Light Management System Market Size and Growth 2025 to 2034

The global light management system market size was estimated at USD 25.02 billion in 2024 and is predicted to increase from USD 28.29 billion in 2025 to approximately USD 83.66 billion by 2034, expanding at a CAGR of 12.83% from 2025 to 2034. The development of smart cities can boost the light management system market.

Light Management System Market Key Takeaways

- In terms of revenue, the global light management system market was valued at USD 25.02 billion in 2024.

- It is projected to reach USD 83.66 billion by 2034.

- The market is expected to grow at a CAGR of 12.83% from 2025 to 2034

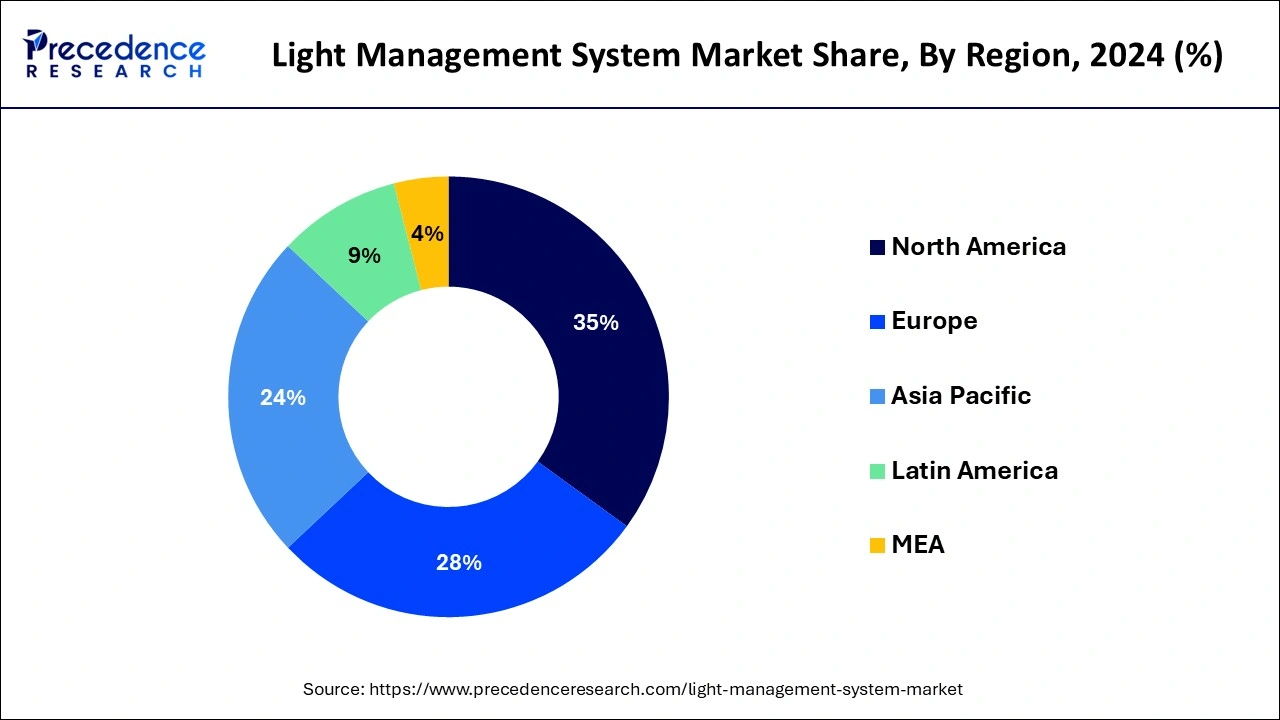

- North America dominated the global market with the largest market share of 35% in 2024.

- Asia Pacific is expected to grow to the highest CAGR in the market during the forecast period.

- By application, the indoor segment dominated the market in 2024.

- By application, the outdoor segment is expected to grow at a notable rate in the market during the forecast period.

- By function, the dimming control management segment dominated the market in 2024.

- By function, the occupancy-based management segment is expected to grow at a notable rate in the market during the forecast period.

- By type, the analogy segment held a significant share in the market.

- By type, the digital segment is the fastest-growing segment in the market.

- By end users, the residential complexes segment dominated the market in 2024.

- By end user, the commercial segment is expected to grow to the highest CAGR in the market during the forecast period.

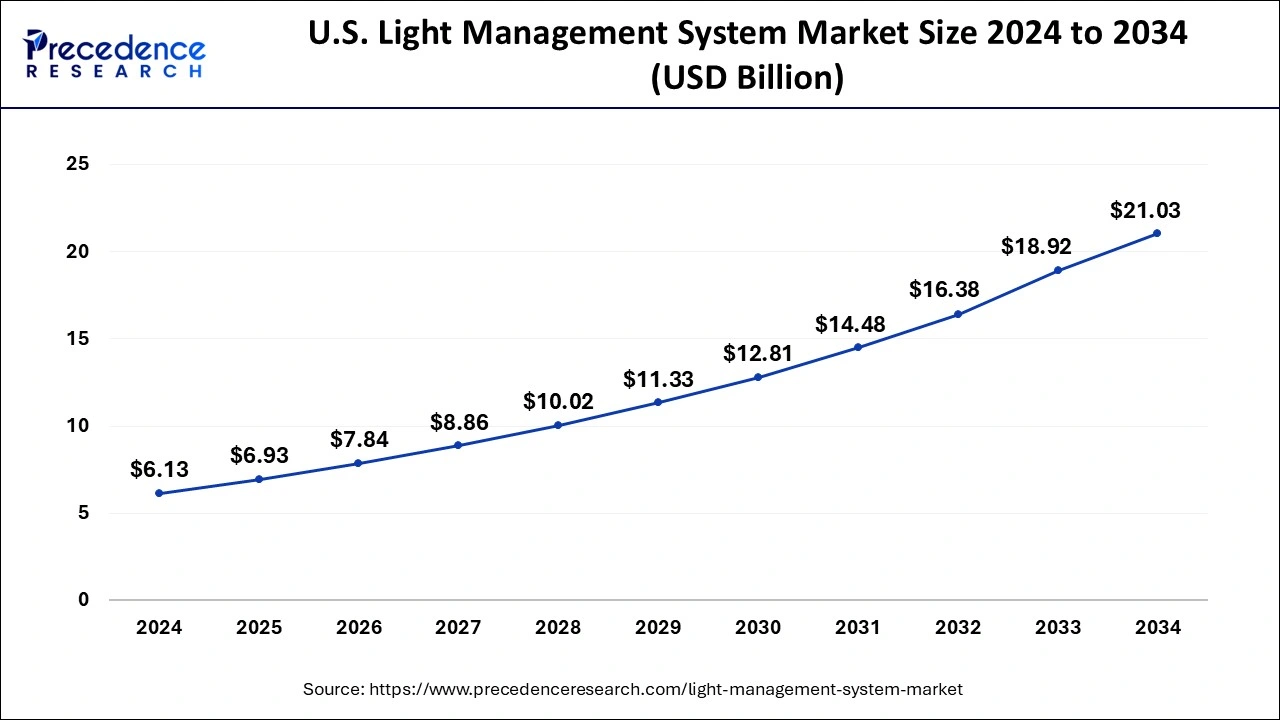

U.S.Light Management System Market Size and Growth 2025 to 2034

The U.S. light management system market size was estimated at USD 6.13 billion in 2024 and is predicted to be worth around USD 21.03 billion by 2034 at a CAGR of 13.12% from 2025 to 2034.

North America dominated the light management system market in 2024. The innovation and development in technology are concentrated in North America, especially in the area of smart building technologies. The acceptance and market domination of light management systems in the region has been fueled by notable improvements in IoT integration, smart sensors, cloud-based platforms, and data analytics.

In North America, there are strict federal and state laws and requirements pertaining to energy efficiency. In both commercial and residential buildings, these laws require the adoption of energy-efficient lighting solutions, including light management systems. Adoption of these systems in the region has been largely fueled by compliance with these requirements.

Asia Pacific is expected to grow to the highest CAGR in the light management system market during the forecast period. In Asia Pacific, people are becoming more conscious of and focused on sustainability and energy efficiency. Energy-efficient technology, such as smart lighting systems, is being adopted by governments, corporations, and consumers more often in order to cut down on energy use, minimize carbon emissions, and adhere to regulatory standards.

Asia Pacific nations are making significant investments in smart city projects. These programs depend heavily on smart lighting since they offer energy efficiency, environmental monitoring, safety improvements, and intelligent lighting management when combined with Internet of Things sensors and data analytics. These expansive smart city initiatives are driving the need for light management solutions. The increasing number of startups and technology businesses with a focus on smart building technologies are based in Asia Pacific.

Market Overview

The light management system market refers to an advanced technology used to optimize and regulate lighting in indoor and outdoor environments. Sensors, controllers, and software are usually used to modify lighting levels according to variables, including occupancy, natural light levels, time of day, and other user preferences. The light management system can increase illumination quality, boost comfort, and increase energy efficiency.

The light management system market is fragmented with multiple small-scale and large-scale players, such as Echelon Corporation, Harman International Industries Inc., Honeywell International, Inc., Hubbell Incorporated, Koninklijke Philips N.V., Legrand SA, Leviton Manufacturing Co. Inc., LG Electronics Inc., Lighting Holding B.V., Osram Licht AG, Schneider Electric SE, Siemens AG, SternbergLighting.

Light Management System Market Growth Factors

- Governments are investing heavily in developing areas that require efficient lighting solutions to ensure safety, security, and sustainability.

- Increasing focus on sustainability and energy conservation.

- Countries are implementing various regulations and initiatives to promote sustainable practices, leading to an increased demand for energy-efficient lighting solutions.

Light Management System Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 12.83% |

| Market Size in 2025 | USD 28.29 Billion |

| Market Size by 2034 | USD 83.66 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, Function, Type, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising adoption of smart home technologies

The rising adoption of smart home technologies can boost the light management system market. Smart home technologies include lighting, which can be controlled by smartphones using apps, voice-activated personal assistants, wi-fi connection, etc. The smart lighting used in smart homes includes smart light bulbs, smart lights connected to the hub, and motion-sensing lights. By increasing the adoption of these lights, the demand for the light management system market grows.

Restraint

Potential for technological glitch

The potential for technological glitches slows down the light management system market. The glitch in the technology might lead to a bad user experience. For example, if a light management system behaves erratically or doesn't react to user directions, it might annoy customers and make them unhappy with the good or service. Issues with light management systems might give rise to worries about security and safety. For example, inadequate lighting levels in key locations or malfunctioning lighting controls during emergencies might jeopardize the safety and security of occupants.

Opportunity

Development of wireless technology

The development of wireless technology can be an opportunity to boost the light management system market. With the wireless technology of light management systems, installation flexibility is increased, and light management systems may be more easily implemented in different situations without requiring a lot of wiring. Additionally, wireless technology offers a simpler way to grow upward and downward according to shifting space or illumination needs.

Application Insights

The indoor segment dominated the light management system market in 2024. Interior lighting control systems are becoming more and more important as smart homes and buildings become more popular. The growth of these systems in the home and commercial indoor areas is fueled by their energy efficiency, customization options, and ease. Technological developments in light management systems, including sensor networks, Internet of Things integration, and sophisticated control algorithms, have improved interior lighting systems' features and performance.

As a result, both businesses and consumers now find them more tempting. The usage of smart lighting systems in interior spaces is encouraged by stringent energy efficiency standards in several countries. These devices can optimize energy use by changing lighting settings according to occupancy, the availability of natural light, and the time of day.

The outdoor segment is expected to grow at a notable rate in the light management system market during the forecast period. Globally, a large number of cities are funding smart city projects aimed at enhancing urban infrastructure, particularly outdoor lighting. The market for smart outdoor lighting systems is expected to rise as a result of its ability to improve public places' energy efficiency, safety, and aesthetics. There are strict energy efficiency requirements for outdoor lighting, just like there are for inside lighting.

Smart outdoor lighting systems that can dynamically alter brightness based on traffic circumstances, pedestrian activity, and natural light levels are being pushed for adoption by governments and regulatory authorities. This will save energy and lessen light pollution. The sophisticated outdoor light control systems have been made possible by the growth of Internet of Things (IoT) technology and improvements in connection. The ability to remotely monitor, operate, and optimize these systems is what attracts companies, governments, and infrastructure developers to them.

Function Insights

The dimming control management segment dominated the light management system market in 2024. One of the important components of lighting systems that helps save energy is dimming control. The dimming control greatly lowers energy usage by modifying light levels according to occupancy, availability of natural light, and time of day. This factor is especially important when it comes to the adoption of energy-efficient lighting solutions, which are being driven by sustainability and energy conservation initiatives.

The dimming control in lighting systems is required by strict energy efficiency requirements and standards in many countries. Businesses and industries have been forced to invest in light control systems with dimming capabilities in order to comply with these rules and reach the necessary energy efficiency standards.

The occupancy-based management segment is expected to grow at a notable rate in the light management system market during the forecast period. Because occupancy-based lighting management minimizes energy waste and lowers carbon footprints, it is consistent with sustainability goals. An increasing number of businesses and individuals who want to conduct their operations in an ecologically responsible way respect this environmentally friendly strategy.

By automatically adjusting lighting to occupancy levels, occupancy-based management makes sure that tenants are in a handy and comfortable space. This function is especially helpful in places where occupancy changes over the day, such as workplaces, classrooms, and residential areas. HVAC (heating, ventilation, and air conditioning) and security systems are two more common smart building solutions that occupancy-based lighting systems frequently interface with. Complete building automation and optimization are made possible by this integration, which raises operational effectiveness all around.

Type Insights

The analogy segment held a significant share in the light management system market in 2024. Since they have been in the market for a long time, analog light management systems are well-known. The fact that analog systems are still widely used in many current structures and facilities accounts for their considerable market share. The large variety of lighting fixtures and equipment are frequently compatible with analog systems.

Because of their compatibility, they are the best option when it comes to retrofitting older buildings or connecting with legacy systems, situations in which digital solutions could be difficult to adopt. The analog technologies are renowned for being dependable and straightforward. They are usually simple to install and maintain since they just require simple wiring and control systems. Users who desire reliable, tested technology without complicated digital interfaces will find this simplicity appealing.

The digital is the fastest growing segment in the light management system market. In comparison to analog systems, digital light management systems have more capability and possibilities. Features including data analytics, energy monitoring, remote control, IoT device integration, programmable scheduling, and data analytics are frequently included. Thanks to these innovations, users now have more flexibility, control, and knowledge about their lighting systems. Smart building ecosystems and Internet of Things (IoT) platforms can be easily integrated with digital light management systems. Through this connectivity, lighting and other building systems like HVAC, security, and occupancy sensors may be controlled, automated, and coordinated centrally, improving operational efficiency and optimization.

End-user Insights

The residential complexes segment dominated the light management system market in 2023. Globally, there has been a notable surge in the use of smart homes due to several factors like improved security, convenience, cost-effectiveness, and increasing connection of smart devices. Smart homes must have light management systems because they enable remote lighting control, schedule creation, and the creation of custom lighting scenarios for their occupants. For financial and ecological grounds, homeowners place a high value on energy efficiency. By including functions like daylight harvesting, occupancy detection, and dimming, light management systems assist in optimizing energy usage and lower power and utility costs.

The commercial segment is expected to grow to the highest CAGR in the light management system market during the forecast period. In larger smart building ecosystems that encompass security, access control, HVAC (heating, ventilation, and air conditioning), and other systems, light management systems are frequently incorporated.

The comprehensive building management, automation, and optimization made possible by this integration improves commercial buildings' operational effectiveness and occupant comfort. The sophistication, scalability, and ease of use of light management systems have increased thanks to technological advancements in the fields of wireless networking, IoT integration, cloud-based platforms, and advanced analytics. The companies are using these technical advances to enhance overall facility management, productivity, and lighting efficacy.

Light Management System Market Companies

- Echelon Corporation

- Harman International Industries Inc.

- Honeywell International, Inc.

- Hubbell Incorporated

- Koninklijke Philips N.V.

- Legrand SA

- Leviton Manufacturing Co. Inc.

- LG Electronics Inc.

- Lighting Holding B.V.

- Osram Licht AG

- Schneider Electric SE

- Siemens AG

- SternbergLighting

Recent Developments

- In February 2024, Philips Healthcare announced the launch of a limited release of a new light-based catheter guidance system for cath labs that represents a step toward radiation-free interventional imaging. The focus of the technology right now is endovascular aortic procedures.

- In October 2023, Halonix Technologies, one of India's fastest-growing electrical companies, announced the launch of India's first 'UP-DOWN GLOW' LED Bulb, demonstrating its commitment to enriching lives through pioneering technology.

- In January 2023, ABB will launch its ABB Cylon Smart Building Management Systems (BMS) for the Middle East region at the Light Middle East and Intelligent Building Middle East 2023 event, held at the Dubai World Trade Centre.

Segment Covered in the Report

By Application

- Indoor

- Outdoor

By Function

- Dimming Control Management

- Occupancy-based Management

- Schedule-based Management

- Daylight Control Management

By Type

- Analog

- Digital

By End-user

- Smart Homes (Residential Complexes)

- Commercial

- Industrial

- Municipal (Public)

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting