What is MEP Service Market Size?

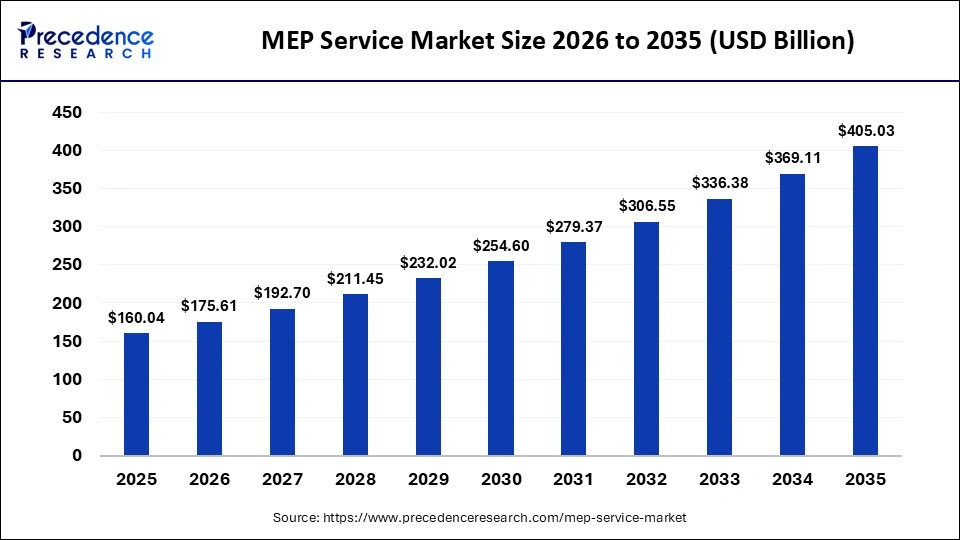

The global MEP service market size is calculated at USD 160.04 billion in 2025 and is predicted to increase from USD 175.61 billion in 2026 to approximately USD 405.03 billion by 2035, expanding at a CAGR of 9.73% from 2026 to 2035. The MEP service market is driven by rising construction activity, increasing demand for advanced building automation, and the growing need for energy-efficient infrastructure.

Market Highlights

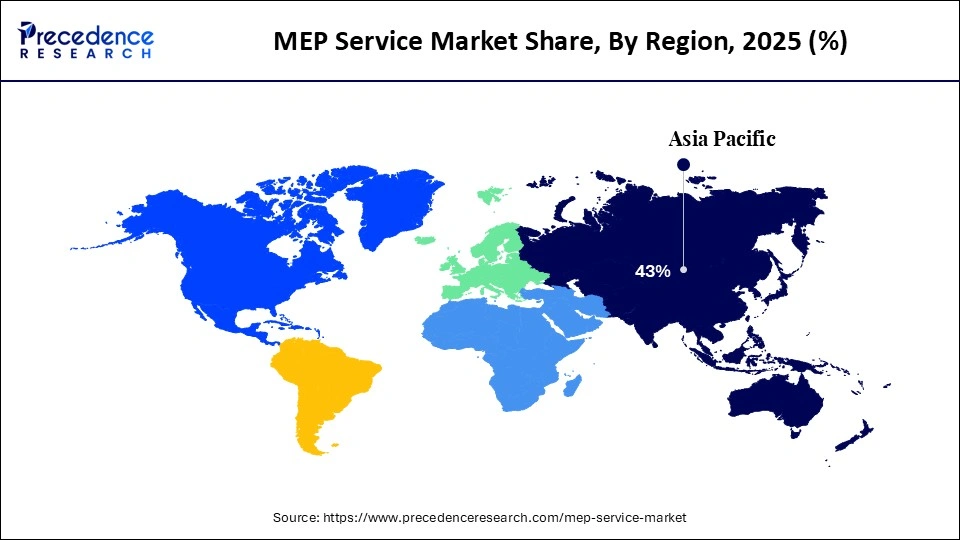

- Asia Pacific accounted for the largest share of 43% in 2025.

- The Middle East and Africa is expected to grow at a strong CAGR from 2026 to 2035.

- By service type, the installation & construction segment held a significant market share in 2025.

- By service type, the retrofit & upgradation segment is growing at a healthy CAGR from 2026 to 2035

- By system type, the electrical systems segment contributed the biggest market share in 2025.

- By system type, the building automation & control systems segment is expanding at a solid CAGR from 2026 to 2035.

- By end-use sector, the commercial buildings segment accounted for the biggest market share in 2025.

- By end-use sector, the industrial facilities segment is poised to grow at a steady CAGR from 2026 to 2035.

- By contract type, the lump sum contracts segment held the major market share in 2025.

- By contract type, the EPC contracts segment is growing at a notable CAGR from 2026 to 2035.

Engineering the Future of Built Environments: How MEP Services Power Modern Infrastructure

The MEP service market deals with the engineering, design, installation, commissioning, operation, maintenance, and upgrading of the mechanical, electrical, and plumbing systems, which constitute the foundation of the operational buildings and infrastructure. The services ensure the best functionality of HVAC networks, power circulation lines, lighting framework, fire security plans, water flow networks, drainage plans, among other smart building integrations that integrate a myriad of systems with automation. In the evolving urban environment, MEP services have played a significant role in the protection, energy conservation, comfort, and sustainability in residential complexes, commercial buildings, industrial facilities, data centres, transportation centres, and institutional centres.

The MEP service market significantly depends on the rate of urbanization, the development of massive projects of smart cities, and the faster pace of green buildings certification, which necessitates the use of resources efficiently and system integration. Increasing energy-saving policies will lead to the modernization of old infrastructure, which will increase the demand for modernized HVAC, electrical optimization, and water management systems. Furthermore, the greater the use of IoT-based building automation, predictive maintenance solutions, and digitally designed building information modeling, the more accurate the services, the lower the cost of operations, and the higher the value proposition of MEP solutions in the long term.

Key AI Integration in the MEP Service Market

A major application of Artificial Intelligence to the MEP service market is to ensure building systems are converted into smart self-optimising conditions that improve efficiency, safety, and performance of the lifecycle. Predictive maintenance based on AI tools is rapidly becoming an industry tool to monitor HVAC, electrical, and plumbing infrastructure in real-time to detect faults before they fail and minimise downtime. More advanced algorithms that utilize energy consumption data in optimizing heating, cooling, and light loads are the means of smart energy management and create smarter energy management and sustainability. With BIM systems, AI is applied to automate the algorithms of clash-detection, load-calculation, and system-sizing to provide the project faster and more precisely.

MEP Service Market Outlook

The growth of the industry is contributed to by the high rate of urbanization, commercial complexes, and the extension of smart city technologies. The move towards sustainable, automated, regulation-compliant building environments also increases the rate of market adoption.

The growth in the market is seen across the world as nations continue to modernize old infrastructure and also use new technologies in building designs. Mega construction projects and industrialization are increasing activity in emerging markets in Asia, the Middle East, and Africa.

Some of the key players are the multinational engineering firms, integrated facility management firms, and facility-specific MEP service providers. The popularity of names such as AECOM, Arup, Jacobs, Schneider Electric, and Siemens keeps them at the top of the list due to their diversified range of portfolios and international reach of projects.

An ecosystem of building automation, predictive maintenance, and digital MEP modeling is developing as a startup. The examples of the companies that have been innovative in cloud-based asset management and AI-based building performance optimization are Jimu Intelligent, BuildOps, 75F, and Kterio.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 160.04 Billion |

| Market Size in 2026 | USD 175.61 Billion |

| Market Size by 2035 | USD 405.03 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 9.73% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered |

Service Type, System Type, End-Use Sector, Contract Type, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

MEP Service MarketSegment Insights

Service Type Insights

The installation & construction segment led the MEP service market and accounted for the largest revenue share in 2025. This stage requires a large number of engineering computations, accurate planning of layout, material planning, and specialized employees; hence, the process is the most resource-consuming and most valuable part of the MEP lifecycle. The increasing construction of business complexes, high-rise residential houses, industries, smart systems, and transport systems has continued to push the high demand for full-scale installation work. The stringent building codes, energy-saving standards, and sustainability certifications continue to augment the requirement for professionally installed and designed MEP systems. With the increased pace of urbanization and the growth of huge construction projects worldwide, installation and construction are the most significant.

The retrofit and upgradation segment will also be experiencing a massive rise in growth since the old infrastructure in the world needs to be modernized to be able to offer efficiency in the modern day, safety standards, and digital integration requirements. Most of the existing buildings have old HVAC systems, ineffective electric systems, and a lack of an efficient plumbing system, which demands urgent energy-saving retrofits and system optimization. The governments and industries are focusing more on sustainability and are upgrading to low-usage lighting, improved ventilation, water-conscious plumbing, and electricity infrastructure that can use renewable energy. Further, commercial buildings, manufacturing plants, hospitals, and data centers are also upgrading systems to ensure increased reliability in operations, lowering maintenance expenses, and making occupants comfortable.

System Type Insights

Electrical systems (power, lighting, backup) contributed the most revenue in 2025 and are expected to dominate throughout the projected period. Electrical services are the most capital-intensive and engineering-intensive component of MEP projects, because every sector, such as commercial, residential, industrial, and institutional, has to be thoroughly designed, wired, and distributed at the panel, and provided with safety. As the high-load facilities, including data centers, hospitals, manufacturing facilities, and large commercial complexes, began to gain dominance, the need to have reliable and scalable electrical networks grew exponentially. Also, the trend in the world towards electrification, the use of renewable energy, and the charging infrastructure of EV vehicles only enhances the leadership of electrical services in terms of revenue. With buildings being shifted towards smart and energy-efficient operations, advanced lighting systems, power layouts that are automation-ready, and intelligent backups, the value of the project is constantly being improved.

Building automation and control systems is the segment that is projected to increase significantly in the MEP service market. Systems that are installed in a combined digital setting include HVAC, lighting, security, fire protection, and an electrical network to maximize the use of energy, enhance safety, and provide real-time visibility. The expansion of IoT sensors, AI-based facility analytics, cloud-based dashboards, and digital twins enables building owners to make smarter decisions and reduce their expenses of building owners. The popularity of automation-based MEP solutions is also growing with the increased adoption of green building certifications and governmental requirements of energy efficiency. Automated controls are being used in commercial complexes, hospitals, hotels, airports, and in industrial facilities as a means of ensuring consistent performance and comfort to the occupants.

End-Use Sector Insights

The commercial buildings segment led the MEP service market and accounted for the largest revenue share in 2025. They need highly sophisticated and large-scale mechanical, electrical, and plumbing systems to accommodate 24/7 operations, large populations, and high safety requirements. Advanced HVAC, electrical network, intelligent lighting, water management, and fire protection systems of offices, retail centers, hotels, hospitals, and complexes with mixed use require intensive engineering and a costly installation. Commercial buildings are also concerned with comfort, the quality of air, energy-saving, and the presence of digital connectivity, which raises the demand for smart systems, automation, and regular maintenance services. As the world becomes urbanized and corporate parks, malls, data centres, and hospitality areas continue to expand, commercial infrastructure investment is also very robust.

The industrial facilities segment is expected to grow at a significant CAGR over the forecast period. The facilities require specific MEP solutions that are distinct to heavy machines, high-capacity electric systems, industrial plumbing, HVAC, compressed air systems, and complex plumbing that is unique to the production process. The increasing automotive facilities, the pharmaceutical facilities, the food processing facilities, and the massive logistics warehouses demand individualized MEP engineering. The increased automation, robotics, and closer equipment also require the management of the power distribution, regulated temperatures, and advanced fire protection technologies. The policies to promote industrial growth by means of infrastructure, economic zones, and manufacturing incentives are encouraged by governments in the world and leading to the acceleration of MEP investments.

Contract Type Insights

The lump sum contracts contributed the most revenue in 2025 and are expected to dominate throughout the projected period. The scope, deliverables, timelines, and fixed price in this model of contract are distinct, which allows decision-making to be made quicker at the stage of project initiation. MEP services providers commonly do lump sum contracts on large commercial, residential, and infrastructure projects in which the detailed engineering designs are undertaken early, so that it is possible to estimate the cost. The effectiveness and predictability of this type of contract will allow for minimizing disputes, facilitating the workflow, and simplifying the procurement process. It reduces the cost inflation surprises to clients, and service providers enjoy the fact that they may streamline their internal processes and make more profits through project efficiency. Lump sum contracting is the most appropriate type of contract due to its simplicity and appropriateness in projects of large magnitude that are executed in most regions and industries.

The EPC contracts segment is expected to grow substantially in the MEP service market. The EPC contracts will experience a significant growth as developers switch to integrated service models where they have engineering, procurement, and construction under one responsibility. This approach reduces the coordination problems, ensures consistency of the quality, and reduces the time during which the projects should be done since the responsibility is centralized. Industrial facilities, energy plants, infrastructures, and high-tech buildings, in particular, are especially interested in the EPC models as the extensive integration of MEP and specialized engineering is required. The necessity of the seamless communication of the design team, the procurement network, the fabrication teams, and the installation teams is essential with the complexity of the projects.

MEP Service MarketRegional Insights

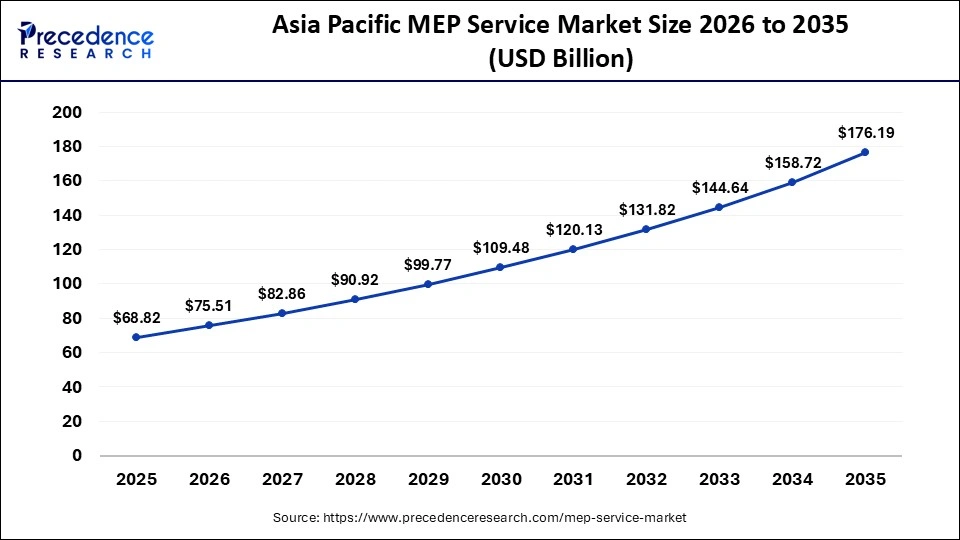

The Asia Pacific MEP service market size is expected to be worth USD 176.19 billion by 2035, increasing from USD 68.82 billion by 2025, growing at a CAGR of 9.86% from 2026 to 2035.

Why Did Asia Pacific Lead the Global MEP Service Market in 2025?

In 2025, the Asia Pacific region recorded the highest market share, due to the propensity for urbanization, building large-scale infrastructure, and commercial, industrial, and residential buildings. The constantly growing megacities, population growth, and the growing economies that have been realized in China, India, Japan, and the Southeast Asian countries have triggered the necessity of mechanical, electrical, and plumbing companies. Programs of smart cities, commercial high-rise complexes, special economic zones, metro trains, airports, and data centers keep increasing MEP integration. Also, the governments in the region are implementing stricter energy-saving policies and green building policies, and more uptake of state-of-the-art HVAC systems, smart electrical grids, smart controls, and sustainable water management technology.

China MEP Service Market Analysis

China has the largest construction ecosystem, a large government-funded infrastructure investment, and the fastest modernization of residential and industrial equipment. The investments that the country has undertaken in the area of smart cities, transport systems, business centers, skyscrapers, renewable energy sources, and modern production centers are creating a high demand for full-fledged MEP services. The increased focus on energy-saving HVAC systems, smart lighting, fire safety measures, and smart building control would spur the use of high-value engineering and maintenance solutions. The stringent regulatory standards, i.e., carbon reduction targets and green building certification, are another factor compelling developers to incorporate contemporary and sustainable mechanical and electrical systems.

The MEA region has been the quickest growing market in the MEP service worldwide as nations augment investment in massive infrastructures, smart cities, hospitality facilities, transportation systems, and industrial growth. The high rate of urban population expansion, increased building of commercial and residential high-rise buildings, and the national diversification policy, particularly in the GCC states, are producing continuous demand for highly developed HVAC systems, electrical distribution improvement, and updated plumbing systems. Saudi Arabia, UAE, Qatar, and Egypt governments are spending massive sums of money on airports, metros, industrial zones, cultural attractions, renewable energy development systems, and medical institutions in need of an integrated MEP engineering and maintenance lifecycle. Mandatory energy efficiency, climate-based demand for high-performance cooling systems in the region are pushing the take-up of next-generation mechanical solutions.

Mega-projects in the form of high-rise commercial zones, mixed-use projects, state-of-the-art tourism infrastructure, and high-tech industrial parks only contribute to the fact that the UAE MEP service market is evolving at an impressive pace. The ambitious smart city solutions of the country, such as strategies of Dubai Smart City and smart city frameworks in Abu Dhabi, are some of the factors that create a demand for intelligent systems in electrical, HVAC, and building automation. Strict energy-saving laws, green building labels, and the sustainability requirements favor the implementation of low-energy air conditioning systems, efficient lighting, and plumbing approaches that focus on conserving water. Advanced electrical and mechanical services are also increased by the data center ecosystem explosion, airport expansions, and logistics facilities witnessed in the UAE.

The North America MEP services market is recording an enormous growth due to the robust investments underway in the modernisation process of the infrastructure, renovation of the old buildings, and quick access to smart building technologies. Retrofitting of HVAC, electrical grids, fire safety systems, and plumbing networks is also growing at an accelerated rate, thus increasing the demand in commercial buildings, health centers, industrial plants, and institutional campuses. The focus on sustainability and net-zero in the region increases the number of installations of energy-efficient cooling systems, new lighting systems, and digital automation systems. Data center expansion, manufacturing reshoring, clean energy projects, and massive transportation upgrades all contribute to engineering and lifecycle maintenance services.

The growing US MEP service market is influenced by the growing renovation of older infrastructure, the growth of new energy control, and the high demand for mechanical and electrical high-performance systems in the commercial sector, industry, and public building sector. HVAC systems, electrical subsystems, emergency power systems, and water management system upgrades are necessitated by efficiency requirements, carbon-cutting objectives. The increased data center construction, semiconductor manufacturing facilities, logistics centers, and medical institutions drive complex MEP integration and engineering needs. IoT sensors, digital twins, and automation based on AI are rapidly deployed in smart buildings, both on the campuses of corporations and institutions.

The European MEP service market is attributed to stricter energy efficiency regulations, extensive retrofitting efforts, and increased investments in smart and sustainable building technologies. Germany, France, the UK, and the Nordics are working on the modernization of residential, commercial, and industrial infrastructure to achieve decarbonization targets and the EU Green Deal. The increased building of data centers, manufacturing facilities, hospitals, certified commercial buildings, and green buildings continues to demand the integrated mechanical, electrical, and plumbing services. The implementation of modern HVAC tools, electrical networks with renewable energy, low-energy consumption, and smart water management systems will guarantee efficiency in performance and compliance with sustainability criteria.

Why Is the Latin American MEP Service Market Emerging Rapidly?

The Latin American MEP service market is currently developing at a high rate as nations inject more funds into urban infrastructure, industrial facilities, commercial complexes, and projects by government projects. Residential towers, mixed-use development, manufacturing facility, hospital, and transport network are rising in Brazil, Mexico, Chile, and Colombia, and this needs sophisticated mechanical, electrical, and plumbing solutions. Governments and home developers are encouraging energy efficiency, water, and fire safety standards, which are leading to the use of modern HVAC systems, smart electrical grids, smart lighting, and smart plumbing design and installation. Emerging trends in the region also include automation of buildings, predictive maintenance, and monitoring, based on the IoT, and these technologies contribute to operational efficiency and minimize the cost of the lifecycle.

Recent Developments

- In September 2025, Amentum also completed an acquisition of Critical Mission Solutions and the Cyber and Intelligence divisions of Jacobs Solutions Inc. The result of this merger is that it provides a worldwide leader in high-level engineering and technology to address the complicated customer issues. (Source:https://www.businesswire.com)

- In May 2025, Kimley-Horn and Associates, Inc. extended its reach in Southern California and incorporated the staff of LPDA, one of the top landscape architecture and land planning companies. This will boost the company's services and its capabilities in serving clients in the region.(Source:https://www.prnewswire.com)

- In May 2025, WSP Global also purchased AKF Group LLC, a New York-based mechanical, electrical, and plumbing engineering firm. The acquisition reinforces WSP Property and Buildings and increases its service businesses in the eastern U.S and Mexico, especially in healthcare, science, and critical facilities developments. (Source: https://www.bnamericas.com)

Top Vendors in the MEP Service Market & Their Offerings

Offers engineering, design, and construction services related to commercial, industrial, and infrastructure MEP projects all over the globe.

Provides MEP consulting, smart building solutions, and energy efficiency design services to construction projects worldwide on a sustainable basis.

Provides engineering, construction, and facility management services, possessing experience in critical mission-driven and technology-driven MEP systems.

This company specializes in healthcare, science, commercial, and infrastructure mechanical, electrical, and plumbing engineering.

MEP services such as planning, design, and engineering services with emphasis on urban and commercial projects.

MEP Service Market Companies

- AECOM

- Arup

- Jacobs Solutions Inc.

- WSP Global

- Kimley-Horn and Associates, Inc.

- Mott MacDonald

- Fluor Corporation

- SNC-Lavalin

- Burns & McDonnell

- Buro Happold

- Black & Veatch

- GHD Group

- HDR, Inc.

- Atkins (SNC-Lavalin)

- Cundall

- Tetra Tech

- Parsons Corporation

- Aurecon

- Stantec

- KPFF Consulting Engineers

MEP Service MarketSegments Covered In the Report

By Service Type

- Design & Engineering

- Installation & Construction

- Commissioning

- Repair & Maintenance

- Retrofit & Upgradation

By System Type

- Mechanical Systems (HVAC, ventilation)

- Electrical Systems (power, lighting, backup)

- Plumbing Systems (water supply, drainage, sanitation)

- Fire Protection Systems

- Building Automation & Control Systems

By End-Use Sector

- Residential Buildings

- Commercial Buildings

- Industrial Facilities

- Institutional Buildings (hospitals, airports, schools)

- Infrastructure (metros, tunnels, water plants)

By Contract Type

- Lump Sum Contracts

- Time & Material Contracts

- Design-Build Contracts

- EPC Contracts

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content