Life science firms expand with mRNA, cell and gene therapies, and capital projects, despite labor shortages, rising competition, and supply chain challenges.

Popular commitments among diverse life companies are to step into the massive venture capital market to strengthen their secure competitive position.

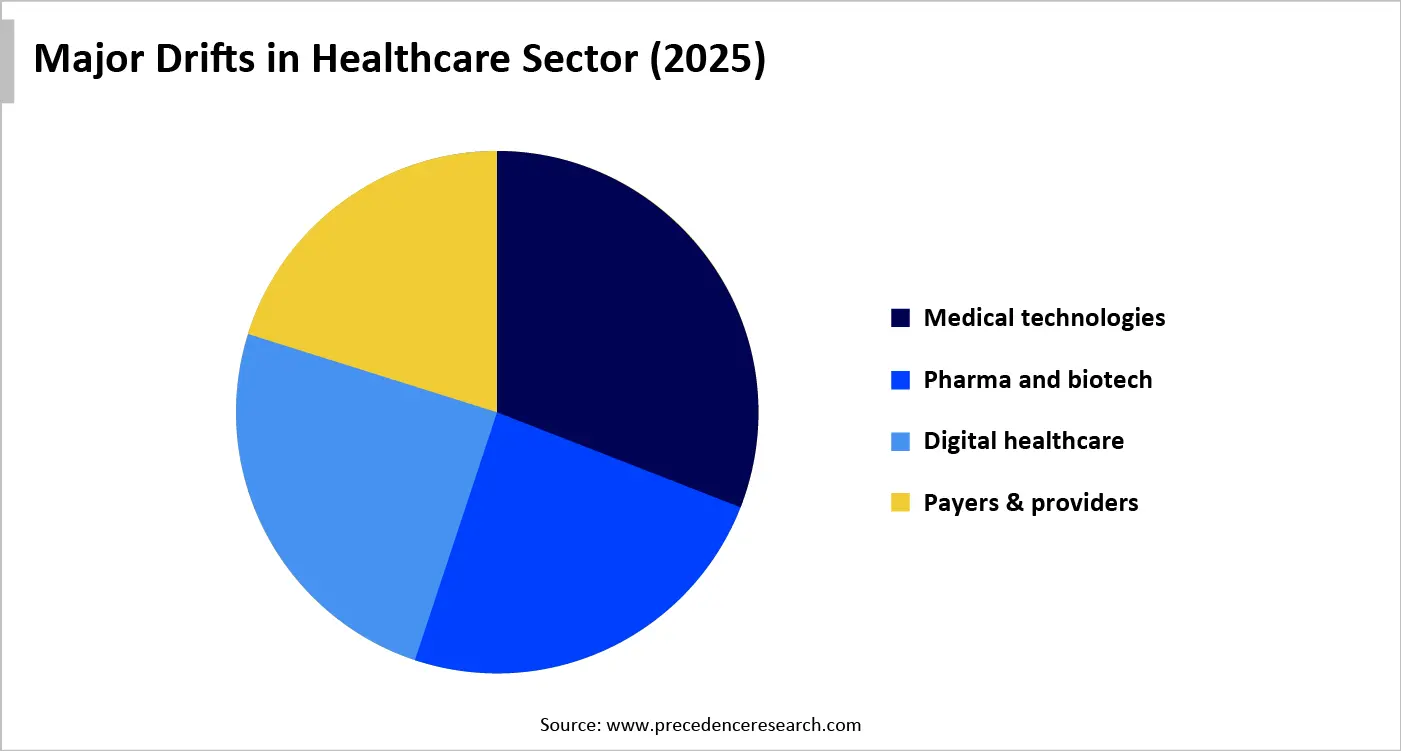

In the case of health innovations, the US healthcare system will reach $5.6 trillion in 2025, and it is estimated to reach about $8.6 trillion by 2033. This merger aims to enlarge production capacity while optimising supply chain resilience.

To be sure, as other industries emerge with consistent investment in capital projects, there will be a rise in competition for skilled labor, specialized equipment, materials, and other resources.

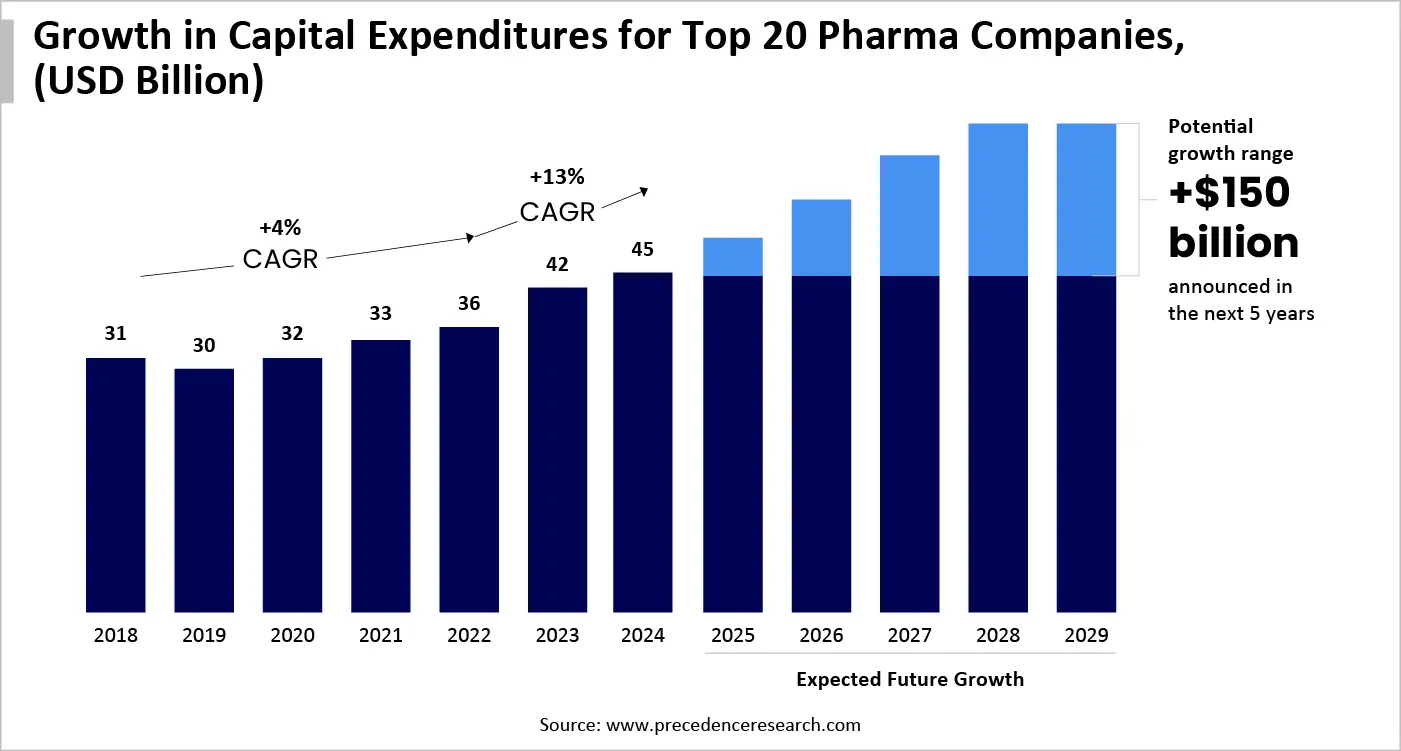

Life science companies are propelling their expansion with transformative advances in messenger RNA (mRNA), cell and gene therapies, and innovative large-scale drugs, like GLP-1s. Whereas exploring life science trends anticipates that in prospective projects, more than $150 billion will be new capital before 2030, this is the utmost statement by significant firms.

Certain firms are lagging in the pursuit of robust, integrated capabilities in project management, exceptional talent, and capital project conveyance in supporting them to derive maximum fruitful results. A lack of labour source and skilled minds for catering to various programs is hindering the future progress. According to Precedence Research's expertise, many executives from pharmaceutical, biotechnology, biosimilar, and medical device manufacturing companies, particularly around the United States, Europe (France, Germany, Switzerland, and the United Kingdom), and Asia (China and Japan), have studied their industrial issues and priorities, eventually in August and September 2024.

This will explore essential efforts in schedule-first project management; vital & robust strategic procurement and contracting models; enhanced commissioning, qualification, and validation (CQV) readiness; and comprehensive integrated delivery capability and talent strategy.

Pivotal Hurdles in the Persistent Growth of Life Science Projects

- Inclusion of Traditional Approaches:- As per the survey, for the rigorous expansion of these firms to acquire a leading position, they face critical barriers, especially the emergence of traditional pathways to novel projects. To rush innovations for the productive life cycle impact, some companies may follow cutting features, downsize the scope, pressure contractors for extending expenditure, or resolve most of the risk onto contractors.

- Shortage of Inward Possession & Talent:- A rise in the necessities of extensive internal facilities in project management, scheduling, and field execution, is restricting venture capital in translation to quicker, better outcomes. Oftentimes, numerous companies depend on engineering, procurement, and construction management partners, which assist in delivering projects.

- ROI Crushing:- Constant spending significance, whereas speed is currently a critical driver of value. Companies are bolstering essentials for the management of time, price, and risk as an integrated system, alongside, requirement for the development of capabilities that allow them to deliver on all three.

Inclusion of a Time-Dependent Capital Approach

The possession of a greater margin of many life science companies look for speed up their marketing, which often concerns more than expense, which can result in losing revenue, minimising patient access, and infirm competitive reach. To put steps with these circumstances, organizations should replan regarding their delivery of capital projects, which will focus not only on lowering price but also on raising pace and reliability. Additionally, the leading companies are combining four capabilities that consistently propel speed, control, and sustainable value creation around their capital portfolios.

Escalation of Scheduling Management as a Prominent Focus

Emerging approach in scheduling, support tracking and fueling the respective progression. Complete embracement of this approach can constrict timelines, with increased value capture and accelerated ROI. Life sciences companies can merge many steps for implementing this approach.

- Appropriate Scheduling Act as a Vital Requirement - An execution of scheduling as a passive reporting tool by many more capital aspects is explored timely manner. However, the current advances are operating the integrated master schedule (IMS) as the functional backbone, which fosters alignment of design, procurement, construction, and CQV, based on a single, authoritative plan.

- Adoption of Generative Tools for Simulation and Optimization - Global leader putting efforts into the application of highly sophisticated solutions, including generative scheduling platforms for executing ways, detecting expansion levers and modeling trade-offs vigorously. For instance, the growth of the biologics encourages the use of generative scheduling in resequencing the installation of a clean room and quality control lab, abbreviating the schedule by six weeks. Companies accepted a schedule-first project management report timeline, lowering 10 to 15 %, with expanded transparency and better coordination across workstreams.

Emergence of Well-Planned Procurement & Contracting Formats

On the completion of proper methods, these strategic procurements can minimizes spending with secured trustworthy delivery. This mainly needs a look at the entire price around the whole contract as against to just “buying cheapest.” Further leverages the protection of the schedule, optimizes capital effectiveness, allowing its implementation at the needed speed for advanced life science portfolios. Ongoing adoption of these progressive contract models becomes helpful for companies even in the generation of barriers.

- Engaging Suppliers for Prior Formulation - The contribution of significant life science organisations in bringing contractors & major suppliers for earlier process shaping, commonly at the concept designing period to formulating scope, clarifying characteristics, and locking in a critical times period schedule is found. Instead of uniform sourcing, workteams are breaking scope into prior bid packages, which enables similar enhancements on design and procurement, and delivers long-lead equipment a head start.

- Leveraging Outcome-based Contracting Models - Day by day, life science organization are exploring innovative, team-oriented contracting models, particularly modern design-build or integrated project-delivery contracts. This further connects incentives through gainshare and painshare arrangements, also shares risk, line up incentives, and offers owners increased control over the project life cycle.

- Formulate Contracts for Reflecting Real-World Conflicts - For ensuring real-world complexity through contracts, life sciences firms foster prior discussion on acceleration terms, lead-time buffers, and productivity assumptions. Teams also encourage engaging capable owner reps, with people who can negotiate performance structures, handle claims risk, and support suppliers integrated with the rigorous scheduling.Comprehensively embedded strategic procurement solutions have displayed procurement cycle time that is upgraded by up to 20 percent, alongside boosted expense specificity through minimized claims and change orders.

Reinforcing CQV Preparedness

It is an important requirement for firms to combine strong CQV with a specialized workstream for delivering safe, high-quality, compliant products. Furthermore, proper execution of CQV assists in increasing products’ time to market, raising ROI. Organizations can admire different ways for this timely delivery and high-quality CQV.

- Coupling a Front-Loaded CQV Scheme with the Construction Process - The CQV has widespread use in developing skippable delays, along with the avoidance of bottlenecks and escalating the construction process without settling compliance or product release itinerary.

- Usage of Modular, Prequalified Approaches to Acquire Pace - For a more concise outline, modern groups locate transportable, pre-validated systems that appear on-site with significant portions of commissioning and testing already completed. At certain times, factory and site acceptance testing are implemented off-site in controlled circumstances, where separate testing of equipment can be possible from the construction development and with minimal start-up risk.

- Employ digital tools and risk-based validation - In the management and automation of protocol implementation, as well as deviation monitoring, the combination of quality management systems (QMS) and laboratory information management systems is boosting the use of digital platforms. This accelerates the pace and control systems. Across this, they support emphasizing resources on critical systems, lowering protocol bloat, and speeding up batch release.From the start, companies that are integrating CQV could experience expansion of their start-up within their to six months, meanwhile they can also possess improvements in compliance and documentation quality.

Establishing Institutional Delivery Potentials & Talent Strategies

The presence of expert talent and inward potentials further results in sharper, quicker, and more-resilient production outputs. While companies can step through various actions for building smarter internal teams and capabilities to control the delivery process.

- Raising Institutionalization and Repeatability - Highly developed companies are seeking a diverse approach with the utilization of engineering, procurement, and construction management for facilitating short-term execution capacity. Through this, they escalate their institutional capabilities for achieving repeatable, high-value delivery.

- Launching Center of Excellence (COE) - The leading firms are evolving capital COEEs, devoted functions in codifying excellent practices, providing experts in assisting projects, and enforcing governance regulations around the portfolio. This comprises diverse engineers, schedulers, contract strategists, and controls experts and locates them seamlessly across projects. This also teams up varied skills for planning, negotiating, and managing capital efficiently.

- Validating Execution Via Playbooks - These well-established COEs are crafting standardized capital playbooks to allow consistency and speed, which further encompass stage gates, contracting models, scheduling protocols, and CQV workflows.Firms that have developed robust internal delivery teams showed reduced delays, rapid ramp-up of new sites, and a 15 to 30 percent rise in capital project throughput across the portfolio.

Exceptional Reliance on Internal Regulatory and Amendable Personnel

With varied geopolitical developments in the life science sector, companies’ CEOs are shifting from the classic belief that their in-house teams consisting of the expertise that necessitates navigation of the complex regulations impacting the evolution of novel customer-centric businesses. Above all, the life science industry is one of the strongly regulated domains, as stated by our organization analysis. While organizations have substantial regulatory and data workforce, which emphasizes confirming compliance, managing regulations, and mitigating patient information. The contribution of numerous experts during the disposal, CEOs of life science companies often expect that their firms will possess beneficial outcomes during the unveiling of groundbreaking business in the well-regulated surroundings.

Welcoming AI Solutions: Implementing in a Variety of Sectors

As of now, 2025 is facing a major global economic drift, trade tariffs, most-favoured-nation costing regulations, supply chain susceptibility and regional pressures. This shows that approximately eight in ten life science firms are increasingly embracing gen AI. Furthermore, as per the Precedence Research study, it is investigated that around 75% to 85% of workflows in different pharmaceutical and medtech are leveraging advanced automated tasks.

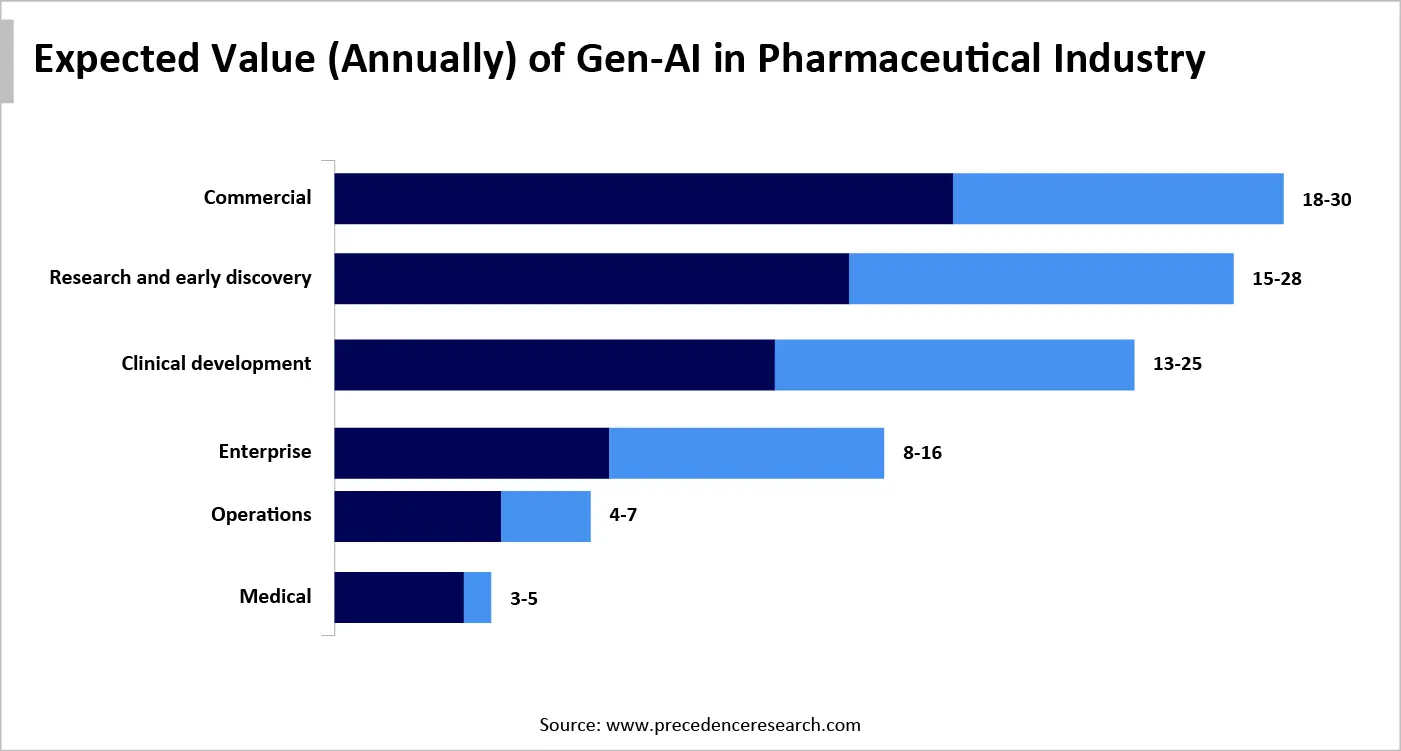

Impactful GenAI in the Pharmaceutical Sector

The digital era of 2025 has experienced the wider use of gen AI across the complete business value chain by its capability to create myriad sources of data, both structured and unstructured, and develop bespoke visual, textual, and even molecular content. According to our study, it has been predicted that advanced technology could add $60 billion to $110 billion a year in economic value for the pharma and medical-product industries.

- Specified Application of Foundational Models - Across the globe, many pharmaceutical companies have been widely employing foundational models, specifically encompassing image models for the analysis of microscopy and pathology data. Additionally, this bolsters natural-language models, particularly BioGPT and Med-PaLM. Moreover, life science companies are encouraging involvement of chemistry models to optimize estimations for functional readouts of small-molecule data, large-molecule models for protein folding and predictions.

- Exclusive Virtual Assistance in Drug Production - A wide range of gen AI-enabled virtual support is making various improvements in dug manufacturing through the faster placement of related standard operating procedures. Alongside automatically establishing checklists and guides for subsequent right-first-time operations, and supporting supervisors for monitoring and managing line performance in real time.

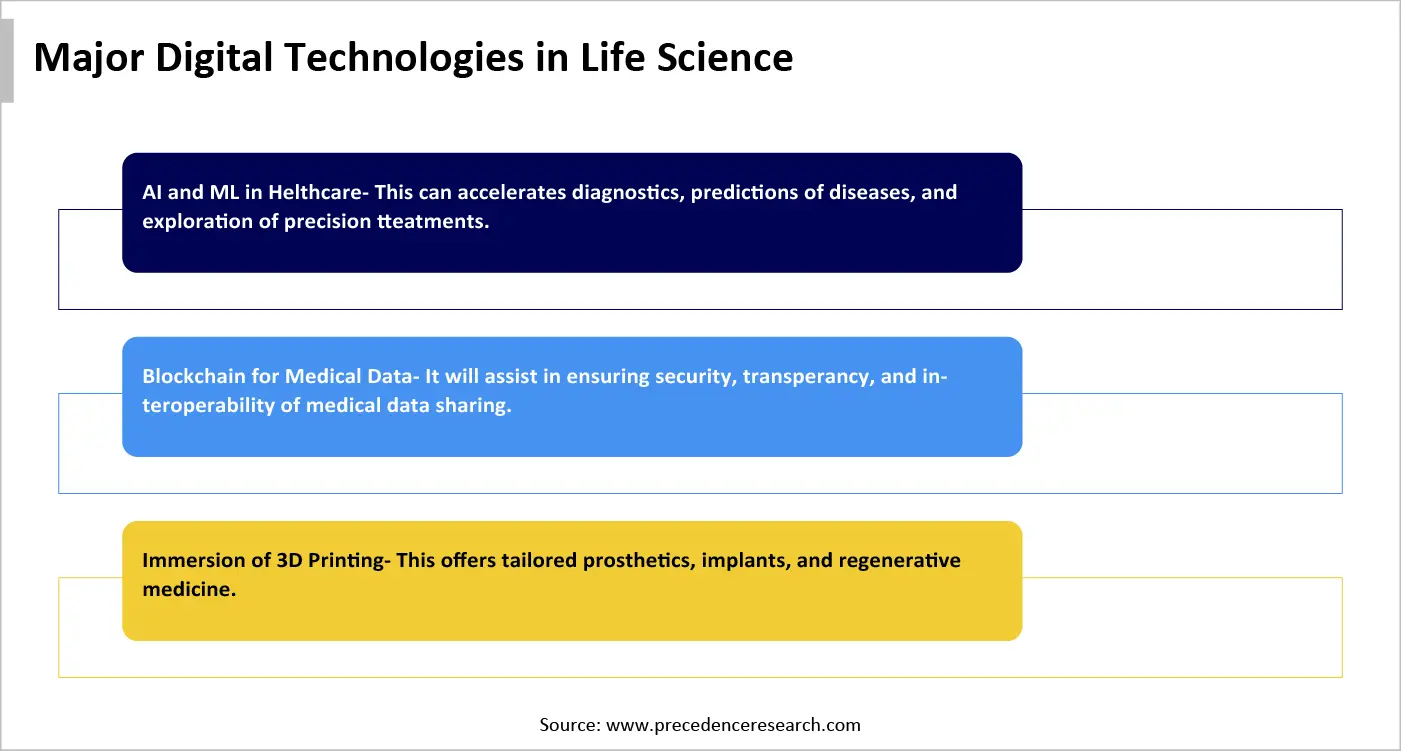

Blooming Digital Health Technology in Life Science

Many life science organizations are promoting advanced technologies in their variety of areas, including the healthcare sector. For this, research analysis is predicted to cross $750 billion by 2028. This will expand due to the greater adoption of innovative technologies, particularly telemedicine, wearable health devices, and remote patient monitoring. These approaches are helping to move towards the healthcare paradigm from reactive to proactive care. Along with the accelerating patient outcomes, this digitalization is resolving limitations among leading industries, including a lack of workforce, increasing spending, and interoperability concerns.

Embedding Complementary Facilities Promotes Prospective Pathways

As per Precedence Research analysis, around 28% of fund managers are actively investing in life science business strategies to leverage acquisitions of complementary services, such as medical devices, diagnostics, and software as a service (SaaS). Similarly, many robust companies are inventing organizational conviction and allowing their teams to deploy sophisticated tools to ready their firms for action.

Reshaping R&D Plans Merged Majorly in Pharma & Medtech Firms

The revolutionary life science sector is expected to surge in reshaping R&D aspects, specifically among half of the medtech executives and 56% of the biopharma executives. This accelerates the requirement of transformative R&D approaches, along with product development policies in the upcoming 12 months. Approximately 40% of the entire survey boosts the significance of R&D productivity to address cross-retaining within the organizations.

Introduction of 5 Major Aspects for a More Efficient R&D Functioning Model

- Exposure to considerably simplified governance, as well as a single centralized decision-making hub influencing priority programs.

- Deployment of spirited, at-risk, and parallel resources, which quickly combine across what works.

- Leveraging ownership of diverse activities for developing unbalanced values.

- Updating a particular sector to foster as an AI-native company.

- Expanding global regional footprint by targeting planned activities into a certain R&D hub.

Major life science companies, including pharma, biotech, medtech and healthcare domains, are surging into the adoption of CQV systems, AI innovations, proper scheduling management, and enhanced capital investment. These all dynamics can be upgraded with the inclusion of modular things, gen AI-based tools, and the launch of various productive approaches and COEs.

About the Authors

Aditi Shivarkar

Aditi, Vice President at Precedence Research, brings over 15 years of expertise at the intersection of technology, innovation, and strategic market intelligence. A visionary leader, she excels in transforming complex data into actionable insights that empower businesses to thrive in dynamic markets. Her leadership combines analytical precision with forward-thinking strategy, driving measurable growth, competitive advantage, and lasting impact across industries.

Aman Singh

Aman Singh with over 13 years of progressive expertise at the intersection of technology, innovation, and strategic market intelligence, Aman Singh stands as a leading authority in global research and consulting. Renowned for his ability to decode complex technological transformations, he provides forward-looking insights that drive strategic decision-making. At Precedence Research, Aman leads a global team of analysts, fostering a culture of research excellence, analytical precision, and visionary thinking.

Piyush Pawar

Piyush Pawar brings over a decade of experience as Senior Manager, Sales & Business Growth, acting as the essential liaison between clients and our research authors. He translates sophisticated insights into practical strategies, ensuring client objectives are met with precision. Piyush’s expertise in market dynamics, relationship management, and strategic execution enables organizations to leverage intelligence effectively, achieving operational excellence, innovation, and sustained growth.

Request Consultation

Request Consultation