What is the Hyperscale Cloud Market Size?

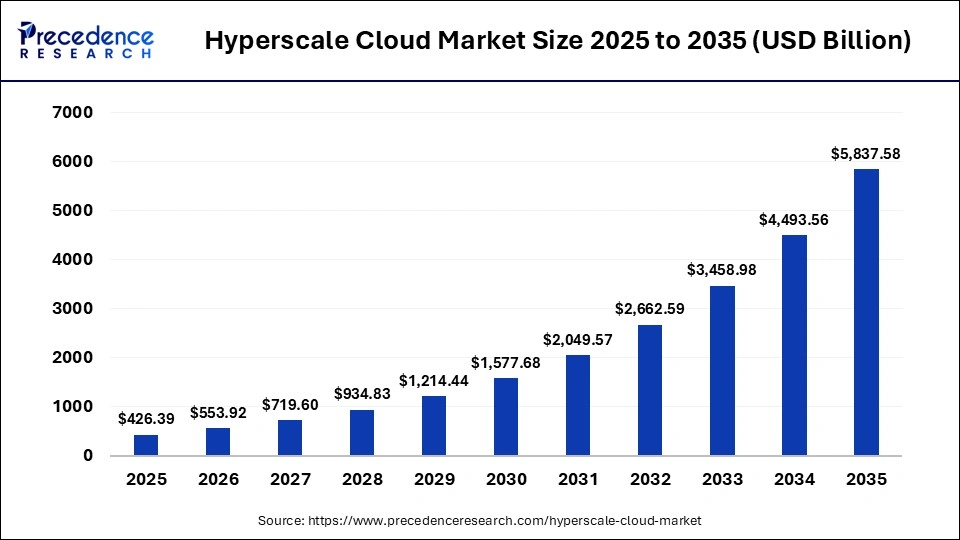

The global hyperscale cloud market size was calculated at USD 426.39 billion in 2025 and is predicted to increase from USD 553.92 billion in 2026 to approximately USD 5,837.58 billion by 2035, expanding at a CAGR of 29.91% from 2026 to 2035. The market is driven by demand for massive scalability, cost efficiency, and data-intensive workloads.

Market Highlights

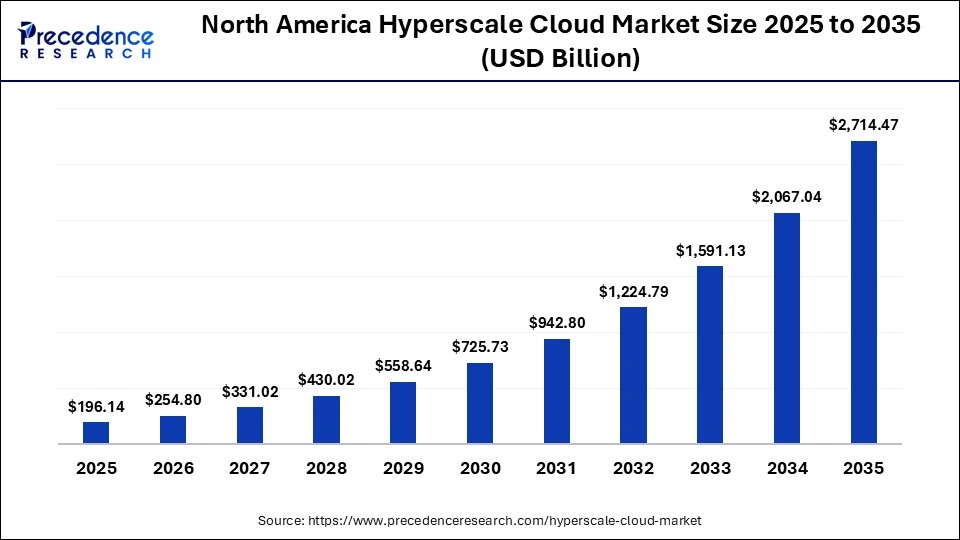

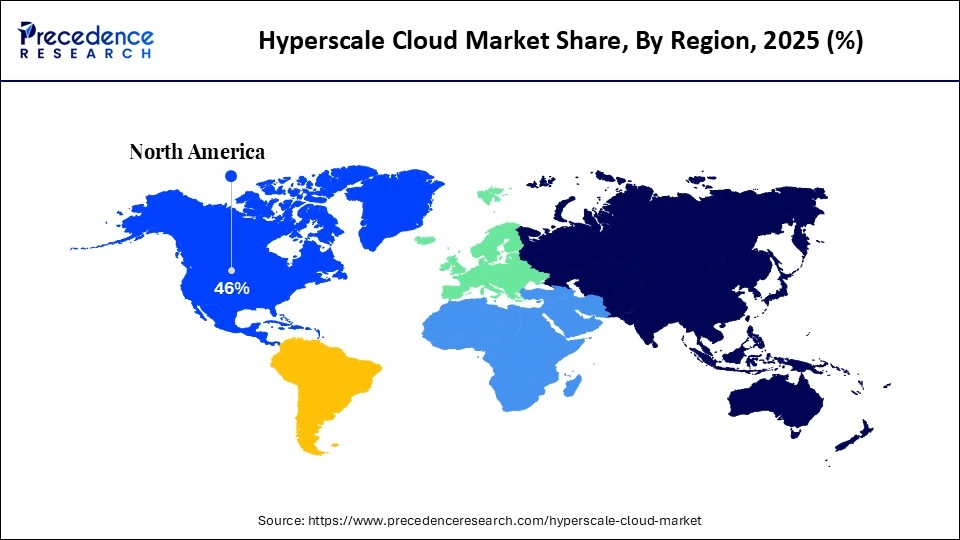

- North America dominated the global market with the largest market share of 46% in 2025.

- The Asia Pacific is expected to grow at the fastest CAGR between 2026 and 2035.

- By enterprise type, the large enterprises segment dominated the market in 2025.

- By enterprise type, the small & medium enterprises segment is expected to expand at the fastest CAGR in the upcoming period.

- By application, the cloud computing segment dominated the market in 2025.

- By application, the big data analytics segment is expected to grow at the fastest rate during the projection period.

- By industry, the IT & telecom segment dominated the market in 2025.

- By industry, the e-commerce & retail segment is expected to grow at the highest CAGR in the coming years.

Market Overview

The hyperscale cloud market is experiencing rapid growth, as enterprises and governments are shifting toward large-scale, flexible, and high-performance computing infrastructure to sustain a digital operation. Hyperscale platforms allow organizations to scale resources on demand, optimize workloads, and provide services with high reliability and cost-efficiency. The market is expanding due to the rapid growth in data generation, accelerated adoption of AI and ML applications, and increased deployment of IoT devices across manufacturing, healthcare, retail, and financial sectors. Supportive government initiatives for digital infrastructure, along with heightened enterprise focus on cybersecurity, disaster recovery, and business continuity, are further driving market growth.

Hyperscale Cloud Market Trends

- The rise of AI and machine learning is increasing the demand on hyperscale clouds, driving the adoption of high-performance computing, specialized chips, and scalable infrastructure to support advanced analytics and automation.

- The need for multi-cloud and hybrid cloud platforms has become critical for businesses seeking resilience, avoiding vendor lock-in, and optimizing cost, regulatory compliance, and data sovereignty during global expansion.

- Edge computing integrated with hyperscale cloud platforms enables low-latency applications, supporting IoT, autonomous systems, and real-time data processing closer to end users.

- The growing adoption of cloud-native applications, including containers, Kubernetes, and microservices, is transforming application development by enabling faster, scalable, and sustainable innovation within digital ecosystems.

Redefining Scalability & Efficiency: How is AI Transforming the Hyperscale Cloud Market?

Artificial Intelligenceis significantly revolutionizing the market by enabling providers to deliver intelligent, scalable, and high-performance services that efficiently manage resources and automate business processes. It enhances security and operational efficiency through predictive analytics and anomaly detection. Rising workloads from generative AI, machine learning, and deep learning are driving investments in specialized hardware such as GPUs, TPUs, and AI accelerators. Furthermore, AI-powered real-time analytics on large datasets supports faster and more accurate business decision-making, accelerating innovation across cloud-based applications and services.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 426.39 Billion |

| Market Size in 2026 | USD 553.92 Billion |

| Market Size by 2035 | USD 5,837.58 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 29.91% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Enterprise Type,Application,Industry, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Outlook

Enterprise Type Insights

Why Did the Large Enterprises Segment Dominate the Hyperscale Cloud Market?

The large enterprises segment dominated the market by holding the largest share in 2025. The dominance of the segment is driven by the adoption of hybrid and multi-cloud strategies, which allow these enterprises to balance the security, compliance, and performance needs. Urgent needs to modernize legacy systems, improve operational efficiency, and support remote workforces further bolstered hyperscale cloud adoption in these enterprises. Rising cybersecurity risks and compliance pressures are motivating large enterprises to invest in secure, compliant cloud infrastructures. Additionally, the growing demand for data-driven business models and automated decision-making systems is accelerating the shift toward scalable and intelligent cloud solutions.

The small & medium enterprises segment is expected to grow at the fastest CAGR in the upcoming period, as these enterprises are rapidly changing their traditional IT infrastructure to incorporate flexible and subscription-based cloud services. Hyperscale cloud services are increasingly used by SMEs as a way of exempting them from making huge initial investments in servers, data centers, and maintenance, and receive enterprise-level computing, storage, and cybersecurity services. Moreover, the increasing digitalization of the retail, education, healthcare, and professional services sectors accelerates the adoption of cloud platforms by SMEs to manage customers and achieve online sales, collaboration, and data analytics.

Application Insights

What Made Cloud Computing the Dominant Segment in the Hyperscale Cloud Market?

The cloud computing segment dominated the market in 2025. This is mainly due to the widespread adoption of IaaS, PaaS, and SaaS, which enable organizations to scale applications, reduce operational costs, and accelerate deployment. The rise of remote work, mobile applications, and online customer interactions increased the demand for flexible and reliable computing resources. Cloud-native architectures also empowered startups and technology innovators to accelerate innovation and expand globally. Additionally, continuous improvements in network connectivity, data security, and service reliability further reinforced cloud computing's dominance in the market.

The big data analytics segment is expected to expand at the fastest rate in the market during the projection period. This is mainly because of the increasing volumes of structured and unstructured data generated by digital transactions, social media, IoT devices, and enterprise systems. The significance of hyperscale platforms is enormous to organizations since they aid them in handling voluminous data collections, accessing real-time information, and making decisions using data.

On-premise systems are less favorable than cloud-based analytics solutions because cloud platforms are more scalable, handle larger data volumes, and are more cost-effective for high-data workloads. Industries such as BFSI, healthcare, e-commerce, and manufacturing are increasingly deploying predictive analytics on the cloud to enhance customer targeting, fraud detection, supply chain optimization, and operational forecasting.

Industry Insights

Why Did the IT & Telecom Segment Lead the Hyperscale Cloud Market?

In 2025, the IT & telecom segment led the market, driven by growing demand for digital services, 5G networks, and cloud hosting. Telecom operators increasingly relied on hyperscale platforms for network virtualization, edge computing, and real-time traffic management, while IT service providers adopted them to deliver managed services, cybersecurity, enterprise software, and AI-powered analytics. The rise of streaming, online gaming, and business communications further increased data volumes, highlighting the need for high-performance cloud environments in the industry.

The e-commerce & retail segment is expected to grow at the fastest rate, driven by the need for scalable digital platforms, real-time processing, and customer-focused technologies. Online retailers rely on robust cloud infrastructure to handle high transaction volumes, dynamic pricing, inventory optimization, and personalized recommendations. Rapid growth in mobile commerce and cross-border digital trade further increases cloud workloads. Leading international retailers also outsource cloud services for logistics optimization and demand forecasting to improve operations and enhance the customer experience.

Regional Insights

How Big is the North America Hyperscale Cloud Market Size?

The North America hyperscale cloud market size is estimated at USD 196.14 billion in 2025 and is projected to reach approximately USD 2,714.47 billion by 2035, with a 30.05% CAGR from 2026 to 2035.

What Made North America the Leading Region in the Global Hyperscale Cloud Market?

North America led the hyperscale cloud market by capturing the largest share in 2025. This is mainly due to advanced digital infrastructure, early cloud adoption, and a high concentration of major hyperscale providers. Leading companies like Amazon Web Services, Microsoft Azure, and Google Cloud drive continuous innovation and significant data center investments. Strong demand is fueled by enterprises implementing AI, big data, IoT, and digital transformation projects. The region also benefits from a robust start-up ecosystem and substantial cloud spending across BFSI, healthcare, retail, and government sectors.

What is the Size of the U.S. Hyperscale Cloud Market?

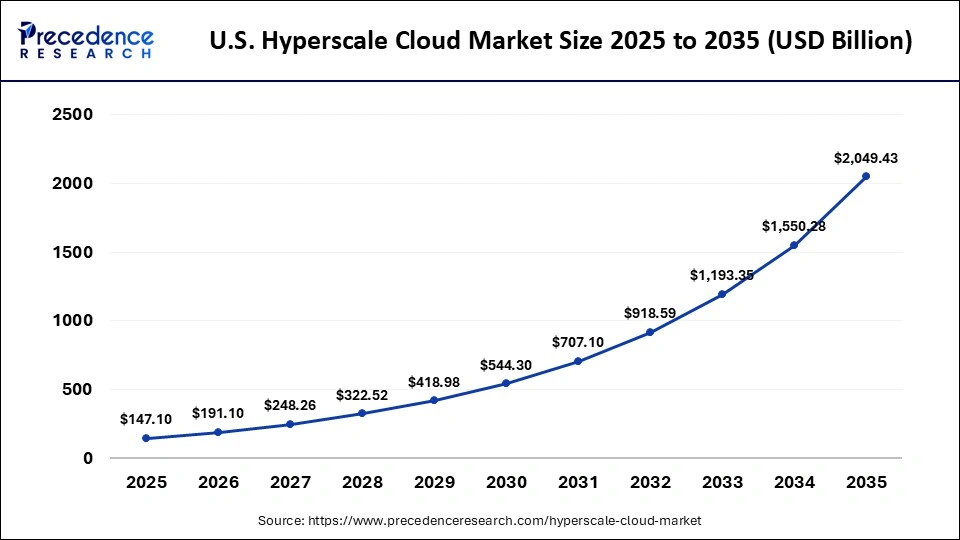

The U.S. hyperscale cloud market size is calculated at USD 147.10 billion in 2025 and is expected to reach nearly USD 2,049.43 billion in 2035, accelerating at a strong CAGR of 30.14% between 2026 and 2035.

U.S. Market Analysis

The hyperscale cloud market is growing in the U.S. as organizations increasingly rely on scalable, on-demand computing to handle complex workloads and digital services. Rising adoption of advanced technologies like machine learning, analytics, and edge computing is driving the need for flexible, high-capacity cloud infrastructure. Furthermore, businesses are investing in cloud solutions to improve operational efficiency, enhance customer experiences, and support rapid innovation across industries.

Why is Asia Pacific Considered the Fastest-Growing Region in the Hyperscale Cloud Market?

Asia Pacific is expected to grow at the fastest CAGR in the market because of the fast pace of digitalization and the penetration of the internet. In the emerging economies, such as China, India, Indonesia, and Vietnam, there is a high adoption of cloud services by both large enterprises and SMEs. Cloud adoption is accelerating as governments, smart cities, and 5G initiatives drive digital projects. Hyperscale cloud deployment is growing rapidly, supported by sectors like e-commerce, fintech, online learning, and streaming. Global providers are also investing in regional data centers to meet data sovereignty and low-latency requirements.

China Market Analysis

China is a major contributor to the market within Asia Pacific. This is due to its rapidly growing digital economy, widespread adoption of e-commerce, fintech, and online entertainment platforms, and massive investments in cloud infrastructure by leading domestic providers like Alibaba Cloud and Tencent Cloud. Additionally, government initiatives supporting smart cities, AI development, and 5G networks are driving strong demand for scalable hyperscale cloud solutions.

How is the Opportunistic Rise of Europe in the Hyperscale Cloud Market?

Europe is expected to grow at a significant rate due to increasing cloud adoption and strict data protection regulations. GDPR and data sovereignty concerns are boosting investment in local cloud infrastructure, while governments and businesses accelerate digital transformation in public services, manufacturing, healthcare, and finance. The rise of hybrid and multi-cloud strategies, along with investments in AI, edge computing, and Industry 4.0, is further driving demand for scalable cloud platforms.

Germany Market Analysis

Germany is a major contributor to the European hyperscale cloud market due to its strong industrial and manufacturing base, which drives high demand for digital transformation and scalable cloud solutions. The country's strict data protection regulations and focus on data sovereignty encourage investments in local cloud infrastructure. Additionally, widespread adoption of technologies like AI, Industry 4.0, and edge computing further fuels the growth of hyperscale cloud services in Germany.

Who are the Major Players in the Global Hyperscale Cloud Market?

The major players in the hyperscale cloud market include Alibaba Group (China), Google LLC (Alphabet, Inc.) (U.S.), Amazon Web Services, Inc. (U.S.), Hewlett-Packard Enterprise Development LP (U.S.), Fujitsu Limited (Japan), IBM Corporation (U.S.), Microsoft Corporation (U.S.), Oracle Corporation (U.S.), Salesforce, Inc. (U.S.), and VMware, Inc. (U.S.)

Recent Developments

- In January 2025, Oracle released the Exadata X11M, which offers significant performance advantages to AI and analytics workloads, as well as OLTP workloads. The system was based on smart power management and efficient design to work with data more rapidly, and fewer systems were needed. (Source:https://www.oracle.com)

- In December 2024,AWS came up with enhanced data center technologies to meet the increasing AI needs with greater energy efficiency. The upgrades enhanced the computing density with liquid cooling, streamlined power systems, and rack control with software, and minimized energy wastage. (Source:

https://www.businesswire.com) - In May 2024, Microsoft opened its first hyperscale cloud data center region in Mexico in order to increase its cloud presence in Latin America. The region offered secure, high-performance, scalable, and in-country data residency and low latency.https://www.intelligentcio.com

Segments Covered in the Report

By Enterprise Type

- Small & Medium Enterprises

- Large Enterprises

By Application

- IoT Applications

- Cloud Computing

- Big Data Analytics

- Others (Social Media & CDNs, Autonomous Vehicles)

By Industry

- Manufacturing

- Energy & Utilities

- BFSI

- Healthcare

- E-Commerce & Retail

- IT & Telecom

- Automotive

- Others (Gaming, Research, Entertainment)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content