What is the Low Foam Surfactants Market Size?

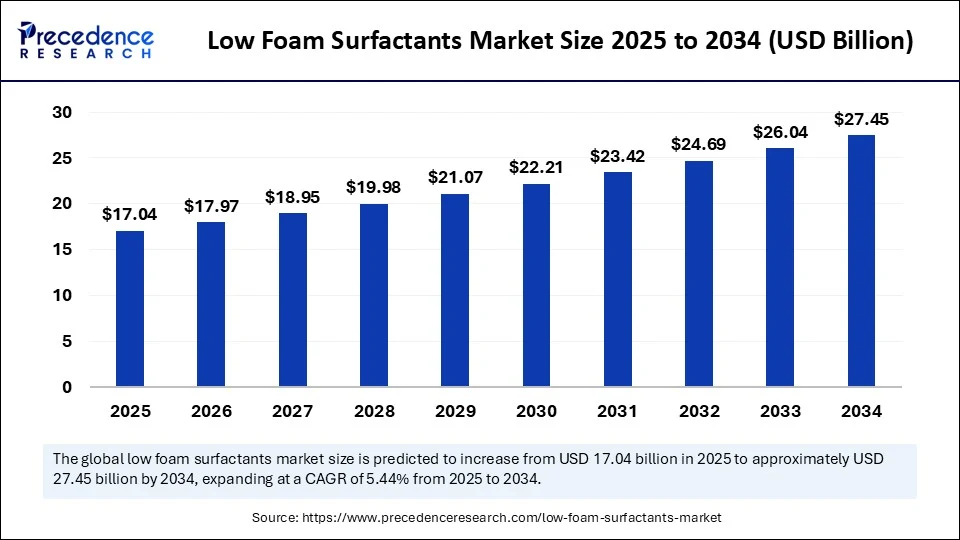

The global low foam surfactants market size is calculated at USD 17.04 billion in 2025 and is predicted to increase from USD 17.97 billion in 2026 to approximately USD 27.45 billion by 2034, expanding at a CAGR of 5.44% from 2025 to 2034. The market is growing due to rising demand for eco-friendly cleaning solutions, increased use in automated industrial systems, and expanding applications across food, pharma, and agrochemical sectors.

Low Foam Surfactants Market Key Takeaways

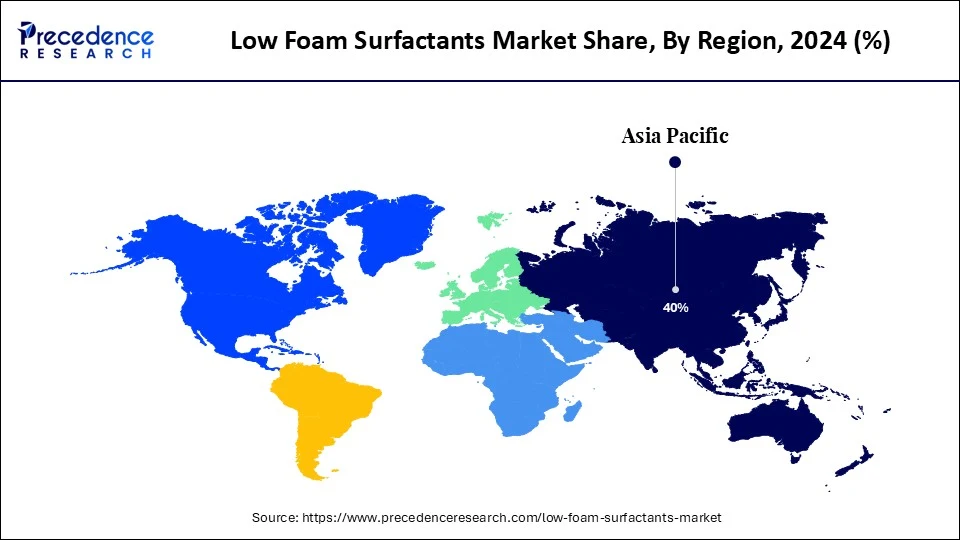

- Asia Pacific dominated the low foam surfactants market with the largest share of 40% in 2024.

- North America is expected to grow at a notable CAGR between 2025 and 2034.

- By type, the nonionic surfactants segment held the biggest market share of 65% in 2024.

- By type, the natural/bio-based surfactants segment is observed to grow at the fastest CAGR during the forecast period.

- By foam performance mechanism, the low-foaming by structure segment held the major market share of 70% in 2024.

- By foam performance mechanism, the low-foaming via antifoam additives segment is expected to grow at the fastest CAGR during the forecast period.

- By functionality, the wetting agents segment captured the highest market share of 28% in 2024.

- By functionality, the dispersing agents segment is emerging as the fastest-growing during the forecast period.

- By application, the home care and I&I cleaning segment contributed the significant share of 35% in 2024.

- By application, the agrochemical formulations segment is observed to grow at the fastest CAGR during the forecast period.

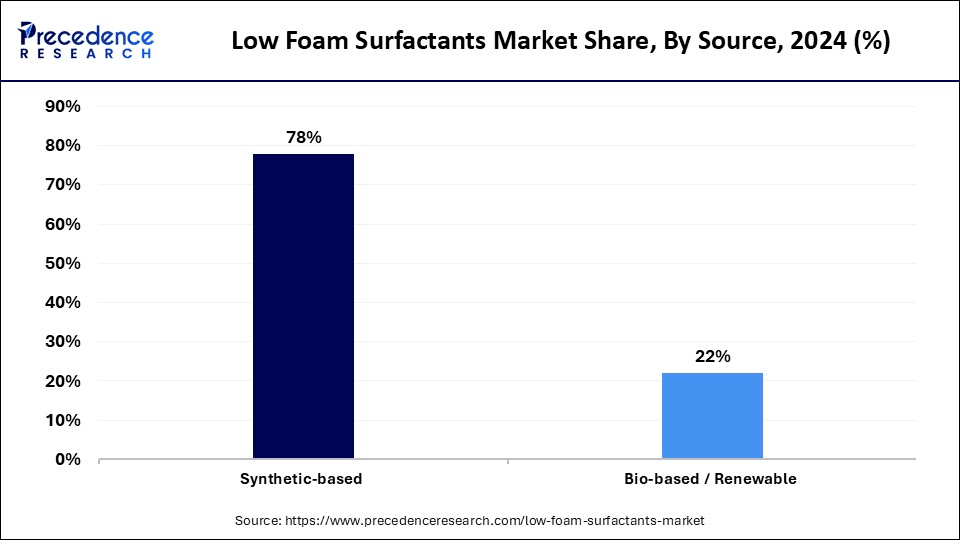

- By source, the synthetic-based segment accounted for largest market share of 78% in 2024.

- By source, the bio-based/renewable segment is observed to grow at the fastest CAGR during the forecast period.

- By end-use industry, the consumer goods segment held the largest share of 32% in 2024.

- By end-use industry, the agriculture segment is observed to grow at the fastest CAGR during the forecast period.

Strategic Overview of the Global Low Foam Surfactants Industry

The low foam surfactants market is witnessing steady growth driven by the growing need for effective and environmentally friendly cleaning products in a variety of sectors, including industrial cleaning, agrochemicals, pharmaceuticals, and food processing. The use of these surfactants is perfect for CIP systems, dishwashers, and industrial washers because they are necessary in automated systems where too much foam can impair performance. Market growth is also being fueled by improvements in surfactant technology, increased environmental regulations, and growing sustainability awareness. The market is poised for rapid growth due to a shift toward multifunctional and biodegradable formulations.

Can low foam surfactants meet the efficiency demands of modern industry?

Low-foam surfactants are specifically engineered to perform effectively in automated and high-speed industrial systems, where excess foam can disrupt operations. These surfactants deliver superior wetting, emulsification, and dispersion without producing disruptive foam, which is utilized in various applications, including pharmaceutical manufacturing, agrochemical formulations, and clean-in-place (CIP) systems in food and beverage processing. As industries place a greater emphasis on sustainability, hygiene practices, and operational efficiency, low-foam surfactants provide a dependable solution that complies with contemporary production requirements and environmental standards.

Artificial Intelligence: The Next Growth Catalyst in Low Foam Surfactants

Artificial Intelligence (AI) is revolutionizing the low foam surfactants market by enabling smarter formulation, optimized production, and faster innovation cycles. Manufacturers can now model surfactant performance under various conditions using machine learning and predictive analytics, significantly reducing the time and expense involved in trial-and-error R&D. Consistent product performance is ensured by AI-driven quality control systems, and smart manufacturing technologies facilitate waste reduction and improved production energy efficiency. Furthermore, by optimizing ingredient selection to reduce environmental impact, AI is helping businesses align their sustainability goals. The next generation of high-performance, environmentally friendly surfactants will be greatly influenced by artificial intelligence as the industry shifts toward precision and personalization.

AI improves real-time temperature control, surfactant purity, and batch reaction control. Efficiency and sustainability are enhanced as AI ensures the optimal use of raw materials and minimizes chemical waste. Artificial intelligence can automatically adjust process parameters to accommodate variations in demand without compromising quality. Manufacturers who employ AI-based systems report on increased plant safety and lower energy consumption.

AI detectors detect contamination or wear and tear in production lines before they lead to malfunctions by using sensor data and machine learning. This ensures steady production of premium, low-foam surfactants and minimizes unscheduled downtime. Artificial intelligence can instantly identify minute changes in surfactant concentration, viscosity, or contamination levels without requiring frequent manual inspection aids in maintaining stricter quality standards and regulatory compliance.

Market Outlook

- Market Growth Overview: The low foam surfactants market is expected to grow significantly between 2025 and 2034, driven by the growing demand for bio-based and sustainable surfactants, the rise of automated and industrial cleaning systems, and research and development on advanced formulations.

- Sustainability Trends:Sustainability trends involve emphasis on biodegradability and low toxicity, a shift to bio-based and renewable feedstocks, and green chemistry in manufacturing.

Major Investors: Major investors in the market include BASF SE, DOW Inc., Evonik Industries AG, and Stepan Company. - Startup Economy:The startup economy is focused on bio-based and biosurfactants, specialty and niche applications, and startups are leveraging advanced technology, particularly in research and development, to optimize formulations and manufacturing processes.

Low Foam Surfactants Market Growth Factors

- Rising demand for eco-friendly and biodegradable formulations

- Increased adoption of automated industrial cleaning systems

- Expanding applications in food processing, pharmaceuticals, and agrochemicals

- Stringent environmental and safety regulations

- Advancements in surfactant chemistry

- High demand for efficient, non-foaming detergents in industrial and institutional cleaning

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 27.45 Billion |

| Market Size in 2025 | USD 17.97 Billion |

| Market Size in 2025 | USD 17.04 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.44% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Foam Performance Mechanism, Functionality, Application, Source, End-Use Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing Demand in Industrial Cleaning

With the increasing industrialization and manufacturing activities worldwide, the demand for effective cleaning agents is growing in industrial cleaning applications. Low-foam surfactants are crucial in industrial cleaning applications, where excessive foam can interfere with cleaning processes and equipment. These surfactants are essential because they effectively clean without producing excessive foam. The increasing need for environmentally friendly cleaning solutions further drives the growth of the market.

In large-scale cleaning operations where foaming can disrupt equipment, low-foam surfactants are crucial. Low-foam sanitization systems are necessary for sectors such as food processing, dairy brewing pharmaceuticals, and hospitals. Through the use of CIP (clean-in-place) and SIP (sterilize-in-place) systems, continuous automated cleaning becomes possible. Demand in institutional settings, such as schools, airports, and manufacturing facilities, has increased as a result of the heightened emphasis on safety and hygiene following the COVID-19 pandemic. Their ability to withstand high temperatures and hard water further bolsters their industrial usefulness.

Rising Demand for Eco-Friendly Cleaning Solutions

An essential component of biodegradable and sustainable cleaning solutions is low foam surfactants. Through the reduction of foam pollution and surfactant residues, they lessen the environmental impact of wastewater. Governments in the U.S. are enforcing regulations supporting green chemistry in Europe and some regions of Asia. They are perfect for eco-label certifications because they can maintain cleaning performance while using less water and energy. The demand from environmentally conscious consumer brands and green building management is speeding up this change.

Restraints

Limited Performance Across Applications

Under extremely harsh industrial or high-foaming conditions, certain low-foam surfactants may not perform well. It is still technically challenging to strictly balance without sacrificing emulsification, high wetting power, or low foam. Users may still favor conventional surfactants with higher foam profiles in applications such as textile dyeing or oilfield chemicals. Some specialized or legacy industrial setups find them less appealing due to this performance limitation.

Supply Chain Disruptions & Raw Material Volatility

The raw materials used to produce low-foam surfactants are often bio-based or specialty materials that are vulnerable to price fluctuations due to global supply chain disruptions, which hampers the growth of the low foam surfactants market. Changes in the cost of components, such as alcohol, plant-based oils, or ethoxylates, can have an immediate impact on profitability. Material availability is further strained by freight delays, the aftereffects of the pandemic, and geopolitical instability. It is challenging for manufacturers to ensure delivery schedules or price stability when supply is inconsistent.

Opportunities

Rising Demand for Green & Biodegradable Surfactants

Low-foam surfactants derived from renewable, plant-based sources are gaining popularity as sustainability becomes a top concern for all industries, creating immense opportunities in the low foam surfactants market. Products with less toxicity and environmental impact are becoming more and more popular with both consumers and businesses. Brands now have the opportunity to introduce eco-labeled biodegradable surfactant lines targeting the home care, personal care, and industrial cleaning markets. Government efforts and green certification programs also support this shift.

Innovation in Multifunctional Formulations

Demand for surfactants that have extra properties like emulsifying, dispersing, wetting, and controlling foam is rising. By lowering the number of ingredients needed in a product, advanced formulations can increase sustainability and cost-effectiveness. Businesses that invest in R&D to create these multipurpose, low-foam surfactants have a better chance of gaining market share. High-throughput screening techniques and artificial intelligence are speeding up these developments.

Segment Insight

Type Insights

Why did the nonionic surfactants segment dominate the low foam surfactants market in 2024?

The nonionic surfactants segment dominated the market with the largest share in 2024. This dominance is attributed to their low sensitivity to water hardness, high chemical stability, and compatibility with other ingredients. They are ideal for formulations that require minimal foam generation, as they can lower surface tension without ionizing, particularly in the food processing, industrial cleaning, and home care industries. Their broad use in a variety of applications is further supported by their efficacy in both acidic and alkaline environments.

The natural/bio-based surfactants segment is expected to grow at the fastest CAGR during the forecast period, driven by a growing global awareness of the negative impacts of petrochemical derivatives and a focus on sustainability. These surfactants meet eco-label requirements and consumer demand for biodegradable ingredients, as they are derived from renewable resources such as corn, sugarcane, and palm oil. Manufacturers are rapidly transitioning to plant-based substitutes as green chemistry regulations become increasingly stringent worldwide, particularly in North America and Europe.

Foam Performance Mechanism Insights

How does the low-foaming by structure segment dominate the low foam surfactants market in 2024?

The low-foaming by structure segment dominated the market with the largest revenue share in 2024. This is mainly due to its naturally occurring low foaming properties, which are inherent to its molecular structure. Because excessive oak can disrupt sensors or reduce operational efficiency, these surfactants are recommended for use in automated systems such as CIP and industrial washers. Their reliable performance in a variety of industrial settings makes them a popular option in industries like beverage manufacturing, dairy, and pharmaceuticals.

The low-foaming via antifoam additives segment is likely to grow at the fastest rate as they offer dual functionality: core surfactant performance combined with added foam control. These solutions are especially useful in processes where foam formulation happens spontaneously, such as those involving heat agitation or variable pressure. These are becoming increasingly necessary for industries such as paints, coatings, and agrochemicals to ensure consistent application and prevent foam accumulations in tanks and pipelines.

Functionality Insights

What made wetting agents the dominant segment in the low foam surfactants market in 2024?

The wetting agents segment held the largest share of the market in 2024 due to their critical role in reducing surface tension and allowing liquids to spread more efficiently across surfaces. In both consumer and industrial applications, like laundry, surface cleaners, and pesticide sprays, wetting agents ensure better coverage and penetration. Their functionality is particularly crucial in low-foam systems, where rapid rinse-off and minimal residue are required.

The dispersing agents segment is expected to expand at the highest CAGR in the upcoming period due to their high demand, especially in formulations where the solids and active ingredients must be suspended steadily. In goods where ingredient separation can impair performance, such as paints, fertilizers, and pharmaceutical liquids, these agents are crucial. To achieve consistent and long-lasting product quality, dispersing capabilities are crucial given the growing demand for multifunctional low-foam surfactants.

Application Insights

Why did the home care & I&I segment dominate the low foam surfactants market?

The home care & I&I cleaning segment continues to dominate the market due to the ongoing need for machine-compatible low-residue cleaners in both residential and commercial settings worldwide. Water consumption is reduced, ensuring easy rinsing, and low-foam surfactants function effectively in automatic dishwashers and flood cleaners. The demand for low-foam surfactants is further fueled by rising hygiene standards. The rising product innovation, such as disinfectant sprays and liquid detergents, and expanding applications in home settings. Moreover, the high demand for dishwashing and laundry detergents supports segmental growth.

The agrochemical formulations segment is expected to grow at the fastest CAGR during the projection period, driven by a greater use of sustainable crop protection methods and precision agriculture. Low foam surfactants minimize foam-related spray equipment failure while ensuring the best possible pesticide spread and absorption. They decrease chemical runoff and increase efficiency, two factors that are becoming increasingly significant in regulated agricultural settings. This sector is expanding due to growing concerns about global food security and government support for intelligent farming methods.

Source Insights

How does the synthetic-based segment dominate the low foam surfactants market?

The synthetic-based segment dominated the market with a major revenue share in 2024. This is primarily due to the growing industrial applications of synthetic-based surfactants, driven by their high performance, consistency, and lower production costs. In the home care and I&I sectors, they provide improved scalability and are chemically tailored to meet a variety of formulation needs. Despite sustainability concerns, they remain competitive due to their long shelf life and strong supply chains. Due to their affordability, they are particularly favored in industrial processes that involve large volumes.

The bio-based/renewable segment is expected to expand at the fastest rate in the coming years. The growth of the segment is attributed to stringent environmental regulations. In personal and household care products, consumers are increasingly opting for plant-based and biodegradable alternatives. Additionally, these surfactants support brand objectives for packaging that is free of plastic and achieves carbon neutrality. Emerging technologies for extraction and synthesis are increasing their effectiveness and cost competitiveness.

End-Use Industry Insights

Why did the consumer goods segment dominate the low foam surfactants market in 2024?

The consumer goods segment dominated the market in 2024, driven by significant demand for low-foam formulations in personal care, laundry, and household cleaning products. For quick rinse-off, minimal residue, and front-loading machine compatibility, low-foam surfactants are crucial. The long-term stability of demand is being aided by rising urbanization and awareness of hygiene. With these surfactants, major FMCG companies continue to come up with new ideas and expand their product lines.

The agriculture segment is expected to grow at the fastest CAGR over the forecast period, as foliar fertilizers, herbicides, and pesticides require effective low-foam surfactants. By lowering foam, which can alter droplet size and coverage, they improve spray application efficiency. Low-impact chemical solutions are being adopted at an accelerating rate as sustainable farming gains international recognition. Development is also being accelerated for contemporary agrochemical formulations.

Regional Insights

Asia Pacific Low Foam Surfactants Market Size and Growth 2025 to 2034

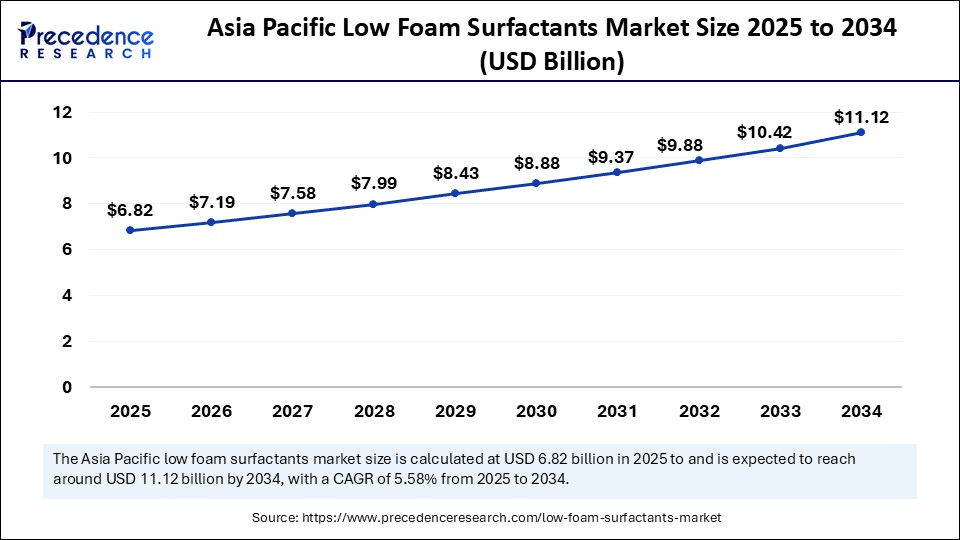

The Asia Pacific low foam surfactants market size is evaluated at USD 6.82 billion in 2025 and is projected to be worth around USD 11.12 billion by 2034, growing at a CAGR of 5.58% from 2025 to 2034.

What made Asia Pacific the dominant region in the low surfactants market?

Asia Pacific dominated the low surfactants market by capturing the largest share in 2024. The region is expected to sustain its position in the market in the coming years. This is primarily due to rapid industrialization and urbanization, which drive the demand for cleaning products in industrial applications. There is a rising demand for specialty cleaning products that offer specific characteristics, such as enhanced cleaning power and improved compatibility. Countries with extensive detergent and chemical production industries, such as China, India, and Indonesia, require low-foam surfactants. Year-over-year market expansion is supported by the rapid growth of the oil & gas industry, where low-foam surfactants are used in enhanced oil recovery. Asia Pacific has a competitive advantage due to the availability of inexpensive labor and raw materials.

China Low Foam Surfactants Market Trends

China's sustainable and bio-based surfactants, expansion in industrial application, and home and personal care sector remain a significant application area, fueled by rising disposable incomes and changing lifestyles in China. Innovation in research and development to develop advanced and eco-friendly surfactant formulations, focusing on higher performance and sustainability compliance.

North America is expected to experience notable growth in the upcoming period, driven by innovations in green chemistry, stringent environmental regulations, and widespread automation. The demand for low foam solutions is being increased by Canada's significant investments in clean technologies and smart manufacturing. Rising institutional cleaning standards and consumer demand for bio-based products also drive market growth. The growing consumer awareness of sustainability is driving demand for bio-based surfactants, thereby contributing to regional market growth.

U.S. Low Foam Surfactants Trends

U.S. shift towards bio-based and sustainable surfactants, increased sales and adoption of automated systems, such as commercial and household dishwashing machines and industrial cleaning equipment, are fueling demand for specific low-foam formulations. Dominance of non-lonic surfactants and diverse application expansion.

Germany Low Foam Surfactants Trends

Germany's dominance of sustainable and bio-based surfactants, significant regulatory environment, and high demand for efficient, low-foam cleaning and processing solutions in metal cleaning, pulp and paper, and food and dairy processing applications. Strong consumer preference for premium products and technological integration.

Low Foam Surfactants Market Value Chain Analysis

Raw Material Sourcing & Procurement

This initial stage involves sourcing raw materials, which can be petrochemical-based or bio-based/renewable feedstocks.

- Key Players: Wilmar International, Archer Daniels Midland (ADM), and ExxonMobil.

Manufacturing & Formulation

This stage involves the chemical synthesis and blending of raw materials into finished low foam surfactant products.

- Key Players: BASF SE, Evonik Industries AG, and Stepan Company.

Distribution & Sales

This stage focuses on the logistics, marketing, and sales of low foam surfactants to a wide array of end-user industries, including detergents, textiles, agrochemicals, and oil & gas.

- Key Players: Univar Solutions (now part of Nexeo Plastics), Brenntag, and BASF.

End-User Application & Post-Sales Service

In this final stage, the surfactants are used by industrial clients in automated processes (e.g., dishwashers, industrial cleaners) or formulated into consumer products (e.g., low-foam laundry detergent, shampoos).

- Key Players: Procter & Gamble, Unilever, Ecolab, and Agrana.

Top Companies in the Low Foam Surfactants Market & Their Offerings

- BASF SE: BASF is a global leader in the chemical industry and a major producer of a wide range of low foam surfactants used across various applications, including industrial and institutional cleaning and personal care.

- Dow Inc.: Dow contributes significantly to the market with a broad portfolio of performance surfactants, including non-ionic and specialty products designed for low-foam applications in industrial and consumer sectors.

- Clariant AG:Clariant provides specialty chemicals with a focus on sustainable solutions, including innovative low foam surfactants derived from renewable resources for use in personal care, industrial cleaning, and agricultural applications.

- Stepan Company: Stepan is a leading global manufacturer of surfactants, offering a comprehensive portfolio that includes many low-foaming options for the consumer and industrial cleaning markets.

- Croda International Plc:Croda specializes in smart science to create ingredients for consumer and industrial markets, providing high-performance, often bio-based, low foam surfactants.

- Evonik Industries AG:Evonik is a key innovator in the low foam surfactants market, particularly with the development of industrial-scale rhamnolipids (biosurfactants).

- Solvay S.A. (now Syensqo for specialty chemicals):Solvay provides a wide range of specialty polymers and surfactants used in demanding low-foam applications, focusing on high-performance solutions for industrial cleaning and agrochemicals.

- Huntsman Corporation: Huntsman is a global manufacturer of differentiated chemicals, including surfactants for industrial, institutional, and personal care applications that require controlled or low foam properties.

- Lonza Group:Lonza focuses on the life sciences and specialty ingredients markets, providing low foam surfactants for personal care, disinfection, and healthcare applications.

- Oxiteno (Indorama Ventures):Oxiteno, now part of Indorama Ventures, is a major producer of surfactants in Latin America with a growing global presence, offering a range of low-foaming non-ionic products for home care and industrial use.

- Sasol Ltd.: Sasol offers a broad range of specialty chemical products, including low foam surfactants derived from its unique feedstock position. They contribute to the market by providing innovative and versatile options for industrial and consumer applications.

- Innospec Inc.: Innospec focuses on specialty chemicals for various markets, including products for personal care and industrial applications that require specific low-foaming characteristics. They aim to deliver performance and value through their tailored chemical solutions.

- Kao Corporation:Kao is a Japanese chemical and consumer goods company that produces specialty surfactants, including low-foaming agents, for use in its own consumer products and for other industrial clients.

- Nouryon:Nouryon provides essential chemistry for industries worldwide and offers a portfolio of specialty surfactants with low-foaming properties for diverse applications, including building and construction, agriculture, and cleaning.

- Galaxy Surfactants Ltd. (India):Galaxy Surfactants is a leading manufacturer of ingredients for personal care and home care products, providing specialty low foam surfactants for various formulations.

- Wacker Chemie AG: Wacker specializes in chemical products based on silicones and polymers, including specialty additives and surfactants used in low-foam industrial applications and consumer goods.

- Venus Ethoxyethers Pvt. Ltd. (India):This company is an Indian manufacturer specializing in ethoxylation and propoxylation, producing various non-ionic and specialty surfactants for industrial and textile applications that often require low foam properties.

- Aarti Surfactants (India):Aarti Surfactants is an Indian chemical manufacturer focused on ingredients for the personal care and home care segments, providing specialty surfactants designed for specific foaming and cleaning requirements.

- KLK OLEO:A leading global producer of oleochemicals, KLK OLEO supplies key bio-based raw materials and derivatives used in the production of sustainable low foam surfactants.

- Lubrizol Corporation: Lubrizol specializes in specialty chemicals for the transport, industrial, and consumer markets, including advanced surfactants with low-foaming and high-performance characteristics.

Recent Developments

- In January 2024, Nouryon announced the launch of Berol Nexus surfactant, at the 2024 ACI Annual Meeting and Industry Convention held in Orlando, Florida, U.S. The Company's latest innovation, designed for the North American cleaning market, is a next-generation, multifunctional hydrotrope. This unique cosurfactant optimizes performance and activity, offering customers a distinct advantage in various applications. It is particularly beneficial in both household and industrial and institutional (I&I) cleaning applications.

(Source: https://www.coatingsworld.com) - In March 2023, Domestos came with a Power Foam Spray. This has a specially engineered formulation that delivers foam which expands and clings to surfaces, and a trigger head that works upside down. Every part of the product has been designed to improve the user experience: from the characteristic ‘swoosh' sound of the spray to the ergonomic trigger, the foam that expands on the surface and its clean, fresh fragrance.

(Source: https://www.unilever.com)

Segments Covered in the Report

By Type

- Nonionic Surfactants

- Alkoxylates (e.g., alcohol ethoxylates, fatty acid ethoxylates)

- Amine Oxides

- Amides

- Alkanolamides

- Amphoteric Surfactants

- Betaine-based

- Amphoacetates

- Amine-based amphoterics

- Anionic Surfactants

- Sulfonates

- Sulfates

- Phosphate esters

- Cationic Surfactants

- Quaternary ammonium compounds

- Ethoxylated amines

- Natural / Bio-based Surfactants

- Alkyl polyglucosides (APGs)

- Rhamnolipids

- Sophorolipids

By Foam Performance Mechanism

- Low-foaming by structure

- Low-foaming via antifoam additives

- Low foam under mechanical agitation

By Functionality

- Wetting agents

- Dispersing agents

- Emulsifiers

- Solubilizers

- Detergents/cleaners

- Antistatic agents

By Application

- Home Care & I&I Cleaning

- Laundry detergents

- Dishwashing detergents

- Surface cleaners

- Dishwasher detergents

- Industrial Processes

- Metal cleaning

- Textile auxiliaries

- Pulp & paper processing

- Personal Care & Cosmetics

- Shampoos & conditioners

- Skin cleansers

- Agrochemicals

- Pesticide/wetting formulations

- Adjuvants in herbicides/insecticides

- Oil & Gas

- Enhanced oil recovery (EOR)

- Drilling fluids

- Paints, Coatings & Inks

- Dispersants

- Defoamers

- Food Processing

- Clean-in-place (CIP) systems

- Sanitizers

By Source

- Synthetic-based

- Petrochemical-derived surfactants

- Bio-based / Renewable

- Plant-derived or fermentation-based

By End-Use Industry

- Consumer Goods (Detergents, Personal care)

- Agriculture

- Manufacturing & Industrial

- Energy & Oilfield

- Food & Beverage

- Healthcare & Pharmaceuticals

- Textiles

By Region

- Asia Pacific

- North America

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting