What is the Floating Storage and Regasification Unit Market Size in 2026?

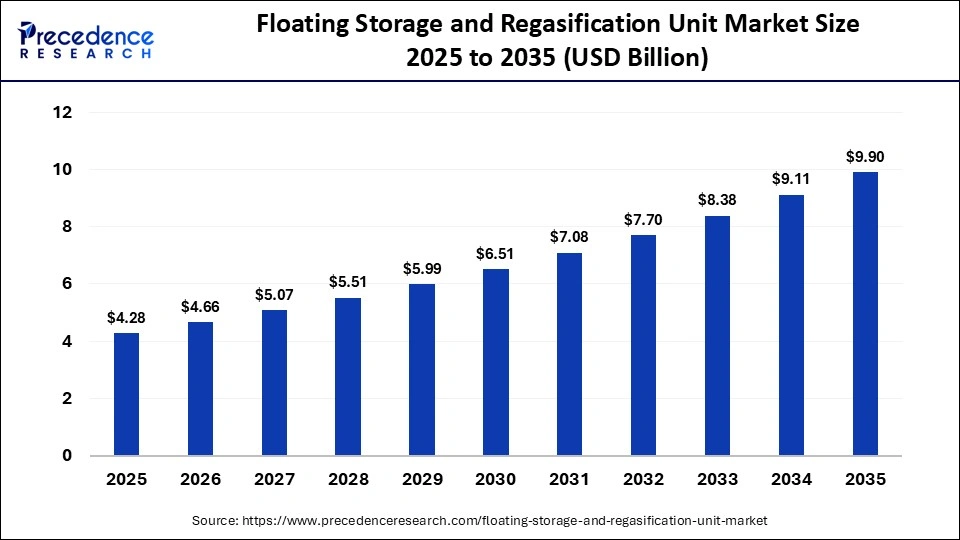

The global floating storage and regasification unit market size was calculated at USD 4.28 billion in 2025 and is predicted to increase from USD 4.66 billion in 2026 to approximately USD 9.90 billion by 2035, expanding at a CAGR of 8.745% from 2026 to 2035.The market is expanding due to rising LNG trade, faster project deployment compared to onshore terminals, and growing energy security needs, especially in emerging economies and gas-importing nations.

Key Takeaways

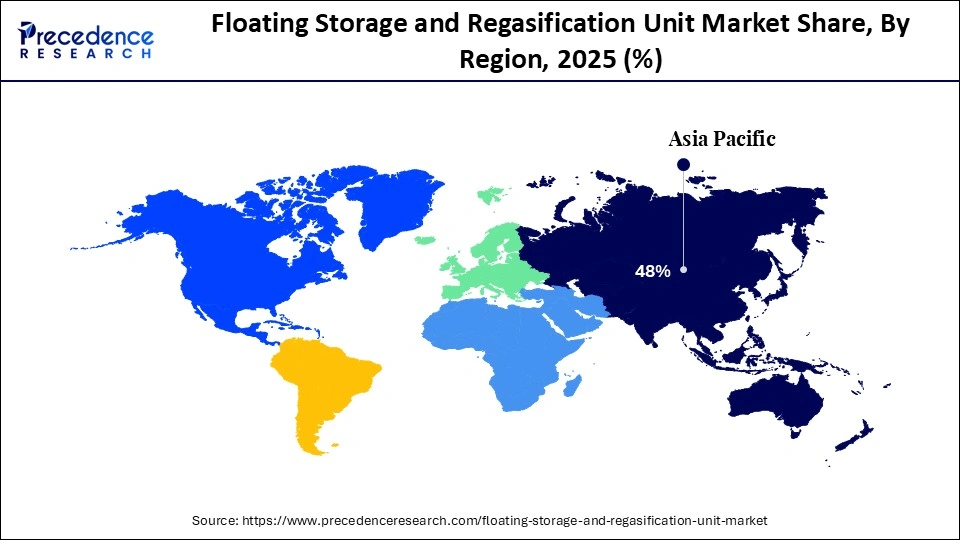

- Asia-Pacific led the floating storage and regasification unit market in 2025 and is expected to sustain as a leader in the upcoming period.

- By vessel type, the newly built segment held a dominant position in the market in 2025.

- By vessel type, the converted segment is expected to grow at a strong CAGR during 2026 and 2035.

- By storage capacity, the 120,000–180,000 m³ segment registered its dominance over the global market in 2025.

- By storage capacity, the up to 120,000 m³ segment is expected to expand at a notable CAGR from 2026 to 2035.

- By application, the LNG import terminals segment dominated the market in 2025.

- By application, the LNG power generation segment is growing at a strong CAGR from 2026 to 2035.

- By propulsion, the self-propelled segment dominated the market in 2025.

- By propulsion, the non-self-propelled segment is expected to expand at a notable CAGR from 2026 to 2035.

Why is the Floating Storage and Regasification Unit Market Expanding Globally?

The floating storage regasification unit (FSRU) is a vessel that transports liquefied natural gas (LNG), stores it on board, and converts it back to gas so that it can be distributed via pipeline. They provide flexibility over traditional LNG import terminals located on land.

As international energy markets change, countries are searching for a low-cost method to import LNG in order to create an energy security plan and to adapt to the changing flow of gas around the world. An FSRU provides several benefits, including shorter lead-time to design and build; less upfront capital required versus land-based terminals; and the ability to be easily transferred from one part of the world to another. Also, as countries in Asia and Europe are contracting for greater amounts of LNG on long-term charters and modular regasification technology becomes available more rapidly, we expect the market for FSRUs to continue to grow.

Based on the infrastructure limitations of countries transitioning from coal to gas because of decarbonization policies, we expect FSRUs to play a large role as an important transition tool connecting the global gas market.

AI Changes the Dynamics of the Floating Storage and Regasification Unit Market

The innovative use of artificial intelligence (AI) technology is transforming the FSRU industry through smarter operations with superior results than before. Companies are benefiting from improved asset utilization and profitability due to AI-enabled predictive maintenance and real-time monitoring systems that maximize equipment health and decrease unplanned downtime while minimizing costly operational disruptions. AI-enabled machine learning (ML) and smart sensors support dynamic regasification control, improve boil-off gas management, and reduce energy cost and environmental impact.

AI also supports improved scheduling of LNG carrier arrivals at ports and port operations, allowing companies to minimize demurrage fees and streamline supply chain operations. To maintain a competitive advantage and to meet the growing global demand for LNG, key players in the oil and gas industry are investing in new technologies as part of a broader trend of digital transformation and increased automation; the trend of companies using AI and IoT technologies to create value within FSRUs continues to gain momentum according to recent reports to indicate a continued strategic shift in this direction.

Floating Storage and Regasification Unit Market Trends

- Rapid Deployment: FSRUs have become popular because they can be constructed and started up much more quickly than onshore LNG terminals. As a result, countries can increase their gas supply more rapidly, increase their energy independence, and have a means to respond quickly to sudden changes in supply or demand for gas.

- Energy Independence: Due to geopolitical uncertainty and government-led strategies to diversify their sources of energy, governments are using FSRUs as strategic assets to help reduce their dependence on pipeline gas and promote national energy security through various national energy resiliency programs in both developed and developing nations.

- Natural Gas as a Transition Fuel: As natural gas bridges the gap between fossil fuels and renewable energy sources, FSRUs are now being viewed as a part of long-term decarbonization strategies by countries looking to transition from relying on coal to using natural gas and to comply with changing regulations regarding environmental impacts and greenhouse gas emissions.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 4.28 Billion |

| Market Size in 2026 | USD 4.66 Billion |

| Market Size by 2035 | USD 9.90 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 8.745% |

| Dominating Region | Asia-Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Vessel Type, Storage Capacity, Application, Propulsion, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Vessel Type Insights

Which Vessel Type Segment Dominated the Floating Storage and Regasification Unit Market?

The newly built segment held a dominant position in the market in 2025. Purpose-built FSRUs with optimized regasification equipment, better storage efficiency, and longer useful lives are increasingly becoming governments' and major energy companies' vessel of choice over converted units.

Specifically, these purpose-built vessels feature advanced containment systems, improving safety measures and providing a robust foundation for long-term LNG import operations. In addition, they have been designed to be readily integrated into modern port infrastructure and to comply with evolving environmental regulations as LNG-importing countries increasingly adopt them as their primary regasification vessel option.

The converted segment is expected to expand rapidly in the market during the forecast period, as they have shorter delivery periods and require less capital to acquire than newly built vessels. In addition, operators are converting existing LNG carriers into combined FSRUs to respond quickly to energy supply shortfalls created by geopolitical disruptions in supply chains. This conversion strategy is particularly advantageous for developing LNG-importing nations to accelerate the pace of infrastructure development without waiting for longer shipyard construction schedules.

Storage Capacity Insights

Which Storage Capacity Segment Led the Floating Storage and Regasification Unit Market?

The 120,000-180,000 m3 segment led the market in 2025, due to its ideal combination of adequate storage capacity, cost-efficiency, and operational flexibility. The 120,000-180,000 m3 is the preferred FSRU size to serve medium and large-scale LNG import terminals and scrubbing systems, providing sufficient pipeline capacity for a steady supply of natural gas, but also not over-tasking the port infrastructure of the receiving terminal.

Additionally, FSRUs within this size range provide sufficient cargo storage capacity while also demonstrating the ability to quickly process steam and regasify before sending natural gas down the various pipelines serving both utility and industrial markets that make up their respective service areas.

The up to 120,000 m3 segment is expected to witness significant growth in the market over the forecast period. They are most suitable for areas with little to no local port facilities and have moderate to low demand for natural gas within their service areas. They are also very desirable for many developing countries and infrastructure-limited island countries because they may require significantly less capital than the much larger FSRU.

Application Insights

How the LNG Import Terminals Segment Dominated the Floating Storage and Regasification Unit Market?

The LNG importing terminals segment held the largest revenue share of the market in 2025, as they allow rapidly introducing the market to importing LNG, offer construction simplicity, and have a smaller environmental footprint than building onshore fast regasification facilities. The need for security of energy supply, plus the need to diversify their supply mix and gas supply from pipelines, increases the desire of Hawaii to create more terminals in both developed and developing countries.

The LNG power generation segment is expected to show the fastest growth over the forecast period, due to global efforts to eliminate coal and oil-fired electricity by using cleaner-burning natural gas as their primary energy source. This will lead to newer FSRUs being integrated with gas-fired power plants to help ensure a stable supply of fuel. This process will lead to rapid, newly placed electrical service to developing areas and assist existing countries to maintain peak loads of electricity where they have very high electricity usage.

Propulsion Insights

How the Self-Propelled Segment Led the Floating Storage and Regasification Unit Market??

The self-propelled segment accounted for the highest revenue share of the market in 2025, due to the vessels' operational flexibility and their ability to be redeployed. Self-propelled FSRUs can move from one project site to another on an as-needed basis, therefore mitigating the asset risk associated with operating long-term. The self-operated natural gas carrier will simplify logistics when installing and repositioning in the event of emergencies, thus giving them a strategic advantage in volatile energy markets.

The non-self-propelled segment is expected to show lucrative growth over the studied period because cost-conscious developers are searching for simple moored regasification solutions. Non-self-propelled FSRUs are installed permanently at pre-defined ports and are reliant on tugs when necessary. Non-self-propelled FSRUs have lower overall construction and operational costs than self-propelled units, making them an attractive option for developers to support medium/long-term LNG supply contracts.

Regional Insights

Asia Pacific Floating Storage and Regasification Unit Market Size and Growth 2026 to 2035

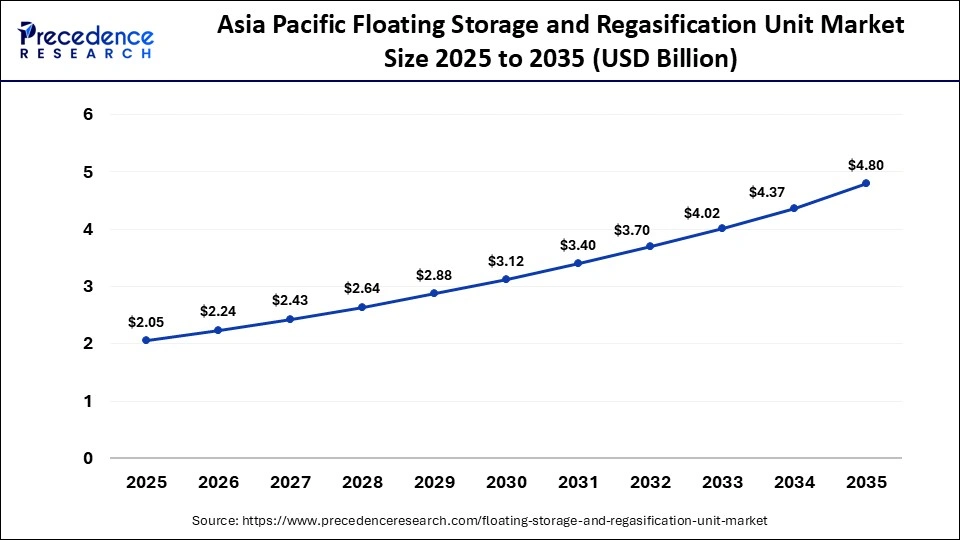

The Asia Pacific floating storage and regasification unit market size is expected to be worth USD 2.05 billion by 2035, increasing from USD 4.80 billion by 2025, growing at a CAGR of 8.88% from 2026 to 2035.

Why Asia-Pacific Dominated the Floating Storage and Regasification Unit Market?

Asia-Pacific held a major revenue share of the market in 2025, and is expected to grow rapidly in the predicted timeframe, as energy demand, urbanisation, and a transition to lower-emission fuels, including LNG, are driving their use in this area. Countries in South and Southeast Asia are utilising FSRUs to expand their import capabilities quickly and efficiently compared to the lengthy construction timelines of traditional greenfield, onshore LNG terminals.

An increase in the amount of industrial energy consumption, implementation of energy diversification policies, and supportive regulatory regimes that remove barriers to the deployment of floating infrastructure further support this trend in the region. FSRU projects and charter arrangements in the Asia-Pacific region are further enhanced by the region's strategic position near key global LNG supply corridors and their proximity to extensive deep-water ports.

India Market Trends

India is positioned as a leader within the Asia-Pacific region, with a reflection of the country's focus on energy security, but also as a response to the rapid increase in the local natural gas consumption. Recent initiatives to establish a floating LNG terminal at Haldia Dock are examples of how India is leveraging both FSRUs and floating LNG terminals to accelerate the build-out of LNG transport and distribution infrastructure nationwide.

These facilities will bridge regional supply gaps while also enabling cleaner energy strategies in both industrial and power sectors. Additionally, India's emphasis on FSRUs reinforces its desire to diversify its energy sources, improve the flexibility of its energy supply, and establish a more integrated global energy marketplace.

How is North America Growing in the Floating Storage and Regasification Unit Market?

North America is expected to grow at a notable CAGR in the foreseeable future. The region's integrated LNG infrastructures and strategic position within the global natural gas value chain fuel market growth in North America. The U.S. and Canada have made large investments in flexible import/export solutions, with FSRUs increasingly used to meet seasonal demand fluctuations, to provide LNG bunkering support, and to reduce peak load issues where onshore terminal congestion or delays exist.

The highly advanced sea engineering capabilities and established LNG export terminals of North America place the region at the forefront of technology and operations, with a large number of North American companies providing FSRU-related product and service expertise to the world. In addition, various expansions in LNG production, new LNG export trains, enhanced pipeline connections, etc., will continue to sustain North America's market growth.

U.S. Market Trends

The U.S., which is the largest market within North America, has an extensive supply chain network for LNG, fulfilling the demand for its national grids and critical energy infrastructure. The presence of key players, such as ABS and Excelerate Energy, and favorable government support promote the market. As the U.S. is the major exporter, FSRUs provide rapid, cost-effective, and flexible import or regional supply options.

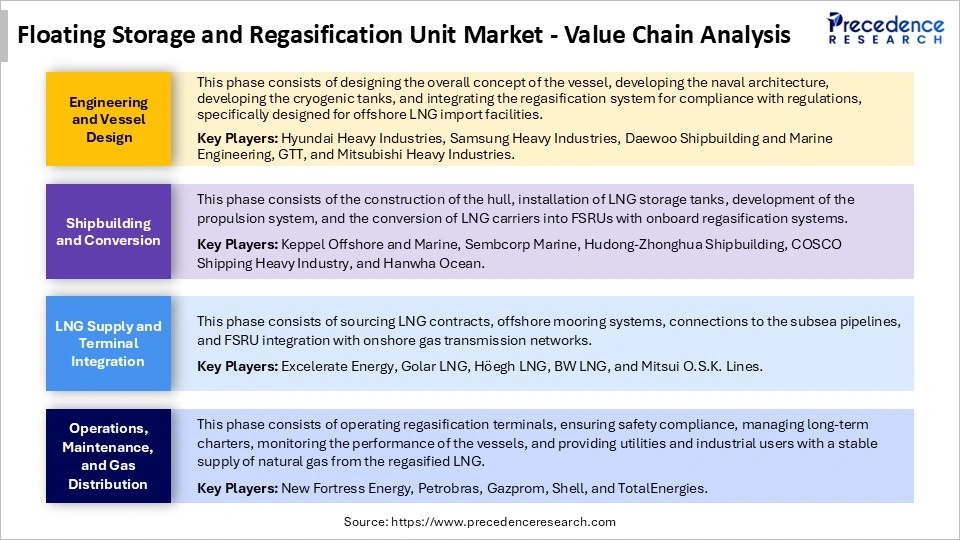

Floating Storage and Regasification Unit Market Value Chain Analysis

Floating Storage and Regasification Unit Market Companies

- Excelerate Energy Inc.

- BW Gas ASA

- Golar LNG Limited

- Hoegh LNG Holdings Ltd.

- Mitsui O.S.K. Lines Ltd.

- Samsung Heavy Industries Co. Ltd.

- Daewoo Shipbuilding and Marine Engineering Co. Ltd.

- Hyundai Heavy Industries Co. Ltd.

- Exmar NV

- Teekay LNG Partners L.P.

- Royal Dutch Shell plc

- Gazprom

- Petrobras

- TotalEnergies SE

- Eni S.p.A.

- Bumi Armada Berhad

- Marubeni Corporation

- Kawasaki Kisen Kaisha Ltd. (K Line)

- NYK Line (Nippon Yusen Kabushiki Kaisha)

- Petronas

Recent Developments

- In January 2026, VTTI and Höegh Evi launched an open season to develop a floating LNG terminal with an expected start-up in late 2029, inviting interest for capacity and planning for future floating import infrastructure. The Zeeland Energy Terminal project centers on an FSRU with around 7.5 bcm of annual send-out capacity.(Source: https://en.portnews.ru)

- In July 2025, Excelerate Energy announced the construction of a new FSRU (Hull 3407) progressed with the hull launch at HD Hyundai Heavy Industries in South Korea, moving Excelerate Energy closer to delivering a 170,000 bcm capacity LNG import vessel in 2026. (Source: https://www.offshore-energy.biz)

- In April 2024, Mitsui O.S.K. Lines, Ltd. announced the start of commercial FSRU operations at Indonesia's Jawa 1 LNG power plant, marking Asia's first integrated gas-to-power FSRU project to supply regasified LNG for electricity generation. The project develops power generation facilities and gas-related facilities using FSRU as an integral element of the power generation process. (Source: https://www.mol.co)

Segments Covered in the Report

By Vessel Type

- Newly Built

- Converted

By Storage Capacity

- Up to 120,000 m3

- 120,000-180,000 m3

- Above 180,000 m3

By Application

- LNG Import Terminals

- LNG Power Generation

- Others

By Propulsion

- Self-propelled

- Non-self-propelled

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting