What is the Gastric Cancer Diagnostics Market Size?

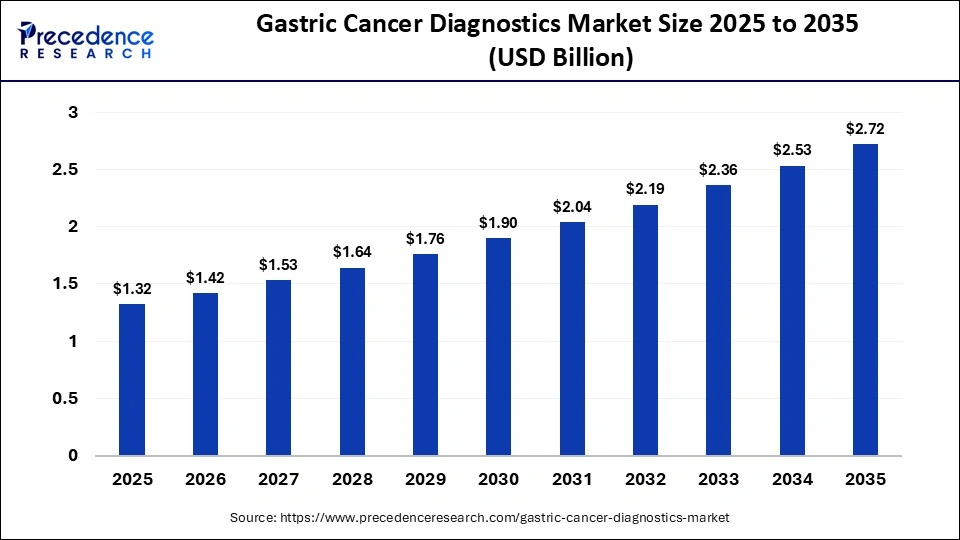

The global gastric cancer diagnostics market size accounted for USD 1.32 billion in 2025 and is predicted to increase from USD 1.42 billion in 2026 to approximately USD 2.72 billion by 2035, expanding at a CAGR of 7.51% from 2026 to 2035. The market is driven by growing investment in oncology research and the shift toward minimally invasive diagnostic tools.

Market Highlights

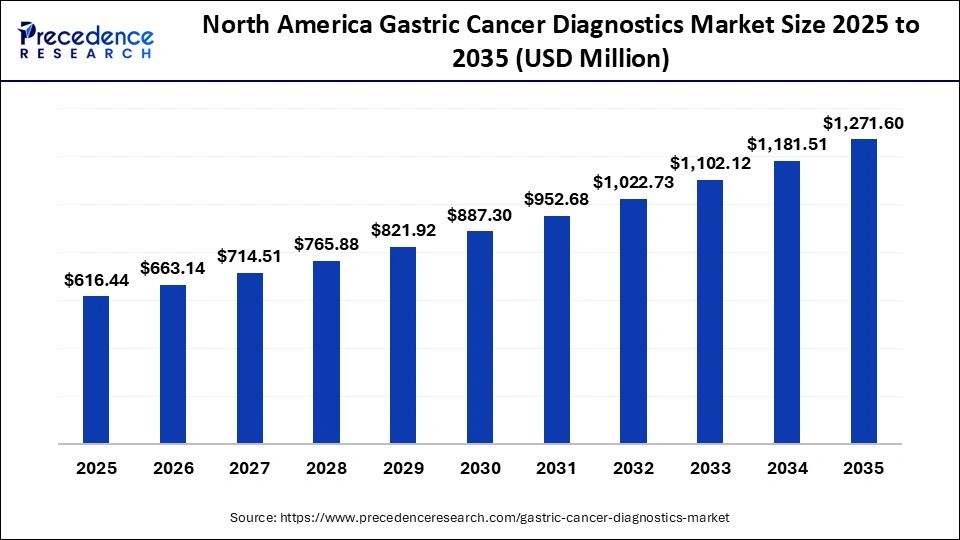

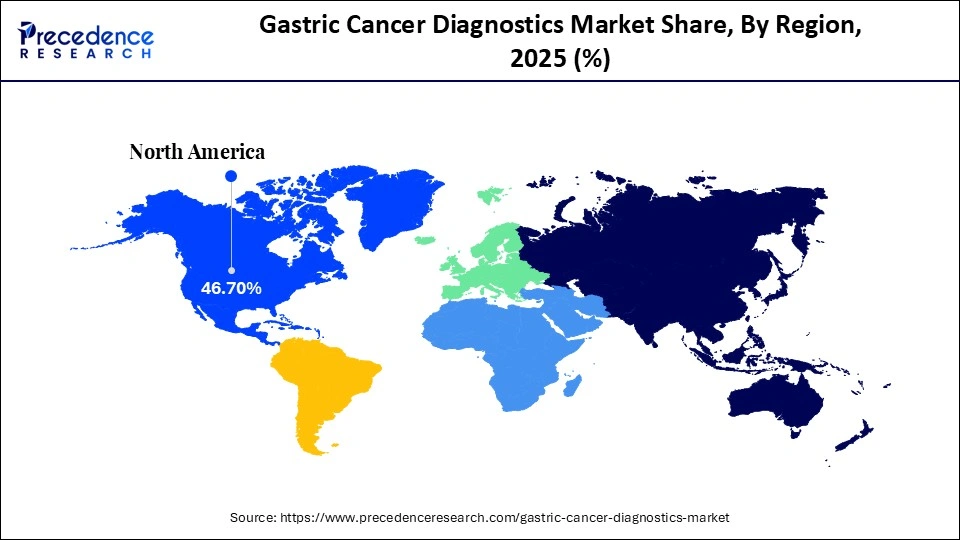

- North America dominated the market with the largest market share of 46.70% in 2025.

- The Asia Pacific is expected to grow at the fastest CAGR from 2026 to 2035.

- By diagnostic method, the endoscopy segment led the market while holding the largest share in 2025.

- By diagnostic method, the biopsy segment is poised to grow at a significant rate between 2026 and 2035.

- By technology, the next-generation sequencing segment dominated the market in 2025.

- By technology, the molecular diagnostics segment is growing at a solid CAGR from 2026 to 2035.

- By end-user, the hospitals segment captured the highest market share in 2025.

- By end-user, the clinics segment is expanding at a healthy CAGR from 2026 to 2035.

Shaping the Future of Gastric Cancer Detection: Market Overview and Trends

The gastric cancer diagnostics market is rapidly evolving worldwide as healthcare systems prioritize early detection and precision-based treatment planning. Growing screening initiatives, improved access to endoscopy, and the development of biomarker based tests are key factors fueling the market's ongoing expansion. Additionally, reimbursement policies supporting many regions and the increased adoption of molecular diagnostics in clinical workflows also influence the market. As the number of cancer cases continues to rise, the need for diagnostic tools that are efficient, accurate, and affordable becomes increasingly critical.

Key Technological Shifts in the Gastric Cancer Diagnostics Market

Technologies like NGS, PCR-based assays, and liquid biopsy are gaining popularity for detecting genetic changes associated with gastric cancer. The industry is adopting AI-enabled diagnostic imaging with machine learning-powered analysis of endoscopic and radiology images, which are improving accuracy, speed, and diagnostic workflow consistency. Liquid biopsy, blood-based biomarkers, and breath tests are emerging as alternatives to invasive biopsy procedures. Automated histopathology systems, digital slide scanners, and AI pathology tools are increasing efficiency and reducing diagnostic errors. The integration of companion diagnostics and technology is shifting toward identifying biomarkers that guide targeted therapy decisions, enabling personalized oncology care.

Key Market Trends

- There is growth in early detection programs, primarily influenced by the rise in cancer incidences, as well as improved national cancer screening initiatives.

- There is an increasing use of precision diagnostics because of which clinicians are focusing more on HER2, PD-L1, MSI, and other biomarkers for treatment stratification.

- The preference for point-of-care and rapid testing is significantly increasing to facilitate diagnosis at an earlier stage, notably in deprived areas.

- Collaboration with diagnostic companies and pharma to create co-diagnostic solutions for targeted therapies.

Gastric Cancer DiagnosticsMarket Outlook

- Industry Outlook: The gastric cancer diagnostics market is poised for rapid growth from 2026 to 2035, driven by increasing cancer rates, higher risk factors such as H. pylori and obesity, and technological advances like AI, liquid biopsies. Rising demand for advanced imaging for earlier, less invasive detection and the focus on personalized medicine also drive the market.

- Global Expansion: The market is expanding worldwide due to the increasing incidence of cancer, rising awareness, technological advancements such as AI and molecular testing (NGS, liquid biopsy), focus on early detection, and demand for personalized medicine. Emerging regions like Latin America and APAC offer immense opportunities due to the rising shift toward non-invasive methods and the expansion of healthcare infrastructure.

- Major Investors: Major investors in the market include venture capital firms, private equity investors, and large pharmaceutical and diagnostic companies such as Roche, Thermo Fisher Scientific, Guardant Health, and Illumina. They contribute by funding research and development of innovative diagnostic technologies, supporting the commercialization of advanced tools like molecular diagnostics and liquid biopsies, and facilitating global market expansion through strategic partnerships and acquisitions.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.32 Billion |

| Market Size in 2026 | USD 1.42 Billion |

| Market Size by 2035 | USD 2.72 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 7.51% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Diagnostic Method, Technology, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Diagnostic Method Insights

Why Did the Endoscopy Segment Dominate the Gastric Cancer Diagnostics Market?

The endoscopy segment dominated the market in 2025, driven by its clinical accuracy, as direct visual assessment of gastric abnormalities is usually performed via endoscopy. Additionally, endoscopy plays a crucial role in routine cancer screening and diagnostic processes, being able to identify lesions at their earliest stages. The use of high-definition, AI-supported endoscopic units is becoming increasingly popular, which significantly benefits the adoption of this technique across various medical centers.

The biopsy segment is expected to grow at a significant CAGR during the forecast period because biopsies provide definitive and accurate tissue-based diagnosis, which is critical for confirming gastric cancer and guiding treatment decisions. As clinicians focus more on making treatment decisions tailored to individual patients, insights gained from biopsy become critically important. The shift toward accuracy and therapeutic alignment is accelerating the adoption of biopsy as a key diagnostic modality. Additionally, the segment is expanding due to the integration of advanced histopathology techniques, immunohistochemistry, and molecular testing on biopsy samples, enabling more precise tumor characterization, supporting personalized therapy, and improving patient outcomes.

Technology Insights

What Made Next-Generation Sequencing the Dominant Segment in the Gastric Cancer Diagnostics Market?

The next-generation sequencing segment dominated the market with the largest share in 2025 due to its ability to provide comprehensive genomic profiling of tumors, enabling clinicians to detect multiple genetic mutations simultaneously. This technology supports personalized medicine by guiding targeted therapies, monitoring disease progression, and identifying actionable biomarkers, making it more valuable than traditional methods. Additionally, the declining cost of sequencing, growing adoption in clinical workflows, and integration with molecular diagnostics have further solidified NGS as the market leader.

The molecular diagnostics segment is expected to grow at the fastest rate in the upcoming period, driven by its ability to identify genetic mutations and molecular tracers, making the technology essential in modern oncology. As targeted therapies become more popular, the demand for molecular data continues to increase. Because molecular diagnostics technology strongly aligns with personalized medicine, it remains a critical technology in gastric cancer detection.

End-User Analysis

How Does the Hospitals Segment Lead the Gastric Cancer Diagnostics Market?

The hospitals segment led the market in 2025, driven by their ability to provide comprehensive diagnostic services and perform complex procedures like endoscopy and advanced imaging. Hospital-based oncological teams enhance diagnostic accuracy and speed up clinical decision-making, while patient preference for hospitals reinforces their prominence. Continuous technological advancements, including AI-assisted tools, and their capacity to manage large patient volumes further solidify hospitals as the leading segment in the market.

The clinics segment is expected to grow rapidly during the projection period due to increased use of point-of-care diagnostics and the rising number of patients sent for early screening. Improved knowledge and the steadily growing number of patients visiting outpatient facilities are key factors driving this expansion. Many clinics have already established partnerships with diagnostic labs to provide a seamless testing process for cancer patients. The availability of basic imaging and initial screening tools has strengthened their role in early detection.

Regional Insights

How Big is the North America Gastric Cancer Diagnostics Market Size?

The North America gastric cancer diagnostics market size is estimated at USD 616.44 million in 2025 and is projected to reach approximately USD 1,271.60 million by 2035, with a 7.51% CAGR from 2026 to 2035.

What Made North America the Dominant Region in the Gastric Cancer Diagnostics Market?

North America led the gastric cancer diagnostics market in 2025, thanks to its advanced healthcare system and strong emphasis on early cancer detection. The region has maintained its leadership through widespread use of molecular diagnostics and AI-powered imaging solutions. Additionally, significant funding for oncology research and close collaborations between universities and diagnostic firms have driven innovation. A supportive reimbursement environment that enables the use of advanced diagnostic tools is another advantage for the region. High public awareness and participation in screening programs have also contributed to maintaining elevated diagnostic volumes.

What is the Size of the U.S. Gastric Cancer Diagnostics Market?

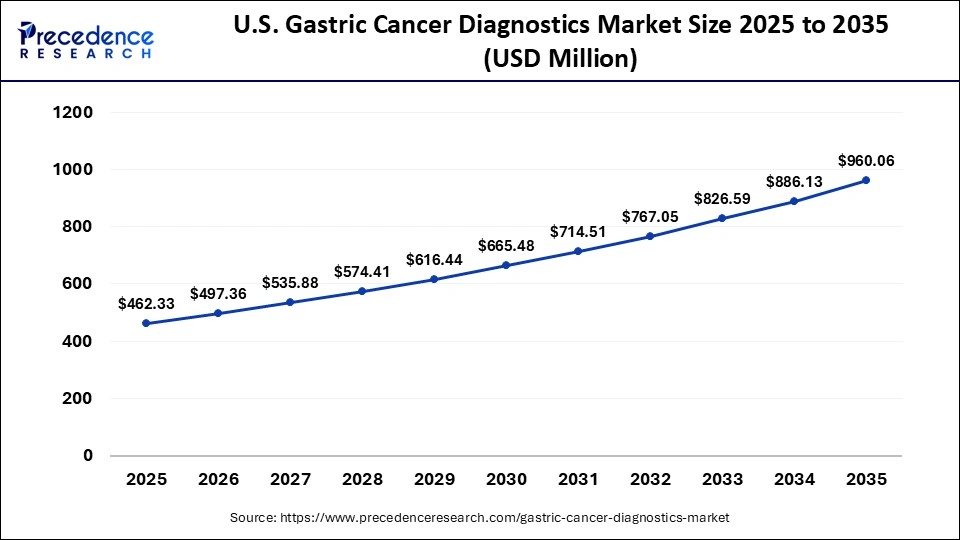

The U.S. gastric cancer diagnostics market size is calculated at USD 462.33 million in 2025 and is expected to reach nearly USD 960.06 billion in 2035, accelerating at a strong CAGR of 7.58% between 2026 and 2035.

The U.S. market is growing due to the rising adoption of liquid biopsy and increased demand for biomarker-based testing, while Canada benefits from cancer screening programs and the modernization of oncology services. Advances in digital pathology and AI are improving diagnostic accuracy in top Canadian institutions, with both countries prioritizing early detection to reduce the long-term impact of gastric cancer.

Why is Asia Pacific Considered the Fastest-Growing Market for Gastric Cancer Diagnostics?

Asia Pacific is expected to grow the fastest during the forecast period, driven by a high disease burden and increased awareness of early detection in the region. With rising healthcare expenditure and rapid development of diagnostic infrastructure, patients are gaining access to advanced diagnostic technologies. A cancer screening initiative launched by governments across the region has led to a sharp rise in testing volumes. The adoption of molecular diagnostics is also increasing due to the growing use of precision oncology.

China continues to dominate the regional market due to its large patient population, expanding hospital infrastructure, and strong adoption of advanced diagnostic systems, while Japan remains a key contributor with a mature screening culture and rapid integration of endoscopic innovations. Meanwhile, India is experiencing fast growth as awareness rises and private healthcare providers expand oncology diagnostics across the country.

Europe: A Notably Growing Area

Europe is expected to experience notable growth in the gastric cancer diagnostics market due to a rising focus on early cancer detection and improving patient outcomes. Key trends transforming the diagnostic landscape include the expanded use of digital pathology, AI-assisted imaging, and genomic testing. Most countries in the region have robust regulatory frameworks supporting the adoption of advanced diagnostic technologies. Increasing collaboration between universities, cancer research institutes, and diagnostic companies also promotes innovation. The enhancement of national cancer control plans across Europe greatly contributes to the growing demand for early screening and more accurate testing tools.

Germany is a major market player due to its advanced diagnostic infrastructure and high adoption of precision oncology tools. The UK is also experiencing strong growth, driven by investments in AI-powered diagnostics and expanded molecular testing capacity. In France, cancer screening programs are being continuously strengthened, leading to an increase in diagnostic volumes.

What Potentiates the Growth of the Market in the Middle East & Africa?

The gastric cancer diagnostics market in the Middle East & Africa (MEA) is expanding due to increasing development in healthcare systems and rising awareness of cancer screening. Gulf countries have invested heavily in enhancing their diagnostic capabilities, primarily focusing on endoscopy and imaging technologies. The region is also benefiting from increased collaboration with global diagnostic companies, which is facilitating much of the technology transfer. The growth of the private healthcare sector is enabling more people to access advanced diagnostic options. Although the adoption rate varies between countries, the overall trend is toward modernization and improved cancer detection capabilities.

What Opportunities Exist in South America for the Gastric Cancer Market?

South America presents significant growth opportunities in the gastric cancer diagnostics market due to rising healthcare investments and improvements in hospital and laboratory infrastructure across countries like Brazil, Argentina, and Chile. Increasing disease awareness and government-led screening initiatives are driving demand for early detection and advanced diagnostic solutions, including molecular tests and imaging technologies. The region's underserved rural populations offer potential for point of care testing and mobile diagnostic programs, addressing gaps in access to care. Additionally, the growing presence of international diagnostic vendors and the import of advanced testing kits create avenues for market expansion and innovation tailored to local needs.

Top Companies in the Market & Their Offerings

- Roche Diagnostics: It provides molecular and immunoassay-based diagnostic solutions, including liquid biopsy tests and biomarker panels, supporting early detection and personalized treatment of gastric cancer.

- Thermo Fisher Scientific: It offers advanced molecular diagnostic platforms, next-generation sequencing (NGS) solutions, and reagents that facilitate genomic profiling of gastric tumors.

- Illumina Inc.: It supplies NGS technologies and sequencing panels that enable comprehensive genetic analysis for precision diagnostics in gastric cancer.

- Agilent Technologies: It provides clinical genomics and molecular pathology tools, including kits and reagents, to enhance gastric cancer biomarker detection.

- QIAGEN N.V.: It delivers molecular diagnostic kits, sample preparation solutions, and companion diagnostic assays for accurate detection of gastric cancer biomarkers.

- Bio-Rad Laboratories: It offers molecular biology reagents, PCR instruments, and quality control solutions that support gastric cancer testing and research.

- Abbott Laboratories: It provides immunoassays, molecular tests, and point-of-care diagnostic solutions for gastric cancer screening and monitoring.

- Hologic Inc.: It supplies molecular diagnostic systems and automated assays that aid in non-invasive testing and early detection of gastric cancer.

Other Major Companies

- GE Healthcare

- Siemens Healthineers

- PerkinElmer Inc.

- Myriad Genetics

- F. Hoffmann-La Roche Ltd

- Quest Diagnostics

- Sysmex Corporation

- Biocept Inc.

- Guardant Health

- Foundation Medicine

- Natera Inc.

Recent Developments

- In October 2025, Mirxes, Asia Pacific's only publicly-listed molecular cancer early detection company, announced that its flagship product GASTROClear received regulatory approval from China's NMPA, becoming the first non-invasive blood test for gastric cancer screening in the country.(Source: https://www.mirxes.com)

- In May 2025, Biohit launched its latest innovation, the GastroPanel Quick Test (GPQT), a state-of-the-art non-invasive serological test for screening high-risk gastric cancer patients. Designed for point-of-care use in a single appointment, GPQT delivers the same results as the GastroPanel ELISA versions and was recently validated at Fortis Hospital, Mohali Chandigarh, in India, a high-risk country for gastric cancer.(Source: https://www.biohithealthcare.com)

Segments Covered in the Report

By Diagnostic Method

- Endoscopy

- Biopsy

- Imaging

- Blood Tests

- Others

By Technology

- Molecular Diagnostics

- Immunoassays

- Next-Generation Sequencing

- Others

By End-User

- Hospitals

- Clinics

- Diagnostic Laboratories

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting