What is the Micro Inverter Market Size?

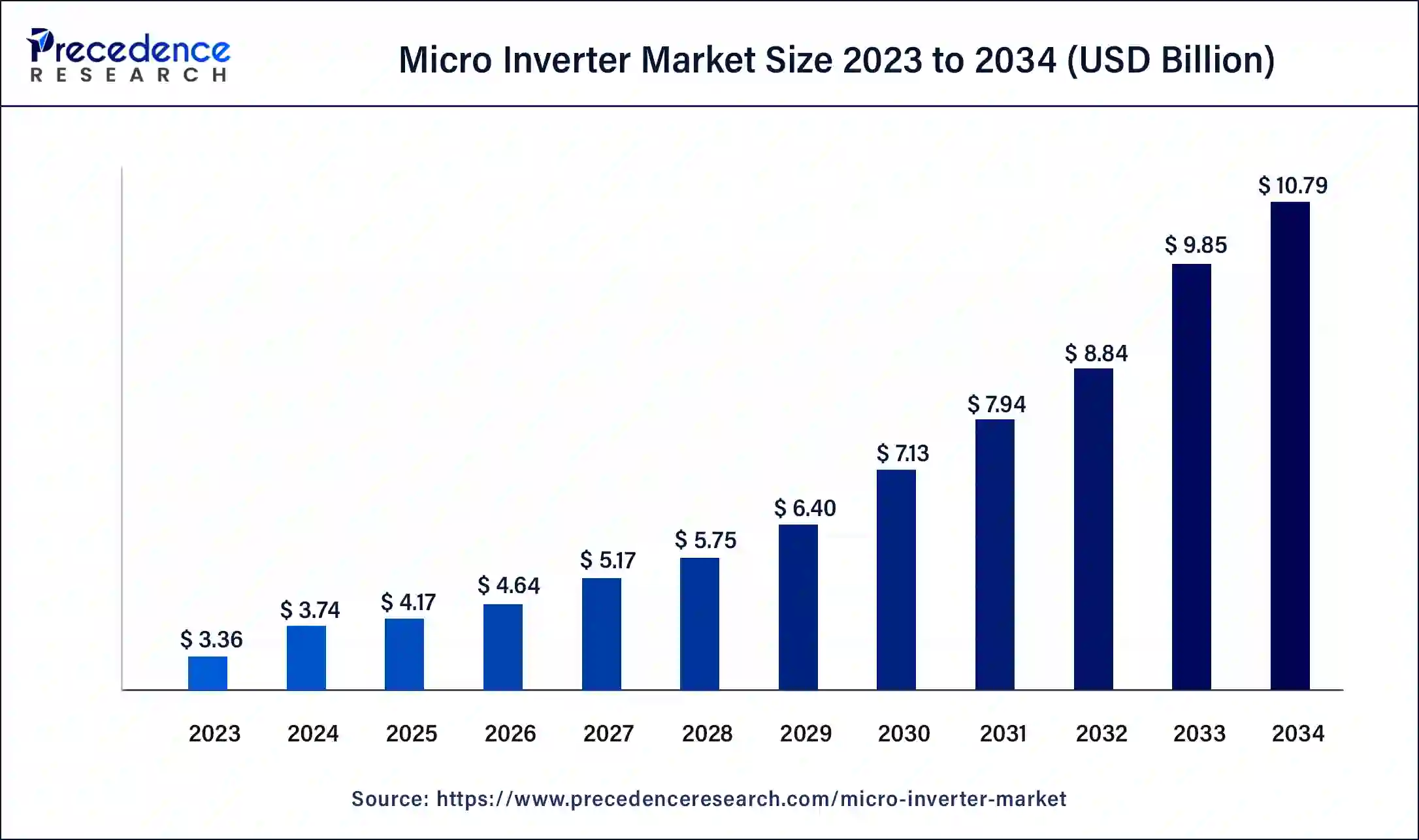

The global micro inverter market size is calculated at USD 4.17 billion in 2025 and is predicted to increase from USD 4.64 billion in 2026 to approximately USD 11.78 billion by 2035, expanding at a CAGR of 10.94% from 2026 to 2035.The micro inverter market size reached USD 1.65 billion in 2023. The micro inverter market is driven by a greater need for monitoring at the module level.

Micro Inverter Market Key Takeaways

- The global micro inverter market was valued at USD 4.17 billion in 2025.

- It is projected to reach USD 11.78 billion by 2035.

- The micro inverter market is expected to grow at a CAGR of 11% from 2026 to 2035.

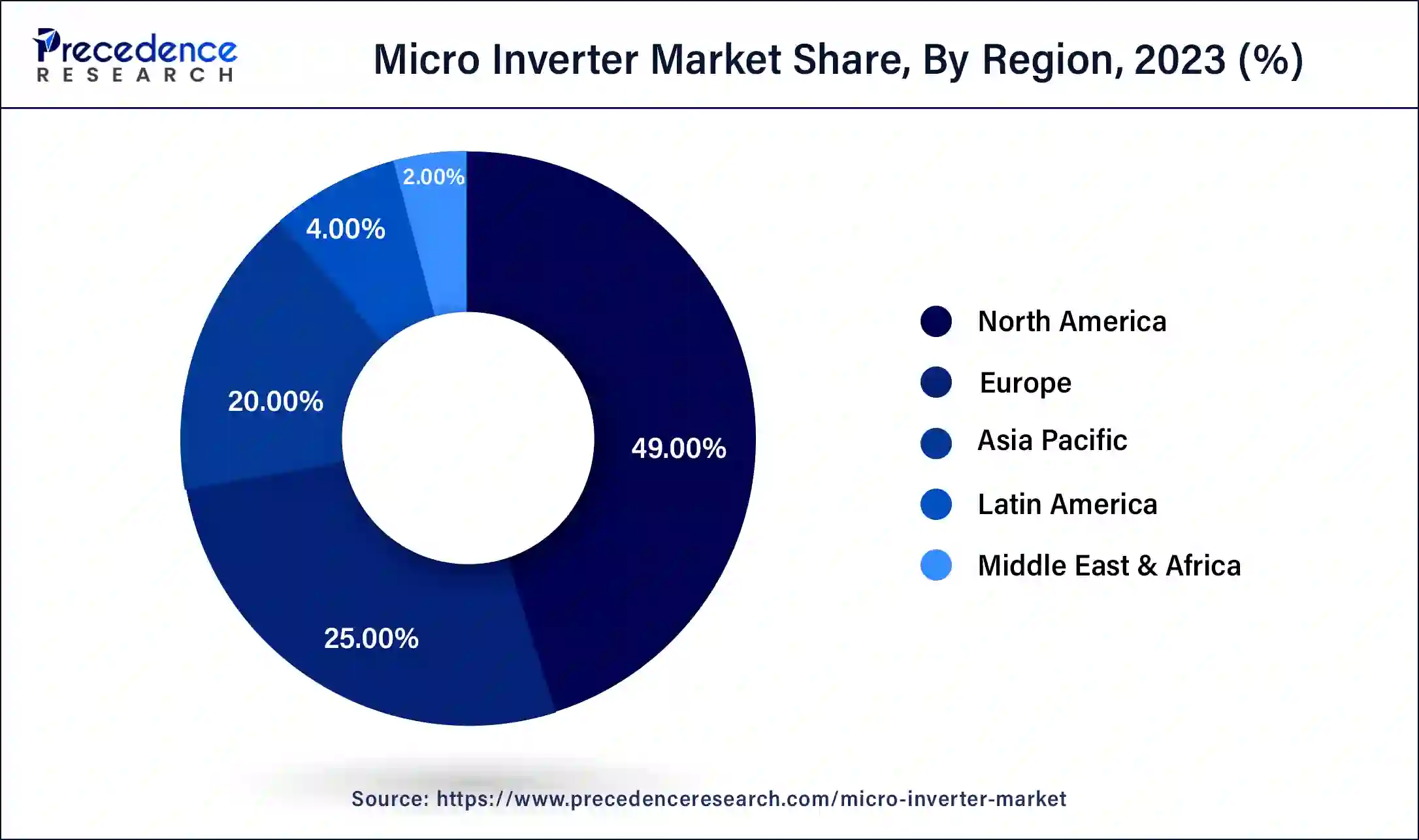

- North America dominated micro inverter market in 2025.

- By phase, the single-phase segment holds the largest market share in 2025.

- By connectivity, the on-grid segment dominated the market in 2025.

- By application, the residential segment dominated the micro inverter market in 2025..

What is Meant by Micro Inverter Market?

The primary objective of the micro inverter market is to offer solar photovoltaic (PV) systems dependable and effective power conversion solutions. The direct current (DC) electricity generated by solar panels is transformed into alternating current (AC) electricity by micro inverters, making it usable in residences, commercial buildings, and the electrical grid. It has improved safety features like quick shutdown times that enable solar PV systems to abide by safety rules and shield maintenance staff and firefighters in an emergency.

The worldwide demand for distributed solar energy systems drives growth in the micro inverter industry, which is essential for supplying utility-scale, commercial, and residential solar installations.

- In June 2023, The HMS-1000W microinverter series was introduced by Hoymiles, the industry leader in smart solar + storage solutions, at Intersolar Europe in Munich, Germany. The model is specifically designed for small photovoltaic systems, such as solar panels on balconies, and comes with an industry-standard Wi-Fi module that guarantees excellent connectivity. The new microinverters are expected to simplify the solar installation process for households and enable balcony solar installation in Europe, as they do not require complicated wiring or external gateway items.

What are the Growth Factors in the Micro Inverter Market?

- Industry Growth Overview: The micro-inverter market is undergoing strong, consistent growth, driven by increasing solar adoption, energy expense concerns, along with tech advancements.

- Major Investors: Major investors and major players in the micro inverter market include dominant leaders such as Enphase Energy, APsystems (Altenergy), SolarEdge, and Chinese firms Hoymiles, Sungrow, Deye, alongside established players such as SMA Solar, ABB, and Delta Electronics, with consistent innovation in many residential solar techs driving investment and market share.

- Startup Ecosystem:The market is dynamic as well as rapidly expanding, driven by increasing worldwide solar adoption, technological advancements such as AI integration, and a target on panel-level efficiency and safety.

What are the Growth Factors in the Micro-mobility Charging Infrastructure Market?

- Micro inverters make make it possible to identify problems with the performance of specific solar panels.

- Increasing emphasis on energy independence and sustainability.

- Growing interest is a result of the advantages of microinverters promote the expansion of the micro inverters market.

- Compared to central inverters, there is less wiring and a more flexible system design.

- Lower costs and increased microinverter efficiency.

- It functions well with various roof angles and allows for partial shading adjustment.

Market Scope

| Report Coverage | Details |

| Global Market Size by 2035 | USD 11.78 Billion |

| Global Market Size in 2025 | USD 4.17 Billion |

| Global Market Size in 2026 | USD 4.64 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 10.94% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Phase, Connectivity, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing positive outlook towards green energy

A growing number of people worldwide are turning to renewable energy sources like wind and solar power to lessen their carbon footprint and address climate change. Governments, corporations, and individuals are adopting renewable energy alternatives at an increasing rate to achieve sustainability goals. Micro-inverters are essential to this change because they transform DC power from solar panels into AC power for households and businesses.

The power system needs solutions that facilitate dispersed energy generation and improve grid stability, including renewable energy sources. Micro-inverters regulate voltage variations and provide a steady supply of clean energy, making it easier for solar power systems to integrate into the grid seamlessly. This makes the energy infrastructure more sustainable and resilient.

Restraint

Availability of auxillary technologies

Interoperability refers to the capacity of various systems and devices to successfully interact and cooperate. Interoperability with other parts, such as energy management platforms or smart home systems, is essential in the context of microinverters. Seamless integration and data transmission might be hampered by limited availability or compatibility problems with auxiliary technologies connected to data communication protocols, such as Modbus, Zigbee, or Wi-Fi standards.

Micro inverters' whole value proposition would be diminished if there was a lack of strong interoperability, making it difficult for end users to monitor, manage, and optimize their solar power systems.

Opportunity

Favorable regulatory inclination toward sustainable energy

Many countries worldwide have set aggressive goals for renewable energy to lower carbon emissions and fight climate change. These objectives frequently include precise targets for solar energy generation capacity. Micro inverters are in high demand because of favorable policies that encourage people and businesses to invest in solar photovoltaic (PV) systems. These rules include subsidies, tax breaks, and feed-in tariffs. Such favorable regulations create a significant opportunity for the micro inverters market.

Governments worldwide are increasingly implementing environmental regulations aimed at reducing carbon emissions and combating climate change. Promoting the adoption of renewable energy technologies like solar power is often a key component of these regulations. Micro inverters enable solar energy systems to generate clean electricity without producing greenhouse gas emissions, aligning with the goals of environmental regulations.

Regulatory bodies often establish energy efficiency standards for electrical equipment to promote sustainability and reduce energy consumption. Micro inverters, compared to traditional string inverters, offer advantages such as individual panel-level optimization and higher efficiency under varying conditions. Regulations that incentivize or mandate the use of more efficient inverters can drive market growth for micro inverter manufacturers.

Favorable regulatory inclination toward sustainable energy

According to the U.S. Energy Information Administration, Total world solar electricity generation grew from 0.4 billion kWh in 1990 to about 1,280 billion kWh (1.3 trillion kWh) in 2022. The top five producers of solar electricity and their percentage shares of the world total solar electricity generation in 2022 were: China–33%, United States–16%, Japan–7%, India–7%, and Germany–5%. China and the United States together accounted for about one-half of the total world solar electricity generation in 2022.

Segment Insights

Phase Insights

The single-phase segment dominated the micro inverter market in 2025. Regarding performance and efficiency, single-phase microinverters outperform conventional string inverters. Power losses from soiling, panel mismatch, and shading are reduced when DC to AC conversion occurs at the panel level. Higher overall system efficiency results from this individual panel optimization, ensuring each panel runs independently at its maximum power point (MPP).

Isolating the output from each solar panel from the rest of the system improves system safety and dependability. When using typical string inverter systems, the performance of the entire string might be impacted by a single panel malfunction or shade. This risk is reduced by using microinverters because continuous power generation is ensured, and the failure of one panel does not adversely affect the others.

The three-phase segment shows a significant growth in the micro inverter market during the forecast period. Improved performance in solar energy systems and grid stability are two benefits of three-phase systems. Distributing power evenly among the three phases lowers the possibility of voltage imbalances and increases system efficiency. This is especially crucial in systems connected to the grid because preserving grid stability is essential. The market for three-phase micro inverters is expanding as utilities and grid operators emphasize power quality and system dependability.

Although three-phase micro inverters were formerly thought to be more expensive, economies of scale and technical advancements have decreased their cost. A wider range of clients, including commercial and industrial project developers, are becoming more interested in three-phase micro inverters due to their cost-competitiveness and improved performance in particular applications.

Connectivity Insights

The on-grid segment held a significant share of the micro inverter market in 2025. There is a noticeable spike in demand for solar energy solutions as the emphasis on renewable energy became more widespread worldwide. To adopt sustainable energy sources and lessen their carbon impact, businesses, consumers, and governments all looked for solutions. The market for micro inverters, particularly the on-grid segment, benefited directly from this increased demand because these inverters are essential to grid-connected solar photovoltaic (PV) installations.

On-grid micro inverter costs have decreased over time due to supplier rivalry, enhanced production techniques, and economies of scale. These inverters are now more affordable, making them more suitable for utility-scale projects, small companies, and home users.

Application Insights

The residential segment dominated the micro inverter market in 2025. Micro inverters can extract more energy from each solar panel by functioning at the panel level. This is very helpful in residential contexts, where rooftops may have different orientations, tilts, and shading patterns. Compared to string inverters, which may have performance losses due to shade or panel mismatch, micro inverters allow each panel to function to its fullest capacity, producing more energy overall. The household solar business has grown significantly due to falling solar panel prices, government incentives, and rising homeowner environmental consciousness. Micro inverters are in high demand as more homes switch to solar power.

The commercial segment is the fastest growing in the micro inverter market during the forecast period. Micro inverters provide a scalable, easily expandable solution to meet changing commercial solar power needs. Businesses that want to grow their solar installations over time or have changing energy needs would significantly benefit from this scalability. Because of their adaptability, micro inverters are an excellent option for commercial projects because they are simple to integrate into new or existing solar installations. Many micro inverter systems have sophisticated monitoring features that offer real-time data on how well each solar panel performs.

This degree of visibility is essential for commercial enterprises looking to maximize energy production, quickly detect problems, and plan maintenance as needed. Identifying issues at the panel level improves system reliability overall and decreases downtime, which is necessary for commercial applications.

Regional Insights

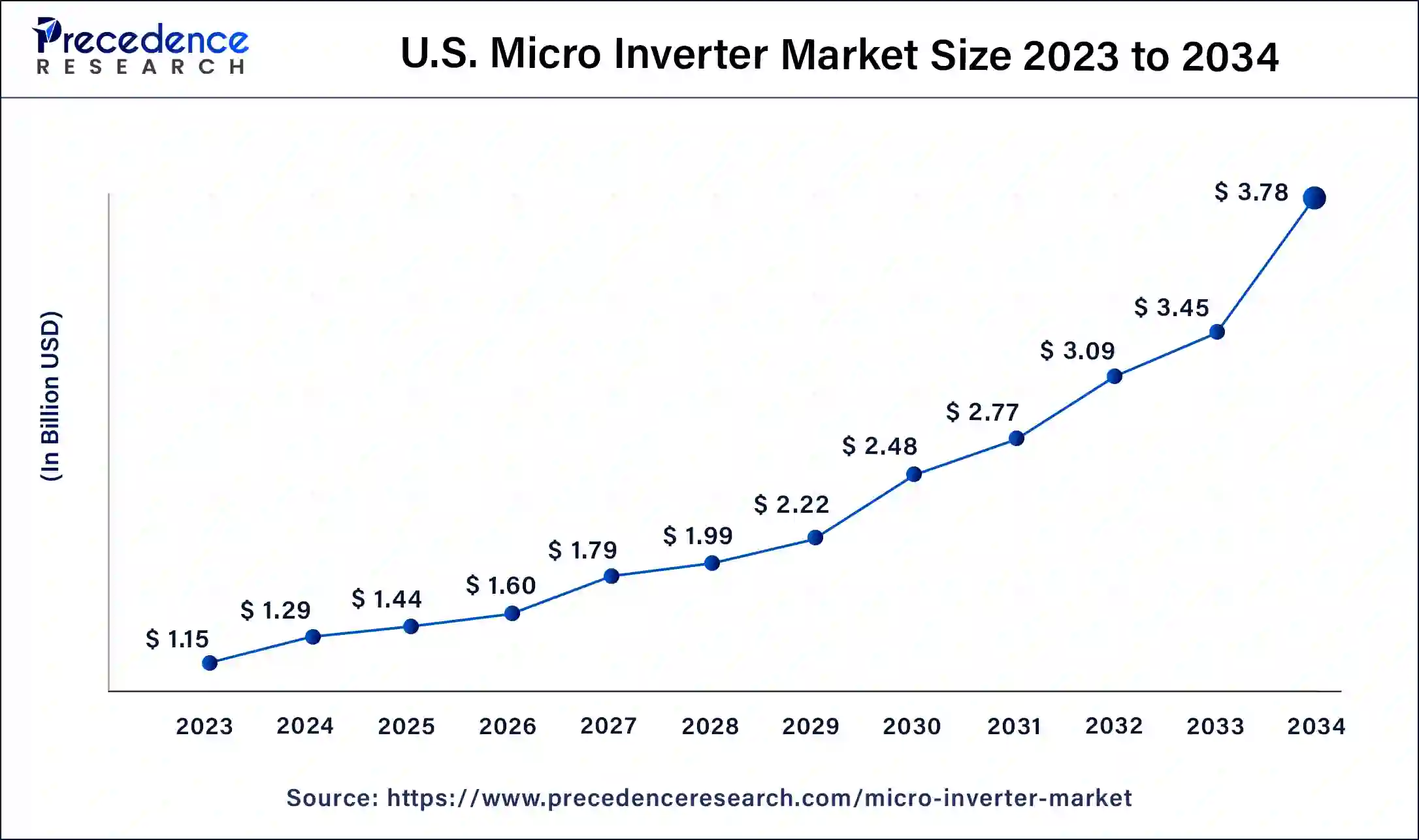

The U.S. micro inverter market size is exhibited at USD 1.44 billion in 2025 and is projected to be worth around USD 4.13 billion by 2035, growing at a CAGR of 11.11% from 2026 to 2035.

North America had the largest share in 2025 of the micro inverter market. The need for micro inverters has increased due to the growing use of solar photovoltaic (PV) systems in utility-scale, commercial, and residential settings. The need for tiny inverters rises along with the solar industry. Micro inverters are appealing to household and commercial customers who want to get the most energy out of their solar installations because they provide features like shadow tolerance, individual panel optimization, and real-time monitoring. This awareness and demand drive the region's sales of micro inverters.

According to the data published by the International Energy Agency (IEA) in July 2023, the United States accounted for approximately 15.9% of the world's solar consumption that year, making it the second-largest solar power consumer worldwide.

U.S. Micro Inverter Market Trends

The U.S. micro inverter market is booming, propelled by residential solar growth, growing energy expenses, and tech like panel-level optimization (MPPT) for efficiency, along with strong need in California and the West.

Europe shows a significant growth in the micro inverter market during the forecast period.Micro inverters and other solar PV components are becoming less expensive as the solar energy sector develops. Because of economies of scale and technological developments, micro inverters are now more reasonably priced and economically viable for use in utility-scale, commercial, and residential solar installations. A growing number of organizations and people in Europe are investing in micro-inverter solar energy systems due to their affordability.

- In April 2023, the world's top manufacturer of inverters and batteries added them to Menlo Electric's product line. Menlo Electric is the biggest distributor of solar photovoltaic panels, battery packs, and inverters in Europe, the Middle East, and Africa.

The European Union (EU) is one of the leading regions for clean energy deployment, and its policy in many countries increasingly focusing on sustainability, is anticipated to increase the investment in renewable energy sources. According to the International Energy Agency (IEA), in 2023, the investment in renewables generation totalled almost USD 110 billion, an increase of more than 6% from the previous year

UK Micro Inverter Market Trends

The UK micro inverter market is experiencing strong expansion, driven by growing energy costs, government fund for renewables, and even the unique benefits microinverters provide for complex residential/commercial rooftops, still trailing global leaders such as the US/Aus in adoption, with major expansion in residential/commercial sectors and major players like Enphase contributing innovation, promising easier installation and also better energy management.

Value Chain Analysis of Micro Inverter Market

- Distribution Network Management

The market involves two distinct yet interconnected aspect i.e., the physical supply chain management of the product itself alongside the electrical grid management of the energy built by the inverters. The latter is a critical technical challenge because of the distributed nature of micro-inverter installations. - Energy Storage Systems

By capturing as well as storing the excess AC electricity generated by solar panels for use later, offering backup power, and assisting balance the energy supply and need within a microgrid or home system.

Micro Inverter Market Companies

- Darfon Electronics Corp.: Darfon Electronics Corp. provides a range of products as well as solutions for the microinverter market, aiming on high efficiency, reliability, and even user-friendly solar power systems.

- Enphase Energy: Enphase Energy dominates the microinverter market by providing panel-level power electronics (microinverters) which convert DC to AC at each solar panel, improving system resilience, maximizing energy harvest, and offering detailed monitoring through their Enlighten platform, all integrated into a safe, modular, and even scalable AC solar ecosystem with batteries and also smart software for backup and energy management.

Other Major Key Players

- SMA Solar Technology AG

- Alternate Power System, Inc.

- Fimer Group

- Chilicon Power LLC

- AEconversion GmbH & Co.

- Sensata Technologies, Inc.

- Northern Electric Power Technology Inc.

- Sparq System

- Yotta Energy

- Growatt New Energy

Recent Developments

- In October 2023, Indian inverter manufacturer FIMER plans to introduce a 5 MVA bidirectional converter (BDC) for massive grid-connected energy storage applications within the next two months. The product will go on sale in early 2019 and will be the biggest BDC produced in India.

- In March 2023, the renowned PV inverter maker SolaX Power had a notable New Product Launch in India. With an eye toward the rapidly expanding solar sector in the nation, it unveiled the X1-MINI G4 and X1-BOOST G4, its newest residential grid-tied inverters.

- In March 2025, SolaX Power, a Global solar inverter brand, announced its plan to introduce its latest innovation of solar micro-inverters that will be tailored for the Indian market. The inverters will be specifically designed for smaller residential rooftop solar installations.

- In December 2024, Enphase Energy, Inc., a global leader in energy technology and microinverter-based solar and battery systems, collaborated with Frank Energie, an energy provider in the Netherlands. This strategic relationship will enable Frank Energie customers with Enphase solar and battery systems to participate in the grid imbalance energy marketplace in the Netherlands.

- In February 2025, GE Vernova announced its plan to invest nearly USD 600 million in its U.S. factories and facilities over the next two years. Among those investments is roughly USD 10 million going to GE Vernova's Pittsburgh facility to add a new domestic manufacturing line for the company's FLEXINVERTER. The total GE Vernova investment in Pittsburgh is expected to create more than 270 new jobs, with the new line producing both the 1500V and 2000V FLEXINVERTER.

Segments Covered in the Report

By Phase

- Single-phase

- Three-phase

By Connectivity

- Stand Alone

- On-grid

By Application

- Residential

- Commercial

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting