Low Temperature Powder Coatings Market Size and Forecast 2025 to 2034

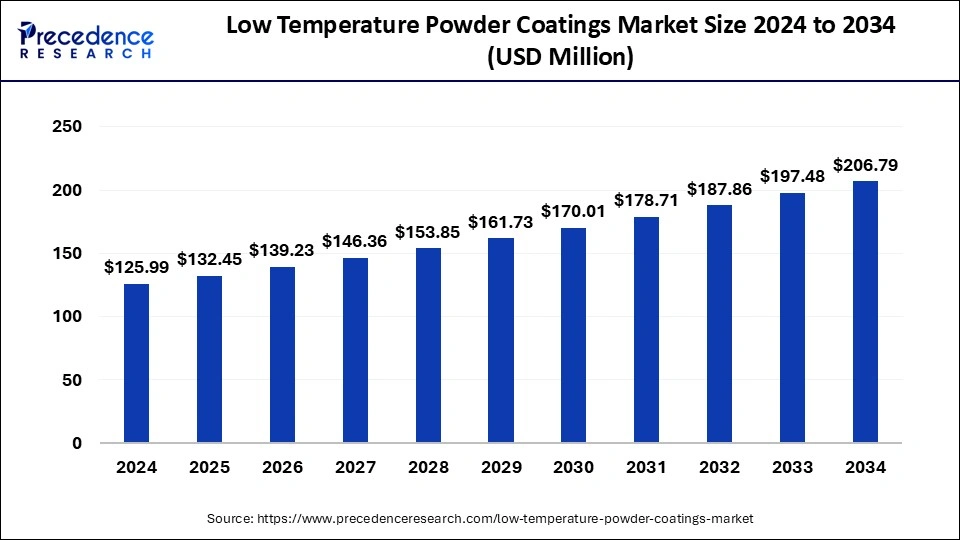

The global low temperature powder coatings market size was estimated at USD 125.99 million in 2024 and is predicted to increase from USD 132.45 million in 2025 to approximately USD 206.79 million by 2034, expanding at a CAGR of 5.08% from 2025 to 2034. The low temperature powder coatings market is observed to expand with the rising demand for energy efficient products for drying process.

Low Temperature Powder Coatings Market Key Takeaways

- In terms of revenue, the global low temperature powder coatings market was valued at USD 125.99 million in 2024.

- It is projected to reach USD 206.79 million by 2034.

- The market is expected to grow at a CAGR of 5.08% from 2025 to 2034

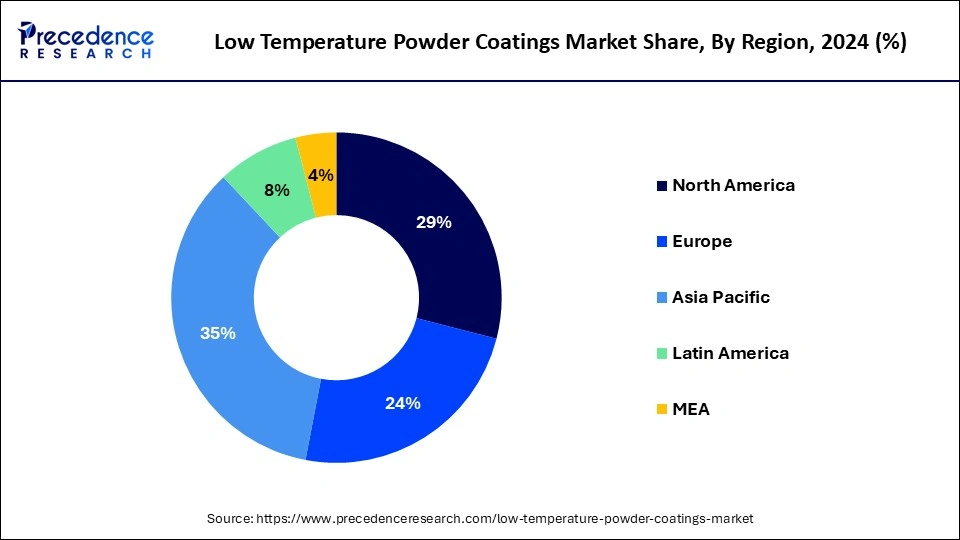

- Asia Pacific dominated the market with the largest revenue share of 35% in 2024.

- By resin type, the polyester segment held the largest share of the market in 2024.

- By resin type, the epoxy segment is expected to be the fastest growing in the market during the forecast period.

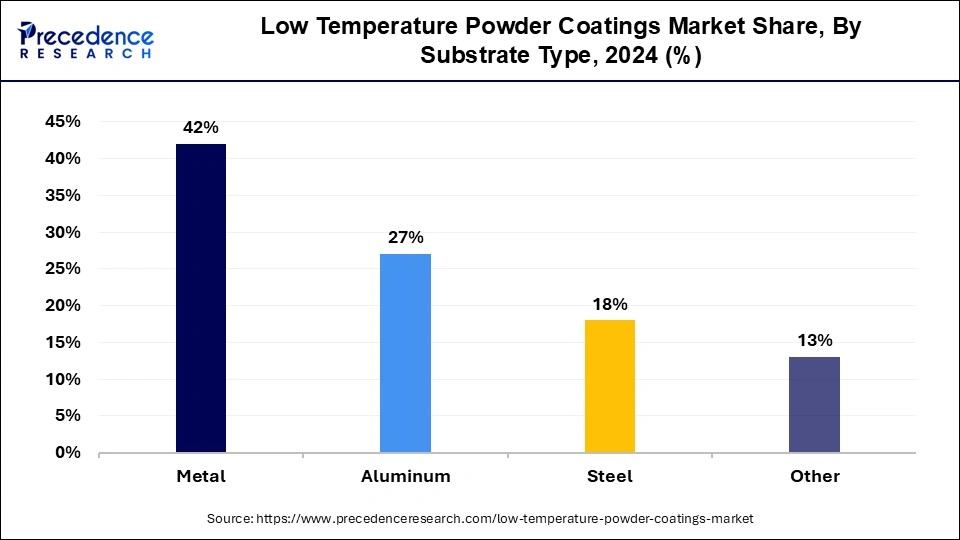

- By substrate type, the metal segment held the biggest revenue share of 42% in 2024.

- By substrate type, the steel segment is expected to be the fastest-growing segment over the predicted timeframe.

- By end use, the automotive segment held a significant share of the market in 2024.

Asia Pacific Low Temperature Powder Coatings Market Size and Growth 2025 to 2034

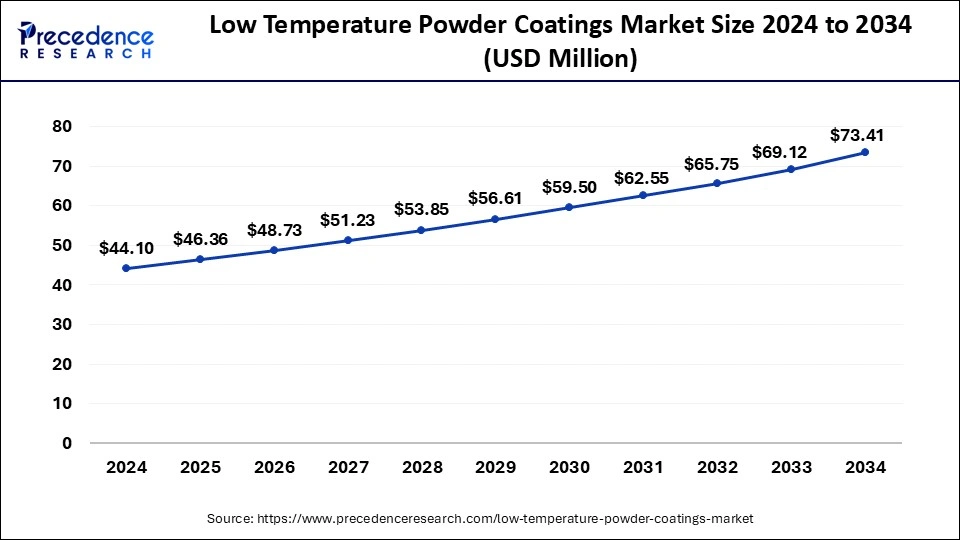

The Asia Pacific low temperature powder coatings market size surpassed USD 44.10 million in 2024 and is projected to attain around USD 73.41 million by 2034, poised to grow at a CAGR of 5.23% from 2025 to 2034.

Asia Pacific led the low temperature powder coatings market in 2024. The region is observed to sustain the dominance over the forecast period. Since low temperature powder coatings release fewer volatile organic compounds (VOCs) than conventional solvent-based coatings, there has been an increase in demand for them since they are more environmentally friendly. China is a major manufacturer and consumer of low temperature powder coatings in the Asia Pacific region. The nation's growing industrial sector and rising use of environmentally friendly coatings are major drivers of market expansion. The market is competitive, with a number of major companies active in the area, including both domestic and international firms. Among the most important elements affecting competitiveness are pricing tactics, product innovation, and environmental consciousness.

North America is expected to generate a notable share in the market during the predicted timeframe. Due to a number of factors, including growing demand from a variety of industries, environmental laws, and developments in coating technology, the low temperature powder coatings market in North America is a dynamic field with tremendous growth potential. The use of powder coatings, which are solvent-free and release very little volatile organic compound (VOC), is being pushed by stricter environmental rules that aim to reduce hazardous air pollutants (HAPs) and volatile organic compounds (VOCs). Manufacturers seeking to balance performance and environmental considerations will find low temperature powder coatings to be the preferred option as a result of ongoing innovation and the adoption of sustainable practices, which will further accelerate market expansion.

Market Overview

A niche of the coatings business, low temperature powder coatings (LTPCs) are made to cure at lower temperatures than conventional powder coatings. These coatings are preferred because they are suitable for heat-sensitive substrates, offer environmental advantages, and are energy-efficient. Lower curing temperatures result in less energy being used, which appeals to businesses trying to minimize expenses and increase sustainability. Demand for environmentally friendly coatings with reduced volatile organic compound (VOC) emissions is being driven by more strict environmental regulations.

The need for LTPCs is increased by the expansion of the automotive, aerospace, and consumer goods industries because of their high finish quality and longevity. The performance features of LTPCs are being improved by advancements in curing agents and resin technology, which will make them more dependable and adaptable.

The low temperature powder coatings market is expected to increase significantly due to rising energy costs, environmental laws, and improvements in coating technology. LTPCs will probably be used more frequently in a variety of sectors as long as businesses keep looking for economical and environmentally friendly alternatives.

It is still essential to educate industry about the uses and advantages of LTPCs in order to encourage broader use. Even with their improvements, LTPCs might still perform worse than high-temperature alternatives in some situations. creation of coatings with raw materials derived from biofuels to increase environmental advantages. coatings that adapt to variations in temperature and humidity are an emerging trend.

Low Temperature Powder Coatings Market Growth Factors

- Low temperature powder coatings are in higher demand than standard liquid coatings because they are more environmentally friendly and can help reduce emissions of volatile organic compounds (VOCs). This demand is being driven by increasing environmental restrictions.

- In industrial applications, low temperature curing lowers energy usage and results in cost savings. This is a crucial consideration for producers trying to cut expenses.

- Low temperature powder coatings are now more effective and versatile for a variety of substrates, including heat-sensitive materials, thanks to advancements in powder coating technology.

- The low temperature powder coatings market is growing as a result of the growing usage of powder coatings in a variety of industries, including appliances, furniture, construction, and automobiles. Powder coatings offer these sectors a high-quality, long-lasting finish.

- Industries are requesting coatings with improved corrosion resistance, longevity, and visual appeal. Since low temperature powder coatings satisfy these conditions, their use is growing.

- Adoption of low temperature powder coatings is rising across a number of industries as a result of growing knowledge of their advantages, which include shorter drying periods and less of an impact on the environment.

- The low temperature powder coatings market is growing as a result of economic expansion and industrialization, especially in emerging economies, which are fueling the need for effective and environmentally friendly coating solutions.

- Low temperature powder coatings are becoming more versatile and appropriate for a greater range of applications due to advancements in raw material and formulation procedures.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 206.79 Million |

| Market Size in 2025 | USD 132.45 Million |

| Growth Rate from 2025 to 2034 | CAGR of 5.08% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Resin Type, Substrate Type, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Durability and Performance

In the low-temperature powder coatings business, where powdered coatings offer notable advantages over conventional liquid coatings, durability and performance are crucial considerations. Powder coatings at low temperatures are renowned for their strong resistance to corrosion, weathering, and UV light. For outdoor applications where exposure to the elements is a problem, this makes them perfect. Low-temperature powder coatings can be applied as low as 120°C (250°F), in contrast to liquid coatings that need greater temperatures to cure. Their use to heat-sensitive substrates like composite materials, wood, and polymers is increased by this capability. In comparison to conventional coatings, these coatings are more economical and environmentally beneficial due to their lower curing temperatures, which also help to save energy during application.

Restraint

Complex Application Process

In order to provide a successful and effective coating application, the application process for low temperature powder coatings in complicated circumstances usually comprises numerous key processes and considerations. To improve adhesion and corrosion resistance, a pre-treatment procedure can be required, depending on the substrate material (wood, metal, etc.). Chemical processes like chromating and phosphating are common techniques. This is the part of the procedure that matters most. Usually between 120°C and 180°C (250°F and 350°F), low temperature powder coatings are intended to cure at lower temperatures than normal powder coatings. To make sure the coating satisfies requirements, do quality testing like adhesion, impact resistance, and corrosion resistance tests.

Opportunity

Customization and Innovation

Offering a large selection of colors and finishes is one of the key components of powder coating customization. Consumers in a variety of industries, including furniture and automobiles, expect coatings that improve the visual attractiveness of their products in addition to providing protection. Low temperature powder coatings, which cure at temperatures much lower than those of conventional powder coatings, are the result of advancements in resin chemistry and curing procedures. Innovation in the coatings sector is significantly influenced by sustainability. Low temperature powder coating innovations are concentrated on decreasing emissions of volatile organic compounds (VOCs), getting rid of hazardous air pollutants (HAPs), and improving the recyclable nature of coated products. thereby, the emergence of customization is observed to act as an opportunity for the low temperature powder coatings market

Resin Type Insights

The polyester segment held the largest share in the low temperature powder coatings market in 2024. Polyester resins are well-known for their exceptional weatherability, chemical resistance, and durability when utilized in LTPC compositions. These characteristics make them appropriate for uses requiring a durable and long-lasting finish. Unlike traditional powder coatings, which normally require higher temperatures (generally above 180°C), polyester resins can be designed to cure at lower temperatures. Polyester resin-based LTPC can be applied with common powder coating tools and methods.

Manufacturers wishing to implement powder coatings without having to make significant equipment investments or process modifications find it appealing due to its simplicity of application. In the low temperature powder coatings market, polyester is in competition with resin types like epoxy and acrylics. It is a favored option in many applications due to its performance, cost-effectiveness, and low-temperature curing characteristics.

The epoxy segment is expected to be the fastest growing in the low temperature powder coatings market during the forecast period. Since epoxy-based powder coatings have high adhesion, corrosion resistance, and durability, they are frequently employed in low-temperature powder coating applications.

These coatings are appropriate for heat-sensitive substrates such as wood, plastics, and some metals because they are designed to cure at lower temperatures than conventional epoxy coatings. Epoxy resins are appropriate for a wide range of applications, such as furniture, appliances, automotive components, and architectural coatings, because they may be designed to satisfy different performance needs. When it comes to mechanical attributes like flexibility, hardness, and impact resistance, epoxy-based powder coatings outperform other low-temperature powder coating alternatives.

Substrate Type Insights

The metal segment held the largest share in the low temperature powder coatings market. Metal is used in low-temperature powder coatings for two reasons: to make them look better and to give them strong protection. These coatings, which are designed to cure at lower temperatures, have benefits like improved compatibility with heat-sensitive substrates and less energy usage during application.

Powder coatings are becoming more and more popular than traditional solvent-based coatings due to rising limitations on volatile organic compound (VOC) emissions. Because they require less energy to cure, low temperature curing powder coatings have a further positive environmental impact by reducing carbon footprint. Reduced energy consumption and processing expenses result from lower curing temperatures, which makes low-temperature powder coatings cost-effective for both producers and consumers.

The steel segment is expected to be the fastest growing segment in the low temperature powder coatings market during the forecast period. When considering substrate materials, steel is more affordable than stainless steel or aluminum. This makes it a desirable choice for many applications where budget is of the utmost importance. Steel substrates can be coated with low-temperature powder coatings, enabling dependable and effective coating procedures. Excellent adhesion and coverage are ensured by the coatings' good adherence to steel surfaces. Steel substrates and low-temperature powder coatings work well together to provide producers with an affordable, long-lasting, and ecologically friendly surface finishing solution. As more companies place a higher priority on sustainability and cost effectiveness in their operations, this industry is probably going to keep expanding.

End-use Insights

The automotive segment held the largest share in the low temperature powder coatings market. When it comes to drying, low-temperature powder coatings use less energy than conventional high-temperature coatings. During the production process, this energy efficiency can save costs and have a less negative influence on the environment. Conventional high-temperature powder coatings have the potential to deform or deteriorate delicate vehicle parts by putting them under thermal stress. Low-temperature powder coatings have become popular in the automobile sector as a result of increased focus on performance, efficiency, and sustainability in production processes.

The furniture segment is expected to be the fastest growing in the low temperature powder coatings market. Strong protection against external factors like sunlight, moisture, and temperature changes is necessary for furniture intended for outdoor use. Low temperature powder coatings offer an effective defense against these elements, preserving the quality and aesthetic appeal of outdoor furniture throughout time. Significant wear and tear is frequently experienced by furniture used in hospitality situations, such as hotels, restaurants, and cafes.

Low Temperature Powder Coatings Market Companies

- PPG Industries Inc.

- Axalta coating systems

- Sherwin-Williams Company

Recent Developments

- With the introduction of Interpon A3000 from AkzoNobel's Powder Coatings division, motorcycle manufacturers can immediately begin to achieve greater cost and energy savings. The recently released product, which is the company's first two-wheeler single layer powder coating, can assist clients in speeding up their efficiency improvements without sacrificing functionality or style. The important Indian market, which is home to well over 200 million two-wheeled vehicles, is the focus of Interpon A3000. It's believed that over 18 million two-wheelers were sold in India in just the previous year. Also, the goods will be accessible everywhere.

- In June 2023, PPG introduced a line of electrocoat (e-coat) coatings called PPG ENVIRO-PRIME EPIC 200R coatings, which cure at a lower temperature than rival technologies. Customers benefit from the products' reduced energy consumption and CO2 emissions at production sites, among other sustainability-related features. Garry Grant, worldwide product manager for substrate protection products at PPG Automotive Coatings, called this technology "a game-changer." Higher oven temperatures are usually needed for conventional e-coats to cure across thicker substrates and complex assemblies, which leads to an uneven look and color variances.

Segment Covered in the Report

By Resin Type

- Polyester

- Epoxy

- Polyurethane

- Hybrid

By Substrate Type

- Metal

- Aluminum

- Steel

- Others

By End-use

- Appliances

- Furniture

- Automotive

- Electronics

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting