What is the High Temperature Grease Market Size?

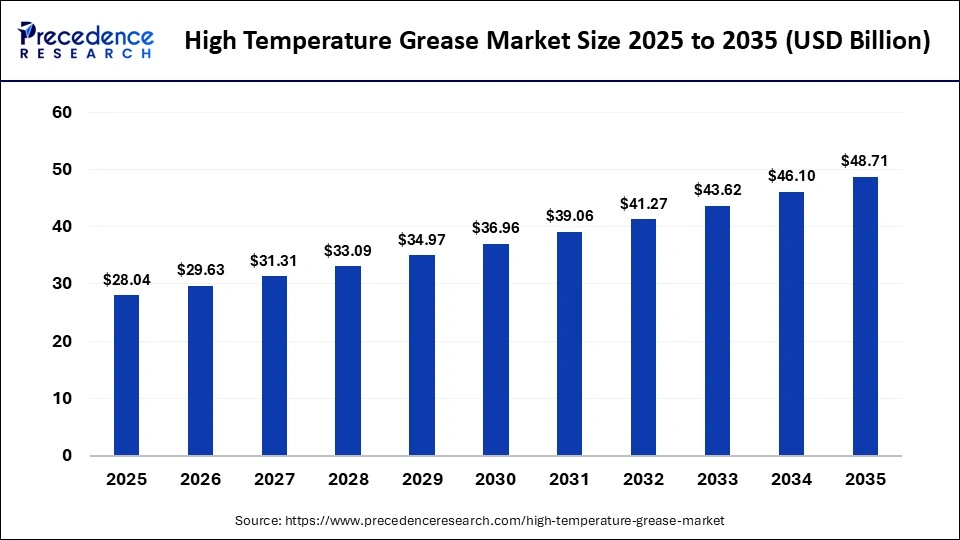

The global high temperature grease market size was calculated at USD 28.04 billion in 2025 and is predicted to increase from USD 29.63 billion in 2026 to approximately USD 48.71 billion by 2035, expanding at a CAGR of 5.68% from 2026 to 2035.The market growth is driven by rising demand for specialty lubricants to facilitate efficient and sustainable heavy duty industrial operations.

Market Highlights

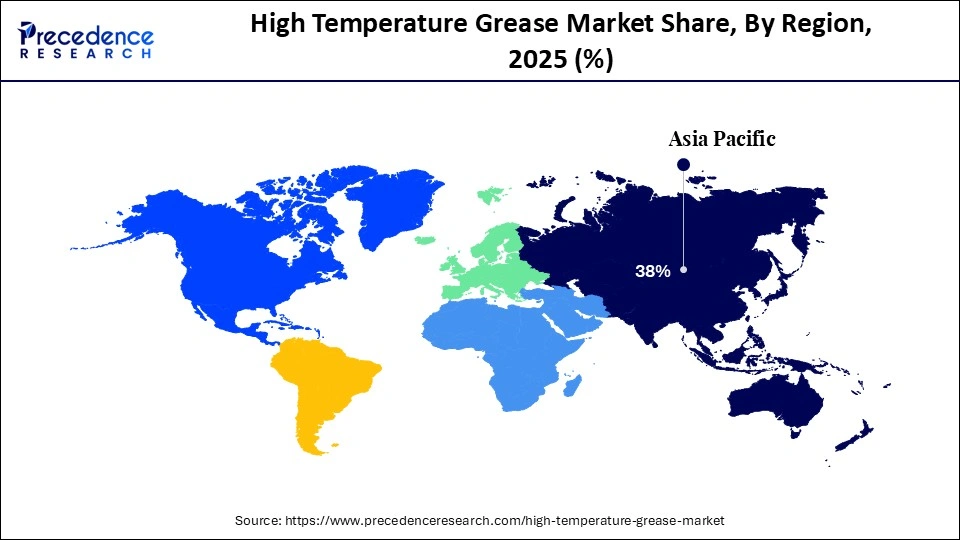

- Asia-Pacific led the high temperature grease market with the largest share of 38% in the global market in 2025.

- North America is expected to be the notably growing region during the forecast period.

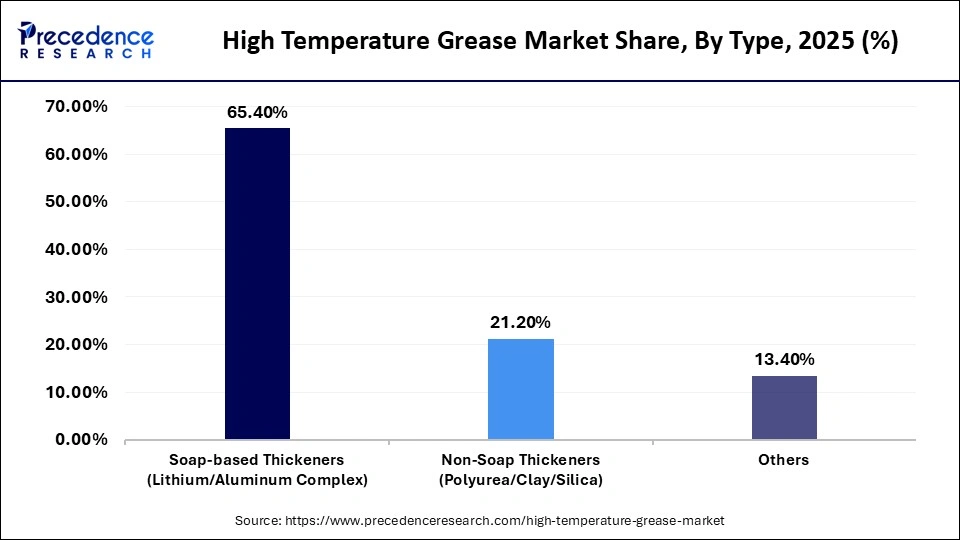

- By type, the soap-based thickeners segment led the market and held approximately 65.4% share in 2025.

- By type, the non-soap thickeners segment is expected to grow at the highest CAGR during the forecast period.

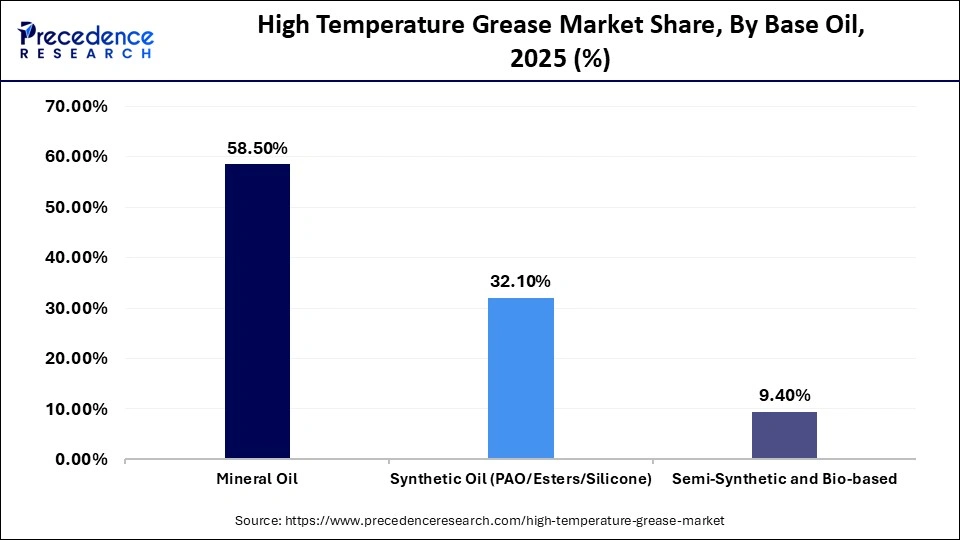

- By base oil type, the mineral oil segment dominated the market with an approximately 58.5% share in 2025.

- By base oil type, the synthetic oil segment expected to grow at the highest CAGR between 2026 and 2035.

- By application type, the automotive segment led the high temperature grease market and captured 42.6% share in 2025.

- By application type, the aerospace and defense segment is expected to expand at the highest CAGR from 2026 to 2035.

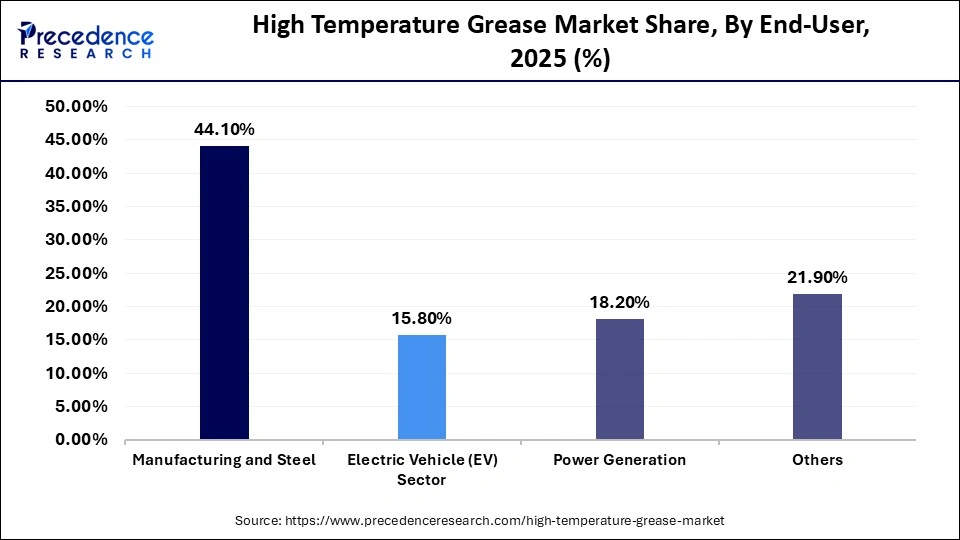

- By end user type, the manufacturing and steel segment led the market and held 44.1% share in 2025.

- By end user type, the electric vehicles (EV) segment is expected to expand at the highest CAGR from 2026 to 2035.

What is the High Temperature Grease Market?

The high temperature grease market involves the development of high performance lubricants that can function effectively at high temperatures and harsh environments. These greases have the ability to retain their consistency and lubricating qualities even at temperatures that are high enough to cause conventional greases to oxidize and lose viscosity. They create a protective layer that resists friction, wear and corrosion in critical machine parts.

The high temperature greases are used in bearings, gears, chains and seals that are subjected to constant heat, heavy loads and high speeds. These greases are valued by industries for their ability to increase equipment life, enhance operational safety and reduce unplanned downtime.

How is AI contributing to the High Temperature Grease Market?

AI is enhancing the high temperature grease market by optimizing formulation and application choices. Machine learning facilitates grease manufacturers to develop greases that can withstand high temperature and machine loads. AI algorithms use performance data to forecast the oxidation, wear and degradation of greases. AI based sensors monitor temperature and equipment conditions in real time. These sensors provide recommendations on the usage of appropriate grease and relubrication duration.

High Temperature Grease Market Trends

- Collaborations & Partnerships: The grease manufacturers are collaborating with each other for development of high performance grease formulations. Such partnerships are aimed at enhancing the thermal stability, oxidation resistance and bearing protection capabilities. For instance, SKF collaborated with ExxonMobil to develop high temperature grease solutions for industrial bearing applications.

- Government Initiatives: Governments are promoting the adoption of high temperature lubricants to achieve better industrial efficiency and safety. Government regulations to save energy are accelerating the adoption of greases which reduce losses and improve equipment reliability. For instance, the U.S government invests in the development of high efficiency industrial lubricants.

- Business Expansions: Companies are expanding their range of products in specialty grease to cater to the growing demand from the steel, cement, power and automotive industries. These companies are investing in the development of synthetic base oils and advanced thickener technologies. For instance, Shell has extended its Gadus high temperature grease range to support several industrial operations.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 28.04Billion |

| Market Size in 2026 | USD 29.63 Billion |

| Market Size by 2035 | USD 48.71Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.68% |

| Dominating Region | Asia-Pacific |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Base Oil , Application , End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insight

Type Insight

Why Did the Soap-Based Thickeners Segment Dominate the High Temperature Grease Market?

The soap-based thickeners segment led the market and held approximately 65.4% share in 2025. The market growth of this segment can be attributed to its ability to strike a balance among heat resistance, cost and reliability. Lithium and lithium-complex soaps have a high drop point and chemical stability. The market growth of this segment is further driven by the compatibility of soap-based thickeners with a wide range of industrial oils resulting in OEM acceptance.

The non-soap thickeners segment is expected to grow at the highest CAGR during the forecast period. The market growth of this segment is due to increasing demand for temperature resistant and long life lubricants. Non-soap thickeners provide enhanced thermal stability, oxidation resistance and relubrication intervals. They are suitable for harsh operating conditions and are being widely adopted in electric vehicles and aerospace industry. The market growth of this segment is further driven by

Base Oil Type Insight

Why Did the Mineral Oil Segment Dominate the High Temperature Grease Market?

The mineral oil segment dominated the market with an approximately 58.5% share in 2025. The market growth of this segment can be attributed to its low cost, availability and proven performance. They have high thermal stability and are compatible with soap thickeners and additives. The manufacturing process is feasible for large volume production and robust global supply chain ensures widespread availability. The market growth of this segment is further driven by its familiarity with OEMs and extensive field adoption.

The synthetic oil segment is growing at the highest CAGR between 2026 and 2035. The market growth of this segment is due to the viscosity and oxidation stability of synthetic oils at high temperatures. The rising emphasis on efficient and low maintenance lubrication leads to accelerated adoption of synthetic oils in industrial operations which involve adverse mechanical conditions. The market growth of this segment is further driven by rapid development of electric vehicles, wind turbines, aerospace industry and high speed machines.

Application Type Insight

Why Did the Automotive Segment Dominate the High Temperature Grease Market?

The automotive segment led the high temperature grease market and captured 42.6% share in 2025. The market growth of this segment can be attributed to rising demand of heavy-duty greases in wheel bearing, CV joints, hubs and braking systems as they are constantly exposed to high temperature and pressure conditions. The market growth of this segment is further driven by high operational temperatures of combustion cycles of modern engines and OEMs preference for high temperature greases.

The aerospace and defense segment is expected to expand at the highest CAGR from 2026 to 2035. The market growth of this segment can be attributed to rising demand for performance and safety in adverse conditions. The mechanical components of aircraft and defense automotives are exposed to severe heat, pressure, vibration and temperature variations. The market growth of this segment is further driven by stringent certification requirements and zero failure tolerance in the aerospace and defense sector.

End User Type Insight

Why Did the Manufacturing and Steel Segment Dominate the High Temperature Grease Market?

The manufacturing and steel segment led the market and held 44.1% share in 2025. The market growth of this segment is due to high demand of specialty lubricants in furnaces, rollers, bearings and conveyors that operate at high temperatures. This creates a need for consistent lubrication of the equipment to prevent downtime. The production process and operating conditions in this segment make high performance lubricants a necessity.

The electric vehicles (EV) segment is expected to expand at the highest CAGR from 2026 to 2035. The market growth of this segment is due to the exposure of mechanical components to high thermal and rotational stresses. High performance greases are required for bearings, e-motors, gearboxes, power electronics and cooling systems. The market growth of this segment is further driven by OEMs emphasis on efficiency, durability optimized maintenance for advanced lubricant formulations.

Regional Insights

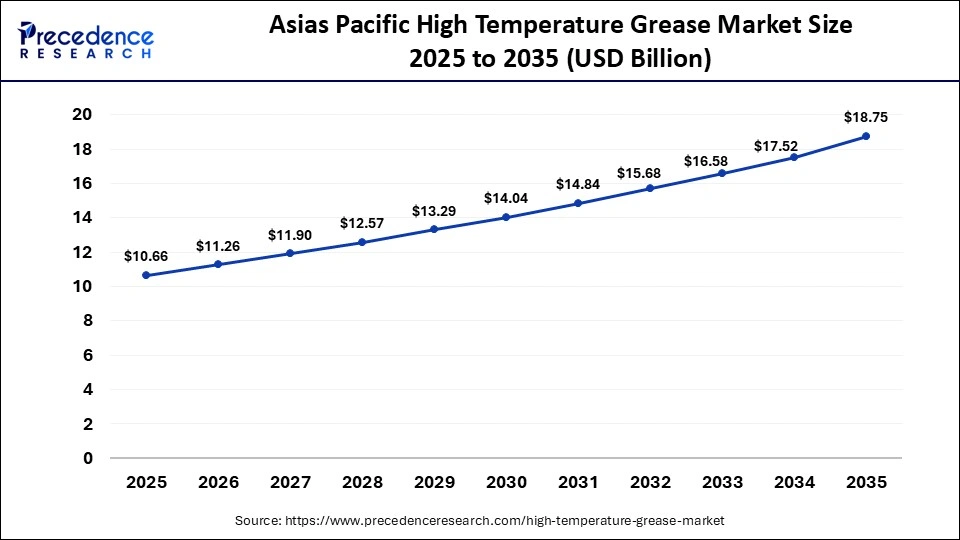

What is the Asia Pacific High Temperature Grease Market Size?

The Asia Pacific high temperature greasemarket size is expected to be worth USD 18.75 billion by 2035, increasing from USD 10.66 billion by 2025, growing at a CAGR of 5.81% from 2026 to 2035.

What Made Asia-Pacific the Leading Region in the High Temperature Grease Market?

Asia-Pacific led the high temperature grease market with the largest share of 38% in the global market in 2025. The market growth of this region can be attributed to its well-developed industrial and manufacturing base. This region has extensive automotive production, steel manufacturing, power generation and heavy equipment base. The market growth in this region is further driven by presence of cost-effective raw materials and prominent grease companies.

China High Temperature Grease Market Analysis

China led the market in Asia Pacific region. The market growth in this country is due to specialty lubricant adoption by industries for manufacturing processes. The industrial components such as furnaces, kilns and rolling mills need to be greased frequently as they operate under extreme mechanical conditions. The market growth in China is further driven by increasing focus on operational efficiency and government initiatives for future sustainability.

Why is  North America the Fastest-Growing Region in the High Temperature Grease Market?

North America is expected to be the fastest growing region during the forecast period. The market growth in this region is due to rising acceptance of advanced and high value industrial technologies. Rapid growth in electric vehicles, aerospace, defense and wind energy sectors is boosting the demand for specialty lubricants. The market growth in this region is further driven by emphasis on operations cost and equipment condition.

U.S High Temperature Grease Market Trends

U.S leads the North American market due to development of high-performance sectors that require advanced technology. This country has well developed aerospace, defense and automotive industry. The high speed and high temperature applications of equipment in these sectors drive the demand for high temperature lubricants. Government initiatives for the adoption of energy efficient and sustainable industrial processes boost the adoption of high-quality greases.

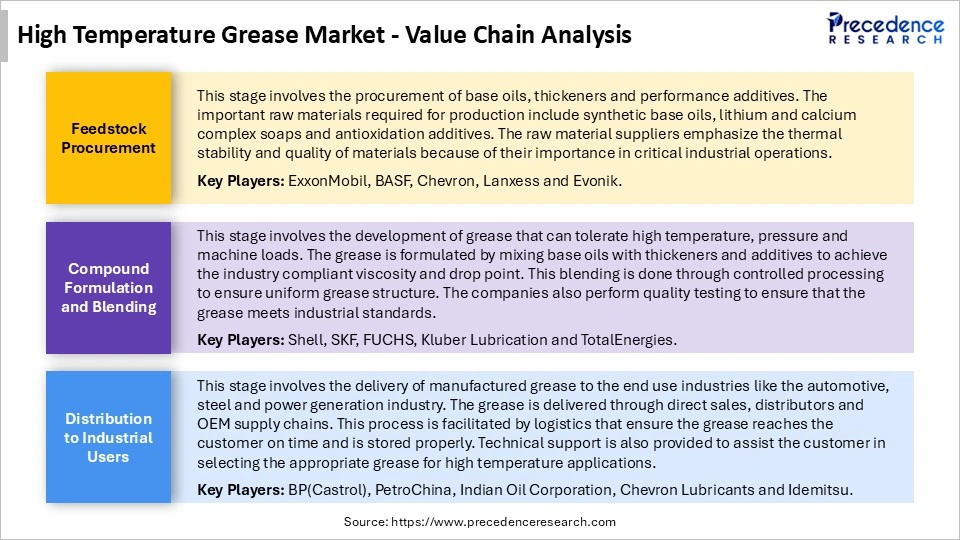

High Temperature Grease Market Value Chain Analysis

Who are the Major Players in the Global High Temperature Grease Market?

The major players in the high temperature grease market include Shell plc, ExxonMobil Corporation, Chevron Corporation, BP p.l.c. (Castrol), TotalEnergies SE, Fuchs Petrolub SE Kluber Lubrication (Freudenberg Group), Sinopec Limited, PetroChina Company Limited, The Dow Chemical Company, SKF Group

High Temperature Grease Market Recent Developments

- In February 2025, Petroking Petroleum Hebei Co. Ltd. launched high-performance high-temperature greases which were designed specifically for use in automotive and industrial equipment. This product enhances the performance and minimizes degradation of heavy-duty machine parts which are constantly exposed to heat and pressure.

- In June 2025, FUCHS Lubricants launched high temperature automotive grease which is specifically designed for electric power steering and automobile transmission systems. This product facilitates low friction and heat resistance for drivetrain components in modern vehicles.

- In September 2025, Lubrizol Corporation launched HybriCal, which is a lithium free grease thickener and provides excellent thermal stability. This product optimizes the power usage in industrial operations and is being widely adopted in various manufacturing applications.

Segments Covered in This Report

By Type

- Soap-based Thickeners (Lithium/Aluminum Complex)

- Non-Soap Thickeners (Polyurea/Clay/Silica)

- Others (Synthetic/PFPE-based)

By Base Oil

- Mineral Oil

- Synthetic Oil (PAO/Esters/Silicone)

- Semi-Synthetic & Bio-based

By Application

- Automotive (Wheel Bearings, Engines, Chassis)

- Industrial Machinery (Steel/Cement/Paper Mills)

- Aerospace & Defense

- Others (Food Processing, Marine)

By End-User

- Manufacturing & Steel

- Electric Vehicle (EV) Sector

- Power Generation

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting