Injectable Cytotoxic Drugs Market Size and Forecast 2025 to 2034

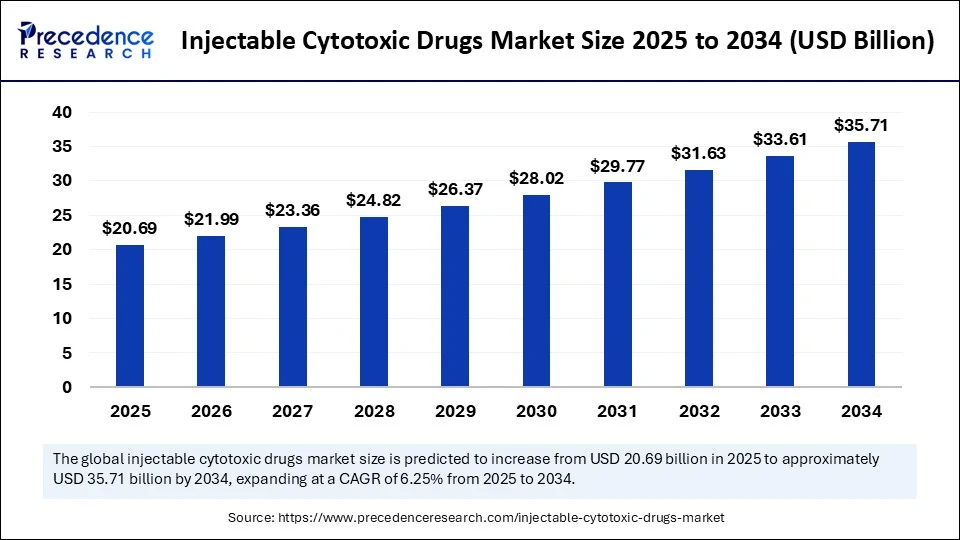

The global injectable cytotoxic drugs market size accounted for USD 19.48 billion in 2024 and is predicted to increase from USD 20.69 billion in 2025 to approximately USD 35.71 billion by 2034, expanding at a CAGR of 6.25% from 2025 to 2034.The injectable cytotoxic drugs market is driven by the increasing cancer prevalence, rising demand for targeted chemotherapy, and growing adoption of injectable oncology treatments.

Injectable Cytotoxic Drugs MarketKey Takeaways

- In terms of revenue, the global injectable cytotoxic drugs market was valued at USD 19.48 billion in 2024.

- It is projected to reach USD 35.71 billion by 2034.

- The market is expected to grow at a CAGR of 6.25% from 2025 to 2034.

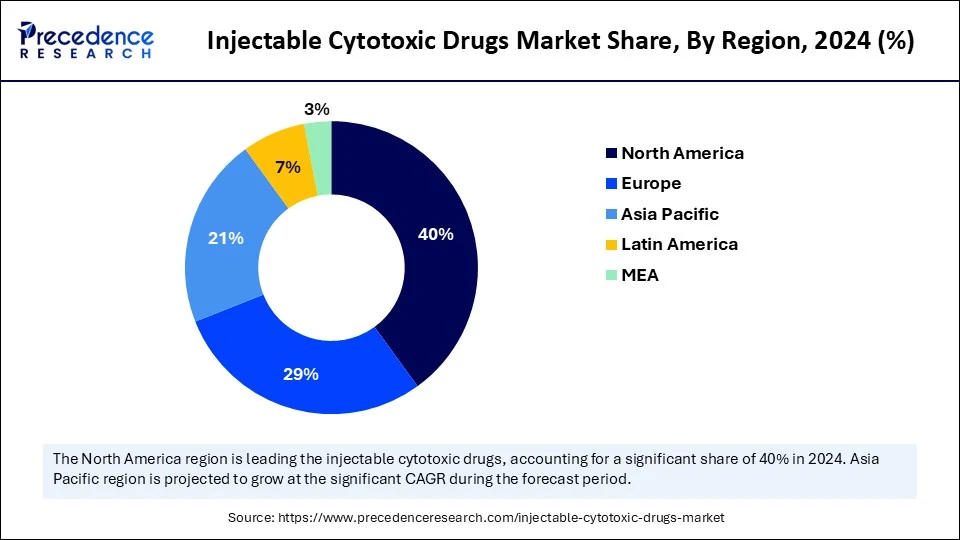

- North America dominated the injectable cytotoxic drugs market with the largest share of 40% in 2024.

- Asia Pacific is anticipated to witness the fastest growth during the forecasted years.

- By drug class, the alkylating agents segment captured the biggest market share of 29% in 2024.

- By drug class, the antimetabolities segment is anticipated to show considerable growth, under which the cytarabine sub-segment is likely to lead the charge in the market over the forecast period.

- By indication, the breast cancer segment contributed the highest market share of 18% in 2024.

- By indication, the hematological malignancies segment is anticipated to show considerable growth over the forecast period.

- By end user, the hospitals segment held the biggest market share of 59% in 2024.

- By end user, the ambulatory surgical centers segment is anticipated to show considerable growth over the forecast period.

- By route of administration, the intravenous injection/infusion segment generated the major market share of 81% in 2024.

- By route of administration, the intramuscular segment is anticipated to show considerable growth over the forecast period.

- By drug origin, the branded cytotoxic drugs segment held a significant market share in 2024.

- By drug origin, the generic cytotoxic drugs segment is anticipated to show considerable growth over the forecast period.

How is AI Integration Transforming the Injectable Cytotoxic Drugs Market?

Artificial Intelligence significantly impacts the cytotoxic drugs market by accelerating the process of drug development and clinical decision-making process, and enabling patient-specific therapy. AI analyzes drug efficacy and toxicity extensively, saving time and money by accelerating the discovery of new cytotoxic compounds in research and development. AI-powered imaging and diagnostic tools also monitor real-time tumor responses to injectable cytotoxic drugs, enabling prompt treatment adjustments. Furthermore, AI enhances supply chain and inventory management by predicting drug demand in hospitals and facilities, ensuring timely drug availability.

U.S. Injectable Cytotoxic Drugs Market Size and Growth 2025 to 2034

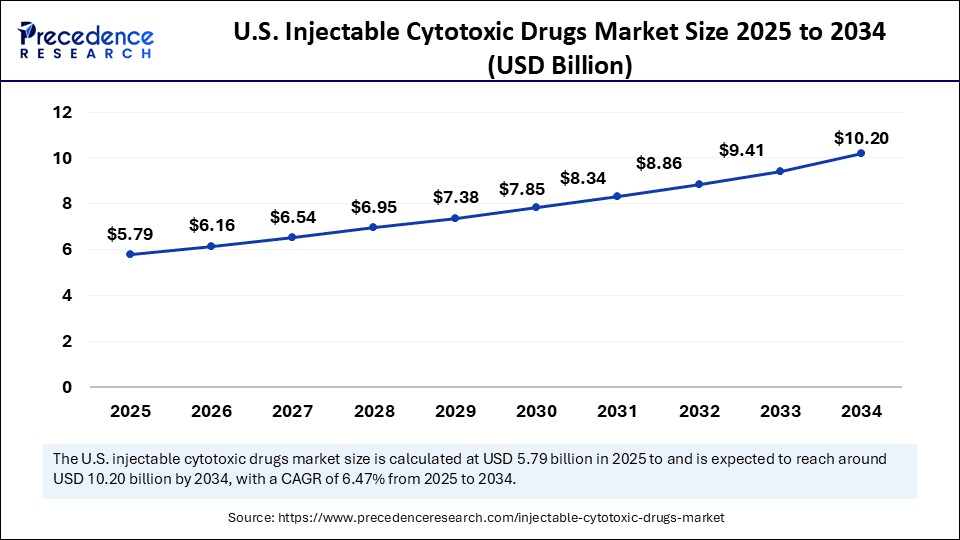

The U.S. injectable cytotoxic drugs market size was exhibited at USD 5.45 billion in 2024 and is projected to be worth around USD 10.20 billion by 2034, growing at a CAGR of 6.47% from 2025 to 2034.

What Made North America the Leading Region in the Injectable Cytotoxic Drugs Market in 2024?

North America led the global injectable cytotoxic drugs market with the highest market share of 40% in 2024. The advanced cytotoxic treatment area is broadly adopted as the mature oncology ecosystem allows for extensive adoption of the advanced treatment category in the region, coupled with the emerging solutions as immunotherapy and radiation, among others. The prevalence of cancer screening and early diagnosis also helps to achieve higher access to injections for patients who receive the administered cytotoxic drugs earlier in the development of the disease, enhancing the outcome of the treatment and increasing demand. Favorable reimbursement policies are also present in North America, which minimizes the cost of treatment and thereby promotes the use of a combination therapy regimen with cytotoxic drugs.

Firms in the U.S. are aggressively producing novel versions of injectable cytotoxic chemotherapeutic agents, liposomal delivery, and more targeted delivery of these drugs that enhance the efficacy of the drugs and reduce side effects. Well-developed capabilities in research and development, with collaboration among large academic institutions and cancer research centers, have led to a robust pipeline of cytotoxic drugs. In addition, strategic marketing, FDA approval of patentable medicines, and the existence of major chain treatment facilities also favor revenue growth.

Why is Asia Pacific Experiencing the Fastest Growth in the Injectable Cytotoxic Drugs Market?

Asia Pacific is expected to grow at the fastest CAGR during the forecast period, driven by rising cancer cases, advancements in healthcare infrastructure, and supportive government policies in oncology. The regional market's growth is fueled by improved drug availability through government healthcare schemes, collaborations with pharmaceutical industries, and local manufacturing of oncology medicines. Increased healthcare expenditure and rising health insurance penetration also enhance patient access to quality medical treatments. Moreover, regional governments' focus on early cancer screening and diagnosis is expected to increase the number of patients receiving timely cytotoxic therapy.

The Chinese government is significantly investing in oncology care through national healthcare reforms, public-private sector engagement, and increased insurance coverage. Increased production capacity by domestic pharmaceutical corporations facilitates easier access to cheaper essential cancer drugs, such as generics. The growing spending capacity of Chinese citizens, combined with a cultural shift towards active engagement in their healing, is boosting demand for contemporary cancer care. China is poised to become a vibrant market for injectable cytotoxic drugs, supported by strong policy and a large patient population.

What are the Key Trends in the European Injectable Cytotoxic Drugs Market?

The European injectable cytotoxic drugs market is expected to grow at a notable rate, driven by high healthcare expenditure, robust oncology infrastructure, and well-established public health systems. The rising incidence of cancer and chronic autoimmune diseases like rheumatoid arthritis is increasing the demand for cytotoxic treatments. Europe's positive reimbursement environment ensures patient access to critical cancer care treatments, including injectable cytotoxics. Regional governments are also implementing policies to enhance early cancer detection and expand chemotherapy drugs in public and medical care centers.

Germany is a key player in the European market, supported by its robust pharmaceutical industry and investment in R&D. The high level of funding and the developed research facilities are key to Germany's innovation, as several institutions and firms are researching innovative formulations and drug delivery methods. The advanced state health sector and reimbursement system guarantee the patients access to the advanced treatments.

Market Overview

The injectable cytotoxic drugs market comprises chemotherapeutic agents administered via injection that work by directly killing or inhibiting the proliferation of cancer cells. These drugs target rapidly dividing cells and are typically used in the treatment of solid tumors and hematological malignancies. Cytotoxic agents are among the most established forms of cancer therapy and include alkylating agents, antimetabolites, plant alkaloids, antitumor antibiotics, and platinum-based compounds. Despite the rise of targeted therapies and immunotherapy, cytotoxic injectables remain widely used due to cost-effectiveness, broad-spectrum efficacy, and proven clinical outcomes.

The injectable cytotoxic drugs market is experiencing rapid growth, driven by increasing cases of cancer and autoimmune diseases like rheumatoid arthritis. Regulatory clearances for novel cytotoxic formulations will expand the therapeutic space, while rising investment in precision oncology enhances drug effectiveness and precision. A rapid surge in the number of cancer care facilities globally is also elevating the need for injectable cytotoxic therapies, contributing to market growth.

What Factors are Fueling the Growth of the Injectable Cytotoxic Drugs Market?

- Increasing Cases of Cancer and Autoimmune Diseases: Rising rates of cancer and autoimmune diseases, like rheumatoid arthritis, worldwide are boosting the demand for effective treatments. Cytotoxic agents used in chemotherapy and immune-modulating drugs are typically injectable, hence are necessary in clinical practice, more so in increasing global awareness and early diagnosis.

- Rising Regulatory Acceptances: Rapid approval of newer injectable cytotoxic drugs with improved safety and efficacy profiles by regulatory authorities encourages pharmaceutical firms to innovate and introduce advanced products in the market.

- Precision Oncology: There is a rise in investment in precision oncology, which makes it possible to develop cytotoxic drugs specific to each tumor profile. These focused cures enhance the results, decrease the side effects, and make the administering of the injectable cytotoxic medicines more preferable with improved results.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 35.71 Billion |

| Market Size in 2025 | USD 20.69 Billion |

| Market Size in 2024 | USD 19.48 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.25% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Drug Class, Indication, End User, Route of Administration, Drug Origin, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

High Dependence on Injectable Cytotoxic Drugs for Cancer Treatment

The high reliance on injectable cytotoxic drugs for cancer treatment significantly drives the growth of the market. Injectable cytotoxic drugs are essential in cancer treatment because they have a wide range of effects. These drugs are central to chemotherapy, often use as the primary approach against cancer. Despite other cancer management methods, cytotoxic medications remain crucial because they are effective against various cancer types. Their use extends beyond oncology, treating autoimmune diseases like severe multiple sclerosis, where immune suppression is needed. This widespread use of injectable cytotoxic drugs, both as primary and supplementary treatments, highlights their essential role in disease management and sustains global market demand.

Restraint

The Advent of Alternate Therapies to Treat Cancer

The rise of alternative therapies restrains the growth of the injectable cytotoxic drugs market. Targeted therapy and immunotherapy have quickly gained momentum because they are more effective in some cancer types and cause less damage to normals, particularly in low- and middle cells, resulting in minimal side effects. Regulatory approvals are increasing as clinical trials prove these alternatives effective, and more patients gain access to new treatments. Biotechnology firms are prioritizing research on developing less toxic and more precise therapies, fueled by technology in genomics and molecular biology. This change in treatment approach presents a significant challenge the injectable cytotoxic drugs market, as patients and healthcare providers favor newer treatments that offer a better quality of life and demonstrate longer-lasting efficacy.

Opportunity

Government and NGO Initiatives

The combined efforts of governments and NGOs create significant opportunities for the injectable cytotoxic drugs market. They implement healthcare plans and provide financial support for cancer treatments, which increases the demand for these drugs. They also work to ensure access to affordable medications through collaborations with pharmaceutical companies and global health agencies. Increased access to essential oncological treatments, including cytotoxic drugs, is being facilitated through national healthcare plans, governmental health programs, and the establishment of comprehensive cancer care centers.

These initiatives aim to reduce cancer mortality rates by improving diagnosis, increasing access to treatments, and ensuring continuity of care. Governments in low- and middle-income countries are collaborating with global health agencies and pharmaceutical companies to ensure affordable access to injectable chemotherapy drugs. NGOs further enhance market opportunities by working closely with governments and other organizations to expand access to therapies in underserved areas.

Drug Class Insights

Why Did the Alkylating Agents Segment Lead the Market in 2024?

The alkylating agents segment led the injectable cytotoxic drugs market while holding a 29% share in 2024. These anticancer medications function by disrupting DNA replication, leading to cell death, making them effective against rapidly dividing cancer cells. The widespread availability of alkylating agents like cyclophosphamide, ifosfamide, and melphalan, often used in combination therapies, solidifies their position in oncology. Their consistent use as first-line treatments and in palliative care further contributes to their market dominance. The widespread use of these agents in hospitals and cancer treatment centers, driven by their cost-effectiveness and integration into standard chemotherapy, underscores their significance.

The cytarabine sub-segment is expected to grow at the fastest CAGR over the forecast period, driven by its significance in treating hematological cancers such as acute myeloid leukemia (AML) and non-Hodgkin lymphoma. Cytarabine, an antimetabolite, inhibits DNA synthesis, making it most effective during the S-phase of the cell cycle. It is widely used in induction therapy and follow-up chemotherapy, particularly in pediatric and adult leukemia protocols. Increased awareness and early detection of blood cancers are leading to more patients receiving cytarabine-based treatments. The liposomal formulation of cytarabine has further enhanced its therapeutic value by improving drug delivery and reducing toxicity.

Indication Insights

What Made Breast Cancer the Dominant Segment in the Market in 2024?

The breast cancer segment held an 18% share in the market in 2024. Injectable cytotoxic treatments are crucial for various breast cancer types, especially in the initial, late, and metastatic stages. They are vital in treating aggressive types like triple-negative breast cancer (TNBC), where specialized treatment options are limited. The segment's growth is also influenced by increased awareness, improved screening, and early intervention programs, leading to earlier injectable therapy interventions. Additionally, expanding access to oncology care and healthcare infrastructure development in low- and middle-income countries contributes to the widening treatment base.

The hematological malignancies segment is expected to grow at the fastest rate in the Injectable cytotoxic drugs market. These cancers are frequently the most challenging to treat, necessitating immediate and potentially aggressive interventions, with injectable cytotoxic drugs being central to standard treatment regimens. Commonly used drugs in combination therapies include cytarabine, cyclophosphamide, and Vincristine, often utilized during induction, consolidation, and maintenance phases. Enhanced awareness, early diagnosis, and improved diagnostic solutions are facilitating earlier treatments, consequently boosting the demand for injectable solutions.

End User Insights

Why Did the Hospitals Segment Dominate the Market in 2024?

The hospitals segment led the injectable cytotoxic drugs market while holding a 59% share in 2024. Oncology departments or cancer centers within hospitals are equipped with advanced treatments like injectable chemotherapy. These facilities adhere to high-risk cytotoxic drug administrations, emphasizing monitoring and emergency support systems available in inpatient settings. Hospitals support multi-disciplinary treatment approaches, where medical oncologists, radiologists, and pathologists collaborate, enhancing their importance in administering injectable cytotoxic drugs. On-site management of side effects and complications makes hospitals a preferred choice for cytotoxic treatments.

The ambulatory surgical centers segment is expected to grow at a significant CAGR over the forecast period. ASCs provide an easy and effective approach to using injectable cytotoxic that is particularly suitable for patients who need frequent chemotherapy but cannot stay a long time in an inpatient facility. The recent improvement in drug formulation and supportive care has contributed to its safety of administering such treatments in outpatient settings and has made ASCs very attractive. They are highly appealing to care providers and clients due to shorter waiting times, reduced treatment expenses, and accelerated processes in such centers. Moreover, the ASCs are increasing their capacity by investing in infusion healthcare facilities, advanced infusion equipment, and safety systems to deal with high-risk medications such as cytotoxics.

Route of Administration Insights

What Factors Contribute to the Dominance of Intravenous Injection/Infusion in 2024?

The intravenous injection/infusion segment held an 81% share of the market in 2024. This dominance is mainly because the majority of cytotoxic agents need to be delivered through precision and closely controlled delivery into the bloodstream so that they are distributed quickly and are most beneficial in their effect. The most dependable approach in delivering these high-potency agents is via IV, where the speed of action is of main concern, like in aggressive or advanced-stage cancer. Moreover, hospital settings, as well as oncology care settings, are prepared with a full-fledged infusion center and with trained personnel to administer the IV chemotherapy in a carefully monitored environment.

The infusion infrastructure is broadly accessible, and patients are comfortable with marrow-based chemotherapy by IV administration; thus, this path remains the standard of care.

The intramuscular segment is expected to grow at the fastest rate in the coming years. The intramuscular segment offers potential benefits in targeted cancer treatment and is easily administered. Intramuscular injections may provide a more gradual, controlled release of cytotoxic drugs. Technological advancements, such as AI-assisted drug delivery systems, enhance the safety and efficacy of intramuscular cytotoxic drugs. Personalized cancer treatment demands adaptable, patient-oriented administration options, increasing interest in alternatives like intramuscular delivery.

Drug Origin Insights

Why Did the Branded Cytotoxic Drugs Segment Hold a Significant Market Share in 2024?

The branded cytotoxic drugs segment contributed the most revenue in 2024, driven by physician loyalty, consistent professional performance, and brand recognition. Branded drugs, with years of research, regulatory validation, and clinical trial data, are favored in cancer treatment protocols. Pharmaceutical companies' investments in research, development, promotions, and physician training enhance their market dominance. Branded cytotoxic drugs are prevalent in high-income regions with well-developed healthcare systems and insurance coverage. Their proven therapeutic credibility and ongoing discovery of new, high-priced agents ensure their market leadership.

The generic cytotoxic drugs segment is expected to grow substantially in the injectable cytotoxic drugs market. With the cancer burden in the world steadily increasing, a significant number of healthcare systems are exploring using generics to enhance affordability and accessibility rates. Generic injectable cytotoxic drugs provide equivalent therapeutic benefits to their brand counterparts at reduced cost and thus form an economic option to the healthcare provider in the public realm and patients. There is also focused advertising by governments and insurance companies to take generic drugs to control healthcare expenditures, particularly for the healthcare of long-term cancer patients. Also, the supply and uptake of generic cytotoxic medications are rising as more production is carried out locally in new markets. With the continuous expiration of patents on several important branded cytotoxic drugs, an increasing number of generic drugs are likely to be introduced into the market.

Injectable Cytotoxic Drugs Market Companies

- Pfizer Inc.

- Novartis AG (Sandoz - generics)

- Teva Pharmaceutical Industries Ltd.

- Roche Holding AG

- Sanofi S.A.

- Bristol-Myers Squibb

- Fresenius Kabi

- Mylan N.V. (Viatris)

- Hikma Pharmaceuticals PLC

- Sun Pharmaceutical Industries Ltd.

- Eli Lilly and Company

- Dr. Reddy's Laboratories

- Cipla Ltd.

- Aurobindo Pharma

- Accord Healthcare

- Hospira (a Pfizer company)

- Intas Pharmaceuticals Ltd.

- Natco Pharma

- Amneal Pharmaceuticals

- Zydus Lifesciences Ltd.

Recent Developments

- In February 2024, Novartis signed a deal to pay a voluntary public takeover offer of 2.7 billion Euros to buy MorphoSys AG, a global, German-based biopharmaceutical firm working to produce oncology drugs. (Source: https://www.novartis.com)

- In May 2023, Innovent Biologics Inc. and Eli Lilly and Company concurrently reported receiving approval of the supplemental New Drug Application (sNDA) of TYVYT (sintilimab injection) combined with bevacizumab and chemotherapy (pemetrexed and cisplatin) to treat patients with non-squamous non-small cell lung cancer in China by the National Medical Products Administration of China. (Source: https://www.innoventbio.com)

- In June 2023, the FDA U.S. unveiled the approval of an injectable cytotoxic product known as the Pemrydi RTU via the 505(b) 2 new drug application process.(Source:https://investors.amneal.com)

Segments Covered in the Report

By Drug Class

- Alkylating Agents

- Cyclophosphamide

- Ifosfamide

- Busulfan

- Antimetabolites

- 5-Fluorouracil (5-FU)

- Methotrexate

- Cytarabine

- Plant Alkaloids

- Vincristine

- Vinblastine

- Paclitaxel, Docetaxel

- Antitumor Antibiotics

- Doxorubicin

- Bleomycin

- Mitomycin

- Platinum-Based Drugs

- Cisplatin

- Carboplatins

- Oxaliplatin

- Combination Cytotoxic Regimens (e.g., CHOP, FOLFIRINOX)

By Indication

- Breast Cancer

- Lung Cancer

- Colorectal Cancer

- Hematological Malignancies

- Ovarian & Cervical Cancer

- Pancreatic & Liver Cancer

- Bladder & Prostate Cancer

- Others (Sarcoma, Head & Neck, Gastric)

By End User

- Hospitals

- Cancer & Specialty Clinics

- Ambulatory Surgical Centers (ASCs)

- Homecare Settings (with mobile infusion units)

- Government Oncology Centers

By Route of Administration

- Intravenous (IV) Injection/Infusion

- Intramuscular (IM)

- Intrathecal

- Intraperitoneal (used in HIPEC protocols)

- Subcutaneous (for select agents)

By Drug Origin

- Branded Cytotoxic Drugs

- Generic Cytotoxic Drugs

- Compounded Cytotoxic Preparations (niche)

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting