What is the Hybrid Power System Market Size?

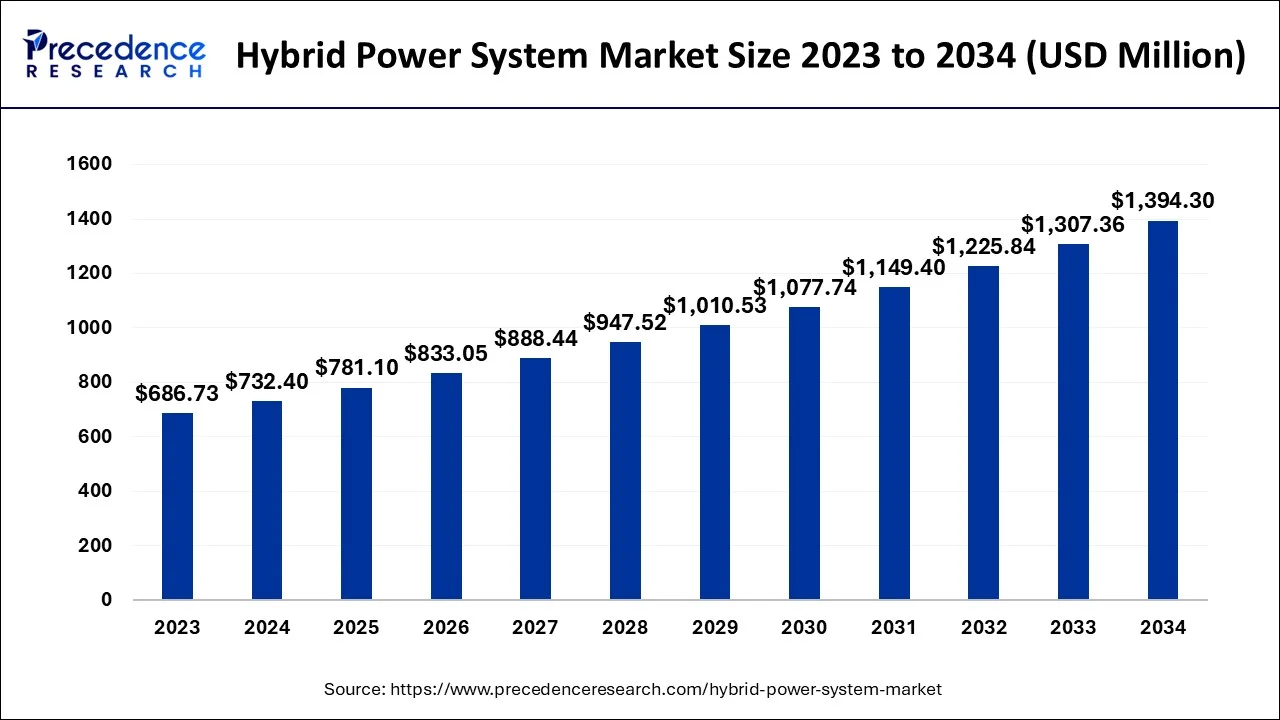

The global hybrid power system market size is calculated at USD 781.10 million in 2025 and is predicted to increase from USD 833.05 million in 2026 to approximately USD 1,477.63 million by 2035, expanding at a CAGR of 6.58% from 2026 to 2035.

Hybrid Power System Market Key Takeaways

- North America dominated hybrid power system market in 2025.

- By type, the solar-diesel segment dominated the market in 2025.

Market Overview

The hybrid power system is a high-efficiency power generating system created for the production and use of energy. The hybrid power system uses many power sources and is independent of the electrical grids. Hybrid power systems are particularly effective when distributing electricity to isolated regions or islands like those in the Pacific or Caribbean that lack grid connectivity.

In contrast to conventional power generating methods, hybrid power generation methods can deal with energy losses and voltage variations. Hybrid power systems are more efficient than conventional ones since they have two power generation systems. During the past ten years, a noticeable worldwide trend has been toward a more sustainable economy. Nowadays, sustainability is more than simply a fad; it is a generally accepted lifestyle change designed to make people and major organizations more responsible for the environment.

Hybrid Power System Market Growth Factors

A rise in hybrid power generation, less fuel generation, and a decrease in carbon emissions are driving demand for hybrid power solutions. Hybrid power systems are also becoming more prevalent as new renewable energy technologies emerge and oil costs increase. Hybrid power systems have become more popular due to the availability of manufacturers and different government incentives. Moreover, the industry is driving the use of hybrid power systems due to cost savings, decreased pollution, and connectivity to other power sources like solar panels.

The market is projected to grow as the need for renewable energy sources develops. Carbon emissions from the electricity industry have increased due to rising energy consumption. The power industry is increasingly using renewable energy technologies like solar PV and wind to reduce the detrimental health effects of carbon emissions. In contrast, a number of variables, such as climate and geographic location, impact the power produced by solar PV and wind-generating systems.

Hybrid power systems assist in overcoming such difficulties by generating steady electricity from a combination of solar and wind power sources. The sector is expected to be driven by the advantages of integrating renewable energy sources with the rising demand for clean energy technologies.

An increasing source of energy, hybrid power solutions are perfect for off-grid or off-the-grid locations, isolated grids, and islands where grid electricity is not an economical or feasible option. Hybrid power systems combine renewable energy sources (wind and sun) with diesel generators for an adequate and reliable power supply. Several residential, commercial, telecommunications, mining, and oil and gas sectors utilize these hybrid power systems.

As a consequence of growing public awareness of renewable energy sources, several companies in the power generation sector are refocusing their attention on sources including wind, solar, fuel cells, and water. This trait bodes well for the future of the hybrid power systems sector.

Elements, including the rise in responsible energy consumption worldwide as a result of industrial development and commercial infrastructure development, are driving the market for hybrid power systems. Additionally, it is expected that the need for hybrid power generation would benefit from the declining cost of solar power generation. Nonetheless, many nations rely on conventional energy-producing technologies for demographic reasons, which is anticipated to restrict market growth throughout the projected period.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 781.10Million |

| Market Size in 2026 | USD 833.05 Million |

| Market Size by 2035 | USD 1,477.63Million |

| Growth Rate from 2023 to 2032 | CAGR of 6.58% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Type and By End-User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Advanced renewable energy technologies

One of the leading market drivers is the ability of hybrid power systems to lower pollution and carbon emissions. Another market driver is reducing the amount of fuel used in the power generation sector. The drive towards more advanced sustainable energy sources is a significant motivator.

For instance, using sustainable renewable energy resources is at the forefront in China and the United States. They are influencing wealthy nations to adopt alternative energy sources, including wind, solar, and hybrid power solutions, under different conditions.

Rise in investments in hybrid power solutions by various governments

High initial expenditures and low switching costs are characteristics of the market for technology-driven hybrid power systems. The demand for and implementation of hybrid power systems has increased in developing countries due to the profusion of component manufacturers and several government incentives.

The construction of these power systems has increased recently due to the grid's instability and lack of access in remote and rural locations. More power firms are concentrating on producing energy from the sun, wind, water, and fuel cells as renewable sources gain popularity. Hybrid power systems are becoming more critical in current edge power generation due to lower carbon emissions and great qualities like a plentiful supply and cost-effectiveness.

A significant factor driving the expected growth of the global hybrid power market is the hybrid power system's ability to produce maximum output while using less fuel.

Restraint:

Several market issues hamper the market growth. High component costs and uneven adoption of hybrid power solutions are a couple of the main problems. While wealthy nations like China and the U.S. have switched to this system recently, many developing and impoverished countries still rely on large-scale hybrid power solutions. The high cost of hybrid power systems components will be addressed in the future to reach parity.

Opportunity:

Although the system is well-known in urban areas, market trends predict that hybrid power solutions will eventually be used in rural areas. Since remote places need constant electrical power delivery, hybrid power solutions are ever more essential. The market's ability to expand into other regions can be made possible by this need. A different choice is to convert to greener fuels and more eco-friendly motor engines. As more well-known automakers switch to hybrid engines, the market's income streams might grow.

Segment Insights

Type Insights

The solar-diesel segment's market share will rise significantly throughout the estimated time. A solar-diesel hybrid power system comprises a solar photovoltaic (PV) system, diesel generator sets, and sophisticated management to ensure solar photovoltaic (PV) system, and sophisticated management to make sure that the amount of solar energy delivered into the systems precisely meets the demand at that particular moment. When the loads are high, the solar PV systems supplement the diesel gensets and provide extra electricity, alleviating the gensets by reducing fuel usage.

End-User Insights

The market for hybrid power systems will be driven by the expanding use of these systems in the residential, commercial, communications, mining, and oil & gas sectors. One of the main areas of use for hybrid power systems is off-grid locations. These are the locations where a grid connection is not necessary to obtain power.

Hybrid power solutions are created to meet the power needs in these areas, which may include telecom towers, industrial buildings, and isolated settlements. An increase in carbon emissions and rising consumer awareness of renewable energy drive the global hybrid power systems market. The global market is booming as a result of the quick uptake of clean energy technologies like solar PV and wind power, as well as the growing awareness of renewable energy sources like solar and wind power.

Regional Insights

What Made North America the Dominant Region in the Hybrid Power System Market?

North America dominated the hybrid power system market with the largest share in 2024. This is due to its strong industrial and commercial sectors, high adoption of renewable energy, and growing demand for energy-efficient solutions. The region benefits from advanced technological infrastructure, government incentives for clean energy, and widespread integration of hybrid systems in transportation, power generation, and microgrid applications. Additionally, increasing focus on reducing carbon emissions and achieving sustainability goals is driving the rapid deployment of hybrid power solutions across North America.

The U.S. is a major contributor to the North American market due to increasing demand for reliable, energy-efficient power solutions across transportation, industrial, and commercial sectors. Additionally, government incentives for renewable energy adoption, rising investments in hybrid and microgrid technologies, and a focus on reducing carbon emissions are accelerating market growth.

What Makes Asia Pacific the Fastest-Growing Region in the Hybrid Power System Market?

Asia Pacific is the fastest-growing region in the market due to rapid industrialization, increasing electrification of transportation, and rising investments in renewable energy infrastructure. Strong government initiatives promoting clean energy, growing energy demand in emerging economies, and the adoption of hybrid systems in remote and off-grid areas are further accelerating market growth.

China is a major contributor to the Asia Pacific hybrid power system market due to its large-scale industrial and transportation sectors, rapid adoption of renewable energy, and strong government support for clean energy initiatives. The country's focus on electrification, energy efficiency, and hybrid microgrid deployment further drives the demand for hybrid power solutions.

How is the Opportunistic Rise of Europe in the Market?

Europe is experiencing an opportunistic rise in the hybrid power system market. This is mainly due to stringent carbon reduction targets, growing renewable energy adoption, and increasing investments in smart grids and energy storage solutions. Additionally, government incentives, technological advancements in hybrid systems, and rising demand for sustainable power in transportation and industrial sectors are driving market growth across the region.

Germany is a major contributor to the European hybrid power system market due to its strong industrial base, ambitious energy transition policies (Energiewende), and leadership in renewable energy adoption. The country's investments in hybrid microgrids, electrified transport, and energy-efficient industrial solutions further drive demand for hybrid power systems.

|

Country / Region |

Regulatory Body |

Key Regulations |

Focus Areas |

Notable Notes |

|

North America |

U.S. EPA; U.S. Department of Energy (DOE); U.S. Department of Transportation (DOT); Environment and Climate Change Canada (ECCC) |

Clean Air Act (vehicle emissions standards, electric vehicle incentives) Canada Clean Fuel Standard |

EV adoption mandates |

Strong federal and state incentives in the U.S. are accelerating EV adoption and grid upgrades; Canada aligns with similar low-carbon transportation policies. |

|

Europe |

European Commission; Directorate-General for Energy (DG ENER); European Environment Agency (EEA) |

Fit-for-55 Package (incl. COâ‚‚ standards for vehicles) |

EV fleet targets |

Europe is aggressively pushing electrification via binding targets for EV sales, rapid deployment of EV chargers, and integration of renewables into grids. Certification schemes and interoperability standards (e.g., CCS/Type 2) are enforced. |

|

Asia Pacific |

China NDRC / NEA / MEE; Japan METI / MOE; India MoP / NITI Aayog; South Korea MoE |

China's New Energy Vehicle (NEV) policies |

EV incentives & subsidies |

China is the world's largest EV market with strong production quotas; India's FAME and state incentives are expanding EV adoption; Japan and Korea emphasize battery technology and electrified transport corridors. |

|

Latin America |

Brazil Ministry of Mines & Energy; Argentina Ministry of Energy; Chile Ministry of Energy |

National EV plans Renewable energy integration policies |

EV infrastructure development |

Latin American countries are early adopters, with Brazil and Chile including EV incentives and grid electrification plans tied to renewable energy goals. |

|

Middle East & Africa |

UAE Ministry of Energy & Infrastructure; Saudi Ministry of Energy; South African DFFE / DoE |

National energy strategies |

Electrification of transport |

Electrification policy is emerging; GCC countries (UAE/Saudi) tie electrification to broader energy diversification and net-zero targets; South Africa includes electrification in Just Energy Transition plans. |

Hybrid Power System Market Companies

- Siemens Energy AG: Siemens Energy provides integrated hybrid power solutions combining renewable sources (solar, wind), energy storage systems, and conventional generation. Its offerings support grid stability, energy optimization, and microgrid applications for industrial, commercial, and utility sectors.

- General Electric (GE) Renewable Energy: GE Renewable Energy delivers hybrid power systems that integrate wind, solar, and energy storage technologies. The company focuses on utility-scale hybrid plants, microgrids, and smart grid solutions that enhance energy reliability and decarbonization.

- Schneider Electric: Schneider Electric offers hybrid power system solutions that combine solar PV, battery storage, and smart energy management platforms. Its systems are widely used in commercial, industrial, and remote electrification projects with a strong emphasis on digital optimization.

- ABB Ltd.: ABB provides hybrid power solutions, including solar, wind, and energy storage integration with advanced power electronics and control systems. The company's offerings are designed to improve energy efficiency, reliability, and grid support in both utility and industrial applications.

- Caterpillar Inc.: Caterpillar integrates renewable sources with gensets and energy storage in its hybrid power systems for remote, industrial, and off-grid operations. Its solutions span microgrids, telecom power, and critical infrastructure, where reliability and fuel savings are key priorities.

Other Major Key Players

- Siemens Energy

- General Electric

- SunWize Power & Battery, LLC

- Aggreko

- Eaton

- Energy Solutions (UK) Ltd.

- Wärtsilä

- UNIPOWER

- MAN Energy Solutions

- Eni

- WindStream Technologies

- Delta Electronics, Inc.

- Huawei Technologies Co., Ltd

- Polar Power Inc.

- Customized Energy Solutions India Pvt Ltd

- Teksan

- Windstrip

Recent Developments

- In December 2025, Pioneer Power Solutions announced the launch of PRYMUS, a gas-powered hybrid mobile power system tailored for the data center and AI sectors.

(Source: datacenterdynamics.com ) - In December 2025, Türkiye achieved a global milestone by successfully operating the world's first hybrid rocket engine in space.

(Source: caspianpost.com ) - In June 2025, Nissan launched third-generation e-POWER technology, which represents a significant evolution of their proprietary "hybrid-like" powertrain, designed to bridge the gap between traditional combustion engines and full battery electric vehicles (EVs).

(Source: global.nissannews.com ) - In December 2022,A memorandum of understanding (MOU) between Vast Solar Pty Ltd. and Sage Geosystems Inc. was made public to assess global opportunities for integrating long-duration energy storage (ES) and concentrated solar power (CSP) generation to produce clean, dispatchable baseload electricity.

- In November 2022, The agreement between Redington Limited and Enertech, a manufacturer of solar inverters, is intended to meet India's growing need for solar hybrid inverters. Redington Ltd is a well-known provider of IT solutions. This cooperation will use Redington's extensive national distribution network and Enertech's manufacturing experience in solar solutions to increase sales and after-sales support for Solar Hybrid Inverters.

- In February 2022, Two hundred fifty workers are working at the new Renewable Hybrids facility in Vallam, close to Chennai, India, which was just opened by GE Renewable Energy.

- In July 2021, The first megawatt-scale hybrid energy storage system for a solar-powered microgrid in India has been delivered, according to battery maker Vision Mechatronics Pvt Ltd.

- In July 2019, Controllis introduced a new hybrid power unit called Smart-48. The hybrid power unit is anticipated to help mobile and telecom providers reduce their carbon footprint and fuel expenditures.

- In January 2019, A state in India has made plans to build 18GW worth of solar, wind, and solar-wind hybrid power facilities by 2022. The state is focused on aiming for US$ 40 billion in investments for renewable capacity in the following ten years.

Segments Covered in the Report:

By Type

- Solar PV-Diesel

- Wind-Diesel

- Others

By End-User

- Residential

- Commercial

- Industrial

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting