What is the Laser Interferometer Market Size?

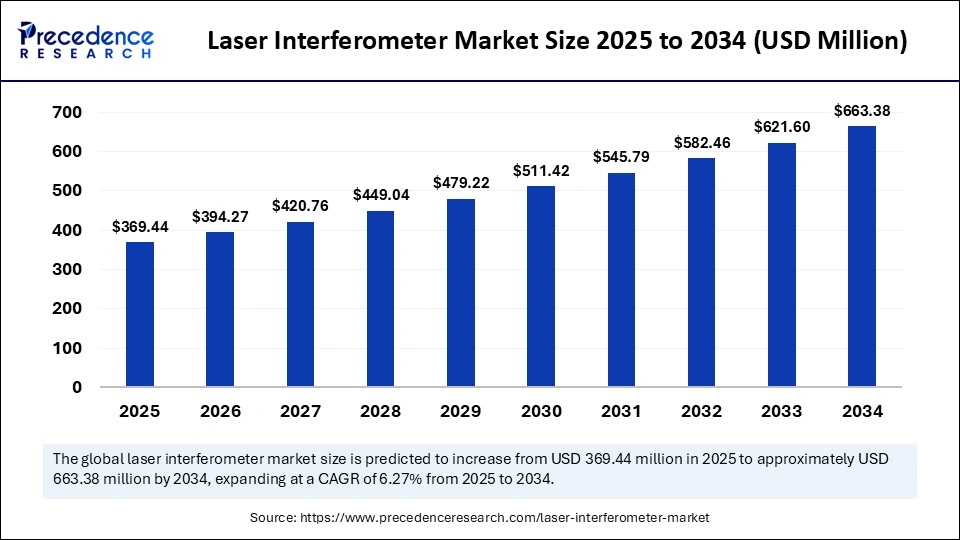

The global laser interferometer market size is anticipated at USD 369.44 million in 2025 and is predicted to increase from USD 394.27 million in 2026 to approximately USD 705.16 million by 2035, expanding at a CAGR of 6.68% from 2026 to 2035. This market is growing due to increasing demand for high-precision measurement and alignment solutions across industries such as semiconductor manufacturing, aerospace, and engineering.

Market Highlights

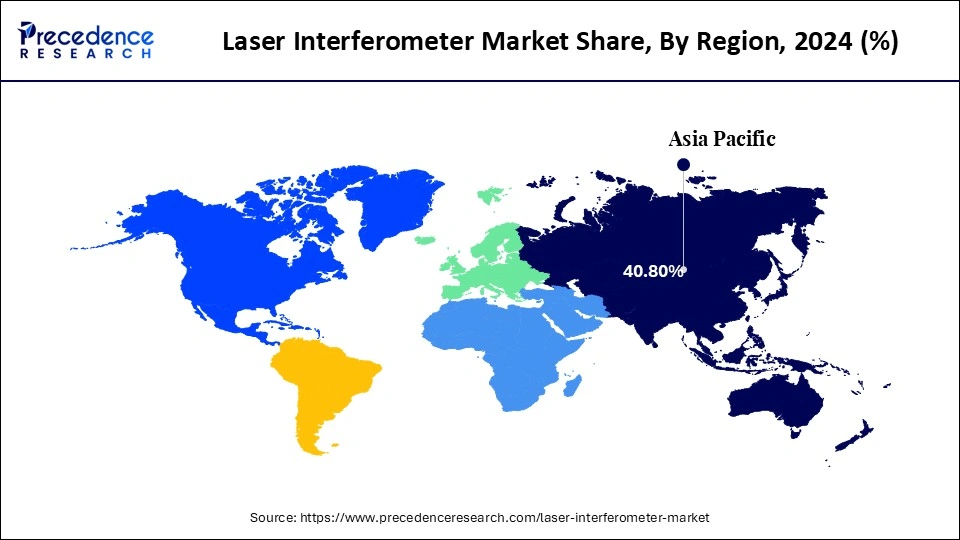

- Asia Pacific dominated the market, holding the largest market share of 40.8% in 2025.

- North America is expected to grow at a notable CAGR from 2026 to 2035.

- By type, the Michelson interferometer segment contributed the highest market share of 48.8% in 2025.

- By type, the Fabry-Perot interferometer segment is growing at a CAGR of 6.0% between 2026 and 2035.

- By axis type, the single-axis segment accounted for the largest market share of 65.4% in 2025.

- By axis type, the multi-axis segment is projected to lead the market in growth during the forecast period with an expected 6.2% CAGR.

- By interferometer configuration, the homodyne segment dominated the market in 2025 by holding the largest share of 73.4%.

- By interferometer configuration, the heterodyne segment is forecast to grow at the fastest CAGR of 6.4% from 2026 to 2035.

- By application, the surface topography segment held the biggest market share of 40.8% in 2025.

- By application, the semiconductor manufacturing segment is growing at a strong CAGR of 6.1% from 2026 to 2035.

Market Size and Forecast

- Market Size in 2025: USD 369.44 Million

- Market Size in 2026: USD 394.27 Million

- Forecasted Market Size by 2035: USD 705.16 Million

- CAGR (2025-2034): 6.68%

- Largest Market in 2024: Asia Pacific

- Fastest Growing Market: North America

Market Overview

What is the Laser Interferometer Market?

A laser interferometer works by splitting a laser beam into two paths: one directed toward a reference mirror and the other toward the target surface. When the beams are recombined, the resulting interference pattern reflects the difference in optical path lengths, which can then be translated into precise distance or displacement measurements.

The laser interferometer market is growing steadily because sectors like engineering, aerospace, and semiconductor manufacturing are experiencing an increase in demand for high-precision measurement solutions. Digital interferometry automation integration and laser source technological developments are increasing market uptake.

Key Technologies Shifts in the Laser Interferometer Market

- Advancements in Laser Sources: The development of coherent and extremely stable laser sources is increasingly improving the precision and accuracy of measurements.

- Digital and Smart Interferometry: Adoption of digital signal processing and smart interferometry techniques enables faster data acquisition, enhanced resolution, and improved reliability.

- Multi-axis and 3D Measurement Capabilities: Modern interferometers support multi-axis and three-dimensional measurements, enabling complex geometrical inspections and surface profiling.

Laser InterferometerMarket Outlook

The laser interferometer market is witnessing steady growth driven by the growing need for precise alignment and measurement in sectors like manufacturing, semiconductors, and aerospace. Global adoption is also fueled by developments in automation, multi-axis measurements, and integration with smart systems.

Sustainability is becoming more and more important as manufacturers concentrate on using eco-friendly materials and energy-efficient laser sources when producing an interferometer. Longer-lasting parts and lower energy usage help to maintain high measurement accuracy while having a smaller environmental impact.

Innovative, driven solutions like portable interferometers, AI-powered analysis software, and specialized measurement tools are being offered by an increasing number of startups entering the laser interferometer market. These startups are advancing technology and making the market more accessible to smaller producers and academic institutions.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 369.44 Million |

| Market Size in 2026 | USD 394.27 Million |

| Market Size by 2035 | USD 705.16 Million |

| Market Growth Rate from 2026 to 2035 | CAGR of 6.68% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Axis Type, Interferometer Configuration, Application, End-User Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Laser Interferometer MarketSegmental Insights

Type Insights

Michelson interferometer holds a dominant market position with a 48.8% share. This dominance is primarily attributed to its high precision, stability, and versatility in measuring optical path differences, making it widely used in calibration, metrology, and surface profiling applications. Its robust design and adaptability for both industrial and research environments have further strengthened its market position in aerospace and automotive.

- In January 2024, Renishaw demonstrated its laser interferometer systems, including those relevant to the aerospace and automotive sectors, at the MACH 2024 event, showcasing technologies for automated process control.

Fabry-Perot interferometer is experiencing the fastest growth with a 6% compound annual growth rate (CAGR), motivated by its great spectral resolution and growing application in optical communications systems and spectroscopes. Advanced industrial and defense applications are increasingly adopting Fabry-Perot devices due to their miniaturization and incorporation into fiber optic sensors.

Axis Type Insights

The single-axis segment is the laser interferometer market leader with a 65.4% share because of its affordability, ease of use, and excellent accuracy for measuring displacement in one dimension. Its widespread application in linear motion control calibration setups and precision positioning systems in manufacturing and research labs has made it the go-to option for users looking for dependable performance with less operational complexity.

- In 2024, Zygo Corporation launched the Qualifire laser interferometer, which is portable, lightweight, and capable of high-precision metrology for applications in semiconductors, consumer electronics, and other industries.

The multi-axis segment is the fastest-growing category, with a CAGR of 6.2% motivated by the growing need for multi-dimensional measurements in the manufacturing of sophisticated semiconductors and the calibration of machinery. For next-generation precision engineering applications, multi-axis interferometers are essential due to their capacity to simultaneously collect data from multiple directions and capture complex geometries.

Interferometer Configuration Insights

Homodyne segment is the market leader with a 73.4% share because of its cost-effectiveness, high accuracy, and ease of setup. For displacement and surface profiling applications where environmental noise and frequency drift are negligible, homodyne interferometers are extensively used in lab and industrial settings. Their market preference is further enhanced by their ease of signal processing and compatibility with standard optical systems.

The heterodyne segment is the fastest-growing category, with a CAGR of 6.4%. It is credited to its exceptional phase sensitivity of noise immunity and stability over extended measurement ranges. For precision motion analysis in semiconductor lithography, aerospace testing, and optical communication research, its ability to provide precise dynamic measurements makes it an excellent choice.

Application Insights

Surface topography holds a dominant market position with a 40.5% share because it is essential for analyzing surface roughness and texture in a variety of manufacturing industries. Its accurate measurement capabilities make it possible to detect defects and maintain quality control in mechanical, electronic, and optical components.

Semiconductor manufacturing is set to be the fastest-growing segment, expanding at a 6.1% CAGR, motivated by the growing demand for accurate lithography calibration, wafer alignment, and defect inspection in the processes used to fabricate chips. The use of laser interferometers for sub-nanometer measurement accuracy is anticipated to increase as the semiconductor industry continues to seek smaller geometries and higher yield.

Laser Interferometer Market Regional Insights

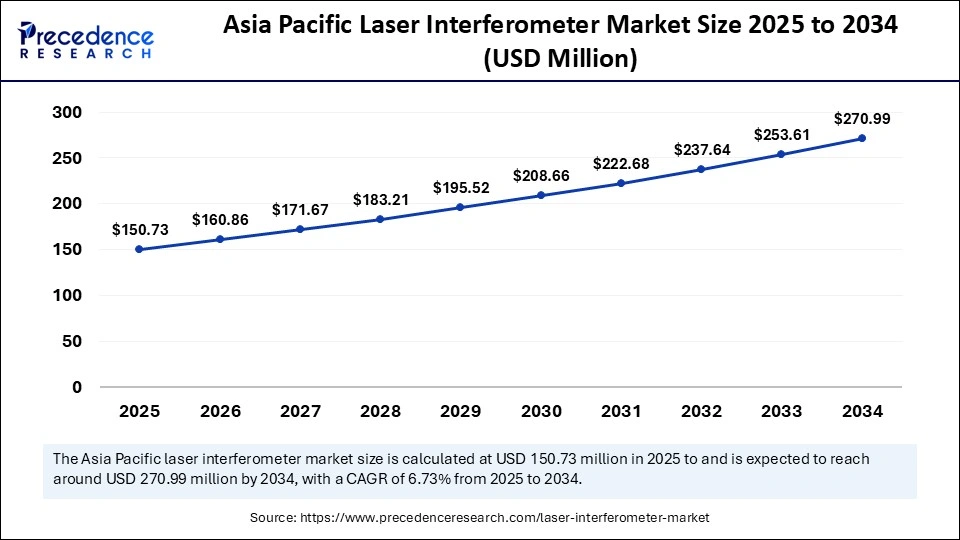

The Asia Pacific laser interferometer market size is evaluated at USD 150.73 million in 2025 and is projected to be worth around USD 287.43 million by 2035, growing at a CAGR of 6.67% from 2026 to 2035.

Why Did Asia Pacific Dominate the Laser Interferometer Sector in 2024, and Why Is It Expected to Be the Fastest Growing?

The Asia Pacific region dominated the global laser interferometer market in 2025, securing a commanding 40.8% market share, driven by robust industrial development and the region's emergence as a global hub for semiconductor and electronics manufacturing. Countries such as China, Japan, South Korea, and Taiwan have established themselves as major centers for precision engineering, chip fabrication, and optical component production, key application areas for laser interferometry. The rapid expansion of industries requiring ultra-precise measurement tools, including automotive, aerospace, and advanced materials, further reinforces the region's leadership.

Moreover, rising R&D investments in metrology, nanotechnology, and optical sciences are fueling technological innovation and the local development of next-generation interferometric systems. Governments across the region are actively promoting precision manufacturing and smart factory initiatives through programs supporting automation, quality control, and digital transformation. The availability of skilled labor, cost-effective manufacturing ecosystems, and strong supply chain networks provides additional advantages.

India Laser Interferometer Market Trends

India dominated the laser interferometer market in 2025 because the country's sector was bolstered by the growth of semiconductor and electronics manufacturing, as well as a quick industrialization. Laser interferometers have become more popular for metrology and calibration applications due to government programs like Make in India and higher investments in precision engineering.

North America is the fastest-growing region in the laser interferometer market, fueled by the expanding use of these systems in advanced research fields such as nanotechnology, aerospace, and defense. The region's strong emphasis on innovation, coupled with the presence of world-class research institutions and high-precision manufacturing hubs, is accelerating demand for ultra-accurate measurement and calibration tools.

The aerospace and defense industries, in particular, are increasingly leveraging laser interferometers for component testing, vibration analysis, and optical alignment, ensuring superior performance and safety standards. The region's semiconductor and electronics sectors are adopting interferometry for wafer inspection, surface profiling, and lithography alignment, supporting the miniaturization and precision required in next-generation chip fabrication.

U.S. Laser Interferometer Market Trends

The U.S. is witnessing rapid growth in the laser interferometer market, driven by high demand from the automotive, semiconductor, and aerospace industries as well as sophisticated R&D activities. Market expansion is being driven by supportive federal programs that encourage the use of precision measurement technologies for chip manufacturing.

Europe is a key market for optical metrology products because of its large industrial manufacturing base, coupled with stringent quality requirements in the automotive and aerospace sectors. Overall, Germany and France have the greatest need and offer the most advanced innovation in laser interferometer technology; both nations will benefit greatly from the continued growth of automation and digital manufacturing capabilities.

Poland Laser Interferometer Market Trends

Poland, a fast-growing country, is rapidly gaining ground due to increased investments in modernizing and upgrading industrial measurement systems and due to a strong interest in precision engineering, which has resulted in increased demand for laser interferometer systems. Collaboration between universities, research centers, and manufacturers is fostering innovation and application development, particularly in photonics, aerospace, and scientific instrumentation.

Latin America: Significant Investments in Industrial Measurement

Latin America's laser interferometer market continues to grow as Latin America increasingly invests in upgrading and improving the way that industrial companies perform their measurements and incorporating advanced optical inspection systems into production processes. The market is further expanding as manufacturing, aerospace, automotive, and research sectors increasingly adopt precision metrology solutions to improve quality control and dimensional accuracy.

Chile Laser Interferometer Market Trends

Chile, a fast-growing country, continues to grow rapidly as a strong candidate for sales of laser interferometry, owing to the increasing adoption of laser interference systems inside the mining and manufacturing industries in Chile. Demand is driven by broader adoption of automation and advanced metrology practices, particularly in industries seeking to improve quality assurance and optimize production efficiency.

Middle East and Africa (MEA): Technology Growth in Key Industries

As investments continue to increase in MEA's laser interferometer market, growth will continue to be completely driven by technological investment in major high-precision industries, including oil and gas, energy, and aerospace sectors. Technological improvements, such as higher resolution, enhanced environmental stability, user-friendly interfaces, and digital connectivity, are expanding the applicability of laser interferometers in both industrial and laboratory settings.

South Africa Laser Interferometer Market Trends

South Africa, which is experiencing strong growth from increased use of automation and quality assurance in industrial operations, is catalyzing the growth of the market for laser interferometer systems in the short run. Partnerships between universities, research labs, and private companies are fostering innovation and tailored solutions for local needs in sectors like optics, engineering, and materials research.

Laser Interferometer Market Value Chain

The value chain begins with sourcing high-purity optical components, stabilized laser sources, photodetectors, mirrors, beam splitters, and precision mechanical assemblies. Suppliers, primarily in Germany, Japan, and the U.S., provide ultra-flat optical substrates, frequency-stabilized laser diodes, and nanometer-level sensors. Quality and wavelength stability directly influence interferometer accuracy. Upstream value is captured by specialty optics and photonics component manufacturers that supply proprietary, high-tolerance materials crucial to system performance.

This is the core value-creation stage, involving integration of optical, mechanical, and electronic subsystems into complete interferometric setups (e.g., Michelson, Fabry–Perot, or heterodyne systems). Manufacturers invest in precision alignment, calibration, and vibration isolation technologies to achieve high measurement accuracy for industrial and scientific applications. Value differentiation occurs through customized configurations, software-driven data analysis, and R&D innovation in metrology and nanotechnology. Companies with in-house optics and system design capabilities (like Renishaw, Zygo, and Keysight) capture the most value due to vertical integration and IP ownership.

Finished systems are distributed to semiconductor fabs, aerospace, automotive, research labs, and calibration centers, often through direct B2B channels or regional distributors. Integration support, including installation, software interfacing, and training, is essential for optimizing measurement precision. Long-term service contracts, recalibration programs, and software upgrades create recurring revenue streams. Downstream value capture lies in aftermarket services, technical support, and data integration solutions, which strengthen brand loyalty and total lifecycle profitability.

Laser Interferometer Market Companies

Keysight Technologies is a leading provider of precision measurement and test instruments, including high-accuracy laser interferometers for metrology and calibration applications. Its interferometric systems enable nanometer-level precision for the semiconductor, aerospace, and optics industries. Keysight’s focus on innovation, digital integration, and photonics testing enhances productivity and reliability in advanced manufacturing environments.

Renishaw is a global leader in metrology and precision engineering, offering laser interferometer systems for calibration and motion control. Its XL-80 laser system provides sub-micron accuracy for machine tool and CMM verification. Renishaw’s expertise in high-precision measurement and industrial automation makes it a trusted partner in manufacturing quality assurance.

Zygo, a subsidiary of AMETEK, designs advanced laser interferometers and optical profilers used in semiconductor, optics, and surface metrology. Its Verifire and NewView systems deliver ultra-precise surface and wavefront measurements. Zygo’s strong R&D in non-contact metrology supports global demand for precision optics manufacturing and testing.

SIOS specializes in laser interferometric measurement systems for displacement, vibration, and angular analysis. Its instruments provide picometer-level precision, ideal for research laboratories, metrology institutes, and nanotechnology applications. The company’s emphasis on thermal stability and long-term accuracy ensures consistent, high-performance measurement results.

Optodyne develops laser interferometer systems for machine calibration, stage alignment, and geometric measurement. Its MCV and LICS series offer high-speed and accurate measurement solutions for industrial metrology. Optodyne’s portable and cost-effective systems are widely used for on-site calibration and quality control in precision manufacturing.

Mahr provides precision measurement equipment, including laser interferometers for surface and dimensional analysis. Its technologies enhance quality control in the automotive, aerospace, and mechanical engineering industries.

Lasertex manufactures laser interferometric systems for CNC machine calibration, alignment, and dynamic testing. Its advanced designs deliver high precision and stability in industrial environments.

Attocube offers compact interferometric sensors for nanometer-scale displacement and vibration measurement. Its products are widely used in cryogenic environments and precision positioning systems.

Thorlabs designs and supplies optical components and interferometric systems used in scientific research and precision metrology. Its broad product portfolio supports academic and industrial measurement applications.

Haag-Streit produces interferometric instruments for ophthalmic and optical metrology applications. Its solutions combine high precision with user-friendly design, supporting clinical and laboratory diagnostics.

HUBNER Photonics manufactures high-performance laser sources and interferometric systems used in metrology and spectroscopy. Its stable and tunable lasers enable accurate interferometric measurements across industrial and research settings.

Apre Instruments specializes in optical interferometers and test systems for precision surface and wavefront analysis. Its advanced algorithms enhance measurement accuracy for optics manufacturing.

4D Technology develops dynamic interferometers capable of measuring surfaces in vibration-prone environments. Its PhaseCam and AccuFiz systems are widely used in aerospace, optics, and semiconductor inspection.

Agilent Technologies designs high-precision interferometric measurement systems for calibration, material analysis, and nanometrology. Its legacy in optical testing continues to influence precision manufacturing and research industries.

Recent Developments

- On 16 December 2024, 4D Technology, a U.S.-based subsidiary of Onto Innovation, launched its AccuFiz SWIR interferometer aimed at providing superior accuracy for infrared optical testing. The product received multiple production orders shortly after release, reflecting the growing demand for high-resolution metrology tools across advanced manufacturing sectors(Source: https://metrology.news)

- On 18 January 2024, Zygo Corporation (U.S.) announced the launch of its Qualifire laser interferometer, designed to deliver high-precision metrology performance for optical testing and surface measurement applications. The system enhances measurement speed, stability, and automation, making it suitable for both production and research environments.(Source: https://www.zygo.com)

Laser Interferometer MarketSegments Covered in the Report

By Type

- Michelson Interferometer

- Fabry Perot Interferometer

- Fizeau Interferometer

- Mach Zehnder Interferometer

- Twyman Green Interferometer

By Axis Type

- Single Axis

- Multi Axis

By Interferometer Configuration

- Homodyne

- Heterodyne

By Application

- Surface Topography

- Semiconductor Manufacturing

- Precision Engineering

- Calibration

- Aerospace and Defense

- Optical Testing

By End User Industry

- Automotive

- Semiconductor and Electronics

- Aerospace

- Optical Industry

- Research & Development

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting