Microwave Ablation Devices Market Size and Forecast 2025 to 2034

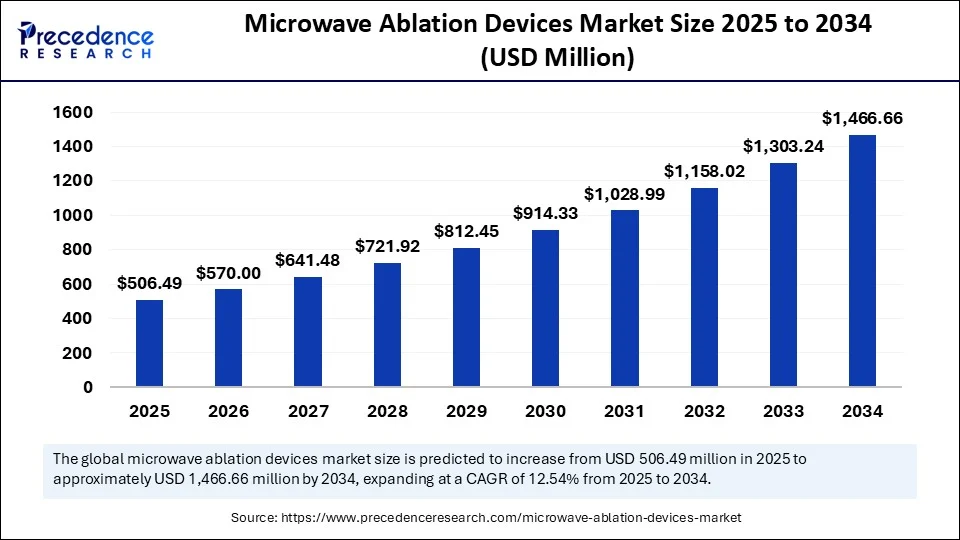

The global microwave ablation devices market size accounted for USD 450.05 million in 2024 and is predicted to increase from USD 506.49 millionin 2025 to approximately USD 1,466.66 million by 2034, expanding at a CAGR of 12.54% from 2025 to 2034. The increase in cancer cases, greater preference for minimally invasive procedures, and rapid advancements in technology that further improve precision and safety are driving the growth of the microwave ablation devices market.

Microwave Ablation Devices Market Key Takeaways

- The global microwave ablation devices market was valued at USD 450.05 million in 2024.

- It is projected to reach USD 1,466.66 million by 2034.

- The market is expected to grow at a CAGR of 12.54% from 2025 to 2034.

- North America led the microwave ablation devices market with the highest share in 2024.

- Asia Pacific is expected to expand at the fastest CAGR between 2025 and 2034.

- By component type, the accessories segment held the largest market share in 2024.

- By component type, the generators segment is expected to grow at the highest CAGR between 2025 and 2034.

- By application, the oncology segment captured the biggest market share in 2024.

- By application, the cardiovascular segment is expected to expand at the fastest CAGR over the projected period.

- By end-user, the hospitals segment generated the major market share in 2024.

- By end-user, the research laboratories segment is expected to expand at the fastest CAGR during the upcoming period.

AI Precision: Smart Ablation Procedures Changing How Tumors are Treated

Artificial intelligence has a transformational impact on the microwave ablation devices market through improvements in accuracy, automation, and patient safety. Most recently, AI-powered systems have been developed in order to aid real-time imaging, optimize probe placements and keep track of how tissues respond during ablation. Companies such as Medtronic and Johnson & Johnson are focusing on AI-based thermal mapping and predictive analytics to protect healthy surrounding tissue.

In recent clinical trials, AI was even shown to decrease procedural time and improve outcomes. As this tech-driven change unfolds, outpatient and minimally invasive cancer therapies will be more accessible, especially in emerging economies. AI will support the rapid evolution of microwave ablation as a transformative first-line oncology strategy.

- In March 2025, Baird Medical's AI tumor ablation surgical robot was honored with the "most valuable investment award" pioneering AI and robotics integration in healthcare. Baird Medical's AI Tumor Ablation Surgical Robot is an intelligent surgical system that integrates multimodal AI algorithms with high-precision robotic arm control.

(Source: https://www.prnewswire.com)

Market Overview

Microwave ablation (MWA) devices are minimally invasive devices that are used to destroy abnormal tissue, especially tumors, using electromagnetic waves that produce localized heat. These devices are used to treat tumors in the liver, lungs, kidneys, and bone. The market is anticipated to grow steadily, primarily because of the preference for non-invasive, image-guided approaches that reduce time to recovery after the procedure and complications.

Advances in MWA technology, such as advances in antenna design and improvements in thermal efficiency, will also contribute to its uptake into the clinical environment. The increase in the global burden of cancer, increasing urgency and awareness of treating tumors earlier, and funding, and targeted investments in minimally invasive technologies will positively correlate to increased demand for MWA devices. In addition, hospitals and specialty outpatient clinics are increasingly replacing existing technologies with MWA systems as part of a total approach by the establishment of a cancer management program, which will help enhance patient longer-term benefits to the patient and improve operational efficiencies.

What are the Major Trends in the Microwave Ablation Devices Market?

- Increasing cancer incidence: The growing global cancer burden, including liver, lung, and kidney cancers, will continue to increase the demand for microwave ablation procedures.

- Shift toward minimally invasive therapies: Increasing patient and physician preferences for minimally invasive therapies are stimulating the adoption of microwave ablation over traditional surgical procedures.

- Technological advancements: Advancements in monitor designs, energy control, and real time imaging will increase the accuracy of treatment and increase the efficiency of the devices.

- Spectrum of use outside oncology: Microwave ablation is being developed for treating benign tumors and other conditions of soft tissue outside of oncology.

- Expansion of hospitals and specialty clinics: Rapid expansion of cancer-specific hospitals and clinics in emerging economies to improve access to healthcare support market growth.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 1,466.66 Million |

| Market Size in 2025 | USD 506.49 Million |

| Market Size in 2024 | USD 450.05 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 12.54% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component Type, Application, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Cancer Burden Drives Shift to Minimally Invasive Microwave Ablation Therapies

One of the major factors driving the growth of the microwave ablation devices market is the increasing preference for minimally invasive cancer therapies. The global incidence of liver, lung, and kidney tumors is rising, and microwave ablation devices are now being adopted by clinicians because they heat the tumor via electromagnetic energy, obliterating cancerous cells while maintaining healthy tissue. According to the World Health Organization (WHO), cancers are responsible for 20% of premature deaths due to noncommunicable diseases (NCDs). Projections predict an 87.5% increase in new cancer cases by 2050.

(Source: https://www.who.int)

Microwave ablation is different from conventional surgery because there is shorter recovery, fewer complications, and fewer traumas a compelling proposition to patients and the healthcare provider. Recent developments in technology (thinner, more flexible probes, integration with real-time imaging) and AI-based planning have made microwave technology more precise and widened ablation areas, allowing the procedure to be done on poorly located tumors. These clinical advantages, along with the increasing research surrounding this field and the adoption of procedures, are solidifying microwave ablation as a preferred therapy in cancer treatment.

Restraint

Limited Clinical Evidence for Some Indications

One of the major factors creating barriers to the microwave ablation devices market is the limited clinical evidence for cancer indications beyond liver, lung, and kidney tumors. While microwave ablation shows promise for these common applications, there is a need for more robust studies on less common cancers like breast, prostate, and pancreatic cancer. The lack of extensive and robust multi-center randomized trials results in uncertainty among clinicians and healthcare systems concerning long-term performance objectives for things like recurrence rates and, ultimately, patient outcomes. This can lead to uncertainty about implementing microwave ablation devices across various clinical oncology settings, particularly where guidelines are heavily evidence-based. In addition, the high cost of these devices limits accessibility and hampers the growth of the market.

Opportunity

Increasing Scope of Applications and Shift Toward Outpatient Procedures

One major opportunity currently exists in the microwave ablation devices market is the rising scope of applications of microwave ablation devices beyond the oncology space to other clinical indications. Oncology still dominates the market as the primary application for microwave ablation, particularly liver, lung, and kidney tumors. However, there is recent research showing interest in microwave ablation for benign tumors, chronic pain conditions, and even structural heart conditions. This interest allows device manufacturers and hospitals to tap into the demand for minimally invasive and precision-driven therapies, resulting in potential revenue opportunities.

At the same time, there is an observable shift toward outpatient procedures in ambulatory surgical centers and specialty clinics, reducing length of stay and optimizing patient convenience and outcomes. As devices become smaller and easier to operate and reimbursement shifts to provide coverage, microwave ablation will have opportunities in settings outside the hospital. Growing healthcare infrastructure in emerging economies opens up new growth avenues.

Component Insights

Why Did the Accessories Segment Dominate the Microwave Ablation Devices Market in 2024?

The accessories segment dominated the market with the largest share in 2024, as they are paramount to the process of transmitting energy from the generator to the site of ablation. Accessories such as cables, connectors, and adaptors are considered vital components of ablation devices as they enhance precision and reliability during their use. They are used most widely in various medical procedures, especially in oncology. Their frequent usage and requirement for replacement create consistent demand for such components. Their important role as a supporting system in ablation supports segmental growth.

The generators segment is expected to grow at the highest CAGR in the upcoming period due to demand for newer systems that facilitate more precise and automated delivery of energy. As hospitals and ambulatory centers move from traditional methods of delivering energy to minimally invasive alternatives, there is more demand for upgrading current generator systems due to reliability issues and demand for next-gen systems with real-time thermal monitoring and frequency modulation. Continued innovation in energy efficiency and treatment accuracy is taking place, and essentially, generators will take a supporting role in future microwave ablation systems. Additionally, generators are experiencing more demand in newer applications and settings, i.e., cardiovascular and orthopedic procedures.

Application Insights

How Does Oncology Segment Dominate the Market in 2024?

The oncology segment dominated the microwave ablation devices market with a major share in 2024 because of the increasing prevalence of cancer and the preference for minimally invasive therapies. Microwave ablation has excellent outcomes for solid tumors, especially for liver, lung, and kidney cancers, because of shorter ablation times, precision, and limited damage to surrounding tissues. The ability to treat high-risk patients with inoperable tumors adds to its suitability. Advancements in technologies like real-time image modalities and AI integration enhance treatment outcomes, supporting segmental growth.

The cardiovascular segment is expected to grow at the fastest CAGR in the coming years, as healthcare providers and systems are becoming aware of using microwave ablation to treat arrhythmias, such as atrial fibrillation. Recent studies and trials have shown positive clinical outcomes in microwave ablation for cardiac tissue modification with little to no complications. The increased incidence of cardiac rhythm disorders in the elderly and the significant increase in elderly populations are expected to drive segmental growth.

End-UserInsights

What Made Hospitals the Dominant Segment in the Microwave Ablation Market?

The hospitals segment dominated the market with the biggest share in 2024. This is mainly due to the increased volume of patients in hospitals receiving microwave ablation procedures. Furthermore, the centralized and established bureaucracy associated with hospitals has resulted in a large investment in potentially upgrading the ablation technology. Hospitals are the early adopter of advanced microwave ablation systems. Hospitals have the ability to provide complex multi-disciplined interventions, especially when applied to oncology and cardiovascular procedures, attracting more patients.

The research laboratories segment is expected to grow at the fastest rate during the forecast period due to their increased focus on innovation and clinical validation of microwave ablation technology. Several laboratories and private R&D institutes have financed or operated numerous studies that aim to discover new anatomical targets, maximize, control of energy sources, or create new and emerging probe designs. In particular, these laboratories are responsible for advancing microwave ablation technology beyond oncology applications. The increase in research and development funding and collaboration between research laboratories and academic institutes contribute to segmental growth.

Regional Insights

What Made North America the Dominant Region in the Microwave Ablation Devices Market?

North America registered dominance in the market by capturing the largest share in 2024. This is mainly due to high clinical adoption, regulatory backing, and ongoing innovation with image-guided interventions. The existing hospital framework in the region and proficient interventional radiology workforce have been instrumental in facilitating microwave ablation procedures. In January 2024, the US FDA approved multiple next-generation MWA systems and facilitated MWA devices market entry, so for example, Hygea Medical's Exceed, as well as Siemens IntelliBlate, is now used by virtually every hospital for minimally invasive tumor treatment, focusing predominantly on liver cancer and lung cancer treatment. Furthermore, well-known cancer treatment providers in the U.S., mostly but not limited to academic medical centers, have integrated MWA technology into standard of care pathways, demonstrating their clinical confidence in the technology.

(Source: https://www.hygeamedtech.com)

The U.S. is leading the market within the region. This is mainly due to the rising demand for minimally invasive procedures and the increasing cancer burden. As a result, there is a high adoption of MWA devices. A large number of hospitals across New York, California, and Texas have recently incorporated MWA systems in oncology units to treat tumors with increased precision and reduced complication rates. Also, by the end of 2025, an estimated 2,041,910 new cases of cancer will be diagnosed in the U.S. and 618,120 people will die from the disease, driving the need for ablation devices.

(Source: https://www.cancer.gov)

Asia Pacific Microwave Ablation Devices Market Trends

Asia Pacific is expected to grow at the fastest CAGR during the projection period. With an escalating cancer burden across Asia Pacific and increasing preference for minimally invasive procedures, microwave ablation devices are quickly gaining traction. China, India, and Southeast Asia are all investing heavily in radiology infrastructure and image-guided therapies. In 2023, China's health commission recommended microwave ablation as a first-line treatment for those with inoperable lung tumors, maximizing use in the largest institutions and hence opening opportunity for skill and service provision for others outside of these institutions.

Japan is a major player in the market because of its specialized clinical model, as well as its willingness to embrace image-guided interventions. The country's rapidly aging population and rising cancer diagnoses have created a significant demand for alternatives to surgical treatment methods. The impetus in mid-2024 for Japanese hospitals to formally standardize microwave ablation for liver tumor removal in elderly patients relates to low complication rates of MWA compared to surgery. Furthermore, Japanese local manufacturers and research groups are developing miniaturized, portable microwave ablation equipment, contributing to regional market growth.

European Microwave Ablation Devices Market

Europe is considered to be a significantly growing area. The region is focusing on making modest advances in microwave ablation technologies, especially in the area of cancer treatment. Europe's well-established healthcare system, with skilled healthcare personnel and an increasing focus on non-invasive and minimally invasive therapies, supports market growth. Educational campaigns by national professional radiology societies across Europe are also raising awareness of ablation therapies as an effective treatment alternative to surgery for patients. The UK has established itself as the leader of MWA adoption in Europe. In February 2024, the Royal Brompton Hospital in London performed its first robotic-assisted microwave ablation procedure using the MicroBlate Flex device on a lung nodule at a diagnostic bronchoscopy as a new, innovative "single-session" process.

(Source: https://www.creomedical.com)

Microwave Ablation Devices Market Companies

- AngioDynamics

- Medtronic

- Emblation Ltd.

- HUBER+SUHNER

- Johnson & Johnson Services, Inc.

- MedWaves, Inc.

- SympleSurgical Inc.

- Mermaid Medical

- Varian Medical Systems, Inc.

- Terumo Corporation

- Others

Recent Developments

- In January 2025, Creo Medical Group PLC announced the commencement of robotic-guided microwave ablation procedures for lung cancer at two UK hospitals. The procedures mark the first clinical use of Creo's MicroBlate Flex ablation device in combination with Intuitive's Ion Endoluminal System.

(Source: https://www.proactiveinvestors.co.uk)

- In October 2024, Medtronic plc announced that the US Food and Drug Administration (FDA) approved its Affera Mapping and Ablation System with Sphere-9 Catheter, an all-in-one, high-density (HD) mapping and pulsed field (PF) and radiofrequency (RF) ablation catheter for treatment of persistent atrial fibrillation (AFib) and for RF ablation of cavotricuspid isthmus (CTI) dependent atrial flutter.

- In July 2024, the US Food and Drug Administration (FDA) granted 510(k) clearance for Varian's IntelliBlate microwave ablation system, designed for soft tissue ablation. The system is engineered to offer clinicians increased predictability, precision, and control during ablation procedures.

(Source:https://www.grandviewresearch.com)

Segments Covered in the Report

By Component Type

- Generators

- Power Distribution Systems

- Accessories

By Application

- Oncology

- Cardiovascular

- Urology

- Orthopedic

- Others

By End-User

- Hospitals

- Ambulatory Surgical Centers

- Research Laboratories

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting