What is the Hydro-Pump Storage Plants Market Size?

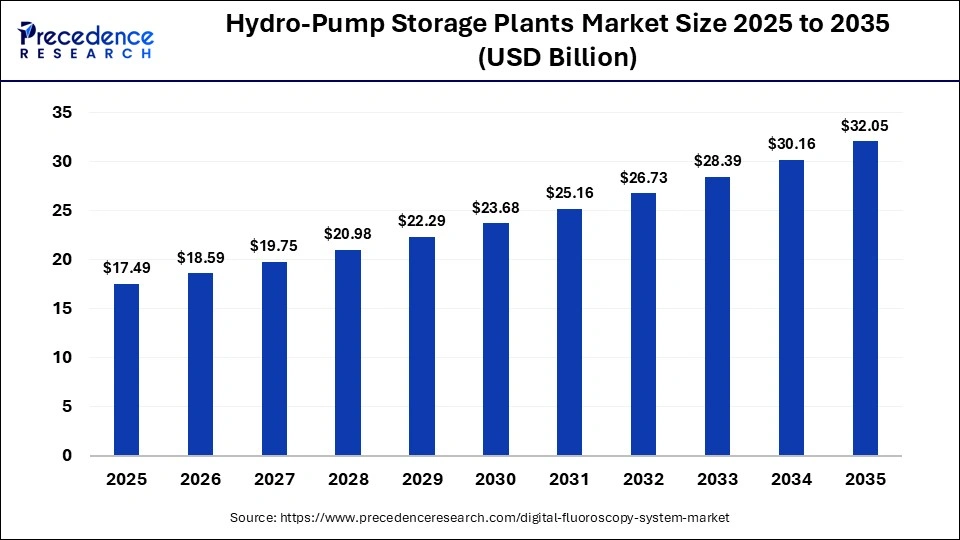

The global hydro-pump storage plants market size was calculated at USD 17.49 billion in 2025 and is predicted to increase from USD 18.59 billion in 2026 to approximately USD 32.05 billion by 2035, expanding at a CAGR of 6.24% from 2026 to 2035. The hydro-pump storage plants market is boosted by the growing adoption of clean energy sources by the grid operators, as well as the technological advancements in the hydropower generation sector.

Hydro-Pump Storage Plants Market Key Takeaways

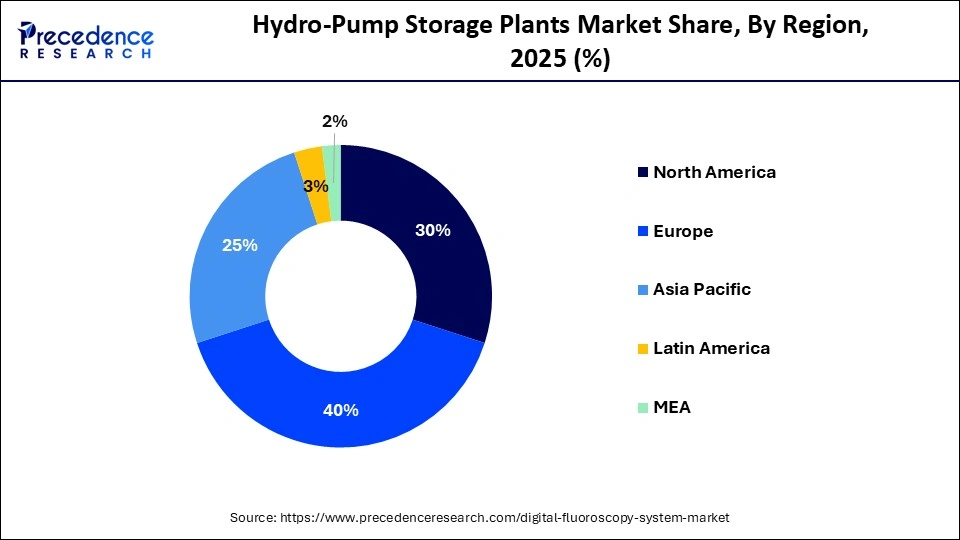

- Europe dominated the hydro-pump storage plants market, holding the largest market share of 40% in 2025.

- The Asia Pacific is expected to grow at the fastest CAGR of 6.5% from 2026 to 2035.

- By system type, the open-loop segment held the largest market share of 55% in 2025.

- By system type, the closed-loop segment is growing at a CAGR of 5.5% between 2026 and 2035.

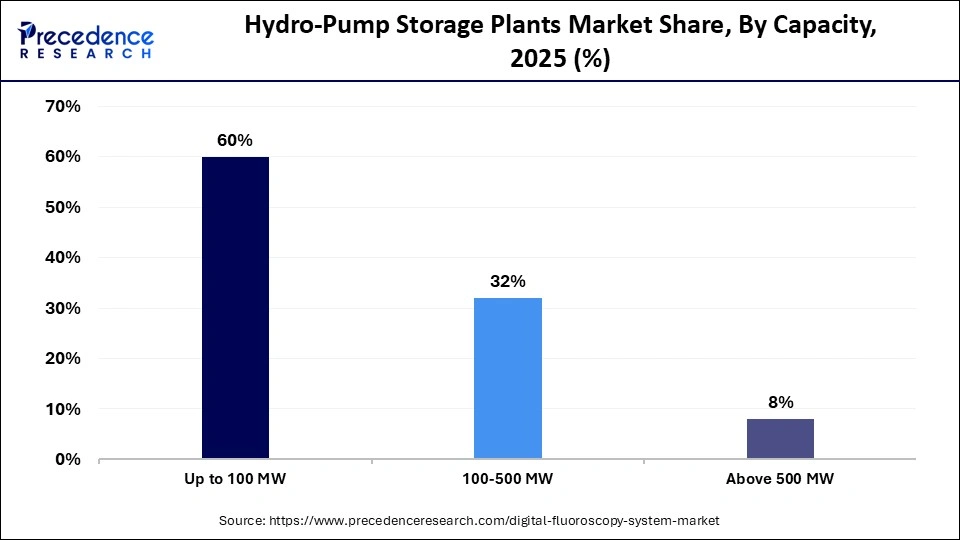

- By capacity, the up to 100 MW segment contributed the highest market share of 60% in 2025.

- By capacity, the above 500 MW segment is poised to grow at a CAGR of 5.7% between 2026 and 2035.

- By application, the grid stability segment generated the biggest market share of 40% in the industry.

- By application, the renewable integration segment is growing at a CAGR of 5.5% between 2026 and 2035.

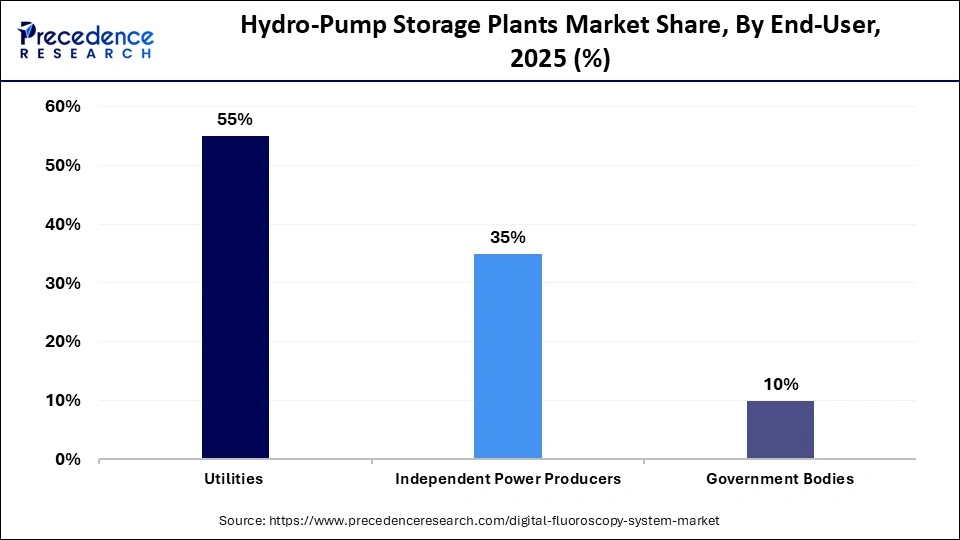

- By end-user, the utilities segment dominated the market with a share of 55% during 2025.

- By end-user, the government bodies segment is expected to grow at a CAGR of 5.6% between 2026 and 2035.

What is the Significance of Hydro-Pump Storage Plants?

The hydro-pump storage plants act as large storage centers that store excess electricity from various sources, including solar and wind. There are different types of PSHP comprising open-loop storage plants, closed-loop storage plants, and pump-back storage plants. These plants come with several capacities consisting of up to 100 MW, 100–500 MW, and above 500 MW. It finds applications in grid stability, renewable integration, peak load management, and ancillary services. The end-users of these plants comprise utilities, independent power producers, and government bodies.

Hydro-Pump Storage Plants Market Trends

- Partnerships: Several market players are partnering with grid operators to construct new energy storage plants in different parts of the world. For instance, in August 2025, Echogen partnered with Westinghouse. This partnership is aimed at constructing a grid-scale pumped thermal energy storage (PTES) facility in Europe.

(Source: ess-news.com) - Government Investments:The governments of several countries, such as Germany, China, the UAE, Spain, and Argentina, are investing heavily to increase the adoption of clean energy sources. For instance, in January 2026, Spain's Ministry for Ecological Transition and the Demographic Challenge (MITECO) announced an investment of 90 million euros. This investment is aimed at accelerating the pumped-storage hydroelectric projects in this nation.

(Source: pv-magazine.com) - Proliferation of Startups:Numerous startup brands are engaged in research and development of clean energy solutions across the globe. For instance, in October 2025, Sizable Energy raised around US$8 million. This funding will be used for launching an ocean-based energy storage system in the Mediterranean Sea.

(Source: businesswire.com)

What is the Role of AI in the Hydro-Pump Storage Plants Market?

The advancements in AI are integral to the development of the energy sector. Nowadays, the hydrogen-pump storage plants have started integrating AI to optimize operations by using machine learning for predictive maintenance, monitoring real-time energy dispatch, and enhancing efficient water management. Additionally, the deployment of AI in hydrogen storage plants helps in enhancing safety and improving grid balancing. Thus, AI has played an integral role in shaping the hydrogen-pump storage plants market positively.

- In December 2025, Husk launched an AI-based distributed energy resources platform. This platform is designed to enhance resource distribution according to the requirements of the end-users globally by 2030. (Source: renewablewatch.in)

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 17.49 Billion |

| Market Size in 2026 | USD 18.59 Billion |

| Market Size by 2035 | USD 32.05 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 6.24% |

| Dominating Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | System Type, Capacity, Application, End User and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Analysis

System Type Insights

Why Did the Open-Loop Segment Dominate the Hydro-Pump Storage Plants Market?

The open-loop segment dominated the hydro-pump storage plants market with a share of 55% in 2025. The increasing usage of open-loop hydro-storage plants for enhancing grid balancing and improving energy storage capabilities has boosted the market expansion. Also, numerous advantages of these systems, including cost-effectiveness, long asset life, less maintenance, and enhanced flexibility, are expected to boost the growth of the hydro-pump storage plants industry.

The closed-loop segment is expected to expand at a CAGR of 5.5% between 2026 and 2035. The growing application of closed-loop hydro pump storage plants for improving renewable integration and enhancing water management has driven the market growth. Moreover, several benefits of these storage systems, such as water efficiency, eco-friendliness, economic advantages, and large-scale energy storage, are expected to drive the growth of the hydro-pump storage plants market.

Capacity Insights

What Made the Up to 100 MW Segment Lead the Hydro-Pump Storage Plants Industry?

The up to 100 MW segment leads the hydro-pump storage industry with a share of 60% in 2025 due to the surging use of 100 MW pumped hydro storage plants for providing grid stability and enhancing frequency regulation, which has driven the market expansion. Additionally, the rapid investment by the governments of several countries, including the U.S., Germany, Qatar, and Argentina, to construct 100 MW storage plants is expected to propel the growth of the hydro-pump storage market.

The above 500 MW segment is expected to rise at a significant CAGR of 5.7% between 2026 and 2035. The growing investment by electricity providers in constructing 500 MW pumped hydro storage (PHS) plants to enhance grid stability has boosted the market growth. Moreover, numerous government initiatives aimed at enhancing the adoption of clean energy sources across the industrial sector are expected to foster the growth of the hydro-pump storage market.

Application Insights

Why Did the Grid Stability Segment Hold the Largest Share of the Hydro-Pump Storage Plants Market?

The grid stability segment held the largest share of the hydro-pump storage plants market with 40%, as the growing use of pumped hydro storage plants for enhancing grid stability has boosted the market expansion. Additionally, numerous functions of these storage systems in the grid sector, including energy balancing, frequency and voltage control, peak shaving, and voltage control, are positively contributing to the industry. Moreover, the rapid deployment of AI-based solutions by the electricity providers to enhance grid stability monitoring applications is expected to propel the growth of the hydro-pump storage plants market.

The renewable integration segment is expected to expand at a considerable CAGR of 5.5% between 2026 and 2035. The surging application of hydro-pump storage plants in renewable integration due to their black start capability has driven the market growth. Additionally, numerous government initiatives aimed at developing the renewable energy sector, coupled with the rapid investment by energy companies for implementing advanced technologies to store clean energy, are playing a crucial role in shaping the industrial landscape. Moreover, the ability of pumped hydro storage to integrate with solar and wind farms for deriving renewable energy is expected to drive the growth of the hydro-pump storage plants market.

End-User Insights

Why Did the Utilities Segment Lead the Hydro-Pump Storage Plants Market in 2025?

The utilities segment leads the hydro-pump storage plants market with a share of 55% during 2025. The increasing use of pumped hydro storage plants in the utilities sector for storing electricity from clean sources to ensure grid stability has boosted the market growth. Also, the growing investment by the electricity providers for constructing pumped storage plants to cater to end-users is positively contributing to the industry. Moreover, technological advancements in the utilities sector to streamline ancillary services are expected to accelerate the growth of the hydro-pump storage plants market.

The government bodies segment is expected to rise at a notable CAGR of 5.6% between 2026 and 2035. The growing focus of governments across several nations, such as China, Germany, Qatar, Canada, and Norway, towards adopting clean energy has driven the market expansion. Additionally, the rapid investment by governmental organizations for building new pumped storage plants in different regions is playing a prominent role in shaping the industrial landscape. Moreover, collaborations among government bodies and market players for constructing open-loop storage systems are expected to drive the growth of the hydro-pump storage plants market.

Regional Insights

How Big is the Europe Hydro-Pump Storage Plants Market Size?

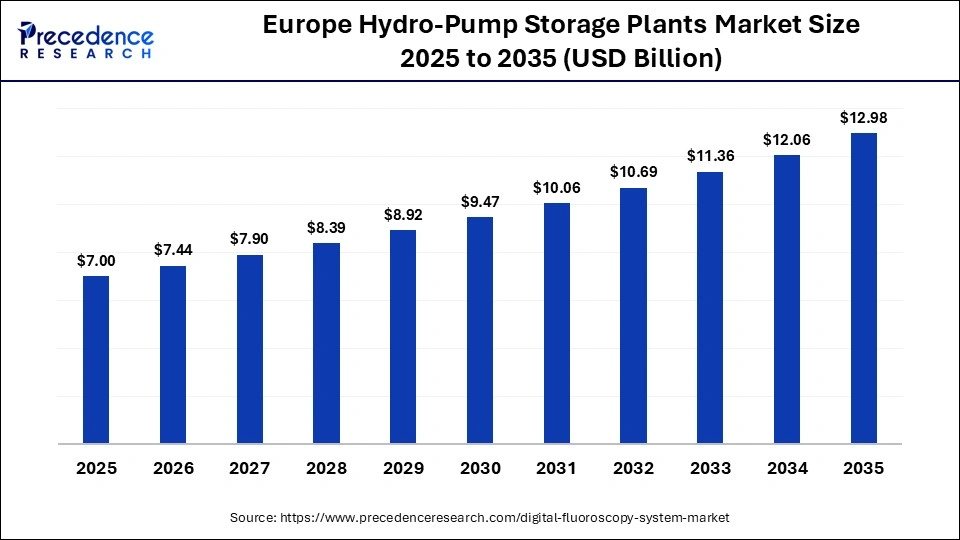

The Europe hydro-pump storage plants market size is estimated at USD 7.00 billion in 2025 and is projected to reach approximately USD 12.98 billion by 2035, with a 6.37% CAGR from 2026 to 2035.

Why Did Europe Dominate the Hydro-Pump Storage Plants Market in 2025?

Europe dominated the hydro-pump storage plants market with a share of 40% in 2025. The increasing demand for high-quality auxiliary transformers from the power generation sectors across several nations, including Germany, France, Italy, the UK, and Norway, has boosted the market expansion. Additionally, numerous government initiatives for deploying clean energy sources in the industrial sector, as well as the rapid investment by energy companies for opening new storage plants, are positively contributing to the industry. Moreover, the presence of various market players such as Voith Hydro, Eurelectric, Siemens Energy, and RusHydro is expected to propel the growth of the hydro-pump storage plants market in this region.

- In September 2025, Eurelectric joined hands with the International Hydropower Association (IHA). This joint venture is done to accelerate the deployment of pumped storage hydropower (PSH) plants in different parts of Europe. (Source: waterpowermagazine.com)

Germany Hydro-Pump Storage Plants Market Analysis

The increasing focus of heavy industries on using renewable energy in their manufacturing plants to lower emissions has driven the market expansion. Also, partnerships among energy companies and the government for constructing new hydrogen storage plants, as well as technological advancements in the energy sector, are playing a prominent role in shaping the industrial landscape.

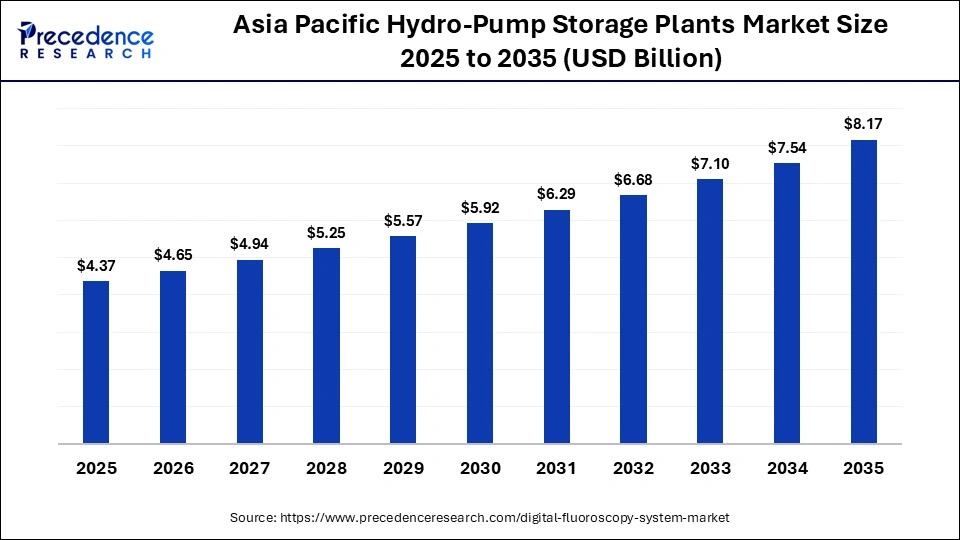

What is the Asia Pacific Hydro-Pump Storage Plants Market Size?

The Asia Pacific hydro-pump storage plants market size is estimated at USD 4.37 billion in 2025 and is projected to reach approximately USD 8.17 billion by 2035, with a 6.50% CAGR from 2026 to 2035.

Why Is Asia Pacific Undergoing the Fastest Growth in the Hydro-Pump Storage Plants Market?

Asia Pacific is expected to expand at the fastest CAGR of 6.5% during the forecast period. The growing focus of government organizations to construct new storage plants for delivering clean energy sources to the residential sector has boosted the market expansion. Additionally, the surging emphasis of electricity providers to enhance grid management capabilities in several countries, such as China, India, Japan, South Korea, and Australia, is contributing to the industrial landscape. Moreover, the presence of various market players, including Hitachi Energy, China Gezhouba Group, Toshiba Hydro Power, Bharat Heavy Electricals Ltd, and Kawasaki Heavy Industries, is expected to accelerate the growth of the hydro-pump storage plants market in this region.

- In May 2025, Toshiba Hydro Power deployed a new range of hydropower generation equipment at the Ninghai Pumped-Storage Power Plant in Zhejiang, China. The equipment includes four 350MW hydro turbines and related balance-of-plant (BOP) systems.

(Source: global.toshiba)

China Hydro-Pump Storage Plants Market Trends

The growing development in the energy production sector, along with the rapid deployment of variable-speed reversible pump-turbines in the hydropower plants for generating maximum clean energy, has driven the market expansion. Moreover, the surging investment by the market players for constructing hydro-pump storage plants in different parts of this nation is playing a crucial role in shaping the industrial landscape.

Who are the Major Players Operating in the Hydro-Pump Storage Plants Market?

The major players operating in the hydro-pump storage plants market are Voith Hydro GmbH & Co. KGaA, General Electric Company (GE Renewable Energy), Siemens AG, Alstom SA, ABB Ltd., Andritz AG, Toshiba Energy Systems & Solutions Corporation, Hitachi Mitsubishi Hydro Corporation, Iberdrola SA, Enel Green Power S.p.A., Duke Energy Corporation, EDF Renewables / Electricité de France SA, RusHydro, Statkraft AS, and NextEra Energy, Inc.

Recent Developments

- In November 2025, Hydro invested around NOK 1.2 billion. This investment is made for building a pumped storage power plant in Illvatn, Norway. (Source: hydro.com)

- In June 2025, GE Vernova deployed a 250-megawatt (MW) variable speed unit in the Tehri pumped storage hydropower plant. The Tehri Hydropower Complex is expected to become the largest hydropower plant in India, capable of generating 2.4 GW capacity.

(Source: gevernova.com) - In February 2025, Adani Green Energy announced the opening of a 1,250 MW pumped hydro energy storage (PHES) plant in Uttar Pradesh, India. This plant will be developed completely by 2030.

(Source: energy-storage.news)

Segments Covered in the Report

By System Type

- Open-Loop

- Closed-Loop

- Pump Back/Open Variants

By Capacity

- Up to 100 MW

- 100-500 MW

- Above 500 MW

By Application

- Grid Stability

- Renewable Integration

- Peak Load Management

- Ancillary Services

By End-User

- Utilities

- Independent Power Producers

- Government Bodies

By Region

- North America

- U.S.

- Canada

- Mexico

- Rest of North America

- Latin America

- Brazil

- Argentina

- Rest of South America

Europe

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

MEA

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting