What is the Malware Analysis Market Size?

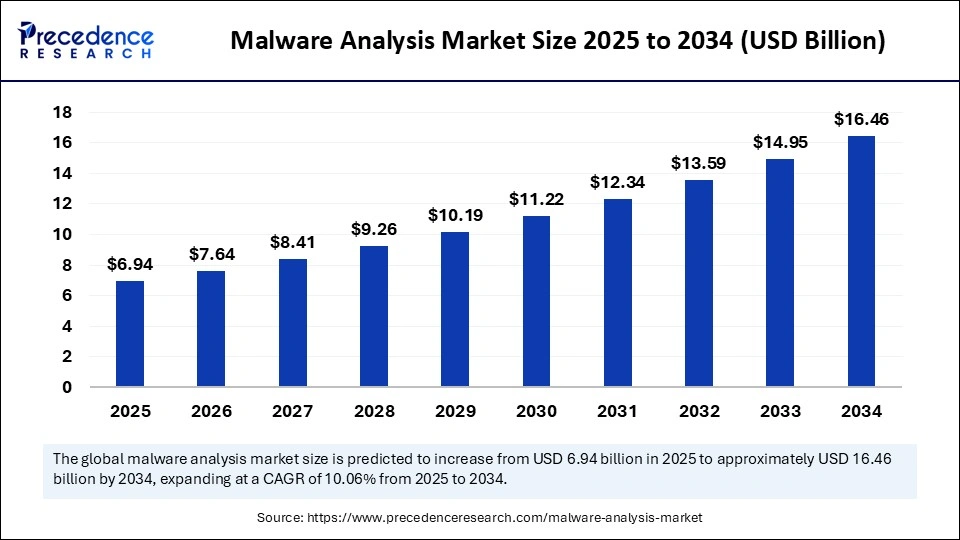

The global malware analysis market size accounted for USD 6.94 billion in 2025 and is predicted to increase from USD 7.64 billion in 2026 to approximately USD 16.46 billion by 2034, expanding at a CAGR of 10.06% from 2025 to 2034. The malware analysis market is expanding steadily as cyberattacks grow more advanced, driving stronger demand for automated threat detection, real-time analysis, and intelligence-driven security solutions.

Market Highlights

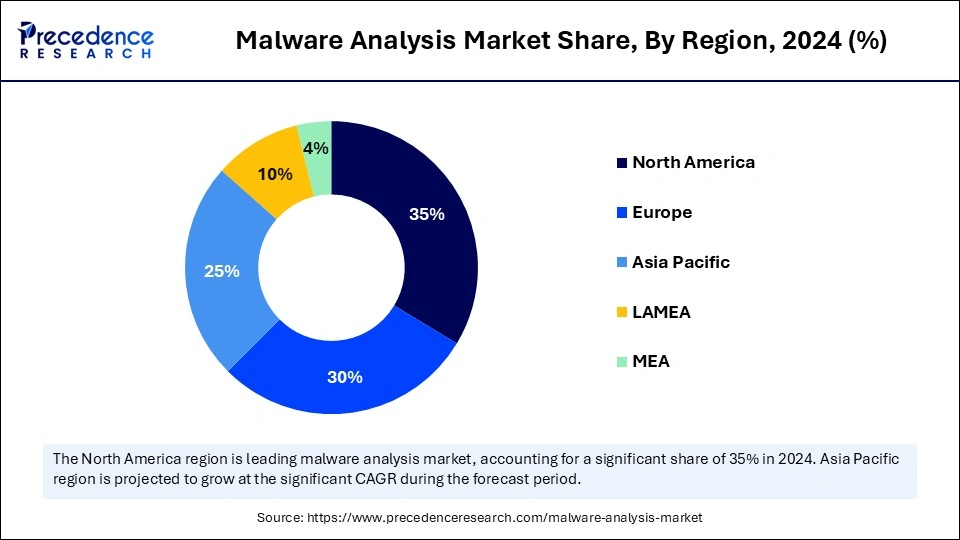

- North America led the malware analysis market with approximately 35% share in 2024.

- The Asia Pacific is estimated to expand the fastest CAGR of 25.70% between 2025 and 2034.

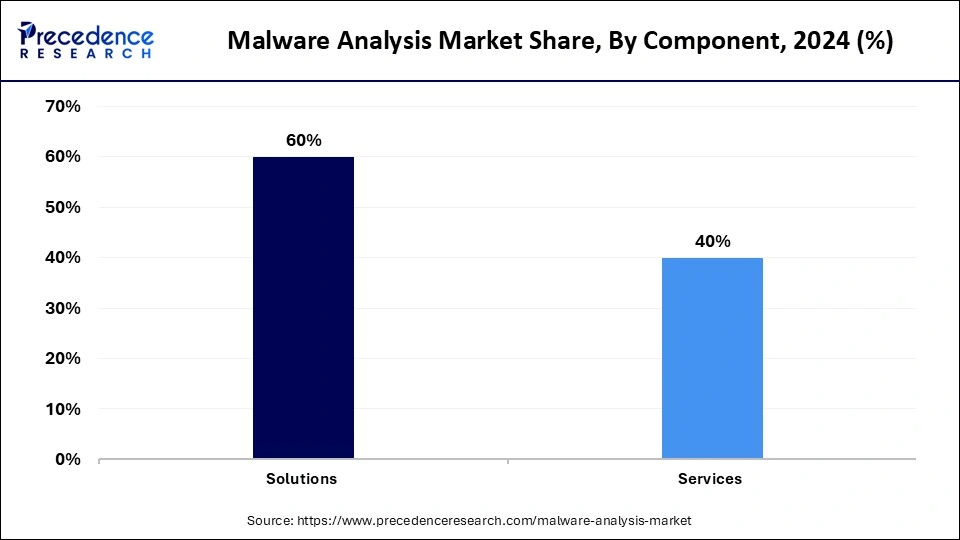

- By component, the solution segment held more than 60% of the market share in 2024.

- By component, the services segment is expanding at the highest CAGR of between 26.80% from 2025 to 2034.

- By technique/analysis type, the dynamic analysis segment held approximate 35% share in the malware analysis market during 2024.

- By technique/analysis type, the behavioral/heuristic analysis segment is expected to expand at a notable CAGR of 28.90% between 2025 and 2034.

- By deployment model, the on-premise segment captured the biggest market share of 55% in 2024.

- By deployment model, the cloud/SaaS-based segment is growing at the fastest CAGR of 27% from 2025 to 2034.

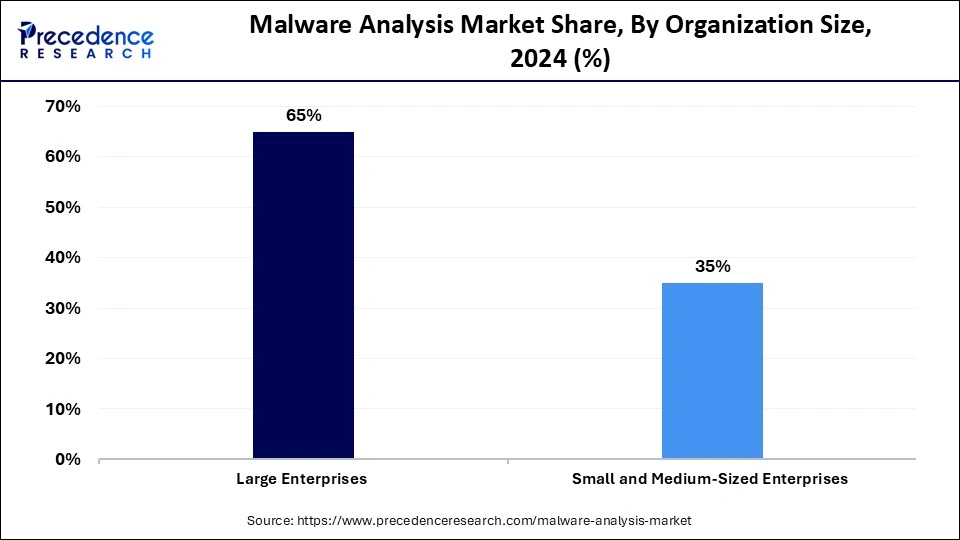

- By organization size, the large enterprises segment captured around 65% of the market share in 2024.

- By organization size, the small & medium-sized enterprises (SMEs) segment is expected to grow at the highest CAGR between 2025 and 2034.

- By end-use industry, the BFSI segment held more than 35% of market share in 2024.

- By end-use industry, the healthcare & manufacturing segment is growing at a solid CAGR of 24% from 2025 to 2034.

Malware Analysis Market: Growing Necessity for Threat Intelligence

The rise in cyberattacks on enterprises and critical infrastructure, along with the emergence of sophisticated malware variants, has heightened the need for global malware analysis solutions. The malware analysis market references technologies and services aimed at detection, dissection and establishing an understanding of malicious software to bolster cybersecurity. It includes use the tools of static, dynamic and hybrid analysis that security teams employ to reveal hidden payloads, examine attack vectors and prevent incidents of compromise.

The rapid digital transformation to cloud adoption, along with the rise in zero-day exploits, underpins the drive for growing organizations to adopt and embrace automated sandbox technologies, artificial intelligence-driven threat analytics, and behavior-based detection systems. Government-driven cybersecurity frameworks, increased vulnerabilities at endpoints, and increased embraced of security orchestration, automation and risk (SOAR) and threat intelligence platforms empower the upward expansion of the market, making the practice of malware analysis a requisite layer of modern security operations.

Rising Minds vs. Rising Malware: Is Artificial Intelligence the Winner in the Arms Race?

The rapid evolution of artificial intelligence (AI) is drastically altering the landscape of malware analysis and affecting both sides of cybersecurity, the attack and the defense. Security teams are beginning to use sophisticated machine learning pipelines, automated investigation agents, and AI-assisted reverse-engineering capabilities to analyze large volumes of telemetry data and forecast new threat indicators. In addition, AI models are increasingly capable of reverse-engineering binaries and determining high-confidence anomalous behavior at a volume previously unthinkable, per Microsofts 2025 Security Outlook and the Project Ire experiments.

While vendors put designs in place to strengthen model-hardening strategies, several security teams interfacing with a major AI platform have also confirmed that attempts to misuse a model have been successfully disrupted, reinforcing the idea that abuse detection and suppression via AI models is now an everyday occurrence. This is prompting SOCs around the world to automate triage workflows, enhance threat sharing frameworks through detailed descriptions and move to continuously monitor environments utilizing monitored, AI-driven analytics.

- In September 2025, Open Source CyberSOCEval, a new evaluation platform, showcased how AI can revolutionize malware analysis and threat intelligence, highlighting rapid threat detection, automated triage, and improved cybersecurity workflows in real-world scenarios.

Malware Analysis Market Outlook

The growth in malware analysis is enormous, mainly due to an increase in cyber-attacks, which include zero-day threats and ransomware that are driving the demand for access to deep forensic and behavioural analysis capabilities.

Cyber-threats know no boundaries. In their 2025 report, Trend Micro reported detecting over 1 billion malware incidents in Japan and hundreds of millions in the US and India. This report highlights not only the frequency of cyber threats but also the global demand for malware analysis capabilities.

The pace of development for AI and ML is increasing; many malware-analysis systems are leveraging behavioural modelling and anomaly detection, along with use cases for identifying fileless malware and evading threats.

New and stricter laws around data protection (such as GDPR) and cybersecurity regulations have encouraged many organizations to adopt malware analysis solutions and to adopt them quickly to comply with new compliance mandates and governance oversight for organizations.

The increase in cloud computing, the rising Internet of Things (IoT), and the ability for many workers to work from home increases the attack surface; each new entry point needs scalable malware analysis and threat-hunting capabilities.

Targeted cyber-attacks targeting critical sectors, such as government, finance, and healthcare, are occurring at even higher rates; one report outlined that things like essential services and government are the most targeted sectors.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 6.94 Billion |

| Market Size in 2026 | USD 7.64 Billion |

| Market Size by 2034 | USD 16.46 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 10.06% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Technique/Analysis Type, Deployment Model, Organization Size, End-Use Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Malware Analysis Market Segment Insights

Component Insights

Solutions: The solutions segment held approximately 60% share of the malware analysis market, as the steady deployment of automated malware detection engines, sandboxing tools, and centralized analysis platforms is sweeping the major sectors. As more ransomware and zero-day threats are discovered, organizations are finding that end-to-end solutions help address these threats and expedite forensic workflows in compliance and legal situations. Static analysis, while a smaller segment, will continue to be a popular choice for initial-stage inspection of binaries, providing fast threat visibility and analysis without executing the binary.

Services: This segment is the fastest growing, as enterprises turn to outsourced incident response, reverse engineering, and round-the-clock continuous threat monitoring services, especially in light of the shortage of available incident response, malware analysis and cybersecurity professionals. Behavioral and heuristic analysis tools are also growing rapidly as they adapt to detect polymorphic and AI-generated malware. Cloud/SaaS deployment models are also rising quickly, as distributed teams require a flexible, scalable malware inspection platform.

Technique/Analysis Type Insights

Dynamic Analysis: This segment comprises approximately 35% of the total malware analysis market share, largely due to its ability to monitor live behavior in a sandbox environment. Security teams, when attempting to identify various forms of obfuscation and self-modifying, encrypted malware, rely heavily on dynamic analysis because these classes of malware bypass or evade static tools. Although static analysis (another relatively small segment) is important for high-speed binary analysis, rule benefits and file triage can be accomplished without executing the file.

Behavioral / Heuristic Analysis: This segment is quickly becoming the fastest-growing, with an approximately 25%-30% CAGR, driven by the new AI-generated malware landscape and the continued evolution of polymorphic threats. Organizations rely heavily on behavior engines that monitor patterns of anomalies, system calls and lateral movements. This method is becoming more popular because it highlights malware families that have never been seen before, maximizes adaptive detection models and minimizes reliance on databases of signatures.

Sandboxing and emulation techniques continue to expand, as advanced sandboxes are increasingly simulating more realistic operating system environments to detect hidden payloads and fully delayed-execution malware. These applications aid malicious software analysts by enabling them to engage with malware files protected by security controls, while also producing incredibly detailed forensic reports. As threat actors on the other end of malicious software start designing mapping code to detect when it is in a virtualized environment designed exclusively for security controls, sandboxing products are evolving with anti-evasion methods, increased visibility into environments, and automated threat scoring.

Deployment Model Insights

On-Premise: This segment deployment leads the market at approximately 55% share of the malware analysis market in 2024, due to being preferred within lines of business where strong data sovereignty is required, the need for offline threat analysis and the need for full control of malware repositories. It is generally the preferred approach for government, defence or financial institutions that must touch classified or sensitive datasets. Hybrid deployment is also an emerging approach but typically represents a smaller segment; hybrid approaches are relevant in any use case where a combination of and internal control and externally scalable analysis capability is needed.

Cloud / SaaS-Based: The cloud/SaaS-based model is the fastest-growing in the malware analysis market, with an approximately 27%, as enterprise customers seek scalable subscription-based malware inspection environments that enable remote teams to submit high-volume threats. The cloud enables faster signature updates, automated behavioural analysis, and integrated threat intelligence feeds. The flexibility of the cloud allows organizations to modernize their security operations without a large investment in on-premise infrastructure.

Hybrid: The segment continues to gain traction as organizations combine local infrastructure for sensitive workloads and cloud-based engines for advanced dynamic analysis. Hybrid deployments best serve organizations that support a complex environment where regulated and operational needs are unique across business units. Hybrid deployments also add resilience; if a threat analysis deployment has reduced resources in the local environment, cloud-based engines could continue malware analysis, or vice versa, given that maintenance/a large dataset is being analyzed during an incident.

Organization Size Insights

Large Firms: This segment holds around 65% of the malware analysis market due to their expansive IT capabilities, high-value digitized assets, and efficient security operations centers. They leverage complex malware analysis platforms to defend against targeted threats, advanced persistent threats (APTs), and ransomware campaigns.

Small- and mid-sized (SME) Firms: This segment is set to be the fastest-growing in the malware analysis market, and is adopting lightweight, automated products more than other segments. However, they continue to lag behind larger firms due to limited budgets and a smaller talent pool. The fastest-growing segment of the overall market share is SMEs, driven by the rising frequency of cyberattacks on small and mid-sized firms, the expansion of digital operations, and access to affordable cloud-based malware analysis products. As supply-chain attacks continue to rise, SMEs are now compelled to invest in automated behavioral analysis, managed detection services, and endpoint-level malware triage to help improve their security posture without the ability to hire and retain a large security team.

End-Use Industry Insights

BFSI: The segment held the largest share of approximately 28% in the malware analysis market due to the heightened risk of financial fraud, credential theft, malware, and ransomware targeting. To protect transaction systems, ATMs, and mobile banking channels, banks and insurance companies utilize advanced dynamic and behavioural analysis tools. The energy, utilities, and manufacturing industries, as adjacent markets, are ramping up investment in malware analysis to protect ICS networks from compromise.

Healthcare: The healthcare sector is the fastest-growing industry in the malware analysis market, with an approximately 24% CAGR, driven by the rising number of ransomware attacks on hospitals, medical devices, and digital health platforms. With the increase in electronic health records and the widespread adoption of IoT-enabled diagnostics, healthcare systems are focused on triaging malware quickly, automating incident response, and leveraging secure cloud-based analysis to prevent data breaches, downtime, and outages.

Energy, Utilities & Manufacturing: The energy, utilities, and manufacturing industries are increasingly adopting malware analysis, as industrial control systems are being targeted with malware designed to disrupt production processes. These organizations use sandboxing, real-time behavioural analysis tools, and on-premises analysis engines to counter disruptions and secure OT-IT convergence and compliance with industry cybersecurity regulations.

Malware Analysis Market Regional Insights

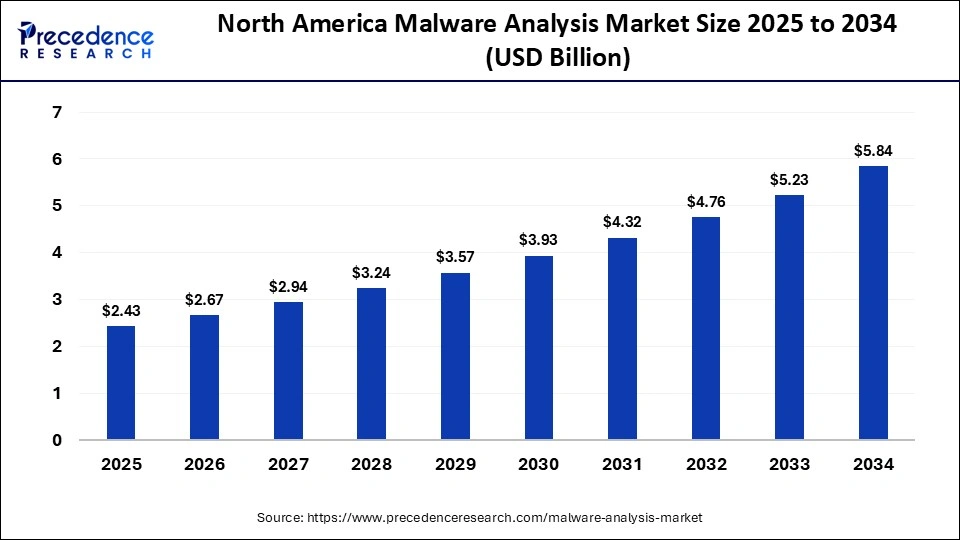

The North America malware analysis market size is estimated at USD 2.43 billion in 2025 and is projected to reach approximately USD 5.84 billion by 2034, with a 10.21% CAGR from 2025 to 2034.

Why is North America Dominating the Malware Analysis Market?

North America is dominating the malware analysis market with an approximately 35% share, as the region is considered the most progressive and strategically aligned region for malware analysis, specifically because of nearly complete cooperation among governmental cybersecurity programs, national labs, and private-sector vendors for threat intelligence. This region leverages immense telemetry pipelines, preemptive and coordinated threat exchange, and rapidly expanding methods for deploying automated analysis systems across critical infrastructure that other geographical areas do not. This operational ecosystem enables rapid sample triage, greater attribution accuracy, and shorter change cycles, all of which are still being developed in other regions.

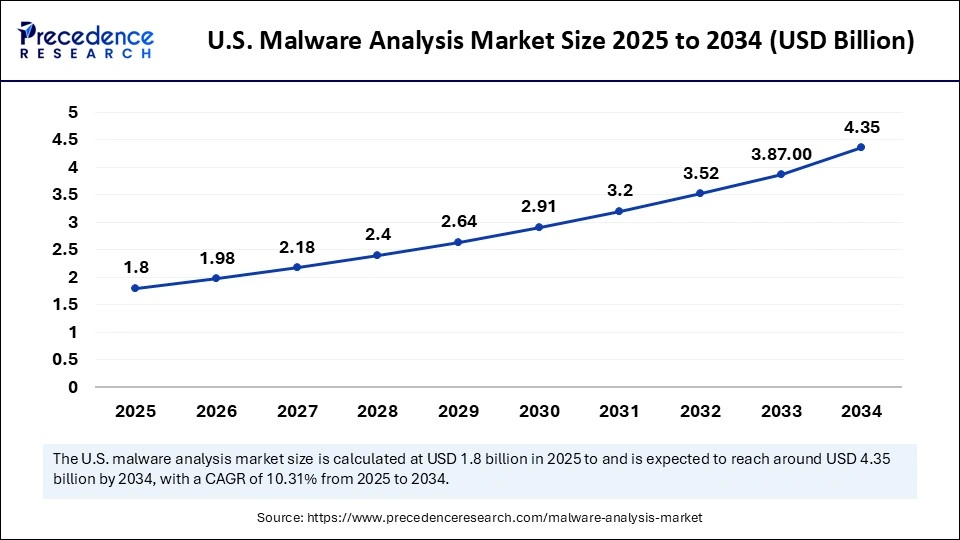

The U.S. malware analysis market size is calculated at USD 1.80 billion in 2025 and is expected to reach nearly USD 4.35 billion in 2034, accelerating at a strong CAGR of 10.31% between 2025 and 2034.

U.S. Malware Analysis Market Trends

The United States is the backbone of North Americas lead, primarily due to the level of federally funded innovation and the existence of high-capacity malware analysis platforms. CISAs Malware Next-Gen Analysis system provides automated capabilities for malware analysis exclusively to U.S. federal, state, local, tribal, and territorial government, which ensures that the sensitive nature of malware analysis is contained to trusted national organizations.

Then in July 2025, Thorium will be launched with Sandia National Laboratories, in an attempt to further greater national capacity along with a scalable container-orchestrated system capable of analyzing millions of files per hour while leveraging commercial, open-source, and custom tools.

The U.S. continues to foster research programs and investments into large-scale malware repositories while simultaneously building and improving a coordinated cyber-defense infrastructure, making it the most effective country in North America regarding innovation of malware analysis.

Asia Pacific is set to be the fastest-growing region for malware analysis, with an approximately 25.70% CAGR, driven by rapid digitalization, the expansion of cloud ecosystems, and a surge in targeted attacks on finance, telecom, e-commerce, and public sector networks. Governments across the region are strengthening cybersecurity policies, while organizations are layering automated, AI-enabled malware-analysis products to combat increasingly evasive attacks. The accelerated growth of small- and mid-sized businesses, alongside the rise in mobile and IoT endpoints, increases the regions exposure to malware and accelerates organizations use of real-time detection platforms, sandboxing, and threat-intelligence-driven analytics.

India Malware Analysis Market Trends

India has emerged as one of the largest growth engines for malware analysis in the region, driven by an exceptional rise in threat volume and the rapid expansion of the countrys digital economy. The India Cyber Threat Report 2025 from Seqrite and DSCI stated that there were 369 million malware threats across 8.44 million installations in India, representing a sheer volume of threat exposure that prompted enterprises to adopt deeper malware forensics and behavioral-analysis solutions. The combination of significant threat exposure and organizations response through professionalization positions India as a major growth engine in Asia Pacific.

In October 2025, Sri Sri University launched its first-of-its-kind MTech in Cybersecurity and Incident Management in partnership with SecurEyes to strengthen Indias capacity to defend against rising cyber threats. This move signaled a rising national emphasis on advanced incident response, malware reverse engineering, and threat-hunting skills.

The threat environment in Europe has evolved from opportunistic malware abuse to coordinated campaigns with high impact, targeting IT and operational technology, and creating a steady demand for deeper dynamic analysis, threat intelligence integration, and automated triage. ENISAs recent economic analysis, threat trends analysis, indicates a significant uptick in disruptive ransomware in the second half of 2024 and in supply-chain incidents, with significant impact across both financial services and manufacturing sectors; defenders are adapting by deploying a combination of sandboxing, behavior-based detonation, and telemetry to prevent incidents and reduce investigation time and costs. There are also cross-border enforcement and information-sharing exercises that have changed the economics of the attack, forcing adversaries to fragment their operations and driving up false positives for SOCs.

Germany Malware Analysis Market Trends

Germany illustrates the twin pressure points for Europe: a large industrial footprint that is attractive as a target for ICS/OT attackers, and systemic exposure in finance and healthcare. The reporting of economic impact, as well as the growing expansion of ransomware into German enterprises, has led to accelerated private sector investment into endpoint detonation, incident response retainer models, and OT-aware malware analysis pipelines; however, public-private coordination and skills gaps will continue to be the binding constraint on procurement cycles and vendor selection.

The Middle East & Africa region shows different but converging forces of change: Gulf States are quickly modernizing critical infrastructure, IT and sovereign cloud stacks, while several African countries are digitizing payments and public services, both of which put you closer to the concentration of ransomware and advanced threat actor attacks. Law enforcement coordination, capacity building, and regional CERT activities are increasing visibility into threats, accelerating enterprises adoption of automated malware analysis to reduce dwell time and remediation costs. Economic headwinds and geopolitical risk create pressure on investments, which are concentrated first in energy, telecom and finance, with cross-border incidents sharing a catalyst for purchasing power.

Saudi Arabia Malware Analysis Market Trends

Saudi Arabias national cyber authority has launched toolkits and tightened governance, while Vision-2030 digitalization, along with multiple incidents of incidents targeting OT, are driving large-scale deployments of malware analysis platforms in public and private sectors. The Kingdom is prioritizing operationalizing sandbox results into SOC automation, establishing national playbooks, and funding talent programs, all of which reduce procurement timeframes for more advanced detection and reverse engineering capabilities. These actions from coordinated policy, budget approvals, and industry action,s help explain why Saudi enterprises (energy, government, financial services) are leading the demand for advanced malware analysis services

Malware Analysis Market Companies

- Symantec

- Check Point Software Technologies Ltd.

- Cisco Systems Inc.

- CrowdStrike Holdings, Inc.

- ESET, spol. s r.o.

- Fortinet, Inc.

- Kaspersky Lab

- McAfee, LLC.

- Palo Alto Networks, Inc.

- Sophos Group plc (part of Thoma Bravo)

- Trend Micro Incorporated

Recent Developments

- In September 2025, Filigran and GLIMPS announced a strategic partnership to industrialise malware analysis by integrating GLIMPS AI-driven file analysis into Filigrans OpenCTI, reducing investigation times by 83%.(Source:https://filigran.io)

- In August 2025, Microsoft unveiled Project Ire, an AI system that autonomously decompiles, analyses, and blocks malware in real time, detecting 90% of threats in early trials; its slated for integration into Defender as Binary Analyser.(Source: https://www.digit.in)

- In July 2025, Booz Allen Hamilton launched Vellox Reverser, a cloud-native, AI-powered reverse-engineering platform that disassembles complex malware via peer-to-peer agents, delivering defensive recommendations in minutes, not days.(Source: https://www.helpnetsecurity.com)

Malware Analysis MarketSegments Covered in the Report

By Component

- Solutions (software, platforms)

- Services (managed analysis, consulting, incident response)

By Technique/Analysis Type

- Static Analysis

- Dynamic Analysis

- Behavioral / Heuristic Analysis

- Sandboxing & Emulation

By Deployment Model

- On-Premise

- Cloud / SaaS-Based

- Hybrid (on-prem + cloud)

By Organization Size

- Large Enterprises

- Small & Medium-Sized Enterprises (SMEs)

By End-Use Industry

- BFSI (Banking, Financial Services & Insurance)

- IT & Telecom

- Government & Defence

- Healthcare

- Retail & E-commerce

- Energy, Utilities & Manufacturing

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting