What is the Injectable Drug Delivery Market Size?

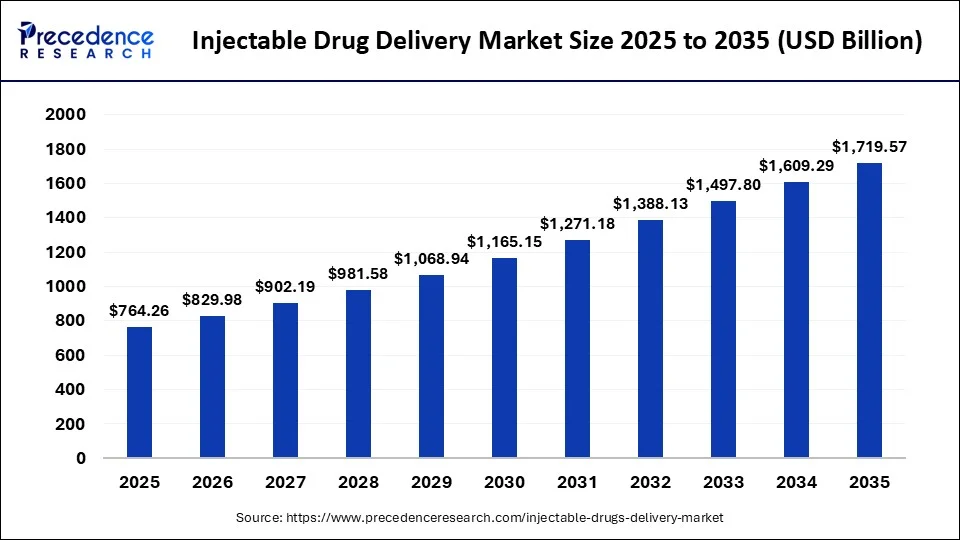

The global injectable drug delivery market size is calculated at USD 764.26 billion in 2025 and is predicted to increase from USD 829.98 billion in 2026 to approximately USD 1,719.57 billion by 2035, expanding at a CAGR of 8.45% from 2026 to 2035.

Injectable Drug Delivery Market Key Takeaways

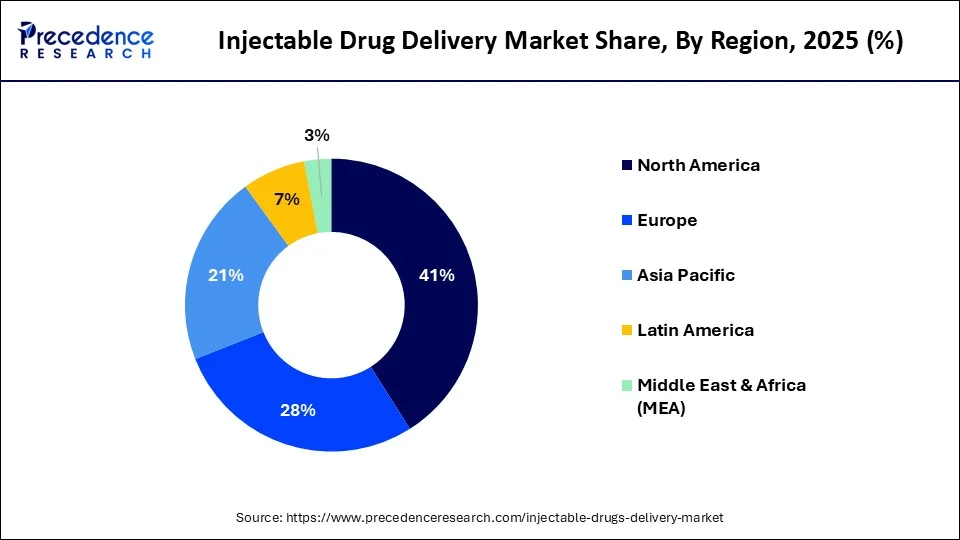

- North America dominated the global injectable drug delivery market with the largest market share of 41% in 2025.

- Asia Pacific is projected to grow at the fastest CAGR during the forecast period.

What is the Infant Injectable Drug Delivery?

The injectable drug delivery market refers to the controlled or sustained injectable systems to achieve a prolonged effect of drugs at targeted sites. This approach reduces the dosing frequency, maximizes the efficacy dose relationship, decreases adverse side effects, and enhances patient compliance. There are several routes of drug administration such as intravenous, subcutaneous, or intramuscular injection. There can be increased safety and potency of drugs, maximum utilization of drugs, improved patient convenience and compliance, reduction in fluctuation, and reduction in healthcare costs through improved therapies, less treatment period, and reduced frequency of dosage. The efficient and controlled drug delivery systems include injectables such as solutions, colloidal dispersions, microcapsules, nanoparticles, liposomes, etc. The infusion devices include osmotic pumps, vapor pressure-powered pumps, and battery-powered pumps. Teva Pharmaceuticals Industries Ltd., Pfizer Inc., Terumo, Baxter International Inc., Sandoz, etc. are the prominent industries in this market.

Role of Artificial Intelligence in the Injectable Drug Delivery Market

Artificial intelligence, deep learning, and machine learning technologies are utilized in drug discovery and delivery while optimizing treatment regimens and patient outcomes. AI also helps in target identification and validation, selection of targets, supply chain optimization, prediction of the synthetic route, predictive maintenance, and monitoring during continuous manufacturing processes. AI enhances efficiency, reduces costs, and improves the quality of medicines and patient health. In drug discovery, AI is used for molecular modeling and chemical structure prediction. Machine learning algorithms can analyze complex datasets which help streamline the drug discovery process by predicting molecular interactions and optimizing drug formulations.

Injectable Drug Delivery Market Growth Factors

- One of the significant factors driving the growth of the global injectable drug delivery market is the growing prevalence of cancer.

- Due to increased demand for medical goods such as pre-filled syringes and injections, manufacturers have expanded their production capacity to keep up with demand.

- Furthermore, governments worldwide are contributing towards the growth of the global injectable drugs delivery market.

- The government is heavily investing in the development and launch of novel injectable drug delivery in the market.

- Due to the broad product portfolio and impressive distribution network of large businesses in both emerging and established nations, the competitive rivalry of the global injectable drug delivery market is unified in nature.

- Some of the primary strategies followed by major market players include significant funding for the development of innovative and latest technologies, as well as the introduction of unique goods such as sophisticated wearable medical devices and gadgets.

Market Outlook

- Industry Growth Overview: Growth is expected to be fueled by the adoption of biologics and increased demand for specialized devices used to deliver injections to pediatrics.

- Sustainability Trends: The change towards reusable injectors, less material waste, and environmentally friendly packaging solutions.

International Growth: The leadership in innovation grows as access to healthcare increases in growing areas. - Major Investors: Johnson and Johnson, Pfizer, Novartis, West Pharmaceutical Services, Becton Dickinson, Gerresheimer, Ypsomed, and Abbott are the investors in the delivery innovations.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 764.6 Billion |

| Market Size in 2026 | USD 829.98 Billion |

| Market Size by 2035 | USD 1,719.57 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 8.45% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Formulation Packaging, Therapeutic Application, Usage Pattern, Site of Administration, Distribution Channel, Facility of Use, Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

The rise of biopharmaceuticals and the growing consumption of sterile injectables all around the world are majorly contributing to the market's growth. The biopharmaceuticals are increasingly preferred to treat chronic conditions like diabetes and arthritis which surges the need for injectable drug delivery systems. A growing focus towards enhancing patient experiences by improving the quality of patient-centric healthcare approaches boosts the demand for these advanced systems.

Restraint

The rising need for precise dosages and the potential risks of infections in drug-administered areas can impose remarkable challenges in front of healthcare professionals. Scaling up injectable formulations is another challenge in these systems and processes. Inadequate biological resources also impact the expansion of the market worldwide.

Opportunity

Scientists could find strategies for selecting the right CDMO to ensure the growth of nasal drug projects and nasal drug delivery. They would also be able to improve aerosol delivery, nanosuspension, and mesh technology. Hospitals, home-care settings, and other healthcare facilities would expand this market by being potential end users.

Segment Insights

Type Insights

The devices segment accounted largest revenue share in 2025. The growing prevalence of chronic disorders is leadingto an increase in overall syringe practice, predominantly disposable syringes. The cardiovascular illnesses, diabetes, and obesity have been found to be leading causes of death from chronic disorders. As populacesurge is believed to be the critical factor in emerging nations, this is likely to have the highest impact all around the world.

The formulations segment is fastest growing segment of the injectable drugs delivery market in 2025. The growing prevalence of chronic disorders, increased acceptance of self-injection, patient adherence, biologics, and innovative technologies are all factors driving this segment's rapid rise.

Therapeutic Application Insights

The auto-immune diseases segment accounted revenue share in 2025. The immune system attacks and destroys its own body tissue in autoimmune diseases. The diabetes, lupus, rheumatoid arthritis, and other auto-immune diseases are among the most frequent. Immune suppressants, anti-inflammatory medicines, and other medications have been licensed to treat auto-immune illness.

The oncology segment is fastest growing segment of the injectable drugs delivery market in 2024. The growing prevalence of cancer is driving the growth of the segment. As per the American Cancer Society, by 2024, there will be roughly 1,806,590 cancer patients in the U.S. alone, up 31% from 2010.

Distribution Channel Insights

The hospitals segment dominated the injectable drugs delivery market in 2025. This is attributed to an increase in the number of people admitted to hospitals with acute and chronic wounds. In addition, expansion of the segment is also being driven by the surge in the number of standalone clinics in established and developing nations.

The retail pharmacy stores segment is expected to strong growth over the forecast period. The retail pharmacy stores sell pharmaceutical medications and drugs. These stores offer generic and branded medications, as well as other pharmaceutical supplies. The growing preference of patients for buying injectable drugs delivery from these stores is driving the growth of the segment. In addition, growing consumption of over the counter drugs is also contributing towards the expansion of the retail pharmacy stores segment.

Regional Insights

What is the U.S. Injectable Drug Delivery Market Size?

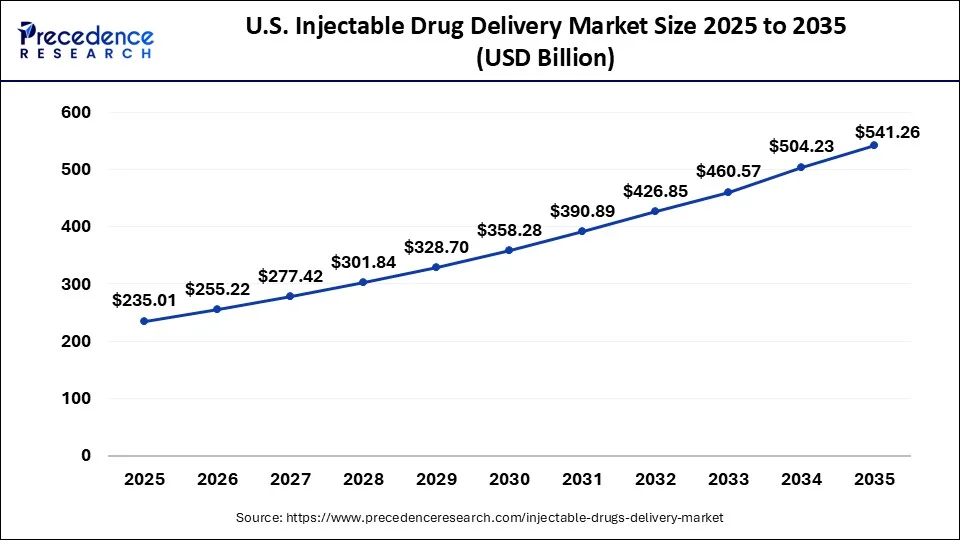

The U.S. injectable drug delivery market size was evaluated at USD 235.01 billion in 2025 and is predicted to be worth around USD 541.26 billion by 2035, rising at a CAGR of 8.70% from 2026 to 2035.

Why North America Dominates the Infant Injectable Drug Delivery Market

North America dominated the injectable drugs delivery market in 2025. The growth of injectable drugs delivery market in North America region is being attributed to the growing prevalence of various disorders. In addition, rising adoption of strategies by market players are also supporting the growth of North America injectable drugs delivery market.

The North America market is growing due to the rising incidence of diabetes, cancer, and autoimmune disorders in the North American region. The need for long-term treatments with injectable medications is fueling the demand for advanced drug delivery devices. Furthermore, the growing adoption of self-administration devices among patients boosts the market's growth in this region. The adoption of such advanced devices empowers people in managing their own health conditions more effectively. The expansion of autoinjectors, needle-free injectors, and wearable injectors is driving this market significantly.

U.S. Infant Injectable Drug Delivery Market Trends

The US has seen a steady and significant growth in the market; the growth is driven by the growing healthcare and pharmaceutical infrastructure in the country, which fuels the growth. Key players in the country play a significant role in the growth of the market. Government initiatives and investments in the healthcare sector also contribute to the growth and expansion of the market in the country.

Accelerating Growth: Europe Leads the Infant Injectable Drug Delivery Boom

Europe, on the other hand, is expected to develop at the fastest rate during the forecast period. The UK dominates the injectable drugs delivery market in Europe region. The Europe injectable drugs delivery market is attributed to the factors such as the rise of the biologics market, rising incidence of chronic disorders, and the rising demand for self-injection devices are all contributing to this trend. The other factors propelling the growth of injectable drugs delivery market in Europe region are rising disposable income, rising number of partnerships, and rising awareness about safety and comfort.

The UK Infant Injectable Drug Delivery Market Trends

The rising geriatric population in Europe along with the growing cases of diabetes, cancer, etc. boosts the need for injectable drug delivery systems and devices in this region. A large healthcare expenditure and a strong shift towards personalized medicine are expected to drive the market in this region. The United Kingdom's Medicines and Healthcare Products Regulatory Agency approved the injectable diabetes medication of Eli Lilly for its use in weight loss and management for adults aged 18 and above.

Rising Demand: Asia Pacific's Growth in Infant Injectable Drug Delivery

Asia-Pacific is expected to witness the fastest growth during the forecast period in the newborn injectable drug delivery market. The increase is mainly attributed to the rapid urbanization and the prevalence of chronic illnesses among children. The expansion of health-care facilities has resulted in better treatment coverage for newborns and infants. The government programs are supporting the production of advanced devices that are both high-quality and low-cost

India Infant Injectable Drug Delivery Market Trends

India has seen a steady growth in the market-driven by the increasing prevalence of chronic diseases like diabetes, cardiovascular diseases, and cancer in the country due to the increasing population of geriatric individuals and the changing lifestyle of individuals, which drives the growth. Technological advancement and innovation in drug delivery systems to improve patient compliance drive the growth, and the growing medical sector in the country further fuels the growth and expansion of the market in the country.

Value Chain Analysis of the Infant Injectable Drug Delivery Market

- R&D: Direction towards finding infant-safe drug molecules and new injectable delivery methods through structured tests.

Key Players: Johnson & Johnson, Roche, AstraZeneca - Clinical Trials and Regulatory Approvals: Test the safety and efficacy, and make sure that it complies with regulations before authorizing infant medical.

Key Players: Duke Pediatric Trials Network, CDSCO, FDA, EMA - Formulation and Final Dosage Preparation: Prepares stable injectable preparations that may be used in the administration needs of infants.

Key Players: Vetter Pharma, Gufic Biosciences, AbbVie - Packaging and Serialization: Provides protection, traceability, and regulatory compliance of product supply chains.

Key Players: West Pharmaceutical Services, BD (Becton Dickinson), Gerresheimer - Delivery to Hospitals and Pharmacies: Manages the logistics of safe storage, handling, and availability.

Key Players: McKesson, Cardinal Health, AmerisourceBergen, DHL LifeConex

Infant Injectable Drug Delivery Market Companies

- Becton Dickinson and Company: Supply prefillable syringes and sophisticated delivery systems that offer accurate, safe, and reliable delivery of the infant injections.

- Pfizer Inc.: Invents new therapies but improves injectable delivery technologies to meet the needs of pediatric and infant treatments.

- Teva Pharmaceuticals Industries Ltd: Provides cheap generic injectable drugs, which enhance access and sustainability of infant health care therapies.

Other Major Key Players

- Dickinson and Company

- Eli Lilly and Company

- Baxter International, Inc.

- Sandoz

- Terumo

- Schott AG

- Gerresheimer

- Ypsomed

- Bespak

- B. Braun Melsungen

Recent Developments

- In March 2025, MIT engineers developed a novel method for delivering high-dose medications with minimal discomfort, using injectable suspensions of microscopic drug crystals. Once under the skin, these crystals self-assemble into a long-lasting drug “depot,” potentially offering months or even years of sustained release. This innovation could significantly reduce injection frequency for treatments like long-acting contraceptives.

(Source: https://news.mit.edu) - In February 2025, Selkirk Pharma, Inc., a privately held U.S. pharmaceutical manufacturer specializing in the fill and finish of injectable drugs, including vaccines and biological therapeutics, introduced ClinFAST, a new service aimed at accelerating the fill-finish process for clinical trial supplies. Tailored for biotech and pharmaceutical companies, ClinFAST offers rapid, small-batch production without compromising quality, addressing a common industry bottleneck often overlooked by larger contract manufacturing organizations.

(Source: https://www.businesswire.com) - In July 2024, Pfizer Inc. announced the selection of its preferred once-daily modified release formulation, an oral glucagon-like peptide-1 receptor agonist (GLP-1).

- In December 2024, Baxter International Inc. announced the launch of five new injectable pharmaceutical products in the U.S. showcasing a continued growth of pharmaceutical portfolio.

Segments Covered in the Report

By Type

- Devices

- Conventional Injectables

- Pre-Filled Syringes

- Auto-Injectors

- Pen-Injectors

- Formulations

By Formulation Packaging

- Ampules

- Vials

- Cartridges

- Bottles

By Therapeutic Application

- Auto-immune diseases

- Hormonal Disorders

- Orphan Diseases

- Oncology

- Others

By Usage Pattern

- Curative Care

- Immunization

- Other

By Site of Administration

- Skin

- Circulatory/Musculoskeletal

- Organs

- Central Nervous System

By Distribution Channel

- Hospitals & Clinics

- Retail Pharmacy Stores

- Others

By Facility of Use

- Hospitals & Clinics

- Home Care Settings

- Other

By Geography

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting