mature field deployment due to the presence of flexible deployment features and low initial infrastructure costs.

AI-Driven Innovations: Smart Offshore Operations

The use of artificial intelligence (AI) is changing how production systems operate in floating because it increases operational efficiency and predictive maintenance. AI analytics can optimize reservoir operations, monitor equipment condition, and minimize downtime by detecting faults before they occur. Machine learning applications can help optimize production rates and manage subsea assets more effectively. Also, AI-based digital twins are facilitating simulation-based decision-making, enhancing safety, and reducing offshore risks in hard operations.

Floating Production Systems Market Trends

- Movement in FPSO and Subsea Integrated Production Solutions: Operators are opting for modular, re-deployable assets, which take less time to install and fit deepwater and ultra-deepwater fields. FPSOs help provide early production, reduce CapEx during an exploration-to-production transition, and provide tiebacks to offshore fields, improving the economic viability of remote or marginal fields.

- Remote Monitoring and Digitalization: Even higher digital technologies, such as IoT sensors, predictive analytics, AI-based performance monitoring, and digital twins, are transforming the FPS operations. These tools enhance predictive maintenance, minimize unplanned downtime, boost safety, and energy efficiency. Remote monitoring solutions allow real-time decision making at shore-based centers, decreasing offshore manpower needs and operational costs.

- Demand for Decommissioning and Life Extension of Aging Assets: A major part of FPS globally is of aging origin, and involves a rush in demand for life extension projects and safe decommissioning solutions. Operators are spending on engineering improvements, hull renovations, and power system improvements to ensure FPS life cycles are extended.

- Combination of Decarbonization Technologies and Energy Transition Initiatives: Environmental regulations and ESG commitments are pushing the use of low-carbon and hybrid power solutions over the FPS units. This involves the introduction of gas reinjection, renewable-based electrification, energy stores, and the effective gas turbine. Methanol and ammonia are also being used more as cleaner sources of fuel.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 16.32 Billion |

| Market Size in 2026 | USD 17.26 Billion |

| Market Size by 2035 | USD 28.52 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.74% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | System Type ,Water Depth, Application, Platform Functionality , Contract/Procurement Model, Deployment Location, Service Type , Contract Duration, Deployment Mode, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

System Type Insights

Which System Type Segment Dominated the Floating Production Systems Market?

The FPSO (Floating Production, Storage and Offloading) segment dominated the market with the largest share of approximately 45% in 2025, because it has the characteristics of integrated processing, storage, and offloading. They are extensively used in deep and distant offshore fields where there is a narrow pipeline infrastructure. FPSOs are cost-efficient for marginal field development and can be redeployed once a field has been exhausted. They are flexible and scalable, promoting operational efficiency. The increasing offshore discoveries are still strengthening the FPSO control globally.

The floating LNG production systems segment is expected to grow at the fastest CAGR in the market between 2026 and 2035 because of the increasing global demand for natural gas. These systems melt natural gas directly at the offshore site, and thus do not require a large infrastructure for LNG on land. Their deployment is being hastened by the growth of their investments in gas-rich offshore basins. Floating LNG facilities are flexible and minimize environmental footprint. Their economic feasibility is also being enhanced by technological developments.

Water Depth Insights

Why Did the Deepwater (500-1500 meters) Segment Dominate the Floating Production Systems Market?

The deepwater (500-1500 meters) segment held a dominant position in the market with a share of approximately 48% in 2025, since many active offshore fields are in this depth range. Well-developed infrastructure and other technologies ensure mass adoption. Deepwater projects are favored by energy companies since the risk and the returns profile are relatively balanced. Exploration activities continue to grow in developed basins, boosting the segment's growth. Floating systems are the best in such conditions.

The ultra-deepwater (>1500 meters) segment is expected to grow with the highest CAGR in the market during the studied years, driven by new hydrocarbon finds in frontier basins. Ultra-deepwater production is becoming viable because of advanced technologies of drilling and subsea production. The increased energy demand attracts exploration of the unexploited resources. An expensive initial capital investment enables prospective production. Constant innovation and technological advancements foster the segment's growth.

Application Insights

How the Oil Production Segment Dominated the Market?

The oil production segment accounted for a considerable revenue share of approximately 58% in the floating production systems market in 2025, owing to the growing global demand for crude oil. Offshore oil fields have a large number of FPS. The offloading and storage capabilities increase the flexibility of crude export. Floating systems are used to recover the mature offshore oil fields. Ongoing exploration of oil reserves helps in dominance in the segments.

The gas production/floating LNG segment is expected to expand rapidly in the market in the coming years due to rising natural gas use, the need for offshore gas, and transitions to cleaner energy. Gas monetization is being quickened by floating LNG technologies. Governments are encouraging the use of gas-based energy to curb carbon emissions.

Platform Functionality Insights

Why Did the Production Only (Processing + Export) Segment Dominate the Market?

The production only (processing + export) segment registered its dominance over the global market with a share of approximately 41% in 2025 because it is less complex and requires less capital. These systems are only interested in hydrocarbon processing that is extracted from the underwater wells. They serve the purpose of areas where there is an established pipeline infrastructure. They are adopted consistently due to their level of efficiency. Many of the offshore fields that are legacy depend on these systems.

The production + storage + offloading (FPSO) segment is expected to witness the fastest growth in the market over the forecast period, driven by the increasing need for production systems, storage, and offloading systems. They make pipelines less essential and increase logistics flexibility. FPSO systems eliminate the need to purchase separate, specialized systems for different operations. These systems are best in offshore distant fields. Increased returns on investment lead to economic growth.

Contract/Procurement Model Insights

Which Contract/Procurement Segment Led the Market?

The EPC (Engineering, Procurement and Construction) segment led the global floating production systems market with a share of approximately 43% in 2025, as projects are on a turnkey basis. EPC contractors deal with design, procurement, installation, and commissioning. Energy firms adopt EPC models to simplify project implementation. Large-scale offshore developments prefer integrated contracts, allowing cost containment and timely delivery.

The lease/charter systems segment is expected to gain the highest market share between 2026 and 2035, as they require less upfront capital investment. FPS can be deployed without operator ownership. This model is flexible and risk-averse. There is growth in lease portfolios amongst independent FPSO operators. Increasing cost optimization policies and cost-effectiveness augment the segment's growth.

Deployment Location Insights

How the Asia-Pacific Offshore Segment Dominated the Market?

The Asia-Pacific offshore segment held the largest revenue share of approximately 31% in the market in 2025 because of the good offshore exploration in China, India, Malaysia, and Australia. Growing energy requirements favor offshore investment. Governments of this region promote indigenous hydrocarbon production. Deepwater project expansion enhances control. The region also witnesses a surge in technological adoption.

The Middle East and Africa offshore segment is expected to show the fastest growth over the forecast period because of new deepwater discoveries and unutilized reserves. Offshore basins in Africa are receiving significant foreign investments. FPS is deployed due to the rise in gas projects in the area. Offshore development is facilitated by government programs. Growth increases because of increasing exploration activities.

Service Type Insights

How the Installation and Commissioning Services Segment Dominated the Market?

The installation and commissioning services segment contributed the biggest revenue share of approximately 37% in the floating production systems market in 2025 since no floating system can be launched without specialized skills in offshore deployment. Engineering and safety compliance raise the service demand to a high level. Offshore lifting, mooring, and hook-up processes are very important. Capital-intensive projects can bring good revenue in terms of services. Market demands are maintained based on skilled workforce requirements.

The maintenance and support services segment is expected to account for the highest growth in the coming years, due to the efficiency of digital monitoring and predictive maintenance. Older infrastructure in offshore needs constant maintenance. Operators are concerned about optimizing uptime and prefer digitalization, necessitating experts for maintenance and support.

Contract Duration Insights

Which Contract Duration Segment Dominated the Market?

The short-term/project-based contracts segment accounted for the highest revenue share of approximately 46% in the market in 2025 because of project offshore developments. These operators like fixed-term contracts, which coincide with field production. Such a model minimizes financial obligations in the long term. Adaptability in project implementation improves adoption. Most of the marginal fields are on short-term agreements.

The spot/as-needed deployments segment is expected to grow rapidly in the predicted timeframe, as operators attempt to gain cost flexibility. Such agreements permit such services or the use of systems based on their requirements. Dynamic contracting, especially by small operators, and offshore growth propel the segment's growth.

Deployment Mode Insights

How the Integrated Floating Systems Segment Dominated the Market?

The integrated floating systems segment held a major revenue share of approximately 53% in the floating production systems market in 2025 because of their overall design of production, processing, and storage. They make operations more efficient and complex logistics simpler. Extremely offshore projects choose integrated solutions. Such systems offer better cost improvement in the long term. Domination is supported by the high demand for turnkey offshore infrastructure.

The modular/plug-and-play configurations segment is expected to expand rapidly in the market in the coming years, as it is more flexible and has a shorter deployment timeline. They are scalable and easily upgradeable. Operators benefit from a less complicated installation. This method facilitates low-cost exploration in small offshore oil.

Regional Insights

How Big is the North America Floating Production Systems Market Size?

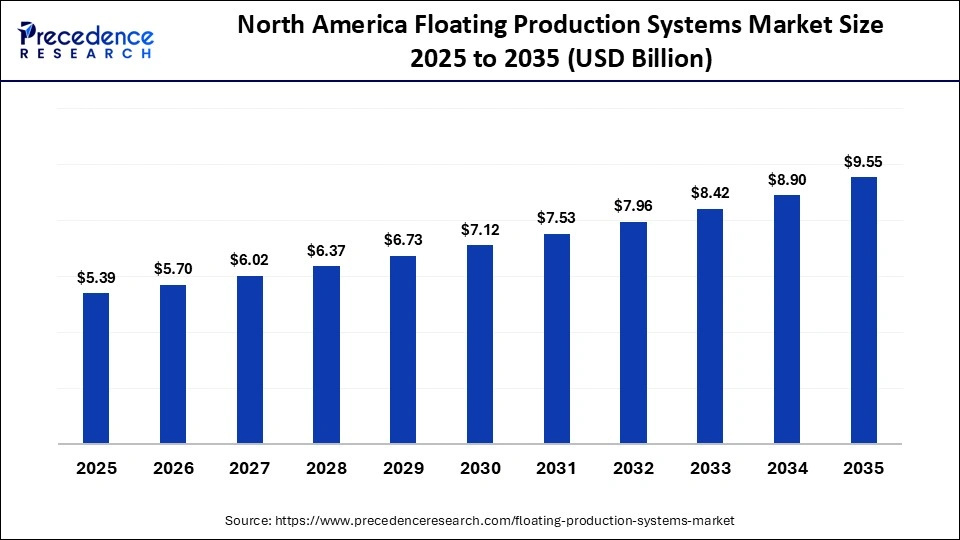

The North America floating production systems market size is estimated at USD 5.39 billion in 2025 and is projected to reach approximately USD 9.55 billion by 2035, with a 5.89% CAGR from 2026 to 2035.

Why North America Dominated the Floating Production Systems Market?

North America led the market with a share of approximately 33% in 2025 because the region has a high level of offshore exploration and production. The Gulf of Mexico is one of the most developed and technologically active deepwater fields in the world, potentiating the demand for FPSOs, TLPs, and spars. Large-scale deployments of floating production are facilitated by strong investment in ultra-deepwater reserves along with high-quality subsea infrastructure. Regional capabilities are also further fortified by the presence of dominant oilfield service providers and engineering companies. There is also regulatory predictability and offshore leasing schemes, which promote capital spending on floating production assets in the long-term.

What is the Size of the U.S. Floating Production Systems Market?

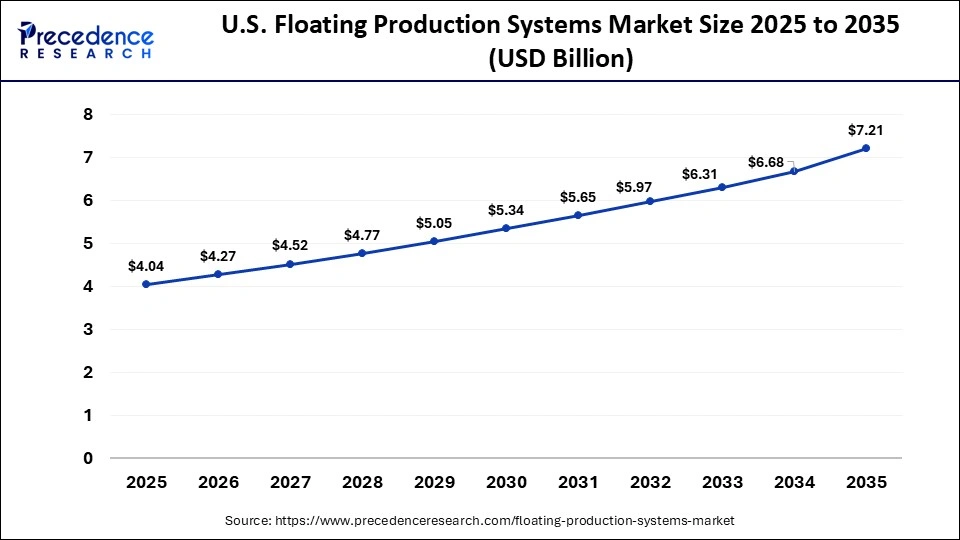

The U.S. floating production systems market size is calculated at USD 4.04 billion in 2025 and is expected to reach nearly USD 7.21 billion in 2035, accelerating at a strong CAGR of 5.96% between 2026 and 2035.

Country-Level Analysis

The U.S. holds a major regional share in the market due to the presence of the Gulf of Mexico, which is specific to high-capacity floating production units that are designed to work in deep water and ultra-deep water. Subsea tieback and online monitoring systems can be improved with technological innovation to increase productivity in offshore fields in the U.S.

Major operators still approve new projects to counter the depletion of natural production by mature fields. Canada is also a contributor to regional development, especially by means of offshore programs in Newfoundland and Labrador. These are projects based on the FPSOs and harsh-environment floating systems adapted to offshore conditions characterized by cold and difficult situations.

How is Asia-Pacific Growing in the Floating Production Systems Market?

Asia-Pacific is expected to host the fastest-growing market with a CAGR of approximately 8.3% in the coming years, due to growing offshore exploration in the deep-water basin. The growing energy needs in developing countries are stimulating the offshore expansion capacities of national oil companies. Governments in the region are encouraging investments in deepwater and ultra-deepwater projects as a way of cutting imports. Offshore drilling technologies and growing foreign direct investments escalate market growth. People are becoming aware of new hydrocarbon fields in the frontier offshore fields, which are providing long-term growth opportunities.

Country-Level Analysis

China is a very important country at the national level because it has a strategic interest in offshore energy security and domestic production. The nation is also still making massive investments in deepwater exploration in the South China Sea, which requires sophisticated floating production units. There is also an offshore surge in India, especially in the Krishna Godavari basin, which is favorable to the deployment of FPS. Countries in Southeast Asia, like Malaysia and Indonesia, have remained consistent in terms of the redevelopment of the offshore oil and gas.

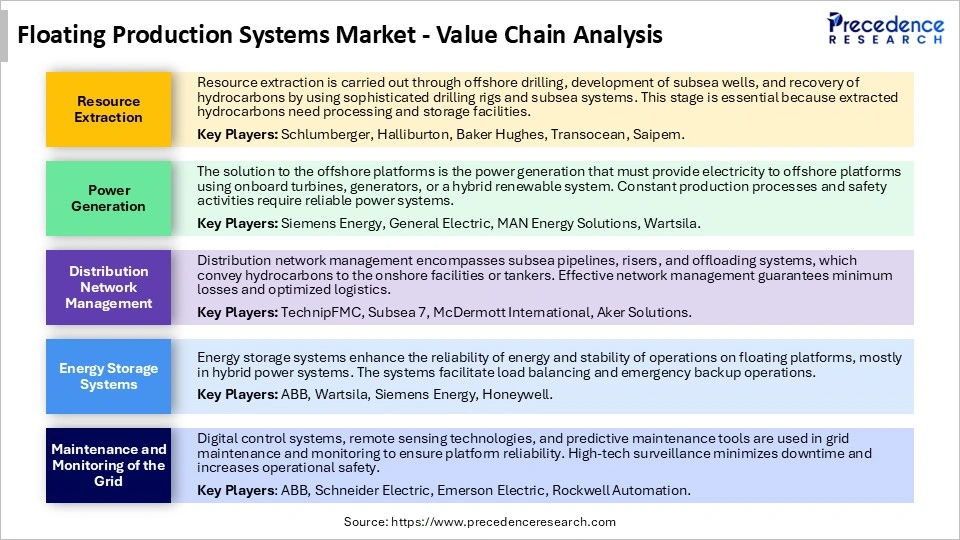

Floating Production Systems Market Value Chain Analysis

Who are the Major Players in the Global Floating Production Systems Market?

The major players in the floating production systems market include Petrobras, SBM Offshore, BW Offshore, Bumi Armada, MODEC, Teekay Corporation, Yinson Holdings, Bluewater Energy Services ExxonMobil Corporation, TotalEnergies SE

Recent Development

- In October 2025, SBM Offshore signed a strategic digital partnership with global energy technology provider SLB to provide better floating production. The alliance will roll out progressive digital solutions aimed at streamlining FPSO activities, enhancing system uptime, and raising long-term production efficiency.(source: SLB and SBM Offshore Agree Digital Alliance to Transform FPSO Production Performance | SLB)

- In August 2025, ABB signed a contract term with SwitchH2 to deliver the latter's highly sophisticated automation and electrification systems to a floating green ammonia production, storage, and offloading ship. The project will also use a 300 MW renewable energy-powered electrolyzer that will allow the production of up to 243,000 tons of green ammonia per year to facilitate the realization of low-carbon maritime fuels.(source: https://new.abb.com)

Segments Covered in the Report

By System Type

- FPSO (Floating Production, Storage and Offloading)

- New build FPSOs

- Converted tankers / refurbished FPSOs

- Semi-submersible Production Platforms

- Spars and TLPs (Deepwater Platforms)

- Floating LNG Production Systems

- Other Floating Systems (FLNG variants)

By Water Depth

- Deepwater (500–1500 meters)

- Ultra-deepwater (>1500 meters)

- Shallow / Sub-deepwater (<500 meters)

By Application

- Oil Production

- Gas Production/Floating LNG

- Oil and Gas Mixed Production

- Other Offshore Resources

By Platform Functionality

- Production Only

- Production + Storage

- Production + Storage + Offloading

By Contract/Procurement Model

- EPC (Engineering, Procurement and Construction)

- EPCI (Engineering, Procurement, Construction and Installation)

- Lease/Charter Systems

- Other Procurement Models

By Deployment Location

- Offshore Atlantic (Americas)

- North Sea and Europe Offshore

- Asia-Pacific Offshore

- Middle East and Africa Offshore

- Other Regions

By Service Type

- Installation and Commissioning Services

- Engineering and Design Services

- Maintenance and Support Services

- Inspection and Warranty Services

- Other Lifecycle Services

By Contract Duration

- Short-term/Project-based Contracts

- Long-term/Multi-year Contracts

- Spot/As-needed Deployments

By Deployment Mode

- Integrated Floating Systems

- Modular/Plug-and-Play Configurations

- Retrofit/Upgraded Conversions

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting