What is Industrial Ethernet Market Size?

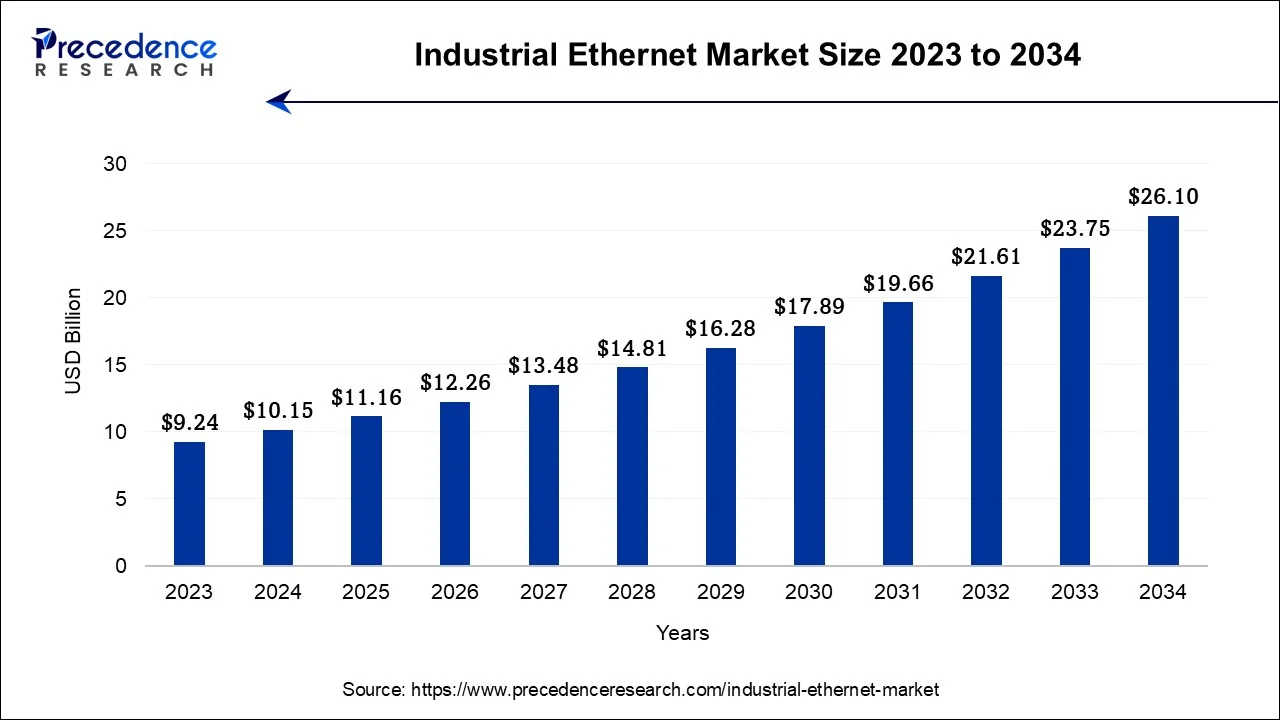

The global industrial ethernet market size was estimated at USD 11.16 billion in 2025 and it is predicted to hit around USD 26.10 billion by 2034, expanding at a CAGR of 9.90% during the forecast period 2025 to 2034.

Market Highlights

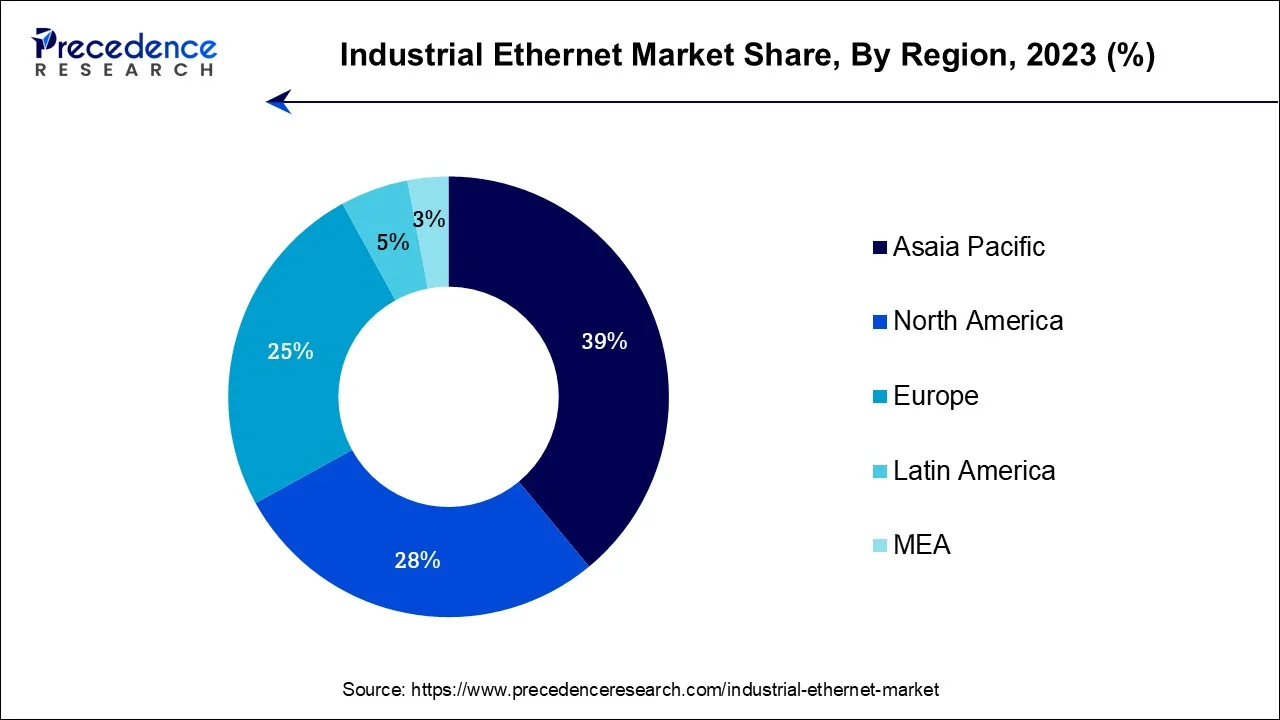

- Asia Pacific contributed more than 39% of revenue share in 2024.

- North America is expected to witness the fastest growth during the forecast period.

- By Offering, the hardware segment is projected to hold the largest share of the market during the forecast period.

- By Offering, the services segment is expected to show notable growth.

- By Protocol, the PROFINET and EtherNet/IP segment is expected to continue its dominance during the forecast period.

- By End-use Industry, the automotive and transportation segment holds the largest market share.

- By End-use Industry, the aerospace and defense segment will continue to grow at a significant CAGR during the forecast period.

What is the Industrial Ethernet Market?

Electricity played a crucial role in the industrial revolution, enabling more efficient and mass production of several durable goods such as home appliances, automobiles, and others. The world is becoming increasingly connected in the digitalization era, and more advanced networking technologies are being launched for industrial applications. Manufacturers are adopting digital industrialization or Industry 4.0. ethernet allows computers to share files, browse the internet, and access printers and other hardware devices connected to the network. Ethernet is efficient, reliable, and flexible. Ethernet is the most widely embraced networking protocol globally. The low cost required in implementation has made ethernet an attractive networking technology for industrial environments.

Industrial ethernet is about creating an automated network. It has surpassed conventional fieldbus architectures to become the leading connection protocol in factories across the globe. Industrial ethernet is expanding steadily, and several standards bodies continue to develop standards to support it. industrial ethernet (IE) uses ethernet in an industrial setting with protocols. Determinism and real-time control are important factors when defining Industrial ethernet.

Industrial ethernet widens the network's value across industries. Due to rapid technological advancements, ethernet protocols have become one of the most crucial types of transmission in automation technology. Industrial ethernet switches, cables, and connectors need to withstand harsh conditions (heat and cold, vibrations, chemicals, factory noise, and others) in an industrial setting. Industrial Ethernet assists in creating a safe and reliable network infrastructure across all business and production levels.

How is AI Contributing to the Industrial Ethernet Market?

AI gives a boost to the Industrial Ethernet by way of smart automation, predictive maintenance, and real-time optimization. It not only improves the performance but also spots the faults, fortifies the cybersecurity, and makes the network configuration adaptive. The use of machine learning and data analytics leads to the emergence of self-learning networks, which in turn translates into less downtime, more capacity, and the entire manufacturing process being made highly efficient, data-oriented, and resistant to changes, hence, being in sync with the industry 4.0 principles.

Industrial Ethernet Market Growth Factors

- With the increasing demand for establishing robust and reliable communication infrastructure within an organization, the global industrial ethernet industry is expected to show a significant expansion during the forecast period.

- The growth of the Industrial ethernet market is driven by factors such as increasing awareness of Industry 4.0, rapid industrialization, increasing adoption of industrial automation, favorable government initiatives, increasing demand across aerospace & defense applications, increasing investment in network infrastructure, and rapid penetration of advanced ethernet technologies.

- In addition, the industrial ethernet gaining tremendous popularity across the globe owing to its excellent features including its capacity to connect multiple nodes, extended connection distances, higher speeds, and ability to withstand harsh conditions in an industrial setting.

- As Industrial ethernet implementations are accelerating, manufacturers and designers can have better choices for high-speed and factory-friendly form factors.

Market Outlook

- Industry Growth Overview: The market is experiencing a significant expansion, which is mainly attributed to the factors of increased automation, the commencement of Industry 4.0, IIoT acceptance, and high-speed connectivity.

- Sustainability Trends: The main concern is the energy-saving measures, such as Single Pair Power over Ethernet (SPoE) and data processing, to control consumption and achieve net-zero targets.

- Global Expansion:Europe and North America are the frontrunners in implementation, while the Asia-Pacific region is the one with the fastest growth due to the rapid progress of industrialization and smart manufacturing projects.

- Major Investors: The likes of Siemens, Rockwell Automation, Cisco, and Belden are the major players who pour substantial funds into research, innovation, and partnership as a way to rule the market.

- Startup Ecosystem: New companies are working on new ideas like Time-Sensitive Networking (TSN), security enhancement, and catering to special sectors in industrial automation.

Market Scope

| Report Coverage | Details |

| Market Size by 2025 | USD 11.16 Billion |

| Market Size in 2026 | USD 12.26 Billion |

| Market Size in 2034 | USD 26.10 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.90% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Offerings, Protocol, Protocol, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing adoption of industrial automation

The increasing adoption of industrial automation is expected to fuel the growth of the market during the forecast period. Industrial automation is the control of machinery and processes by autonomous systems through the use of advanced technologies such as robotics and computer software. Industrial ethernet networks deliver uninterrupted and seamless connectivity services between different automation devices.

Connected devices such as actuators, PLCs (Programmable Logic Controllers), sensors, and industrial automation and control systems (IACS) deliver real-time data that can be used for monitoring quality, and cost reduction. Several enterprises across the globe are embracing Industry 4.0 with integrating advanced technologies such as robotics and artificial intelligence to boost productivity.

The use of industrial ethernet hardware plays a crucial role in automation and machine control networks. The rapid adoption of the Industrial Internet of Things (IIoT) and Industry 4.0, and advanced technologies have promoted industrial ethernet's position as a leading technology fueling digital transformation for smart manufacturing. Thereby, the market is expected to get accelerate.

Restraint

The high initial investment is likely to hamper the market

The high initial investment associated with the deployment of the industrial ethernet network is likely to hamper the market. A huge amount of capital is required to set up the infrastructure, implement software solutions, and purchase key hardware components. Small and medium-sized enterprises (SMEs) most often face budget constraints that discourage them from embracing advanced industrial ethernet technologies. In addition, the implementation and establishment of industrial ethernet networks can be complex and need specific professional skills, which can be difficult for enterprises lacking the required resources and is likely to limit the expansion of the global industrial ethernet market during the forecast period.

Opportunity

Several government initiatives

Several government initiatives are projected to boost the growth of the industrial ethernet market. Rising government initiatives in developing nations and increasing expenditure for the introduction of automation aim to boost the manufacturing sector. For instance, India is one of the fastest developing countries in the world with a rapidly expanding industrial industry. Technology-driven processes offer visibility and transparency accelerating the growth of India's manufacturing market and becoming a manufacturing hub in the coming years. India's government's “Make in India” initiative encourages businesses to automate processes in their existing manufacturing facilities with the use of smart technologies.

To strengthen India's manufacturing capabilities and boost the smart manufacturing sector, several initiatives announced by the Indian government such as the Phased Manufacturing Programme (PMP), Atmanirbhar packages, Production Linked Incentive (PLI) Scheme, and others. The Indian government has implemented several initiatives to attract foreign investors, such as Goods and Services Tax, the reduction in corporate tax rates, reforms in the FDI policy, and addressing liquidity issues in banks and non-banking financial companies (NBFCs).

In addition, to encourage investment, several policies have been introduced including the Industrial Park Rating System (IPRS), India Industrial Land Bank (IILB), National Single Window System (NSWS), National Monetization Pipeline (NMP), and National Infrastructure Pipeline (NIP).

Regional Insights

Offering Insights

The hardware segment is projected to hold the largest share of the market during the forecast period. The innovation in hardware products including routers, switches, controllers, connectors, and others is the primary factor boosting the growth of the segment. On the other hand, the services segment is expected to show notable growth. Emerging trends in the communication network and integration with the increasing usage of the Internet of Things (IoT) have resulted in the use of the cloud and networking.

Protocol Insights

The PROFINET and EtherNet/IP segment held the largest share in 2024, with the growing technological advancements across the globe; PROFINET and EtherNet/IP are the most widely used protocols in a variety of industries owing to their several advantages. PROFINET is used to exchange data between controllers and devices in industrial automation. PROFINET is very deterministic and exchanges data in a predefined arrangement. Controllers include Programmable Logic Controllers (PLCs), Distributed Control Systems (DCSs), and Programmable Automation Systems (DDCSs).

Devices include Input and Output (I/O) blocks, Radio Frequency Identification (RFID) readers, drives, process instruments, vision systems, and others. PROFINET boosts productivity with openness, flexibility, efficiency, and performance. Since PROFINET is an open standard, PROFINET products such as PACs, PLCs, Robots, Drives, IOs, Proxies & diagnostic tools are developed by several manufacturers globally.

End-use Industry Insights

The automotive and transportation segment is the leading segment of the market; the rising technological advancements in the automobile industry are anticipated to grow the demand for industrial ethernet systems during the forecast period. Industrial ethernet is becoming an innovative approach and is expected to fuel the transport industry in the coming years. Real-time applications such as Advanced Driver Assistance Systems (ADAS), infotainment systems, and others are positively impacting the market's growth. The automotive industry has unceasingly pioneered new manufacturing processes, propelling the rapid embracing of innovative technologies on the factory floor.

Regional Insights

Asia Pacific Industrial Ethernet Market Size and Growth 2025 to 2034

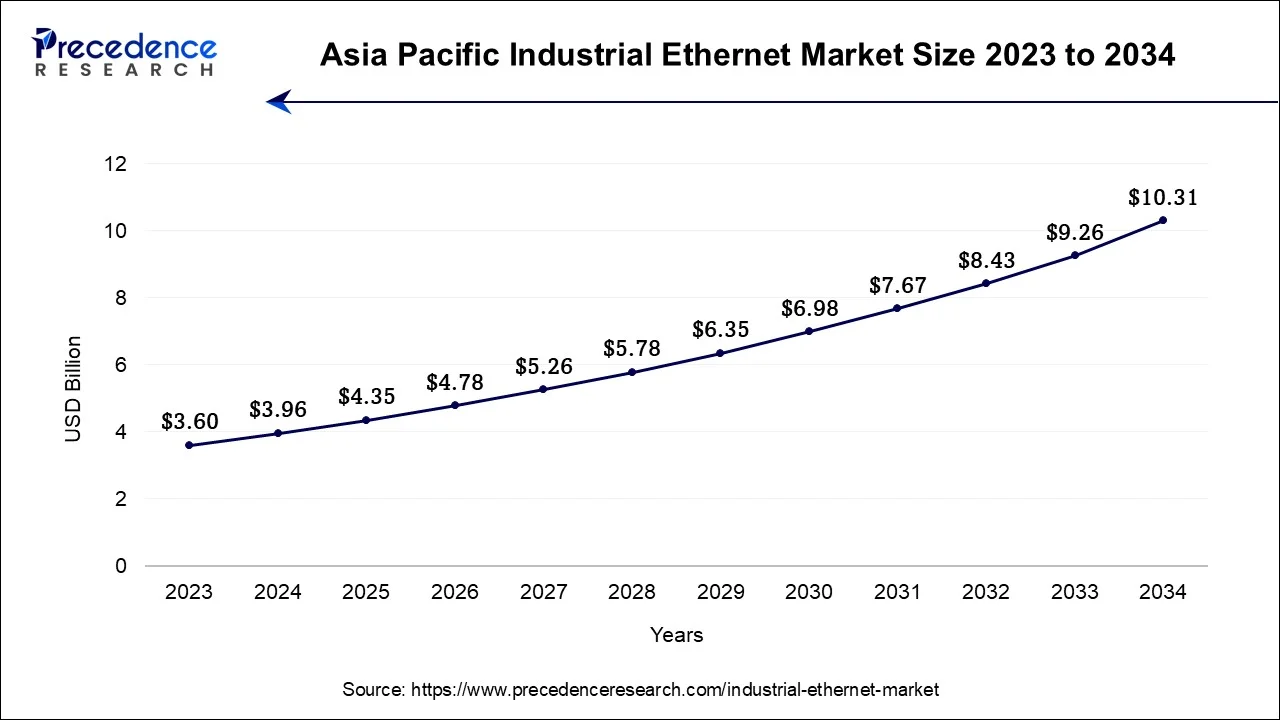

The Asia Pacific industrial ethernet market size accounted for USD 4.35 billion in 2025 and is estimated to reach around USD 10.31 billion by 2034, growing at a CAGR of 10.04% from 2025 to 2034.

Asia Pacific accounted for the largest share of the Industrial ethernet market in 2024, the region is anticipated to continue its growth during the forecast period. The Asia Pacific industrial ethernet market is characterized by the presence of prominent market players, supportive government policies, rapid adoption ofIndustry 4.0, increasing investment in industrial automation, and rapid industrialization.

The increasing popularity of industrial ethernet across automotive sectors and consumer electronics in countries such as China, Japan, and India are the major factors behind the dominance of the Asia Pacific industrial ethernet market during the forecast period. Additionally, various initiatives have been by many developing nations such as China, India, Japan, and others, promoting automation and rapid digitalization across all industrial verticals. In a study by HMS Networks on the industrial network market, HMS concludes that the industrial ethernet continues to grow at the fastest growth rate.

North America is the fastest-growing region in the global Industrial ethernet market. The North American region is experiencing a strong penetration of the Internet of Things (IoT) devices, increasing investments in industrial infrastructure, huge investments in industrial automation, and an upsurge in industrialization. Thereby, these factors create a strong potential for the industrial ethernet market to expand in North America.

How Will Europe Become a Notable Region in the Industrial Ethernet Market?

Europe plays a significant role in the industrial Ethernet market, primarily driven by its strong manufacturing base. Countries such as Germany, the UK, France, and Italy are at the forefront of industrial automation and digital transformation, showcasing an early adoption of automation technologies. The emphasis of region on Industry 4.0 and the need for robust, high-speed communication networks in manufacturing, which include sensors, PLCs, and HMIs, enhances efficiency and enables real-time monitoring, ultimately contributing to the growth of industrial Ethernet. Additionally, stringent regulations regarding industrial safety and efficiency, along with substantial investments in upgrading industrial infrastructure, are further fostering market growth in Europe.

Industrial Ethernet Market Companies

- ABB Ltd.

- Robert Bosch GmbH

- Analog Devices Inc.

- B&R Automation

- Moxa Inc

- Belden Inc

- Rockwell Automation

- Schneider Electric

- Siemens AG

- Innovasic, Inc

- Cisco Systems, Inc

- Beckhoff Automation

- Hitachi Ltd.

- Nexans SA

Leaders' Announcements

- In April 2025, ABB partnered with the Instrumentation Technology and Economy Institute (ITEI) to establish a laboratory in Beijing. This facility aims to standardize and implement Ethernet-APL + PROFINET technology in China, focusing on compatibility testing, technology demonstrations, and training to support the digital transformation of the country's process industries. The collaboration seeks to advance industrial communication technology for sustainable development.

Recent Developments

- In November 2022, Delta, a global provider of power management and industrial automation solutions. Delta unveiled its extensive range of smart energy-efficient and highly integrated industrial automation hardware and software solutions engineered for Industrial Internet of Things (IIoT) applications at SPS Nuremberg. The demonstration includes a SaaS Digital Dashboard tool. DIACloud Digital Dashboard, that offers remote visualization of cloud data for various applications, and a new Industrial Internet of Things (IIoT) function card for the PLC series to enable several Industrial Internet of Things (IIoT) applications.

- In November 2024, Orca introduced an IO-Link transceiver that enhances communication between sensors and industrial control systems. This product aims to improve connectivity for automation applications, reinforcing the role of IO-Link in driving intelligence on factory floors. Identifying potential malfunctions in machinery helps reduce the risk of unexpected breakdowns, increases uptime, and saves on the cost of replacement parts.

- In November 2024, Renesas Electronics Corp. launched the RZ/T2H microprocessor, designed for high-speed control of industrial robotic motors. This high-performance microprocessor consolidates functions that traditionally required multiple components, thus saving time and costs in FPGA development. It supports various industrial communications on a single chip.

Segments Covered in the Report

By Offerings

- Hardware

- Software

- Services

By Protocol

- EtherCAT

- EtherNet/IP

- PROFINET

- POWERLINK

- SERCOS III

- CC-Link IE

- Others

By End-use Industry

- Oil and Gas

- Automotive & Transportation

- Energy & Power

- Chemical & Fertilizer

- Food & Beverages

- Electrical & Electronics

- Aerospace & Defense

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting