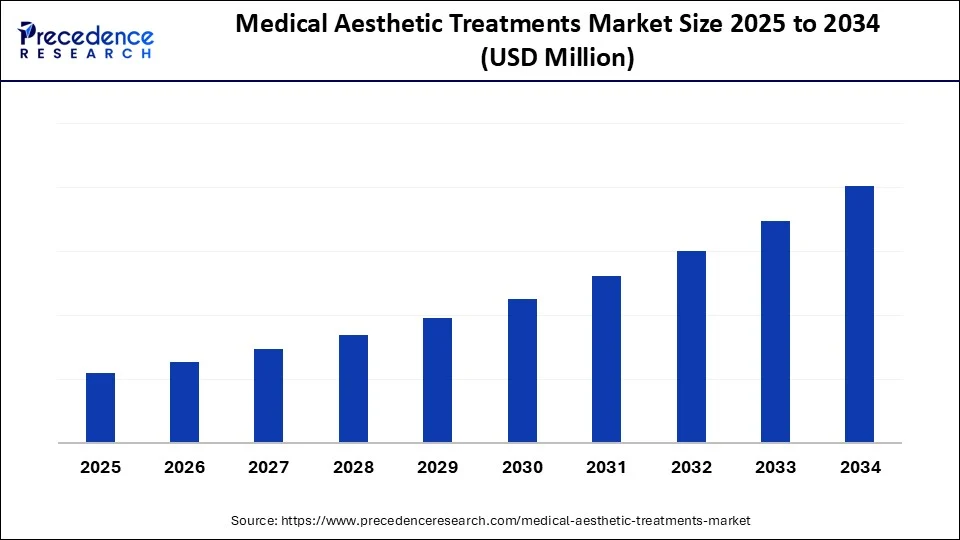

Medical Aesthetic Treatments Market Size and Forecast 2025 to 2034

The global medical aesthetic treatments market is witnessing rapid growth due to increasing demand for non-invasive cosmetic procedures and technological innovation. The market is experiencing significant growth due to the rising demand for minimally invasive cosmetic procedures and an increased focus on physical appearance. Technological advancements in lasers, injectables, and skin rejuvenation devices are further driving this market expansion. Additionally, the growing acceptance of aesthetic treatments among both the younger and aging populations is expected to boost market growth in the coming years.

Medical Aesthetic Treatments MarketKey Takeaways

- North America dominated the global medical aesthetic treatments market with the largest share of 38% in 2024.

- Asia Pacific is expected to grow at a significant CAGR from 2025 to 2034.

- By treatment type, the injectable aesthetic treatment segment led the market in 2024.

- By treatment type, the injectable treatments segment is also experiencing the fastest growth, especially in biostimulators as a subsegment.

- By gender, the women's segment captured the biggest market share of 72% in 2024.

- By gender, the male segment is expected to grow at a significant CAGR over the projected period.

- By age group, the 26-35 years segment contributed the largest market share of 38% in 2024.

- By age group, the 18-25 years segment is anticipated to grow at a significant CAGR from 2025 to 2034.

- By provider type, the dermatology clinics segment held the biggest market share of 34% in 2024.

- By provider type, the medspas/aesthetic clinics segment is expanding at a significant CAGR from 2025 to 2034.

- By end-use purpose, the anti-aging and rejuvenation segment generated the major market share of 46% in 2024.

- By end-use purpose, the body enhancement/fat reduction segment is experiencing rapid growth during the forecast period.

How Can AI Impact the Medical Aesthetic Treatments Market?

Artificial intelligence is changing the medical aesthetic treatments market by enabling more personalized, precise, and safer procedures. AI-powered tools are being used to conduct facial analysis and 3D modelling, allowing healthcare providers to customize treatment plans, fine-tune any tweaks, taking into account individual facial structure, skin type, and medical and genetic history. Patients can now visualize potential results for procedures such as rhinoplasty or facelifts before committing to procedures, improving decision-making and satisfaction.

Tools such as SkinVision are also assisting dermatologists in detecting skin issues early, allowing for more effective treatment and better patient outcomes. Artificial-intelligence systems can optimize laser settings, guide surgical procedures, and ensure consistent results in non-invasive treatments. They can also simulate potential outcomes, helping patients visualize results and make informed decisions, thereby reducing risks and complications.

Market Overview

The medical aesthetic treatments market includes minimally invasive and non-invasive procedures that enhance or alter a person's physical appearance through clinical interventions. These procedures are usually performed by trained medical professionals such as dermatologists, plastic surgeons, or aesthetic physicians, and are designed to improve cosmetic appearance without major surgery. Treatments include botulinum toxin injections, dermal fillers, laser hair removal, chemical peels, body contouring, skin tightening, and more. These services combine technology and medical science to achieve anti-aging, rejuvenation, and enhancement results. The market grows due to rising demand for youthful looks, increasing aesthetic awareness among millennials, higher disposable incomes, and advances in aesthetic technology.

What Are the Key Trends in the Medical Aesthetic Treatments Market?

- Increasing Awareness and Acceptance: Social media, influencer marketing, and a greater openness to discussing and undergoing aesthetic procedures have created a more accepting environment for cosmetic enhancements. This shift is fostering an increase in demand as individuals seek to enhance their self-confidence and overall well-being.

- Technological Advancements: Ongoing innovation in medical aesthetic devices and techniques, including improvements in laser and energy-based treatments, has made these procedures safer, more effective, and more accessible to a wider audience.

- Evolving Beauty Standards: Cultural norms are shifting, leading to broader acceptance of personal aesthetic enhancements, which is contributing to market growth. Developing countries, with their lower treatment costs and high standards of care, are also attracting medical tourists seeking aesthetic procedures.

- Focus on Self-Confidence and Well-Being: Medical aesthetics are increasingly perceived to enhance self-esteem and overall well-being, driving demand for these treatments. Medical aesthetic treatments go a long way in improving patient mental health by helping increase their self-esteem, reducing stress, anxiety, and leading to positive self-perception.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Treatment Type, Gender, Age Group, Provider Type, End Use Purpose, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing Demand for Minimally Invasive and Non-Invasive Cosmetic Procedures

The main driver in the medical aesthetic treatments market is the growing demand for minimally invasive and non-invasive cosmetic procedures. This trend is boosted by technological progress, increased consumer awareness, and a desire for natural-looking results with less downtime. More people now choose treatments like Botox, dermal fillers, laser therapies, and chemical peels because they have quicker recovery times and lower risks than traditional surgery. Greater awareness about aesthetic treatments, along with social media influence and celebrity endorsements, has further fueled the demand for procedures that improve appearance, leading to growth and more treatment options.

Restraint

High Cost of Cosmetic Procedures

The main obstacle in the medical aesthetic treatments market is the high cost of procedures. This includes both surgical and non-surgical options, and the limited insurance coverage for cosmetic treatments makes them less affordable for many potential patients. Many procedures, like facelifts, breast enlargements, and non-surgical treatments such as Botox and laser skin resurfacing, can be expensive. Some non-surgical treatments, like Botox, need repeated sessions to maintain results, which adds to the long-term costs. The high prices of medical aesthetic devices, like those used for laser treatments or body contouring, also push up the overall cost of treatments.

Opportunity

Shift Towards Personalized and Customized Treatments

A key opportunity in the medical aesthetics market is offering personalized and customized treatments. Consumers increasingly seek tailored solutions that meet their specific aesthetic goals, moving away from one-size-fits-all approaches. This trend is driven by technological advances like AI and 3D imaging, which allow for more precise assessments and treatment planning. Practitioners are using combinations of different treatments to deliver the best results for each patient. Personalized approaches tend to produce more natural-looking results, which is a major factor behind this trend. The demand for minimally invasive and non-invasive procedures continues to grow because they are safer, faster, and involve less downtime. Awareness of the benefits of early intervention also encourages the use of medical aesthetic treatments for preventive care. The continuous development of new technologies and products is further fueling expansion in the medical aesthetics market.

Treatment Type Insights

What Made the Dental Aesthetic Treatment Segment Lead the Medical Aesthetic Treatments Market in 2024?

The dental aesthetic procedures segment led the market in 2024 due to high consumer priority on enhancing facial harmony and smile enhancement. The advent of new dental aesthetic tools, such as invisible aligners, is being pursued as a result of increasing disposable income, a cultural shift in global beauty standards, and high social media influence. Teeth whitening is a very popular kind of minimally invasive treatment, with the widespread availability of DIY whitening strips which consumers can use within the comfort of their homes. For individuals willing to pay more, in-clinic whitening treatments have become more accessible due to advances in LED and laser technology. Braces have been widely used, especially in parts of North America, and are becoming increasingly popular in the Asia Pacific region. Additionally, the technology behind aligners, often supported by AI-powered treatment planning, enables faster, more precise results, further driving demand.

The injectable treatments segment is also experiencing the fastest growth, especially with regard to biostimulators. This growth is driven by increasing demand for minimally invasive procedures, rising awareness and acceptance, and the long-lasting results biostimulators provide. Treatments such as Botox and dermal fillers offer a safer and less time-consuming alternative to surgical options, which appeals to a wide range of consumers. As these treatments deliver noticeable improvements relatively quickly, with minimal recovery time, they are convenient for individuals with busy lifestyles. These treatments work by stimulating collagen production, leading to gradual, natural improvements in skin quality and texture, factors that contribute to their rising popularity. Social media has played a significant role in educating younger audiences about aesthetic treatments like biostimulators, making their results appear more natural and appealing to a broader range of patients. Additionally, these allow for precise targeting of specific facial areas and concerns, effectively addressing issues such as wrinkles, volume loss, and skin laxity through customized treatment plans. This precision enhances both treatment outcomes and safety.

Gender Insights

What Made the Women's Segment Lead the Medical Aesthetic Treatments Market in 2024?

The women's segment dominated the market in 2024. This is mainly due to higher demand for cosmetic procedures, cultural emphasis on feminine appearance, proactive health trends, targeted product development, and greater economic independence. Women are generally more proactive about seeking preventative treatments and maintaining a youthful look. The industry has long focused on developing products and services tailored specifically to women's needs and preferences. Many popular treatments, including Botox and dermal fillers, are primarily sought after by women to combat signs like wrinkles and facial volume loss.

The male segment (particularly between the ages of 26 and 35) is witnessing the fastest growth. This rise is largely due to changing societal norms, increased influence from social media and celebrities, and a desire for improved self-esteem and confidence. Social media platforms and celebrity endorsements have made cosmetic procedures more visible and normalized. Men are increasingly investing in their appearance to boost self-esteem and confidence, both for personal and professional reasons. Men in this age group are especially open to treatments like jawline definition, chin augmentation, and hair restoration, reflecting a broader shift toward male aesthetic care.

Age Group Insights

How Did the 26-35 Years Segment Dominate the Medical Aesthetic Treatments Market in 2024?

The 26-35 years age group dominated the market in 2024, mainly due to increasing disposable incomes, a strong focus on physical appearance, and the rising popularity of minimally invasive procedures. This demographic actively seeks aesthetic improvements to look younger, advance their careers, and keep up to date with social media trends. They often experience higher earning potential, enabling investment in cosmetic procedures. Additionally, this age group prefers less invasive options with quicker recovery times, like laser treatments and injectables, which deliver effective results with minimal downtime.

The 18-25 years segment is expected to grow the fastest, driven by influencer marketing, greater awareness of preventative treatments, normalization of aesthetic procedures, and social media endorsements. Younger people tend to choose preventive treatments such as Botox or fillers to delay aging signs instead of waiting for them to become more noticeable. This group is increasingly interested in preventative measures to preserve a youthful look and enhance natural features, motivated by a desire to stay ahead of aging and mirror social media trends.

Provider Type Insights

How Will the Dermatology Clinics Segment Lead the Medical Aesthetic Treatments Market in 2024?

The dermatology clinics segment led the market in 2024, primarily because of their skin health expertise, focus on minimally invasive treatments, and the rising popularity of aesthetic dermatology. These clinics specialize in skin conditions and are trusted sources for aesthetic solutions addressing aging, pigmentation, and acne. The popularity of non-surgical and minimally invasive procedures like Botox, fillers, and laser treatments has increased demand, as they provide effective results with less downtime and risk. Many are also adopting advanced technologies such as AI-powered skin analysis, energy-based devices, and robotic procedures to improve outcomes and patient experience.

The medspas/aesthetic clinics segment is experiencing the fastest growth, primarily due to rising consumer interest in non-invasive procedures, a preference for treatments supervised by medical professionals, and the relaxing atmosphere these facilities offer. Many individuals prefer aesthetic treatments performed by licensed medical staff in a clinical setting, even if non-surgical, leading to a preference for med spas over traditional medical offices. Med spas provide a more comfortable, less clinical environment while also offering access to advanced medical treatments and wellness services like skincare, body contouring, and nutritional counseling, catering to diverse needs.

End Use Purpose Insights

Why Did the Anti-Aging and Rejuvenation Segment Lead the Medical Aesthetic Treatments Market in 2024?

The anti-aging and rejuvenation segment held the top spot in 2024, driven by an aging global population, increasing desire for youthful looks, and technological advancements in minimally and non-invasive treatments. Rising disposable incomes, especially in developed countries, make elective aesthetic procedures more accessible. There is a growing preference for treatments that produce natural-looking results, such as Botox and fillers. Society also places a high value on youthful appearances, prompting more individuals to seek anti-aging treatments to address visible signs of aging.

The body enhancement/fat reduction segment in medical aesthetics is growing rapidly, fueled by increasing demand for non-invasive procedures, technological innovations, and heightened awareness. The popularity of non-surgical fat reduction options like cryolipolysis is rising as consumers seek safer, less painful, and more convenient alternatives to traditional liposuction. Advances in cryolipolysis, ultrasound, and laser lipolysis have resulted in more effective, safer, and patient-friendly treatments with minimal downtime. The global rise in obesity and increased awareness about appearance and weight management have further boosted demand for both surgical and non-surgical fat reduction procedures.

Regional Insights

How Did North America Lead the Medical Aesthetic Treatments Market in 2024?

North America led the medical aesthetic treatments market in 2024, supported by high consumer spending, a strong presence of key companies like AbbVie (Allergan), Bausch Health, Johnson & Johnson, Galderma, and Cynosure, favorable reimbursement scenarios, and technological progress. The region benefits from a well-developed healthcare infrastructure and a high volume of aesthetic procedures. Reimbursement policies for certain treatments considered medically necessary can help offset costs and encourage adoption. Continuous innovation in non-invasive treatments like CoolSculpting, Ultherapy, and other minimally invasive options drives market growth. Growing awareness and acceptance, often fueled by social media and celebrity influence, also increase demand.

In May 2023, Allergan Aesthetics announced the U.S. FDA approval of SKINVIVE™ by JUVÉDERM, the first intradermal microdroplet injection using hyaluronic acid (HA) to improve skin smoothness in the cheeks for adults over 21. This injectable gel, containing lidocaine for comfort, enhances skin quality by smoothing and hydrating the cheeks and is suitable for all Fitzpatrick Skin Types I-VI. It is minimally invasive with little to no downtime. (Source: https://news.abbvie.com)

The U.S. Medical Aesthetic Treatments Market Trends

The U.S. continues to play a dominant role in the global medical aesthetics market, supported by its advanced healthcare infrastructure, high per capita expenditure on cosmetic treatments, and ongoing innovation in therapy technologies. The U.S. market is experiencing steady growth because of rising consumer awareness and demand for minimally invasive procedures like Botox and dermal fillers, along with an aging population seeking anti-aging treatments, and the influence of social media and changing beauty standards. The U.S. also leads in developing and adopting innovative technologies, such as laser treatments, injectables, and skin rejuvenation methods.

What Made Asia Pacific the Fastest-Growing Region in the Medical Aesthetic Treatments Market in 2024?

Asia Pacific is projected to see the fastest growth in the medical aesthetics market. This is mainly due to rising disposable incomes, a growing middle class, evolving beauty standards, and increasing medical tourism. The region has become a hub for medical tourism, with countries like South Korea and Thailand offering cost-effective yet advanced aesthetic treatments that attract patients worldwide. Cultural acceptance of cosmetic enhancements, ongoing research and development, and local manufacturing also boost this growth, particularly in countries such as China, South Korea, and India. Innovations in minimally invasive and non-invasive aesthetic procedures, along with advances in devices and techniques, are making treatments more accessible, safer, and appealing to broader audiences.

India Medical Aesthetic Treatments Market Trends

India plays a key role in the global market, experiencing rapid growth driven by a rising middle class with higher disposable incomes, greater awareness of aesthetic treatments fueled by social media and celebrity influence, and significant technological advancements offering safer, more effective, and less invasive procedures. The expanding network of clinics and increasing medical tourism, where patients seek affordable yet high-quality treatments, further establishes India as a major player and emerging hub in this sector.

Why Did Europe Consider a Notable Region in the Medical Aesthetic Treatments Market in 2024?

Europe is expected to grow at a notable rate in the coming years. This growth is mainly driven by an aging population, increased awareness of aesthetic procedures, and advances in minimally invasive treatments. Additionally, rising disposable incomes and strong healthcare systems in many countries like Germany, Russia, and Turkey support this expansion. Social media, celebrity endorsements, and growing acceptance of aesthetic procedures as part of healthy living have increased demand. Innovations in medical devices and injectable products have improved treatment efficacy and safety, fueling further adoption.

How Will Latin America Surge in the Medical Aesthetic Treatments Market in 2024?

Latin America is experiencing significant growth in the global market, mainly due to rising demand for minimally invasive procedures, technological progress, and the popularity of medical tourism. Countries like Brazil and Mexico benefit from a large pool of plastic surgeons and improved healthcare infrastructure. Patients prefer treatments with shorter recovery times and less downtime, such as energy-based devices and injectable fillers. Growing awareness of aesthetic options and rising disposable incomes in the region fuel the demand for cosmetic enhancements, supporting market growth.

How Will the Middle East and Africa Emerge in the Medical Aesthetic Treatments Market in 2024?

The Middle East and Africa are also seeing considerable growth, driven by increasing awareness of aesthetic procedures, higher disposable incomes, and cultural emphasis on beauty and youthfulness. Many cultures in the region highly value appearance and maintaining a youthful look, which boosts demand for cosmetic treatments. Countries like Saudi Arabia and the UAE have higher disposable incomes, enabling more people to invest in aesthetic procedures. Governments are contributing too, by investing in healthcare infrastructure, promoting medical research, and streamlining regulations to support the growth of the medical aesthetics market.

Medical Aesthetic Treatments Market Companies

- Allergan Aesthetics (AbbVie Inc.)

- Revance Therapeutics

- Ipsen

- Medytox Inc.

- Evolus Inc.

- Hugel Inc.

- Galderma

- Merz Pharma

- Lumenis

- Syneron Candela

- Cutera Inc.

- Alma Lasers (Sisram Medical)

- Cynosure (a division of Lutronic)

- BTL Aesthetics

- Fotona

- Sciton Inc.

- Venus Concept

- InMode Ltd.

- Ulthera Inc.

- Sinclair Pharma

Industry Leader Announcements

- In April 2025, Healthcare Holding Schweiz AG acquired Aestheticbedarf AG to strengthen its Medical Beauty platform, which also includes CDP Swiss AG and CDP Austria GmbH. Chairman Fabian Kröher expressed enthusiasm about the partnership, noting that Aestheticbedarf's focus on affordable quality will expand their reach in Switzerland. Managing Director Pascal Hauser added that the collaboration will improve their customer offerings. (Source: https://winterberg.group)

Recent Developments

- In May 2024, GC Aesthetics launched the LUNA xt™ Anatomical Breast Implant, a groundbreaking product designed to meet the needs of surgeons and patients in breast reconstruction. CEO Carlos Reis Pinto highlighted its safety and innovation, noting it is the first MDR-approved breast implant. This complements their unique FixNip™ implant for nipple-areola reconstruction, reinforcing GC Aesthetics' commitment to women's healthcare. (Source: https://www.consultingroom.com)

- In March 2024, Perfect Corp. announced an upgrade to its Skincare Pro app by integrating a cloud-based CRM system. This enhancement improves medspas and clinics' customer consultations with features like profile management, treatment tracking, and HIPAA compliance. The update makes skincare consultations more personalized and efficient, transforming them into comprehensive client experiences. (Source: https://www.businesswire.com)

Segments Covered in the Report

By Treatment Type

- Injectable Aesthetic Treatments

- Botulinum Toxin (Botox, Dysport, Xeomin)

- Dermal Fillers (Hyaluronic Acid, Calcium Hydroxylapatite, Poly-L-lactic Acid)

- Biostimulators

- Fat Dissolving Injections

- Others (Platelet Rich Plasma, Mesotherapy)

- Energy-Based Aesthetic Treatments

- Laser Hair Removal

- Skin Resurfacing (Laser, RF, IPL)

- Skin Tightening (Radiofrequency, Ultrasound)

- Tattoo Removal

- Others (LED, Cryolipolysis, Electroporation)

- Body Contouring & Cellulite Reduction

- Cryolipolysis

- Ultrasound Cavitation

- Radiofrequency Lipolysis

- Electromagnetic Muscle Stimulation (EMS)

- Others (Carboxytherapy, Laser Lipolysis)

- Facial Aesthetic Treatments

- Chemical Peels

- Microneedling

- Microdermabrasion

- LED Facial Rejuvenation

- Others (OxyFacial, Vampire Facial, Dermaplaning)

- Hair Restoration Treatments

- PRP for Hair

- Laser Hair Growth Therapy

- Hair Transplant (FUE, FUT)

- Others

- Dental Aesthetic Procedures

- Teeth Whitening

- Dental Veneers

- Aligners & Braces

- Others (Bonding, Gingivoplasty)

- Others

- Scar Reduction (Keloid, Acne)

- Hyperpigmentation Treatments

- Stretch Mark Removal

- Nail Aesthetic Therapies

By Gender

- Female

- Male

- Others / Non-binary

By Age Group

- 18–25 Years

- 26–35 Years

- 36–50 Years

- 51+ Years

By Provider Type

- Dermatology Clinics

- MedSpas / Aesthetic Clinics

- Hospitals & Specialty Clinics

- Cosmetic Surgery Centers

- Dental Clinics

- Others (Home-use Aesthetic Devices by Professionals)

By End Use Purpose

- Anti-aging & Rejuvenation

- Skin Correction (Acne, Scars, Pigmentation)

- Body Enhancement / Fat Reduction

- Hair & Scalp Restoration

- Cosmetic Dentistry

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting