What is the Food Preservatives Market Size?

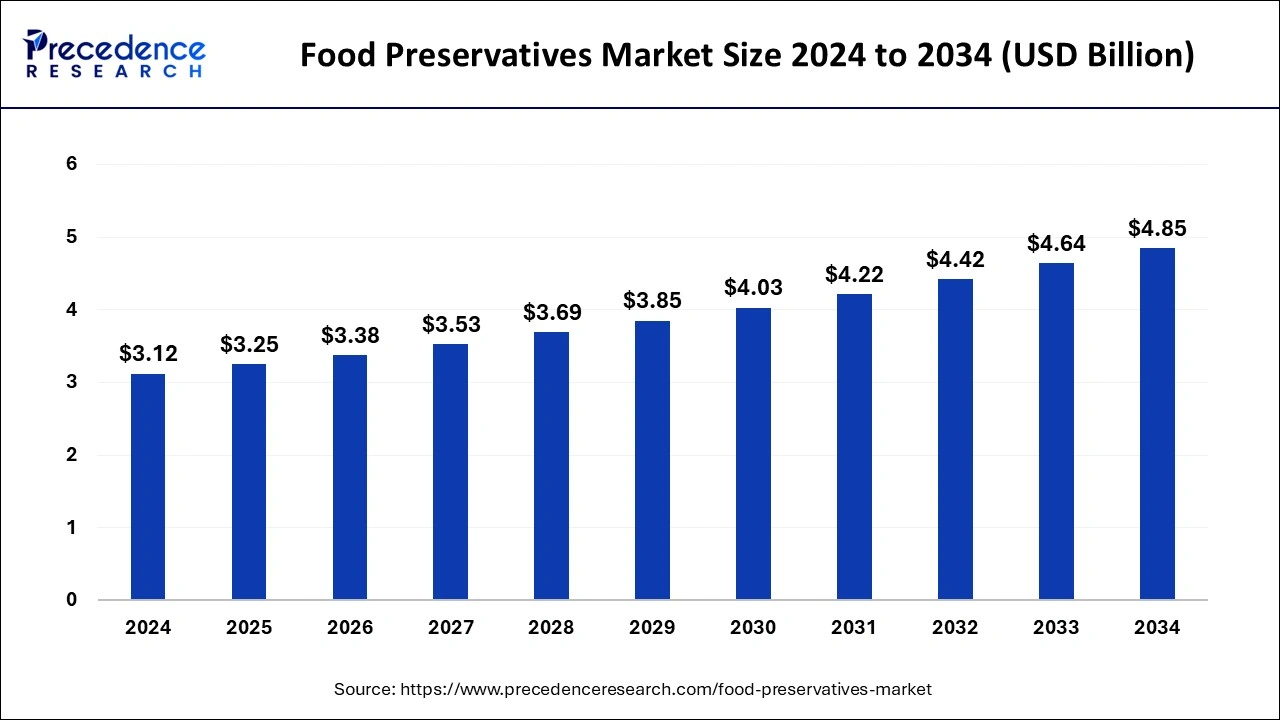

The global food preservatives market size is valued at USD 3.25 billion in 2025 and is predicted to increase from USD 3.38 billion in 2026 to approximately USD 4.85 billion by 2034, expanding at a CAGR of 4.51% from 2025 to 2034. The food preservatives market is driven by the growing market share for clean-label and natural preservatives.

Food Preservatives MarketKey Takeaways

- In terms of revenue, the global food preservatives market was valued at USD 3.12 billion in 2024.

- It is projected to reach USD 4.85 billion by 2034.

- The market is expected to grow at a CAGR of 4.51% from 2025 to 2034.

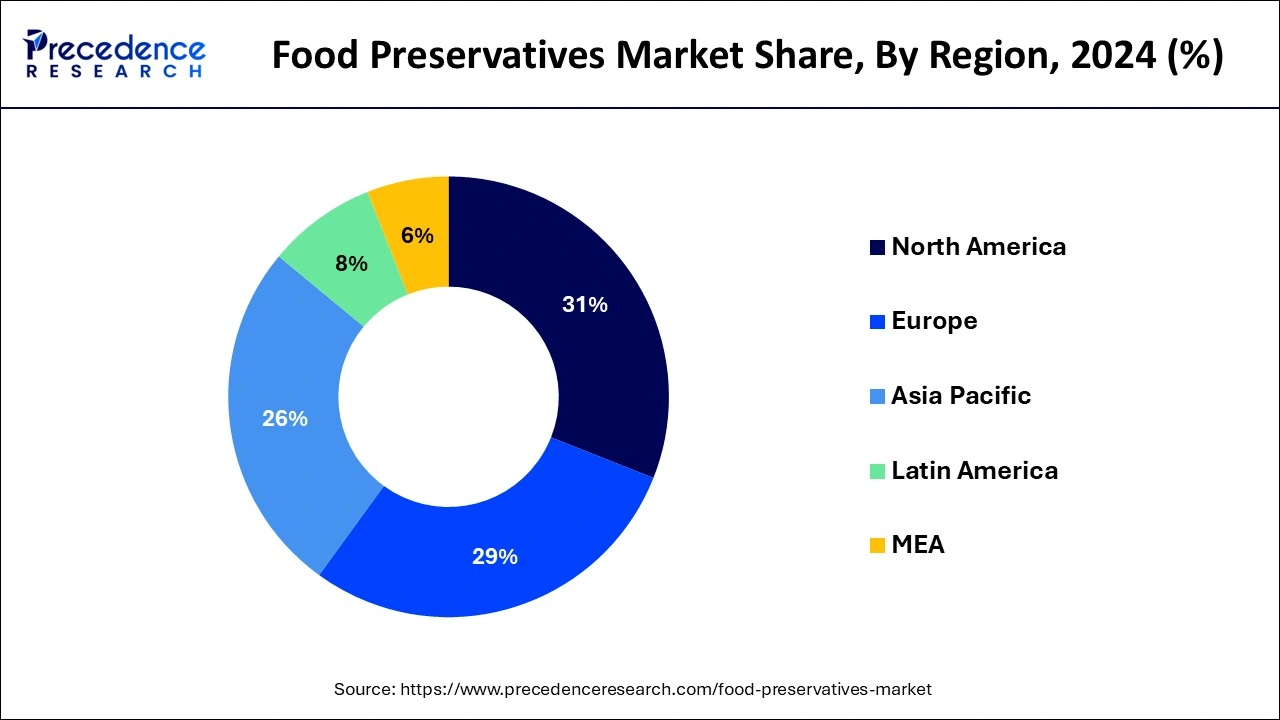

- North America dominated the global market with the largest market share of 31% in 2024.

- Asia Pacific is observed to be the fastest-growing region in the market during the forecast period.

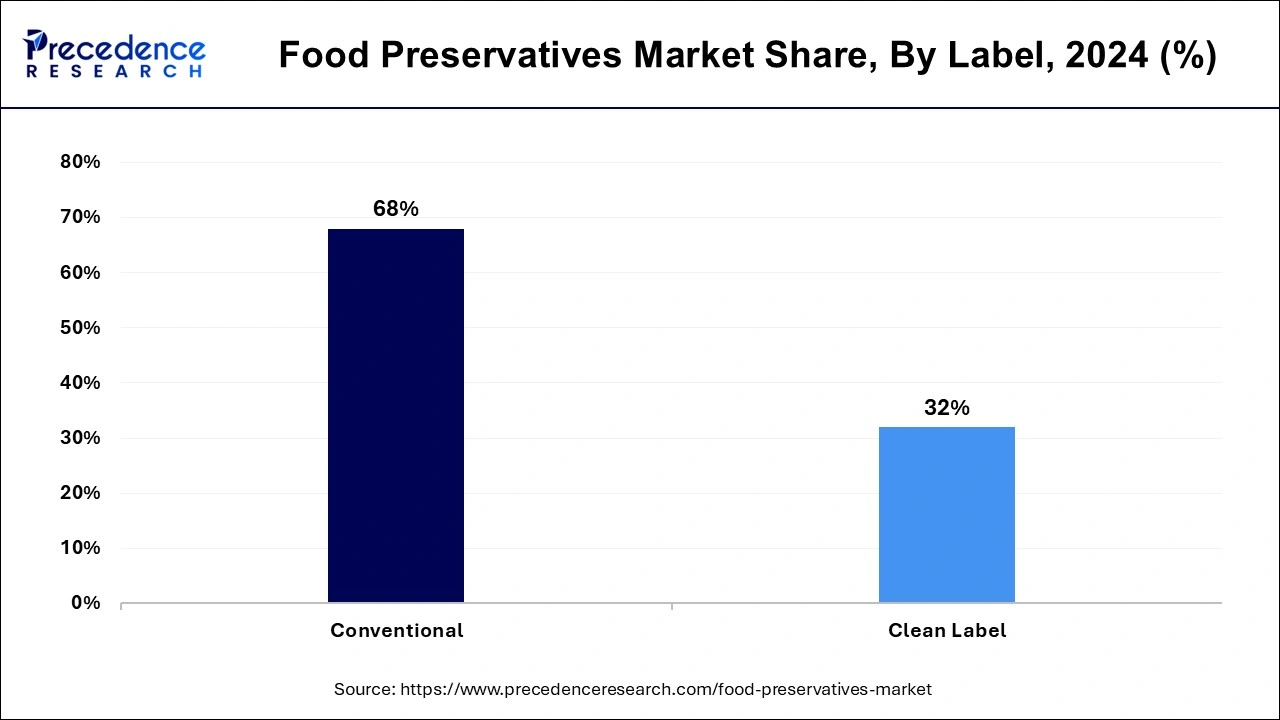

- By label, the conventional segment held the largest market share of 68% in 2024.

- By label, the clean label segment is observed to grow at a notable rate during the forecast period.

- By type, the synthetic segment dominated the market with 70% of market share in 2024.

- By function, the anti-microbial segment dominated the market with 76% of market share in 2024.

- By application, the meat and poultry products segment contributed the biggest market share of 32% in 2024.

- By application, the beverages segment is expected to be the fastest-growing segment during the forecast period.

Food Preservatives: Ensuring Safety, Shelf Life, and Quality

The food preservatives market offers compounds that are mostly added to industrially manufactured processed foods or other foods for technical reasons, such as enhancing food safety, extending the shelf life of food, or altering the food's sensory qualities. These preservatives are meant to destroy microorganisms that could decompose and ruin food in any other way. For decades, common preservatives such as sugar, salt, vinegar, and alcohol have been employed; nevertheless, contemporary food labels now list more unusual compounds, including potassium sorbate, sodium benzoate, and calcium propionate.

- In July 2023, an efficient clean-label mold inhibitor that eliminates the need for conventional, petrochemical-based chemicals without sacrificing flavor was created by the US bio-based ingredient business BioVeritas. The firm, which uses a patented fermentation and upcycling technique, released the results of an independent third-party study proving the effectiveness of the component, which a top-tier university sensory research lab carried out.

Food Preservatives Market Growth Factors

- The need for processed easy foods with extended shelf-life results from busier lifestyles.

- By extending shelf life, innovative packaging can lessen the need for preservatives.

- Preservatives maintain food safety and quality when transported over long distances.

- Longer shelf-life items are in demand due to online grocery shopping. Because they increase shelf life, preservatives help cut down on food waste.

- Rising disposable incomes drive the demand for processed foods and preservatives in developing nations.

- Preservatives play a significant role in the longer shelf life of processed meat.

- Preservatives made naturally are thought to be healthier substitutes.

Market Outlook

- Industry Growth Offerings-The market is growing due to rising demand for processed and convenience foods, increasing consumer awareness of food safety, innovations in natural and plant-based preservatives, and strong investments by key companies in research, formulation, and clean-label solutions.

- Global Expansion- The global market is expanding as manufacturers adopt innovative natural and plant-based solutions, meet international safety standards, and cater to rising demand in emerging regions, supported by cross-border collaborations, advanced processing technologies, and growing processed food consumption.

- Startup ecosystem- The food preservatives startup ecosystem is growing with innovative companies developing natural, plant-based, and clean-label solutions, supported by venture funding, incubators, and research collaborations, addressing rising consumer demand for safe, long-lasting, and high-quality processed and packaged foods globally.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 4.85 Billion |

| Market Size in 2025 | USD 3.25 Billion |

| Market Size in 2026 | USD 3.38 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.51% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Label, Type, Function, Function and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising demand for convenience and processed foods

For processed foods to stay safe and high-quality, their shelf lives must frequently be extended. Food preservatives prevent oxidation, microbiological development, and other types of deterioration, extending the shelf life of these goods. Due to urbanization and hectic lifestyles, there is an increasing need for ready-to-eat and portable food items. By creating portable, easy-to-transport items with extended shelf lives, food preservatives help manufacturers satisfy the demands of urban consumers. Thereby, the rising demand for convenient and processed foods is observed to drive the growth of the food preservatives market.

Shifting consumer preferences

Consumers avoid artificial additives and preservatives to favor fresher, healthier, and more natural food options. Food producers are being forced by this shift in customer preferences to look for alternate preservation strategies, including natural preservatives or creative packaging, to satisfy demand while preserving product safety and shelf life. As a result, natural and clean-label preservatives made from plant extracts, essential oils, and fermentation processes are becoming increasingly popular in the food preservatives market. As consumer preferences for healthier products change, manufacturers are emphasizing transparency in their labeling and marketing to convey that their products do not contain artificial preservatives.

Restraint

Growing preference for "clean label" and natural ingredients

Customers are becoming picky about artificial additives, especially synthetic preservatives, and gravitate toward products with shorter ingredient lists. Food producers have reformulated their goods to eliminate or reduce the use of artificial preservatives in favor of natural substitutes due to the shift in consumer tastes. Consequently, as customers move toward goods, they believe to be healthier and more natural, the market for conventional synthetic preservatives is decreasing.

Opportunities

Investing in research and development of new natural preservatives

Customers are becoming increasingly interested in natural and clean-label products because they are worried about the possible health implications of synthetic ingredients. Creating natural preservatives gives businesses a competitive edge in satisfying consumer wants and is in line with this trend. When it comes to their effects on the environment, natural preservatives frequently outperform their synthetic equivalents. Businesses can lower their carbon footprint and attract eco-aware customers by investing in sustainable R&D.

Developing cost-effective and efficient preservatives

Putting money into research and development to create new preservatives or enhance current ones. Improve efficacy and cost-effectiveness; this can entail investigating natural sources, bio-based materials, and creative formulations. It can also entail integrating sustainability into preservative development by emphasizing eco-friendly ingredients, cutting energy use, and minimizing environmental impact throughout the product lifecycle.

Label Insights

The conventional segment led the food preservatives market with a 68% market share in 2024. Since they effectively inhibit microbial growth, prevent oxidation, and extend shelf life, conventional preservatives like sodium benzoate, sorbic acid, synthetic antioxidants (like butylated hydroxyanisole and butylated hydroxytoluene), and chelating agents (like EDTA) are preferred. Furthermore, as compared to natural alternatives, they are frequently more affordable. Despite the growing consumer desire for natural and clean-label products, the conventional sector maintains a substantial market share. This is attributed to regulatory approvals, stability under different processing conditions, and effectiveness in preserving food quality and safety.

The clean label segment shows notable growth in the food preservatives market during the forecast period. Clean-label ingredient demand results from growing consumer awareness and concerns about the safety and health of food items. Customers prefer natural preservatives over synthetic ones and look for items with identifiable, essential ingredients.

Food manufacturers are spending money on R&D to create novel clean-label preservatives that satisfy customer demands for natural ingredients and efficiently increase shelf life. The clean label market now offers more possibilities thanks to this innovation.

Type Insights

The synthetic segment had the largest share of 70% in 2024 in the food preservatives market. For food makers, synthetic preservatives are more financially feasible because they are frequently less expensive than natural ones. Compared to natural alternatives, it often has more robust antibacterial qualities, giving food products a longer shelf life and better preservation.

- In August 2023, to deceive customers and retailers, Grillo's Pickles, Inc. filed the federal Lanham Act and traditional unfair competition asserts against Patriot Pickle Inc. and Wahlburgers I, LLC. The pickles were marketed as "fresh," "all-natural," and "no preservatives," but they contained sodium benzoate.

Function Insights

The anti-microbial segment had the largest share of 76% in 2024 in the food preservatives market. Preservatives that successfully stop the growth of dangerous bacteria are in higher demand as consumer awareness of foodborne illnesses and the value of food safety grows. Antimicrobial preservatives minimize food spoilage and waste by inhibiting the growth of bacteria, yeast, and molds, extending the shelf life of food goods.

Food manufacturers have adopted antimicrobial preservatives more widely due to regulatory agencies approving their use in food items and ensuring their safety and effectiveness.

- In March 2023, Noble Biomaterials' innovative Ionic+ Botanical has officially been registered with the EPA. It reduces odor on fabrics and other soft surfaces by blocking the growth of germs with a registered citric acid formula derived from biotechnology.

The antioxidant segment shows a notable growth in the food preservatives market during the forecast period. Since oxidation can cause spoiling and a decline in quality, antioxidants are essential in prolonging the shelf life of food goods. Products with few additives and preservatives are in greater demand as people seek healthier and more natural food options. Demand for antioxidants has increased since they are considered safer and more natural than synthetic preservatives.

Furthermore, people are actively looking for food products fortified with antioxidants due to growing awareness of these compounds' advantages for health, including the ability to lower the risk of chronic diseases and promote general wellness.

Application Insights

The meat & poultry products segment had the largest share of 32% in 2024 in the food preservatives market. Due to the substantial demand for these goods worldwide, preservatives are inevitably needed to preserve the freshness and lengthen the shelf life of meat and poultry products. Compared to other food products, meat and poultry are highly perishable. Throughout distribution, storage, and transit, preservatives guard against deterioration and preserve quality. Extended shelf life is required to enable the long-distance transportation of meat and poultry products due to the globalization of supply chains.

The beverages segment is the fastest growing in the food preservatives market during the forecast period. Preservatives are in high demand because busy-conscious consumers prefer convenient, ready-to-drink beverages. The desire for natural and clean-label preservatives over synthetic ones is rising as consumers become more health-conscious. In response, producers modify beverage formulas to include natural preservatives derived from spices, herbs, and plant extracts. Beverage makers constantly innovate with new flavors, formulas, and packaging to satisfy changing consumer demands. Preservatives must be used to preserve the freshness and quality of the product.

The meat & poultry products segment

Globally, meat production in 2024 is expected to see a slight increase, led by the United States, Brazil, and China. India holds the position of the fifth-largest producer, accounting for 7% of global meat production with a contribution of 4.57 MMT. India maintains its status as the world's largest exporter of buffalo meat, with exports projected to grow by 4% in 2025, driven by rising demand from the Middle East, Southeast Asia, and African nations.

- According to the article published by the FNB news in April 2025, India's meat industry has shown remarkable growth, particularly in rural areas. In 2023-24, the country's meat production rose to 10.25 million metric tons (MMT), reflecting a 4.95% increase over the previous year. Poultry remains the highest-produced category, contributing over 5 MMT, while buffalo (carabeef) production stood at 4.57 MMT.

Regional Insights

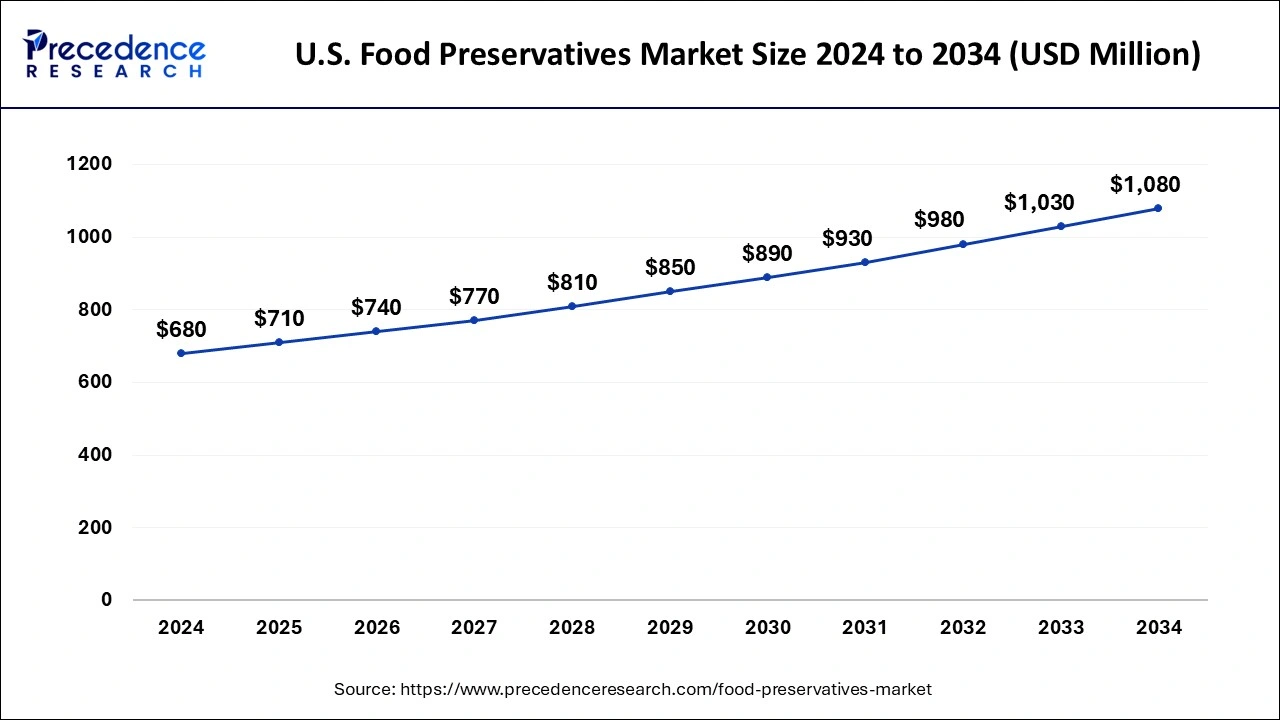

U.S. Food Preservatives Market Size and Forecast 2025 to 2034

The U.S. food preservatives market size is valued at USD 710 million in 2025 and is anticipated to reach around USD 1,080 million by 2034, poised to grow at a CAGR of 4.73% from 2025 to 2034.

How Consumer Awareness is Driving North America's Food Preservatives Market

North America dominated the food preservatives market while contributing 31% of the market share in 2024. The factors driving the market's expansion include rising consumer demand for processed and convenience foods, strict laws encouraging food safety, and significant investments in R&D by leading industry companies. North America is likely to maintain its dominant position in the food preservatives market for the foreseeable future due to its robust infrastructure and technical developments, as well as the rise in consumer awareness of food quality and safety and preservative innovations.

- In June 2024, Chinova Bioworks is a Canadian firm that uses recycled mushroom stalks to make natural preservatives and fining agents. This year, the company plans to quadruple its capacity to satisfy demand in rapidly increasing areas like non-alcoholic beer and support worldwide expansion.

The rising consumer awareness regarding the significance of plant-based preservatives in the region is anticipated to propel the growth of the food preservative market. Consumers are increasingly gaining knowledge regarding clean labels, natural, and plant-based ingredients as food additives.

Around 83% of shoppers are knowledgeable about clean-label products or have heard the term, according to a survey of more than 1200 U.S. consumers from the earlier months of the year 2024 conducted by the Acosta Group.

The significant surge in disposable income, coupled with the rise in the health-conscious population, led to accelerating demand for healthy foods with all-natural ingredients are anticipated to offer lucrative growth opportunities to the plant-based preservatives market in the region.

Rising Awareness and Innovation Fuel Asia-Pacific's Food Preservatives Market

Asia-Pacific is the fastest-growing in the food preservatives market during the forecast period. Technological developments infood processing and packing are driving up the use of preservatives to preserve food quality and safety through the supply chain. Furthermore, the region's regulatory agencies strongly emphasize food safety laws, forcing producers to utilize preservatives to meet these requirements. Additionally, rising consumer awareness of foodborne illnesses and the value of food preservation drive up preservative demand in the Asia-Pacific region.

- In February 2024, the start of McCain Foods India's most recent campaign was revealed. "Shart Mat Lagana," which asserts that all its goods are 100% free of preservatives. This campaign highlights their commitment to providing families with guilt-free, high-quality, healthful products.

Why U.S. Food Preservatives Market Experiencing Rapid Growth?

The U.S. market is growing due to rising demand for processed and convenience foods, increasing consumer awareness of food safety, and strict regulatory standards. Innovations in natural and plant-based preservatives, coupled with growing interest in clean-label products, further drive adoption. Additionally, investments by leading companies in R&D, coupled with a health-conscious population seeking safe and longer-lasting food products, are boosting market expansion.

What's Driving the Expansion of China's Food Preservative Market?

China's market is expanding due to the growth of the packaged and frozen food sectors, rising middle-class income, and increased export-oriented food production. Manufacturers are adopting preservatives to extend shelf life, reduce spoilage, and meet international quality standards. Additionally, awareness of foodborne diseases and the demand for innovative, functional preservatives that maintain flavor, color, and texture are driving market growth across urban and semi-urban regions.

Why is Europe Seeing a Surge in Food Preservatives Demand?

The European market is growing due to increasing demand for processed and convenience foods, coupled with stringent food safety regulations enforced by the EU. Rising consumer preference for clean-label and natural preservatives, along with innovations in plant-based and functional ingredients, supports market expansion. Additionally, strong R&D initiatives by leading companies and the adoption of advanced food processing and packaging technologies are driving growth across the region.

What's Fueling the Growth of the UK Food Preservatives Market?

The UK market is growing due to rising consumption of ready-to-eat and packaged foods, increasing awareness of food safety, and strict regulatory standards. Consumers' preference for clean-label, natural, and plant-based preservatives is driving innovation. Additionally, advancements in food processing, preservation technologies, and growing investments by key industry players to develop safer, longer-lasting, and high-quality food products are supporting market expansion in the region.

Value Chain Analysis

Raw Material Procurement

- Extends shelf life and prevents spoilage using methods like heat treatment, cold storage, chemical additives, and physical techniques.

- Inhibits microbial growth and chemical reactions to maintain food safety, quality, and appearance.

- Focuses on maintaining nutritional value, taste, and visual appeal of food products.

Key players: ADM, Kerry, BASF SE, Tate & Lyle, Galactic S.A.

Processing and Preservation

- Food preservatives help prevent spoilage and extend shelf life through methods like heat treatment, cold storage, chemical additives, and physical techniques.

- They maintain food safety, quality, and appearance by inhibiting microbial growth and chemical reactions.

Key players: ADM, Kerry, BASF SE, Tate & Lyle

Quality Testing and Certification

- Involves sourcing natural and synthetic ingredients that inhibit microbial growth and prevent food spoilage.

- Requires a balanced strategy ensuring cost-efficiency, consistent supply, regulatory compliance, and high product quality.

Key players: ADM, Kerry, BASF SE, Tate & Lyle, Galactic S.A.

Top Vendors and their Offerings

- ADM – ADM provides natural and synthetic food preservatives, flavor solutions, and functional ingredients that enhance food safety, shelf life, and sensory qualities for processed and packaged foods.

- Kerry – Kerry offers preservatives, clean-label solutions, and functional ingredients, focusing on maintaining food quality, extending shelf life, and supporting natural and plant-based product development.

- BASF SE – BASF develops chemical preservatives, antioxidants, and food additives that improve shelf life, prevent microbial growth, and enhance safety in processed food and beverage products.

- Tate & Lyle – Tate & Lyle supplies natural preservative solutions, stabilizers, and functional ingredients for processed foods and beverages, emphasizing clean-label, plant-based, and health-conscious applications.

- Galactic S.A. – Galactic S.A. specializes in natural food preservatives like lactic acid and lactates, providing safe, clean-label solutions for processed foods, meat, dairy, and bakery applications.

Food Preservatives Market Companies

- Cargill, Inc.

- Kemin Industries, Inc.

- ADM

- Tate & Lyle

- Koninklijke DSM N.V.

- BASF SE

- Celanese Corporation

- Corbion N.V.

- Galactic S.A.

- Kerry

Recent Developments

- In September 2022, the company introduced propionic acid (PA) and neopentyl glycol (NPG) with a CPF of zero for the first time. Applications for PA include the economic and environmental advantages of airtight silos or drying for preservation.

- In June 2022, Cargill and Delacon will establish a market-leading company for plant-based phytogenic feed additives that promote better animal nutrition. The acquisition will result in increased manufacturing of healthful food, worldwide presence, and experience with deep feed additives.

- In January 2022, In the International Production & Processing Expo (IPPE) in Atlanta, Georgia, January 25–27, 2022, Florida Food Products (FFP), a leading creator, formulator, and manufacturer of vegetable and fruit-based clean-label component solutions, will introduce VegStable Fresh, a new plant-based antioxidant.

- In April 2025, Maya East Africa, one of the region's renowned distributors and manufacturers of raw food ingredients, announced the launch of its Rwandan franchise.

- In June 2023, BioVeritas, a U.S. bio-based ingredients startup, developed an effective clean-label mould inhibitor that removes the need for traditional, petrochemical-based ingredients, without compromising taste.

- In January 2025, CURRYiT, one of the most loved food startups, launched preservative and chemical-free tomato puree.

- In April 2025, the Spanish government, alongside the regional governments of Navarra and La Rioja, introduced Europe's first AgriFoodtech Sandbox, designed to accelerate technological advancements in the agrifood industry. Managed by the National Center for Food Technology and Safety (CNTA), the initiative will offer a controlled environment where innovative products, processes, and technologies can be tested under regulatory oversight.

Segments Covered in the Report

By Label

- Clean Label

- Conventional

By Type

- Natural

- Edible Oil

- Rosemary Extracts

- Natamycin

- Vinegar

- Chitosan

- Others

- Synthetic

- Propionates

- Sorbates

- Benzoates

- Others

By Function

- Anti-microbial

- Antioxidant

- Others

By Application

- Meat & Poultry Products

- Bakery Products

- Dairy Products

- Beverages

- Snacks

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting