Lysozyme Market Size and Forecast 2025 to 2034

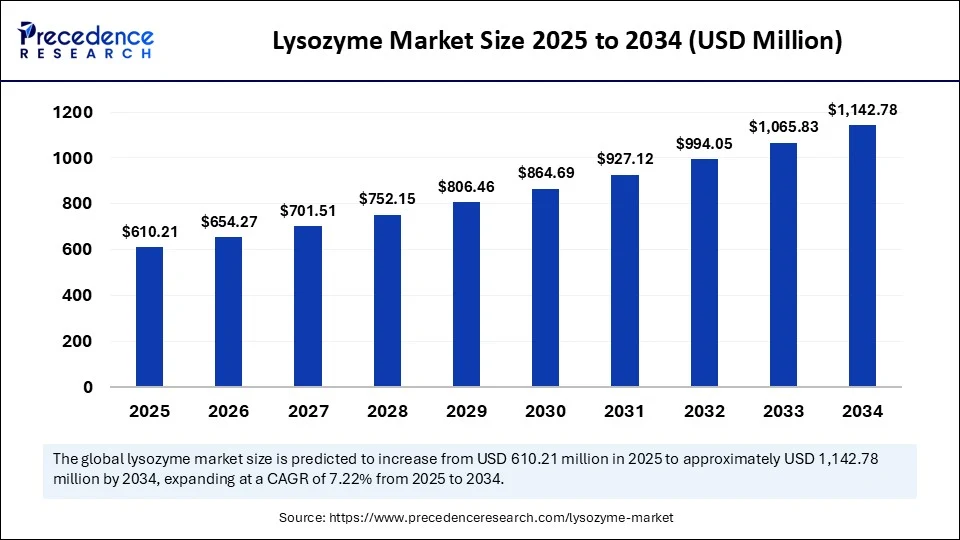

The global lysozyme market size accounted for USD 569.12 million in 2024 and is predicted to increase from USD 610.21 million in 2025 to approximately USD 1,142.78 million by 2034, expanding at a CAGR of 7.22% from 2025 to 2034. The market is driven by its wide applications in pharmaceuticals, food preservation, and biotechnology. Known for its antibacterial properties, lysozyme plays a critical role in extending product shelf life and supporting human health.

Lysozyme Market Key Takeaways

- In terms of revenue, the global lysozyme market was valued at USD 569.12 million in 2024.

- It is projected to reach USD 1,142.78 million by 2034.

- The market is expected to grow at a CAGR of 7.22% from 2025 to 2034

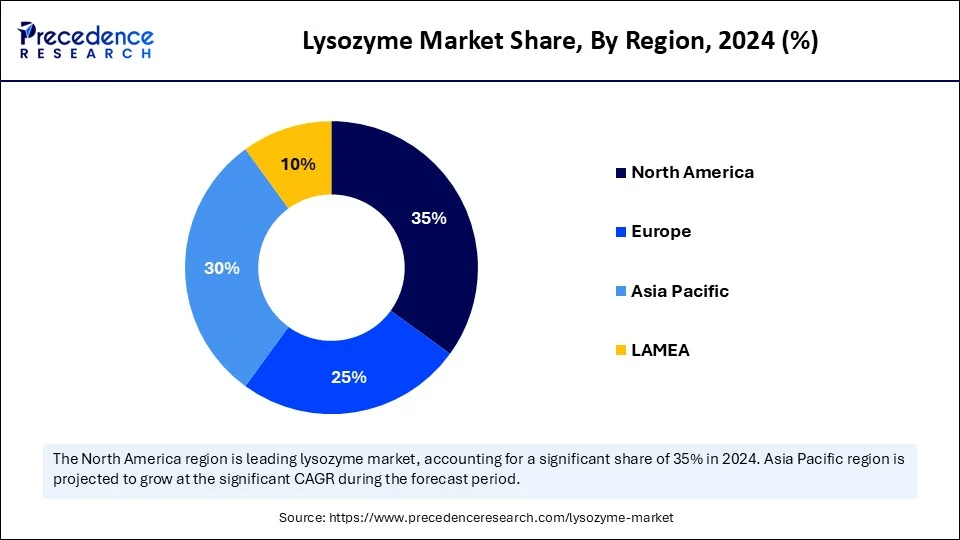

- North America accounted for the largest market share of 35% in 2024.

- Europe is expected to grow at a notable CAGR of 7.5% between 2025 and 2034.

- By source, the egg white derived lysozyme segment held the maximum market share of 60% in the adult lysozyme market in 2024.

- By source, the microbial derived lysozyme segment is expected to witness the fastest growth in the market over the forecast period.

- By form, the powdered lysozyme segment held the biggest market share of 70% in 2024.

- By form, the liquid lysozyme segment is expected to witness the fastest growth in the market over the forecast period.

- By application, the food and beverage segment contributed the major market share of 45% in 2024.

- By application, the pharmaceuticals segment is expected to witness the fastest growth in the market over the forecast period.

- By end-use, the food processing segment generated the highest market share of 50% in 2024.

- By end-use, the pharmaceutical and healthcare segment is expected to witness the fastest growth in the market over the forecast period.

How Is AI Reshaping the Lysozyme Market Landscape?

Artificial intelligence is reshaping how lysozyme is researched, produced, and commercialized. AI-driven molecular modeling allows scientists to predict lysozyme activity under different conditions, accelerating product development cycles. Advanced algorithms help optimize the extraction and purification processes, reducing costs while improving yields. Machine learning models can also forecast demand across industries, enabling smarter inventory management. Predictive analytics further aids in identifying novel lysozyme applications, such as in personalized medicine and targeted antimicrobial therapies. By integrating AI into supply chain monitoring, manufacturers can ensure consistent product quality and traceability. Overall, AI is transforming lysozyme production into a more efficient, precise, and innovation-driven process.

U.S. Lysozyme Market Size and Growth 2025 to 2034

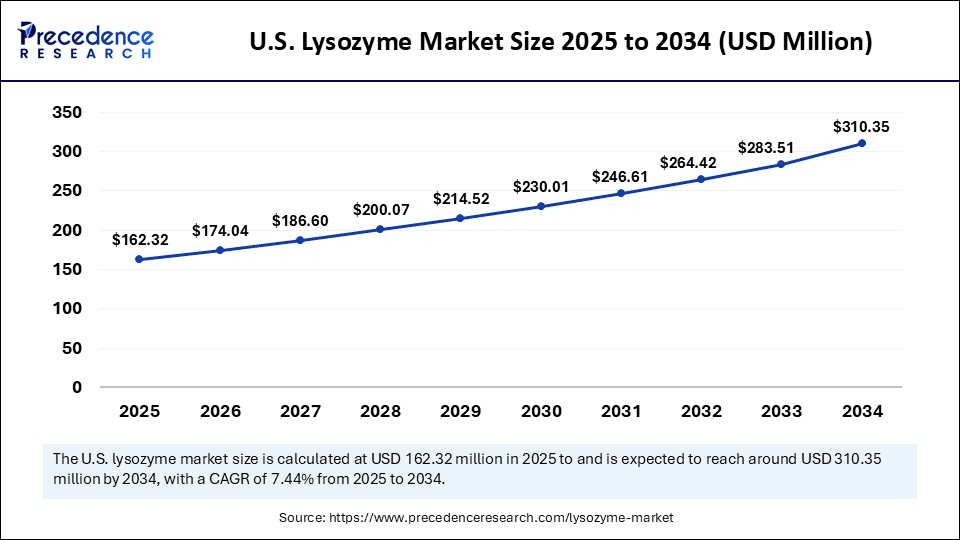

The U.S. lysozyme market size was exhibited at USD 151.39 million in 2024 and is projected to be worth around USD 310.35 million by 2034, growing at a CAGR of 7.44% from 2025 to 2034.

How Is North America Meeting Innovation Demand?

North America continues to dominate the lysozyme market, driven by advanced biotechnology infrastructure. The U.S. and Canada have a strong presence of pharmaceutical and food processing companies actively integrating lysozyme into products. Consumer demand for clean-label, natural ingredients aligns perfectly with lysozyme's properties. Regulatory bodies like the FDA provide a well-defined framework for the use of lysozymes, encouraging industrial adoption. Research and development efforts in recombinant lysozyme production are particularly strong in this region. The growing nutraceutical sector is further widening its application area.

The region also benefits from high consumer awareness about antimicrobial resistance and food safety. Cross-industry collaborations between biotech firms and research institutions are driving breakthroughs. Lysozyme producers are increasingly adopting lysozyme to replace antibiotics, meeting both market and regulatory pressures. Continuous innovation ensures that North America will remain a leader in the lysozyme market over the coming decade.

Why Is Europe Seeing Rising Consumption and Expanding Lysozyme Production?

Europe continues to dominate the lysozyme market, due to the rising demand for natural and clean-label antimicrobial agents in food preservation, pharmaceuticals, and nutraceuticals. Consumers in the region are increasingly favoring functional ingredients sourced from natural origins, aligning with the European Union's stringent food safety and quality regulations. The adoption of lysozyme in dairy, meat processing, and beverage sectors is accelerating, driven by its ability to inhibit spoilage-causing bacteria without altering product taste or texture. Additionally, the surge in probiotic-based and immune-boosting formulations is boosting lysozyme's role in dietary supplements. Growing research initiatives, coupled with government-backed innovation programs, are further expanding the potential applications. This heightened awareness and regulatory support position Europe as a hub for lysozyme innovation and market expansion.

In parallel, European pharmaceutical and biotechnology companies are incorporating lysozyme into advanced drug formulations, particularly in respiratory care, wound healing, and infection control. Countries such as Germany, France, and the Netherlands are investing heavily in research and development to enhance extraction methods and improve lysozyme's bioavailability. The market is also benefiting from the region's strong network of contract manufacturing organizations (CMOs) and contract research organizations (CROs), which facilitate product development and scale-up. Strategic partnerships between food producers, biotech startups, and academic institutions are fostering innovation in both application diversity and production efficiency. The increasing shift towards sustainable and animal-friendly lysozyme sources, including microbial fermentation, is also driving adoption. Overall, Europe's combination of innovation, regulatory clarity, and consumer-driven demand makes it the fastest-growing region in the global lysozyme market.

A Natural Antimicrobial on the Rise

The lysozyme market refers to the global commercial trade and application of lysozyme, a naturally occurring enzyme widely recognized for its antimicrobial and preservative properties. Lysozyme, primarily derived from egg whites, human secretions, and microbial sources, is extensively used across various industries such as food preservation, pharmaceuticals, cosmetics, animal feed, and biotechnology. Its ability to break down bacterial cell walls makes it valuable as a natural preservative and an active agent in health-related applications. The market dynamics are influenced by growing consumer preference for natural preservatives, increasing demand in pharmaceutical formulations, and expanding applications in animal nutrition.

The lysozyme market is expanding due to its versatility and clean-label appeal. It is increasingly used in pharmaceuticals for infection control, in food products for preservation, and animal feed to reduce antibiotic usage. Growing consumer preference for natural additives is creating strong market momentum. Technological advancements in enzyme extraction from eggs, milk, and microbial sources are improving availability and cost-efficiency. Regulatory approvals for lysozyme use in multiple industries are boosting confidence among manufacturers. With rising global awareness of antimicrobial resistance, lysozyme is becoming a preferred alternative to synthetic preservatives.

Market Key Trends

- Increasing adoption of lysozyme in clean-label food formulations.

- Growing R&D investment for higher yield.

- Expanding applications in veterinary medicines as an antibiotic alternative.

- Rising incorporation in cosmetic formulations for skin health.

- Emergence of plant-based lysozyme extraction methods.

- Wider regulatory acceptance across new geographies.

Makret Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 1,142.78 Million |

| Market Size in 2025 | USD 610.21 Million |

| Market Size in 2024 | USD 569.12 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.22% |

| Dominating Region | North America |

| Fastest Growing Region | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type / Grade, Application, End-Use Industry, Distribution Channel, Packaging Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Health and Safety at the Core

The primary growth for the lysozyme market is the increasing global demand for natural antimicrobial agents. Consumers and regulators alike are pushing for reduced reliance on synthetic preservatives, and lysozymes offer an effective solution. In healthcare, its role in preventing bacterial growth is gaining traction, especially in wound care and oral health products. In the food industry, lysozymes help extend shelf life without compromising nutritional quality. Growing public awareness about antimicrobial resistance is prompting industries to seek safer alternatives like lysozyme. Additionally, the rise in livestock production is boosting demand for lysozyme-based feed additives to maintain animal health without antibiotics. Collectively, these factors are sustaining strong market growth.

Restraint

Challenges on the Growth Path

Despite its potential, the lysozyme market faces notable hurdles. High production costs, particularly from egg-white-derived sources, can limit affordability. Allergen concerns associated with animal-based lysozyme may restrict its use among consumers with allergies. Regulatory variations between countries can slow product launches. In some cases, lysozyme's activity is reduced in certain food matrices, limiting its effectiveness. Competition from alternative natural preservatives, such as nisin, also poses a challenge. Addressing these barriers will be crucial for sustained market expansion.

Opportunity

Tapping New Frontiers

The lysozyme market has significant untapped potential in emerging sectors. Biotechnology companies can explore their use in advanced drug delivery systems and tissue engineering. Plant-based or lab-cultured lysozyme could open new opportunities for vegan and allergen-sensitive markets. Expansion into regions with rising demand for processed food, such as Southeast Asia and Africa, offers promising growth avenues. Collaborations between pharmaceutical and enzyme production companies can lead to breakthrough applications in infection control. The cosmetic industry presents another lucrative segment, with lysozyme's skin-protective benefits gaining interest. Furthermore, government initiatives promoting natural additives could accelerate adoption across industries.

Source Insights

Why is Egg White Derived Lysozyme Dominating the Market?

The egg white segment has become a dominant force in the lysozyme market, due to its abundant availability, proven safety, and high enzymatic activity. They are extensively utilized in food preservation, where their ability to inhibit bacterial growth enhances product shelf life naturally. The extraction process from chicken eggs is well-established, ensuring consistent quality and supply. Their recognition as a GRAS (Generally Recognized As Safe) substance by regulatory authorities has further boosted adoption across industries. In addition to food applications, egg-white lysozymes are widely applied in pharmaceuticals, particularly for their antibacterial and antiviral properties. This established demand, coupled with a strong production infrastructure, ensures their continued market leadership.

Egg-white lysozymes also benefit from consumer preference for naturally sourced bioactive compounds. Their minimal environmental footprint compared to synthetic preservatives supports the growing clean-label movement. The protein's stability under a range of processing conditions makes it suitable for multiple formulations, from powdered supplements to ready-to-use food ingredients. Furthermore, advancements in extraction technologies are improving yield and reducing costs, further solidifying their competitive advantage. With such advantages, egg-white lysozymes are expected to remain the cornerstone of lysozyme production in the coming years.

The microbial-derived lysozyme segment is expected to experience the fastest growth in the market during the forecast period, driven by biotechnology advancements and scalable fermentation processes. These lysozymes are produced by genetically engineered microorganisms, enabling consistent quality without reliance on animal sources. Their appeal is particularly strong in vegan, halal, and kosher-certified product lines, opening doors to new consumer segments. Production through microbial fermentation also reduces dependence on fluctuating egg supply and mitigates concerns over avian-related diseases. This makes them a reliable and sustainable alternative in a market increasingly driven by ethical sourcing.

Their adaptability to industrial customization further supports the growth trajectory of microbial lysozymes. Manufacturers can tailor enzyme activity and stability for specific end-use requirements, such as high-temperature food processing or pharmaceutical-grade applications. With the rise of precision fermentation, cost-efficiency is improving, making microbial lysozymes more competitive with traditional sources. Additionally, regulatory acceptance for fermentation-derived enzymes is expanding globally, further accelerating market penetration. These factors collectively position microbial lysozymes as the next big disruptor in the lysozyme industry.

Form Insights

How Are Powdered Lysozymes Dominating the Lysozyme Market?

The powered lysozyme segment has become a dominant force in the market, due to its extended shelf life, ease of transportation, and application versatility. They are preferred by food and pharmaceutical manufacturers who require long-term storage without compromising enzymatic activity. The powder form allows for precise dosage control, making it ideal for industrial-scale operations. In the food industry, powdered lysozymes are extensively used in cheese production, beer brewing, and processed meat preservation. Their stability under various temperature and humidity conditions further strengthens their demand in global supply chains.

From a cost perspective, powdered lysozymes offer reduced logistics expenses compared to liquid formats. Their non-perishable nature minimizes wastage, which is crucial for high-volume manufacturing. They can be seamlessly incorporated into dry blends, capsules, or powdered food additives without affecting product quality. The growing demand for functional foods and nutraceuticals is also fuelling the need for powdered enzyme formulations. Given their broad compatibility with manufacturing processes and extended usability, powdered lysozymes are set to maintain their dominant position.

The liquid lysozyme segment is expected to experience the fastest growth in the lysozyme market during the forecast period, due to its ready-to-use nature and superior solubility in various formulations. They eliminate the need for rehydration, making them highly convenient for real-time production lines. Liquid lysozymes are particularly beneficial in applications where rapid microbial inhibition is essential, such as fresh dairy products, beverages, and pharmaceuticals. They ensure uniform distribution in aqueous solutions, enhancing efficacy in liquid-based products.

One of the biggest benefits of liquid lysozymes is their immediate bioavailability, which reduces processing time in manufacturing environments. They are increasingly favored in the pharmaceutical sector for injectable or topical applications due to their ease of formulation. In the food industry, liquid lysozymes support faster throughput in continuous production systems. Their rising adoption is also linked to advancements in cold-chain logistics, which now allow stable storage and transportation. As industries prioritize speed, efficiency, and high-performance antimicrobial solutions, liquid lysozymes are positioned for significant expansion.

Application Insights

How Food and Beverage Industry Leading the Lysozyme Market?

The food and beverage segment has become a dominant force in the market, driven by growing demand for natural preservatives. Lysozymes are extensively used in dairy, meat, seafood, and beverage products to inhibit spoilage-causing bacteria without altering taste or texture. In cheese manufacturing, they prevent late blowing defects caused by Clostridium tyrobutyricum, ensuring product quality and consumer satisfaction. Similarly, in beer production, lysozymes enhance clarity and extend shelf life. Their clean-label status aligns perfectly with consumer demand for chemical-free food processing.

Regulatory approvals in multiple countries further support the continued dominance of lysozymes in this sector. They are considered a safe and effective antimicrobial tool for reducing food waste while maintaining nutritional integrity. The rise of minimally processed and artisanal food products has also expanded the scope of lysozyme applications. With global supply chains emphasizing freshness and safety, lysozymes will remain integral to food preservation strategies for years to come.

The pharmaceutical segment is expected to experience the fastest growth in the lysozyme market during the forecast period, due to its broad-spectrum antibacterial, antiviral, and anti-inflammatory properties. They are increasingly being used in therapeutic formulations, wound care products, and drug delivery systems. Lysozymes' ability to target bacterial cell walls without harming human cells makes them an attractive option in combating antibiotic-resistant infections. Additionally, they are utilized in ophthalmic solutions, nasal sprays, and oral care products.

Rising healthcare investments and the demand for novel biopharmaceutical ingredients fuel the expansion of lysozyme use in pharmaceuticals. Research into lysozyme-based therapeutics for chronic diseases and immune support is also accelerating. Their natural origin and safety profile give them an edge over synthetic antimicrobial agents, especially in pediatric and geriatric care. With the pharmaceutical industry seeking innovative and safe bioactive compounds, lysozymes are poised to become a cornerstone in next-generation medical formulations.

End-Use Insights

Why Food Processing is Dominating the Lysozyme Market?

The food processing segment has become a dominant force in the market, due to its critical role in ensuring product safety and extending shelf life. From dairy and meat to seafood and beverages, lysozymes are used at multiple stages to control microbial growth. Their effectiveness in preserving taste, texture, and nutritional value makes them indispensable for high-quality food production. Large-scale processors favor lysozymes for their versatility and compatibility with existing production lines.

In addition, the food processing sector's shift toward natural and clean-label preservatives has amplified lysozyme demand. Their GRAS status in many regions enables quick integration into various product categories without lengthy regulatory delays. As global food trade grows, lysozymes help maintain quality during long-distance transportation and storage. This combination of safety, efficiency, and consumer trust ensures that food processing will remain the largest end-use market for lysozymes in the foreseeable future.

The pharmaceutical and healthcare segment is expected to experience the fastest growth in the lysozyme market during the forecast period, as it benefits from advancements in biotechnology and a rising focus on antimicrobial resistance. Lysozymes are increasingly incorporated into topical creams, wound dressings, and medical devices to prevent infections. Their natural antimicrobial action, coupled with low toxicity, makes them ideal for sensitive applications in hospitals and clinics.

The surge in demand for immune-boosting supplements and functional ingredients further supports the healthcare sector's adoption. Lysozymes are also being explored for use in diagnostic tools and targeted drug delivery systems. As medical research continues to uncover new therapeutic potentials, the role of lysozymes in healthcare will only grow. This rapid expansion is a testament to the enzyme's versatility and potential to address pressing global health challenges.

Lysozyme Market Top Companies

- Danisco (DuPont)

- Brenntag AG

- Advanced Enzymes

- Enzyme Development Corporation

- Henan Dida Biological Products

- Hangzhou Ruibang Biotechnology

- Novozymes

- Amano Enzyme Inc.

- Tianjin Binhai Chemical Industry Group

- Lysobact

- AB Enzymes

- Jinan Shengquan New Materials

- Changsha Zhengbang Bio-technology

- Nihon Pharmaceutical

- Shaanxi Huike Botanical Development

- Shandong Longli Bio-Technology

- DSM

- Jinan Jianfeng Natural Product

- Jiangsu Yonghui Biotechnology

- Qufu Shengjin Biological Engineering

Recent Developments

- In August 2025, shares of Zydus Lifesciences climbed 2 percent, reaching an intraday high of ?955 apiece on the BSE. The uptick in buying interest followed the US Food and Drug Administration's (USFDA) approval for the company's Diltiazem Hydrochloride Tablets.

(Source: https://www.business-standard.com)

Segments Covered in the Report

By Source

- Egg White Derived Lysozyme

- Microbial Derived Lysozyme

- Human-Derived Lysozyme

- Others

- Plant-based Lysozyme

- Synthetic Lysozyme

By Form

- Powdered Lysozyme

- Liquid Lysozyme

- Others

- Tablet form

- Gel form

By Application

- Food & Beverage Industry

- Meat & Poultry Preservation

- Dairy Products

- Bakery & Confectionery

- Beverages

- Pharmaceuticals

- Antibacterial Formulations

- Respiratory Treatment

- Wound Healing Products

- Animal Feed

- Poultry Feed

- Aquaculture Feed

- Livestock Feed

- Cosmetics & Personal Care

- Skin Care

- Hair Care

- Biotechnology & Research

- Others

- Industrial Enzymes

- Agricultural Applications

By End-Use

- Food Processing

- Pharmaceutical & Healthcare

- Animal Nutrition

- Cosmetics & Personal Care

- Biotech & Research Institutes

By Region

- North America

- Europ

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting