What is High Temperature Insulation Materials Market Size?

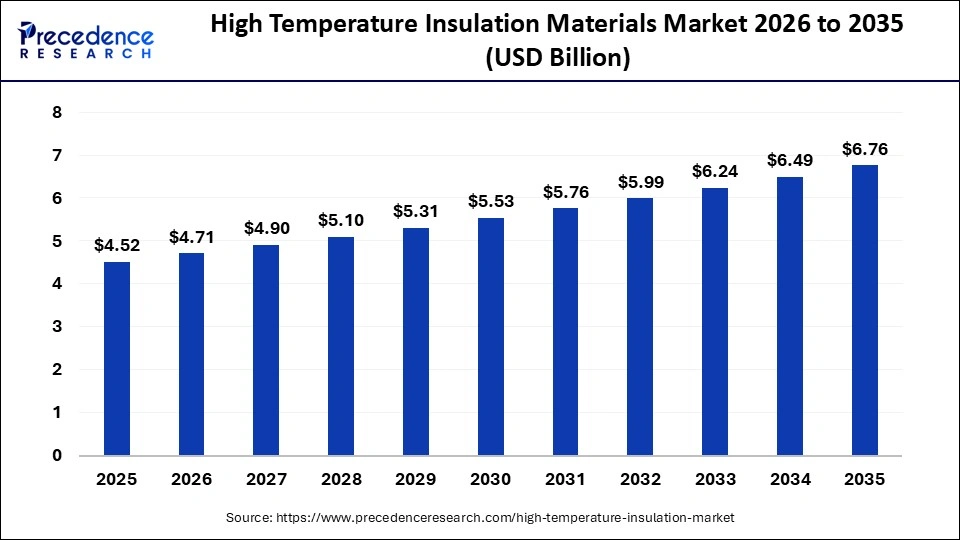

The global high temperature insulation materials market size is calculated at USD 4.52 billion in 2025 and is predicted to increase from USD 4.71 billion in 2026 to approximately USD 6.76 billion by 2035, expanding at a CAGR of 4.11% from 2026 to 2035. The high-temperature insulation materials market is driven by rising energy-efficiency needs and increasing adoption in high-heat industrial applications.

Market Highlights

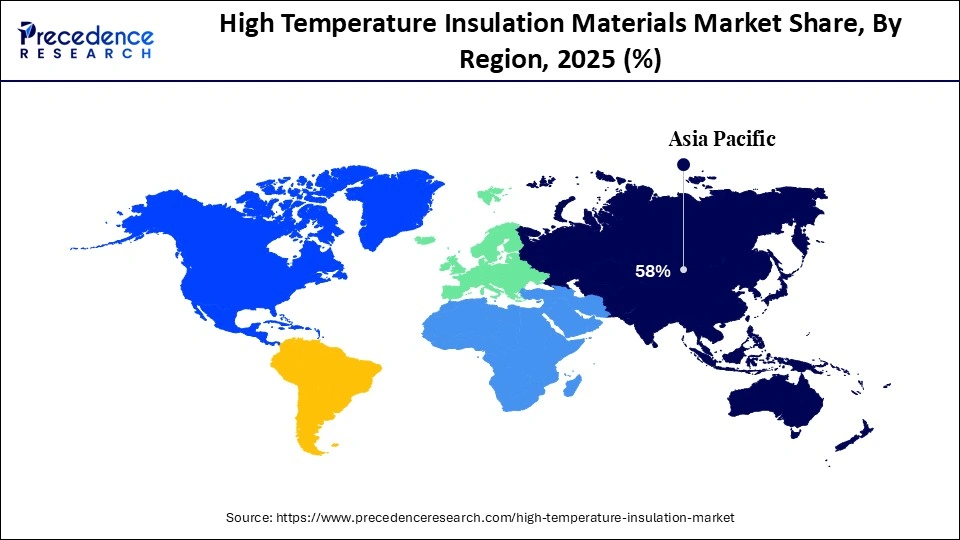

- Asia Pacific accounted for the largest share of 58% in 2025.

- By region, North America is expected to grow ay the fastest CAGR between 2026 and 2035.

- By material type, the ceramic fibre segment held a significant share in 2025.

- By material type, the other material types (aerogel blankets, microporous panels, etc.) segment is growing at a considerable CAGR between 2026 and 2035.

- By application, the industrial equipment segment contributed the biggest market share in 2025.

- By application, the insulation segment is expanding at a solid CAGR between 2026 and 2035.

- By end-use industry, the petrochemicals segment contributed the highest market share in 2025.

- By end-use industry, the electrical and electronics segment is growing at a healthy CAGR between 2026 and 2035.

Redefining Efficiency and Resilience: How Innovation Is Transforming the High Temperature Insulation Materials Market

The high-temperature insulation materials market is a critical market, which finds application in various industries doing business in extreme thermal environments such as petrochemicals, metallurgy, ceramics, generation, foundries, and industrial production. This material, which consists of ceramic fibers, insulating firebricks, microporous insulation, and aerogels, is meant to be resistant to heat and not to lose its energy, equipment wear and tear, and occupational hazards. With the world's industrial systems becoming modern, there is a need to have modern-day thermal management solutions that will enhance efficiency, reduce operating costs, and meet the safety and environmental standards that are increasingly becoming more stringent.

The high-temperature insulation materials market is driven by the growth of industrialization, the escalating energy-saving goals, and the escalating investments in thermal equipment improvements in the manufacturing industries that require heavy-duty production. With the industry trying to cut down on the heat loss and fuel usage as well as meeting the requirements of reducing emissions, the advanced insulation becomes essential in making the operations in accordance with the world standards of sustainability. Moreover, the shift in the direction of lightweight and environmentally friendly insulation materials provokes the technological competition among the manufacturers, leading to constant innovations and the extension of the scope of the market. The development of infrastructure in developing economies, the fast growth of the chemical and metal processing industry, and the modernization of power-generating facilities are the factors that contribute to demand.

Key AI Integration in the High Temperature Insulation Materials Market

The introduction of Artificial Intelligence into the high-temperature insulation materials market is changing the landscape in a very rapid way, as it is redesigning the way materials are developed, tested, fabricated, and implemented in an industrial system. AI-driven predictive analytics is one of the most important applications that allow manufacturers to optimize the fiber composition, minimize inconsistencies in porosity, and maximize thermal resistance more accurately than in the case of traditional trial-and-error techniques. AI-powered digital twins recreate full heating systems, furnaces, reactors, kilns, etc., and enable industries to test the insulation before construction.

Operating conditions, AI-powered condition-monitoring software is used in operation environments to track the heat flow, identify the early symptoms of insulation breaking down, and provide maintenance teams with real-time recommendations, enhancing safety and decreasing thermal accidents. Further, AI will enhance the predictions of supply chains, on-site quality, and automated production patterns to ensure that production is consistent with accelerating the delivery process.

High Temperature Insulation Materials Market Outlook

The high temperature insulation materials market has a good momentum, with the industries trying to be energy efficient, thermally stable, and emissions are being kept at a low level. The increased use of sophisticated furnaces and manufacturing systems that are heat-intensive has continued to drive the need to achieve better and long-lasting insulation solutions.

The major organizations, like Morgan Advanced Materials, 3M, Unifrax, and RHI Magnesita, are heavily investing in highly advanced fiber and lightweight refractory systems. These players are focused on R&D in order to emerge with sustainable and low-conductivity material, which is safe and efficient in operations.

New entrants in the market have been launching products, including aerogel insulation, nanomaterial composites, and high-temperature fibers that can be recycled. These are early-stage innovators who are working on smart thermal monitoring systems and modular panels of insulation that can be used in industries quickly.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 4.52 Billion |

| Market Size in 2026 | USD 4.71 Billion |

| Market Size by 2035 | USD 6.76 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 4.11% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Material Type, Application, End-use Industry, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

High Temperature Insulation Materials MarketSegment Insights

Material Type Insights

The ceramic fibre segment was the existing market leader in high temperature insulation materials and in 2025 had the largest level of revenue. It is widely used in furnaces, kilns, boilers, and petrochemical plants, where the high-quality sound insulation at high temperatures is critical in energy conservation and safety of work. Its ability to resist thermal shock, chemical corrosion, and mechanical stress ensures that industries have constant and high-temperature operation with minimum maintenance. The versatility of the segment, such as the use of a blanket and rigid ones, allows an easy installation and a retrofitting that is economical. Its dominance is further strengthened by the increasing demand for petrochemicals, power generation, aerospace, and metal processing. In general, ceramic fibre holds the top position in the high temperature insulation with its capability of yielding a significant share of revenue within the global industry due to its performance, versatility, and reliability over time in the different industrial processes.

The other material types (aerogel blankets, microporous panels, etc.) segment is expected to grow at a significant CAGR over the forecast period. These high-technology materials have exceptionally low thermal conductivity, light-weight construction, and compactness, which make them suitable in industries that need insulation of high performance and within a space-efficient structure. Aerogel blankets are finding application in aerospace, electronics, renewable energy, and EV production, and microporous panels are used to insulate with a thin layer over retrofitting old equipment. Increase in thermal resistance, durability, and fire protection is done through the development of technology such as nanomaterials and composite engineering. The driving force behind the rapid adoption is the growing environmental regulations, energy-efficiency initiatives, and the wish to possess modernized industrial processes.

Application Insights

Industrial equipment contributed the most revenue in 2025 and is expected to dominate throughout the projected period. It is used in the equipment needed in petrochemicals and metal processing, power generation, and chemical industries, such as furnaces, boilers, kilns, turbines, reactors, and heat exchangers. Such materials can reduce heat loss, enhance energy consumption, ensure safety when operating equipment, and increase the life of equipment. The leadership of the segment is further buttressed by the increased industrial modernization and retrofitting of the old infrastructure. Moreover, the use of ceramic fibers, microporous panels, and aerogel blankets is becoming more popular in industries to provide highly precise thermal control in high-temperature activities. Widespread adoption is also necessitated by regulatory requirements on energy conservation and emission reduction, and the safety of workers.

The insulation segment will also have a significant increase in the market of high-temperature insulation materials due to the increased focus on energy efficiency, sustainability, and optimization in the industries. The use of ceramic fibres, aerogel blankets, microporous panels, and vacuum-formed products is gaining popularity as the preferred lining equipment, pipelines and areas that need high temperatures but do not require conventional insulation any longer. Industries are seeking skinny, airy, and extremely tough insulation to reduce the amount of heat loss, lower fuel consumption, and comply with the laws of emission. Its segment is experiencing growth in the petrochemicals, power plants, EV battery-based, aerospace, and renewable energy initiatives. With the growing focus on environmental awareness and low cost of operation, the insulation segment is expected to grow at a high rate, achieving an increasing market share and supplementing the leading industrial equipment application.

End Use Industry Insights

The petrochemicals contributed the most revenue in 2025 and are expected to dominate throughout the projected period. The high-temperature insulation materials cannot be ignored in the petrochemical processes, refining, cracking, polymerization, and chemical synthesis, where consistent thermal control guarantees the efficiency of the process, energy savings, and the life of equipment. Ceramic fibers, microporous panels, and solutions based on aerogels are used by industries to decrease heat loss, ensure operational safety, and decrease fuel costs. Tough environmental laws and the requirement to comply with emission reduction require further spreading the implementation of advanced insulation in petrochemical facilities. Also, the high demand is supported by the expansion of petrochemical production in the Asia Pacific, North America, and the Middle East.

The electrical and electronics segment is expected to grow substantially in the high-temperature insulation materials market, with the increased demand for heat-resistant materials in semiconductors, power electronics, EV battery systems, and high-power devices. Ceramic fibers, aerogel blankets, and microporous panels are the high-performance insulation materials that are required to ensure thermal stability in electronic component equipment with compact and high-temperature aspects.

Development of renewable energy, electric movement, automation of the industry, and high-tech production further increases uptake. The materials are used to avoid excess heating, improve the reliability of the devices, and lessen the energy wastefulness in delicate electrical systems. Innovations in technology, in which nanomaterial composites and lightweight insulation panels can be used, make it highly effective and durable, and facilitate the sustainable energy objectives.

High Temperature Insulation Materials MarketRegional Insights

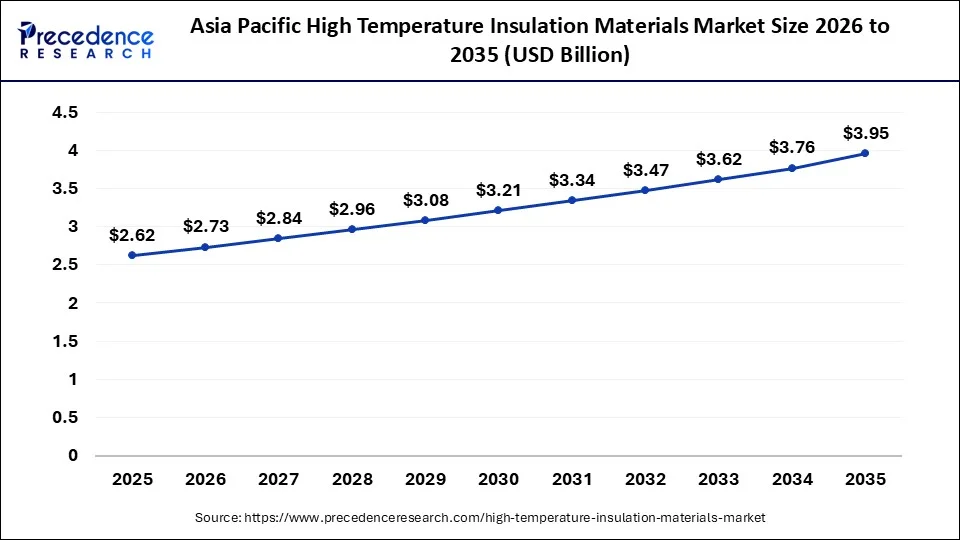

The Asia Pacific high temperature insulation materials market size is expected to be worth USD 3.95 billion by 2035, increasing from USD 2.62 billion by 2025, growing at a CAGR of 4.19% from 2026 to 2035

How Did Asia Pacific Lead the High Temperature Insulation Materials Market in 2025?

Asia Pacific led the global market with the highest market share in 2025, because of its high industrial foundation, vigorous growth in manufacturing, and high consumption of insulation in the heavy industries. The area is crammed with a large complex of petrochemical processing plants, metal processing facilities, power plants, as well as cement production plants, most of which need constant thermal regulation, as well as reliable and high temperature insulation so as to keep high operation safety and efficiency. Rapid industrialization in India, China, Southeast Asia, and South Korea also added pressure on the need to make sophisticated thermal solutions. The governments within the region are also encouraging energy-saving technologies and emission-cut policies, as well as urging companies to replace the old system with high-performance insulation materials. The increasing investment in electric vehicles, electronics, and renewable energy infrastructure enhances long-term adoption.

- In June 2025, Armacell completed the opening of its new factory in Pune, India on 11 June 2025. The opening was an important growth in the production capacity of the company and expanded its market share in the insulation business in the Asia-Pacific region.

China High Temperature Insulation Materials Market Trends

The Chinese market is the largest and powerful market in the Asian Pacific because of the vast industrial capacity, technology, and high-heat processing industries that are growing. The nation is still augmenting its investments in petrochemicals, steel production, non-ferrous metals, glass production, and heavy machinery production, which are all advanced, insulation power consuming ventures, thus enhancing energy economies and minimizing operational losses. The high pressure of the government to achieve carbon-neutrality aims is increasing the pace of transition to high-performance insulation materials, which are substituting the old refractory systems. China is an important producer of EVs, semiconductor fabrication, and battery production markets, which require high accuracy of thermal control and lightweight insulation.

North America is estimated to achieve the highest CAGR throughout the forecast period, because of the increased modernization in the industrial sector, the focus on energy-saving issues, and the implementation of the most recent thermal technologies. The petrochemical industries, aerospace industries, EV production, power generation, and metal processing are all industries that are quickly upgrading their equipment to comply with stringent regulatory requirements on emissions and heat-loss reduction. Retrofitting old industrial infrastructure with new insulations such as ceramic fibre, aerogels, and microporous panels also has a high rate of implementation in the region to enhance the reliability of its operations and to lower the energy consumed. Increased demand is further increased by growing investment in renewable energy, hydrogen technologies, and high-temperature battery systems. Furthermore, the existence of large insulation innovators, a high level of R&D, and a high level of incentives by the government to ensure industrial efficiency, makes North America the most rapidly growing regional market.

The U.S. takes the upper hand in the regional market because it has a technologically conducted industrial ecosystem, notable investment in the energy-efficient manufacturing process, and the introduction of high-performance thermal insulation to the key areas. It has a high demand in the aerospace, defense, oil and gas refining, chemicals, power generation, and the fast-growing electric vehicle and battery markets. The initiative of the country towards carbon mitigation and industrial sustainability causes industries to switch to light-weight, high-performance insulation solutions to replace the old refractory system. With the continued modernization of industries that use high-temperature operations, the U.S. is still the economic powerhouse of the insulation materials market in North America.

Sustainable growth is being recorded in the European high-temperature insulation materials market due to the increased growth in tightening of policies concerning energy efficiency and modernisation of industrial infrastructure, as well as increased use of modern thermal management technologies. The petrochemicals, steel, glass, power generation, and chemical processing industries, among others, are investing in high-performance insulation materials to minimize energy losses, enhance operational safety, and comply with environmental standard requirements. The area is advantageous to good R&Ds on ceramic fiber, microporous panel, aerogels, as well as vacuum-formed products, which allow the manufacturers to design lightweight, durable as well and environmentally friendly solutions of insulation. The increasing need to use sustainable manufacturing methods, alongside the emphasis on the minimization of carbon footprints, increases the upgrades to the current facilities.

UK High Temperature Insulation Materials Market Trends:

The UK market is recording progressive growth with industries considering high-performance insulation solutions in order to reduce energy intensity in their processes and energy-saving operations. The concern of the government in terms of net-zero and attention to applying energy-saving technologies supports the substitution of the traditional system of refractory by modern ceramic fibers, aerogels, and microporous panels. Lightweight, customizable, and durable insulation solutions help in the modernization of the industry and lower the cost of operation. Further expansions in aerospace, auto, and chemical industries remain in place, which enhances growth.

The MEA high-temperature insulation materials market is experiencing a velocity following a consistent industrialization, infrastructure development, and investment in areas of energy-intensive industries like petrochemicals, steel, cement, and power generation. In the region, the countries are retrofitting old high-temperature equipment to enhance energy saving, minimise heat loss, and meet the environmental conditions and safety standards. The use of ceramic fibers, microporous panels, and solutions with aerogel bands is increasingly being used to deal with extreme temperatures and improve the reliability of operations. The increasing government efforts to modernize its industrial plants, the introduction of new chemical and metal processing plants, are driving up the demand for advanced insulation materials.

In MEA, the major stakeholders in expanding the market are the United Arab Emirates, Saudi Arabia, and South Africa. High investments in the petrochemical and energy infrastructure projects are underway in the UAE and Saudi Arabia, as advanced types of insulation materials save on energy and enhance the efficiency of the process. The metal processing, mining, and power industry of South Africa is becoming more modern and uses high-performance insulation solutions more. Moreover, increasing industrial safety requirements and regulatory focus on environmental emissions decreases in all these countries hasten the substitution of the conventional refractory systems.

Latin American High Temperature Insulation Materials Market Trends:

The Latin America (LATAM) high temperature insulation materials market is rising because of increased industrialization, the modernization of manufacturing plants, and increased energy-consuming industries like mining, metal processing, cement, and petrochemicals. Increasing investments in industrial infrastructure, regulatory efforts to control pollution, and sustainable operations are also increasing demand. The market has enjoyed the technological advancements, the rising consciousness towards energy saving, and the emphasis on the reduction of the operation downtime and maintenance expenses of the industrial plants.

The mining and petrochemical industries of Brazil are also investing much in high-performance insulation solutions to maximize thermal performance. The metal processing and power generation sectors in Mexico are modernizing the equipment using new refractory and lightweight insulation materials. The increasing pressure on the need to adopt sustainable practices in industries, coupled with the advent of new high-temperature insulation technologies, makes LATAM a market that is gradually increasing.

Value Chain Analysis of the High Temperature Insulation Materials

- Raw Material Supply & Sourcing: The upstream part of the value chain concerns the processing of raw materials, including ceramic fibers, calcium silicate, and refractory aggregates. These are basic inputs supplied by mineral and chemical producers to function in high-temperature conditions.

Key players: Morgan Thermal Ceramics, Unifrax, RHI Magnesita. - Manufacturing & Processing: Specialized processes, including heat treatment, integrative processes to include binders, and precision cutting, are important to HTI products. These are value-adding stages by virtue of raising thermal resistance, mechanical strength, and safety profiles.

Key players: Saint-Gobain, 3M, Isolite Insulating Products. - Distribution & End-Use Integration: The finished HTI products are dispatched towards their destinations through a global supply network to industrial users in energy, aerospace, iron & steel, glass, and cement.

Key players: Promat, Koei Chemical, Thermal Ceramics.

Top Vendors in High Temperature Insulation Materials Market & Their Offerings

Leader in the provision of ceramic fiber, microporous, and refractory insulation (fibers, modules, boards) suitable for furnaces and other heavy industrial processes.

Specializes in aerospace-grade aerogel-based insulation in the form of blankets, in addition to microporous insulation, particularly for energy, oil and gas, and high-efficiency industrial uses.

Supply of refractory insulation boards, microporous products, and high-temperature fire-resistant materials to suit industrial furnaces and other safety-critical installations.

Provides high-temperature ceramic fibers and insulation materials with thermal resistance and long life, and durability.

Provides high-performance refractory ceramic fibers, low-bio persistent fibers, and modular insulation systems to energy-intensive industries.

Provides advanced ceramic fibers and acoustic absorbers designed for aerospace and automotive thermal control.

Specializes in extreme-heat protection through fireproof sleeves, blankets, and fabrics designed to withstand molten splashes.

Offers high-purity zirconia fibers and textiles capable of operating at extreme temperatures up to 2200�C.

Manufactures ceramic fiber blankets, boards, and papers specifically for industrial fire protection and furnace linings.

Specializes in high-performance fiber-based insulation solutions such as the Superwool and Kaowool product lines.

Focuses on premium alumina-based specialty materials used in refractories for the steel and glass industries.

Offers a comprehensive portfolio of refractory bricks and ceramic fibers for lining industrial kilns and furnaces.

Produces specialized aerogel insulation blankets known for having the lowest thermal conductivity in extreme environments.

Delivers customized insulation components and fabricated blankets for the power generation and aerospace sectors.

Supplies heat-resistant textiles, gaskets, and sealing solutions for high-temperature process industries.

Manufactures ceramic fiber products and insulating firebricks primarily for the industrial kiln market.

Acts as a fabricator of removable insulation jackets and aerogel blankets for industrial equipment maintenance.

Provides microporous insulation boards and high-performance calcium silicate products for heavy industry.

Offers thermal barriers and molten metal handling solutions specifically designed for aluminum and glass processing.

Specializes in high-temperature kiln components and heating elements for laboratory and industrial furnaces.

Recent Developments

- In October 2025, Carlisle Companies Inc. stated that it had agreed to acquire the enlarged polystyrene (EPS) insulation part of PFB Holdco, Inc. The acquisition enhanced the insulation lines at Carlisle and gave it a boost into the building material market.

- In October 2025, Knauf Insulation and Texnopark signed a deal to purchase the Rock Mineral Wool insulation unit of the company. The takeover had a state-of-the-art Tashkent, Uzbekistan, plant with electric melting technology that has minimized the emission of carbon dioxide. (Source: https://www.knaufinsulation.com)

- In September 2025, Armacell unveiled the ArmaGel XG system of aerogel insulation products. This new product diversified the Armacell aerogel-based products as far as thermal insulation of high-performance is concerned. (Source:https://www.armacell.com)

High Temperature Insulation Materials MarketSegments Covered in the Report

By Material Type

- Fiberglass

- Ceramic Fibre

- Mineral Wool

- Alkaline Earth Silicate (AES)

- Aluminum Silicate Wool (ASW) or Refractory Ceramic Fibre (RCF)

- Polycrystalline Wool or Fibre (PCW)

- Long Fibre

- Vacuum-Formed Insulating Products

- Polyurethane Foam

- Polystyrene

- Insulating Fire-Bricks (IFB)

- Other Material Types (Aerogel Blankets, Microporous Panels, etc.)

By Application

- Insulation

- Industrial Equipment

- Other Applications (Building and Fire-Protection, etc.)

By End-use Industry

- Petrochemicals

- Industrial

- Power Generation

- Transportation

- Electrical and Electronics

- Construction

- Other End-use Industries (Metal Processing, etc.)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content