What is the Fluid Management Systems Market Size?

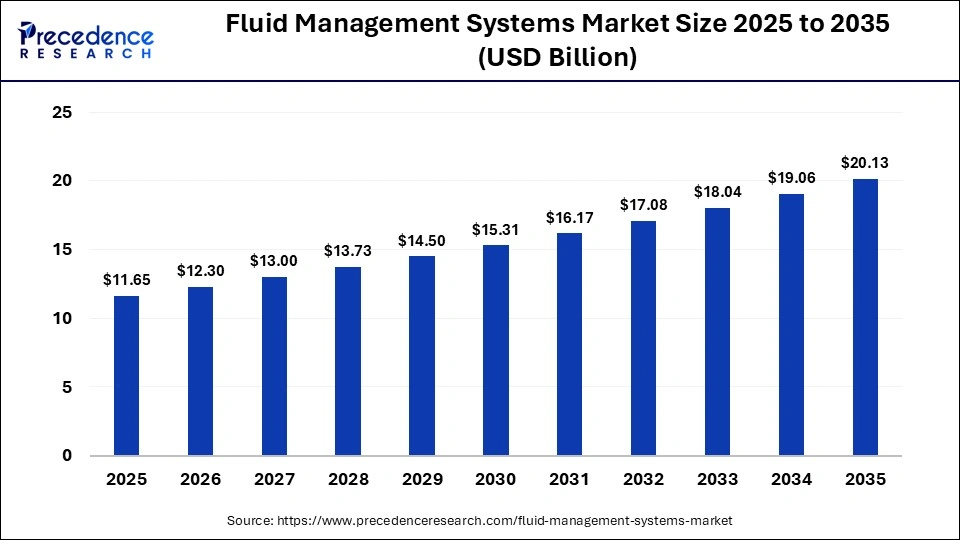

The global fluid management systems market size was calculated at USD 11.65 billion in 2025 and is predicted to increase from USD 12.30 billion in 2026 to approximately USD 20.13 billion by 2035, expanding at a CAGR of 5.52% from 2026 to 2035. The market is driven by the increasing demand for automated infusion monitoring, enhanced patient safety, and efficient management of intravenous fluids and medications in hospitals and clinics.

Market Highlights

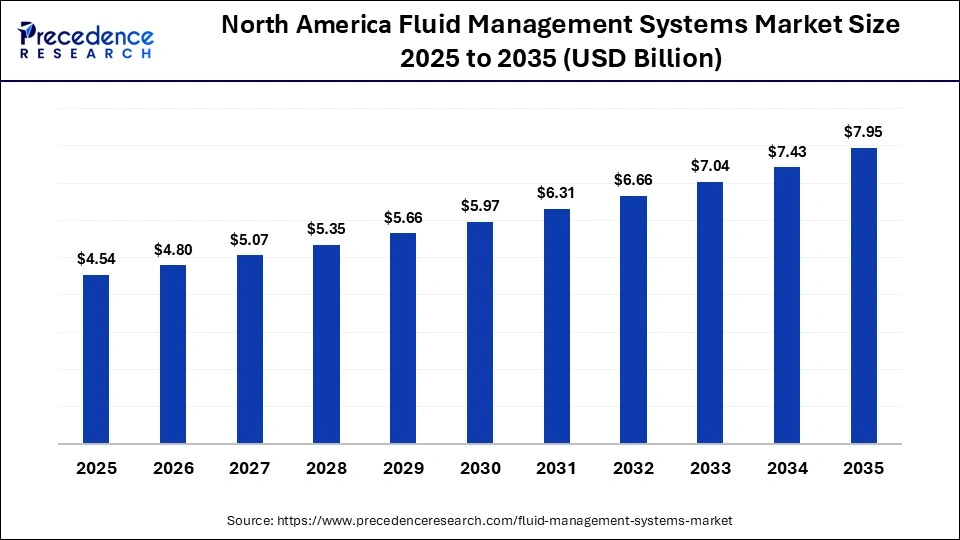

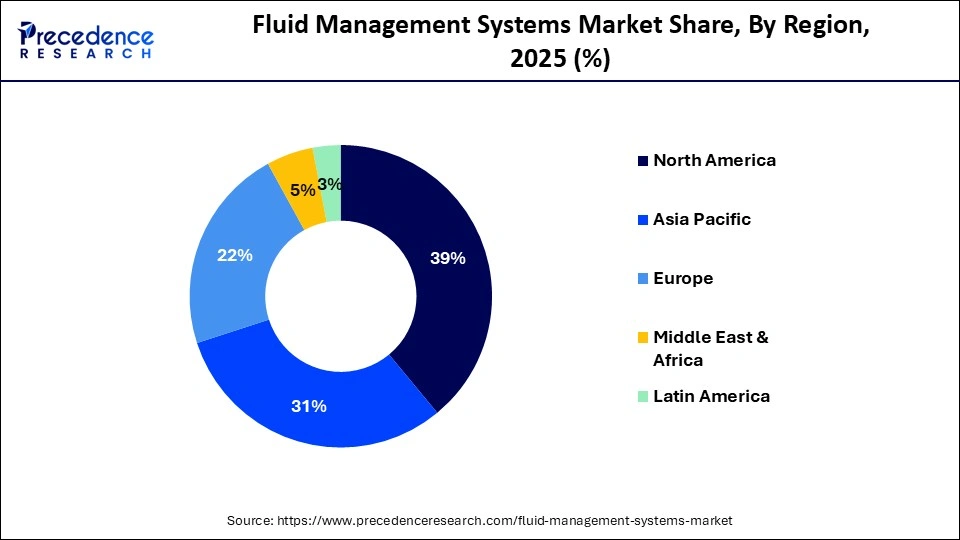

- North America dominated the market with a major market share of around 39% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR of 11.4% between 2026 and 2035.

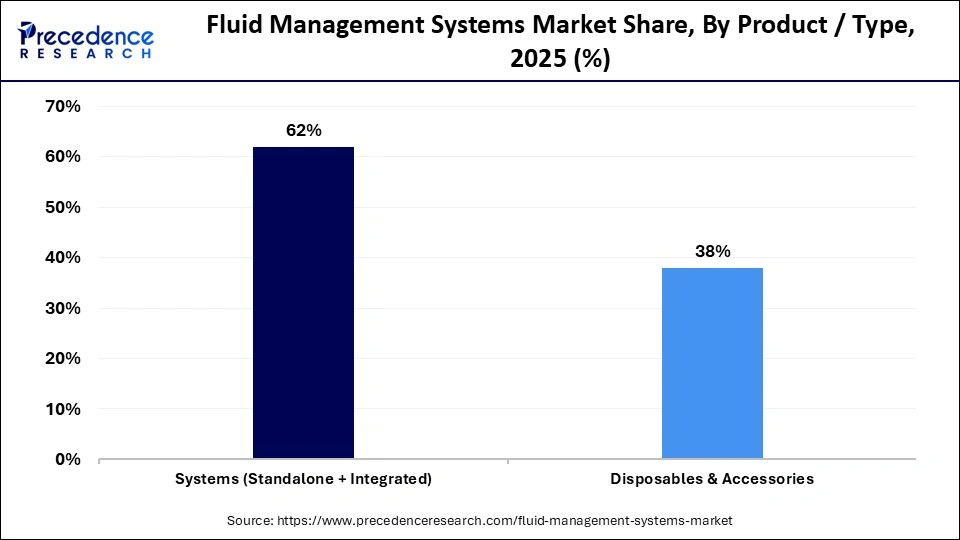

- By product / type, the systems segment held the biggest market share of around 62% in 2025.

- By product / type, the disposables & accessories segment is expected to expand at the fastest CAGR of 9.4% between 2026 and 2035.

- By application, the urology and nephrology segment held the largest market share of 34% in 2025.

- By application, the laparoscopy segment is expected to grow at a solid CAGR of 9.6% between 2026 and 2035.

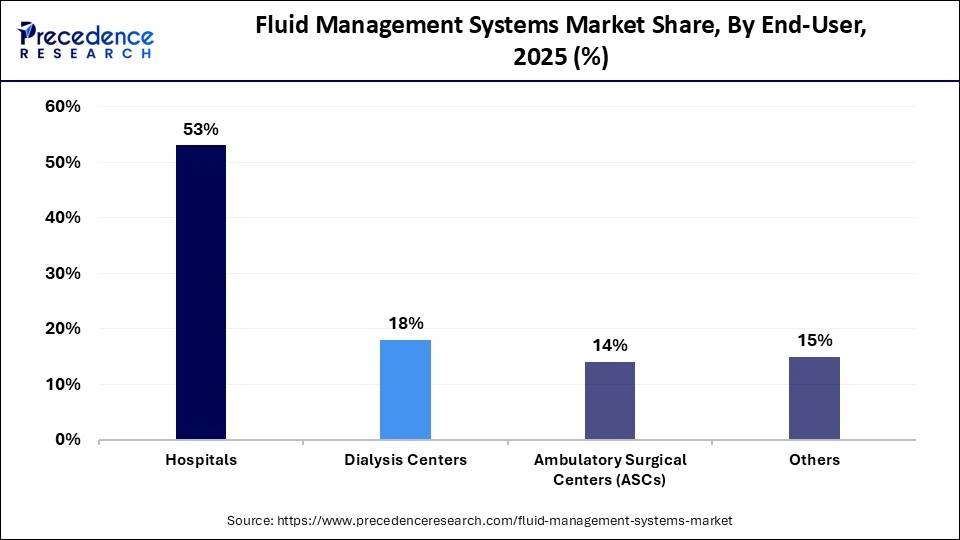

- By end-user, the hospitals segment contributed the highest market share of around 53% in 2025.

- By end-user, the ambulatory surgical centers (ASCs) segment is expected to grow at the highest CAGR of 10.1% between 2026 and 2035.

Why are Fluid Management Systems Essential?

Fluid management systems are essential for controlling, monitoring, and regulating bodily fluids during medical procedures, such as dialysis, surgeries, and irrigation/suction operations. These systems consist of hardware, such as pumps and consoles, consumables like catheters and tubing, and integrated software that ensures accurate delivery, waste management, and patient safety. Fluid management systems are widely used in hospitals, dialysis centers, and outpatient surgical settings, supporting the growing demand for minimally invasive procedures, chronic disease care, and efficient fluid handling across various clinical specialties worldwide.

How Does AI Transform the Fluid Management Systems Market?

Artificial intelligence (AI) is revolutionizing the fluid management systems market by enabling predictive analytics for patient fluid demands, optimizing surgical workflows, automating adjustments, and integrating the IoT for real-time monitoring, leading to personalized care. AI quickly identifies leaks, inefficiencies, and anomalies, facilitating seamless communication between sensors and control units. It helps create individualized treatment plans based on complex patient profiles, enhances treatment outcomes, and works in conjunction with imaging and robotics to predict fluid loss and automate waste disposal, ultimately improving precision and workflow.

Major Trends in the Fluid Management Systems Market

- Demand for Digital Integration and Smart Systems: There is a rapid shift from standalone to connected devices, using AI, IoT, and cloud platforms, for predictive fluid management, automated alerts, and better data capture for surgical records, improving precision and workflow.

- Intense Focus on Minimally Invasive Procedures and Portability: Increasing MIP volumes, especially in neurology, orthopedics, and gastroenterology, demand more sophisticated fluid management systems for home dialysis and ambulatory care settings, expanding beyond traditional hospitals.

- Increasing Chronic Disease Burden: The increasing prevalence of kidney diseases, diabetes, and other conditions requiring fluid management is a significant factor, fueling demand for advanced dialysis and fluid therapy solutions.

- Integrated Fluid and Waste Management: Hospitals are adopting systems that automatically handle fluid infusion, irrigation, and waste removal, often with smart disposables, ensuring regulatory compliance and boosting operating room efficiency.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 11.65 Billion |

| Market Size in 2026 | USD 12.30 Billion |

| Market Size by 2035 | USD 20.13 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.52% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product/Type, Application, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Product/Type Insights

How Did the Systems Segment Dominate the Fluid Management Systems Market?

The systems segment dominated the market while holding approximately 62% share in 2025. This is primarily due to the increased demand for integrated solutions that enhance safety and efficiency in minimally invasive procedures. Integrated systems combine irrigation, suction, and waste management into single units, reducing the number of procedural steps, a significant attraction for high-volume centers. Meanwhile, standalone systems offer flexibility, promoting their adoption in smaller facilities and various procedures, due to their precision and compatibility with diverse surgical fields such as arthroscopy, laparoscopy, and urology.

The disposables & accessories segment is expected to grow at the fastest CAGR of 9.4% during the forecast period. The growth of this segment is primarily driven by the rising volume of minimally invasive surgeries, which necessitate specialized fluid management for irrigation, suction, and single-use sterile consumables. Hospitals are increasingly transitioning from reusable to single-use components to minimize contamination risks and comply with stringent infection-control guidelines. Moreover, the increasing preference for outpatient and day-care surgeries in ASCs drives the demand for cost-effective and high-turnover disposables.

Application Insights

What Made Urology & Nephrology the Leading Segment in the Fluid Management Systems Market?

The urology & nephrology segment led the market with a 34% share in 2025. This is largely due to the high prevalence of kidney diseases, which drives a substantial demand for dialysis and related devices, such as catheters and stents. Conditions such as chronic kidney disease, end-stage renal disease, kidney stones, and prostate issues require ongoing fluid management and treatment. Recent advances have also enabled less invasive urological surgeries, resulting in greater use of specialized devices, including ureteral stents and guidewires.

The laparoscopy segment is expected to grow at the fastest CAGR of 9.6% in the upcoming period. This growth is attributable to the global shift toward minimally invasive surgeries that rely on precise irrigation and suction for clear visualization. Smaller incisions reduce pain, lower infection risk, and enable faster recovery, making laparoscopy more attractive than traditional open surgery. Its adoption is expanding beyond general surgery into gynecology, gastroenterology, urology, and neurology, where accurate fluid management is critical.

End-User Insights

Why Did the Hospitals Segment Lead the Fluid Management Systems Market?

The hospitals segment led the market in 2025 by holding a 53% share. This leadership is primarily due to high patient volumes, complex surgeries, advanced infrastructure, and the capacity to invest in integrated systems, which drive the demand for precise fluid control in critical care and various procedures. Well-established infrastructure, integrated operating rooms, and higher budgets support the adoption of advanced fluid management systems. Hospitals perform the majority of surgical and dialysis procedures, necessitating extensive fluid management to enhance safety and efficiency, driven by infection control and improved visualization.

The ambulatory surgical centers (ASCs) segment is expected to grow at the fastest CAGR of 10.1% over the forecast period. The segment's growth is attributed to the global shift toward cost-effective outpatient care, the rising popularity of minimally invasive procedures, and the growing adoption of same-day surgeries. ASCs typically offer lower procedural costs than hospitals, and favorable reimbursement policies encourage their adoption, making fluid management systems more accessible. Shorter recovery times, reduced infection risks, and greater convenience are driving both patients and surgeons toward outpatient settings. As a result, demand for fluid management systems in ASCs continues to grow steadily.

Regional Insights

How Big is the North America Fluid Management Systems Market Size?

The North America fluid management systems market size is estimated at USD 5.54 billion in 2025 and is projected to reach approximately USD 7.95 billion by 2035, with a 5.76% CAGR from 2026 to 2035.

What Made North America the Dominant Region in the Fluid Management Systems Market?

North America dominated the fluid management systems market by holding about 39% share in 2025. This dominance is driven by advanced healthcare infrastructure, strong R&D activity, and high adoption of minimally invasive surgical procedures. An aging population with a high prevalence of chronic diseases, along with robust reimbursement frameworks, supports sustained demand for sophisticated fluid handling technologies such as smart pumps and automated systems. Additionally, strong regulatory emphasis on infection control, accurate fluid balance, and early adoption of innovative solutions reinforces the region's market leadership.

What is the Size of the U.S. Fluid Management Systems Market?

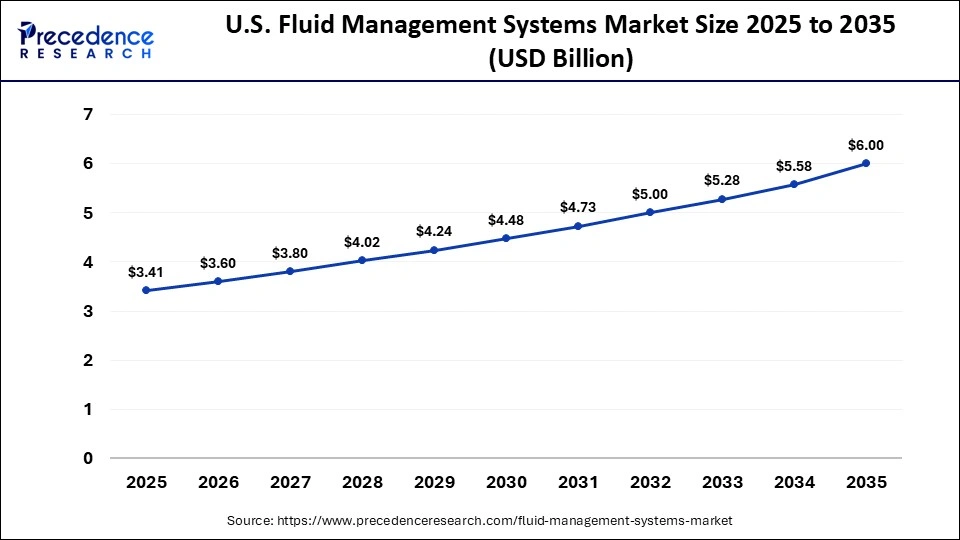

The U.S. fluid management systems market size is calculated at USD 3.41 billion in 2025 and is expected to reach nearly USD 6.00 billion in 2035, accelerating at a strong CAGR of 5.81% between 2026 and 2035.

U.S. Fluid Management Systems Market Trends

The U.S. is a key contributor to the North American fluid management systems market, driven by a large geriatric population, rising prevalence of chronic diseases, a well-established healthcare infrastructure, and high volumes of surgical procedures. Early adoption of advanced technologies, including smart fluid-handling systems, automation, and digital integration, enhances safety and operational efficiency. Significant investments and continuous innovation by leading companies such as Baxter and Stryker further strengthen the country's market position.

How is the Opportunistic Rise of Asia Pacific in the Fluid Management Systems Market?

Asia Pacific is expected to grow at the fastest CAGR of 11.4% throughout the forecast period. This is mainly due to rapid healthcare modernization, a large patient population, and increasing adoption of advanced surgical technologies. Significant government investments and private initiatives to modernize healthcare facilities, especially in India, China, and Southeast Asia, are increasing the adoption of advanced medical devices. The availability of high-quality surgical treatments at lower costs attracts medical tourists to nations like India and Thailand, boosting the utilization of fluid management products.

India Fluid Management Systems Market Trends

India is an emerging market for fluid management systems, driven by increasing healthcare expenditure and the rapid expansion of hospital infrastructure. Rising prevalence of chronic diseases, growing awareness, and demand for improved infection control and surgical workflow efficiency are further boosting adoption. As healthcare standards continue to rise, India presents significant growth opportunities for global fluid management systems manufacturers.

Why is Europe Considered a Significantly Growing Region in the Market?

Europe is considered a significantly growing region in the fluid management systems market due to its well-established healthcare infrastructure, rising adoption of minimally invasive surgeries, and increasing prevalence of chronic diseases among an aging population. Strong regulatory standards and a high focus on patient safety and infection control are driving hospitals to adopt advanced fluid management technologies. Additionally, sustained investments in healthcare modernization and the presence of leading medical device manufacturers support steady market growth across the region.

Germany Fluid Management Systems Market Trends

The market in Germany is growing due to the country's advanced healthcare infrastructure, high adoption of minimally invasive surgical procedures, and strong emphasis on patient safety and infection control. An aging population and rising prevalence of chronic diseases are increasing surgical volumes, driving demand for efficient fluid management. Additionally, strong government support, robust reimbursement policies, and the presence of leading medical device manufacturers are accelerating market growth.

Fluid Management Systems Market Value Chain Analysis

- Research & Development (R&D)

This focuses on developing advanced, IoT-enabled, and AI-driven fluid management devices to improve precision, reduce contamination, and improve patient safety.

Key Players: Fresenius Medical Care AG & Co. KGaA, B. Braun Melsungen AG, Medtronic plc, Baxter International Inc., and Stryker Corporation.

- Regulatory Approval and Component Sourcing

This involves navigating stringent regulatory standards to ensure biocompatibility and electrical safety.

Key Players: Teleflex Incorporated, B. Braun Melsungen AG, and Medtronic.

- Manufacturing

This involves the production of complex, reusable hardware and high-volume, single-use, disposables.

Key Players: Fresenius Medical Care, Cardinal Health, Stryker Corporation, B. Braun Melsungen AG, and CONMED Corporation.

- Logistics and Supply Chain

This involves specialized logistics involving the storage and delivery of surgical and dialysis equipment to hospitals and ambulatory surgical centers.

Key Players: DHL Supply Chain, UPS Healthcare.

- Distribution and Commercialization

This involves targeted sales and distribution to hospitals, dialysis centers, and Ambulatory Surgical Centers, often bundled with IoT, services, and software analytics.

Key Players: Baxter, Medtronic, Cardinal Health, and Stryker.

Who are the Major Players in the Global Fluid Management Systems Market?

The major players in the fluid management systems market include Fresenius Medical Care AG, Smith & Nephew Plc, B. Braun Melsungen AG, Stryker Corporation, Medtronic plc, Baxter International Inc., Cardinal Health Inc., CONMED Corporation, Ecolab Inc., Olympus Corporation, ICU Medical, Zimmer Biomet Holdings Inc., Hologic Inc, Johnson & Johnson, and Nipro Corporation.

Recent Developments

- In October 2025, Mode Sensors announced that its Re:Balans hydration monitoring system received 510(k) clearance from the U.S. FDA, allowing it to enter the American market. The device enables non-invasive monitoring of adult patients with fluid management issues, such as fluid overload or dehydration, using proprietary bioimpedance technology. Gøran van den Burgt, CEO of Mode Sensors, emphasized the growing interest in fluid management as a significant market opportunity.(Source: https://www.businesswire.com)

- In June 2025, IPRO launched LiniXia, a new reverse osmosis (RO) water treatment system for dialysis clinics, introduced at the European Renal Association (ERA) conference. Developed with feedback from healthcare professionals, LiniXia provides high-quality water for dialysis treatments and includes NIPRO's first RO system with full heat disinfection. This system focuses on safety, reliability, and digital integration, ensuring efficient use of water and energy resources in dialysis care.(Source: https://www.nipro-group.com)

Segments Covered in the Report

By Product / Type

- Systems

- Disposables & Accessories

By Application

- Urology & Nephrology

- Gastroenterology

- Laparoscopy

- Gynecology/Obstetrics

- Cardiology / Neurology / Others

By End-User

- Hospitals

- Dialysis Centers

- Ambulatory Surgical Centers (ASCs)

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content