What is the Food Enzymes Market Size?

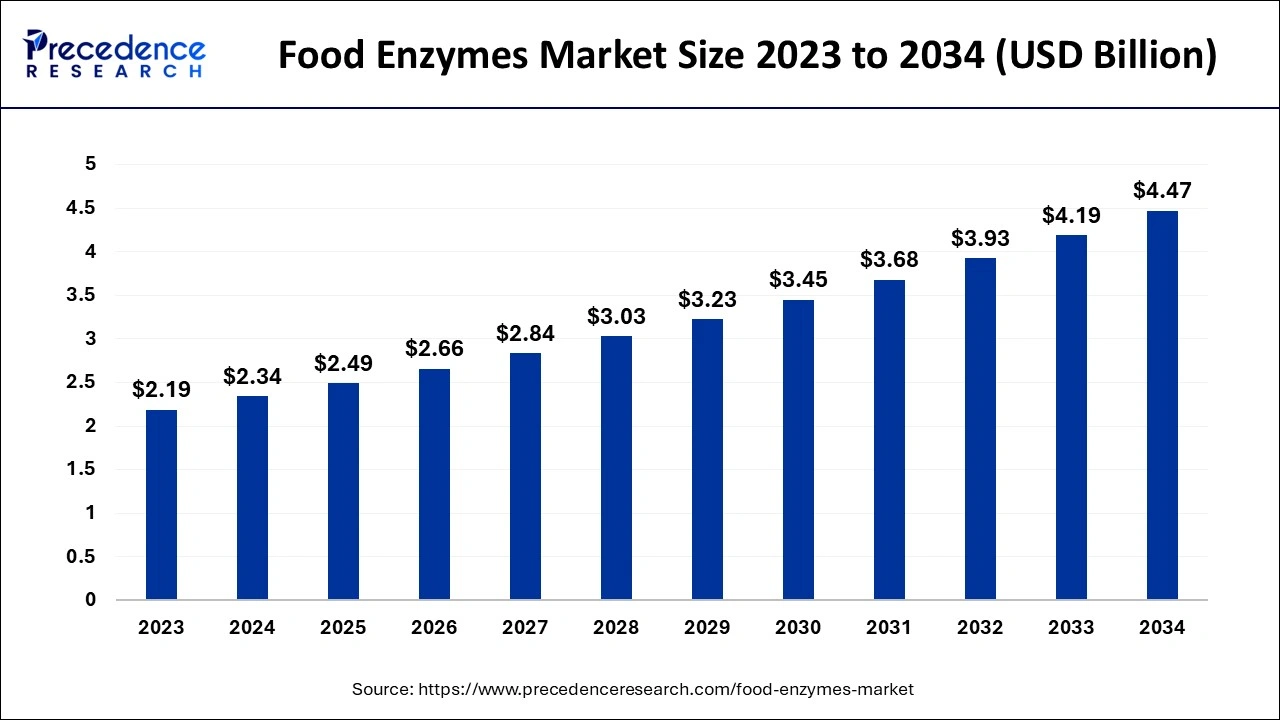

The global food enzymes market size was estimated at USD 2.49 billion in 2025 and is predicted to increase from USD 2.66 billion in 2026 to approximately USD 4.74 billion by 2035, expanding at a CAGR of 6.65% from 2026 to 2035.

Food Enzymes Market Key Takeaways

- In terms of revenue, the market is valued at 2.49 billion in 2025.

- It is projected to reach 4.74billion by 2035.

- The market is expected to grow at a CAGR of 6.65% from 2026 to 2035.

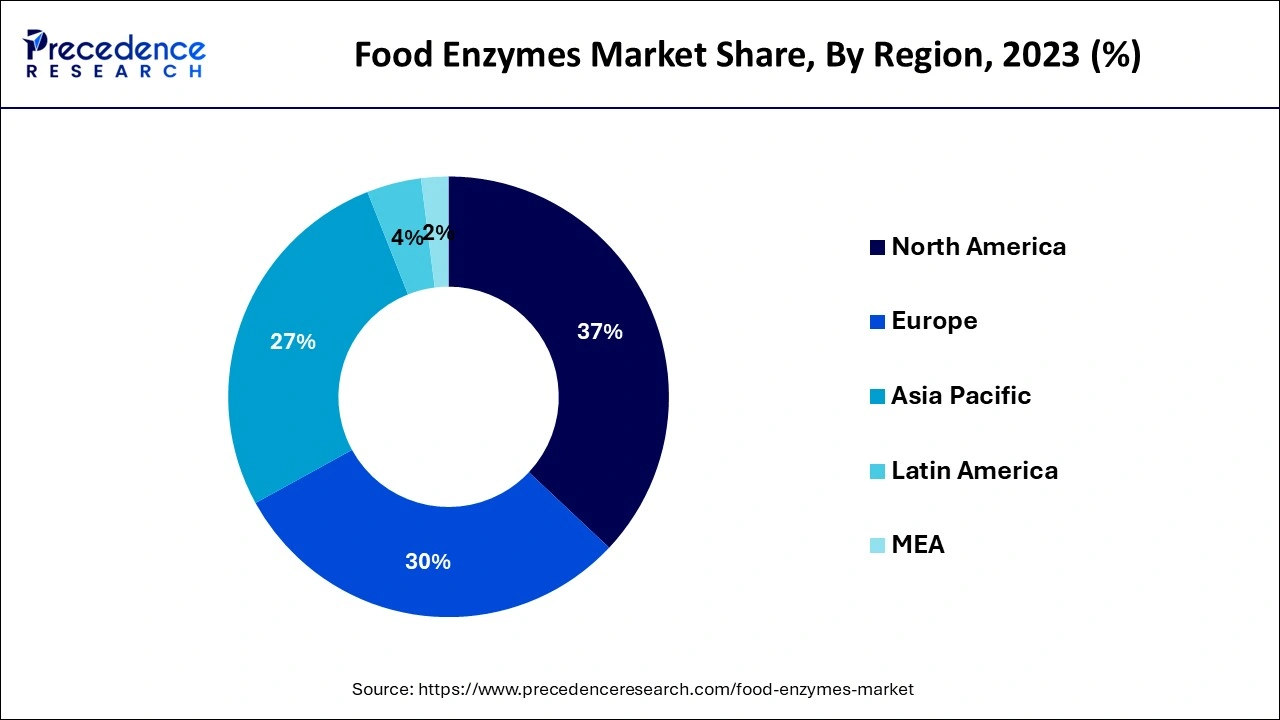

- North America has the largest market share in the food enzymes market.

- Based on the source, the microorganisms segment is projected to dominate the global market.

- Based on type, the carbohydrases segment is predicted to dominate the global market.

- Based on application, the beverages segment is expected to witness the biggest growth in terms of revenue, from 2026 to 2035.

Market Overview

Enzymes are proteins that initiate or increase biological events and are often utilized to accelerate and target specific chemical reactions. Enzymes are derived from several sources, the most common being plant & animal extraction or fermentation from microbes, including genetically engineered microorganisms. Food enzymes are frequently employed in food processing due to their numerous advantages, which include texture, flavor, aroma improvement, preservation, viscosity, and tenderization. Enzymes are widely utilized in the baking, fruit juice, and cheese-producing industries, as well as in brewing.

Technological Advancement

Technological advancements in the food enzymes market feature biosensors, synthetic biology, nanotechnology, microencapsulation, biotechnology, and enzyme engineering. Biosensor technology detects nutrients and harmful substances, ensuring food safety standards and quality are leveraged. Synthetic biology is a form of cell factories used in the production of food additives such as preservatives, colors, and sweeteners.

Nanotechnology and microencapsulation techniques are used to improve storage time, stability, and catalytic properties. The technology benefits a vast range of applications, including dairy products, baking, and beverages. It also contributes to the production of fortified and nutraceutical foods. Enzyme engineering technique consists of de novo design and genetic modification. Biotechnological advancements in the food enzymes market provide the production of enzymes containing functional properties, and initiate new development for enzymes.

Food Enzymes Market Growth Factors

The significant factors leading to the growth of the food enzymes market are attributed by increase in demand of food enzymes market have been pushed due to the rise in demand for processed food by working individuals, which is fueling the market. The emergence of developing countries as strong consumers of nutritional products.

- Technological advancement in food enzymes

- Increased demand from the food and beverage industry

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 4.74Billion |

| Market Size in 2025 | USD 2.49 Billion |

| Market Size in 2026 | USD 2.66 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 6.65% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Source, Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Growing awareness about the nutritional benefits of digestive enzymes

The rise in knowledge about the importance of healthy food items is steadily expanding among global consumers. This nutritional knowledge is linked to increased development, pollution, health complications, and changing dietary patterns.

Furthermore, government programs to educate rural people about nourishment, a rising share of working women and qualified individuals, and the lack of time for meal preparation have raised the demand for healthful food. Concurrently, with the expanding population in Asia-Pacific nations, the arrival of new food categories, accessibility to Western products, and the growing number of nuclear families led to increased demand for nutritional food.

Each of these contributing factors drives the requirement for enzymes from nutritional food product manufacturers, as products manufactured with enzymes have high levels of nutrients and aid in food digestion which assists in the breakdown of food products into recombinant proteins, lipids, and carbohydrates o provide nourishment.

Furthermore, the population is shifting toward more significant food categories, and their health quest significantly influences nutritional items. As a result, consumers increasingly seek nutritionally dense, healthful foods, leading to greater output by food manufacturers. As a result of the growing need to address the nutritional needs of the population, nutritious food manufacturers are progressively adding enzymes into their offerings, propelling the global food enzymes market forward.

Key Market Challenges

Regulatory uncertainty to stymie market expansion

The increased use of dietary enzymes as processing components in the food business has resulted in the rapid evolution and improvement of the safety regulatory framework. Enzymes are classified as food additives or food processing aids under food regulation. Food enzyme classification is critical since pre-market authorization, including safety review, is only required for food ingredients in some countries.

Furthermore, the varieties of elements and chemical additives differ among nations and regions, resulting in regulatory ambiguities that impede market expansion. For instance, in Canada, the United States, and Japan, all dietary enzymes are controlled as food additives. However, in the EU and Australia, most dietary enzymes are classified as processing aids, with only a handful classified as additives.

Regulation on enzymes as food processing aids vary significantly between European Union (EU) member states. These proteins are subject to the licensing procedure in France, Denmark, Poland, and Hungary, but in the UK, a unilateral approval system exists, resulting in a geographical disparity. The Asia Pacific area is varied, and its authority oversees each country's food standards.

Global harmonization of safety laws about food catalysts, specifically food additives, has yet to be conceived. A disjointed and fragmented approach to ingredient regulation is predicted to have a detrimental influence on the expansion of food enzymes in the region's food industry.

Temperature change slows down the reaction rate of enzymes

The activity of dietary enzymes is heavily regulated by environmental circumstances. Temperature decreases the reaction substantially, but thermal stimulation inactivates the food enzyme, degrading its structure and rendering it non-functional.

On the other hand, changing the pH beyond the enzyme's operating range lowers enzyme activity and, therefore, can eventually lead to irreversible denaturation. Food enzyme producers are working hard to develop enzymes that can function in a wide pH range and temperature range; nevertheless, there is still a long path before enzymes are used in all food and beverage manufacturing processes.

Key Market Opportunities

To make the most of the opportunity, vendors are advised to focus on growth prospects in the fastest-growing segments while being rigid in the slow-growing part.

- Introduction of plant enzymes for vegan

- Technological advancement in food enzymes.

Segment Insights

Source Insights

Based on source, food enzymes are segmented into microorganisms, plants, and animals. Microorganisms are projected to dominate the industry since they are less expensive and more reliable than animal and plant enzymes.

Microorganism enzymes may be efficiently created utilizing various fermentation processes, including solid-state and immersed fermentations. Microorganism enzymes are easier to produce on a big scale than animals and plants.

Type Insights

Based on type, food enzymes are segmented into carbohydrase, lipase, protease, and others. Carbohydrases have the highest proportion due to their widespread application in the food sector. Carbohydrases are enzymes that catalyse the conversion of carbohydrates into simple sugars. Carbohydrates' general use in the food business propels the segment's expansion.

Amylases, a carbohydrate, are commonly utilized as flavour enhancers and anti-staling agents in the brewery and baking sectors to enhance nutritional quality. Glucoamylase is widely used in manufacturing modified starches such as glucose syrups and high-fructose syrups.

Application Insights

Based on application, food enzymes are segmented into bakery products, beverages, dairy products, nutraceuticals, and others. The substantial expansion of the bakery industry worldwide is one of the primary reasons driving the market growth. In the bread, pastry, and biscuit industries, enzymes are commonly used to adjust dough rheological characteristics, preservation, and crumb tenderness.

The increased demand for clean-label, organic, and high-quality bakery items in industrialized countries drives food enzyme sales. Consumer lifestyle changes in emerging countries have increased demand for luxury bakery items. Bakery goods' qualities, particularly taste, texture, flavor, and shelf life, are critical, and this is accomplished through the employment of baking enzymes.

Regional Insights

What is the U.S. Food Enzymes Market Size?

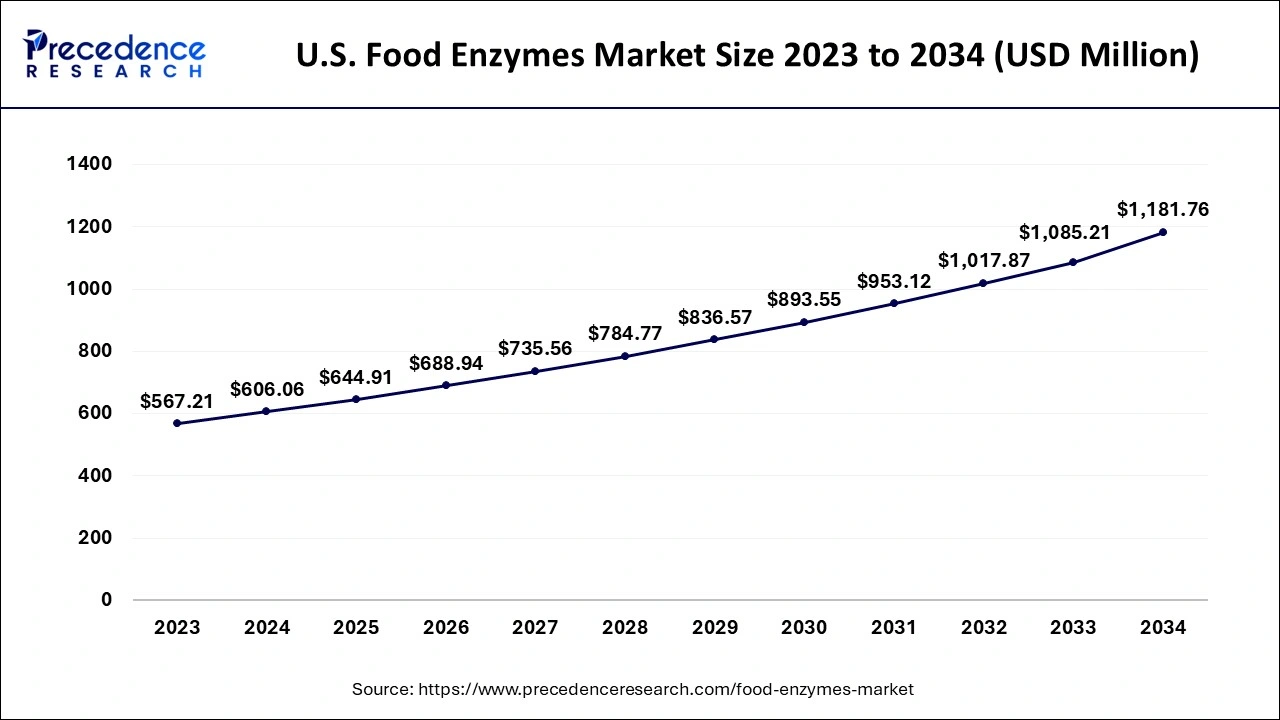

The U.S. food enzymes market size was exhibited at USD 644.91 million in 2025 and is expected to be worth around USD 1,258.84 million by 2035, growing at a CAGR of 6.92% between 2026 to 2035.

North America has the highest market share in the food enzymes market, and it is expected to retain its dominance for the forecasted period. The growing trend of adopting naturally derived foods is related to the market's robust expansion in North America. The rising consumer impression that organic additives are healthy and safe is driving up demand for food enzymes in the area.

The increasing demand for premium processed meals free of chemical additives has expanded the use of enzymes in various food systems. Major players' increased investments in novel solutions, such as enzymes with high precision, are fuelling the region's market expansion.

Currently, North America is dominating the food enzymes market. With the robust food and beverage industry and enhanced processed food sector, the region is in high demand for this market. The investment in biotechnological innovation and advancements stimulates the growth of the food enzymes industry. Most of the population prefers high-quality and natural foods. The implementation of new technology and manufacturing processes is possible due to the government's initiatives. The concern for health and safety measures is the priority for the region.

Furthermore, thanks to the thriving food and beverage business, Asia Pacific is the fastest-growing food enzyme market region. The region's adoption of Western diets, connected with rising demand for bread items, dairy products, and drinks, is continuing to rise. These products are anticipated to use food enzymes rather than synthetic chemicals in response to growing concerns about sustainability and food safety. The increase in the working population is expected to increase the demand for processed food, which will directly boost the Asian-Pacific region's market growth.

What are the Advancements in the Food Enzymes Industry in Europe?

Europe is expected to have significant growth in the market, driven by strict food quality standards and a strong preference for natural processing solutions. They are used across bakery, dairy, and beverage products. The region also benefits from well-established enzyme producers, strong research capabilities, and a tradition of fermented foods, which thus ensures consistent demand across both traditional and emerging food categories.

The UK Food Enzymes Market Trends

The country's rapidly expanding bakery industry, high consumer spending on convenience foods, and rising interest in plant-based enzymes are some of the key factors propelling market expansion. Sustainability and cost-efficiency goals are encouraging the use of enzyme-based processes that lower energy and resource consumption in food production.

What are the Key Trends in the Food Enzymes Industry in Latin America?

Latin America is expected to witness substantial growth in the market. This is due to their growing popularity in processed foods and beverages in regional diets. Enzymes are increasingly adopted in order to improve shelf stability, texture, and yield. The availability of high-quality agricultural raw materials and the gradual expansion of industrial food manufacturing in the region have further encouraged the use of food enzymes.

Brazil Food Enzymes Market Trends

The food and beverage sector is expanding rapidly in the country, due to the country's rapidly growing population and rising disposable incomes. As a result, it is anticipated that the market will have several growth opportunities

How is the Middle East and Africa Region Growing in the Food Enzymes Industry?

The Middle East and Africa are expected to witness steady growth in the market, driven by the rising demand for packaged foods and increasing investment in local food processing facilities. The region is also witnessing growth in bakery and dairy processing, along with efforts to strengthen food security and reduce imports, which propels the market even more.

Saudi Arabia Food Enzymes Market Trends

Food and beverage manufacturers in the country are increasingly utilizing enzymes in order to improve the flavor and texture of their goods while also extending their shelf life. Investments in local food manufacturing and processing infrastructure are supporting increased enzyme utilization across segments.

Value Chain Analysis of the Food Enzymes Market

- Raw Material Sourcing

This stage deals with sourcing microbial strains like bacteria or fungi, fermentation substrates and nutrient media.

Key Players: BASF, Hansen, DuPont - Manufacturing Process

In this stage, enzymes are produced through fermentation processes, then followed by cell separation, filtration, concentration, purification and drying.

Key Players: Novoenzymes, AB Enzymes, IFF - Distribution Process

Here, the finished food enzymes are distributed through direct supply contracts to food producers, specialty ingredient distributors, and formulation partners.

Key Players: Brenntag, Univar Solutions, Danone

Food Enzymes Market Companies

- Associated British Foods Plc.

- Advanced Enzyme Technologies

- Amano Enzyme Co., Ltd

- BASF SE

- Chr. Hansen Holding A/S

- DuPont

- Kerry Group PLC

- Novozymes

- Royal DSM N.V

- Aum Enzymes

- Biocatalyts

- Nutritech Enzymes

Recent Developments

- In April 2025, Deutsche Bank presented new enzymes for flavor and freshness. The improved flavor and freshness include aromatic sandwich bread and freshly mixed bread.

- In April 2025, BioEnz developed next-generation enzymes to underpin industries from food to therapeutic drugs. This will protect the environment and improve nutritional factors.

- In July 2024, EFSA launched a new web tool to calculate dietary exposure to food enzymes. This tool was launched on the occasion of the first plenary meeting of EFSA's new Food Enzymes (FEZ) panel.

- Nurica, a dairy enzyme that organically harnesses the lactose inherent in milk in the U.S., was released in June 2021 by International Flavors & Fragrances, Inc. The enzyme aids in the natural production of a larger yield of prebiotic galacto-oligosaccharides (GOS) fibers, which aid in the management of lactose intolerance and the optimization of fiber intake.

- Biocatalysts Ltd. announced the launch of a new dairy enzyme, PromodTM 517MDP (P517MDP), in April 2021, to broaden its Kosher and Halal-certified dairy protein enzymes.

- International Flavors & Fragrances, Inc. announced the launch of Enovera 3001 enzyme as the newest addition to their bread sector ingredients line in March 2021. The novel enzyme provides a label-friendly formulation for reinforcing baking dough without sacrificing texture or flavor.

- Amano Enzyme Inc. announced Umamizyme Pulse, a non-GMO enzyme developed for use in diverse plant protein products, in March 2021. The enzyme contributes to the umami taste of plant-based proteins.

Segments Covered in the Report

By Source

- Microorganism

- Animal

- Plant

By Type

- Carbohydrase

- Lipase

- Protease

- Others

By Application

- Bakery Products

- Beverages

- Dairy Products

- Nutraceuticals

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting