What is the Fuel Management Market Size?

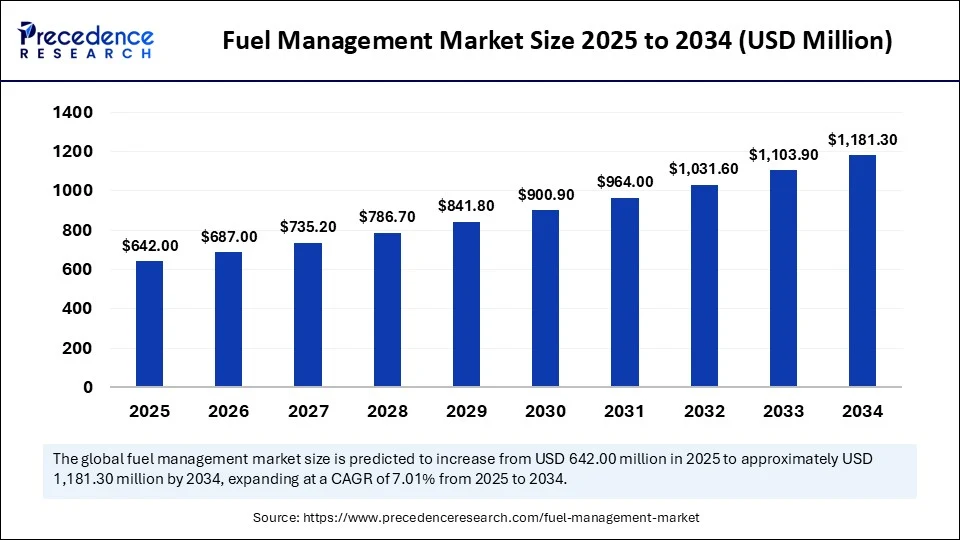

The global fuel management market size is accounted at USD 642.00 million in 2025 and predicted to increase from USD 687.00 million in 2026 to approximately USD 1,181.30 million by 2034, expanding at a CAGR of 7.01% from 2025 to 2034. The market is playing an increasingly critical role in helping industries, transport operators, and governments optimize fuel usage, reduce operational costs, and meet sustainability targets. With rising global fuel prices, tightening environmental regulations, and the push towards energy efficiency, the demand for advanced fuel monitoring and control systems is accelerating.

Fuel Management MarketKey Takeaways

- In terms of revenue, the global fuel management market was valued at USD 642.00 billion in 2024.

- It is projected to reach USD 1,264.10 billion by 2034.

- The market is expected to grow at a CAGR of 7.01% from 2025 to 2034.

- North America held a major revenue share of approximately 35% in the fuel management market in 2024.

- Asia Pacific is expected to be the fastest-growing region in the upcoming years.

- By solution/component type, the hardware segment held the maximum revenue share of 40% in the long-acting injectable market in 2024.

- By solution/component type, the software & analytics segment is expected to witness the fastest growth in the market over the forecast period.

- By fuel type, the diesel segment held the maximum revenue share of 45% in the long-acting injectable market in 2024.

- By fuel type, the AdBlue / DEF segment is expected to witness the fastest growth in the market over the forecast period.

- By deployment model/solution type, the on-premises / local systems segment held the maximum revenue share of approximately 55% in the long-acting injectable market in 2024.

- By deployment model/solution type, the cloud-based / SaaS Platforms segment is expected to witness the fastest growth in the market over the forecast period.

- By end-use, the road freight & logistics/fleet operators segment held the maximum revenue share of approximately 35% in the long-acting injectable market in 2024.

- By end-use, the construction & mining segment is expected to witness the fastest growth in the market over the forecast period.

- By fleet size/customer type, the large fleets/enterprises segment held the maximum revenue share of approximately 50% in the long-acting injectable market in 2024.

- By fleet size/customer type, the small fleets/SMEs segment is expected to witness the fastest growth in the market over the forecast period.

- By functionality/use case, the consumption monitoring & optimization segment held the maximum revenue share of approximately 40% in the long-acting injectable market in 2024.

- By functionality/use case, the fuel theft prevention & access control segment is expected to witness the fastest growth in the market over the forecast period.

- By distribution channel, the direct sales segment held the maximum revenue share of approximately 50% in the long-acting injectable market in 2024.

By distribution channel, the channel partners & resellers segment is expected to witness the fastest growth in the market over the forecast period.

Artificial Intelligence: The Next Growth Catalyst in Fuel Management

Artificial Intelligence is transforming fuel management from a tracking tool into a predictive and optimization powerhouse. AI algorithms analyse historical and real-time fuel usage patterns to forecast consumption and detect anomalies like leaks or theft. Machine learning models help fleet managers plan fuel-efficient routes and schedule refuelling stops to minimize downtime. AI-powered systems can also predict maintenance needs based on consumption behaviour, reducing operational disruptions. In large-scale operations, AI enables demand forecasting, helping businesses negotiate better fuel procurement contracts. As AI becomes more integrated, decision-making shifts from reactive responses to data-driven, strategic actions.

Strategic Overview of the Global Fuel Management Industry

The fuel management market covers systems, hardware, software, and services designed to monitor, control, measure, optimize, and account for fuel use across vehicles, fleets, stationary equipment, and fixed-site facilities. Fuel management solutions include fuel dispensers and forecourt controllers, fuel tanks and level sensors, flow meters, automated fueling points, fuel cards & payment systems, telematics integration, fuel reconciliation and analytics software, and related maintenance & auditing services. The market serves industries such as road freight & logistics, mining, construction, agriculture, aviation, marine, public transit, and retail forecourts, delivering benefits in cost control, theft-prevention, regulatory compliance, uptime optimization, and carbon fuel-efficiency tracking.

The fuel management market is witnessing robust growth driven by the convergence of digital technology and operational efficiency demands. Modern solutions integrate telematics, IoT sensors, and cloud platforms to provide accurate fuel usage insights and predictive analytics. Businesses are shifting from reactive fuel tracking to proactive fuel optimization, enabling cost savings and emissions reduction. Furthermore, hybrid and alternative fuel systems are influencing market evolution, with solutions adapting to multi-fuel monitoring. The market's growth is also supported by infrastructure expansion, particularly in emerging economies, where logistics and public transportation networks are scaling rapidly.

Market Key Trends

- Integration of IoT and AI for predictive fuel: Allowing real-time monitoring and early detection of inefficiencies.

- Shift towards multi-fuel and hybrid monitoring: The systems to accommodate electric, biofuel, and hydrogen-powered fleets.

- Cloud-based fuel management platforms: Providing remote access, scalability, and centralized data management.

- Automation in refueling operations: To minimize wastage and human error.

- Sustainability-driven adoption: As governments impose stricter emission and fuel economy standards.

Market Outlook:

- Market Growth Overview: The Fuel Management market is expected to grow significantly between 2025 and 2034, driven by the shift towards digitalization, sustainability, and cost optimization. The integration of IoT and AI for real-time visibility, the adoption of alternative fuels, and the demand for automated solutions to prevent theft and enhance efficiency.

- Sustainability Trends: Sustainability trends involve the real-time monitoring and data analytics for efficiency, the adoption of alternative and sustainable fuels, and integrated fleet and fuel management.

- Major Investors: Major investors in the market include Vontier Corporation, Dover Corporation, Fortive Corporation, WEX Inc., FleetCore Technologies, Inc., and Volvo Group Venture Capital.

- Startup Economy: The startup economy is focused on advanced analytics and software platforms, alternative fuel management and EV Charging, and industrial monitoring and asset management.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 1,181.30 Million |

| Market Size in 2025 | USD 642.00Million |

| Market Size in 2026 | USD 687.00 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.01% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Solution/Component, Fuel Type Monitored / Managed, Deployment Model / Solution Type, End-User Industry, Distribution Channel, Functionality / Use Case and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Need to Reduce fuel Costs and Improve operational efficiency

The primary driver for the fuel management market is the rising need to reduce fuel costs and improve operational efficiency. With volatile fuel prices affecting profit margins, companies are investing in systems that provide detailed usage reports and optimization recommendations. This cost-conscious environment is amplified by environmental policies pushing for lower carbon footprints. Fuel management technologies allow operators to comply with regulations while improving fleet productivity. The growing adoption of telematics in transportation further accelerates integration.

Opportunity

Renewable and alternative pool management

The market is ripe for expansion into renewable and alternative fuel management systems. As fleets adopt electric, hydrogen, and biofuel-powered vehicles, there is a need for monitoring solutions capable of tracking diverse fuel types in one platform. Emerging economies with expanding transport infrastructure present untapped potential, particularly for smart city projects where fuel efficiency is a priority. Additionally, integration with blockchain for transparent fuel transactions could open new value streams.

Restraint

High Initial Investment

High initial investment costs and complex system integration remain barriers to adoption. Small and medium-sized enterprises often hesitate to deploy advanced fuel management due to upfront expenses and training requirements. In regions with limited digital infrastructure, implementing IoT-based systems can be challenging. Data privacy concerns and the need for cybersecurity measures also limit adoption in sensitive sectors.

Solution / Component Insights

Why Hardware Segment Dominating the Fuel Management Market?

The hardware segment captured a significant portion of the fuel management market in 2024 due to fuel sensors, dispensers, storage tank gauges, and automated pumps, supported by operational monitoring systems. Many industries still prefer tangible equipment for reliability and direct measurement, especially in remote or rugged operational environments. Hardware upgrades are also easier to justify when replacing outdated mechanical systems with digital-capable devices. These systems provide immediate, real-world interaction, ensuring accurate data capture before software processing begins. As businesses prioritize operational continuity, robust and durable hardware remains a top investment priority.

In addition, large fleets and industrial operators often integrate advanced hardware solutions with IoT modules for real-time data relay. The demand for tamper-proof devices has increased, especially in regions with high fuel theft risks. Service providers are designing hardware with modular configurations, making it easier to scale across multiple sites. Preventive maintenance capabilities built into smart pumps and tank monitors further enhance operational efficiency. Hardware also serves as the interface for access control systems, ensuring only authorized personnel can dispense fuel. This physical reliability continues to give hardware an enduring edge in the global market.

The software & analytics segment is set to grow substantially in the fuel management market, transforming raw fuel data into actionable insights. Businesses are increasingly leveraging AI algorithms, predictive analytics, and machine learning to optimize fuel consumption patterns. Cloud-based platforms allow centralized monitoring of multiple fleets or facilities in real time, reducing inefficiencies and preventing losses. Advanced software tools can integrate with GPS and telematics for route optimization, further lowering fuel expenses. The ease of updating software compared to replacing hardware also makes it attractive for rapid innovation. As fuel costs and sustainability goals align, analytical tools are becoming essential for decision-making.

This growth is further fueled by the shift toward remote and automated operations, where managers need visibility without being physically present. Custom dashboards provide KPIs tailored to specific industries, from mining to maritime. Integration capabilities with ERP and supply chain platforms make software a strategic asset for enterprise fuel management. Vendors are offering AI-driven alerts for abnormal fuel usage, helping prevent theft and leaks before they escalate. Data visualization features allow users to track historical patterns and forecast future consumption. Overall, the intelligence layer provided by software is redefining efficiency standards in the industry.

Fuel Type Monitored / Managed Insights

Does Diesel Dominate the Fuel Management Market?

The diesel segment accounted for a considerable share of the fuel management market in 2024, due to its dominance in commercial transport, construction equipment, and heavy-duty machinery. Fleet operators rely heavily on diesel-powered vehicles for long-haul logistics, making consumption tracking vital for cost control. Its widespread use in generators and industrial operations further cements its position as the most critical fuel to manage. Diesel's high cost compared to alternatives increases the financial incentive for precise tracking. Fuel management systems for diesel often include features like idle time monitoring and engine performance tracking. The importance of diesel efficiency is amplified by tightening emission regulations worldwide.

Furthermore, diesel theft remains a major concern, especially in large fleets and remote worksites, making advanced security features a must. Real-time tank level sensors and automated dispenser logs are widely deployed for diesel operations. Many markets are adopting bi-fuel solutions, but diesel still accounts for the bulk of operational energy needs. Software algorithms are tailored to account for disease-specific combustion efficiency and maintenance implications. Predictive analytics can identify early signs of engine inefficiency, saving fuel and maintenance costs. This long-standing dependence on diesel ensures its continued dominance in fuel management deployments.

The AdBlue / DEF segment is set to spur growth in the fuel management market during the forecast period due to the global push for emission compliance in diesel engines. Stricter environmental regulations have made DEF usage mandatory in many sectors, especially trucking and heavy equipment. Fleet operators are increasingly integrating DEF monitoring alongside diesel. DEF has a specific shelf life and storage requirements, which makes monitoring systems critical to avoid waste. Automated alerts for low DEF levels help prevent engine derating or shutdown in vehicles using selective catalytic reduction technology. As emission standards get tighter, DEF monitoring is becoming a non-negotiable part of fuel management.

The fastest growth is seen in regions with aggressive clean air policies, such as Europe, North America, and parts of the Asia Pacific. Vendors are now offering dual-tank monitoring solutions that track both diesel and DEF in a single dashboard. Predictive replenishment systems help fleets maintain DEF levels without overstocking, reducing storage costs. IoT integration allows for remote verification of DEF quality and concentration. This capability not only ensures compliance but also prevents operational disruptions. The rising number of diesel vehicles equipped with SCR systems guarantees that DEF monitoring will remain a high-growth segment.

Deployment Model/Solution Type Insights

How On-Premise/Local Systems Are Dominating the Fuel Management Market?

The on-premise/local Systems segment has become a dominant force in the fuel management market, due to its perceived reliability and data security. Many large industrial operators prefer local servers and in-house monitoring to maintain control over sensitive operational data. This is particularly relevant in sectors like defense, mining, and oil and gas, where cybersecurity risks are high. On-premise deployments also allow for customized integration with legacy equipment. The hardware-software ecosystem can be tailored to site-specific conditions, ensuring maximum uptime. In remote areas with limited internet connectivity, on-premise systems remain the most practical solution.

Moreover, some operators prioritize immediate data processing without relying on cloud latency. On-site IT teams can troubleshoot issues directly, reducing downtime. The ability to operate independently of external servers provides resilience against network outages. Compliance-sensitive industries often prefer local data storage to meet regulatory requirements. For many traditional operators, on-premise systems align with existing infrastructure investments. This control-centric approach keeps on-premise solutions firmly in the dominant position.

The cloud-based / SaaS platforms segment is expected to be the fastest growing in the coming years in the fuel management market. They enable fleet managers and operators to access fuel data from any location with internet connectivity. Automatic software updates ensure the system remains compliant with evolving regulations and feature-rich without manual intervention. Cloud models reduce the need for heavy IT infrastructure, making them attractive for SMEs and multi-location enterprises. Integration with telematics, GPS, and ERP systems is often seamless in cloud-based solutions. This flexibility is driving adoption across industries from logistics to public transport.

End-User Industry Insights

How Are Road Freight & Logistics / Fleet Operators Dominating the Fuel Management Market?

The road freight & logistics/fleet operators segment has become a dominant force in the fuel management market, driven by the sheer volume of fuel consumed by heavy-duty trucks, long-haul carriers, and delivery fleets. With rising fuel costs and growing environmental concerns, logistics companies are increasingly investing in advanced monitoring systems to optimize fuel consumption and minimize wastage. Real-time tracking, route optimization, and automated refueling records have become standard, enabling operators to improve efficiency and cut operational costs. Additionally, the integration of IoT sensors and GPS solutions helps fleet managers gain actionable insights for better decision-making. Regulatory compliance, particularly related to emissions and fuel storage, further fuels the adoption of robust management systems. This dominance is expected to continue as global trade and e-commerce expand, pushing demand for efficient freight movement.

The construction & mining segment is set to drive future growth in the fuel management market, driven by its heavy reliance on fuel-intensive equipment and vehicles. Excavators, dump trucks, drilling machines, and loaders consume massive quantities of fuel daily, making efficiency a top priority. Fuel theft and pilferage have been long-standing challenges in remote project sites, leading to the rapid adoption of secure, automated fuel dispensing and tracking systems. Advanced telematics solutions now enable site managers to track equipment-specific consumption, detect anomalies, and schedule refueling in sync with operations. The rising cost of fuel, combined with tightening environmental regulations, has accelerated the shift toward technology-driven fuel optimization. Furthermore, large-scale infrastructure projects and mining expansions in emerging economies are boosting demand for such solutions.

Fleet Size / Customer Type Insights

Why Are Large Fleets / Enterprises Dominating the Fuel Management Market?

The large fleets/enterprises segment registered the largest share in the fuel management market in 2024, due to data-driven fuel monitoring solutions. Fuel management for large fleets often involves integrating AI analytics, cloud connectivity, and predictive maintenance tools. The sheer scale of fuel consumption in these enterprises makes even a 1–2% efficiency gain translate into significant savings. Large-scale deployments also enable the standardization of practices across vast networks. These companies are increasingly motivated by ESG goals, driving the adoption of technologies that reduce emissions.

With rising global supply chain demands, large fleets are investing heavily in fuel optimization to ensure competitive pricing and sustainability compliance. Cloud-based systems allow headquarters to monitor every vehicle in real-time, regardless of geography. Integration with IoT and telematics helps enterprises detect inefficiencies instantly. Data gathered across thousands of trips provides valuable insights into driver behavior and fuel usage patterns. Additionally, large fleets have a stronger financial capacity to adopt premium solutions. This scalability advantage positions the segment as the most promising for revenue growth over the next decade.

The small fleets/SME's segment is set to grow at the highest CAGR during the coming years as the highly reliant on efficient fuel, which is significantly impacted by fuel costs, thereby affecting profitability. Fuel management systems for small fleets are typically more affordable and easier to implement, resulting in higher adoption rates. Many providers offer modular solutions that cater to smaller budgets without sacrificing functionality. These fleets often prefer on-premise or compact hardware-based solutions for real-time monitoring. As fuel price volatility continues, small fleets will likely maintain their stronghold in many markets. Government subsidies and local business incentives also drive the popularity of small fleet-focused fuel management solutions in these markets. These operators are quicker to adopt technologies that directly show cost-saving results. Shorter decision-making chains make implementation faster than in large corporations. Maintenance and training requirements are lower, ensuring quick ROI. The flexibility of scaling systems as fleets grow gives these businesses confidence in adopting fuel monitoring technologies. Overall, small fleets continue to represent a steady and resilient revenue stream for market players.

Functionality / Use Case Insights

Why Fuel Consumption Monitoring & Optimization is dominating the Fuel Management Market?

The fuel consumption monitoring & optimization segment has the largest share in the fuel management market, driven by increasing pressure to reduce operating costs and emissions. This functionality uses real-time telematics and AI analytics to track fuel burn per trip, route, and driver. Fleet operators can identify inefficient driving behaviors such as idling, speeding, or poor route planning. AI models can even suggest the most fuel-efficient routes and maintenance schedules. The global push toward net-zero goals makes this functionality attractive for sustainability reporting. As fuel costs continue to climb, demand for consumption optimization is set to accelerate.

The small fleets/SME's segment is projected to expand rapidly in the market in the coming years, due to rising fuel prices globally have made theft a critical concern for fleet operators. Access control systems such as RFID, PIN authentication, and biometric verification are increasingly standard. These features help ensure only authorized personnel can fuel vehicles, reducing pilferage. Real-time alerts and transaction logs enable instant intervention when anomalies are detected. For many operators, the cost savings from preventing fuel theft far outweigh system implementation costs.

Distribution Channel Insights

Why Direct Sales Is Dominating the Market?

The direct sales segment maintained a leading position in the market in 2024 due to tailored system design, transparent pricing, and strong after-sales support. Large industrial clients and government contracts particularly favor direct procurement for quality assurance. This approach also fosters long-term relationships, allowing providers to upsell additional modules and services over time. Many direct sales teams also offer training and installation, making adoption smoother. For critical infrastructure operations, direct purchase ensures accountability and immediate recourse in case of issues.

The channel partners & resellers segment will gain a significant share of the fuel management market over the studied period of 2025 to 2034, driven by the need to reach untapped regions and niche customer segments. Resellers often have localized knowledge and established relationships, making it easier to penetrate smaller or specialized markets. Channel partnerships allow solution providers to scale without significantly expanding their own sales teams. This model also supports quicker adoption in emerging economies, where smaller vendors can bundle fuel management with other fleet services. For many global providers, partners serve as vital links in their expansion strategies.

Regional Insights

Why is North America the Chief in the Fuel Management Race?

North America continues to dominate the fuel management market due to its advanced transport infrastructure, early adoption of telematics, and high fuel consumption across industries. The region's focus on reducing operational costs and meeting strict environmental regulations drives technology adoption. The presence of leading market players and strong R&D capabilities further strengthens its position. The region benefits from a well-developed IoT and telematics ecosystem, enabling smooth Integration of AI-powered analytics into fuel management platforms. Moreover, high fuel prices in the U.S. and Canada create financial pressure on operators, encouraging the adoption of cost-saving solutions.

From a competitive standpoint, North America houses several leading solution providers, fostering innovation and rapid deployment of new features like automated fuel tracking, theft prevention, and predictive maintenance alerts. The growing push for fleet electrification is also creating opportunities for hybrid fuel monitoring solutions, capable of tracking both liquid fuel and electric energy usage.

North America: U.S. Fuel Management Market Trends

The U.S. dominated in North America due to its vast logistics and freight operations, expansive road network, and reliance on long-haul trucking. Major shipping companies, airlines, and public transit agencies are adopting AI-driven solutions to optimize routes, reduce idle time, and cut operational costs. Federal and state-level initiatives promoting clean fuel technology have increased investments in advanced monitoring tools. Additionally, the presence of oil and gas giants with integrated distribution networks allows for the scaling of fuel management systems across multiple locations. Additionally, fuelled by its vast logistics network, heavy reliance on long-haul trucking, and widespread adoption of AI-powered fleet management tools. Government incentives for fuel efficiency and emissions reduction encourage both public and private operators to invest in advanced systems.

How is Asia Pacific Accelerating Towards Fuel Efficiency?

Asia Pacific is the fastest-growing region in the fuel management market, driven by rapid industrialization, expanding logistics networks, and government-led smart city initiatives. Countries in the area are heavily investing in modernizing their transport and energy systems, creating strong demand for efficient fuel management. Major shipping companies, airlines, and public transit agencies are adopting AI-driven solutions to optimize routes, reduce idle time, and cut operational costs. Federal and state-level initiatives promoting clean fuel technology have increased investments in advanced monitoring tools. Additionally, the presence of oil and gas giants with integrated distribution networks allows for the scaling of fuel management systems across multiple locations.

Asia Pacific: China Fuel Management Market Trends

China is the fastest-growing economy in the Asia Pacific, driven by its massive logistics network, fast-growing e-commerce sector, and large-scale industrial production. The government's emphasis on energy efficiency and emission reduction aligns closely with the adoption of advanced fuel monitoring technologies. China's rapidly expanding electric vehicle ecosystem is also influencing the development of dual-mode fuel management systems that can track both fossil fuel and battery usage. Additionally, the country's Belt and Road Initiative is increasing cross-border transportation, creating demand for regionally integrated fuel tracking systems.

Value Chain Analysis of the Fuel Management Market

- Hardware Manufacturing and Supply

This stage involves the design, development, and production of physical components of fuel management systems, such as sensors, probes, fuel dispensers, flow meters, and controllers.

Key Players: Gilbarco Veeder-Root, LLC, Dover Fueling Solutions, Inc., and Franklin Fueling Systems, LLC. - Software Development and Analytics

This stage focuses on creating the intelligence layer that collects, stores, analyzes, and reports fuel-related data.

Key Players: Companies specializing in software and analytics include WEX Inc., FleetCor Technologies, Inc., Omnitracs, LLC, and Verizon Connect US, Inc. - Integration and Solution Assembly

This stage involves integrating the hardware, software, and sometimes third-party systems (like telematics) to provide a complete, end-to-end fuel management solution for clients.

Key Players: Trimble Inc. and TomTom International BV - Distribution and Sales

This stage involves the marketing, sales, and delivery of fuel management systems to various end-user industries such as road transportation, railways, marine, and construction.

Key Players: DHL and FedEx. Companies like Piusi and Banlaw - Service and Post-Sale Support

The final stage is crucial for ensuring the longevity and optimal performance of the installed systems.

Key Players: Gilbarco Veeder-Root, LLC, Dover Fueling Solutions, Inc.

Top Companies in the Fuel Management Market & Their Offerings:

- Gilbarco Veeder-Root: This company is a global leader in fuel management, providing a comprehensive suite of hardware and software solutions for retail and commercial fueling operations.

- Dover Fueling Solutions: A key player in the market, Dover offers a broad range of innovative fueling equipment, software, and services designed to enhance efficiency and security. Their integrated solutions are crucial for optimizing fuel logistics across the entire supply chain, from refinery to vehicle.

- OPW Fuel Management Systems: OPW provides a variety of solutions for monitoring and managing fuel, including automatic tank gauging, fuel control systems, and monitoring software.

- Franklin Fueling Systems: Specializing in underground and aboveground fueling systems components, Franklin provides pipes, sumps, and automatic tank gauging systems crucial for safe and efficient fuel transfer and monitoring. Their products help ensure environmental compliance and operational integrity for fuel sites.

- Banlaw: Banlaw excels in high-speed, secure, and accurate fluid management solutions, focusing on heavy industry like mining and construction. Their systems help prevent fuel spillage, ensure accurate fuel tracking, and manage fluid transfer in demanding environments.

- Triscan Group: Triscan offers a range of fuel management systems, from basic manual tracking to sophisticated integrated software solutions with fuel access control. The company provides a range of solutions for commercial and public refueling sites.

- PIUSI S.p.A: PIUSI produces a wide array of fuel transfer pumps, meters, and dispensing solutions for diesel, gasoline, and other fluids across the globe. Their robust and reliable equipment is used in various commercial applications to manage fuel use efficiently.

- SmartFlow Technologies: This company develops hardware and software solutions focused on optimizing fuel usage and managing logistics for commercial fleets. Their technology provides real-time monitoring and advanced analytics to help businesses control costs.

- Fluid Management Technology: FMT specializes in fuel management systems for the aviation, mining, and transport industries, offering products like fuel management terminals and integrated software.

- HID Global: A leader in secure identity solutions, HID provides access control technologies used in fuel management systems to restrict who can access fuel and when. Their technology enhances security and ensures accountability at fueling points.

- ESI Total Fuel Management: ESI provides comprehensive, end-to-end fuel management services, including site design, installation, and ongoing maintenance. The company acts as a vital integrator and service provider for complex fuel management needs.

- Chevin Fleet Solutions: Chevin offers fleet management software that integrates with fuel management systems to provide a holistic view of vehicle operations and costs.

- Orpak Systems Ltd.: Acquired by Gilbarco Veeder-Root, Orpak provides a broad range of fuel management solutions, including forecourt automation, station management, and fleet solutions.

Fuel Management Market Companies

- Gilbarco Veeder?Root

- Dover Fueling Solutions

- OPW Fuel Management Systems

- Franklin Fueling Systems

- Banlaw

- Triscan Group

- PIUSI S.p.A

- SmartFlow Technologies

- Fluid Management Technology

- HID Global

- ESI Total Fuel Management

- Chevin Fleet Solutions

- Orpak Systems Ltd.

Recent Developments

- In August 2025, according to a State Bank of India (SBI) report, India's crude oil import bill could rise by USD 9 billion to USD 12 billion if the country discontinues purchasing Russian crude. The report estimates that halting Russian oil imports for the remainder of FY26 could push the fuel bill up by USD 9 billion in FY26 and by USD 11.7 billion in FY27, mainly due to higher global prices.(Source: https://economictimes.indiatimes.com)

Segments Covered In the Report

By Solution/Component

- Hardware

- Sensors & Meters

- Tank & Adblue Systems

- Telematics & IoT Devices

- Software & Analytics

- Fuel Cards & Payment Systems

- Services

By Fuel Type Monitored / Managed

- Diesel

- Gasoline / Petrol

- AdBlue / DEF (diesel exhaust fluid)

- Liquefied Petroleum Gas (LPG)

- Compressed Natural Gas (CNG) / LNG

- Aviation Turbine Fuel (ATF) / Jet Fuel

- Marine Fuels / Bunker Fuels

- Alternative Fuels & Energy (Hydrogen, Electric charging management)

By Deployment Model / Solution Type

- On-Premise / Local Systems

- Cloud-Based / SaaS Platforms

- Hybrid Deployments

By End-User Industry

- Road Freight & Logistics / Fleet Operators

- construction & mning

- Agriculture

- Public Transport & Buses

- Aviation (ground fueling & airline operations)

- Marine & Ports

- Retail Fuel Stations / Forecourts

- Government & Municipalities

By Fleet Size / Customer Type

- Small Fleets / SMEs

- Large Fleets / Enterprises

- Single-site Industrial Users (mines, plants)

By Functionality / Use Case

- Fuel Theft Prevention & Access Control

- Fuel Consumption Monitoring & Optimization

- Automated Fueling & Reconciliation

- Regulatory Reporting & Emissions Tracking

- Preventive Maintenance & Uptime Optimization

- Driver Behavior & Route Fuel Efficiency

By Distribution Channel

- Direct Sales (OEMs & Integrators)

- Channel Partners & Resellers

- Fuel Retailers / Forecourt Integrations

- Online Marketplaces / Platform Partnerships

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting