GLP-1 Analogues Market Size and Forecast 2025 to 2034

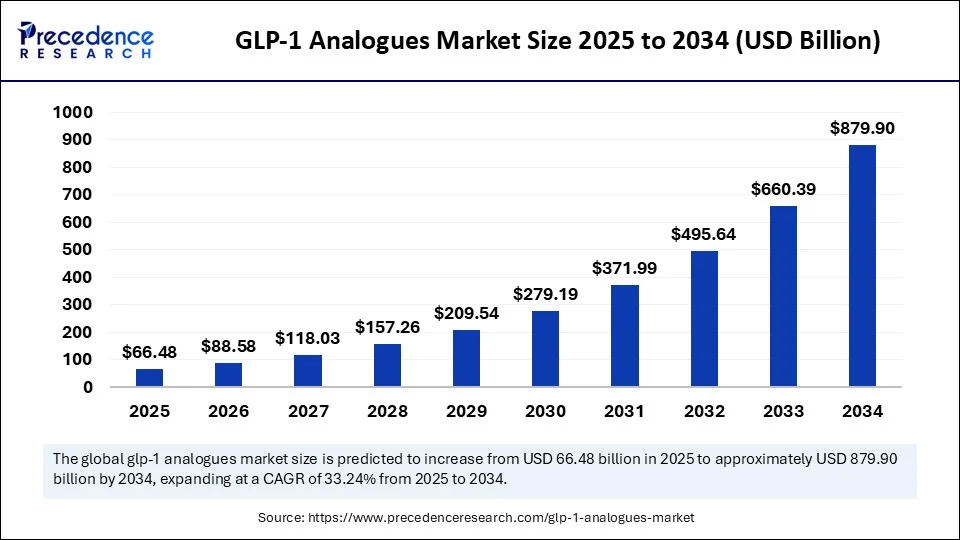

The global GLP-1 analogues market size was calculated at USD 49.90 billion in 2024 and is predicted to increase from USD 66.48 billion in 2025 to approximately USD 879.90 billion by 2034, expanding at a CAGR of 33.24% from 2025 to 2034. The market is growing due to the rising prevalence of diabetes and obesity, driving demand for effective treatment options.

GLP-1 Analogues Market Key Takeaways

- In terms of revenue, the global GLP-1 analogues market was valued at USD 49.90 billion in 2024.

- It is projected to reach USD 879.90 billion by 2034.

- The market is expected to grow at a CAGR of 33.24% from 2025 to 2034.

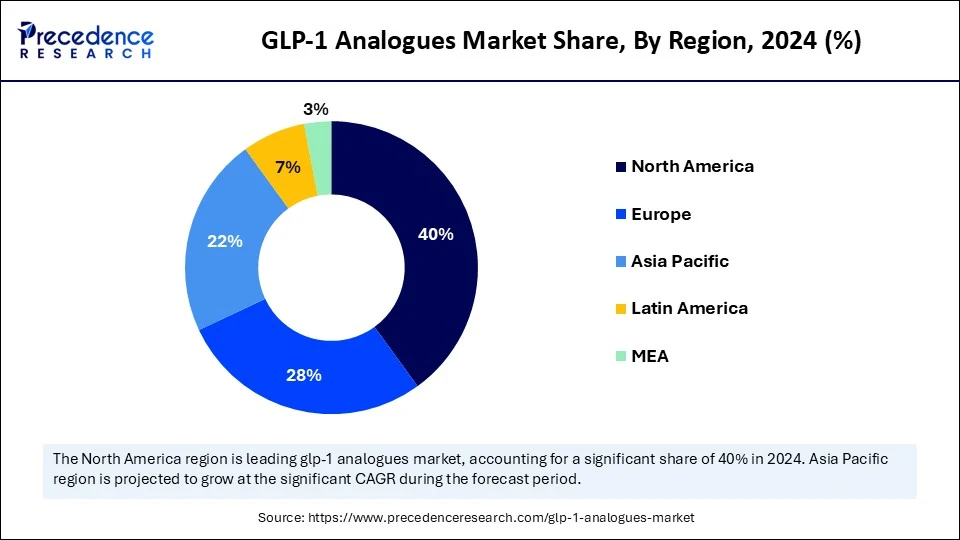

- North America dominated the GLP-1 analogues market with the largest market share of 40% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR during the forecast period.

- By product type, the injectable GLP-1 analogues segment held the biggest market share of 70% in 2024.

- By product type, the oral GLP-1 segment is expected to grow at the fastest CAGR during the forecast period.

- By application, the type 2 diabetes mellitus segment captured the highest market share of 60% in 2024.

- By application, the obesity management segment is projected to grow at the fastest CAGR during the forecast period.

- By route of administration, the subcutaneous injection segment contributed the highest market share of 75% in 2024.

- By route of administration, the oral administration segment is the fastest growing during the forecast period.

- By distribution channel, the hospital pharmacies segment generated the major market share of 50% in 2024.

- By distribution channel, the online pharmacies segment is emerging as the fastest-growing during the forecast period.

How Is AI Improving Drug Discovery for GLP-1 Analogues?

Artificial intelligence is transforming drug discovery for GLP-1 analogues by rapidly analyzing vast datasets from chemical libraries, preclinical studies, and clinical trials to identify promising molecular candidates. To help researchers optimize molecular structures prior to expensive lab testing, machine learning algorithms can forecast the efficacy, stability, and safety profiles of novel compounds. This allows for the creation of next-generation GLP-1 analogs with increased potency, fewer side effects, and better patient compliance while also speeding up the discovery process, cutting down on R&D timelines, and lowering development costs. Further simplifying the process from concept to clinical trials AI AI-driven simulations also enable virtual testing of drug interactions.

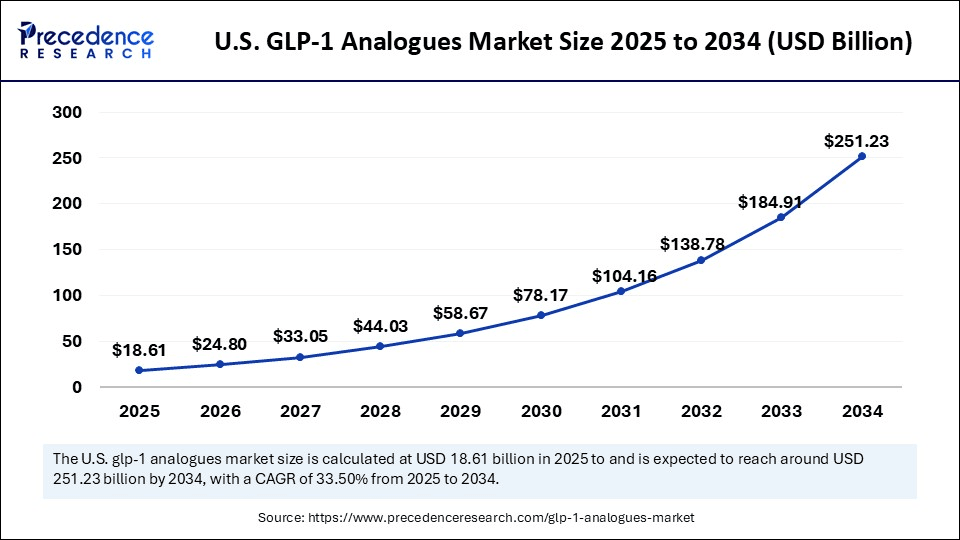

U.S. GLP-1 Analogues Market Size and Growth 2025 to 2034

The U.S. GLP-1 analogues market size was exhibited at USD 13.97 billion in 2024 and is projected to be worth around USD 251.23 billion by 2034, growing at a CAGR of 33.50% from 2025 to 2034.

Why Did North America Dominate the GLP-1 Analogues Market in 2024?

North America is dominating the GLP-1 analogues market, supported by a high prevalence of type 2 diabetes and obesity, strong healthcare infrastructure, and rapid adoption of innovative therapies. Widespread physician awareness, favorable reimbursement policies, and significant investments from leading pharmaceutical companies have driven strong uptake of GLP-1 treatments. In addition, rising public awareness about weight management and cardiometabolic health is fueling further demand. With a mature regulatory environment and steady product launches, North America continues to be the epicenter of market leadership.

U.S. GLP-1 Analogues Market Trends

The U.S. GLP-1 analogues market is witnessing rapid growth as the nation's high obesity prevalence and increased emphasis on weight loss drive demand for obesity treatment in addition to diabetes management. FDA approvals for weight loss indications have increased use and patient demand for easy-to-use formulations is increasing interest in oral GLP-1 alternatives in addition to the most popular injectables. In addition, despite continuous discussions about affordability, insurers are progressively expanding reimbursement coverage, increasing the accessibility of these treatments. Pharmaceutical firms are making significant investments in the U. S. S. trials for long-acting injectable combination treatments and next-generation oral medications, escalating competition. Adding to this momentum, the emergence of e-pharmacy and telehealth channels is changing distribution, guaranteeing quicker and more widespread patient access throughout the country.

Asia Pacific is the fastest-growing region in the GLP-1 analogues market, propelled by the rising incidence of lifestyle-related disorders, expanding healthcare access, and a growing middle-class population seeking advanced therapies. Increased government focus on diabetes management programs and rising investments from global pharma players are accelerating adoption in the region. Patients are becoming more aware of innovative treatments for both diabetes and obesity, boosting demand. With improving affordability and rapid urbanization, the Asia Pacific is emerging as the strongest growth engine for the GLP-1 analogue market.

Indian GLP-1 Analogues Market Trends

The Indian GLP-1 analogues market is expanding quickly, driven by the growing prevalence of obesity and type 2 diabetes in the nation, as well as increased knowledge of cutting-edge treatment options. Metabolic disorders have become more severe due to dietary changes, lifestyle changes, and growing urbanization, which have increased demand for novel treatments like GLP-1 analogues. Despite the current dominance of injectables, patient preference for simpler oral formulations is growing, especially as a result of continuous international product launches. As private healthcare infrastructure grows and multinational pharmaceutical companies increase their investments, accessibility is getting better. GLP-1 analogues are becoming more accessible to patients with diabetes and obesity in urban and semi-urban areas thanks to the growth of digital health platforms and e-pharmacies in India.

Market Overview

Why Is the GLP-1 Analogues Market Growing Rapidly?

The GLP-1 analogues market is growing rapidly due to the increasing incidence of diabetes and obesity in the world, which is fueling a high demand for treatments that can efficiently control body weight and blood sugar. Further speeding up adoption are rising awareness of lifestyle-related illnesses and increased acceptance of GLP-1 treatments for conditions other than diabetes, such as obesity. At the same time, supportive regulatory approvals and growing healthcare coverage are facilitating wider market penetration while pharmaceutical innovations like oral formulations and longer-acting injectables are improving patient convenience and compliance. Collectively, these elements are supporting the market's robust and long-term growth trajectory.

GLP-1 Analogues Market Growth Factors

- The rising prevalence of diabetes and obesity is fueling strong demand for GLP-1 analogues as effective treatment options.

- Increasing awareness about weight management and metabolic health is expanding patient adoption.

- Advancements in drug formulations are improving patient compliance.

- Favorable regulatory approvals and clinical trial success rates are accelerating market expansion.

- Strong investments from pharmaceutical companies are driving innovations and global availability.

- Growing healthcare spending and insurance coverage are supporting wider accessibility to these therapies.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 879.90 Billion |

| Market Size in 2025 | USD 66.48 Billion |

| Market Size in 2024 | USD 49.90 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 33.24% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Application, Route of Administration, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Prevalence of Type 2 Diabetes and Obesity

A major factor driving the adoption of GLP-1 analogues is the rise in diabetes and obesity cases worldwide. These medications support weight loss and blood sugar regulation, which makes them very appealing to patients with coexisting illnesses. There is a huge patient pool because of the nearly threefold increase in obesity rates since 1975, according to the World Health Organization. The need for efficient remedies like GLP-1 therapies is only increasing because of the rise in sedentary lifestyles and poor diets.

- In December 2025, Eli Lilly announced $3 billion expansion of its Wisconsin facility to meet surging demand for GLP-1 drugs like Zepbound and Mounjaro.

(Source: https://apnews.com)

Dual Therapeutic Benefits of Glycemic Control and Weight Management

In contrast to many conventional therapies, GLP-1 analogues decrease appetite and encourage weight loss in addition to controlling blood sugar levels. Compared to conventional antidiabetic medications, these dual-action medications are more beneficial and effective because they simultaneously address two significant health issues. Particularly, the ability to reduce weight has increased their use among patients who are obese but do not have diabetes. Adoption in international healthcare systems is speeding up due to these wider applications.

Restraints

High Treatment Costs and Limited Affordability

A major obstacle is affordability, as GLP-1 analogue therapies are substantially more costly than traditional diabetes treatments. Patients in many emerging economies are unable to obtain these medications due to high out-of-pocket costs. Some patients are unable to continue long-term therapy because insurance coverage varies greatly even in developed markets. In price-sensitive areas, this cost factor restricts adoption and slows market penetration.

- In 2025, Eli Lilly announced a $27 billion U.S. manufacturing build-out across four new sites, while it aims to expand GLP-1 supply, lawmakers raised concerns over whether such investments will translate into lower patient prices.(Source: https://pharmasource.global)

Side Effects and Patient Safety Concerns

GLP-1 analogues frequently cause gastrointestinal distress, nausea, and vomiting as side effects, which may deter long-term use. Thyroid tumors, gallbladder problems, and pancreatitis are uncommon but dangerous risks that make doctors and patients worry about their safety. Adverse clinical results or bad press could undermine confidence in prescribing. In certain groups, these difficulties cause slow adoption and affect patient adherence.

Opportunities

Expanding Use in Obesity Management

The growing use of GLP-1 analogues for the treatment of obesity is one of the largest opportunities. Given the sharp rise in obesity rates worldwide, these treatments are promoted as efficient weight loss options. Strong results in appetite suppression and improved metabolic health are demonstrated by clinical studies. For manufacturers, the potential for this wider therapeutic use is worth billions of dollars.

Pipeline Innovation and Next-Generation Drugs

Next-generation GLP-1 treatments with increased efficacy, fewer side effects, and more convenient dosing options are attracting significant investment from pharmaceutical companies. New developments, such as dual and triple agonists that target the glucagon, GLP-1, and GIP receptors, promise better results. These developments might increase access to care and give innovators a stronger edge over rivals. Long-term growth potential is guaranteed by the constant flow of R&D pipelines.

- In June 2025, Amgen announced positive Phase 2 trial results for MariTide showing up to ~20% weight loss in obese patients and ~17% in type 2 diabetes patients, presented at the ADA 85th scientific sessions.(Source: https://www.biopharmadive.com)

Product Type Insights

Why Did Injectable GLP-1 Analogues Dominate the Market in 2024?

The injectable GLP-1 analogues segment currently dominates the market due to their proven efficacy, widespread physician preference, and established regulatory approvals. They are the standard of care in managing type 2 diabetes, with a strong track record of reducing HbA1c levels and improving cardiovascular outcomes. Their availability across multiple branded formulations has further cemented their leadership. Additionally, strong insurance coverage and physician familiarity ensure stable prescribing patterns. With clinical confidence high, injectables are expected to remain a cornerstone even as new formats emerge.

Oral GLP-1 analogues are the fastest-growing category, fueled by growing patient demand for easy-to-use needle-free substitutes. Advances in drug delivery technologies have improved bioavailability, making oral options more effective and accessible. Pharmaceutical companies are investing heavily in this market, which is predicted to grow quickly as adoption spreads throughout the world. Uptake is being accelerated by increased patient compliance and a preference for non-invasive treatments. Furthermore, continuous pipeline advancements point to robust future expansion in this market.

Application Insights

Why Did the Type 2 Diabetes Mellitus Segment Dominate the GLP-1 Analogues Market in 2024?

Type 2 diabetes mellitus remains the dominant application segment for GLP-1 analogues as these drugs are widely prescribed to manage blood glucose levels and provide cardiovascular protection. With a rising global diabetes burden, GLP-1 therapies continue to be a mainstay in treatment regimens. Their strong clinical outcomes and inclusion in leading diabetes guidelines reinforce their market dominance. Growing emphasis on reducing long-term complications is further strengthening demand. Pharmaceutical giants continue expanding indications, ensuring ongoing relevance in diabetes care.

Obesity management is emerging as the fastest-growing application. GLP-1 analogues have been shown in clinical trials to improve metabolic health and significantly reduce body weight. Regulatory approvals for weight management indications and growing awareness of the risks associated with obesity are driving these segments' explosive growth. The growing recognition of obesity as a treatable condition by payers and governments is bolstering demand. Due to consumer interest and celebrity endorsements, uptake is expanding beyond people with typical diabetes.

Route of Administration Insights

Why Did the Subcutaneous Injection Segment Dominate the Market in 2024?

Subcutaneous injection dominates the GLP-1 analogues market since it is the conventional delivery method that has demonstrated therapeutic results. Patients have grown accustomed to using injectables, and doctors feel at ease prescribing them, particularly now that once-weekly formulations that improve adherence are available. Prescription and usage barriers are decreased by strong clinical familiarity. Additionally established injectable delivery infrastructure in clinics and hospitals guarantees sustained dominance.

Oral administration is the fastest-growing route, because the traditional delivery method has shown therapeutic benefits. Doctors feel comfortable prescribing injectables because patients have become accustomed to using them, especially with the availability of once-weekly formulations that increase adherence. Well-established clinical familiarity reduces prescription and usage barriers. Additionally, a well-established infrastructure for injectable delivery in hospitals and clinics ensures continued dominance.

Distribution Channel Insights

Why Did the Hospital Pharmacies Segment Dominate the Market in 2024?

Hospital pharmacies dominate distribution as they are the primary centers for chronic disease treatment and specialty drug dispensing. They play a critical role in managing diabetes patients, ensuring adherence to therapy, and facilitating physician-patient-pharmacy coordination. Their ability to handle complex prescriptions and monitor adverse reactions strengthens their role. In addition, hospitals often negotiate directly with manufacturers, ensuring a steady supply and competitive pricing.

Online pharmacies are the fastest-growing channel, fueled by patient preference for home delivery, growing digital adoption, and affordable prices. This expansion is being sped up by greater telehealth integration and increased insurance coverage for online pharmacy purchases. Working patients and the elderly are especially drawn to the convenience of doorstep delivery. This channel is growing rapidly in tandem with subscription models and emerging mobile health platforms.

GLP-1 Analogues Market Companies

- Novo Nordisk

- Eli Lilly and Company

- Sanofi

- AstraZeneca

- Boehringer Ingelheim

- Pfizer

- Amgen

- Roche

- Zealand Pharma

- Structure Therapeutics

- Viking Therapeutics

- Hangzhou Sciwind Biosciences

- Fudan University

- Eccogene

- Medtronic

- Merck & Co.

- AbbVie

- Bayer AG

- Teva Pharmaceutical Industries Ltd.

- Boehringer Ingelheim

Recent Developments

- In August 2025, Viking Therapeutic announced encouraging mid-stage trial results for its experimental oral/injectable weight loss drug VK2735, which achieved up to 12.2% body weight reduction over 12 weeks, through shares dropped due to higher treatment discontinuation from gastrointestinal side effects.

(Source: https://www.reuters.com) - In July 2025, Dr. Reddy's Laboratories announced plans to launch a generic version of Novo Nordisk's weight loss drug Wegovy in 87 countries beginning next year, contingent on patent expirations initially targeting markets like India, with expansion to the U.S. and Europe between 2029-2033.

(Source: https://www.reuters.com)

Segments Covered in the Report

By Product Type

- Injectable GLP-1 Analogues

- Oral GLP-1 Analogues

By Application

- Type 2 Diabetes Mellitus

- Obesity Management

- Cardiovascular Diseases

By Route of Administration

- Subcutaneous Injection

- Oral Administration

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting