What is theLow-Power Microcontrollers Market Size?

The global low-power microcontrollers market is witnessing strong growth as manufacturers develop ultra-efficient chips for IoT, automation, and wearable applications.The market is driven by rising demand for energy-efficient IoT and wearable devices.

Low-Power Microcontrollers Market Key Takeaways

- Asia Pacific dominated the low-power microcontrollers market with the largest share of 54% in 2024.

- By core ISA / architecture, the ARM Cortex-M segment led the market while holding a 73% share in 2024.

- By core ISA / architecture, the RISC-V segment is expected to grow at the fastest CAGR of 28% over the forecast period.

- By bit width, the 32-bit segment captured approximately 81% revenue share in 2024.

- By bit width, the 16-bit segment is expected to grow at the fastest rate over the forecast period.

- By non-volatile memory type, the embedded flash segment led the market while holding about 88% share in 2024.

- By non-volatile memory type, the FRAM segment is expanding at the highest CAGR of 9% in the upcoming period.

- By connectivity focus, the BLE segment held a 46% share of the market in 2024.

- By connectivity focus, the zigbee / thread / matter segment is growing at a notable CAGR of 22% from 2025 to 2034.

- By application, the consumer IOT & wearables segment held a 34% share of the market in 2024.

- By application, the smart home & building segment is poised to grow at the fastest CAGR of 22% over the forecast period.

What are Low-Power Microcontrollers?

Low-power microcontrollers are MCU devices engineered to minimize energy consumption across active, standby, and deep-sleep states while delivering sufficient compute, memory, and I/O for battery-powered and energy-constrained applications. They combine ultra-low-leakage processes, dynamic voltage/frequency scaling, fast wake-up, and optimized peripherals (ADC/DAC, timers, DMA) with integrated security and, increasingly, on-chip wireless. Typical use cases include wearables, sensor nodes, smart home devices, asset tracking, smart metering, medical and industrial IoT endpoints, and automotive low-power controllers.

The low-power microcontrollers market is a rapidly growing segment of the semiconductor and embedded systems industry, driven by the global shift toward energy-efficient electronics and the increasing use of connected smart devices. Low-power MCUs are designed to deliver high performance with minimal energy consumption, making them ideal for applications that require long battery life and operational efficiency, such as portable, remote, and IoT-based devices. Their compatibility with wireless networks like Bluetooth Low Energy (BLE), Zigbee, and LoRa further enhances their role in enabling seamless connectivity and smart control systems.

The rise of IoT devices and wearable electronics, where energy efficiency is a critical performance metric, has significantly contributed to the market's growth. The high demand for MCUs capable of providing both performance and low energy consumption is further fueled by the expanding markets for smart home systems, industrial automation, and healthcare monitoring. Additionally, government initiatives focused on energy conservation, advancements in semiconductor production, and the development of low-power design architectures are all driving the continued growth of the market.

Key Technological Shifts in the Low-Power Microcontrollers Market Driven by AI

Along with artificial intelligence, the field of low-power microcontrollers (MCUs) is evolving, enabling more intelligent edge processing in resource-constrained systems. Recent low-power MCUs are augmented with AI accelerators and optimized architectures that allow them to perform inference with minimal computational requirements. AI-enabled MCUs enable devices to make local decisions without needing a connection to the cloud, reducing reliance on cloud services, lowering latency, and minimizing data transmission costs. With their intelligent capabilities, rapid processing, and ultra-low energy consumption, low-power MCUs are becoming essential components in smart edge applications as AI and embedded technologies converge.

Low-Power Microcontrollers Market Outlook

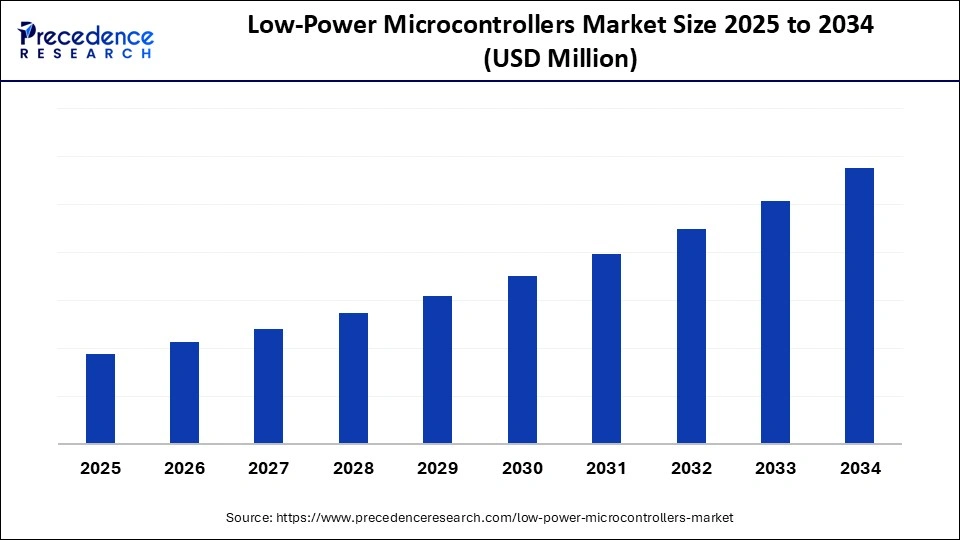

- Market Growth Overview: The low-power microcontroller (MCU) market is set for rapid growth between 2025 and 2034, driven by the increasing production of IoT devices, wearables, automotive electronics, and energy-efficient consumer electronics. The persistent demand for high-performance, low-energy MCUs has fueled innovation and adoption across various industries globally, making them indispensable for future technological advancements.

- Global Expansion: Regions like Asia-Pacific, Latin America, and the Middle East are witnessing rapid industrialization, urbanization, and rising consumer demand for smart products. These trends are driving the need for low-power, high-performance MCUs, particularly in sectors focused on energy conservation, smart infrastructure, and consumer electronics. Government initiatives promoting sustainable development and the growing middle class in these regions create favorable conditions for the widespread adoption of low-power MCUs. Additionally, emerging markets offer significant opportunities in IoT applications, including smart agriculture, smart cities, healthcare monitoring, and industrial automation—all of which require energy-efficient solutions for remote operations and long battery life.

- Major Investors: Key semiconductor companies such as STMicroelectronics, Microchip Technology, Texas Instruments, NXP Semiconductors, and Renesas Electronics are making significant R&D investments in low-power MCUs to meet the increasing demand. These industry leaders are advancing high-performance MCU technologies to capture the growing market share, setting the stage for innovation and more efficient device designs in the coming years.

- Startup Ecosystem: The startup ecosystem around low-power MCUs is also expanding, with new ventures focused on energy-efficient solutions, IoT, and edge computing based on innovative architectures like RISC-V. These emerging players are complementing established market leaders by driving technological advancements and increasing the diversity and frequency of MCU applications across industries. Their contributions are shaping the future of the market and opening new avenues for low-power MCU integration in a wide range of use cases.

What Factors Are Fueling the Growth of the Low-Power Microcontrollers Market?

- IoT and Wearable Adoption: The push towards the increasing number of IoT ecosystems and wearable products is pushing the need to have low-power MCUs that enable continuous sensing, wireless communication, and the processing of data with a longer battery life and reduced device form factors.

- Sustainability and Energy Saving: The increased demand for energy conservation across the world and on sustainable electronics drives the use of ultra-low-power MCUs, which aim to reduce energy wastage and increase the use of life of battery-operated and remote devices.

- Development of Smart Home and Industrial Automation: The growth in the number of applications of smart homes and Industry 4.0 would require energy-saving sensor, actuator, and connectivity module control systems, which will expand the use of low-power MCUs in automation networks.

Market Scope

| Report Coverage | Details |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Core ISA / Architecture, Bit Width, Non-Volatile Memory Type, Connectivity Focus, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Need to Optimize Energy Efficiency in Consumer Electronics

The rising need to optimize energy efficiency in consumer electronics is a major factor driving the growth of the low-power microcontrollers market. As consumers seek devices that offer high performance, extended battery life, and low energy consumption, manufacturers are incorporating low-power MCUs to meet these expectations. These microcontrollers are designed to efficiently manage power across various operational states, active, standby, and deep sleep, enabling portable and IoT devices to function longer on limited energy resources. Products like wearables, wireless sensors, smart home appliances, and mobile devices rely on MCUs that balance functionality with energy efficiency. This progress is further supported by innovations in semiconductor fabrication, such as ultra-low leakage processes and dynamic voltage scaling, which optimize energy usage and extend device performance.

Restraint

Manufacturing Complexities and Unsuitability for Power-Critical Applications

Despite the rapid growth of the low-power microcontroller (MCU) market, several limitations hinder broader implementation, with the most significant being the complexities in the manufacturing process and performance constraints. Designing and producing low-power MCUs requires the use of advanced semiconductor technologies, circuit optimization, and extensive testing to create devices that consume ultra-low energy while maintaining reliability. These technical requirements make production expensive, and the development process lengthy. Additionally, a strong focus on energy savings may lead to trade-offs, such as reduced processing performance, memory, or response times, factors that may not be ideal for certain use cases.

Opportunity

Growing Adoption of Power Electronics in the EV Industry

The growing adoption of electric vehicles (EVs) worldwide presents a significant growth opportunity for the low-power microcontroller market. As EV manufacturers focus on enhancing energy efficiency, safety, and driving range, the demand for smart, energy-efficient control systems is increasing rapidly. Low-power MCUs play a critical role in controlling key power electronics in EVs, such as battery management systems (BMS), motor control units, regenerative braking systems, and energy conversion units. These microcontrollers efficiently monitor and manage parameters like voltage, current, and temperature, maximizing performance while minimizing power wastage. Additionally, as automakers integrate smart electronics and connected vehicle technologies, low-power MCUs are becoming essential for enabling real-time control and communication systems, further streamlining vehicle operations.

Segment Insights

Core ISA / Architecture Insights

Why Did the ARM Cortex-M Segment Lead the Market in 2024?

The ARM Cortex-M segment led the low-power microcontrollers market while holding a 73% share in 2024 due to its outstanding performance, energy-saving, and ecosystem maturity. Optimized power saving, offering advanced sleep modes and dynamic voltage scaling, is offered in the Cortex-M, widely used in consumer electronics, industrial automation, healthcare, and IoT devices. Scalability to a variety of energy-saving products with a common architecture, which allows manufacturers to design both at the entry-level and at the high-performance end. Moreover, the large developer base, extensive software libraries, and strong support of third-party tools have enhanced the industry standard of ARM.

Cortex-M is the choice of low-power and real-time embedded applications due to proven reliability, large code density, and wide compatibility with existing software frameworks. These strengths, and a strong relationship with semiconductor giants, such as STMicroelectronics, NXP, and Renesas, have consolidated the leadership of ARM in the world of low-power microcontrollers.

The RISC-V segment is expected to grow at the fastest CAGR over the forecast period. Its instruction set architecture (ISA) is a free and open-source design that enables manufacturers to focus on designing exceptionally customized and low-cost MCUs that meet specific low-power demands. This flexibility, coupled with the lack of licensing fees, promotes more innovation and uptake, especially by startups and academic developers. MCUs with RISC-V are increasingly used in IoT nodes, wearables, and edge devices where efficiency and scalability are important, and costs are a key factor.

The modular design of architecture allows for the optimization of energy implementation without excessive overhead instructions, enhancing performance per watt. The increasing number of ecosystem partners, including SiFive, Andes Technology, and Alibaba T-Head, along with governmental efforts to encourage the use of open hardware, is further driving the adoption of RISC-V.

Bit Width Insights

How Does the 32-bit Segment Hold the Largest Market Share in 2024?

The 32-bit segment held about 81% share of the low-power microcontrollers market in 2024 due to its stronger processing capabilities, scalability, and power demands, allowing it to be used to design complex algorithms, multi-peripheral applications, and advanced industrial applications such as IoT units, automotive control units, and smart industrial applications without necessarily consuming a lot of power. Their capability to perform high-precision calculations and data processing in real-time makes them ideal for applications requiring high performance with a very limited amount of energy.

Moreover, developments in semiconductor design have significantly reduced the power consumption of 32-bit MCUs, allowing 32-bit processor architectures to be used in battery-operated equipment much more widely. The manufacturers of semiconductors like STMicroelectronics, NXP, and Texas Instruments are still developing 32-bit platforms using ARM Cortex-M and RISC-V cores, with enhanced connectivity, integrated security, and edge AI.

The 16-bit segment is expected to grow at the fastest rate in the market during the projection period, as 16-bit MCUs have enough processing power to run applications that require moderate processing power, but with ultra-low power consumption. They find extensive applications in consumer electronics, hand-held medical devices, and smart sensors, where simplicity, reliability, and long battery life are of primary concern.

The segment growth is also influenced by developments in mixed-signal integration and on-chip peripherals, such as on-chip ADCs, DACs, and timers, which enhance functionality without increasing power consumption. Also, 16-bit Multichip manufacturers such as Renesas, Microchip, and Texas Instruments still bring out 16-bit MCU families that have been optimized to work with low voltages and embedded control applications.

Non-Volatile Memory Type Insights

What Made Embedded Flash the Dominant Segment in the Low-Power Microcontrollers Market?

The embedded flash segment dominated the market while holding about 88% share in 2024, because it is cost-effective, reliable, and easy to integrate. The flash embedded provides non-volatile storage directly on the microcontroller chip, which helps in faster data access, reducing the need for external memory and making the system less complex. This makes it highly suitable for use in consumer electronics, wearables, IoT devices, and automotive control systems, where space, power, and power efficiency are essential.

Moreover, its wide presence has been supported by the mature ecosystem around flash-based MCUs and large software libraries, development tools, and established manufacturing processes. Microchip, Renesas, and STMicroelectronics, the leading semiconductor manufacturers, are continuing to increase embedded flash with higher read/write speed and ultra-low power features, ensuring the competitiveness of the segment.

The FRAM segment is expected to grow at a significant CAGR over the forecast period. This is due to its unique features, which include ultra-fast read/write speeds, extremely low power consumption, and high endurance. These characteristics make it suitable for applications where frequent data logging is necessary, such as industrial IoT systems. Moreover, continuous technological advancement and cost-cutting are increasing the use of FRAM in niche applications like medical devices, smart meters, and automotive electronics. As more industries focus on energy-efficient profits, durability, and fast data access, MCUs based on FRAM will continue to rise steadily over time alongside other conventional embedded flash-based products.

Connectivity Focus Insights

Why Did the BLE Segment Lead the Market in 2024?

The BLE segment led the low-power microcontrollers market, holding about 46% share in 2024. This is mainly due to the increased popularity of connected devices and industrial products. It has short-range connectivity that is reliable and consumes little energy, making it well-suited to low-energy microcontrollers. In addition, BLE is highly interoperable, has highly developed protocol stacks, and is supported by a vast number of smartphones, tablets, and IoT hubs, facilitating the successful integration of devices.

The wide range of developer ecosystems, standardized profiles, and the presence of off-the-shelf BLE-enabled MCUs by large players, including Nordic Semiconductor, Texas Instruments, and STMicroelectronics, further reinforced its market niche. Devices are becoming more dependent on wireless communication to exchange data and be controlled remotely.

The Zigbee / thread / matter segment is expected to grow at the highest CAGR in the upcoming period. These protocols offer high-quality mesh networking, making smart home, industrial, and IoT ecosystem communication scalable and energy-efficient. Zigbee and Thread provide mesh networks with low latency, security, and self-healing capabilities, while the Matter standardizes interoperability across devices and ecosystems, enhancing faster adoption. MCUs with low-power consumption and these connectivity standards enable the device to run on limited power for extended periods, making them suitable for use in sensors, lighting systems, home automation hubs, and energy monitoring. There is a rise in the utilization of Zigbee/Thread/Matter-enabled MCUs due to the increased adoption of smart homes, the growth of industrial automation, and the global demand for interoperable and connected devices.

Application Insights

How Does the Consumer IoT & Wearables Segment Sustains Dominance in 2024?

The consumer IOT & wearables segment sustains dominance in the low-power microcontrollers market by holding around 34% share in 2024. This dominance is driven by the increasing demand for interconnected, portable devices. Wearables that rely heavily on low-power MCUs include fitness trackers, health monitoring devices, and smartwatches, which require real-time data processing, long battery life, and seamless wireless connectivity. Consumer IoT devices such as smart sensors, personal assistants, and portable devices also depend on energy-efficient MCUs to operate with minimal power consumption.

The growing interest in health monitoring, fitness tracking, wearable technology, and IoT-enabled smartphone ecosystems is fueling demand for these devices. Manufacturers like Nordic Semiconductor, Texas Instruments, and STMicroelectronics are providing optimized MCU solutions tailored to the needs of consumer IoT and wearables, driving market expansion in this segment.

The smart home & building segment is expected to grow at the highest CAGR in the coming years. The growth of the segment is driven by the increasing demand for energy-efficient lighting, HVAC controllers, security systems, and smart appliances—all of which require reliable low-power embedded controllers. Low-power MCUs are essential for enabling wireless connectivity, sensor integration, and real-time automation with minimal energy consumption.

Rising consumer demand for convenience, security, and energy efficiency in both residential and commercial buildings is pushing manufacturers to adopt powerful low-power MCUs. As smart building infrastructure continues to advance globally, this segment presents significant opportunities for MCU providers to deliver scalable, energy-efficient solutions that support automation, IoT connectivity, and sustainable energy management.

Regional Insights

Why Did Asia Pacific Lead the Global Low-Power Microcontrollers Market in 2024?

Asia-Pacific dominated the low-power microcontroller market, capturing the largest share of 54% in 2024. This dominance is driven by the region's growing role as an electronicsmanufacturing hub, the increasing use of consumer IoT devices, and the rising demand for energy-efficient solutions in wearable electronics, smart home devices, and industrial automation. Countries like Japan, South Korea, and Taiwan are making significant investments in semiconductor R&D, which is fostering innovation in low-power MCU design. The region benefits from low-cost production, high-volume manufacturing facilities, and government-backed projects focused on smart infrastructure and energy efficiency, positioning Asia-Pacific as a leading development hub for low-power microcontrollers.

China is a major contributor to the market within Asia Pacific, driven by rapid industrialization, a booming consumer electronics sector, and government policies supporting the development of smart cities, IoT integration, and renewable energy solutions. Chinese manufacturers are increasingly adopting low-power MCUs in smartphones, wearables, electric vehicles, and home automation systems to optimize battery life and reduce operational costs. Additionally, the development of the semiconductor ecosystem, local MCU fabrication, and a strong focus on R&D are accelerating domestic production and adoption. Government incentives, coupled with growing domestic demand and the presence of large electronics manufacturers, position China at the forefront of regional market growth.

What Factors Support the Growth of the North American Low-Power Microcontrollers Market?

North America is expected to experience significant growth throughout the forecast period, driven by its well-established semiconductor ecosystem, robust industrial base, and thewidespread adoption of energy-saving technologies. Leading semiconductor and MCU developers like Texas Instruments, Microchip Technology, and NXP Semiconductors have cemented the region's position as a technological leader, fostering rapid innovation.

North America's strong focus on research and development, supported by substantial funding and government initiatives for energy-efficient electronics, IoT devices, and smart infrastructure, further strengthens its market dominance. Additionally, the rising demand for low-power MCUs is fueled by the development of consumer IoT devices, wearable electronics, and connected car applications, including electric and autonomous vehicles.

The U.S. is a leader in IoT and wearable innovation, with companies increasingly adopting low-power MCUs to optimize battery life, energy efficiency, and device performance. Applications in smart home systems, industrial automation, and medical devices have rapidly integrated MCUs, supported by government initiatives focused on energy conservation and sustainability, as well as the growth of a robust startup ecosystem. Additionally, advancements in semiconductor manufacturing, embedded security, and wireless connectivity have enabled U.S.-based manufacturers to develop complex low-power MCUs tailored to specific applications.

Low-Power Microcontrollers Market Value Chain Analysis

- Raw Material Suppliers: The value chain starts with raw material suppliers who provide essential materials like silicon wafers, semiconductor substrates, and other critical components for manufacturing low-power microcontrollers (MCUs). These suppliers play a crucial role in ensuring that high-quality, reliable materials are available for semiconductor fabrication, thus impacting the final performance and efficiency of the low-power MCUs.

- Semiconductor Fabricators (Chip Manufacturers): Once raw materials are sourced, semiconductor manufacturers fabricate the MCUs through complex processes like photolithography, etching, and doping. These fab facilities are responsible for transforming raw materials into functional semiconductor chips, which serve as the core of low-power MCUs. This stage requires highly advanced technologies to ensure the chips are produced at smaller sizes (e.g., 7nm or 5nm processes) to improve energy efficiency while maintaining high processing power and speed.

- MCU Design & Development: In the design and development stage, companies create the architecture and intellectual property (IP) for low-power MCUs. These designs focus on optimizing power consumption while ensuring high performance, scalability, and reliability for various applications. Key developments include adding embedded security features, wireless connectivity (e.g., Bluetooth, Zigbee), and AI accelerators, making them suitable for IoT devices, wearables, automotive, and other energy-efficient technologies. Companies use simulation and testing to refine MCU designs to meet specific industry standards.

- Assembly and Packaging: After semiconductor fabrication, the MCUs undergo assembly and packaging, which includes placing the chip in a protective enclosure and adding necessary connections and interfaces. This stage is crucial for ensuring that the low-power MCUs can function effectively under various environmental conditions, such as heat, moisture, and physical stress. Packaging technologies like System in Package (SiP) or chip-on-board (COB) are employed to maximize functionality while keeping the size small, crucial for embedded systems and portable devices.

- Distribution & Supply Chain Management: The distribution phase involves the transportation, warehousing, and sale of the MCUs to Original Equipment Manufacturers (OEMs), system integrators, and end customers. Distribution players manage a complex network of global supply chains to ensure timely delivery and availability of low-power MCUs across different regions. These distributors also provide critical services, such as product technical support, selection guidance, and tailored solutions to ensure that customers use the most appropriate microcontrollers for their applications.

- Integration into End Products (OEMs & ODMs): OEMs and ODMs integrate low-power MCUs into their final products, including smartphones, wearables, electric vehicles, and smart home devices. At this stage, companies select and incorporate the MCUs based on their power needs, processing requirements, and integration capabilities for wireless communications and sensors. The MCUs' role is to provide energy-efficient processing and control over the product's functions, such as battery management, sensor data processing, and real-time control.

Top Companies Operating in the Low-Power Microcontrollers Market

Tier I: Market Leaders

These companies dominate the market, offering comprehensive solutions across a wide range of industries with extensive portfolios and global reach. Their advanced technologies and strong R&D pipelines make them key players in shaping market trends.

| Company | Key Offerings |

| Texas Instruments | Industry-leading low-power microcontrollers for automotive, industrial, and consumer electronics applications. Strong focus on energy efficiency and embedded system integration. |

| Microchip Technology | Diverse portfolio of low-power MCUs, with a focus on automotive, IoT, and industrial sectors, known for their robust analog and digital capabilities. |

| STMicroelectronics | Offers a wide array of low-power MCUs for IoT, automotive, industrial automation, and consumer electronics. Specializes in energy-efficient solutions with integrated sensors. |

| NXP Semiconductors | Provides power-efficient MCUs for automotive, smart home, and industrial applications. Known for wireless connectivity integration and high-performance computing. |

| Renesas Electronics | Focuses on embedded systems, offering energy-efficient MCUs with strong market presence in the automotive, industrial, and IoT sectors. |

Tier II: Established Players

These companies have a significant presence in the market but focus on specific application areas or geographic regions. They provide specialized low-power MCUs with a robust product portfolio, often engaging in strategic collaborations for technological advancements.

| Company | Key Offerings |

| Infineon Technologies | Low-power MCUs for automotive, industrial, and IoT sectors. Focus on energy-saving technologies and robust security features. |

| Analog Devices | Specializes in energy-efficient MCUs for precision analog, wireless communication, and industrial automation applications. |

| ON Semiconductor | Offers energy-efficient solutions for industrial automation, IoT, and consumer electronics, with a focus on power management and processing efficiency. |

| Silicon Labs | Known for its wireless MCUs targeting IoT, smart homes, and wearables. Focus on ultra-low power operation and sensor integration. |

| Cypress Semiconductor | Focus on low-power, Bluetooth-enabled MCUs for IoT, automotive, and wearable devices, specializing in connectivity and energy optimization. |

Tier III: Emerging and Niche Players

These companies are emerging players or niche providers contributing innovative solutions, targeting specific regions or application areas. Their technologies are often at thecutting edge, driving growth in specialized market segments.

| Company | Key Offerings |

| Nordic Semiconductor | Specializes in Bluetooth Low Energy (BLE) solutions for IoT, wearables, and home automation devices. Known for ultra-low power wireless MCUs. |

| Maxim Integrated | Focuses on power-efficient analog and digital systems, offering MCUs for consumer electronics, industrial applications, and sensor systems. |

| Holtek Semiconductor | Provides low-power, energy-efficient microcontrollers, particularly in consumer electronics, home appliances, and automotive applications. |

| Embest Technology | Offers customized low-power MCUs with applications in industrial, automotive, and IoT sectors, along with development tools for embedded systems. |

| GigaDevice Semiconductor | Focus on low-power MCUs with a strong market presence in Asia, particularly for IoT, consumer electronics, and automotive applications. |

Recent Developments

- In August 2025, Renesas Electronics Corporation launched the 16-bit RL78/L23 family of microcontrollers, enhancing the energy efficiency of its RL78 series. It is used in low-power, high-performance applications with 32MHz, dual-bank flash, segment LCD control, and capacitive touch.(Source: https://www.embedded.com)

- In April 2025, Microchip Technology released the PIC16F17576 8-bit microcontroller, targeting low-cost, low-power analog sensor products. These MCUs have a comparator with a voltage reference that works in sleep mode and uses less than 3.0 μA during analog measurements.(Source: https://www.cnx-software.com)

- In March 2025, Texas Instruments announced the smallest microcontroller (MCU) in the world, tailored to small equipment, including medical wearables and personal electronics. The latest MCU is 38 percent smaller than the previous industry record, occupying less space without impacting performance.(Source: https://www.ti.com)

Exclusive Analysis on the Low-Power Microcontrollers Market

The low-power microcontrollers market is poised for robust growth driven by the rapid proliferation of Internet of Things (IoT) devices, wearables, and energy-efficient consumer electronics. With global industries increasingly pivoting towards energy conservation, the demand for MCUs that offer high computational power while minimizing power consumption is escalating.

From a strategic perspective, the market presents significant opportunities in sectors such as automotive electronics, industrial automation, and smart home infrastructure, where low-power solutions are pivotal to enhancing operational efficiency, extending battery life, and ensuring sustainable performance. The convergence of low-power MCUs with emerging technologies like AI at the edge further amplifies market potential, positioning these devices as critical enablers of autonomous systems and real-time data processing in constrained environments.

Moreover, the proliferation of government-backed energy conservation initiatives and smart city projects across emerging markets, particularly in Asia-Pacific, creates a fertile landscape for innovation and growth. With established players like Texas Instruments and NXP Semiconductors reinforcing their R&D capabilities, coupled with increasing collaborations across the semiconductor and system integration ecosystem, the market is witnessing heightened competitive intensity, which is likely to foster incremental breakthroughs and scalable adoption. However, challenges related to the inherent trade-off between power efficiency and processing capability, alongside complex manufacturing processes, remain. Despite these constraints, the market's trajectory is overwhelmingly positive, offering fertile ground for continued investment and technological advancement, particularly in IoT and automotive domains.

Segments Covered in the Report

By Core ISA / Architecture

- ARM Cortex-M

- RISC-V

By Bit Width

- 8-bit

- 16-bit

- 32-bit

By Non-Volatile Memory Type

- Embedded Flash

- FRAM

- MRAM/EEPROM/Others

By Connectivity Focus

- BLE / Bluetooth Low Energy

- Zigbee / Thread / Matter-capable

- Sub-GHz (LoRa/FSK)

- Wi-Fi Low-Power

By Application

- Consumer IoT & Wearables

- Smart Home & Building

- Industrial IoT & Automation

- Smart Metering & Utilities

- Medical & Healthcare Devices

- Automotive (Body, RKE, Sensor Nodes)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting