Magnetoresistive Random Access Memory (MRAM) Market Size and Forecast 2025 to 2034

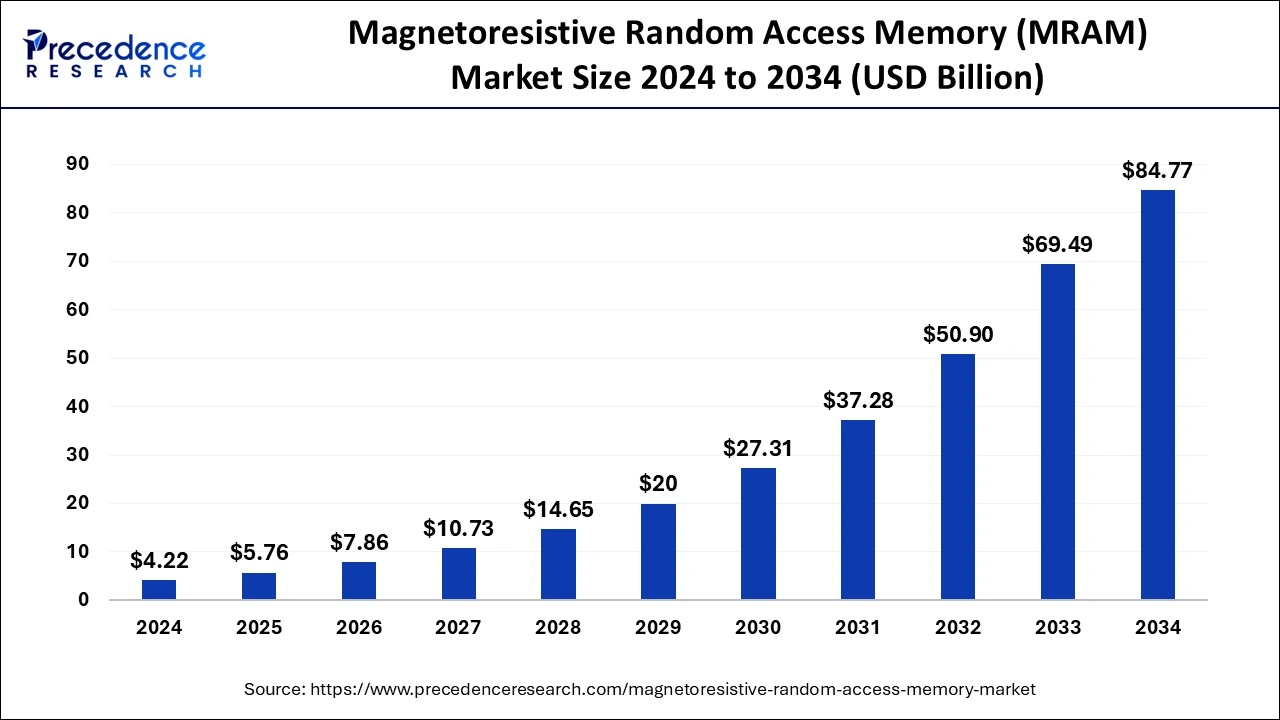

The global magnetoresistive random access memory (MRAM) market size was estimated at USD 4.22 billion in 2024 and is predicted to increase from USD 5.76 billion in 2025 to approximately USD 84.77 billion by 2034, expanding at a CAGR of 34.99% from 2025 to 2034.

Magnetoresistive Random Access Memory (MRAM) MarketKey Takeaways

- The global magnetoresistive random access memory (MRAM) market was valued at USD 4.22 billion in 2024.

- It is projected to reach USD 84.77 billion by 2034.

- The magnetoresistive random access memory (MRAM) market is expected to grow at a CAGR of 34.99% from 2025 to 2034.

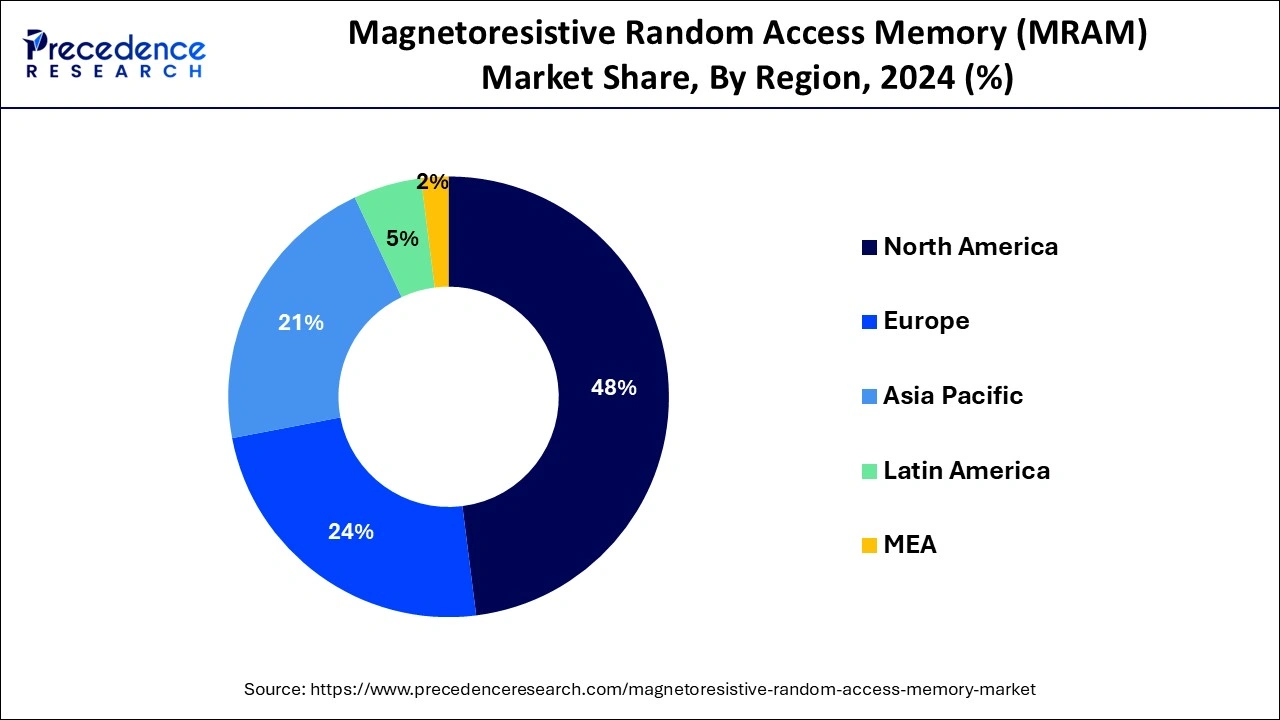

- North America contributed more than 48% of market share in 2024.

- The Asia Pacific region is estimated to expand the fastest CAGR of 39.6% between 2025 and 2034.

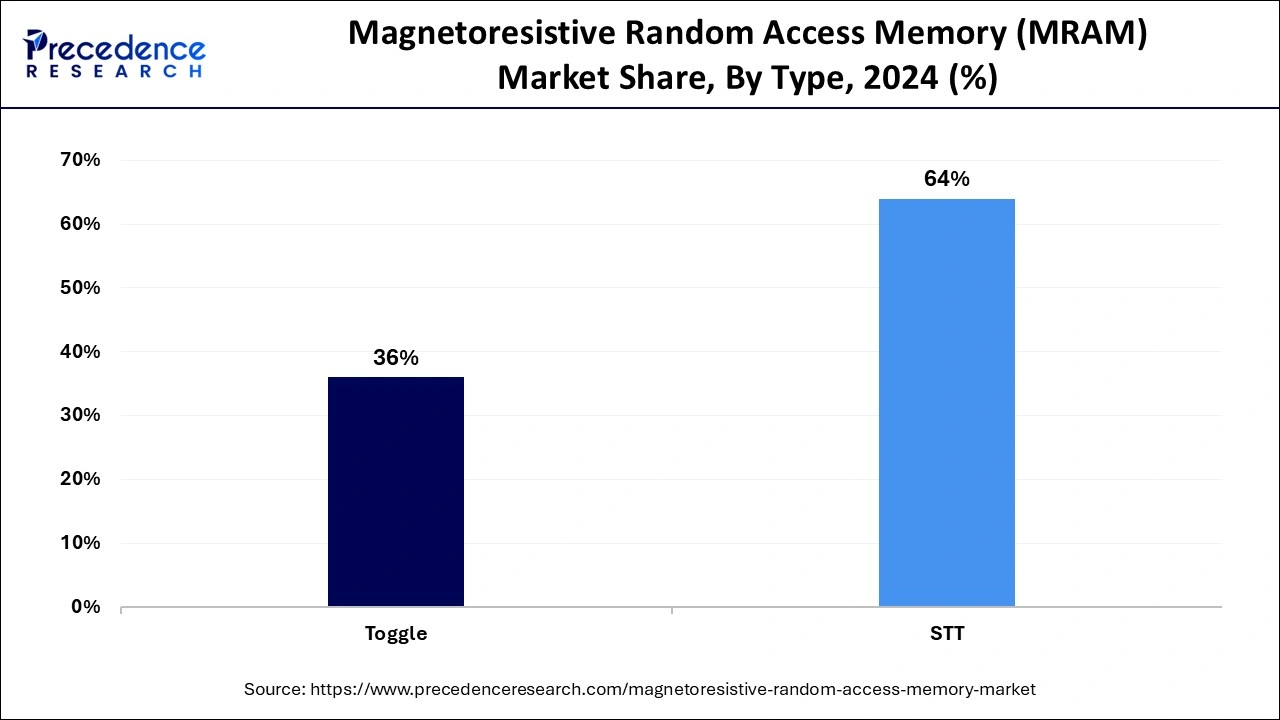

- By type, in 2024, the STT segment held the highest market share of 64%.

- By type, the toggle segment is anticipated to witness rapid growth at a significant CAGR of 36.2% during the projected period.

- By application, the aerospace and defense segment has held 44% market share in 2024.

- By application, the automotive segment is anticipated to witness significant growth of 37.4% over the projected period.

U.S.Magnetoresistive Random Access Memory (MRAM) Market Size and Growth 2025 to 2034

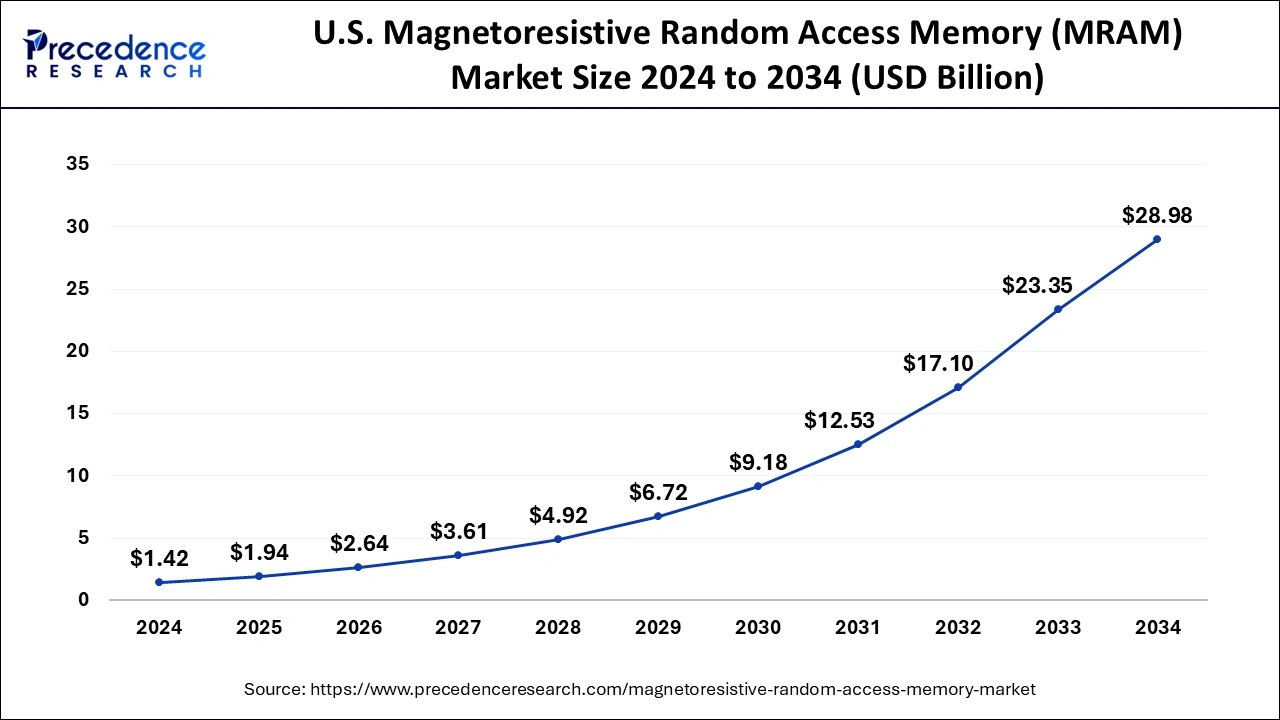

The U.S. magnetoresistive random access memory (MRAM) market size reached USD 1.42 billion in 2024 and is predicted to be worth around USD 28.98 billion by 2034 at a CAGR of 35.20% from 2025 to 2034.

North America contributed 48% of the market share in 2024, primarily due to the concentration of leading market players and the extensive research and development initiatives undertaken in the technological domain. The region boasts a robust ecosystem for innovation and technological advancement, fostering the development of MRAM solutions that cater to the increasing demand for faster computation, improved scalability, and reduced power consumption. These factors contribute significantly to the region's dominance in the MRAM market, positioning it as a key driver of global innovation and technological progress.

Asia Pacific is expected to experience the fastest revenue CAGR of 39.6% during the projected period.This growth can be attributed to several key factors, including advancements in data center infrastructure, the widespread adoption of cloud computing technologies, and the exponential increase in internet usage across various sectors. Additionally, the region's burgeoning market for smartphones, smart wearables, and other advanced electronic devices presents significant growth opportunities for MRAM solutions. The demand for high-performance memory solutions that offer enhanced speed, reliability, and efficiency is expected to drive the adoption of MRAM technology across various industries in the Asia Pacific region.

Market Overview

The magnetoresistive random access memory (MRAM) market offers solutions that are aligned with advancement in memory technology, offering non-volatile storage capabilities that retain data even when power is removed. Its storage mechanism, based on various magnetic domains, sets it apart from conventional RAM chips, which rely on electric charge or current flows. MRAM boasts several advantages over technologies like Flash and EEPROM, including higher read-write speeds and lower power consumption levels. Importantly, MRAM data remains intact and does not degrade over time, enhancing its reliability for long-term data storage.

This technology serves as a replacement for traditional memory solutions such as SRAM, DRAM, and flash memory, offering enhanced performance and reliability for a wide range of computing and processor-based systems. Its architecture, which utilizes ferromagnetic plates separated by a thin insulating layer, enables efficient data storage and retrieval processes. As companies worldwide increasingly adopt MRAM, the development of this memory technology is driving innovations in computer systems and processor-based devices. The ability of MRAM to offer fast, reliable, and non-volatile storage solutions positions it as a key player in advancing memory technologies and meeting the evolving demands of modern computing applications.

Magnetoresistive Random Access Memory (MRAM) Market Data and Statistics

- In September 2022, Avalanche Technology, a provider of next-generation MRAM technology, partnered with United Microelectronics Corporation (UMC), a semiconductor foundry, to introduce their new high-reliability Persistent SRAM (P-SRAM) memory devices utilizing UMC's 22nm process technology. Based on Avalanche Technology's latest generation of Spin Transfer Torque Magneto-resistive RAM (STT-MRAM) technology, these memory devices offer customers significant density, reliability, endurance, and power benefits compared to existing non-volatile solutions.

- In July 2021, researchers at IIT Delhi's Centre for Applied Research in Electronics (CARE) collaborated with the National University of Singapore (NUS) to enhance integration density in SOT-MRAMs (spin-orbit torque magneto-resistive RAM). Researchers noted that while SOT-MRAMs exhibit better reliability and writing speed than STT-MRAM, they do not match the latter in terms of high integration density.

Magnetoresistive Random Access Memory (MRAM) MarketGrowth Factors

- As the demand for non-volatile memory solutions increases across various industries such as automotive, aerospace, consumer electronics, and enterprise storage, MRAM technology emerges as a viable option. MRAM's ability to retain data without power and offer fast read and write speeds makes it attractive for applications requiring reliable and high-performance memory solutions.

- MRAM offers several advantages over traditional memory technologies like SRAM, DRAM, and flash memory. It provides faster read and write speeds, lower power consumption, higher density, and improved endurance. These advantages make MRAM suitable for a wide range of applications, driving its adoption across different sectors.

- Ongoing advancements in MRAM technology, including the development of Spin Transfer Torque MRAM (STT-MRAM) and Spin-Orbit Torque MRAM (SOT-MRAM), are further enhancing its performance and reliability. Research and development efforts aimed at improving MRAM's density, scalability, and integration are fueling market growth.

- Companies operating in the MRAM market are investing heavily in research and development activities to innovate and develop advanced MRAM solutions. Additionally, strategic partnerships and collaborations between MRAM technology providers and semiconductor foundries are facilitating the commercialization and mass production of MRAM products, driving magnetoresistive random access memory (MRAM) market's expansion.

- The expanding application areas of MRAM, including data storage, automotive electronics, IoT devices, industrial automation, and artificial intelligence, are contributing to the market's growth. The versatility and reliability of MRAM make it suitable for diverse applications, increasing its adoption across multiple industries.

Magnetoresistive Random Access Memory (MRAM) Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 34.99% |

| Market Size in 2025 | USD 5.76 Billion |

| Market Size by 2034 | USD 84.77 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing demand for electronic devices and wearables

The magnetoresistive random access memory (MRAM) market is experiencing significant growth due to the increasing demand for electronic devices and wearables across various industries. With the proliferation of smartphones, tablets, smartwatches, fitness trackers, and other wearable devices, there is a growing need for reliable and high-performance memory solutions like MRAM. These devices require memory solutions that offer fast read and write speeds, low power consumption, and data retention even when power is turned off.

One of the key advantages of MRAM is its ability to retain data without power consumption. Unlike traditional memory technologies that require constant power to maintain data integrity, MRAM can store data securely without the need for continuous power supply. This feature makes MRAM highly suitable for applications where power efficiency and data security are critical considerations, such as consumer electronics, wearable devices, and smart devices.

Moreover, MRAM is increasingly being integrated into standalone and embedded memory solutions across a wide range of consumer electronics products. From smartphones and tablets to smart home devices and IoT gadgets, MRAM offers a cost-effective and energy-efficient memory solution that meets the demands of modern electronic devices. Its affordability and low energy consumption make it an attractive option for manufacturers looking to optimize the performance and battery life of their products.

Furthermore, the versatility of MRAM extends beyond consumer electronics to other industries such as robotics, automotive, and business storage systems. As these industries continue to adopt advanced technologies and require high-speed, non-volatile memory solutions, the demand for MRAM is expected to rise further. Hence, the increasing demand for electronic devices, wearables, and smart devices, coupled with the benefits of MRAM in terms of power efficiency, data security, and affordability, is driving the growth of the magnetoresistive random access memory (MRAM) market. As the need for electronics continues to grow across various industries, the demand for MRAM is expected to increase, making it a key component in the future of memory technology.

Restraint

High designing costs associated with RAM devices

The magnetoresistive random access memory (MRAM) market faces challenges due to the high designing costs associated with RAM devices, which could potentially hamper its growth trajectory. One of the primary reasons behind these high designing costs is the complexity involved in developing MRAM technology, which requires specialized expertise and resources. Designing MRAM involves intricate processes such as integrating magnetic elements, optimizing read and write operations, and ensuring compatibility with existing semiconductor manufacturing processes. These tasks demand significant investments in research and development, as well as specialized equipment and facilities.

Moreover, the relatively small market size of MRAM compared to established memory technologies like DRAM and NAND Flash further exacerbates the designing costs. Manufacturers must recoup their investments in MRAM development through higher pricing, which can limit its adoption, especially in cost-sensitive markets. Additionally, the need for extensive testing and validation during the design phase adds to the overall designing costs of MRAM devices.

Ensuring reliability, data integrity, and performance consistency across different operating conditions requires thorough testing protocols, further driving up expenses. Despite these challenges, efforts to streamline the design processes, improve manufacturing efficiency, and optimize supply chain management could help mitigate the impact of high designing costs on the MRAM market. Collaboration among industry stakeholders and advancements in semiconductor fabrication technologies may also contribute to reducing overall costs and fostering the wider adoption of MRAM in various applications.

Opportunity

Innovation in analytical chemistry

Growing investments in the research and development of next-generation read access memory, particularly in the context of Magneto Resistive RAM (MRAM), are poised to unlock new opportunities and drive market growth. These investments are instrumental in advancing the technological capabilities of MRAM, leading to innovations that address existing limitations and enable new product applications. Research and development efforts in MRAM focus on enhancing key performance metrics such as speed, endurance, density, and power efficiency.

By exploring novel materials, fabrication techniques, and device architectures, researchers aim to push the boundaries of MRAM technology, making it more competitive with existing memory solutions like DRAM and NAND Flash. One area of particular interest is the development of spintronic-based MRAM, which leverages the intrinsic properties of electron spin for data storage. Spintronic MRAM promises faster read and write speeds, higher density, and lower power consumption compared to conventional MRAM technologies.

Moreover, investments in MRAM research foster collaboration between academia, industry, and government agencies, facilitating knowledge sharing and technology transfer. This collaborative ecosystem accelerates the pace of innovation and promotes the commercialization of MRAM-based products across diverse applications, including consumer electronics, automotive systems, industrial automation, and data storage solutions. Hence, the increasing investments in MRAM research and development herald a promising future for the magnetoresistive random access memory (MRAM) market, offering opportunities for breakthrough advancements and sustainable growth in the semiconductor industry.

Type Insights

The STT segment held the largest market share of 64% in the magnetoresistive random access memory (MRAM) market in 2024, reflects its superior attributes in terms of energy efficiency, high speed, and endurance. STT MRAM technology seamlessly integrates low power consumption with rapid data processing capabilities, making it particularly well-suited for a wide range of applications including gaming, wearables, and Internet of Things (IoT) devices. Its ability to offer efficient and high-performance memory solutions positions STT MRAM as a preferred choice among manufacturers and consumers seeking reliable and energy-efficient memory solutions for diverse technological applications.

The toggle segment is anticipated to witness rapid growth at a significant CAGR of 36.2% during the projected period. This growth is due to its distinct advantages. Toggle MRAM offers high-speed read and write operations, low power consumption, and excellent endurance, making it suitable for various applications in the electronics industry. Its ability to provide fast and reliable memory solutions has fueled its adoption in data storage, automotive systems, aerospace, and other sectors where rapid data access and robust performance are critical. The growing demand for efficient and dependable memory technologies has propelled the growth of Toggle MRAM, positioning it as a key contender in the competitive magnetoresistive random access memory (MRAM) market landscape.

Application Insights

The aerospace and defense segment has held 43.43% market share in 2024. The dominance of the aerospace and defense category in the magnetoresistive random access memory (MRAM) market highlights the critical role of MRAM technology in addressing the specific needs of these sectors. With a significant market share, these industries require high-temperature data storage solutions that offer reliability, durability, and resistance to radiation.

The increasing demand for MRAM in aerospace and defense applications underscores the importance of product innovations tailored to meet stringent requirements, such as low-power variants for radiation-hardened microchips. As a result, MRAM technology continues to expand its presence in these sectors, driven by the necessity for advanced data storage solutions capable of withstanding extreme environments.

The automotive segment is anticipated to witness significant growth of 37.4% over the projected period. The automotive sector is witnessing significant growth in the MRAM market, accounting for a notable share due to the increasing integration of advanced electronics in vehicles. MRAM technology offers high reliability, fast access times, and non-volatility, making it ideal for automotive applications such as infotainment systems, advanced driver-assistance systems (ADAS), and autonomous driving platforms.

As vehicles become more connected and autonomous, the demand for MRAM-enabled memory solutions continues to rise. Manufacturers are increasingly incorporating MRAM into automotive electronics to enhance performance, improve data storage efficiency, and ensure the robustness of critical automotive systems, driving the growth of MRAM adoption in the automotive industry.

Magnetoresistive Random Access Memory (MRAM) Market Companies

- Everspin Technologies Inc. (United States)

- Samsung Electronics Co., Ltd. (South Korea)

- Spin Memory, Inc. (United States)

- Avalanche Technology, Inc. (United States)

- NVE Corporation (United States)

- Crossbar, Inc. (United States)

- Intel Corporation (United States)

- Honeywell International Inc. (United States)

- Crocus Technology (United States)

- Toshiba Corporation (Japan)

- SK Hynix Inc. (South Korea)

- IBM Corporation (United States)

- Fujitsu Ltd. (Japan)

- Crocus Nano Electronics LLC (Russia)

- Avalanche Computing, Inc. (United States)

Recent Developments

- In May 2022, Everspin introduced the EMxxLX xSPI MRAM, a non-volatile memory technology tailored for industrial IoT and integrated devices. With capacities ranging from 8MB to 64MB and significantly faster read/write speeds of up to 400MB/s, it aims to provide customers with an alternative to SPI NOR/NAND flash memory.

- In January 2022, Samsung Electronics showcased the first in-memory computer system based on MRAM (Magneto-resistive Random Access Memory). The research was conducted in collaboration with the Samsung Electronics Foundry Business, Semiconductor R&D Center, and the Samsung Advanced Institute of Technology (SAIT). Samsung intends to integrate storage and system semiconductors for AI chips using this technological breakthrough, thereby strengthening its market position.

- In April 2022, one of the most notable advancements in AI over the past decade has been the rise of large language models such as OpenAI's GPT-3, Microsoft's MT-NLG, and Google's BERT.

Segments Covered in the Report

By Type

- STT

- Toggle

By Application

- Consumer Electronics

- Robotics

- Automotive

- Enterprise Storage

- Aerospace & Defense

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting