What is the High Throughput Process Development Market Size in 2026?

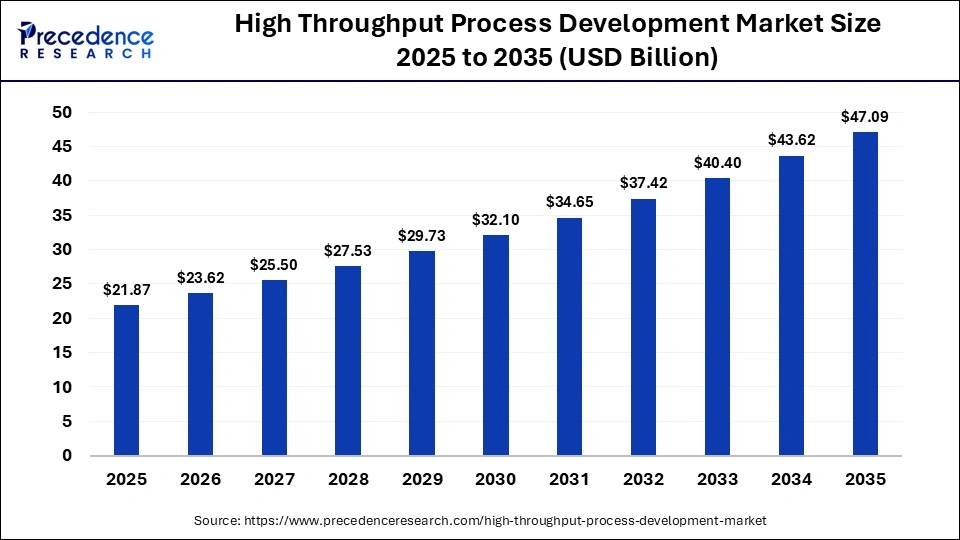

The global high throughput process development market size accounted for USD 21.87 billion in 2025 and is predicted to increase from USD 23.62 billion in 2026 to approximately USD 47.09 billion by 2035, expanding at a CAGR of 7.97% from 2026 to 2035. The growing demand for high-throughput processes in the pharmaceutical sector, along with technological advancements in the materials science industry, is driving the market.

Key Takeaways

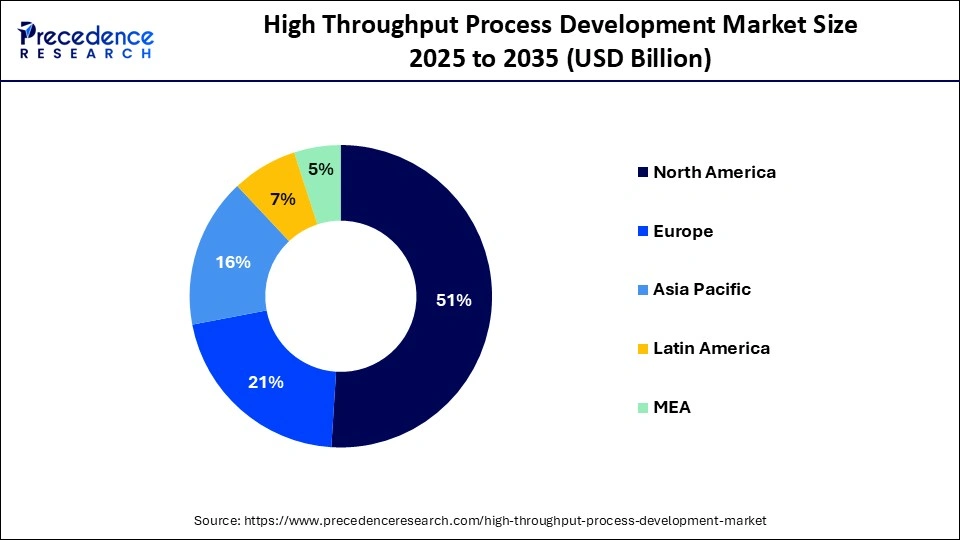

- North America led the market in 2025.

- Asia Pacific is expected to grow with the highest CAGR during the forecast period.

- By technology, the high-throughput experimentation (HTE) segment held the largest share of the market in 2025.

- By technology, the design of experiments (DoE) segment is expected to expand with the highest CAGR during the forecast period.

- By application, the pharmaceutical development segment held the largest share of the market in 2025.

- By application, the biotechnology segment is expected to grow at the highest CAGR between 2026 and 2035.

- By scale, the pilot-scale segment held the highest share of the market in 2025.

- By scale, the micro-scale segment is expected to grow with the fastest CAGR during the forecast period.

- By product format, the batch segment dominated the market in 2025.

- By product format, the continuous segment is expected to grow with the highest CAGR during the forecast period.

Market Overview

The high throughput process development market deals with technologies and platforms that enable rapid, parallel testing and optimization of biopharmaceutical processes, including cell line development, fermentation, and formulation. These systems allow companies to accelerate R&D timelines, reduce costs, and improve reproducibility by simultaneously evaluating multiple conditions. Growing emphasis of pharmaceutical companies on integrating advanced screening tools to enhance drug discovery, as well as the increasing demand for efficient drug development processes, is driving the market. Additionally, the need for efficient, scalable, and data-driven process optimization in the biopharmaceutical industry continues to fuel HTPD adoption.

What is the Significance of AI in the High Throughput Process Development Market?

Artificial intelligence plays a significant role in the market by enabling faster, data-driven decision-making and process optimization. Machine learning algorithms can analyze large datasets from parallel experiments to identify optimal conditions for cell growth, protein expression, and formulation with greater accuracy. AI also helps reduce experimental costs and timelines by predicting outcomes, automating routine analyses, and improving reproducibility.

Nowadays, AI has been integrated into the throughput process development solutions to enhance real-time process optimization, streamlining the DMTA cycle, and improving the downstream process. Overall, the integration of AI enhances efficiency, scalability, and reliability in biopharmaceutical R&D and manufacturing processes.

- In June 2025, ThroughPut.AI launched the Catalyst Program. Catalyst Program is an AI-enabled software offering designed to help businesses by accelerating digital transformation and improving operational optimization.

Major Market Trends

- Product Launches: Numerous companies are engaged in launching a wide range of solutions to cater to the needs of the research labs. For instance, in February 2026, QIAGEN launched QIAsprint Connect. QIAsprint Connect is a high-throughput benchtop sample-prep automation solution that finds numerous applications in research labs.

- Opening New Production Centers: Several pharmaceutical brands are investing rapidly in opening new production units to increase the manufacturing of medicines. For instance, in January 2026, Jubilant Biosys Limited opened a new manufacturing facility in Noida, India. This new production center was inaugurated to enhance drug development capacity in this country.

- Partnerships: Various biopharma companies are partnering with medical technology brands to deploy automation solutions for accelerating drug discovery. For instance, in January 2025, Becton, Dickinson, and Company partnered with Biosero. This partnership aims to integrate automated solutions in the pharma sector to enhance the drug development process.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 21.87 Billion |

| Market Size in 2026 | USD 23.62 Billion |

| Market Size by 2035 | USD 47.09 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 7.97% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Scale, Product Format, Technology, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Technology Insights

Why Did the High-Throughput Experimentation (HTE) Segment Dominate the Market?

The high-throughput experimentation (HTE) segment dominated the high throughput process development market in 2025. This is due to the increased use of high-throughput experimentation (HTE) to discover new catalytic processes, optimize reaction conditions, and screen compound libraries, which are crucial in pharmaceutical development. Additionally, HTE helps in minimizing material usage, reducing development time, and optimizing process chemistry. Moreover, the rapid adoption of HTE technology by material science researchers for developing new materials has boosted the growth of this segment.

The design of experiments (DoE) segment is expected to grow with the highest CAGR during the forecast period. This is mainly due to the rapid adoption of the design of experiments (DoE) by scientists and researchers to optimize products and processes for minimizing development time. Additionally, the increasing use of design of experiments (DoE) in several sectors, such as chemical engineering, manufacturing, and pharmaceuticals, is playing a prominent role in driving the segment. Numerous advantages of the DoE, including cost reduction, identification of interactions, systematic data analysis, and accelerating product development, are expected to propel the growth of this segment.

Application Insights

What Made Pharmaceutical Development the leading Segment in the Market?

The pharmaceutical development segment led the high throughput process development market with the largest share in 2025. This is due to the increased application of design of experiments (DoE) in the pharmaceutical sector to improve formulation development, enhance process optimization, robust testing, and accelerate product discovery. The rapid investment by the pharmaceutical companies in deploying advanced technologies such as AI and ML in their research centers played a prominent role in shaping the segmental landscape. Moreover, collaborations among pharma companies and DOE providers to perform risk assessment and conduct experiments have boosted the growth of this segment.

The biotechnology segment is expected to expand at the highest CAGR between 2026 and 2035. This is due to the increasing adoption of robots and miniature systems in the biotech sector to validate the manufacturing process for cell culture and chromatography. Additionally, numerous government initiatives are aimed at developing the biotechnology sector, and the deployment of automated liquid handling for testing various samples in biotech labs is positively contributing to the growth of this segment. Moreover, the growing application of advanced process control (APC) in the biotech companies to maintain several parameters, such as pH and temperature, is expected to drive segmental growth.

Scale Insights

Why Did the Pilot-Scale Segment Dominate the High Throughput Process Development Market?

The pilot-scale segment dominated the market with a major revenue share in 2025. This is due to the rising use of the pilot-scale throughput development process to connect laboratory-scale research with full-scale commercial manufacturing. Also, numerous benefits of pilot-scale throughput process development, including process optimization, data generation for commercialization, and technology transfer capability, have driven the segmental development.

The micro-scale segment is expected to grow at the fastest CAGR during the forecast period. This is due to the growing use of micro-scale throughput development processes to accelerate drug discovery, reduce material consumption, improve predictive scalability, and enhance safety. Moreover, several benefits of micro-scale throughput process development, such as reduced costs, fast development cycle, efficient data collection, and high sustainability, are expected to propel the growth of this segment.

Product Format Insights

What Made Batch the Leading Segment in the High Throughput Process Development Market?

The batch segment led the market in 2025. This is due to increased use of batch processing solutions in biotech companies for manufacturing various types of biopharmaceuticals such as proteins, vaccines, and monoclonal antibodies. Additionally, its rising application in healthcare data management to process massive data sets for accelerating drug research, along with the surging use of batch processing solutions in the chemical sector to optimize the production of chemicals, is playing a crucial role in shaping the segmental landscape. Moreover, numerous advantages of batch processing solutions, including resource optimization, improving data quality, improving workflow automation, and operational simplicity, have driven the growth of this segment.

The continuous segment is expected to grow with the fastest CAGR during the forecast period. This is due to the increasing adoption of continuous processing solutions in the pharmaceutical industry for improving product efficiency and reducing the production cost of medicines. Additionally, several advantages of these processing solutions, such as high stability, enhanced flexibility, superior efficiency, and high safety, are expected to drive segmental development.

Regional Insights

North America High Throughput Process Development Market Size and Growth 2026 to 2035

The North America high throughput process development market size is estimated at USD11.15 billion in 2025 and is projected to reach approximately USD24.25 billion by 2035, with a 8.08% CAGR from 2026 to 2035.

What Made North America the Dominant region in the High Throughput Process Development Market?

North America dominated the high throughput process development market by capturing the largest share in 2025. The dominance of the region in the market is attributed to the increasing demand for advanced production solutions from the biotechnology sector in the U.S., Canada, and Mexico. The rapid investment by the government in strengthening the biotechnology sector, along with technological advancements in the chemical industry, is playing a crucial role in shaping the industrial landscape. Moreover, continuous product launches and partnerships among various market players, such as Agilent Technologies, Thermo Fisher Scientific, and Danaher Corporation, have driven the growth of the market in this region.

- In January 2026, Agilient launched the S540MD Slide Scanner System. This slide scanner system is integrated with AI to enhance diagnostics workflows in the U.S.

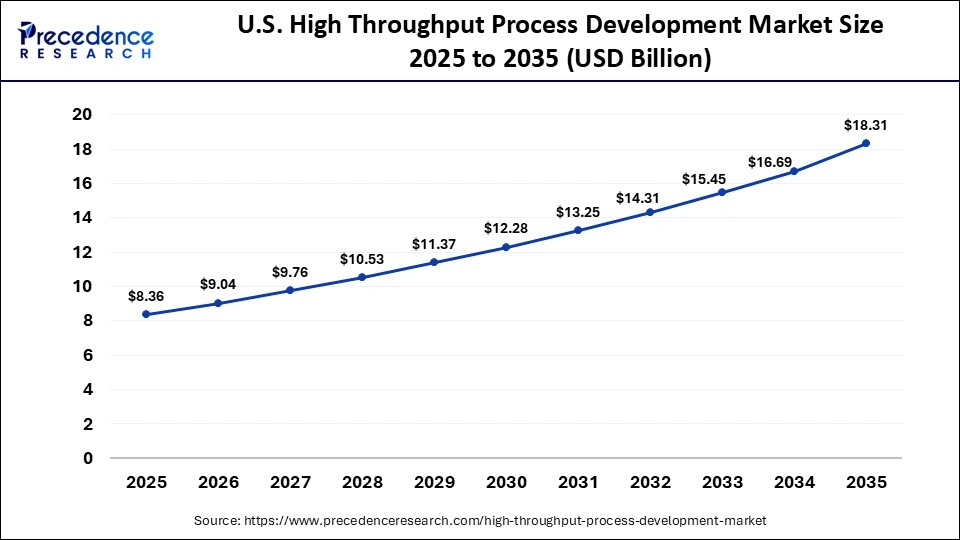

U.S. High Throughput Process Development Market Size and Growth 2026 to 2035

The U.S. high throughput process development market size is calculated at USD 28.36 billion in 2025 and is expected to reach nearly USD 18.31 billion in 2035, accelerating at a strong CAGR of 8.16% between 2026 and 2035.

U.S. High Throughput Process Development Market Trends

The U.S. leads the high throughput process development market within North America. This is due to the rapid investment by pharmaceutical companies in opening new research labs, as well as the rise in the number of biotechnology startups. Moreover, numerous government initiatives aimed at developing the food and beverage industry are positively contributing to the market growth.

Why is Asia Pacific Expanding with the Highest CAGR in the Market?

Asia Pacific is expected to expand with the highest CAGR during the forecast period. This is due to the increasing adoption of advanced process control (APC) solutions by biotech companies in various nations, such as India, China, South Korea, and Japan. Additionally, the increase in the number of pharmaceutical companies, as well as the technological advancements in the biotech industry, is positively contributing to the market. Moreover, innovations and business expansions by various market players, including Wuxi Biologics, Porton Pharma Solutions, and Telstar, are expected to drive the growth of the high throughput process development market in this region.

- In January 2026, WuXi Biologics launched PatroLab. PatroLab is a digital twin platform designed to enhance bioprocess development and manufacturing in the Asia Pacific region.

Japan High Throughput Process Development Market Analysis

Japan is a major contributor to the high throughput process development market in Asia Pacific. This is due to the surging adoption of high-throughput experimentation (HTE) in the chemical sector, as well as the rapid deployment of robots in the food and beverage industry. Additionally, the increasing application of pilot-scale processes in the manufacturing sector is playing a vital role in shaping the industrial landscape.

High Throughput Process Development Market Companies

- Thermo Fisher Scientific (US)

- Agilent Technologies (US)

- PerkinElmer (US)

- Merck KGaA (DE)

- Sartorius AG (DE)

- Bio-Rad Laboratories (US)

- Hamilton Company (US)

- Danaher Corporation (U.S.)

- General Electric Company (U.S.)

- Tecan Group (CH)

- Waters Corporation (US)

Recent Developments

- In February 2026, Fujifilm Biotechnologies unveiled its expanded site in Teesside, UK, backed by a £400 million investment from Fujifilm Corporation, Japan. The expansion includes the UK's largest single-use biopharmaceutical CDMO facility, featuring 2,000 L and 5,000 L bioreactors with up to 19,000 L capacity for small- and mid-scale antibody manufacturing, operational by H1 2026. Additionally, the new Bioprocess Innovation Centre UK (BIC UK) will serve as a global hub for high-throughput and continuous process development, driving biomanufacturing innovation.(Source: https://www.biospectrumasia.com)

- In January 2026, Sysmex America launched CN-9000. It is an automated hemostasis solution that finds application in high-throughput labs.(Source: https://www.labmanager.com)

- In November 2025, Aber Instruments partnered with Sartorius Stedim Biotech. This partnership aims at developing BioPAT Viamass single-use biomass sensor that finds application in throughput single-use bioreactor vessels.(Source: https://www.technologynetworks.com)

Segments Covered in the Report

By Scale

- Micro-scale

- Milli-scale

- Liter-scale

- Pilot-scale

By Product Format

- Batch

- Continuous

- Semi-continuous

By Technology

- High-Throughput Experimentation (HTE)

- Design of Experiments (DoE)

- Advanced Process Control (APC)

- Machine Learning (ML) and Artificial Intelligence (AI)

By Application

- Pharmaceutical Development

- Fine Chemical Synthesis

- Biotechnology

- Food and Beverage Production

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting