What is the IT Infrastructure Management Tools Market Size?

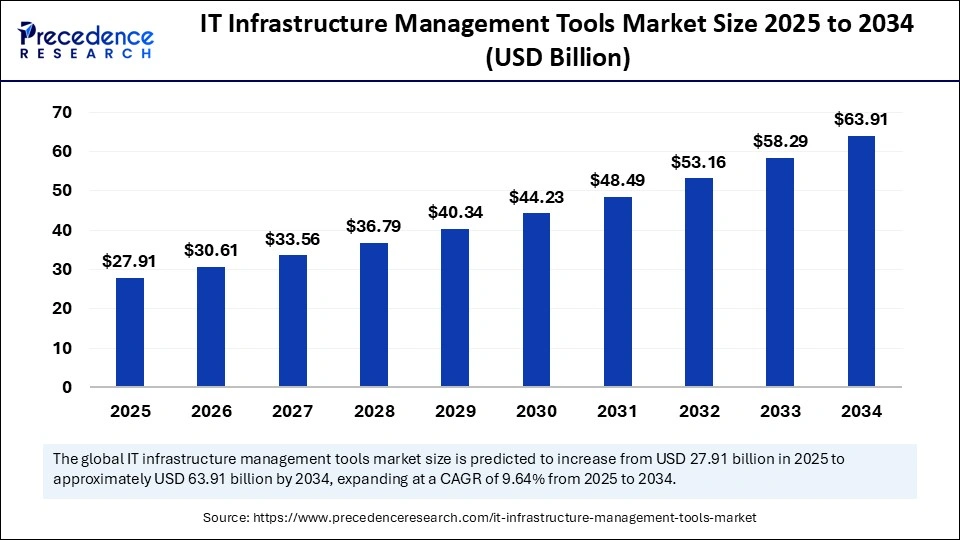

The global IT infrastructure management tools market size was calculated at USD 25.46 billion in 2024 and is predicted to increase from USD 27.91 billion in 2025 to approximately USD 63.91 billion by 2034, expanding at a CAGR of 9.64% from 2025 to 2034. The market is driven by the rising demand for cloud-based solutions, automation, and real-time monitoring to enhance operational efficiency and security.

Market Highlights

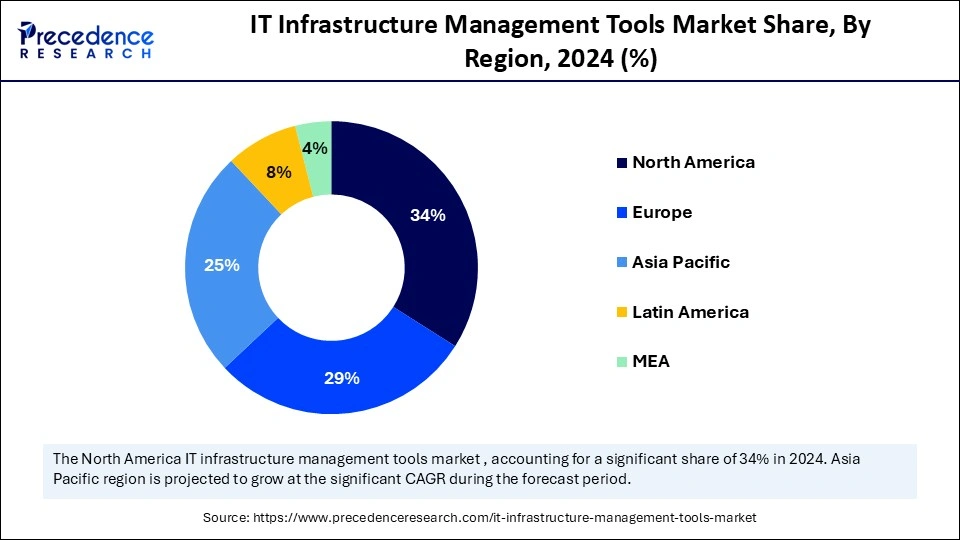

- North America dominated the IT infrastructure management tools market with the largest market share of 34% in 2024.

- Asia Pacific is anticipated to witness the fastest growth during the forecasted years.

- By functionality/tool type, the IT service management (ITSM) integration (incidents, change) segment led the market in 2024.

- By functionality/tool type, the AIOps (anomaly detection, root-cause, event correlation) segment is anticipated to show considerable growth over the forecast period.

- By managed component/domain, the server/compute management segment held the biggest market share in 2024.

- By managed component/domain, the container & Kubernetes management segment is anticipated to show considerable growth over the forecast period.

- By deployment model, the hybrid segment captured the highest market share in 2024.

- By deployment model, the cloud/SaaS segment is anticipated to show considerable growth over the forecast period.

- By organization size, the large enterprises segment contributed the maximum market share in 2024.

- By organization size, the mid-market enterprises segment is anticipated to show considerable growth over the forecast period.

- By industry vertical, the financial services & fintech segment dominated the market in 2024.

- By industry vertical, the healthcare & life sciences segment is anticipated to show considerable growth over the forecast period.

- By component/offering, the pure software license segment generated the major market share in 2024.

- By component/offering, the managed services / 24x7 operations segment is anticipated to show considerable growth over the forecast period.

Market Size and Forecast

- Market Size in 2024: USD 25.46 Billion

- Market Size in 2025: USD 27.91 Billion

- Forecasted Market Size by 2034: USD 63.91 Billion

- CAGR (2025-2034): 9.64%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

Market Overview

The IT infrastructure management tools market is centered on the highly diverse software packages and services that oversee, control, automate, and safeguard IT ecosystems to guarantee well-operating and compliant enterprises. These tools encompass essential infrastructure components (servers, storage, networking, virtualization, containers, cloud resources, and related processes), including configuration, capacity planning, patch management, and incident or change management. IT infrastructure management tools can enable organizations to optimize system efficiency and improve performance, and reduce downtime because they offer centralized visibility and control.

The organizations are under constant pressure to deliver high-performing digital services by having control of hybrid infrastructures that cross on-premises systems, private clouds, as well as public cloud services. Such complexity leads to the necessity of having multi-level infrastructure management tools that can deliver real-time monitoring, automation, and predictive analytics to foresee failure and use resources to their highest extent. The businesses are also exploiting the tools to reduce the cost of operation by automating monotonous activities, as well as improving the efficiency of service delivery.

How Is AI Integration Transforming the IT Infrastructure Management Tools Market?

Artificial intelligence and automation are transforming the IT infrastructure management tools market because they are redefining the relationship between organizations in terms of monitoring, securing, and optimizing their IT ecosystems. Conventionally, infrastructure management was heavily dependent on manual intervention, which in most cases resulted in inefficiency and slow response time, and high chances of human error. The AI is automated to monitor the systems, detect incidents, analyze performances, and solve problems, which is now much faster and more precise. With the growing pressure of the business on the needs of agility, scalability, and resilience, the use of AI-based infrastructure management tools is accelerating, generating innovation and facilitating the general development of the market.

What Factors Are Fueling the Rapid Expansion of the IT Infrastructure Management Tools Market?

- Hybrid Cloud Adoption: The deployment of hybrid and multi-cloud environments is making IT infrastructure management tools in demand. Organizations require coherent platforms to plan various resources and have flawless integration, workload optimization, and consistent governance of on-premise, private, and public cloud environments.

- Security and Compliance Requirements: The growing number of cyber threats and the growing regulatory demands are leading to the utilization of IT infrastructure management tools that provide real-time monitoring, compliance tracking, and proactive risk management. These solutions help businesses to enhance the governance of IT, protect sensitive data, and maintain continuous operations without violating industry standards.

- Teleworking and E-commerce: The modern trend of remote and hybrid work models and processes worldwide has only increased the necessity of effective IT infrastructure management. As devices become increasingly connected, and with operations spread across geographies, organizations are embracing innovative management tools to ensure access security, reliability of the system, as well as the optimization of performance, which will enable smooth collaboration in the digital domain.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 25.46 Billion |

| Market Size in 2025 | USD 27.91 Billion |

| Market Size by 2034 | USD 63.91 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.64% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Functionality/Tool type, Managed Component/Domain, Deployment Model, Organization Size, Industry Vertical, Component/Offering, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising demand for operational agility and cost efficiency in complex IT environments

The current state of the enterprise industry is characterized by hybrid infrastructures that cut across on-premises systems, private clouds, and various public cloudplatforms that pose a governance, monitoring, and performance optimization challenge. Organizations are pressed in need to provide efficient and smooth digital experiences without fail while keeping high levels of compliance and security. The IT infrastructure management tools solve these issues through centralization of control, automation, and real-time visibility in the various systems. Moreover, the increasing trend toward remote and hybrid work patterns has made the necessary to have tools that would help to secure, scale, and make the IT systems always available.

Restraint

High Implementation and Maintenance Costs

Even though the IT infrastructure management tools present a tremendous operational advantage, the high cost of implementation and maintenance remains a significant hindrance, especially among SMEs. The cost of implementation of such tools can include a high cost at the onset in terms of software licensing, hardware modification, and integration services, which might not be affordable on tight IT budgets. In addition to the initial configuration, there are recurrent costs that an organization should consider, like updates in the system, patches for security, support, and ongoing training for staff to be able to efficiently use the system. As the financial capacity of the businesses is limited, these accumulating costs are prohibitive to businesses with limited resources that are unable to afford a comprehensive IT management solution.

Opportunity

Growing Adoption of Cloud Computing

The IT infrastructure management tools market is gaining a huge opportunity due to the rapid growth of services of cloud computing services. With the rising number of organizations moving their heavy workloads to the cloud, the challenge of dealing with hybrid and multi-cloud environments has grown more complex and needs more sophisticated solutions to ensure a smooth integration and optimization. Businesses have been experiencing issues related to do with the allocation of the workload, allocation of resources, cost-effectiveness, and regulatory conformity in the different platforms. This increasing complexity is a driving force behind the need to have infrastructure management tools that would offer centralized visibility, automation, and security of both on-premise and cloud systems.

Segment Insights

Functionality/Tool type Insights

Why Does the Infrastructure Monitoring + ITSM integration Segment Lead the IT Infrastructure Management Tools Market?

The IT service management (ITSM) integration (incidents, change) segment led the IT infrastructure management tools market and accounted for the largest revenue share in 2024, due to its vital contribution to the smooth functioning of the more complex IT environment. Monitoring of infrastructure allows real-time access to the performance of the systems, to pinpoint any issues in the performance before they escalate, and IT service management (ITSM) integration provides efficient incident, problem, and change management. The combination of these features brings a single platform that empowers the delivery of services, reduces downtime, and improves user experience.

The AIOps (anomaly detection, root-cause, event correlation) segment is expected to grow at a significant CAGR over the forecast period, driven by the increasing demand of having smart automated IT processes. AIOps (Artificial Intelligence for IT Operations) detects and offers proactive management of infrastructure through the use of big data analytics and machine learning, which applies anomalies, outage prediction, and recommended corrections. The introduction of cloud-native applications, microservices, and containerized environments makes AIOps-enabled automation more significant as well, and the value of manual management is growing in impracticality.

Managed Component/Domain Insights

Why Did Server/Compute + Network Management Contribute the Most Revenue in the IT Infrastructure Management Tools Market?

The server/compute + network management segment contributed the most revenue in 2024 and is expected to dominate throughout the projected period. Servers, compute resources, and networking continue to form a significant support base in enterprise IT environments to support critical applications, databases, and digital services. With the growth of the operations of businesses as well as the outsourcing of their services to the hybrid or multi-cloud platform, the need to monitor, optimize, and ensure the security of the underlying components has risen.

The container and Kubernetes management segment is expected to grow substantially in the IT infrastructure management tools market. As more enterprises are moving to cloud-native architectures, however, containers and Kubernetes have become the core of application deployment, scaling, and management of applications in hybrid and multi-cloud environments. These dynamic environments, though, have to be handled with certain tools that provide automated coordination, real-time tracking, and compliance with security measures.

Deployment Model Insights

Why Did the Hybrid Deployments Segment Lead the IT Infrastructure Management Tools Market in 2024?

The hybrid deployments segment led the IT infrastructure management tools market and accounted for the largest revenue share in 2024. The hybrid models give the organizations the freedom to strike a balance between data security, compliance needs, and scalability needs. The tools focused on managing IT infrastructure in a hybrid environment will allow monitoring the infrastructures centrally, integrating them smoothly, and maintaining similar governance criteria across multiple infrastructures to achieve the best performance with minimal downtime. Hybrid deployment models are regarded as the most effective and safe choice due to the acceleration of digital transformation by businesses and the pressure of regulations and increases in cyber risks.

The cloud/SaaS segment is expected to grow at a significant CAGR over the forecast period, due to the growing demand of the enterprise to gain agility, cost efficiency, and simplified IT operations. Cloud-native deployment models enable organizations to scale their IT infrastructure fast, do not require heavy initial investments, and also enjoy subscription-based pricing. The tools in SaaS also make them easy to access, update automatically, and integrate with the existing systems, thereby being of great interest to small and medium-sized enterprises. The model is particularly useful in organizations that have low IT resources or expertise.

Organization Size/Buyer Insights

Why Did Large Enterprises Contribute the Most Revenue in the IT Infrastructure Management Tools Market?

The large enterprises contributed the most revenue in 2024 and are expected to dominate throughout the projected period. The financial capability and technical expertise to install extensive suites mean that these companies invest in devices that have AI-powered alerts, cross-platform support, predictive analytics, and automatic remediation. Also, big companies tend to be in a highly-regulated business, such as banking, healthcare, and telecommunications, in which compliance, security, and dependability of the infrastructure are a critical part of the mission.

The mid-market enterprises segment is expected to grow substantially in the IT infrastructure management tools market, due to the presence of the mid-market and MSP-led SMB adoption through the SaaS segment as small and medium-sized businesses start adopting more cloud-first strategies. In comparison with bigger businesses, SMBs in most cases do not have huge IT budgets and internal knowledge, so IT infrastructure management tools based on SaaS can be a cheaper and more scalable option. The solutions do not require massive initial investments and allow access to enterprise-level capabilities like real-time monitoring, automated workflows, and built-in security provisions.

Industry Vertical Insight

Why Did the Financial Services and Telecom Segment Lead the IT Infrastructure Management Tools Market in 2024?

The financial services and fintech segment led the IT infrastructure management tools market and accounted for the largest revenue share in 2024, because they are based on mission-critical service level agreements (SLAs), and the necessity of highly resilient IT environments. Both sectors involve massive real-time transactions and interactions with customers and sensitive data, where any downtime can cost them a lot of money and regulatory fines, and a tarnished reputation. IT infrastructure management tools are deployed by telecom operators to support the large-scale network, to maintain a constant network, and to satisfy the performance demands of the digitally connected world.

The healthcare and life sciences segment is expected to grow at a significant CAGR over the forecast period, motivated by the current digital transformation programs and the urgent compliance necessity. The digitization of patient records, telemedicine solutions, and interconnected medical devices is becoming a common tool among healthcare providers, demanding sophisticated IT management tools to maintain the safety of patient data, its availability, and its adherence to such regulations as the HIPAA and the GDPR. One of the areas that is increasingly popular in infrastructure management is the use of infrastructure management tools that offer centralized monitoring, scalability, and automated compliance reporting.

Component/Offering Insights

Why Did Software + Professional Services Bundles Contribute the Most Revenue in the IT Infrastructure Management Tools Market?

The pure software license segment contributed the most revenue in 2024 and is expected to dominate throughout the projected period. Companies tend to move towards the integrated packages of improved software platforms, professional implementation, integration, as well as consulting services. These packages offer end-to-end services, deployment, and customization for the optimization of complex IT infrastructures, to ensure that complex IT infrastructures are well managed. The increasing complexity of hybrid and multi-cloud environments has driven the need to offer customized services that meet the organization-specific requirements, including compliance, risk management, as well as AI-driven automation.

The managed services/24x7 operations segment is expected to experience substantial growth in the IT infrastructure management tools market, due to the decision of enterprises to choose the predictability of the performance-based solutions. As IT environments continue to be further dispersed and consume more resources, organizations are delegating monitoring, optimization, and remediation capabilities to trusted service providers. Managed services simplify the operational experiences, cut the load of staffing, and provide 24/7 control, which are especially attractive to the buyers of the mid-market and SMB.

Region Insights

U.S. IT Infrastructure Management Tools Market Size and Growth 2025 to 2034

The U.S. IT infrastructure management tools market size was exhibited at USD 6.06 billion in 2024 and is projected to be worth around USD 15.32 billion by 2034, growing at a CAGR of 9.72% from 2025 to 2034.

Why Did North America Dominate the IT Infrastructure Management Tools Market in the IT Infrastructure Management Tools Market?

North America dominated the IT infrastructure management tools market, holding the largest market share of 34% in 2024,because the region was well-developed in a digital environment and had established enterprise needs in IT. Multinational companies, banking institutions, medical practitioners, and government departments are numerous in the area in need of adaptable, high-quality, and reliable IT systems. The innovation in the sphere of IT management reached the highest speed in North America, where cloud computing, artificial intelligence, and machine learning are adopted at a high rate. Further, the heightened emphasis on cybersecurity, data management, and compliance systems has also led to the growth in the number of advanced IT infrastructure management tools, which in turn enhanced the North American dominance.

The U.S. market is the engine of growth and contributes a huge share of the market in the region. U.S. enterprises encounter strict regulations regarding data protection and privacy, such as frameworks, such as HIPAA, SOX, and GDPR-aligned frameworks, that compel organizations to implement an extensive IT management platform. Digital transformation initiatives are also at the forefront in the U.S since a significant amount of money on infrastructure monitoring, cloud optimization, and automation technologies is spent in the finance, telecommunication, and healthcare industries. Furthermore, the startup, hyperscale cloud, and managed service organizations ecosystem that was doing well in the country encourages innovation and market development.

Why is the Pacific Expected to Grow at the Fastest CAGR in the IT Infrastructure Management Tools Market?

Asia Pacific is estimated to grow at the fastest CAGR during the forecast period, due to the accelerated digitalization and the growing enterprise IT ecosystems. The presence of cloud computing, virtualization, and AI-based technologies has massive penetrations in such countries as India, Japan, South Korea, and Southeast Asian countries. The new digitalization of infrastructure monitoring, automation of IT services, and solutions aimed at cybersecurity is required due to the accelerated development of 5G and e-commerce, fintech, and manufacturing. The growth of the markets is also supported by investments in smart city projects, Industry 4.0 projects, and government-sponsored digital policies. The increasing concern of regulatory compliance and the necessity of an operationally resilient environment also compel organizations to implement more sophisticated IT infrastructure management tools.

China has become one of the most prominent participants in the development of the Asia Pacific in the IT infrastructure management tools market. The country has a vast enterprise environment, fast-growing cloud solutions, and government-led efforts such as Digital China, which makes the country highly invested in sophisticated IT management services. The financial services, telecommunication, and manufacturing industries in China are actively embracing the hybrid cloud, automation, and AI-based monitoring tools to improve the performance and security of systems. The digitalization sweeping through the industries, the role of China as a technological development center, and mass adoption will remain one of the keys to the fast development of the Asia Pacific in the global market.

IT Infrastructure Management Tools Market Companies

- ServiceNow

- Microsoft

- IBM

- BMC Software

- VMware

- HPE

- Cisco

- Splunk

- Dynatrace

- Datadog

- New Relic

- SolarWinds

- ManageEngine

- Micro Focus

- Red Hat

Recent Developments

- In July 2025, startup cloud management env0 introduced an AI-based infrastructure intelligence tool that is meant to make it easier to deploy at scale in enterprises. The solution will remove the use of spreadsheets, scripts, and solving issues late at night because it will offer easily understandable and queryable insights.(Source: https://campustechnology.com)

- In March 2025, IBM added another as-a-service option to them by introducing IBM Storage Ceph as a Service. This addition complements services such as IBM Power that are offered as a service, which allows greater flexibility in the consumption and deployment model of on-premises infrastructure.

(Source: https://newsroom.ibm.com) - In April 2024, Accenture expanded its expertise in IT infrastructure management and system integration by acquiring Japan-based CLIMB of Japan-based CLIMB, an IT services provider. The acquisition brought in approximately 230 workers, 200 cloud and security engineers, which boosted the digital transformation potential in the financial sector and the government segments of Accenture in Japan.(Source: https://newsroom.accenture.com)

Segment Covered in the Report

By Functionality/Tool type

- Infrastructure monitoring (metrics, logs, events)

- Application performance monitoring (APM)

- Configuration management (CMDB, IaC)

- Automation and orchestration (runbooks, workflows)

- Patch and vulnerability management

- Asset and inventory management

- Capacity planning and cost optimization

- IT service management (ITSM) integration (incidents, change)

- AIOps (anomaly detection, root-cause, event correlation)

- Disaster recovery orchestration

By Managed Component/Domain

- Network performance and configuration management

- Server/compute management (physical and virtual)

- Storage management and SAN/NAS monitoring

- Cloud infrastructure management (IaaS/PaaS)

- Container and Kubernetes management

- Edge/IoT infrastructure management

By Deployment Model

- On-premises (self-hosted)

- Cloud/SaaS (multi-tenant)

- Hybrid (management across on-prem + cloud)

- Managed service (vendor/partner operated)

By Organization Size

- Small and medium businesses (SMBs)

- Mid-market enterprises

- Large enterprises/global 2000

- Hyperscalers and large cloud providers

By Industry Vertical

- Financial services and fintech

- Telecom and managed service providers

- Healthcare and life sciences

- Public sector and government

- Retail and e-commerce

- Manufacturing and industrial

By Component/Offering

- Pure software license (or subscription)

- Professional services (implementation, onboarding)

- Managed services/24x7 operations

- Training and support (SLA tiers)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting