HT Supplement (50X) Market Size and Forecast 2025 to 2034

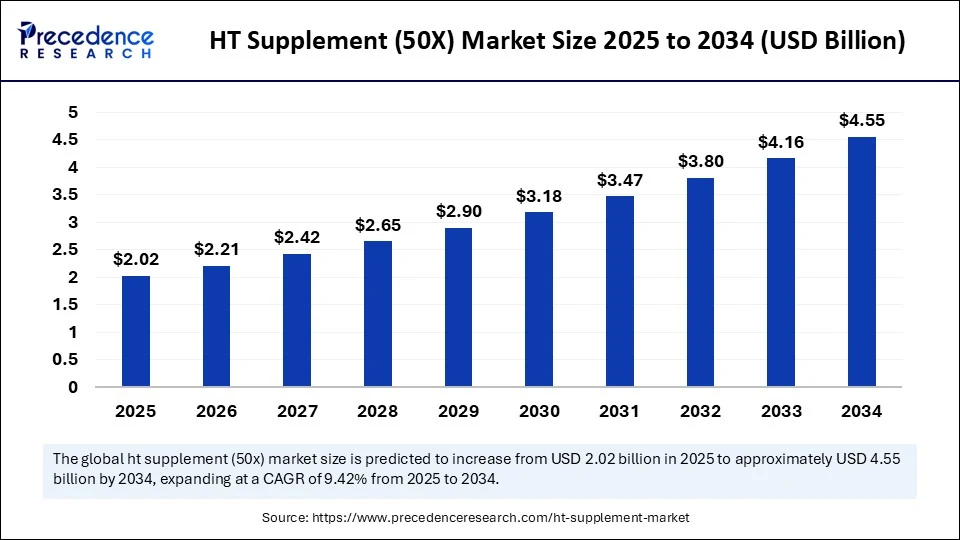

The global HT supplement (50X) market size was calculated at USD 1.85 billion in 2024 and is predicted to increase from USD 2.02 billion in 2025 to approximately USD 4.55 billion by 2034, expanding at a CAGR of 9.42% from 2025 to 2034. The market for HT supplement is growing due to increased interest in biotechnology research and the prior use of cellular science, cell culture, and protein expression, and increased funding in the life sciences sector research, clearly being an area of high growth, use, and demand.

HT Supplement (50X) Market Key Takeaways

- In terms of revenue, the global sodium tetraborate market was valued at USD 1.85 billion in 2024.

- It is projected to reach USD 4.55 billion by 2034.

- The market is expected to grow at a CAGR of 9.42% from 2025 to 2034

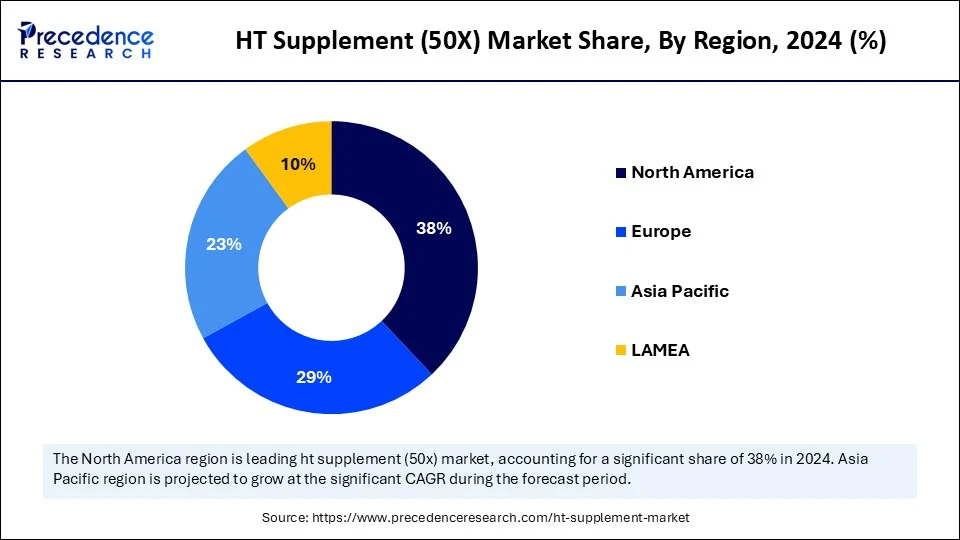

- North America led the HT supplement (50X) market with approximately 38% revenue share in 2024.

- Asia Pacific is estimated to expand at a CAGR between 15.5% from 2025 to 2034.

- By product type, the herbal extracts (50X) segment held the largest market share of 35% in 2024.

- By product type, the vitamin and mineral blends (50X) segment is anticipated to grow at a CAGR of 13.5% between 2025 and 2034.

- By formulation, the capsules segment captured more than 45% of market share in 2024.

- By formulation, the gummies and chewables segment is expected to expand at a CAGR of 18.5% from 2025 to 2034.

- By application, the immune support segment contributed the highest market share of 30% in 2024.

- By application, the cognitive health segment is expected to expand at a CAGR of 16.4% CAGR from 2025 to 2034.

- By end user, the adults (general health and wellness) segment generated more than 50% of market share in 2024.

- By end user, the elderly population segment is expected to expand at a notable CAGR 15% CAGR from 2025 to 2034.

- By distribution channel, the online retail (e-commerce platforms, brand websites) segment accounted for the highest market share of 40% in 2024.

- By distribution channel, the direct selling (MLM and network marketing) segment is expected to expand at a 15. 7% CAGR from 2025 to 2034.

How Emerging Technologies Are Shaping the HT Supplement (50X) Market?

The HT supplement (50X) market continues to develop rapidly through predictive analysis in testing and trials, making them better able to understand product efficacy and safety. Successful stakeholders are using efficient data management and estimation of their market to better inform decisions and variants to optimize growth plans.

The merging of internet of things (IoT) and IIoT technology is giving stakeholders new visibility and awareness, from monitoring production to targeted marketing activities that will improve operational efficiency. Automation and robotics are improving production, storage, and logistics, resulting in lower costs and faster delivery times. All of these technologies have the potential to increase/contribute to a smarter, faster, and more dependable HT supplement (50X) market expansion.

U.S. HT Supplement (50X) Market Size and Growth 2025 to 2034

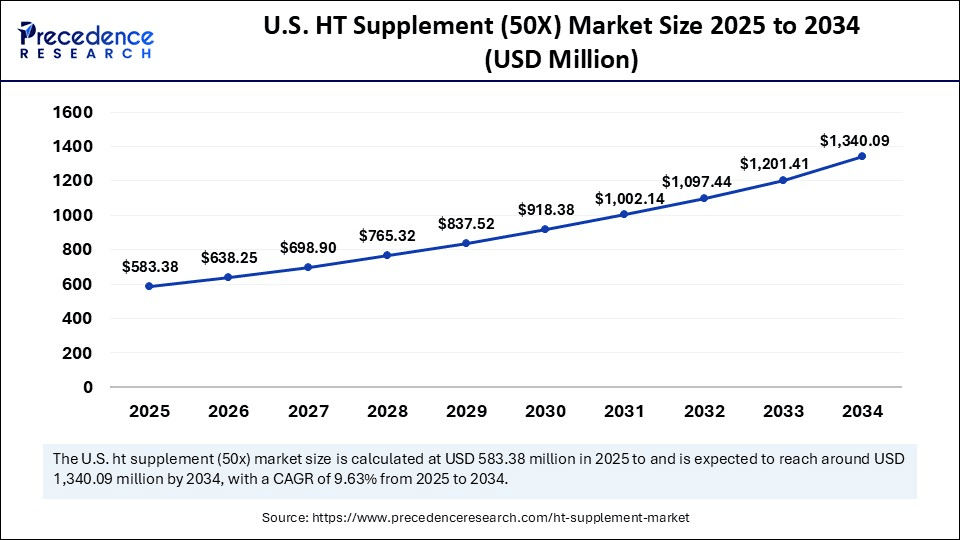

The U.S. HT supplement (50X) market size was evaluated at USD 534.28 million in 2024 and is projected to be worth around USD 1,340.09 million by 2034, growing at a CAGR of 9.63% from 2025 to 2034.

What Led North America to Dominate the HT Supplement (50X) Market In 2024?

North America's leadership in 2024 as opposed to other regions can be attributed to a historical trend towards a mature health-supplement ecosystem, high consumer expenditure on wellness, and existing distribution vehicles such as pharmacies, specialty retailers, and distribution channels like e-commerce. The combination of regulatory clarity and a strong commitment to quality-control standards, along with a desire for reputable manufacturers to invest in product development, clinical assessments, and branding, has provided factors for branded offerings to present as structurally sound. Contract manufacturers, logistics structure, and access to raw materials further entrench the region's leadership in HT supplements.

The macro-economic component in the U.S. is seeing winning characteristics related to scale, conscientious consumerism sophistication, and clusters of innovation webs focused on nutraceuticals. Large domestic retailers' infrastructure, direct-to-consumer ecosystem, and high per-capita spending on preventive health give companies a rapid and tuned response cycle for market reach and product iteration. The ecosystem also provides supporting research institutions and private labs to lend to ingredient validation so firms can focus on efficacy and safety. Moreover, venture funding and the concentration of manufacture around contract manufacturers in the U.S. enable faster product time to market and allow for supply chain continuity.

Asia Pacific is the Fastest-Growing Region in the Market

Asia Pacific is rapidly growing due to rising disposable incomes, growing middle classes, and the accumulation of positive health awareness among urban and peri-urban demographics. Education and trial are hastened through e-commerce penetration and social commerce channels, while younger demographics embrace preventive wellness sooner. Local manufacturers are increasing production rates, decreasing per-unit costs, and improving affordability for products. In addition, cultural familiarity with herbal and supplement traditions reduces acceptance barriers. Taken together, these structural trends create a fertile market landscape for the HT supplement, growing faster than a more mature region.

China's leadership reflects enormous scale, sophisticated e-commerce frameworks, and local manufacturing capacity. There are various routes to market, including cross-border marketplaces and domestic social commerce that provide quick product discovery and viral growth. Strong national distribution logistics help to fulfill orders nationwide. With ingredient sourcing done locally, companies can utilize local contract manufacturers to reduce lead times and costs, enabling domestic brands and international entrants to test and scale quickly. Added to all that is regulatory modernization, increased investment in nutraceutical research, and energetic marketing strategies based on the robust local customer base in China.

Market Overview

The HT supplement (50X) market refers to the global market of highly concentrated dietary supplements, often marketed as "50X" formulations, indicating a potency or concentration 50 times greater than the standard or base formula. These supplements generally contain a blend of vitamins, minerals, herbal extracts, or other bioactive compounds designed to provide enhanced health benefits such as improved metabolism, immune support, cognitive function, or hormonal balance. They are commonly used for targeted therapeutic benefits or general wellness improvement, and are available in various forms like capsules, powders, liquids, or tablets.

HT Supplement (50X) Market Growth Factors

- Health Awareness Increase:The growing attention on preventative health and wellness is increasing the demand for concentrated supplements like HT Supplement (50X), which consumers consistently value for their higher potency, greater effectiveness, and their ability to support consumer health goals over the long term.

- Growing Demand for Personalized Nutrition: Consumers are demanding products that are more personalized to their own health, wellness, and lifestyle goals. This means consumers are increasingly more interested in HT supplement products that are formulated for specific needs, such as immunity, sports performance, or stress management, which align with the growing interest in personalized nutrition.

- Increase in Income and Lifestyle Changes: The rise in disposable incomes and increasingly urban lifestyles has created a demand for premium supplements. Consumers in urban populations that are health conscious are looking for convenience, quality, and concentrated health benefits, and that includes the HT supplement.

- Formulation Innovations: Evolving technologies in extraction and formulation have contributed to the HT supplement being able to deliver a product with greater potency, bioavailability, and safety. The increased trust consumers now have in these products will naturally lead to an increased acceptance of consumption in every consumer's health and wellness regimen.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 4.55 Billion |

| Market Size in 2025 | USD 2.02 Billion |

| Market Size in 2024 | USD 1.85 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.42% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Formulation, Application, End User, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Can the Proliferation of E-Commerce and Direct-to-Consumer Channels Be the Trigger for the HT Supplement (50X) Market?

The emergence of online and direct-to-consumer (DTC) categories is a huge opportunity for the HT supplement (50X) market as it increases product accessibility and the potential for more tailored approaches to reach consumers and customers. In recent years, it has become easier to purchase a range of specialty supplements through online and DTC channels, which offer subscription models, allow customer reviews, and provide on-demand ordering and delivery. This growth coincides with changing consumer behavior as consumers increasingly prefer customized health solutions and transparency.

Brands' ability to reach customers directly, particularly for a specialty product such as the HT supplement, gives them an opportunity to educate the user about specific benefits for using the HT Supplement from RM, such as for cell culture or research applications, while building trust and brand loyalty. As digital commerce maturity becomes more prevalent globally, e-commerce and DTC are likely to be the largest growth catalysts in this product category.

Restraint

Could Undisclosed and Mislabeled Ingredients be a Significant Risk to the Trust of the HT Supplement (50X) Market?

A major limiting factor to the HT supplement (50X) market is the issue of undisclosed, adulterated, or mislabeled ingredients that undermine consumer safety and trust. A 2023 study in JAMA Network Open found that 89% of the dietary supplement labels tested contained errors, and 12% contained substances banned by the FDA anything from intense excitants to unapproved medications.

The FDA has warned about counterfeit supplements that are advertising themselves legally, but are instead containing unreported prescription medications (synthetic steroids in some cases) in sometimes dangerous quantities. These findings create consumer distrust, complicate the regulatory approval processes, and may result in negative health risks, ultimately inhibiting mainstream acceptance and long-term growth of the HT supplement industry.

Opportunity

Can the Expanding Natural and Herbal Health Trend Catapult the HT Supplement (50X) Industry?

A primary opportunity within the HT supplement realm is the increasing global interest in natural and herbal-based health solutions, made even more salient with the increasing prevalence of chronic disease, greater awareness about fitness levels, and a preference for chemically-free nutrition. In a 2024 survey by the Council for Responsible Nutrition released in Nutrition Business Journal, more than three in four U.S. adults regularly consume dietary supplements. 74% of U.S. adults take dietary supplements, and 55 percent qualify as “regular users.”, which points to the widespread adoption of these products.(Source: https://www.crnusa.org)

Additionally, Asia-Pacific countries are seeing an explosion in adoption as more consumers have more disposable income to spend on health products, as fitness culture is rising, etc. The HT supplement (50X) delivers 50× potency levels to support a market that demands effective, convenient wellness solutions. The shift toward plant-derived, high-strength supplements is a perfect opportunity for innovation, functional blends, and access to emerging health-conscious markets around the globe.

Product Type Insight

Which Product is Dominating the HT Supplement (50X) Market?

The ginseng extract sub-segment of the herbal extracts (50X) segment dominated the market in 2024. It has the advantage of being a historic product known for energy, vitality, and general health. The shift toward natural and plant-based ingredients is leading to demand for these products remaining steady in the market.

The vitamin and mineral blends segment is likely to expand quite quickly, particularly the single vitamin 50X formulations. The key factors promoting growth in this segment will be increased consumer interest in nutrition targeted to their specific health challenges (e.g., immunity, bones, skin) and increased personalization of supplementation. The growth of the vitamin and mineral blends segment will also be supported by improvements in formulation technology and increased awareness of the benefits of other micronutrients.

Formulation Insights

Which Formulation Dominates the HT Supplement (50X) Market in 2024?

In the HT supplement (50X) market, the capsules segment captured the largest market share. The increased popularity of capsules is driven by their accurate dose, extended shelf stability, and ease of use in a daily regimen. More specifically, capsules are commonly sought by health individuals looking for convenient and reliable supplementation.

The gummies and chewable segment has quickly capitalized on growth opportunities due to flavour appeal and enjoyment of ingestion, particularly among younger consumers and the elderly. Gummies and chewables are both considered "delicious and functional," encapsulating immune health, cognitive health, and other functional ingredients. Innovation in texture, natural flavouring, gummy-like and sugar-free formulations all have contributed to the growth of these formats, particularly among customers seeking benefits and taste.

Application Insights

Why the Immune Support Segment Dominated the HT Supplement (50X) Market in 2024?

The immune support segment held the largest share of that overall market in 2024 due to a larger consumer emphasis on fortifying the body's natural defences against infection or illness. This segment not only benefits from additional awareness toward immune health after the pandemic, but also from a burgeoning use of specific herbal extracts and vitamin blends.

The cognitive health segment is forecasted to grow the fastest during the forecast period. Rising concerns about people's mental health, memory retention, and age-related cognitive decline support increasing demand for supplements with scientific backing aimed at supporting brain function. Additionally, while familiarity with cognitive support nootropic ingredients and optimal formulations continues to be a novelty in HT segments, this only deepens the potential expansion in this segment.

End User Insights

Which End-User Dominates the HT Supplement (50X) Market in 2024?

In 2024, the adults (general health and wellness) segment led the market share due to increased attention to preventive health and daily nutritional needs. This segment is made up of consumers who have adopted supplements generally with no other health claim or specified conditions, including herbal extracts, vitamins, and minerals. While prepared products, like capsules and tablets, are still preferred, the growing increase of online retailers allows consumers easy access to comparing products and products selling more premium formulations based on a previously chosen health goal, making it less intimidating for consumers to onboard into supplements.

The elderly population segment is expected to experience the fastest growth during the forecast period due to the increased awareness of health-related issues associated with ageing, including hormonal imbalance, lower bone density, and cardiovascular problems. Increased life expectancy and focus on preventive healthcare and active ageing have boosted the adoption of these supplements among the elderly population. Moreover, targeted formulations that are better suited for the elderly are being developed, which further propels demand in this population.

Distribution Channel Insights

Which Distribution Channel Is the Leader in the HT Supplement (50X) Market?

The online retail segment continues to be a thriving opportunity in the HT supplement (50X) market as of 2024 due to increasing internet access, smartphone ownership, and consumers shifting accustomed shopping behaviours toward convenience. Online stores provide consumers with an abundance of offerings, detail descriptions of products including ingredient lists, customer reviews, and competitive prices. Consequently, for many buyers, online platforms are quickly becoming the preferred marketplace. These online marketplaces allow consumers to get new product launches quickly, access deals, and discover new items easily without intimidation from a store management or staff.

The direct selling segment is expected to have the most growth in the market in the upcoming years. The direct selling segment provides individuals with personalized consultations, the ability for trust to be built through face-to-face interactions, and a tailored health choice. The direct selling channel is more conducive to nurturing consumer relations and providing customized product recommendations, both of which can foster loyalty and repeat orders.

HT Supplement (50X) Market Companies

- Herbalife Nutrition

- Amway (Nutrilite)

- GNC Holdings, Inc.

- NOW Foods

- Nature's Bounty

- NutraScience Labs

- Swanson Health Products

- Himalaya Herbal Healthcare

- USANA Health Sciences

- Solgar, Inc.

- Nature's Way

- Yakult Honsha Co., Ltd.

- Garden of Life

Life Extension - Pharmavite LLC (Nature Made)

- BioTechUSA

- ON (Optimum Nutrition)

- Nutrex Hawaii

- Jarrow Formulas

- Herbaland

Segments Covered in the Report

By Product Type

- Herbal Extracts (50X)

- Ginseng Extract

- Turmeric Extract

- Ashwagandha Extract

- Green Tea Extract

- Others (e.g., Gingko Biloba, Echinacea)

- Vitamin and Mineral Blends (50X)

- Multivitamin Complexes

- Single Vitamin (e.g., Vitamin C 50X, Vitamin D 50X)

- Mineral Complexes (e.g., Zinc, Magnesium 50X)

- Amino Acids and Protein Supplements (50X)

- Branched-Chain Amino Acids (BCAAs)

- Collagen Peptides

- Other Protein Concentrates

- Enzyme and Probiotic Supplements (50X)

- Digestive Enzymes

- Probiotic Strains

- Synbiotics

- Others

- Specialty formulations (e.g., Omega-3 50X, Antioxidants)

- Combination Supplements

By Formulation

- Capsules

- Tablets

- Powders

- Liquids and Tonics

- Gummies and Chewables

- Others (e.g., effervescent tablets, sprays

By Application

- Immune Support

- Energy and Metabolism Boost

- Cognitive Health

- Digestive Health

- Anti-Aging and Skin Care

- Hormonal and Reproductive Health

- Joint and Bone Health

- Weight Management

- Others (e.g., cardiovascular support)

By End User

- Adults (General Health and Wellness)

- Athletes and Fitness Enthusiasts

- Elderly Population

- Women (e.g., prenatal supplements, hormonal balance)

- Children and Adolescents

- Others (e.g., specific disease-related supplementation)

By Distribution Channel

- Online Retail (E-commerce platforms, brand websites)

- Pharmacy and Drug Stores

- Health and Wellness Stores

- Supermarkets and Hypermarkets

- Direct Selling (MLM and network marketing)

- Others (specialty clinics, fitness centers)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting