What is the Green Data Center Market Size?

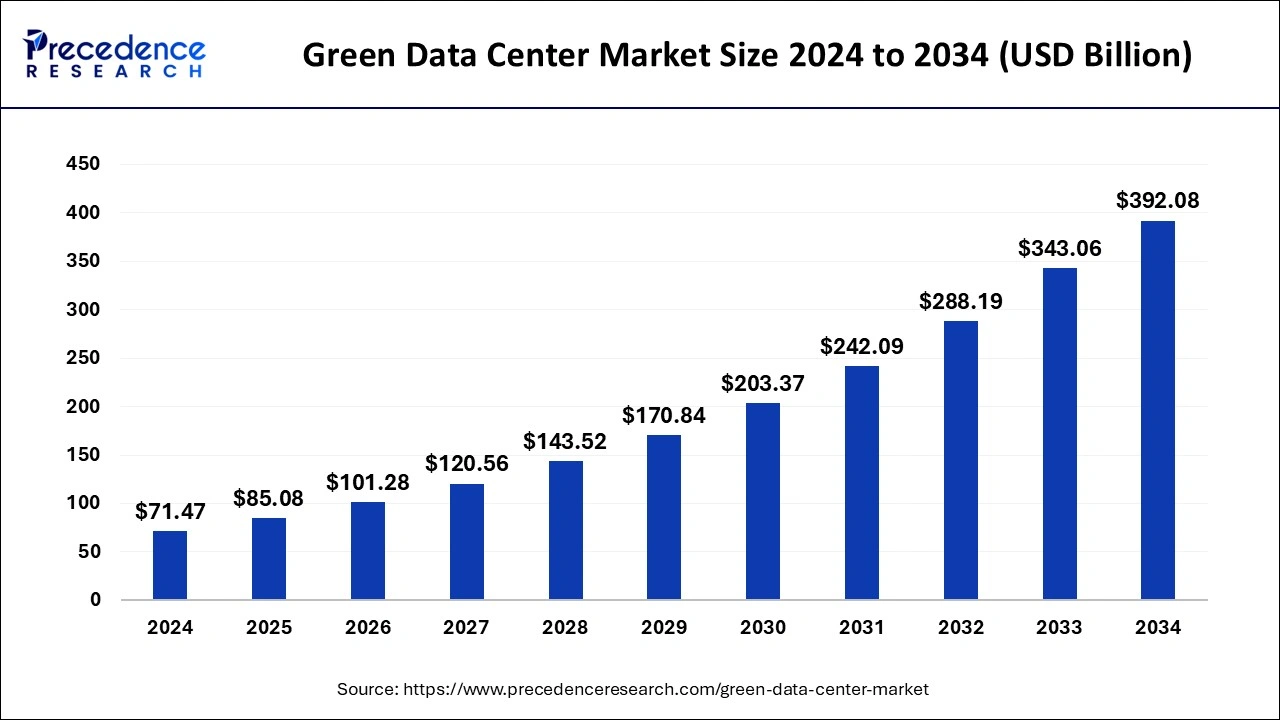

The global green data center market size was estimated at USD 85.08 billion in 2025 and is predicted to increase from USD 101.28 billion in 2026 to approximately USD 445 billion by 2035, expanding at a CAGR of 17.99% from 2026 to 2035. The green data center market is driven by increasingly strict environmental laws.

Green Data Center MarketKey Takeaways

- In terms of revenue, the global green data center market was valued at USD 85.08 billion in 2025.

- It is projected to reach USD 445 billion by 2035.

- The market is expected to grow at a CAGR of 17.99% from 2026 to 2035.

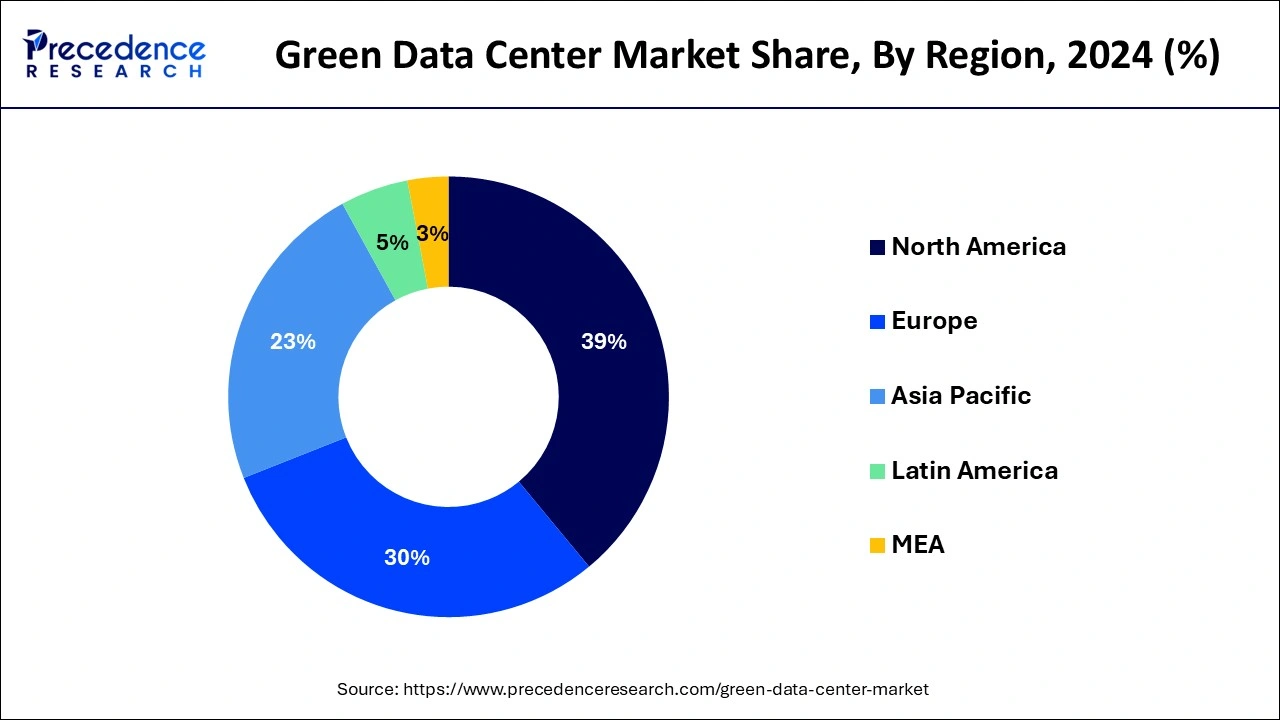

- North America dominated the market with the largest market share of 39% in 2025.

- By component, the solution segment has contributed the largest market share of 65% in 2025.

- By component, the service segment is projected to grow at a notable CAGR of 21.45% during the forecast period.

- By enterprise size, the large enterprise segment dominated the market with the maximum market share of 74% in 2025.

- By end-use, the BFSI segment captured the biggest market share of 25% in 2025.

Market Overview

Leading the way in deploying 5G, cloud computing, and big data analytics demand a large amount of data processing and storage. The green data center market offers a solution to the safe and dependable data management of banks and other financial institutions. The industrial Internet of Things (IoT) and smart manufacturing drive the need for effective data centers to handle complicated operations. Healthcare businesses are implementing green data centers to ensure patient data security and privacy due to the growing use of telemedicine and electronic health records. Concentrate on technologies such as liquid immersion, free cooling, and energy-efficient servers to reduce energy usage.

Government policies encourage the use of green data centers and offer incentives, while promising sustainable growth for the green data center market. The significance of certifications such as LEED and Energy Star is increasing in terms of proving a commitment to the environment and proving quickly deployable, scalable data centers with less environmental effect and construction time. Green data centers are becoming more popular among public sector organizations to cut expenses and achieve sustainability objectives.

- In November 2022, by 2027, VW AG wants to achieve net carbon neutrality in its data center activities. The Group has increased processing power at Green Mountain, a Norwegian provider of CO2-neutral data centers, to accomplish this. With this expansion, VW will operate 25% of its global data centers carbon-neutrally. This equates to 10,000 tons of CO2 reductions each year.

Artificial Intelligence: The Next Growth Catalyst in the Green Data Center Industry

AI and ML are revolutionizing the green data center industry by analyzing real-time data from IoT sensors, operations from reactive to proactive, and data-driven sustainability management, and ML algorithms optimize cooling systems, which account for roughly energy usage, reducing energy consumption. AI-driven predictive maintenance prevents unexpected equipment failures, extending the life of hardware and significantly reducing e-waste.

Green Data Center MarketGrowth Factors

- Continued development of chips and server CPUs with reduced power consumption.

- Creation of cutting-edge microgrids and intelligent energy management systems to maximize energy efficiency and reliance on renewable resources, promoting the overall growth of the green data center market.

- It is reusing and renovating IT hardware to increase its useful life and save waste.

- Many businesses run corporate social responsibility (CSR) programs with high sustainability objectives.

- Consumers are putting more and more pressure on businesses to provide environmentally friendly goods and services.

- High energy costs and strict environmental restrictions drive the early adoption of green data centers.

- The demand for additional data centers is enormous due to the rapid development in internet traffic and data requirements.

- It improves heat dissipation and ventilation through improved infrastructural design.

- Adoption of flexible and scalable modular data center architectures.

- Expanded accessibility to direct-to-chip, liquid immersion, and other cutting-edge cooling methods.

Green Data Center Market Trends

- Growing integration of renewable energy:- Data centers giving priority to renewable energy sources like hydro, solar, and wind power to lower their carbon footprint. The growing environmental concerns increase the demand for renewable energy helps in the green data centers market growth.

- Growing utilization of AI and automation:- The growing utilization of various technologies like AI, machine learning, and automation increases demand for green data centers. The growing usage of automation helps in energy saving. The ongoing innovations in technologies like AI, machine learning, and automation help in the growth of the green data centers market.

Market Outlook

- Market Growth Overview: The green data center market is expected to grow significantly between 2025 and 2034, driven by rising energy costs and consumption, innovations in efficient cooling systems, and integration of renewable energy.

- Sustainability Trends: Sustainability trends involve advanced cooling technologies, water usage effectiveness management, and renewable energy integration.

- Major Investors: Major investors in the market include Hyperscalers, Amazon Web Services, Google LLC, Huawei Technologies, and Equinix Inc.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 17.99% |

| Market Size in 2025 | USD 85.08 Billion |

| Market Size by 2035 | USD 445Billion |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Component, By Enterprise Size, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing environmental concerns and regulations

There is a significant push in the IT industry towards more sustainable practices due to growing awareness of climate change and the carbon footprint of typical data centers. Green data centers reduce their environmental impact using cutting-edge cooling methods, renewable energy sources, and energy-efficient systems. Businesses are also encouraged to use greener data center solutions by strict laws and obligations about emissions and energy consumption.

Rising energy costs and operational efficiency

Green data centers use renewable energy sources and energy-efficient technologies to cut operating costs and energy consumption over time. Companies are increasingly concerned about reaching sustainability targets and lowering their carbon footprint. Green data centers reduce energy use and carbon emissions to help accomplish these goals. Technological advancements in server architectures, energy management software, and cooling systems allow green data centers to run at higher performance levels more efficiently. Thereby, the rising energy cost and operational efficiency act as driver for the green data center market.

Restraint

High initial investment

It costs a lot of money upfront to build or upgrade data centers using green technology and equipment, such as renewable energy sources, cooling systems, and energy-efficient servers. Despite their long-term advantages, some investors might view green data center technologies as unproven or hazardous compared to standard alternatives. This could discourage investment by acting as a major restraint for the green data center market. The original investment is increased by training employees in new technology and sustainable practices, which call for resources for education and skill development.

Implementing state-of-the-art green technologies such as energy management software, sophisticated power distribution systems, and effective HVAC (heating, ventilation, and air conditioning) systems can be costly.

Opportunity

Emerging technologies and their adoption

Data centers can use less energy due to smart power management systems, enhanced server designs, and sophisticated cooling systems. The energy needed to cool servers can be significantly reduced, for example, by implementing immersion and liquid cooling systems. Within data centers, task scheduling, resource allocation, and energy consumption may all be optimized using artificial intelligence (AI) and machine learning algorithms. The integration of such technologies is observed to create a significant potential for the green data center market. These technologies anticipate demand patterns and dynamically modify server operations, increasing efficiency and lowering overall energy use. Intelligent lighting systems, cutting-edge building materials, and environmentally friendly construction techniques all play a part in creating green data centers. Data center operators can reduce environmental effects by optimizing building designs for environmental sustainability and energy efficiency.

Segment Insights

Component Insights

The solution segment dominated the green data center market with the largest share in 2025. Solution providers maximize data center performance while minimizing environmental effects by holistically combining hardware,software, and services. This all-inclusive strategy appeals to companies looking for complete solutions instead of fragmented deployments. Options for incorporating renewable energy sources, such as solar or wind power, into data center operations are widely available from solution vendors. Organizations can align with sustainability goals by reducing carbon emissions and dependency on fossil fuels through clean energy sources.

Solution providers help businesses acquire green certifications like Energy Star or LEED (Leadership in Energy and Environmental Design) and comply with environmental legislation. Brand reputation is improved, and ecological responsibility is demonstrated by adhering to these requirements.

The service segment shows notable growth in the green data center market during the forecast period. The need for consultancy and advisory services to evaluate current data center operations and provide strategies for greener alternatives is rising as businesses work to implement sustainable practices. Many firms use managed services to offload the complexity of managing and maintaining the infrastructure of green data centers. This trend fuels the expansion of services designed to manage and maximize energy-efficient technologies.

Since each data center environment differs, integrating green technologies into existing ones requires specialized solutions and integration services. Tailored solution providers rise as businesses look to maximize energy efficiency without affecting daily operations.

Enterprise Size Insights

The large enterprise segment dominated the green data center market with the largest share in 2025. These businesses are excellent candidates for implementing green data center solutions since they often have extensive IT infrastructures and data storage requirements. Furthermore, stakeholders, consumers, investors, and regulators are frequently under pressure to lessen their environmental impact. Large businesses have been early adopters of cutting-edge cooling systems, renewable energy sources, and energy-efficient technology to maximize their data center operations while reducing their environmental effects.

The small and medium enterprises (SMEs) segment show a significant growth in the green data center market during the forecast period. In comparison to larger businesses, small and medium-sized enterprises (SMEs) sometimes have stricter budgets, green data centers lower operating costs for SMEs by providing energy-efficient infrastructure and cost-effective solutions. Because green data centers are scalable, SMEs can grow their operations without seeing appreciable increases in energy use or environmental effects. Using green technologies helps SMEs project a more ecologically conscious image. This can draw partners and consumers who care about the environment, offering SMEs a competitive edge in the market.

End-use Insights

The BFSI segment dominated the green data center market in 2025. BFSI firms handle enormous data from financial analytics, customer information, and transactions. This calls for a reliable, scalable, and efficient data center infrastructure. A growing number of businesses in all industries, including BFSI, are concentrating more on sustainability initiatives due to the increasing awareness of environmental issues. Green data center solutions can help a business attract clients and investors by enhancing its brand image and committing to corporate social responsibility.

Energy-efficient technology, including virtualization, effective cooling systems, and renewable energy sources, are employed in green data centers. In the long term, BFSI businesses can save money by consuming less energy.

The IT & telecom segment is the fastest growing in the green data center market during the forecast period. Data centers are desperately needed to handle the demand resulting from the exponential rise of data supplied by telecom and IT services effectively. Companies in the telecom and IT sectors are under pressure to increase energy efficiency and lower their carbon footprint. With cutting-edge cooling systems, renewable energy sources, and energy-efficient technology, green data centers provide solutions that support these objectives.

Numerous telecom and IT firms promote environmental responsibility and corporate social responsibility. These businesses can show their dedication to sustainability and draw in eco-aware clients by investing in green data centers.

Regional Insights

What is the U.S. Green Data Center Market Size?

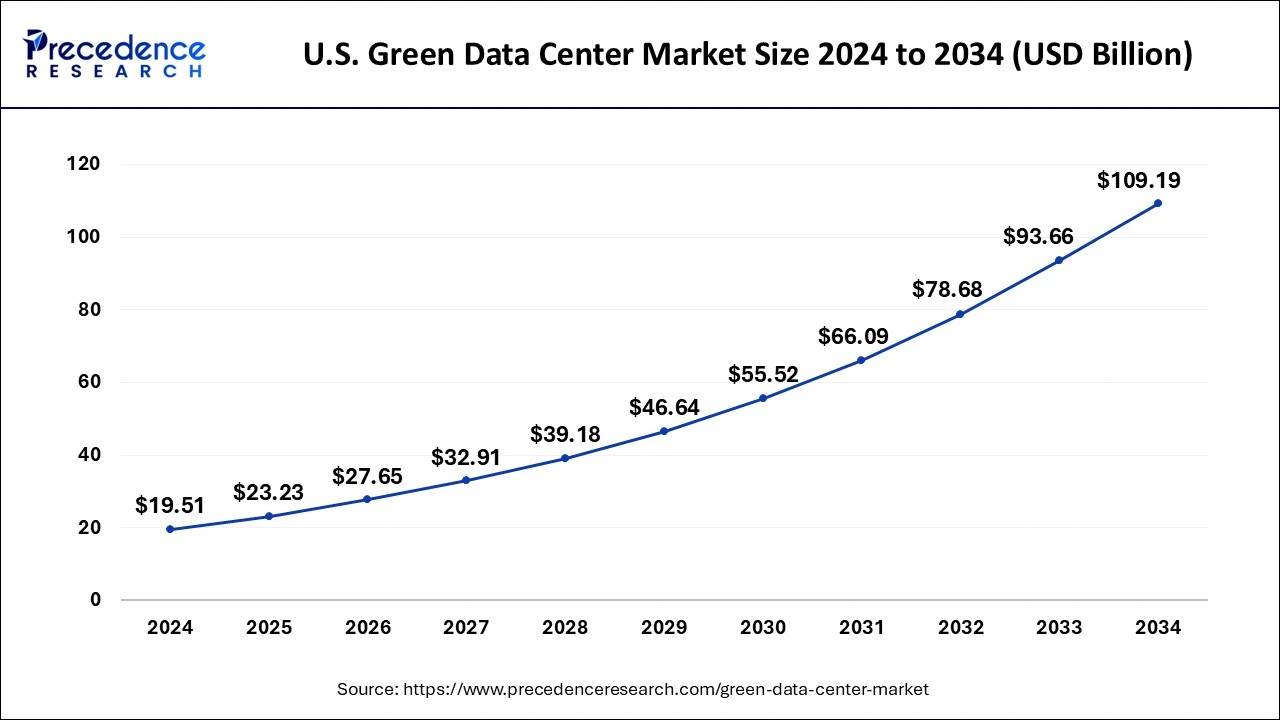

The U.S. green data center market size was valued at USD 23.23 billion in 2025 and is expected to be worth USD 124.35 billion by 2035 with a noteworthy CAGR of 18.27% from 2026 to 2035.

United States green data center market trends

North America held the largest share of the green data center market in 2025. The United States and Canada along with other countries in North America are leading the way in technological developments for green data center infrastructure. This covers advancements in intelligent management techniques, integration of renewable energy sources, and energy-efficient cooling systems. It has made significant investments in the infrastructure of green data centers, bolstered by a strong financial environment and demand for data services. The implementation of green methods is spearheaded by significant tech corporations operating big data centers in the region, such as Google, Amazon, and Microsoft.

The growing adoption of sustainable practices and green technologies increases demand for green data centers. The strong support from a large number of data center operators and IT infrastructures increases demand for green data centers. The strong government regulations and growing investment in renewable energy sources help in the market growth. The availability of AI-powered technology and growing environmental concerns increase demand for green data centers. The presence of major data centers like Microsoft, Google, and Amazon supports the overall growth of the market.

Companies and the public are becoming more conscious of data centers' environmental effects. The increasing emphasis on sustainability in company operations drives demand for green data center solutions.

Asia-Pacific is the fastest-growing in the green data center market during the forecast period. Data centers are increasing due to the region's growing demand for data processing and storage capacity, driven by the region's developing economy and population. By lowering energy usage and running costs over time, green data centers can provide significant cost savings over regular data centers, making them a desirable choice for companies trying to streamline their operations.

Building and running green data centers is one of the more sustainable practices businesses and governments are being forced to use due to increased awareness of environmental issues, including energy usage and climate change.

China green data center market trends

China is a major contributor to the green data centers. The government support for green transformations and growing renewable energy technology increases demand for green data centers. The diverse supply chains and strong manufacturing base of green technologies help in the market growth. The growing development of energy infrastructure like wind & solar farms and strong investment in research & development of green technologies drive the overall growth of the market.

India green data center market trends

The strong government support for green technologies and sustainability initiatives is fueling the adoption of green data centers. The presence of extensive renewable energy sources like wind & solar power increases demand for green data centers. The growing demand for data centers and significant investment in data centers support the overall market growth.

Value Chain Analysis of the Green Data Center Market

- Raw Material & Component Suppliers

This stage involves manufacturers providing energy-efficient IT hardware (servers, storage) and power infrastructure that minimizes PUE (Power Usage Effectiveness).

Key Players: Schneider Electric SE, Vertiv Holdings Co., Eaton Corporation Plc, Dell Technologies Inc., Hewlett Packard Enterprise, Cisco Systems Inc., Legrand SA, Panduit Corp. - Design, Engineering & Sustainable Construction

This stage focuses on designing and building facilities using sustainable materials, with a focus on optimizing location (e.g., using natural cooling) and structural efficiency to minimize the environmental footprint.

Key Players: Turner Construction Company, DPR Construction, Turner & Townsend, and specialized firms like Asetek A/S (cooling design). - Service Providers & Operations

Service providers offer expert consultancy for energy-efficient retrofits, maintenance of liquid/air cooling, and AI-driven predictive maintenance to keep operations running sustainably.

Key Players: Accenture, IBM, NTT Global Data Centers, HCL Technologies, Equinix, Digital Realty.

Green Data Center Market Companies

- ABB Ltd.: ABB provides energy-efficient power distribution systems, high-efficiency motors, and smart variable speed drives (VSDs) that significantly reduce electricity consumption in data center cooling.

- Asetek, Inc.: Asetek is a leader in direct-to-chip (D2C) liquid cooling technology, which enables up to 50% energy savings on cooling by allowing server hardware to operate at higher temperatures.

- Delta Electronics, Inc.: Delta provides energy-efficient power solutions, including uninterruptible power supplies (UPS) with high-efficiency rates and modular power supplies, allowing for better efficiency and less energy waste.

- Digital Realty Trust: As a major REIT, Digital Realty is a leader in green building certifications (LEED, BREEAM), using renewable energy for 100% of its power in over 185 facilities, with a 1.5GW portfolio of contracted wind and solar.

- Cisco Systems, Inc.: Cisco enables green data centers through energy-optimized network hardware and software, including "Data Center Anywhere" initiatives designed to reduce power consumption.

- Dell Technologies, Inc.: Dell provides advanced, energy-efficient server and storage infrastructure engineered for high-performance computing while helping companies reduce operating expenses and carbon emissions.

Other Major Key Players

- Equinix, Inc.

- Fujitsu Ltd.

- General Electric

- Hewlett Packard Enterprise Company

- Huawei Technologies Co., Ltd.

- Hitachi, Ltd.

- International Business Machines Corporation

- Schneider Electric

- Siemens AG

Recent Developments

- In December 2024, Canada proposes $15 billion to boost AI green data centers. The investment prioritizes clean energy solutions to support sustainability for AI growth. The aim of the proposal is to address the AI surging energy requirement, accelerate the development of clean energy in the country, and promote sustainable tech infrastructure.

- In November 2024, Equinix to launch $260M SG6 Green Data Center in Singapore. The new facility provide liquid cooling capability for technologies like AI and covered by renewable energy. The data center supports Smart Nation 2.0 efforts and use of green energy to support sustainability.

- In November 2022, Google has announced it will buy about 75% of the renewable energy generated by four of S.B. Energy Global, LLC's under-development solar projects. With 1.2 gigawatts (G.W.) of capacity, the projects will help Google achieve its goals for sustainable energy and its Texas investment.

Segments Covered in the Report

By Component

- Solution

- Monitoring & Management System

- Cooling System

- Networking System

- Power Systems

- Others

- Services

- Installation & Deployment

- Consulting

- Support & Maintenance

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By End-use

- BFSI

- Retail

- IT & Telecom

- Healthcare

- Manufacturing

- Government & Defense

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting