Ultra-High Temperature Ceramics (UHTCs) Market Size and Forecast 2025 to 2034

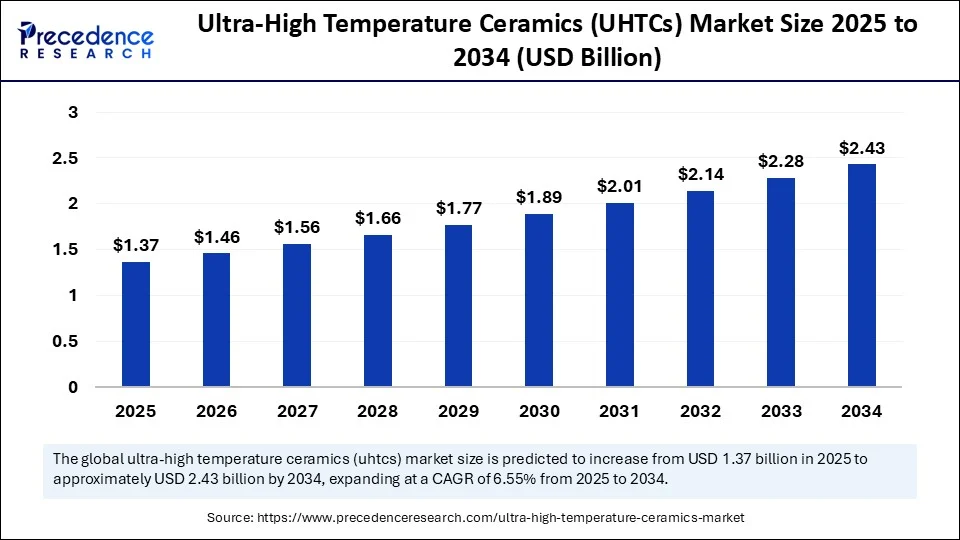

The global ultra-high temperature ceramics (UHTCs) market size accounted for USD 1.29 billion in 2024 and is predicted to increase from USD 1.37 billion in 2025 to approximately USD 2.43 billion by 2034, expanding at a CAGR of 6.55% from 2025 to 2034.The rising demand for UHTCs from the aerospace and defense sectors is boosting the growth of the ultra-high temperature ceramics (UHTCs) market. The growing demand for high-performance and energy-efficient materials across industrial applications further contributes to market growth.

Ultra-High Temperature Ceramics (UHTCs) MarketKey Takeaways

- In terms of revenue, the global ultra-high temperature ceramics (UHTCs) market was valued at USD 1.29 billion in 2024.

- It is projected to reach USD 2.43 billion by 2034.

- The market is expected to grow at a CAGR of 6.55% from 2025 to 2034.

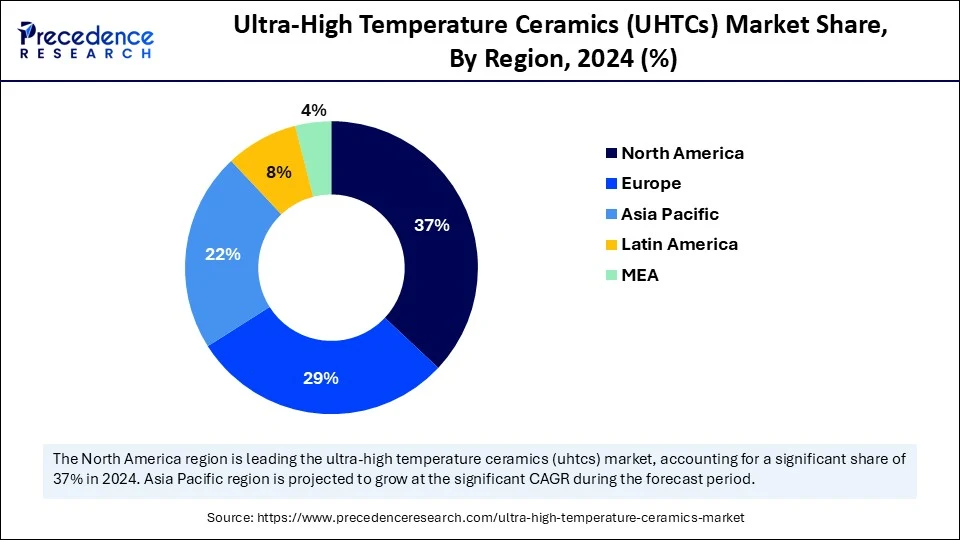

- North America dominated the global ultra-high temperature ceramics (UHTCs) market with the largest share of 37% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR from 20245 to 2034.

- By material type, the carbides segment contributed the biggest market share of 38% in 2024.

- By material type, the borides segment will expand at a significant CAGR between 2025 and 2034.

- By form, the monolithic ceramics segment captured the highest market share of 42% in 2024.

- By form, the fiber-reinforced composites segment will grow at the fastest CAGR between 2025 and 2034.

- By application, the hypersonic & aerospace vehicles (thermal protection systems) segment generated the highest market share of 34% in 2024.

- By application, the nose cones and leading edges segment will expand at a significant CAGR between 2025 and 2034.

- By end-user industry, the aerospace & defense segment held the largest market share of 51% in 2024.

- By end-user industry, the research & academia segment will expand at a significant CAGR between 2025 and 2034.

- By manufacturing technology, the hot pressing and sintering segment generated the major market share in 2024.

- By manufacturing technology, the spark plasma sintering (SPS) segment will grow at the highest CAGR between 2025 and 2034.

How Does AI Impacts the Ultra-High Temperature Ceramics (UHTCs) Market?

Artificial Intelligenceis transforming the ultra-high temperature ceramics industry by revolutionizing activities like materials discovery, process optimization, predictive maintenance, quality control, and design of components. AI technologies like large language models, including GPT-ol and GPT-o3, graph neural networks (GNNs), multimodal AI, reinforcement learning (RL), neurosymbolic AI, and multi-agent systems are advancing ultra-high temperature ceramics (UHTCs) components in areas like both functional and technical. AI is making the discovery of high-entropy ceramics easier, improving tribological performance, optimizing manufacturing processes, making expanding ultra-high temperature ceramics applications. AI analyzes vast datasets of material properties, which helps predict material performance in various applications.

U.S. Ultra-High Temperature Ceramics (UHTCs) Market Size and Growth 2025 to 2034

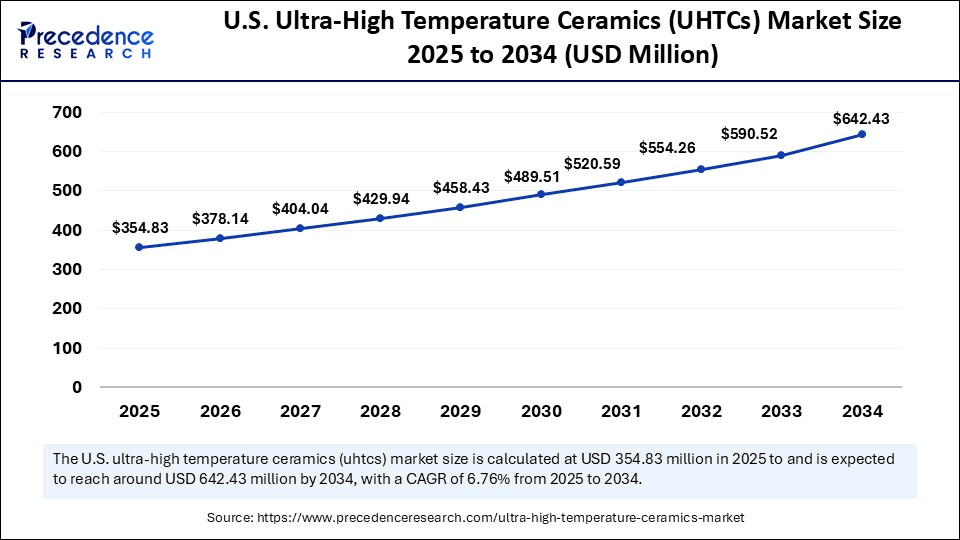

The U.S. ultra-high temperature ceramics (UHTCs) market size was exhibited at USD 334.11 million in 2024 and is projected to be worth around USD 642.43 million by 2034, growing at a CAGR of 6.76% from 2025 to 2034.

What Made North America the Dominant Region in the Ultra-High Temperature Ceramics (UHTCs) Market in 2024?

North America dominated the ultra-high temperature ceramics (UHTCs) market while capturing the largest share in 2024 due to its robust aerospace, defense, and energy industries. North America has experienced rapid demand for high-performance materials in hypersonic vehicles and space exploration activities. The rising need for high-temperature ceramics in various industrial applications and advancements in aerospace technologies contribute to the market growth. Additionally, the ongoing emphasis on the adoption of AI-driven material design platforms is leading to significant discoveries of novel ultra-high temperature formulations.

The U.S. is a major player in the regional market due to its well-established industrial base, technological advancements, and rising adoption of high-performance materials in various industrial applications. The demand for ultra-high temperature ceramics is high in aerospace, military, nuclear, and automotive industries. The adoption of ultra-high temperature ceramics (UHTCs) with temperature ranges of 1500- 1800°C, 1800-2000°C, and over 2000°C is high in various sectors.

The American Ceramic Society Bulletin, issued in January and February 2025 to explore the latest and upcoming applications of ultrahigh-temperature ceramics (UHTCs). David Pham, Jenna Marie Gray, and Eric Corral provide an overview of the latest industrial applications for UHTCs in the cover story. In a second feature study, the ACerS-USACA Hypersonic Materials Training Program was overviewed by Helen Widman. Vladimir Krstic demonstrated a novel class of oxidation-resistant silicon carbide in another feature story. (Source: https://ceramics.org)

Asia Pacific Ultra-High Temperature Ceramics (UHTCs) Market Trends

Asia Pacific is the fastest-growing region in the market, driving growth due to increased government investments in the aerospace and defense sector. The demand for high-performance materials has increased in industrial applications like aerospace, nuclear energy, and industrial manufacturing. The rapid expansion of industrialization and demand for advanced materials in manufacturing activities are fueling the market. Asian countries are conducting continuous innovations in ultra-high temperature ceramics (UHTCs), bringing significant innovations to the emerging market.

China is a major player in the regional market, contributing to growth due to its robust aerospace and defense industry and strong R&D infrastructure. China's government initiatives like “Made in China 2025” are driving innovations and advancements in materials and technologies. Countries expanding tech-savvy consumer base and focus on the integration of cutting-edge technologies like IoT are contributing to the market growth.

Europe Ultra-High Temperature Ceramics (UHTCs) Market Trends

Europe is a notable player in the market. This is mainly due to its expanding aerospace and defense industries. Europe has been investing heavily in the nuclear energy sector and aerospace & defense applications, driving demand for high-performance materials, including ultra-high temperature ceramics (UHTCs) components. The region's robust research & development infrastructure and growing demand for UHTCs in the automotive sector contribute to this growth.

Germany is a major player in the regional market due to its robust industrial base, large emphasis on automotive and green energy, and government investments in cutting-edge materials R&D. The robust manufacturing sector in Germany drives demand for high-performance materials. Additionally, the strong focus on Industry 4.0 initiatives is promoting digital integration, driving adoption of ultra-high temperature ceramics in sustainability and energy efficiency projects.

Market Overview

The ultra-high temperature ceramics (UHTCs) market comprises materials capable of withstanding extreme temperatures exceeding 2000°C, along with intense mechanical, chemical, and thermal stresses. These ceramics are typically based on carbides, borides, and nitrides of transition metals such as zirconium, hafnium, and tantalum, which are vital for applications in aerospace, defense, nuclear energy, and hypersonic vehicles, where traditional materials often fail. UHTCs provide exceptional thermal shock resistance, oxidation resistance, and chemical inertness, making them indispensable for thermal protection systems (TPS), rocket nozzles, and leading-edge applications in extreme environments. The growth of the market is driven by ongoing advancements in hypersonic vehicle developments, space exploration activities, and defense applications. Researchers are currently working on high-entropy boride ceramics and fabrication strategies for 3D Cf/UHTCs.

What are the Growth Factors of the Ultra-High Temperature Ceramics (UHTCs) Market?

- Aerospace and Defense Demands: The ultra-high temperature ceramics are widely used in aerospace and defense applications for thermal stability and resilience at high temperatures. The aerospace & defense industry has increased demands for advancing their projects, space exploration, and hypersonic flight.

- High-performance Materials Demand: The demand for high-performance materials has increased in industries like aerospace, defense, electronics, and energy, driving the adoption of ultra-high temperature ceramics (UHTCs).

- Demand for Energy Efficiency: The demand for energy efficiency has increased, driving the use of high-performance ceramics to reduce energy consumption and improve industrial environmental performance.

- Expanding Aerospace and Defense Industry: The major countries in the world are focusing on expanding their aerospace and defense sector by investing heavily in advanced technologies, driving the use of ultra-high temperature ceramics (UHTCs).

- Technology Advancements: Advancements in technologies like the development of ultra-high temperature ceramics with improved properties and abilities are contributing to their increased demand.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 2.43 Billion |

| Market Size in 2025 | USD 1.37 Billion |

| Market Size in 2024 | USD 1.29 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.55% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material Type, Form, End User Industry, Application, Manufacturing Technology, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Advancements in Manufacturing Technologies

Ongoing advancements in manufacturing technologies for the production of more complicated ceramic components, enhancing material properties, improving precision, efficiency, and reducing production costs, are driving the growth of the ultra-high temperature ceramics (UHTCs) market. Advancements in manufacturing technologies like additive manufacturing and spark plasma sintering (SPS), chemical vapor deposition (CVD), enhanced sintering techniques, and hot pressing are driving transformation in the production process and performance. Additive manufacturing (3D printing) techniques are enabling precise shaping and production of complex ceramic components. Spart plasma sintering technology enables the production of fine-grained and high-density materials. Chemical vapor deposition technologies are used to manufacture high-performance UHTCs. Hot pressing applies high temperature and pressure for consolidating powder in high-strength ceramics. Additionally, the enhanced sintering techniques like liquid phase sintering and hot pressing, advance material properties, and reduce overall manufacturing costs.

Restraint

High Production Cost

The manufacturing of ultra-high temperature ceramics (UHTCs) is complex, requiring advanced raw materials and specialized equipment. The high cost associated with raw materials increases production costs and hampers adoption in cost-conscious industries. The complex manufacturing process, like hot pressing, spark plasma sintering, and chemical vapor deposition, further adds to production costs. Additionally, the high potential risk of ceramic materials increases production cost, limiting their adoption in various industries with cost sensitivity.

Opportunity

Government Support and Infrastructure Development

Increased demand for high-performance materials in various industries has drawn significant attention from the government. Governments worldwide are applying various policies and funding for research and development of high-performance materials like ultra-high temperature ceramics (UHTCs). Governments are investing heavily in space exploration and defense projects, making an essential step for enhancing the growth of the ultra-high temperature ceramics (UHTCs) components. Government investments in research and development in industries like aerospace, clean energy, and industrial applications are bringing significant innovative approaches in the development of advanced ultra-high temperature ceramics (UHTCs).

Material Type Insights

What Made Carbides the Dominant Segment in the Ultra-High Temperature Ceramics (UHTCs) Market in 2024?

The carbides segment dominated the market in 2024. The dominance of carbides stems from their high usage, driven by their high-temperature stability and strength. The demand for these materials has increased in various industrial applications to handle extreme temperatures and harsh environments. Carbides, such as tantalum carbides and silicon carbides, are highly adopted in industries due to their high hardness, thermal stability, resistance, and durability. Industries like aerospace, defense, and power plants are high adopters of the carbides.

The borides segment is expected to grow at the fastest rate during the projection period due to their high-temperature properties used in aerospace and defense applications. Borides have superior properties like thermal stability, high melting point, and high resistance to oxidants. The demand for zirconium diboride (ZrB2) is large in industrial applications for its high mechanical strength at extreme temperatures, high melting point, and exceptional resistance to oxidants.

Form Insights

Which Form Segment Dominates the Ultra-High Temperature Ceramics (UHTCs) Market in 2024?

The monolithic ceramics segment dominated the market in 2024 due to their ability to exhibit high-temperature properties. Monolithic ceramics are single-phase materials, essential in industries like aerospace, energy, and the industrial sector for operating under exceptional thermal conditions. Monolithic ceramics offer high strength and resistance to deformation at extreme temperatures. The high thermal stability and corrosion resistance make monolithic ceramics ideal for industries like energy and aerospace.

The fiber-reinforced composites segment is expected to expand at the fastest CAGR in the upcoming period, driven by their rapid adoption in aerospace, defense, and energy applications like rocket engines, thermal protection systems, and hypersonic technologies. The fiber-reinforced composites improve mechanical properties, toughness, and resistance to thermal shock. The ability of fiber-reinforced composites to enhance damage tolerance makes them suitable for extreme environments. The use of fiber-reinforced composites is a high thermal protection system for hypersonic vehicles and spacecraft re-entry, and high-performance engine parts.

Application Insights

Why Did the Hypersonic & Aerospace Vehicles Segment Dominate the Ultra-High Temperature Ceramics (UHTCs) Market in 2024?

The hypersonic & aerospace vehicles (thermal protection systems) segment led the market in 2024, due to increased use of ultra-high temperature ceramics in the production of hypersonic & aerospace vehicles. Ultra-high temperature ceramics (UHTCs) offer extreme temperature resistance, making them ideal for thermal protection systems in hypersonic & aerospace vehicles. The ultra-high temperature ceramics (UHTCs) offer high thermal protection by shielding vehicles from superior heat generation during hypersonic flight and atmospheric re-entry. The extreme refractory and resistance to oxidation properties of ultra-high temperature ceramics (UHTCs) make them suitable for harsh environments.

The nose cones and leading edges segment is expected to grow at the fastest rate over the forecast period, driven by their role in increasing the adoption of ultra-high temperature ceramics in the aerospace sector. The nose cones and leading edges in aerospace require materials to handle extreme temperatures and harsh environments. The ultra-high temperature ceramics can handle temperatures more than 2000°C, making them suitable for nose cones and landing edges in hypersonic vehicles and atmospheric re-entry. The ultra-high temperature ceramics, including Hafnium diboride (HfB2) and Zirconium diboride (ZrB2), are highly used components in nose cones and leading edges due to their high melting points and oxidation & thermal shock resistance properties.

End-Use Industry Insights

Which End-Use Industry Dominates the Ultra-High Temperature Ceramics (UHTCs) Market?

The aerospace & defense segment dominated the market in 2024. This is mainly due to increased use of ultra-high temperature ceramics (UHTCs) in aerospace & defense applications. The aerospace & defense applications require high-performance materials to withstand extreme temperatures and harsh environments, making the ultra-high temperature ceramics (UHTCs) ideal for them. The use of ultra-high temperature ceramics (UHTCs) in aerospace & defense has increased for thermal protection systems in hypersonic vehicles, spacecraft, and advanced propulsion systems.

The research & academia segment is expected to grow at the fastest CAGR over the forecast period, due to rising research and advancements in material properties and applications. The growing emphasis of research & academia for the development of novel materials with high performance is contributing to the segment growth. The growing demand for advanced materials in various industries and government support for research and development are driving innovation and advancements of ultra-high temperature ceramics (UHTCs) in the research & academia sector.

Manufacturing Technology Insights

How Does the Hot Pressing and Sintering Segment Dominate the Ultra-High Temperature Ceramics (UHTCs) Market in 2024?

The hot pressing and sintering segment dominated the market in 2024 due to the ability of this technology to offer high-density and high-strength components. The hot pressing and sintering technologies are crucial in obtaining high-density and required microstructures for extreme temperature applications. The hot pressing and sintering technologies produce ultra-high temperature ceramics with high thermal stability and resistance to extreme temperatures. The ability of hot pressing and sintering technologies to produce complex shapes makes them suitable for various industrial applications, including aerospace and defense.

The spark plasma sintering (SPS) segment is expected to expand at the fastest rate in the upcoming period due to its ability to create ultra-high temperature ceramics with high-density and fine-grained properties. The ability of spark plasma sintering (SPS) to produce rapid densification and enable sintering of ultra-high temperature ceramics (UHTCs) at lower temperatures makes it ideal for industrial applications. The spark plasma sintering (SPS) technology creates ultra-high temperature ceramics (UHTCs) to exhibit high thermal stability and resistance to extreme temperatures, driving its adoption in aerospace and defense applications.

Ultra-High Temperature Ceramics (UHTCs) MarketCompanies

- U.S. Ceramics LLC

- COI Ceramics Inc. (Northrop Grumman)

- General Electric (GE Research)

- Bharat Dynamics Ltd. (India)

- ZIRCAR Ceramics Inc.

- 3M Advanced Materials

- Ultramet

- Refractron Technologies Corp.

- Morgan Advanced Materials

- Ortech Advanced Ceramics

- KT Refractories

- SGL Carbon SE

- Entegris Inc.

- CeramTec GmbH

- TYK Corporation (Japan)

- Mersen Group

- CoorsTek Inc.

- Hunan Rui Yue Industrial and Trade Co., Ltd. (China)

- Advanced Refractory Technologies (ART)

- Saint-Gobain Performance Ceramics & Refractories

Recent Development

- In January 2025, the University of Virginia School of Engineering and Applied Science developed a groundbreaking electromagnetic levitation (EML) system under the Defense University Research Instrumentation Program (DURIP) grant. The system is designed to enable researchers to study ultra-high-temperature ceramics (UHTCs) in the solid and molten states. This innovation is likely to bring possibilities in aerospace, defense, and industrial applications. (Source: https://engineering.virginia.edu)

Segment Covered in the Report

By Material Type

- Carbides

- Hafnium Carbide (HfC)

- Zirconium Carbide (ZrC)

- Tantalum Carbide (TaC)

- Borides

- Zirconium Diboride (ZrBâ‚‚)

- Hafnium Diboride (HfBâ‚‚)

- Titanium Diboride (TiBâ‚‚)

- Nitrides

- Boron Nitride (BN)

- Silicon Nitride (Si₃N₄)

- Composite UHTCs

- UHTC-Reinforced Carbon Composites

- UHTC-Oxide Hybrids

By Form

- Monolithic Ceramics

- Coatings

- Fiber-Reinforced Composites

- Ceramic Matrix Composites (CMCs)

- Powder/Granular UHTCs (for sintering or additive manufacturing)

By Application

- Hypersonic & Aerospace Vehicles (Thermal Protection Systems)

- Rocket & Missile Nozzles

- Nose Cones and Leading Edges

- Nuclear Reactors & Fuel Cladding

- High-Temperature Furnace Linings

- Cutting Tools & Industrial Machinery

- Aerospace Brake Disks

- Re-entry Spacecraft Components

By End User Industry

- Aerospace & Defense

- Energy & Nuclear

- Automotive (Performance & Racing)

- Industrial Processing (Metallurgy, Refractories)

- Research & Academia

By Manufacturing Technology

- Hot Pressing and Sintering

- Spark Plasma Sintering (SPS)

- Chemical Vapor Deposition (CVD)

- Additive Manufacturing / 3D Printing

- Slip Casting & Cold Isostatic Pressing

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting